NYISO Agreements --> Attachment 3 - CSA No. 1752 - NiMo and Churchville

ASSET PURCHASE AND SALE AGREEMENT

THIS ASSET PURCHASE AND SALE AGREEMENT (the "Agreement") is made and entered into as of April ___, 2011 by and between Niagara Mohawk Power Corporation d/b/a National Grid, a New York corporation (“National Grid” or “Seller”) and the Village of Churchville, a New York municipal corporation (the “Buyer” or “Churchville”). National Grid and Buyer are each a “Party” and are, collectively, the “Parties” hereto.

WHEREAS, Buyer wishes to purchase, and National Grid is willing to sell, the assets identified on Exhibit A attached hereto and made a part hereof (the “Assets”), presently located at Churchville, New York (the “Location”), subject to the terms of this Agreement;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, National Grid and Buyer agree as follows:

ARTICLE I

PURCHASE AND SALE

Section 1.1 Assets to be Sold to Buyer. Subject to the terms and conditions contained in this Agreement, National Grid shall transfer to Buyer at Closing (as defined below) all of National Grid ’s right, title and interest in and to the Assets

.

Section 1.2 Inspection. Buyer shall have the right, prior to Closing upon reasonable prior notice and during customary business hours, to inspect and test the Assets and to inspect any of Seller's maintenance records pertaining to the Assets.

Section 1.3 Purchase Price, Costs and Taxes.

(a) Buyer shall pay Seller at Closing One Dollar ($1) (the “Purchase Price”) as the purchase price for the Assets. The Purchase Price shall be paid to Seller in immediately available funds by check or by wire transfer or such other means as may be mutually agreed by the Parties prior to Closing.

(b) Buyer shall be solely responsible for, and agrees to pay, all sales, use and transfer taxes, if any, arising from the transactions contemplated hereby (“Taxes”). To the extent applicable, Buyer agrees to provide Seller an appropriate tax exemption document at Closing, in a form satisfactory to Seller, that will relieve Seller of any obligation to collect sales taxes from Buyer. The provisions of this Section 1.3 (b) shall survive delivery of the Bill of Sale and Closing.

(c) Seller is responsible for the payment of all property taxes with respect to the Assets, assessed, accruing or due before Closing (“Property Taxes”), and will fully pay the Property Taxes. Buyer will at no time assume liability for the Property Taxes. Buyer shall assume all liability for property taxes on the Assets to the extent such property taxes are assessed or accrue after Closing.

Section 1.4 Transfer of Title and Delivery.

(a) At Closing, Seller shall transfer the Assets to Buyer by a Bill of Sale substantially in the form set forth in Exhibit B attached hereto and made a part hereof (the "Bill of Sale").

(b) Upon execution and delivery of the Bill of Sale by Seller and Buyer, and Seller’s receipt of the Purchase Price and Tax Estimate at Closing, (i) Buyer shall be the sole owner of the Assets and shall assume all of the rights and duties of ownership in connection therewith including, without limitation, operation, maintenance and risk of loss, and (ii) the Assets shall be delivered in-situ at the Location. Without limiting the foregoing, Buyer shall be solely responsible for, and agrees to pay, all personal property taxes with respect to the Assets which accrue after the Closing Date.

Section 1.5 Regulatory Approvals. The transactions contemplated by this Agreement are subject to the receipt of any required approvals from regulatory agencies having jurisdiction over such transactions (“Required Regulatory Approvals”), which may include, without limitation, the New York State Public Service Commission (“NYPSC”) and the Federal Energy Regulatory Commission (“FERC”). Seller agrees to make the appropriate filings with any such regulatory agencies (the “Applications”) following execution and delivery of this Agreement. The Parties agree to use their respective commercially reasonable efforts to obtain any and all Required Regulatory Approvals. The terms and conditions of this Agreement are expressly contingent upon the Required Regulatory Approvals, if any, each being granted without the imposition of any material modification or condition of the terms of this Agreement or the subject transactions, unless such modification(s) or condition(s) as may be required by the applicable regulatory agency is (are) agreed to by the Parties in their respective sole discretion. If any Application is denied, this Agreement shall terminate as of the date that the Parties receive notification of such denial, in which event the obligations of the Parties under this Agreement shall cease and this Agreement shall terminate without recourse to either Party.

