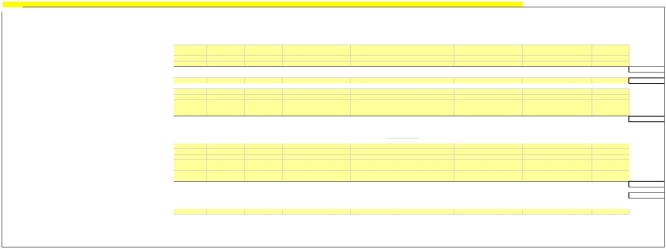

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

6.12.5.2.1 Formula Rate Template

6.12.5.2.1 Formula Rate Template

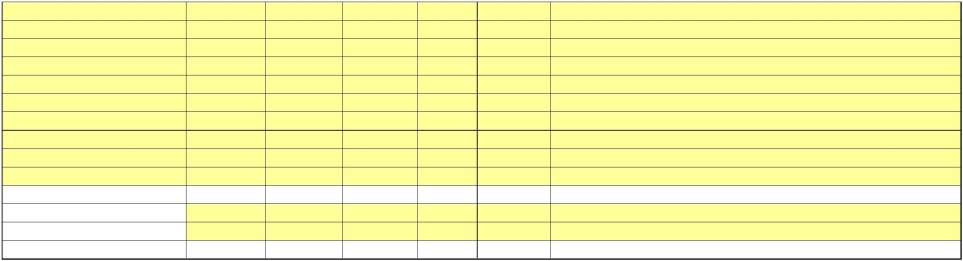

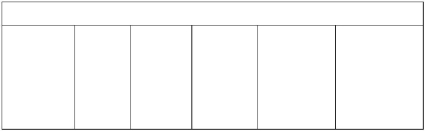

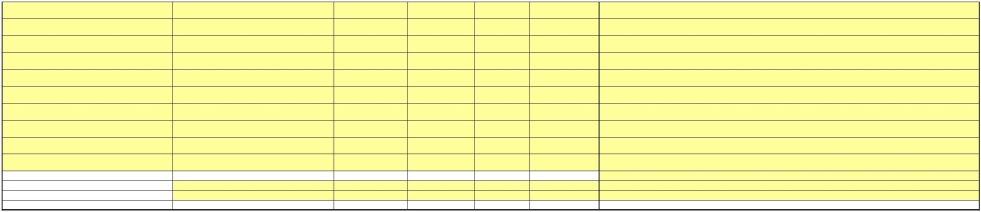

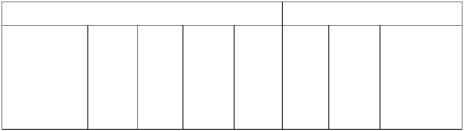

Index

Central Hudson Gas and Electric Corporation

Rate Formula Template

Utilizing FERC Form 1 Data Projected Annual Transmission Revenue Requirement

For the 12 months ended 5/31/XX

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Appendix A Calculation of Annual Transmission Revenue Requirement

Attachment 1 Revenue Credits

Attachment 2 Cost Support - Monthly Plant and Accumulated Depreciation

Attachment 3 Cost Support

Attachment 4 Cost Support - Cost of Capital

Attachment 5 Excess or Deficient Accumulated Deferred Income Taxes

Attachment 6a-6d Accumulated Deferred Income Taxes

Attachment 7 Annual True-Up Adjustment Attachment 8 Depreciation Rates

Attachment 9 Workpapers - Hurley Avenue Project Investment

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

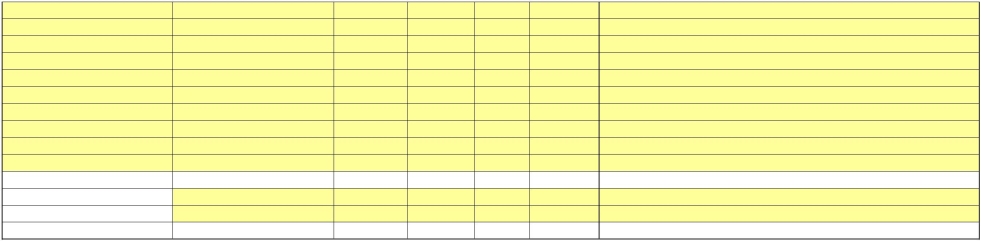

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

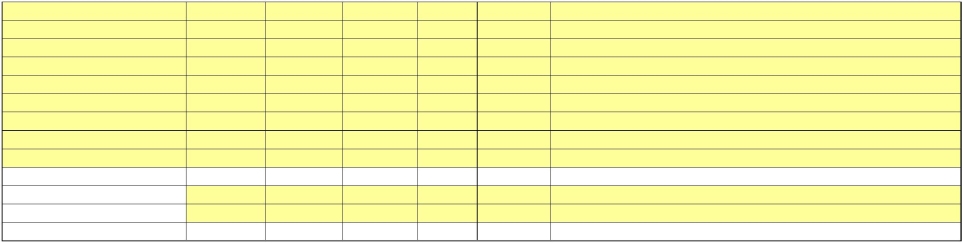

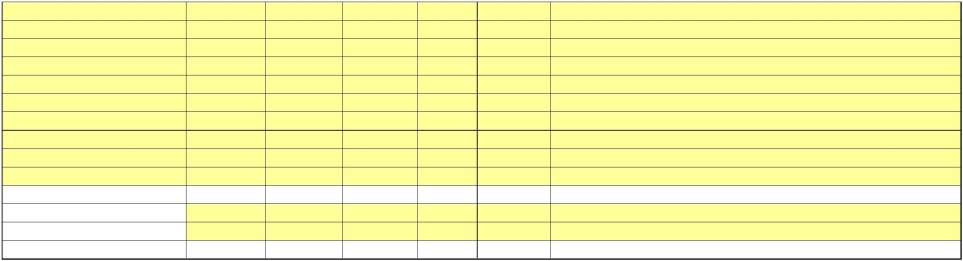

Appendix A

Appendix A

Page 1 of 5

Central Hudson Gas and Electric Corporation

Formula Rate - Non-Levelized Rate Formula Template

Utilizing FERC Form 1 Data Projected Annual Transmission Revenue Requirement

For the 12 months ended 5/31/XX

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

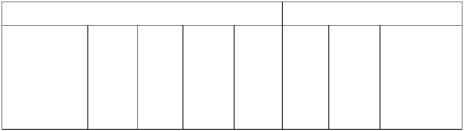

(1) (2) (3)

Line Allocated

No. Amount

1 GROSS REVENUE REQUIREMENT Line 60 12 months $ -

REVENUE CREDITS Total Allocator

2 Total Revenue Credits Attachment 1, Line 6 - TP 100% -

3 Net Revenue Requirement Line 1 - Line 2 -

| 4 | | True-up Adjustment (Included Only With Projected ATRR) Attachment 7 0 DA 100% - |

5 NET ADJUSTED REVENUE REQUIREMENT Line 3 + Line 4 -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

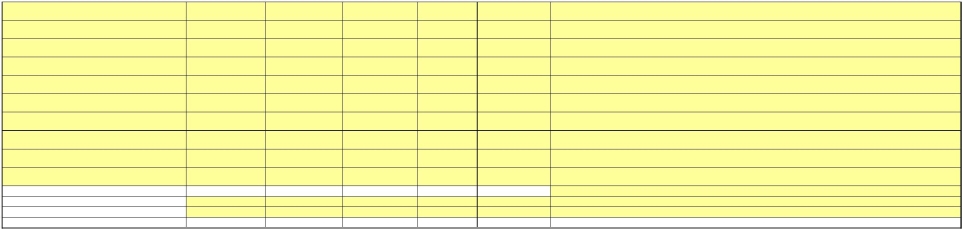

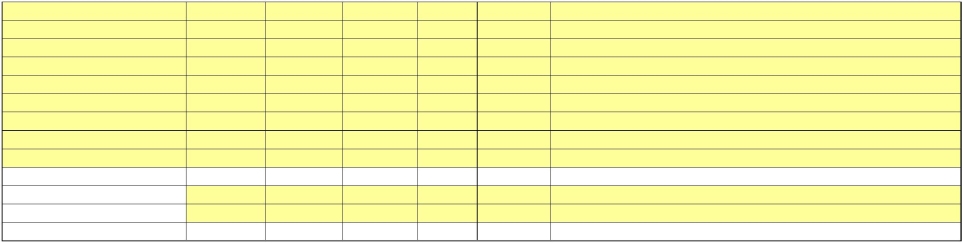

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Appendix A

Appendix A

Page 2 of 5

Formula Rate - Non-Levelized Rate Formula Template

Utilizing FERC Form 1 Data

For the 12 months ended 5/31/XX

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

(1) (2) (3) (4) (5)

