NYISO Tariffs --> Market Administration and Control Area Services Tariff (MST) --> 25 MST Attachment J - Determination Of Day-Ahead Margin Assu

25Attachment J – Determination of Day-Ahead Margin Assurance Payments and Import Curtailment Guarantee Payments

25.1Introduction

If a Supplier that is eligible pursuant to Section 25.2 of this Attachment J buys out of a Day-Ahead Energy, Regulation Service or Operating Reserve schedule in a manner that reduces its Day-Ahead Margin it shall receive a Day-Ahead Margin Assurance Payment, except as noted in Sections 25.2, 25.3, 25.4, and 25.5 of this Attachment J. The purpose of such payments is to protect Suppliers’ Day-Ahead Margins associated with real-time reductions after accounting for: (i) any real-time profits associated with offsetting increases in real-time Energy, Regulation Service, or Operating Reserve schedules; and (ii) any Supplier-requested real-time de-rate granted by the ISO.

In addition, a Supplier may be eligible to receive an Import Curtailment Guarantee Payment if its Import is curtailed at the request of the ISO as determined pursuant to Section 25.6 of this Attachment J.

25.2Eligibility for Receiving Day-Ahead Margin Assurance Payments

25.2.1General Eligibility Requirements for Suppliers to Receive Day-Ahead Margin Assurance Payments

Subject to Section 25.2.2 of this Attachment J, the following categories of Resources bid by Suppliers shall be eligible to receive Day-Ahead Margin Assurance Payments: (i) all Self-Committed Flexible and ISO-Committed Flexible Generators, other than Energy Storage Resources, that are either online and dispatched by RTD or available for commitment by RTC; (ii) Demand Side Resources committed to provide Operating Reserves or Regulation Service; (iii) any Resource, including an Energy Storage Resource, that is scheduled out of economic merit order by the ISO in response to an ISO or Transmission Owner system security need or to permit the ISO to procure additional Operating Reserves; (iv) any Resource, including Energy Storage Resources, internal to the NYCA that is derated or decommitted by the ISO in response to an ISO or Transmission Owner system security need or to permit the ISO to procure additional Operating Reserves; and (v) Energy Limited Resources with an ISO-approved real-time reduction in scheduled output from its Day-Ahead schedule.

25.2.2Exceptions

Notwithstanding Section 25.2.1 of this Attachment J, no Day-Ahead Margin Assurance Payment shall be paid to:

25.2.2.1a Resource, otherwise eligible for a Day-Ahead Margin Assurance Payment, in hours in which the NYISO has increased the Resource’s real-time minimum operating level above the Resource’s Day-Ahead Market Energy schedule either: (i) at the Resource’s request including through an adjustment to the Resource’s self-commitment schedule; or (ii) in order to reconcile the ISO’s dispatch with the Resource’s actual output or to address reliability concerns that arise because the Resource is not following Base Point Signals; or (iii) an Intermittent Power Resource that depends on wind as its fuel.

25.2.2.2a Resource, otherwise eligible for Day-Ahead Margin Assurance Payments, in hours in which the NYISO has increased the Resource’s real-time minimum operating level at the Resource’s request, including through an adjustment to the Resource’s self-commitment schedule, above the MW level determined by subtracting the Resource’s Day-Ahead Market Regulation Service schedule from its Day-Ahead Market Energy schedule.

25.2.2.3 a Resource, otherwise eligible for Day-Ahead Margin Assurance Payments, in hours in which the Resource reduces the MW quantity specified in its real-time Regulation Capacity Bid below its Day-Ahead Market Regulation Service schedule.

25.2.2.5A Generator that is available for commitment by RTC and otherwise eligible for Day-Ahead Margin Assurance Payments, for (i) any hour in which the Start-Up Bids submitted in the rReal-tTime mMarket for that Generator exceed the Start-Up Bids submitted in the Day-Ahead Market, or the mitigated Day-Ahead Start-Up Bids where appropriate, and that Generator was scheduled for Energy or Regulation Service in that hour in the Day-Ahead Market; and (ii) the two hours immediately preceding and the two hours immediately following the hour(s) in which the Start-Up Bids submitted in the rReal-tTime mMarket for that Generator exceed the Start-Up Bids submitted in the Day-Ahead Market, or the mitigated Day-Ahead Start-Up Bids where appropriate, and that Generator was scheduled for Energy or Regulation Service in that hour in the Day-Ahead Market.

25.2.2.6A Generator that is available for commitment by RTC and otherwise eligible for Day-Ahead Margin Assurance Payments, for (i) any hour in which the dollar component of the Minimum Generation Bids submitted in the Real-Time Market for that Generator exceed the dollar component of the Minimum Generation Bids submitted in the Day-Ahead Market, or the dollar component of the mitigated Day-Ahead Minimum Generation Bids where appropriate, and that Generator was scheduled for Energy in that hour in the Day-Ahead Market; and (ii) the two hours immediately preceding and the two hours immediately following the hour(s) in which the dollar component of the Minimum Generation Bids submitted in the Real-Time Market for that Generator exceed the dollar component of the Minimum Generation Bids submitted in the Day-Ahead Market, or the dollar component of the mitigated Day-Ahead Minimum Generation Bids where appropriate, and that Generator was scheduled for Energy in that hour in the Day-Ahead Market.