ARTICLE II

CLOSING AND CONDITIONS PRECEDENT

Section 2.1 Time and Place of Closing; Bill of Sale. The consummation and closing of the transactions provided for in this Agreement (the "Closing") shall occur within ten (10) business days after all conditions precedent to the consummation of the transactions contemplated by this Agreement have been fully satisfied or waived (the "Closing Date") at Syracuse, New York, or at such other place or time as the Parties shall mutually agree. Exchange of documents to be delivered at Closing may be conducted by delivery via facsimile or in “.PDF” format by electronic mail, followed by mailing of original deliverables to each Party.

Section 2.2 Conditions Precedent to Closing. The obligation of each Party to consummate the Closing shall be subject to the satisfaction at or prior to the Closing of each of the following conditions:

(a) the representations made by the other Party in Article III of this Agreement shall be true and correct in all material respects at and as of the Closing with the same effect as though such representations had been made or given at and as of the Closing;

(b) the other Party shall have performed and complied in all respects with all of its obligations under this Agreement to be performed or complied with by it on or prior to the Closing;

(c) Seller shall have obtained a release of lien for the Assets from the trustee or trustees under any applicable mortgage indenture or indentures to which Seller is a party;

(d) all Required Regulatory Approvals have been obtained, each in form and substance satisfactory to Seller and Buyer in their respective sole discretion;

(e) the other Party shall have obtained all other necessary licenses, permits, consents and other approvals of governmental entities, agencies, or bodies, and all other persons or entities, if any, required for it to consummate the transactions contemplated by this Agreement; and

(f) Buyer has transferred its electric loads from its existing Richmond Street Station to its newly constructed Sanford Road North Substation.

ARTICLE III

REPRESENTATIONS

Section 3.1 Representations of Each Party. Each Party hereby represents that the following statements are true, correct and complete as of the execution date of this Agreement and as of the date of the Closing:

(a) the Party is validly existing and in good standing under the laws of the state in which it is organized and is in good standing, and is duly qualified to conduct business, in all of the jurisdictions in which it operates;

(b) the Party has all requisite power and authority to enter into this Agreement, execute and deliver the Bill of Sale, undertake its obligations hereunder and consummate the transactions contemplated hereby; this Agreement constitutes, and, as of the Closing, the Bill of Sale will constitute, the valid and legally binding obligations of the Party, are or will be enforceable in accordance with their respective terms, except as the enforceability thereof may be limited by applicable bankruptcy, insolvency, reorganization or other similar laws affecting creditors’ rights generally and by general equitable principles (regardless of whether enforceability is sought in a proceeding in equity or law); and

(c) neither the execution and delivery of this Agreement by the Party, nor the consummation by the Party of the transactions contemplated hereby, will constitute a violation of, or be in conflict with, or constitute or create a default under: any applicable charter, certificate of incorporation, bylaws, operating agreement and/or similar organizational documents of the Party, each as amended to date; any agreement or commitment to which the Party is a party or by which the Party or any of its properties is

bound or to which the Party or any of such properties is subject; or any statute or any

judgment, decree, order, regulation or rule of any court or governmental authority.

Section 3.2 Required Notices. Each Party shall give prompt notice to the other of the occurrence, or failure to occur, of any event which would be likely to cause any representation or of that Party contained in this Agreement to be or become untrue or incorrect in any material respect at any time from the date hereof to the Closing.

Section 3.3 Timing and Survival. The respective representations made by Seller and Buyer in this Agreement shall be deemed remade as of the Closing with the same force and effect as if in fact made at that time. All representations made in this Agreement shall survive and shall not merge at Closing.

ARTICLE IV

LIABILITY AND INDEMNIFICATION

Section 4.1 Examination of Assets. Buyer acknowledges that it has examined the Assets as fully as desired. Upon transfer of title to the Assets at Closing, (i) Buyer waives and disclaims any right to seek recovery from Seller based on the current condition of the Assets, and

(ii) Buyer assumes any and all liability of any kind for claims or damages in connection with the Assets arising from acts, omissions, or events occurring after the Closing Date.

Section 4.2 Assets Sold “As Is, Where Is,” Disclaimer of Warranties. Buyer acknowledges and agrees that the Assets are being sold and transferred “As is, where is” and, accordingly, Seller is not making any covenants, representations, guarantees or warranties, written or oral, statutory, express or implied, concerning such Assets, except those representations or warranties contained in Section 4.3 below, including, in particular, and without limitation, any covenants, representations or warranties with respect to title design or the quality of the Assets, any warranty of merchantability, usage, suitability or fitness for a particular purpose, or any warranties arising from a course of dealing or usage or trade, all of which are hereby expressly excluded and disclaimed, or as to the workmanship thereof or the absence of any defects therein, whether latent or patent, or as to the condition of the Assets, or any part thereof, or whether the Buyer possesses sufficient real property or personal property to operate the Assets.