Form No. 1 Reference Transmission

Line Attachment Reference Company Total Allocator (Col 3 times Col 4)

No. RATE BASE:

GROSS PLANT IN SERVICE (Note M)

6 Production Attachment 2, Line 75 - NA

7 Transmission Attachment 2, Line 15 - TP 100% -

8 Distribution Attachment 2, Line 30 - NA

9 General & Intangible Attachment 2, Line 45 + Line 60 - W/S - -

10 TOTAL GROSS PLANT Sum of Lines 6 through 9 - GP= - -

ACCUMULATED DEPRECIATION & AMORTIZATION (Note M)

11 Production Attachment 2, Line 151 - NA

Attachment 2, Line 91 or Attachment 9,

12 Transmission Line 38 - DA -

13 Distribution Attachment 2, Line 106 - NA

14 General & Intangible Attachment 2, Line 121 + Line 136 - W/S - -

TOTAL ACCUMULATED DEPRECIATION &

15 AMORTIZATION Sum of Lines 11 through 14 - -

NET PLANT IN SERVICE

16 Production Line 6- Line 11 - -

17 Transmission Line 7- Line 12 - -

18 Distribution Line 8- Line 13 - -

19 General & Intangible Line 9- Line 14 - -

20 TOTAL NET PLANT Sum of Lines 16 through 19 - NP= - -

ADJUSTMENTS TO RATE BASE

21 Accumulated Deferred Income Taxes (Note A) Attachment 6a, Line 11 - DA 100% -

Excess or Deficient Accumulated Deferred Income

22 Taxes (Note N) Attachment 5 0 DA 100% -

23 Account No. 255 (enter negative) (Note F) Attachment 3, Line 1 - NP - -

24 Unfunded Reserves (enter negative) Attachment 3, Line 22 - DA 100% -

25 TOTAL ADJUSTMENTS - -

26 LAND HELD FOR FUTURE USE Attachment 9, Line 11 - DA 1.0000 -

WORKING CAPITAL (Note C)

27 CWC Calculated (1/8 * Line 39 - -

28 Materials & Supplies Attachment 3, Line 55 - Attachment 3 -

29 Prepayments Attachment 3, Line 15 - GP - -

30 TOTAL WORKING CAPITAL Sum of Lines 27 through 29) - -

31 RATE BASE Sum of Lines 20, 25, 26, & 30) - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

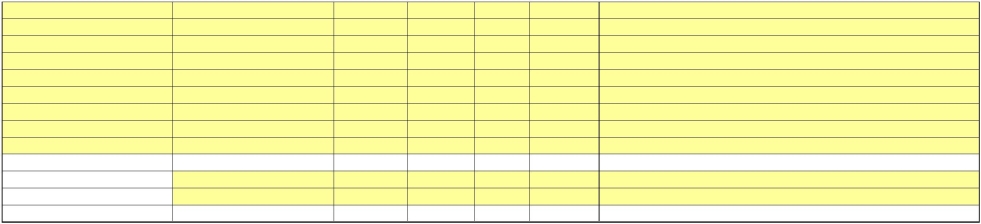

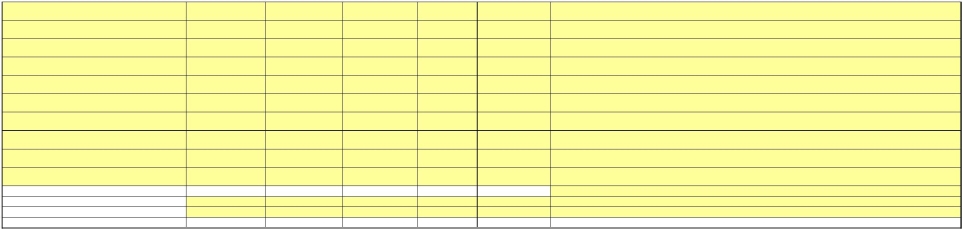

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Appendix A

Appendix A

Page 3 of 5

Formula Rate - Non-Levelized Rate Formula Template

Utilizing FERC Form 1 Data

For the 12 months ended 5/31/XX HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

(1) (2) (3) (4) (5)

Form No. 1 Reference Transmission Attachment Reference Company Total Allocator (Col 3 times Col 4)

O&M

32 Transmission 321.116.b - AGP - -

33 Less Accounts 565, 561 and 561.1 to 561.8 321.99.b & 87.b to 94.b - AGP - -

34 Net Transmission O&M Line 32- Line 33 - -

35 A&G (Note D) 323.205.b - W/S - -

36 | | Less EPRI, EEI, Regualotry Expenses and Safety Expenses Attachment 3, Line 37 + 38 + 40 - W/S - - |

37 Plus Safety Advertising Attachment 3, Line 40 - W/S - -

38 Plus Transmission Related Reg. Comm. Exp. Attachment 3, Line 38 - AGP - -

39 TOTAL O&M Lines 34 + 35 - 36 + 38 - -

DEPRECIATION EXPENSE

40 Transmission 336.7.f fn - Attachment 9 -

41 General and Intangible 336.1.f + 336.10.f - W/S - -

42 TOTAL DEPRECIATION Lines 40 + 41 - -

TAXES OTHER THAN INCOME TAXES (Note E) 43 LABOR RELATED

44 Payroll 263._.l +263._.l + 263._.l - W/S - -

45 Highway and vehicle 263._.l (enter FN1 line #) - W/S - -

PLANT RELATED

46 Property 263._.i +263._.i - AEP - -

47 Gross Receipts 263._.i +263._.i - NA - -

48 Other 263._.i - AEP - -

49 TOTAL OTHER TAXES Sum of Lines 44 through 48 - -

INCOME TAXES (Note F)

50 T=1 - {[(1 - SIT) * (1 - FIT)] / (1 - SIT * FIT * p))} = -

51 CIT=(T/1-T) * (1-(WCLTD/R)) = -

52 where WCLTD=(line 83) and R= (line 86)

53 and FIT, SIT, p, & n are as given in footnote F.

54 1 / (1 - T) = (T from line 50) -

55 Investment Tax Credit Amortization (Note F) Attachment 3, Line 1 -

56 Income Tax Calculation Line 50 * Line 59 - -

57 Investment Tax Credits Line 54 * Line 55 - NP - -

58 TOTAL INCOME TAXES Line 56 + Line 57 - -

RETURN

59 Rate Base * Rate of Return Line 31 * Line 86 - -

60 TOTAL GROSS REVENUE REQUIREMENT - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Appendix A

Appendix A

Page 4 of 5

Formula Rate - Non-Levelized Rate Formula Template

Utilizing FERC Form 1 Data

For the 12 months ended 5/31/XX

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

SUPPORTING CALCULATIONS AND NOTES

61 TRANSMISSION PLANT INCLUDED IN RTO RATES

62 Total transmission plant Line 7 -

Less transmission plant excluded from RTO rates

63 (Note H) Attachment 3, Line 41 -

Less transmission plant included in OATT

64 Ancillary Services (Note H) Attachment 3, Line 41 -

65 Transmission plant included in RTO rates Line 62 - Lines 63 & 64 -

| 66 | | Percentage of transmission plant included in RTO Rates Line 65 / 62 TP= 100.00% |