Without limiting the generality of the foregoing, Seller expressly disclaims any covenant, representation, guarantee or warranty of any kind regarding the condition of the Assets or the suitability of the Assets for operation for the transmission or distribution of electricity and no other material or information provided by or communication made by Seller, or any officer, employee, consultant or agent thereof, will cause or create any covenant, representation, guarantee or warranty, express or implied, as to the title, condition, value or quality of the Assets or any part thereof. The provisions hereof shall survive the transfer of the Assets.

The provisions hereof have been negotiated by the Parties hereto after due consideration and are intended to be a complete exclusion and negation of any representations, guarantees and warranties, whether express or implied or statutory, except for the representations and warranties contained in Section 4.3 below.

Buyer agrees to take the Assets with knowledge that they have been used for a period of time by Seller in its business.

Section 4.3 Representations and Warranties of Seller. Seller hereby represents and warrants to Buyer that, except as disclosed on Schedule 4.3 attached to this Agreement, the following statements are true, correct and complete as of the execution date of this Agreement and as of the date of the Closing:

(a) there has not been a Release (as hereinafter defined) or Threat of Release (as hereinafter defined) of any Hazardous Substances (as hereinafter defined) in connection with the Assets;

Seller has not received any notice that it is the subject of any investigation or proceeding pertaining to the presence of or the release or threatened release of any hazardous substance, hazardous waste, petroleum or petroleum product, or the compliance or noncompliance with any Environmental Laws, relating to, or in connection with, the Assets;

Seller is in compliance with all Environmental Laws relating to the ownership and operation of the Assets and Seller has obtained all permits, authorizations, and licenses and caused all notifications to be made as required by all Environmental Laws in connection with the Assets;

For purposes of this Agreement, the following words and phrases shall have the following meanings:

"Environment" shall mean soil, surface waters, groundwaters, land, stream sediments, surface or subsurface strata and ambient air;

"Environmental Law" shall mean any environmental or health and safety-related law, regulation, rule, ordinance or by-law at the federal, state or local level, whether existing as of the date hereof, previously enforced or subsequently enacted, or any judicial or administrative interpretation thereof;

"Hazardous Substances" shall mean any pollutant, contaminant, toxic substance, hazardous material, hazardous waste or hazardous substance, or any oil, petroleum or petroleum product, as defined in or pursuant to the Federal Clean Water Act, as amended, the Comprehensive Environmental Response, Compensation and Liability Act, as amended, 42 U.S.C. Section 9601, et seq., the Resource Conservation and Recovery Act, as amended, 42 U.S.C. Section 6901, et seq., or any other Environmental Law;

"Release" shall mean any releasing, spilling, leaking, contaminating, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, disposing or dumping of any Hazardous Substances into the Environment;

"Threat of Release" shall mean a substantial likelihood of a Release that requires action to prevent or mitigate damage to the Environment that may result from such Release;

(b) Seller has filed all Tax Returns (as defined below) that it was required to file and all such Tax Returns were correct and complete in all material respects; Seller has paid all Taxes with respect to the Assets that were due on or before the date of this Agreement; all Taxes that Seller is or was required by law to withhold or collect with respect to the Assets have been duly withheld or collected and, to the extent required, have been paid to the proper governmental entity; There are no encumbrances for Taxes upon the Assets except for the statutory encumbrances for current taxes not yet due; There are no actions, suits, proceedings, investigations, or claims pending in connection with the Assets in respect of any unpaid Taxes;

For purposes of this Agreement, "Taxes" means all taxes, charges, fees, levies, or other similar assessments or liabilities with respect to the Assets, including without limitation, gross receipts, ad valorem, premium, value-added, excise, severance, stamp, occupation, windfall profits, customs, duties, real property, personal property, sales, use, transfer, withholding, employment, unemployment insurance, social security, Medicare, business license, business organization, environmental, payroll, and franchise taxes imposed by the United States of America or any state, local or foreign government or agency thereof, or other political subdivision of the United States or any such government, and any interest, fines, penalties, assessments or additions to tax resulting from, attributable to or incurred in connection with any tax or any contest or dispute thereof;

For purposes of this Agreement, "Tax Returns" is defined to mean all reports, returns, declarations, statements, or other information in connection with the Assets required to be supplied to a taxing authority in connection with Taxes;

(c) Seller is not under audit, examination, or discussion with any governmental entity relating to Taxes in connection with the Assets nor has Seller been notified of any threatened or contemplated audit, examination, or discussion; Seller has not waived any statute of limitations with respect to Taxes or agreed to an extension of time with respect to a tax assessment or deficiency; all Tax deficiencies which have been claimed, proposed, or asserted against Seller have been fully paid or finally settled, and no issue has been raised in any examination which, by application of similar principles, could be expected to result in the proposal or assertion of a Tax deficiency for any other year not so examined;

(d) no broker, finder, or other person is entitled to any broker's, finder's or similar fees, commissions, or expenses in connection with the transactions contemplated by this Agreement;

(e) Seller is now in compliance in all material respects with all statutes, laws, ordinances, rules, regulations, orders, and directives of any and all governments, governmental bodies and agencies, and public authorities whatsoever and in compliance with applicable insurance underwriting standards pertaining or relating to the Assets or the operation thereof;

(f) Seller possesses all licenses, permits, franchises, and other authorizations, approvals, and consents necessary for the ownership and operation of the Assets (altogether "Licenses"), all of the Licenses are valid, binding, and in full force and effect, and Seller has complied with all requirements of the Licenses and no party is in default thereunder and no default thereunder is threatened; and

(g) no representation or warranty made by Seller in this Agreement or in any attachment, certificate, or other document or writing delivered to, or to be delivered to, Buyer pursuant to this Agreement, or in connection with the transactions contemplated hereby, contains or will contain any untrue statement of material fact or omits or will omit to state any material fact necessary in order to make the representation or warranty not misleading.

Section 4.4 Indemnity.

(a) Buyer hereby releases and discharges Seller from all obligations and liabilities with respect to the Assets (including their condition environmental or otherwise) other than (i) any obligation or liability arising from a Release or Threat of Release of Hazardous Substances occurring prior to Closing in connection with the Assets and (ii) any noncompliance with Environmental Laws by Seller (or by any person for whom Seller is legally responsible) prior to Closing relating to the ownership or operation of the Assets, and agrees to indemnify, defend (with counsel satisfactory to the Seller) and hold harmless Seller, its officers, directors, shareholders, employees, agents, contractors, direct and indirect parent companies, affiliates and subsidiaries, and its or their successors and assigns, to the full extent permitted by applicable law, from and against any and all costs, losses, expenses, damages, claims, liens, fines, penalties, encumbrances, obligations, actions and causes of action, of any kind whatsoever, of every name and nature, in law and equity, whether known or unknown, suspected or unsuspected (“Damages”), including, without limitation, attorneys’ and other professional expenses and fees, third party claims for personal injury or property damage, diminution of property value and remediation costs or lost income suffered or incurred by or asserted against Seller, which arise from or in connection with, directly or indirectly, the Assets, but excluding Damages to the extent arising from (x) a Release or Threat of Release of Hazardous Substances occurring prior to Closing in connection with the Assets and (y) any noncompliance with Environmental Laws by Seller (or by any person for whom Seller is legally responsible) prior to Closing relating to the ownership or operation of the Assets.

- Seller agrees to indemnify, defend (with counsel satisfactory to the Buyer) and hold harmless Buyer, its officers, directors, employees, agents, contractors and its or their successors and assigns, to the full extent permitted by applicable law, from and against any and all costs, losses, expenses, damages, claims, liens, fines, penalties, encumbrances, obligations, actions and causes of action, relating to (i) Hazardous Substances present as of the Closing in, on or as part of the Assets, or the release or threat of release of Hazardous Substances from the Assets prior to Closing (ii) noncompliance with any Environmental Laws prior to Closing by Seller, or by any person for whom Seller is legally responsible, and (iii) any Release or Threat of Release occurring prior to Closing, or the processing of, or disposal of, Hazardous Substances prior to Closing in connection with the Assets, in each case by Seller, or by any person for whom Seller is legally responsible, including, without limitation, attorneys’ and other professional expenses and fees, third party claims for personal injury or property damage, diminution of property value and remediation costs or lost income suffered or incurred by or asserted against Buyer, which arise from or in connection with, directly or indirectly, the Assets.