PROJECT AS PERCENTAGE OF TOTAL 67 TRANSMISSION PLANT

68 Transmission plant included in RTO rates Line 65 -

Plus CIAC Received (O&M, A&G and Taxes other

69 than income would be on full amount) Attachment 9, Line 24 -

70 Total Adjusted Transmission Plant Line 68 + Line 69 -

71 Total transmission plant Line 7 -

72 Project as percentage of transmission plant Line 70 / 71 AGP= -

PROJECT AS PERCENTAGE OF TOTAL PLANT

73 Transmission plant included in RTO rates Line 65 -

Plus CIAC Reveived (O&M, A&G and Taxes other

74 than income would be on full amount) Line 69 -

75 Total Adjusted Transmission Plant Line 73 + Line 74 -

76 Total Gross Plant Line 10 -

77 Project as percentage of total plant Line 75 / 76 AEP= -

WAGES & SALARY ALLOCATOR (W/S)

Form 1 Reference $ AGP Allocation 78 Production 354.20.b -

79 Transmission 354.21.b - - -

80 Distribution 354.23.b - W&S Allocator

81 Other 354.24,25,26.b - ($ / Allocation)

82 Total Sum of Lines 78 through 81 - - = -

W/S

RETURN (R) (Note J)

$ % Cost Rate Weighted

83 Long Term Debt Attachment 4, Line 6 - 0.00% 0.00% - =WCLTD

84 Preferred Stock Attachment 4, Line 7 - 0.00% - -

85 Common Stock Attachment 4, Line 12 - 0.00% 9.40% -

86 Total Sum of Lines 83 through 85 - 0.00% - =R

Appendix A

Page 5 of 5

For the 12 months ended 5/31/XX

SUPPORTING CALCULATIONS AND NOTES

Formula Rate - Non-Levelized Rate Formula Template

Utilizing FERC Form 1 Data

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

General Note: References to pages in this formulary rate are indicated as: (page#, line#, col.#)

References to data from FERC Form 1 are indicated as: #.y.x (page, line, column)

Note Letter

A The balances in Accounts 190, 281, 282 and 283, as adjusted by any amounts in contra accounts identified as regulatory assets or liabilities related

to FASB 106 or 109. The formula uses the stated average of the beginning and end of year balances to prorate ADIT to comply with IRS normalization rules. Balance of Account 255

is reduced by prior flow throughs and excluded if the utility chose to utilize amortization of tax credits against taxable income as discussed in Note F. Account 281 is not allocated.

B For future use

C Cash Working Capital assigned to transmission is one-eighth of O&M allocated to transmission

Prepayments are the electric related prepayments booked to Account No. 165 and reported on Pages 110-111 line 57 in the Form 1.

D A&G excludes EPRI Annual Membership Dues listed in Form 1 at 353, all Regulatory Commission Expenses itemized in Form 1 at page 351.h.

and all advertising expenses included in Account 930.1, except safety, education or out-reach related advertising.

A&G includes all Regulatory Commission Expenses directly related to transmission service, RTO filings, or transmission siting itemized at 351.h.

E Includes only FICA, unemployment, highway, property, gross receipts, and other assessments charged in the current year.

Taxes related to income are not included here. Gross receipts taxes are not included in the transmission revenue requirement in the Formula Rate Template,

since they are recovered elsewhere.

F The currently effective income tax rate, where FIT is the Federal income tax rate; SIT is the State income tax rate, and p =

"the percentage of federal income tax deductible for state income taxes". If the utility is taxed in more than one state it must attach a

work paper showing the name of each state and how the blended or composite SIT was developed. Furthermore, include amortization of investment tax credit for a utility that

elected to utilize amortization of tax credits against taxable income, rather than book tax credits to Account No. 255 and reduce rate base.

Inputs Required: FIT = 0.0%

SIT= 0.0% (State Income Tax Rate or Composite SIT from Attach 3)

p = - (percent of federal income tax deductible for state purposes)

For each Rate Year (including both Annual Projections and True-Up Adjustments) the statutory income tax rates utilized in the Formula Rate shall reflect the weighted average rates

actually in effect during the Rate Year. For example, if the statutory tax rate is 10% from January 1 through June 30, and 5% from July 1 through December 31, such rates would be weighted

181/365 and 184/365, respectively, for a non-leap year.

G For future use.

H All transmission gross operating property except that related to the Hurley Avenue Substation.

I For future use.

J ROE will be supported in the original filing and no change in ROE may be made absent a filing with FERC under FPA Section 205 or 206.

The capital structure will be the actual capital structure up to 53% equity. If the actual equity ratio exceeds 53%, the common stock ratio will be reset to 53% and

the debt ratio will be equal to 1 minus sum of the preferred stock ratio and common stock ratio.

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

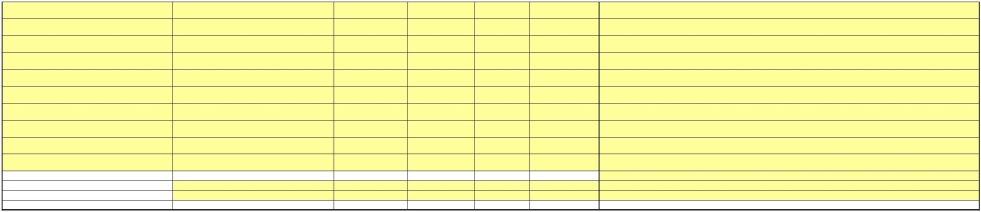

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Attachment 1 - Revenue Credit Workpaper*

Attachment 1 - Revenue Credit Workpaper*

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Account 454 - Rent from Electric Property (300.19.b) Notes 1 & 3

1 Rent from FERC Form No. 1 -

Account 456 (including 456.1) (300.21.b and 300.22.b) Notes 1 & 3

2 Other Electric Revenues (Note 2) -

3 Professional Services -

4 Revenues from Directly Assigned Transmission Facility Charges (Note 2) -

5 Rent or Attachment Fees associated with Transmission Facilities -

6 Total Revenue Credits Sum lines 2-5 + line 1 -

Note 1 Note 2 | | All revenues booked to Account 454 that are derived from cost items classified as transmission-related will be included as a revenue credit. All revenues booked to Account 456 (includes 456.1) that are derived from cost items classified as transmission-related, and are not derived from rates under this transmission formula rate will be included as a revenue credit. Work papers will be included to properly classify revenues booked to these accounts to the transmission function. A breakdown of all Account 454 revenues by subaccount will be provided below, and will be used to derive the proper calculation of revenue credits. A breakdown of all Account 456 revenues by subaccount and customer will be provided and tabulated below, and will be used to develop the proper calculation of revenue credits. |

If the facilities associated with the revenues are not included in the formula, the revenue is shown below, but not included in the total above and explained in the Attachment 3.

Note 3 All Account 454 and 456 Revenues must be itemized below

Line No.