- Buyer agrees to indemnify, defend (with counsel satisfactory to the Seller) and hold harmless Seller, its officers, directors, employees, agents, contractors and its or their successors and assigns, to the full extent permitted by applicable law, from and against any and all costs, losses, expenses, damages, claims, liens, fines, penalties, encumbrances, obligations, actions and causes of action, relating to (i) the introduction or creation of Hazardous Substances in, on or as part of the Assets, or the release or threat of release of Hazardous Substances from the Assets, from and after the Closing (ii) noncompliance with any Environmental Laws from and after the Closing by Buyer, or by any person for whom Buyer is legally responsible, and (iii) any Release or Threat of Release occurring from and after the Closing, or the processing of, or disposal of, Hazardous Substances in connection with the Assets from and after the Closing, in each case by Buyer, or by any person for whom Buyer is legally responsible, including, without limitation, attorneys’ and other professional expenses and fees, third party claims for personal injury or property damage, diminution of property value and remediation costs or lost income suffered or incurred by or asserted against Seller, which arise from or in connection with, directly or indirectly, the Assets.

Section 4.5 Defense and Costs.

The Party having the indemnification obligation under Section 4.4, above, (the “Indemnifying Party”) shall take prompt action to defend and indemnify the persons or entities entitled to be indemnified pursuant to Section 4.4 (the “Indemnified Parties”) against claims, actual or threatened, but in no event later than notice by the Indemnified Party to the Indemnifying Party or Parties of the service of a notice, summons, complaint, petition or other service of process alleging damage, injury, liability, or expenses that may be subject to indemnification hereunder. The Indemnifying Party shall defend any such claim or threatened claim, including, as applicable, engagement of legal counsel satisfactory to the Indemnified Party, to respond to, defend, settle, or compromise any claim or threatened claim. In the event that the Indemnifying (i) fails to promptly undertake such defense, (ii) fails to pay such defense costs and damages, (iii) uses counsel not reasonably acceptable to the Indemnified Parties or (iv), does not allow the Indemnified Parties to be part of the settlement or compromise discussions, then the Indemnified Party(ies) shall have the right, but not the obligation, to undertake such defense and settlement discussions. In the event an Indemnified Party undertakes its own defense or pays any associated damages, whether by settlement or pursuant to judicial order, judgment or decree, then the Indemnifying Party shall not raise or plead as a defense to a claim by the Indemnified Party for reimbursement for all or any part of the expense so incurred that in doing so the Indemnified Party acted as volunteer or waived its right to defense, indemnification, or insurance coverage reimbursement in accordance with this Agreement. The Indemnifying Party understands and agrees that it shall be responsible for any and all reasonable costs and expenses incurred by Indemnified Parties to enforce this indemnification provision. Such costs incurred by the Indemnified Parties can include attorney’s fees and expenses for litigation, accounting, consulting or engineering fees and related expenses, judgments, liens and encumbrances arising from such lawsuits, actions or claims whenever made or incurred. Furthermore, the Indemnifying Party shall, at its sole cost and expense, testify, as required by the Indemnified Parties, at any judicial or administrative proceeding, or deposition, and shall be responsible to reimburse the Indemnified Parties for any damages the Indemnified Parties pays as a result of the Indemnifiying Party’s failure to comply with its indemnification obligations under this Article

Section 4.6 Limitation of Liability; Disclaimer of Certain Damages.

In no event, whether as a result of breach of contract, tort (including negligence and strict liability), or otherwise shall Seller be liable for any or all special, indirect, incidental, penal, punitive or consequential damages of any nature in connection with, or arising from, the transactions contemplated by this Agreement, including, without limitation, delays, lost profits, business interruptions, loss of use, lost business opportunities, loss of revenue, losses and other damages by reason of facility shutdown, equipment damage, cost of replacement power or substitute or temporary facilities or services, cost of capital, loss of goodwill, and claims of suppliers and customers, whether or not such damages were reasonably foreseeable or Seller was advised or aware that such damages might be incurred.

Without limiting the foregoing, Buyer, from and after the Closing Date, shall assume any and all liability of any kind for any claims relating to:

(i) resale of the Assets by Buyer or any other person or entity;

(ii) use of the Assets by Buyer or any other person or entity;

(iii) disposal of the Assets by Buyer or any other person or entity; and

(iv) loss of, or damage to, the Assets.

Section 4.6 Survival. The provisions of this Article shall apply notwithstanding any other provisions of this Agreement, and shall survive termination, expiration, cancellation, or completion of this Agreement and Closing.

ARTICLE V

GENERAL PROVISIONS

Section 5.1 Assignment. This Agreement may not be assigned without the express written consent of both Parties hereto. The foregoing notwithstanding, either Party may assign this Agreement to an affiliate without the other Party's consent, provided, however, that no such assignment shall serve to release the assignor, pledgor or transferor of any of its obligations under this Agreement without the written consent of the non-assigning Party. For purposes of this Agreement, the term “affiliate” shall mean any entity controlling, controlled by, or under common control with the Party; “control” of an entity shall mean the ownership of, with right to vote, fifty percent (50%) or more of the outstanding voting securities, equity, membership interests, or equivalent, of such entity.

Section 5.2 Notices. Any notice required or permitted to be given hereunder shall be addressed to the Parties as follows:

If to Seller:

Niagara Mohawk Power Corporation

300 Erie Boulevard West

Syracuse, New York 13202

Attention: Sarah Steitz

Transmission Commercial Services

Phone: 315.428.5047

Email: sarah.steitz@us.ngrid.com

If to Buyer:

Village of Churchville

23 E Buffalo Street PO Box 613

Churchville, NY 14428

Attention: Paul Robinson, Churchville, Electric Superintendent

Phone: ______________

Email: _______________________

Any notices, requests, or other correspondence and communication given under this Agreement shall be in writing and must be sent (i) by hand delivery, (ii) by registered or certified mail, return receipt requested, (iii) by a reputable national overnight courier service, postage prepaid, or (iv) facsimile transmission, addressed to the Party at its addresses or telephone facsimile number set forth above. For purposes of this Agreement, notices sent by hand delivery, overnight courier or facsimile (if followed by the original as required by this Section) shall be deemed given upon receipt and notices sent by mail shall be deemed given three (3) business days following the date of mailing. Each Party may give notice, as herein provided, specifying a different person, address or facsimile number than that which is listed above.

Section 5.3 Amendments. This Agreement shall not be amended, superseded or modified, in whole or in part, except in a writing signed by both Parties.

Section 5.4 Approvals; Entire Agreement; Effectiveness. This agreement shall be subject to approval of any federal, state or local regulatory body whose approval is a legal prerequisite to its execution and delivery or performance. This Agreement and the Bill of Sale shall be deemed to constitute the entire agreement among the Parties relating to the subject matter hereof and shall supersede all previous agreements, negotiations, courses of dealings, oral or written offers, understandings, discussions, communications and correspondence with respect thereto.

Section 5.5 Counterparts. This Agreement and the Bill of Sale may be executed in multiple counterparts, each of which shall be deemed an original when signed, and such counterparts shall constitute one and the same instrument and shall be binding and inure to the benefit of the Parties' successors and assigns.

Section 5.6 Applicable Law; Severability; Survival. This Agreement shall be governed by the laws of the State of New York, without regard to the conflict of laws principles contained therein. To the extent that any provision of this Agreement shall be held to be invalid, illegal or unenforceable, it shall be modified so as to give as much effect to the original intent of such provision as is consistent with applicable law and without affecting the validity, legality or enforceability of the remaining provisions of the Agreement. The covenants and agreements of the Parties contained in, or given pursuant to, this Agreement, shall survive the Closing until they have been fully satisfied or otherwise discharged.

Section 5.7 Further Assurances. Before, at, and after the Closing, each of the Parties hereto agrees to take such further action and to execute and deliver such further documents and agreements as may be reasonably requested by the other in order to fulfill the intents and purposes of this Agreement.

Section 5.8 No Third Party Beneficiaries. This Agreement is for the use and benefit of Seller and Buyer only, and not for the use and benefit of the public generally or any other person, party, or entity. Any use of, or reliance upon, this Agreement, or any performance or non-performance hereunder, by any third party shall be at the sole risk of such person.

Section 5.9 Construction. Unless otherwise specified, references in this Agreement to Sections or Articles are to sections and articles of this Agreement. Any reference in this Agreement to any statute or any section thereof will be deemed, unless otherwise expressly stated, to be a reference to such statute or section as amended, restated or re-enacted from time to time. The division of this Agreement into Articles and Sections is for convenience only, and shall not affect the interpretation of this Agreement. Unless the context requires otherwise, words importing the singular include the plural and vice versa and words importing gender include all genders. Where the word “including” or “includes” is used in this Agreement it means “including (or includes) without limitation. The Section headings of this Agreement are for convenience of reference only, do not constitute part of this Agreement, and shall not be deemed to limit or otherwise affect any of the provisions hereof.