6 Account 456 TOTAL NY-ISO Other 1 Other 2

7 Transmission Service - -

8 Trans. Fac. Charge - - - -

9 Trans Studies - - - -

10 Other - - - -

11

12 Total - - - -

13 Less:

14 Revenue for Demands in Divisor - - - -

15 Sub Total Revenue Credit - - - -

16 Prior Period Adjustments - - - -

17 Total - - - -

9 Account 454 $

10 Joint pole attachments - telephone -

11 Joint pole attachments - cable -

12 Underground rentals -

13 Transmission tower wireless rentals -

14 Misc non-transmission rentals -

15 -

16 -

17

18 -

19 Total -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Attachment 2 - Cost Support

Attachment 2 - Cost Support

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Plant in Service Worksheet

Less: Asset

Retirement

1 Calculation of Transmission Plant In Service Source Year Balance Obligations Adjusted Balance

2 May company records 2018 - - -

3 June p204-207, l. 58 2018 - - -

4 July company records 2018 - - -

5 August company records 2018 - - -

6 September p204-207, l. 58 2018 - - -

7 October company records 2018 - - -

8 November company records 2018 - - -

9 December p204-207, l. 58 2018 - - -

10 January company records 2019 - - -

11 February company records 2019 - - -

12 March p204-207, l. 58 2019 - - -

13 April company records 2019 - - -

14 May company records 2019 - - -

15 Transmission Plant In Service Average of Lines 2-14 - - -

16 Calculation of Distribution Plant In Service Source

17 May company records 2018 - - -

18 June p204-207, l. 75 2018 - - -

19 July company records 2018 - - -

20 August company records 2018 - - -

21 September p204-207, l. 75 2018 - - -

22 October company records 2018 - - -

23 November company records 2018 - - -

24 December p204-207, l. 75 2018 - - -

25 January company records 2019 - - -

26 February company records 2019 - - -

27 March p204-207, l. 75 2019 - - -

28 April company records 2019 - - -

29 May company records 2019 - - -

30 Distribution Plant In Service Average of Lines 17-29 - - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

31 Calculation of Intangible Plant In Service Source

31 Calculation of Intangible Plant In Service Source

32 May company records 2018 - - -

33 June p204-207, l. 5 2018 - - -

34 July company records 2018 - - -

35 August company records 2018 - - -

36 September p204-207, l. 5 2018 - - -

37 October company records 2018 - - -

38 November company records 2018 - - -

39 December p204-207, l. 5 2018 - - -

40 January company records 2019 - - -

41 February company records 2019 - - -

42 March p204-207, l. 5 2019 - - -

43 April company records 2019 - - -

44 May company records 2019 - - -

45 Intangible Plant In Service Average of Lines 32-44 - - -

46 Calculation of General Plant In Service Source

47 May company records 2018 - - -

48 June p204-207, l. 99 2018 - - -

49 July company records 2018 - - -

50 August company records 2018 - - -

51 September p204-207, l. 99 2018 - - -

52 October company records 2018 - - -

53 November company records 2018 - - -

54 December p204-207, l. 99 2018 - - -

55 January company records 2019 - - -

56 February company records 2019 - - -

57 March p204-207, l. 99 2019 - - -

58 April company records 2019 - - -

59 May company records 2019 - - -

60 General Plant In Service Average of Lines 47-59 - - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

61 Calculation of Production Plant In Service Source

61 Calculation of Production Plant In Service Source

62 May company records 2018 - - -

63 June p204-207, l. 46 2018 - - -

64 July company records 2018 - - -

65 August company records 2018 - - -

66 September p204-207, l. 46 2018 - - -

67 October company records 2018 - - -

68 November company records 2018 - - -

69 December p204-207, l. 46 2018 - - -

70 January company records 2019 - - -

71 February company records 2019 - - -

72 March p204-207, l. 46 2019 - - -

73 April company records 2019 - - -

74 May company records 2019 - - -

75 Production Plant In Service Average of Lines 62-74 - - -

76 Total Plant In Service | | Sum Lines 15, 30, 45, 60, & 75) - - - |

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Accumulated Depreciation Worksheet

Accumulated Depreciation Worksheet

Less: Asset

Retirement

77 Calculation of Transmission Accumulated Depreciation Source Year Balance Obligations Adjusted Balance

78 May company records 2018 - - -

79 June p219.25c 2018 - - -

80 July company records 2018 - - -

81 August company records 2018 - - -

82 September p219.25c 2018 - - -

83 October company records 2018 - - -

84 November company records 2018 - - -

85 December p219.25c 2018 - - -

86 January company records 2019 - - -

87 February company records 2019 - - -

88 March p219.25c 2019 - - -

89 April company records 2019 - - -

90 May company records 2019 - - -

91 Transmission Accumulated Depreciation Average of Lines 78-90 - - -

92 Calculation of Distribution Accumulated Depreciation Source

93 May company records 2018 - - -

94 June company records 2018 - - -

95 July company records 2018 - - -

96 August company records 2018 - - -

97 September company records 2018 - - -

98 October company records 2018 - - -

99 November company records 2018 - - -

100 December company records 2018 - - -

101 January company records 2019 - - -

102 February p219.25.b 2019 - - -

103 March company records 2019 - - -

104 April company records 2019 - - -

105 May company records 2019 - - -

106 Distribution Accumulated Depreciation Average of Lines 93-105 - - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

107 Calculation of Intangible Accumulated Amortization Source

107 Calculation of Intangible Accumulated Amortization Source

108 May company records 2018 - - -

109 June company records 2018 - - -

110 July company records 2018 - - -

111 August company records 2018 - - -

112 September company records 2018 - - -

113 October company records 2018 - - -

114 November company records 2018 - - -

115 December company records 2018 - - -

116 January company records 2019 - - -

117 February p200.21.c 2019 - - -

118 March company records 2019 - - -

119 April company records 2019 - - -

120 May company records 2019 - - -

121 Accumulated Intangible Amortization Average of Lines 108-120 - - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

122 Calculation of General Accumulated Depreciation Source

122 Calculation of General Accumulated Depreciation Source

123 May company records 2018 - - -

124 June company records 2018 - - -

125 July company records 2018 - - -

126 August company records 2018 - - -

127 September company records 2018 - - -

128 October company records 2018 - - -

129 November company records 2018 - - -

130 December company records 2018 - - -

131 January company records 2019 - - -

132 February p219.28.b 2019 - - -

133 March company records 2019 - - -

134 April company records 2019 - - -

135 May company records 2019 - - -

136 Accumulated General Depreciation Average of Lines 123-135 - - -

137 Calculation of Production Accumulated Depreciation Source

138 May company records 2018 - - -

139 June company records 2018 - - -

140 July company records 2018 - - -

141 August company records 2018 - - -

142 September company records 2018 - - -

143 October company records 2018 - - -

144 November company records 2018 - - -

145 December company records 2018 - - -

146 January company records 2019 - - -

147 February p219.20 thru 219.24.b 2019 - - -

148 March company records 2019 - - -

149 April company records 2019 - - -

150 May company records 2019 - - -

151 Production Accumulated Depreciation Average of Lines 138-150 - - -

152 Total Accumulated Depreciation and Amortization | | Sum of Lines 91, 106, 121, 136, & 151) - - - |

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Attachment 3 - Cost Support

Attachment 3 - Cost Support

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Investment Tax Credits and Prepayments

Details Investment Tax Credit Beginning of Year End of Year Average Balance Annual Amortization

1 Account No. 255 (enter negative) 267.8.h - - - -

Prepayments (Account 165)

(Prepayments exclude Prepaid Pension Assets) Year Balance

2 May company records 2018 -

3 June 111.57.c 2018 -

4 July company records 2018 -

5 August company records 2018 -

6 September 111.57.c 2018 -

7 October company records 2018 -

8 November company records 2018 -

9 December 111.57.c 2018 -

10 January company records 2019 -

11 February company records 2019 -

12 March 111.57.c 2019 -

13 April company records 2019 -

14 May company records 2019 -

15 Prepayments Average of Lines 2-14 -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Reserves

Reserves

(b) (c) (d) (e) (f) (g) (h)

Enter 1 if NOT in a Enter the percentage

trust or reserved Enter 1 if the accrual account is paid for by customers, 1 account, enter zero included in the formula rate, less the percent

(0) if included in a enter (0) if O if the accrual associated with an Amount Allocated:

trust or reserved account is NOT included in the offsetting liability on the Allocation (Plant or Col. (d) * Col. (e) *

Electric only 13 Month Average Amount account formula rate balance sheet Labor Allocator) Col. (f) * Col. (g)

16 Injuries & Damages Reserve 112.27.d - 1 1 100.0% - -

17 Reserve 2 - - - - - -

18 Reserve 3 - - - - - -

19 Reserve 4 - - - - - -

20 … - - - - - -

21 … - - - - - -

22 Total -

All applicable unfunded reserves will be listed above, specifically including (but not limited to) all subaccounts for FERC Account Nos. 228.1 through 228.4. "Unfunded reserve" is defined as an accrued balance (1)

created and increased by debiting an expense which is included in this formula rate (column (e), using the same allocator in column (g) as used in the formula to allocate the amounts in the corresponding expense

account) (2) in advance of an anticipated expenditure related to that expense (3) that is not deposited in a restricted account (e.g., set aside in an escrow account, see column (d)) with the earnings thereon retained

within that account. Where a given reserve is only partially funded through accruals collected from customers, only the balance funded by customer collections shall serve as a rate base credit, see column (f). The

source of monthly balance data is company records.

Average Reserve Balance Year Injuries and Damages Reserve 2 Reserve 3 Reserve 4

23 May 2018 - - - - - -

24 June 2018 - - - - - -

25 July 2018 - - - - - -

26 August 2018 - - - - - -

27 September 2018 - - - - - -

28 October 2018 - - - - - -

29 November 2018 - - - - - -

30 December 2018 - - - - - -

31 January 2019 - - - - - -

32 February 2019 - - - - - -

33 March 2019 - - - - - -

34 April 2019 - - - - - -

35 May 2019 - - - - - -

36 Reserves - - - - - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

EPRI Dues Cost Support

EPRI Dues Cost Support

Amount Allocated General & Common Expenses

| 37 EPRI and EEI Dues to be excluded from the formula rate | | EPRI Dues EEI Dues p353._.f (enter FN1 line #) - 3._.f (enter FN1 line #) - |

Regulatory Expense Related to Transmission Cost Support

| Form 1 Amount | | Transmission Related Other | | Details* |

Directly Assigned A&G

38 Regulatory Commission Exp Account 928 p323.189.b - -

* insert case specific detail and associated assignments here

Multi-state Workpaper

New York MTA NYC Weighed Average

Income Tax Rates

Weighting 100% 0% 0%

39 SIT=State Income Tax Rate or Composite 0.00% 0.00% 0.00% 0.00%

Multiple state rates are weighted based on the state apportionment factors on the state income tax returns and the number of days in the year that the rates are effective (see Note F of Appendix A)

Safety Related and Education and Out Reach Cost Support

| Safety Related, Education, Siting & Form 1 Amount Outreach Related Other Directly Assigned A&G 40 General Advertising Exp Account 930.1 company records - - - | | Details |

Safety advertising consists of any advertising whose primary purpose is to educate the recipient as to what is safe or is not safe.

Education advertising consists of any advertising whose primary purpose is to educate the recipient as about transmission related facts or issues.

Outreach advertising consists of advertising whose primary purpose is to attract the attention of the recipient about a transmission related issue.

Siting advertising consists of advertising whose primary purpose is to inform the recipient about locating transmission facilities.

Lobbying expenses are not allowed to be included in account 930.1.

Excluded Plant Cost Support

| Excluded Transmission Facilities | | Transmission plant included in OATT Ancillary Services and not otherwise excluded | | Description of the Facilities |

Adjustment to Remove Revenue Requirements Associated with Excluded Transmission Facilities

| 41 Excluded Transmission Facilities - - | | All other Transmission Assets besides the Hurley Project are not included in the Hurley Project formula rate. |

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Materials & Supplies

Materials & Supplies

| Stores Expense Undistributed | | Construction Materials & Supplies Total Gross Plant Allocator | | Allocated Amount | | Transmissio n Materials & Supplies | | Transmission Plant Allocator | | Allocated Amount Total |

Form No.1 page Year p227.16 p227.5 p227.8

42 May Company Records 2018 - - - -

43 June Company Records 2018 - - - -

44 July Company Records 2018 - - - -

45 August Company Records 2018 - - - -

46 September Company Records 2018 - - - -

47 October Company Records 2018 - - - -

48 November Company Records 2018 - - - -

49 December FF1 p. 227 2018 - - - -

50 January Company Records 2019 - - - -

51 February Company Records 2019 - - - -

52 March Company Records 2019 - - - -

53 April Company Records 2019 - - - - 54 May Company Records 2019 - - - -

55 Average - - - - 100.00% - -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Attachment 4 - Cost Support

Attachment 4 - Cost Support

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

COST OF CAPITAL

Form No.1 May June July August September October November December January February March April May

Line No. Description Reference 2018 2019 13 Month Avg.

company records FF1 company records company records FF1 company records company records FF1 company records company records FF1 company records company records

1 Long Term Debt:

2 Acct 221 Bonds 112.18.c,d - - - - - - - - - - - - - -

3 Acct 223 Advances from Assoc. Companies 112.20.c,d - - - - - - - - - - - - - -

4 Acct 224 Other Long Term Debt 112.21.c,d - - - - - - - - - - - - - -

5 Less Acct 222 Reacquired Debt 112.19 c, d enter negative - - - - - - - - - - - - - -

6 Total Long Term Debt Sum Lines 2 - 5 - - - - - - - - - - - - - -

7 Preferred Stock 112.3.c,d - - - - - - - - - - - - - -

8 Common Equity- Per Books 112.16.c,d - - - - - - - - - - - - - -

9 Less Acct 204 Preferred Stock 112.3.c,d - - - - - - - - - - - - - - 10 Less Acct 219 Accum Other Compre. Income 112.15.c,d - - - - - - - - - - - - - -

Less Acct 216.1 Unappropriated Undistributed

11 Subsidiary Earnings 112.12.c,d - - - - - - - - - - - - - -

12 Adjusted Common Equity Lines 8 - 9 - 10 - 11 - - - - - - - - - - - - - -

13 Total Capitalization Lines 6 + 7 + 12 - - - - - - - - - - - - - -

Cost of Debt

14 Acct 427 Interest on Long Term Debt 117.62.c - - - - - - - - - - - - - -

15 Expense 117.63.c - - - - - - - - - - - - - -

16 Acct 428.1 Amortization of Loss on Reacquired Debt 117.64.c - - - - - - - - - - - - - -

Acct 430 Interest on Debt to Assoc. Companies

17 (LTD portion only) (Note 1) 117.67.c - - - - - - - - - - - - - -

18 Less: Acct 429 Amort of Premium on Debt 117.65.c enter negative - - - - - - - - - - - - - -

19 Reacquired Debt 117.66.c enter negative - - - - - - - - - - - - - - 20 Total Interest Expense Sum Lines 14 - 19 - - - - - - - - - - - - - -

21 Average Cost of Long-term DebtDebt Line 20 / Line 6 0.00%

Cost of Preferred Stock

22 Preferred Stock Dividends 118.29.c - - - - - - - - - - - - - -

23 Average Cost of Preferred Stock Line 22 / Line 7 0.00%

Note 1. Interest on Debt to Associated Companies (FERC 430) will be populated with interest related to Long-Term Debt only.

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Central Hudson Gas and Electric Corporation

Central Hudson Gas and Electric Corporation

Attachment 5: Excess or Deficient Accumulated Deferred Income Taxes

Resulting from Income Tax Rate Changes (Note A)

Debit amounts are shown as positive and credit amounts are shown as negative.

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) (n)

Deficient or Adjusted Protected (P)

Excess Deficient or Schedule 19 Unprotected ADIT Balances Accumulated Excess Projects Property (UP)

ADIT Balances After Deferred Accumulated Allocation Allocated to Unprotected

Prior to Remeasurement Taxes at Adjustments After Deferred Factors (Note Schedule 19 Other (UO) Amortizatio Balance at Amortization Balance at

Line Description Remeasurement (Note C) December 31, Remeasurement Taxes B) Projects (Note B) n Year December 31 Year December 31 `

Column (b) * Column (b) - Column (d) Column (f) * Column (h) - Column (k) -

Line 43 Column (c) + Column (e) Column (g) Column (j) Column (l)