[Signatures are on following page.]

IN WITNESS WHEREOF, the Parties have caused this Agreement to be signed by their

respective corporate officers as of the day and year first above written.

Niagara Mohawk Power Corporation, as Seller

By______________________________________________

Name:

Title:

Village of Churchville, as Buyer

By______________________________________________

Name:

Title:

Schedule 4.3

The consolidated Form 1120 Federal income tax return of Seller’s ultimate parent (National Grid plc) is currently under Internal Revenue Service examination for the period 4/1/05 through 3/31/07. Seller is also currently under examination by New York State for the period 4/1/05 - 3/31/08. Statutes have been extended as they relate to the above referenced audit periods in each jurisdiction.

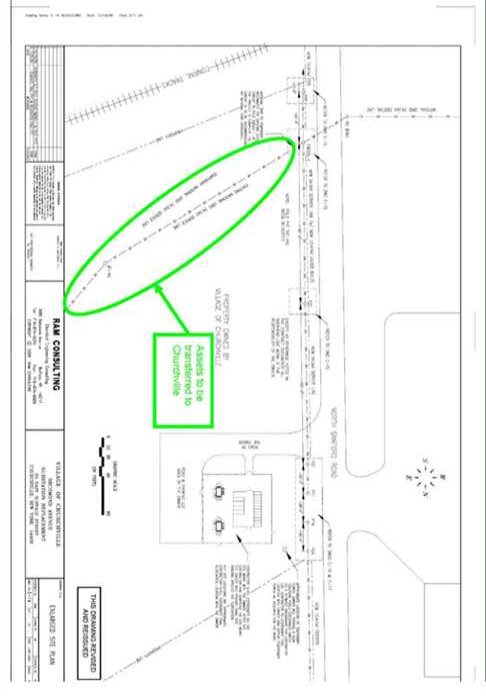

EXHIBIT A

DESCRIPTION OF ASSETS

The existing section of Seller’s 34.5 kV service connection, approximately 1486 circuit feet of 3 phase conductor and 6 existing poles from future pole 595-1 including insulators, guys, anchors and associated appurtenances, terminating at and presently serving Buyer’s existing Richmond Street Substation, as depicted on the Enlarged Site Plan below.

EXHIBIT B

BILL OF SALE

Reference is made to that certain Asset Purchase and Sale Agreement dated as of April ___, 2011 between the VILLAGE OF CHURCHVILLE. and NIAGARA MOHAWK POWER CORPORATION (the “Transaction Agreement”). Pursuant to the Transaction Agreement, the undersigned, NIAGARA MOHAWK POWER CORPORATION (the “Seller” or “National Grid”), for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, hereby grants, bargains, sells, and transfers, all of its right, title, and interest in and to the assets described on Annex A attached hereto and incorporated herein by reference and made a part hereof (collectively, “Assets”) to the VILLAGE OF CHURCHVILLE, a New York municipal corporation, with its principal place of business at 3500 River Road, Tonawanda, New York (the “Buyer” or “Churchville”).

It is the intent of the Seller and Buyer that this instrument transfer all of Seller’s right, title, and interest in and to the Assets. Seller hereby represents to Buyer that Seller has the right to transfer all of Seller’s right, title, and interest in and to the Assets as contemplated by this Bill of Sale.

Seller hereby covenants and agrees for the benefit of Buyer that Seller will defend, at Seller’s sole cost and expense, the right, title, and interest of Buyer in and to the Assets against the lawful claims and demands of all persons.

Buyer acknowledges and agrees that it has examined the Assets as fully as it desired and Buyer waives and disclaims any right to seek recovery from Seller based on the current condition of the Assets. Buyer acknowledges and agrees that the Assets are being sold and transferred “as is, where is” and, accordingly, Seller is not making any covenants, representations, guarantees or warranties, written or oral, statutory, express or implied, concerning such Assets, except those covenants, representations or warranties contained in Section 4.3 of the Transaction Agreement, including, in particular, and without limitation, any covenants, representations or warranties with respect to design or the quality of the Assets, any warranty or merchantability, usage, suitability or fitness for a particular purpose, or any warranties arising from a course of dealing or usage or trade, all of which are hereby expressly excluded and disclaimed, or as to the workmanship thereof or the absence of any defects therein, whether latent or patent, or as to the condition of the Assets, or any part thereof, or whether the Buyer possesses sufficient real property or personal property to operate the Assets.