Deficient Deferred Income Taxes -

amortized to 410.1

FERC Account 190

1 0 0 0 0 0 0.000% 0 0 0 0 0

2 0 0 0 0 0 0.000% 0 0 0 0 0

3 0 0 0 0 0 0.000% 0 0 0 0 0

4 0 0 0 0 0 0.000% 0 0 0 0 0

5 0 0 0 0 0 0.000% 0 0 0 0 0

6 Total FERC Account 190 0 0 0 0 0 0 0 0 0 0

FERC Account 282

7 Depreciation - Liberalized Depreciation 0 0 0 0 0 0.000% 0 0 0 0 0

8 0 0 0 0 0 0.000% 0 0 0 0 0

9 0 0 0 0 0 0.000% 0 0 0 0 0

10 0 0 0 0 0 0.000% 0 0 0 0 0

11 Total Account 282 0 0 0 0 0 0 0 0 0 0

FERC Account 283

12 0 0 0 0 0 0.000% 0 0 0 0 0

13 0 0 0 0 0 0.000% 0 0 0 0 0

14 0 0 0 0 0 0.000% 0 0 0 0 0

15 0 0 0 0 0 0.000% 0 0 0 0 0

16 0 0 0 0 0 0.000% 0 0 0 0 0

17 Total FERC Account 283 0 0 0 0 0 0 0 0 0 0

Subtotal Before Being Grossed up for

18 Income Taxes 0 0 0 0 0 0 0

19 Gross Up 0 0 0 0 0

Total Deficient Accumulated Deferred

20 Income Taxes - Account 182.3 0 0 0 0 0

Excess Accumulated Deferred Income Taxes - amortized to 411.1

FERC Account 190

21 0 0 0 0 0 0.000% 0 0 0 0 0

22 0 0 0 0 0 0.000% 0 0 0 0 0

23 Total Account 190 0 0 0 0 0 0 0 0 0 0

FERC Account 282

24 Depreciation - Liberalized Depreciation 0 0 0 0 0 0.000% 0 P 0 0 0 0

25 0 0 0 0 0 0.000% 0 0 0 0 0

26 0 0 0 0 0 0.000% 0 0 0 0 0

27 0 0 0 0 0 0.000% 0 0 0 0 0

28 0 0 0 0 0 0.000% 0 0 0 0 0

29 Total Account 282 0 0 0 0 0 0 0 0 0 0

FERC Account 283

30 0 0 0 0 0 0.000% 0 0 0 0 0

31 0 0 0 0 0 0.000% 0 0 0 0 0

32 0 0 0 0 0 0.000% 0 0 0 0 0

33 0 0 0 0 0 0.000% 0 0 0 0 0

34 0 0 0 0 0 0.000% 0 0 0 0 0

35 Total Account 283 0 0 0 0 0 0 0 0 0 0

| 36 37 Gross Up 0 0 0 0 0 38 Income Taxes - Account 254 0 0 0 0 0 | Subtotal Before Being Grossed up for Income Taxes 0 0 0 0 0 0 0 Total Excess Accumulated Deferred |

39 Grand Total 0 0 0 0 0

40 Total Amortization 0 0

Note A: Includes Excess or Deficient Deferred Income Tax Liabilities or Income Tax Assets and the associated amortization arising from income tax rate changes in the future. This sheet will be populated and replicated for any future change in federal, state or local income tax rates.

Note B: The allocation factors used to allocate total excess accumulated deferred income taxes to local transmission projections are (to be completed when used) Note C: Remeasurement Factor equals the ratio of the current nominal tax rate to the prior nominal tax rate

41 New nominal rate 1.0% 42 Prior nominal rate 1.0% 43 Remeasurement Factor 100.0%

Note D:

Note E:

Note F:

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Attachment 6a - Accumulated Deferred Income Taxes (ADIT) Worksheet (Beginning of Year)

Beginning of Year

Transmission Plant Labor Total Item Related Related Related

Nonprorated Items

1 ADIT-282 - - - From Acct. 282 total, below

2 ADIT-283 - - - From Acct. 283 total, below

3 ADIT-190 - - - From Acct. 190 total, below

4 Subtotal - - -

5 Wages & Salary Allocator - Appendix A

6 Gross Plant Allocator - Appendix A

7 Beginning of Year - - - -

8 End of Year - - - - Attachment 6b, line

9 Average - - - -

10 Prorated ADIT Attachment 6c, line 14 or Attachment 6d, line 13

11 Total ADIT - Enter as negative Appendix A, line 21.

In filling out this attachment, a full and complete description of each item and justification for the allocation to Columns B-F and each separate ADIT item will be listed,

Dissimilar items with amounts exceeding $100,000 will be listed separately. For ADIT directly related to project depreciation or CWIP, the balance must shown in a separate row for each project.

A B C D E F G

Total Gas, Prod

ADIT-190 Or Other Transmission Plant Labor

Related Related Related Related Justification

12

Cost of Removal - - Related to Hurley Substation Project

13

- -

14

-

15

-

16

-

17

18

19

20

21

22

Subtotal - p234 - - - - -

23

Less FASB 109 Above if not separately removed -

24

Less FASB 106 Above if not separately removed - -

25 Total - - - - -

Instructions for Account 190:

1. ADIT items related only to Non-Electric Operations (e.g., Gas, Water, Sewer) or Production are directly assigned to Column C

2. ADIT items related only to Transmission are directly assigned to Column D

3. ADIT items related to Plant and not in Columns C & D are included in Column E 4. ADIT items related to labor and not in Columns C & D are included in Column F

5. If the item giving rise to the ADIT is not included in the formula, the associated ADIT amount shall be excluded

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Attachment 6a - Accumulated Deferred Income Taxes (ADIT) Worksheet (Beginning of Year)

Beginning of Year

A B C D E F G

Total Gas, Prod

ADIT- 282 Or Other Transmission Plant Labor

Related Related Related Related Justification

26

MACRS for plant additions - - Timing difference related to depreciation on Hurley Avenue Substation Project.

27

28

29

30

31

32

33

34

35

Subtotal - p275 - - - - -

36

Less FASB 109 Above if not separately removed -

37

Less FASB 106 Above if not separately removed - -

38 Total - - - - -

Instructions for Account 282:

1. ADIT items related only to Non-Electric Operations (e.g., Gas, Water, Sewer) or Production are directly assigned to Column C

2. ADIT items related only to Transmission are directly assigned to Column D

3. ADIT items related to Plant and not in Columns C & D are included in Column E 4. ADIT items related to labor and not in Columns C & D are included in Column F

5. If the item giving rise to the ADIT is not included in the formula, the associated ADIT amount shall be excluded

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Attachment 6a - Accumulated Deferred Income Taxes (ADIT) Worksheet (Beginning of Year)

Beginning of Year

A B C D E F G

Total Gas, Prod

ADIT- 283 Or Other Transmission Plant Labor

Related Related Related Related

39

- -

40

-

41

-

42

-

43

-

44

45

46

47

48

49 Subtotal - p277 - - - - -

50 Less FASB 109 Above if not separately removed - -

51 Less FASB 106 Above if not separately removed

52 Total - - - - -

Instructions for Account 283:

1. ADIT items related only to Non-Electric Operations (e.g., Gas, Water, Sewer) or Production are directly assigned to Column C

2. ADIT items related only to Transmission are directly assigned to Column D

3. ADIT items related to Plant and not in Columns C & D are included in Column E

4. ADIT items related to labor and not in Columns C & D are included in Column F

5. If the item giving rise to the ADIT is not included in the formula, the associated ADIT amount shall be excluded

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Attachment 6b - Accumulated Deferred Income Taxes (ADIT) Worksheet (End of Year)

End of Year

Transmission Plant Labor Total

Related Related Related

Nonprorated Items

1 ADIT-282 - - - From Acct. 282 total, below

2 ADIT-283 - - - From Acct. 283 total, below

3 ADIT-190 - - - From Acct. 190 total, below

4 Subtotal - - -

5 Wages & Salary Allocator - Appendix A

6 Gross Plant - Appendix A

7 End of Year ADIT - - - -

In filling out this attachment, a full and complete description of each item and justification for the allocation to Columns B-F and each separate ADIT item will be listed,

dissimilar items with amounts exceeding $100,000 will be listed separately. For ADIT directly related to project depreciation or CWIP, the balance must be shown in a separate row for each project.

A B C D E F G

Total Gas, Prod

ADIT-190 Or Other Transmission Plant Labor

Related Related Related Related Justification

8 Cost of Removal - Related to Hurley Avenue Substation Project.

9 -

10 -

11 -

12 -

13

14

15

16

17

18 Subtotal - p234 - - - - -

19 Less FASB 109 Above if not separately removed -

20 Less FASB 106 Above if not separately removed - -

21 Total - - - - -

Instructions for Account 190:

1. ADIT items related only to Non-Electric Operations (e.g., Gas, Water, Sewer) or Production are directly assigned to Column C

2. ADIT items related only to Transmission are directly assigned to Column D

3. ADIT items related to Plant and not in Columns C & D are included in Column E 4. ADIT items related to labor and not in Columns C & D are included in Column F

5. If the item giving rise to the ADIT is not included in the formula, the associated ADIT amount shall be excluded

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Attachment 6b - Accumulated Deferred Income Taxes (ADIT) Worksheet (End of Year)

End of Year

A B C D E F G

Total Gas, Prod

ADIT- 282 Or Other Transmission Plant Labor

Related Related Related Related Justification

22 MACRS for plant additions Timing difference related to depreciation on Hurley Avenue Substation Project.

23

24

25

26

27

28

29

30

31 Subtotal - p275 - - - - -

32 Less FASB 109 Above if not separately removed -

33 Less FASB 106 Above if not separately removed - -

34 Total - - - - -

Instructions for Account 282:

1. ADIT items related only to Non-Electric Operations (e.g., Gas, Water, Sewer) or Production are directly assigned to Column C

2. ADIT items related only to Transmission are directly assigned to Column D

3. ADIT items related to Plant and not in Columns C & D are included in Column E 4. ADIT items related to labor and not in Columns C & D are included in Column F

5. If the item giving rise to the ADIT is not included in the formula, the associated ADIT amount shall be excluded

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Attachment 6b - Accumulated Deferred Income Taxes (ADIT) Worksheet (End of Year)

End of Year

A B C D E F G

Total Gas, Prod

ADIT- 283 Or Other Transmission Plant Labor

Related Related Related Related

35

36

37

38

39

40

41

42

43

44

45 Subtotal - p277 - - - - -

46 Less FASB 109 Above if not separately removed - -

47 Less FASB 106 Above if not separately removed - -

48 Total - - - - -

Instructions for Account 283:

1. ADIT items related only to Non-Electric Operations (e.g., Gas, Water, Sewer) or Production are directly assigned to Column C

2. ADIT items related only to Transmission are directly assigned to Column D

3. ADIT items related to Plant and not in Columns C & D are included in Column E

4. ADIT items related to labor and not in Columns C & D are included in Column F

5. If the item giving rise to the ADIT is not included in the formula, the associated ADIT amount shall be excluded

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Central Hudson Gas and Electric Corporation

Central Hudson Gas and Electric Corporation

Workpaper 6c: Accumulated Deferred Income Taxes - Prorated Projection

Debit amounts are shown as positive and credit amounts are shown as negative. Rate Year =

Account 282 (Note A)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) (n) (o) (p) (q) (r)

Beginning Balance & Monthly Year Days in Number of Total Days Weighting Beginning Transmission Transmission Plant Gross Plant Plant Plant Proration Labor W/S Labor Labor Total Transmission

Changes the Month Days in the for Balance/ Proration Related Allocator Allocation (f) x (l) Related Allocator Allocation Proration Prorated Amount

Remaining in Projected Projection Monthly Amount/ (f) x (h) (Appendix A) (j) * (k) (General (Appendix A) (n) * (o) (f) x (p) (i) + (m) + (q)

Year After Rate Year (d)/(e) Ending Balance and

Current Month Common)

May 31st balance of Prorated ADIT

1 (Note B) 2020 100.00% 0 0 0 -

2 June 2021 30 336 365 92.05% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

3 July 2021 31 305 365 83.56% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

4 August 2021 31 274 365 75.07% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

5 September 2021 30 244 365 66.85% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

6 October 2021 31 213 365 58.36% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

7 November 2021 30 183 365 50.14% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

8 December 2021 31 152 365 41.64% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

9 January 2021 31 121 365 33.15% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

10 February 2021 28 93 365 25.48% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

11 March 2021 31 62 365 16.99% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

12 April 2021 30 32 365 8.77% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

13 May 2021 31 1 365 0.27% 0 0 0 0 0.000% 0 0 0 0.000% 0 0 -

14 Prorated Balance 365 0 0 0 0 0 0 0 -

Note A: The calculations of ADIT amounts resulting from liberalized depreciations are performed in accordance with the proration requirements of Treasury Regulation Section 1.167(l)-1(h)(6).

Note B: From Worksheet 6d-Prior Year ADIT Proration Actual

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Central Hudson Gas and Electric Corporation

Central Hudson Gas and Electric Corporation

Workpaper 6d: Accumulated Deferred Income Taxes - Actual Proration

Year =

Debit amounts are shown as positive and credit amounts are shown as negative.

Account 282 (Note A)

| Days in Period | | Projection - Proration of Projected Deferred Tax Activity | | Actual Activity - Proration of Projected Deferred Tax Activity and Averaging of Other Deferred Tax Activity |

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) (n)

| Month | | Days in the Month | | Number of Days Remaining in Year After Month's Accrual of Deferred Taxes | | Total Days in Projected Rate Year (Line 14, Col b) | | Proration Percentage (c)/(d) | | Projected Monthly Activity | | Prorated Amount (e) * (f) | | Prorated Projected Balance Sum of (g) | | Actual Monthly Activity (table below, grand total) | | Difference between projected monthly and actual monthly activity (i) - (f) | | Preserve proration when actual monthly and projected monthly activity are either both increases or decreases. (See Note A) | | Difference between projected and actual activity when actual and projected activity are either both increases or decreases. (See Note A) | | Actual activity (Col I) when projected activity is an increase while actual activity is a decrease OR projected activity is a decrease while actual activity is an increase. (See Note A) | | Balance reflecting proration or averaging (n) + (k) +((l) + (m))/2 |

1 May 31st balance 0 0

2 June 30 336 365 92.05% 0 0 0 0 0 0 0 0 0

3 July 31 305 365 83.56% 0 0 0 0 0 0 0 0 0

4 August 31 274 365 75.07% 0 0 0 0 0 0 0 0 0

5 September 30 244 365 66.85% 0 0 0 0 0 0 0 0 0

6 October 31 213 365 58.36% 0 0 0 0 0 0 0 0 0

7 November 30 183 365 50.14% 0 0 0 0 0 0 0 0 0

8 December 31 152 365 41.64% 0 0 0 0 0 0 0 0 0

9 January 31 121 365 33.15% 0 0 0 0 0 0 0 0 0

10 February 28 93 365 25.48% 0 0 0 0 0 0 0 0 0

11 March 31 62 365 16.99% 0 0 0 0 0 0 0 0 0

12 April 30 32 365 8.77% 0 0 0 0 0 0 0 0 0

13 May 31 1 365 0.27% 0 0 0 0 0 0 0 0 0

14 Total 365 0 0 0 0 0 0 0

Labor

Gross Plant

Related

Schedule 19 Allocator Total (d) * W/S Allocator Grand Total (b)

Projects Plant Related (Appendix A) (e) (Appendix A) Total (g) * (h) + (f) + (i)

(General and

Actual Monthly Activity

15 June 0 0 0.000% 0 0 0.000% 0 0

16 July 0 0 0.000% 0 0 0.000% 0 0

17 August 0 0 0.000% 0 0 0.000% 0 0

18 September 0 0 0.000% 0 0 0.000% 0 0

19 October 0 0 0.000% 0 0 0.000% 0 0

20 November 0 0 0.000% 0 0 0.000% 0 0

21 December 0 0 0.000% 0 0 0.000% 0 0

22 January 0 0 0.000% 0 0 0.000% 0 0

23 February 0 0 0.000% 0 0 0.000% 0 0

24 March 0 0 0.000% 0 0 0.000% 0 0

25 April 0 0 0.000% 0 0 0.000% 0 0

26 May 0 0 0.000% 0 0 0.000% 0 0

Note A: The calculations of ADIT amounts resulting from liberalized depreciations are performed in accordance with the proration requirements of Treasury Regulation Section 1.167(l)-1(h)(6).

Differences attributable to over-projection of ADIT in the annual projection will result in a proportionate reversal of the projected prorated ADIT activity to the extent of the over-projection.