Seller expressly disclaims any covenant, representation, guarantee or warranty of any kind regarding the condition of the Assets or the suitability of the Assets for operation for the transmission or distribution of electricity and no other material or information provided by or communication made by Seller, or any officer, employee, consultant or agent thereof, will cause or create any covenant, representation, guarantee or warranty, express or implied, as to the title, condition, value or quality of the Assets or any part thereof. The provisions hereof shall survive the transfer of the Assets.

The provisions hereof have been negotiated by the Buyer and the Seller after due consideration and are intended to be a complete exclusion and negation of any representations, guarantees and warranties, whether express or implied or statutory, except for the representations and warranties contained in Section 4.3 of the Transaction Agreement.

Buyer shall take title to the Assets upon execution of this document, and Buyer assumes any and all liability of any kind for claims or damages in connection with the Assets arising from acts, omissions, or events occurring after the date hereof. Buyer agrees to take the Assets with knowledge that they have been used for a period of time by Seller in its business. The provisions of this paragraph shall apply notwithstanding any other provisions of this Bill of Sale or the Transaction Agreement, and shall survive, termination, cancellation, or completion of this Bill of Sale or the Transaction Agreement.

Nothing in this instrument, express or implied, is intended or shall be construed to confer upon, or give to, any third party any remedy or claim under or by reason of this instrument or any agreements, terms, covenants or conditions hereof, and all the agreements, terms, covenants and conditions contained in this instrument shall be for the sole and exclusive benefit of the Buyer and Seller and their respective successors and assigns.

This instrument and all of the provisions hereof shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns.

To the extent that any provision of this instrument shall be held to be invalid, illegal or unenforceable, it shall be modified so as to give as much effect to the original intent of such provision as is consistent with applicable law and without affecting the validity, legality or enforceability of the remaining provisions of this instrument. Each party represents and warrants to the other that the signatory identified beneath its name below has full authority to execute this instrument on its behalf.

This instrument shall be governed by and construed in accordance with the laws of the State of New York (regardless of the laws that might otherwise govern under applicable principles of conflicts of laws). Venue in any action with respect to this instrument shall be in the State of New York; the parties agree to submit to the personal jurisdiction of courts in the State of New York with respect to any such actions.

This instrument may be executed in multiple counterparts, each of which shall be considered an original.

[Signatures are on following page.]

IN WITNESS WHEREOF, the parties hereto have each caused these presents to be signed in their names and behalf by their respective duly authorized representatives as of the dates set forth below.

Niagara Mohawk Power Corporation, as Seller

By______________________________________________

Name:

Title:

Village of Churchville, as Buyer

By______________________________________________

Name:

Title:

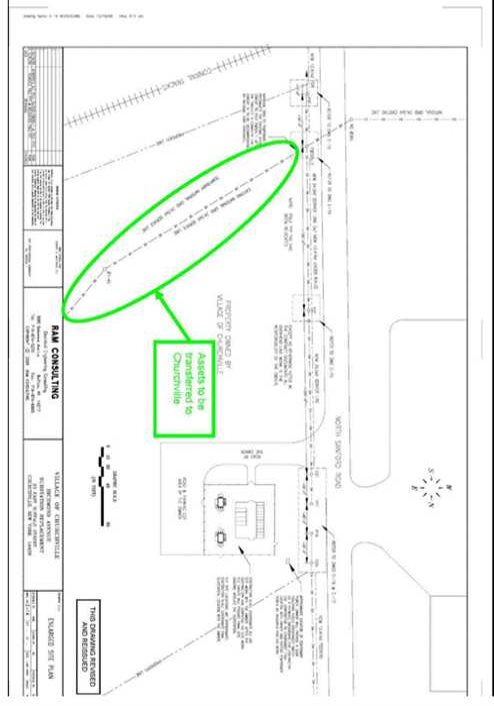

Annex A to Bill of Sale

Description of Assets.

The existing section of Seller’s 34.5 kV service connection, approximately 1486 circuit feet of 3 phase conductor and 6 existing poles from future pole 595-1 including insulators, guys, anchors and associated appurtenances, terminating at and presently serving Buyer’s existing Richmond Street Substation, as depicted on the Enlarged Site Plan below.

Effective Date: 4/27/2011 - Docket #: ER11-3523-000 - Page 1