Differences attributable to under-projection of ADIT in the annual projection will result in an adjustment to the projected prorated ADIT activity by the difference between the projected monthly activity

and the actual monthly activity. However, when projected monthly ADIT activity is an increase and actual monthly ADIT activity is a decrease, actual monthly ADIT activity will be used.

Likewise, when projected monthly ADIT activity is a decrease and actual monthly ADIT activity is an increase, actual monthly ADIT activity will be used.

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Central Hudson Gas and Electric Corporation

Central Hudson Gas and Electric Corporation

Attachment 7 - Annual True-Up Adjustment

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

| Year Year Revenue Requirement Billed Actual Revenue Requirement (Note 1) (Note 2) | | Over (Under) Recovery |

0 Less 0 Equals $0

Interest Rate on Amount of Refunds or Surcharges | | Over (Under) Recovery Plus Interest | | Monthly Interest Rate on Attachment 7a Months Calculated Interest Amortization 0.0000% | | Surcharge (Refund) Owed |

An over or under collection will be recovered prorata over year collected, held for one year and returned prorata over next year.

If the first year is a partial year, the true-up (over or under recovery per month and interest calculation) will reflect only the

number of months for which the rate was charged.

Calculation of Interest Year Monthly

June 2018 - 0.0000% 12 - -

July 2018 - 0.0000% 11 - -

August 2018 - 0.0000% 10 - -

September 2018 - 0.0000% 9 - -

October 2018 - 0.0000% 8 - -

November 2018 - 0.0000% 7 - -

December 2018 - 0.0000% 6 - -

Janiary 2019 - 0.0000% 5 - -

February 2019 - 0.0000% 4 - -

March 2019 - 0.0000% 3 - -

April 2019 - 0.0000% 2 - -

May 2019 - 0.0000% 1 - -

- -

Annual

June through May 2019-2020 - 0.0000% 12 - -

Over (Under) Recovery Plus Interest Amortized and Recovered Over 12 Months Monthly

June 2020 - 0.0000% - - -

July 2020 - 0.0000% - - -

August 2020 - 0.0000% - - -

September 2020 - 0.0000% - - -

October 2020 - 0.0000% - - -

November 2020 - 0.0000% - - -

December 2020 - 0.0000% - - -

Janiary 2021 - 0.0000% - - -

February 2021 - 0.0000% - - -

March 2021 - 0.0000% - - -

April 2021 - 0.0000% - - -

May 2021 - 0.0000% - - -

-

Total Amount of True-Up Adjustment $ -

Less Over (Under) Recovery $ -

Total Interest $ -

Note 1: Revenue requirements billed is input, source data are the invoices from NYISO. The amounts exclude any true ups or prior period adjustments.

Note 2: The actual revenue requirement is input from Appendix A. The amounts exclude any true-ups or prior period corrections.

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Attachment 7a - Interest Rate for Annual True-Up Adjustment

Attachment 7a - Interest Rate for Annual True-Up Adjustment

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

FERC

Interest 18 C.F.R. Section

Rate 18 35.19 (a)

1 QTR 3 2018 0.00%

2 QTR 4 2018 0.00%

3 QTR 1 2019 0.00%

4 QTR 2 2019 0.00%

5 QTR 3 2019 0.00%

6 QTR 4 2019 0.00%

7 QTR 1 2020 0.00%

8 QTR 2 2020 0.00%

9 QTR 3 2020 0.00%

10 QTR 4 2020 0.00%

11 QTR 1 2021 0.00% 12 QTR 2 2021 0.00%

13 Average 0.00%

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Central Hudson Gas and Electric Corporation

Central Hudson Gas and Electric Corporation

Attachment 8 - Depreciation and Amortization Rates

HURLEY AVENUE PROJECT - SYSTEM DISTRIBUTION UPGRADE

Effective July 1, 2024

| Account Number FERC Account | | Rate (Annual) Percent |

TRANSMISSION PLANT

1 350.1 Land Rights - Substations and Other 1.18%

2 352 Structures and Improvements 1.63%

3 353 Station Equipment 2.26%

4 353 Supervisory Equipment - In Use 3.64%

5 353 Supervisory Equipment - Held 2.67%

6 353 Station Equipment - Electronics 4.00%

7 354 Towers and Fixtures 1.63%

8 355 Poles and Fixtures 3.09%

9 356 Overhead Conductor and Devices 2.29%

10 356 Overhead Lines - Clearing 2.13%

11 356.3 Smart Wire Devise 2.75%

11 357 Underground Conduit 2.44%

12 358 Underground Conductor and Devices 1.92%

GENERAL PLANT

12 390 Structures & Improvements 2.89%

13 390 Structures & Improvements - Equipment and Landscaping 3.75%

14 391 EDP Equipment - System and Main Frame 12.50%

15 391 EDP - Systems Operations - SCADA Data Handling Equipment 9.89%

16 391 Office Furniture 10.00%

17 392 Transportation Equipment 7.50%

18 393 Stores Equipment 4.00%

19 394 Garage and Repair Equipment 3.55%

20 394 Shop Equipment 1.80%

21 394 Tools and Work Equipment 3.92%

22 395 Laboratory Equipment 4.00%

23 396 Power Operated Equipment 6.92%

24 397 Communication Equipment 10.00%

25 398 Miscellaneous Equipment 5.00%

INTANGIBLE PLANT

26 303 3 Yr 33.33%

27 5 Yr 20.00%

28 15 year 6.67%

29 Transmission Facility Contributions in Aid of Construction Note 1

These depreciation and amortization rates will not change absent the appropriate filing at FERC.

Note 1: The Contribution in Aid of Construction (CIAC) related to this Project is applied to offset all

transmission plant categories with the remaining balance in account 356.3 for the new Smart Wire Device for the

purposes of calculating rate base and depreciation to be recovered.

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

NYISO Tariffs --> Open Access Transmission Tariff (OATT) --> 6 OATT Rate Schedules --> 6.12.5.2.1 OATT Schedule 12 - Formula Rate Template

Central Hudson Gas and Electric Corporation

Central Hudson Gas and Electric Corporation

Attachment 9 - Workpapers

HURLEY AVENUE PROJECT - SYSTEM DELIVERABILITY UPGRADE

Land Held for Future Use (LHFU)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) (n) (o) (p) (q)

Land Held for May June July August September October November December January February March April May Average of

Future Use and Columns (d)

No. Subaccount No. Item Name Estimated Date 2018 2018 2018 2018 2018 2018 2018 2018 2019 2019 2019 2019 2019 Through (p)

1 -

2 -

3 -

4 -

5 -

6 -

7 -

8 -

9 -

10 -

11 Total LHFU in rate base (sum lines 5a-5x): -

Actual Additions by FERC Account - Hurley Avenue Project

The Total column is included in a footnote to FERC Form No.1 on page 204-207.

Project 350 352 352 353 354 355 356 357 358 356

Structures

and Overhead Underground Contribution in To Be

Structures and Improvements Station Towers and Poles and Conductor and Underground Conductor and Smart Wire Aid of Included in the

Land Rights Improvements - Equipment Equipment Fixtures Fixtures Devices Conduit Devices Device Total Construction Formual Rate

12 May 2018 Hurley Avenue SDU - - - - - - - -

13 June - - -

14 July - - -

15 August - - -

16 September - - -

17 October - - -

18 November - - -

19 December - - -

20 January 2019 - - -

21 February - - -

22 March - - -

23 April - - -

24 13 Month Average Total (sum lines 9a-9x) - - -

Accumulated Depreciation The amounts are included in a footnote to FERC Form No.1 on page 219.

Hurley

25 May 2025 -

26 June -

27 July -

28 August -

29 September -

30 October -

31 November -

32 December -

33 Janaury 2026 -

34 February - 35 March -

Depreciation Average 36 April - Expense Depreciation

37 May - $0.00 0.00%

38 13 Month Average -

Effective Date: 6/1/2025 - Docket #: ER25-2636-000 - Page 1

![]() 6.12.5.2.1 Formula Rate Template

6.12.5.2.1 Formula Rate Template