25.3Calculation of Day-Ahead Margin Assurance Payments

25.3.1 Formula for Day-Ahead Margin Assurance Payments for Generators, Except for Limited Energy Storage Resources

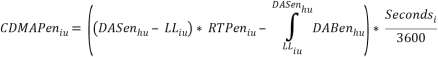

Subject to Sections 25.4 and 25.5 of this Attachment J, Day-Ahead Margin Assurance Payments for Generators, except for Limited Energy Storage Resources, shall be determined by applying the following equations to each individual Generator using the terms as defined in Section 25.3.4:

![]()

where:

![]()

25.3.1.1 Energy Contribution for Day-Ahead Margin Assurance Payments

If the Generator’s (i) Day-Ahead schedule is to inject Energy (i.e., greater than zero MW) and its real-time Energy schedule is lower than its Day-Ahead Energy schedule; or (ii) Day-Ahead schedule is to withdraw Energy (i.e., less than zero MW) and its real-time Energy schedule is greater than its Day-Ahead Energy schedule, then:

If the Generator’s (i) Day-Ahead Energy schedule is to inject Energy (i.e., greater than zero MW) and its real-time Energy schedule is greater than or equal to its Day-Ahead Energy schedule; or (ii) Day-Ahead Energy schedule is to withdraw Energy (i.e., less than zero MW), and its real-time Energy schedule is less than or equal to its Day-Ahead Energy schedule; or (iii) Day-Ahead Energy schedule is for zero MW, then:

25.3.1.2Operating Reserve Contribution for Day-Ahead Margin Assurance Payments

If the Generator’s real-time schedule for a given Operating Reserve product, p, is lower than its Day-Ahead Operating Reserve schedule for that product then:

![]()

If the Generator’s real-time schedule for a given Operating Reserve product, p, is greater than or equal to its Day-Ahead Operating Reserve schedule for that product then:

![]()

25.3.1.3Regulation Service Contribution for Day-Ahead Margin Assurance Payments

If the Generator’s real-time Regulation Service schedule is less than its Day-Ahead Regulation Service schedule then:

![]()

If the Generator’s real-time Regulation Schedule is greater than or equal to the Day-Ahead Regulation Service schedule then:

![]()

25.3.2Formula for Day-Ahead Margin Assurance Payments for Demand Side Resources

25.3.2.1Formula for Day-Ahead Margin Assurance Payment for Demand Side Resources

Subject to Section 25.5 of this Attachment J, Day-Ahead Margin Assurance Payments for Demand Side resources scheduled to provide Operating Reserves or Regulation Service shall be determined by applying the following equations to each individual Demand Side Resource using the terms as defined in Section 25.3.4, except for RPIiu, which is defined in Section 25.3.2.2:

![]()

where:

![]()

If the Demand Side Resource’s real-time schedule for a given Operating Reserve product, p, is lower than its Day-Ahead Operating Reserve schedule for that product then:

![]()

If the Demand Side Resource’s real-time schedule for a given Operating Reserve product, p, is greater than or equal to its Day-Ahead Operating Reserve schedule for that product then:

![]()

If the Demand Side Resource’s real-time Regulation Service schedule is less than its Day-Ahead Regulation Service schedule then:

![]()

If the Demand Side Resource’s real-time Regulation Schedule is greater than or equal to the Day-Ahead Regulation Service schedule then:

![]()

25.3.2.2Reserve Performance Index for Demand Side Resource Suppliers of Operating Reserves

The ISO shall produce a Reserve Performance Index for purposes of calculating a Day Ahead Margin Assurance Payment for a Demand Side Resource providing Operating Reserves. The Reserve Performance Index shall take account of the actual Demand Reduction achieved by the Supplier of Operating Reserves following the ISO’s instruction to convert Operating Reserves to Demand Reduction.

The Reserve Performance Index shall be a factor with a value between 0.0 and 1.0 inclusive. For each interval in which the ISO has not instructed the Demand Side Resource to convert its Operating Reserves to Demand Reduction, the Reserve Performance Index shall have a value of one. For each interval in which the ISO has instructed the Demand Side Resource to convert its Operating Reserves to Demand Reduction the Reserve Performance Index shall be calculated pursuant to the following formula, provided however when UAGi is zero or less, the Reserve Performance Index shall be set to zero:

![]()

Where:

![]() = Reserve Performance Index in interval i for Demand Side Resource u;

= Reserve Performance Index in interval i for Demand Side Resource u;

![]() = average actual Demand Reduction for interval i, represented as a positive generation value; and

= average actual Demand Reduction for interval i, represented as a positive generation value; and

![]() = average scheduled Demand Reduction for interval i, represented as a positive generation base point.

= average scheduled Demand Reduction for interval i, represented as a positive generation base point.

25.3.3Formula for Day-Ahead Margin Assurance Payments for Limited Energy Storage Resources

Day-Ahead Margin Assurance Payments for Limited Energy Storage Resources scheduled to provide Regulation Service shall be determined by applying the following equations to each Resource using the terms as defined in Section 25.3.4; provided, however, that a Day-Ahead Margin Assurance Payment is payable only for intervals in which the NYISO has reduced the real-time Regulation Service offer (in MWs) of a Limited Energy Storage Resource and the NYISO is not pursuing LESR Energy Management for such Resource for such interval, pursuant to ISO Procedures:

If the LESR’s real-time Regulation Service schedule is less than its Day-Ahead Regulation Service schedule and the real-time Regulation Capacity Market Price is greater than the Day-Ahead Regulation Capacity Bid price then:

![]()

![]() If the LESR’s real-time Regulation Service schedule is less than its Day-Ahead Regulation Service schedule and the real-time Regulation Capacity Market price is less than or equal to the Day-Ahead Regulation Capacity Bid price then:

If the LESR’s real-time Regulation Service schedule is less than its Day-Ahead Regulation Service schedule and the real-time Regulation Capacity Market price is less than or equal to the Day-Ahead Regulation Capacity Bid price then:

![]()

If the LESR’s real-time Regulation Service schedule is greater than or equal to the Day-Ahead Regulation Service schedule then:

![]()

25.3.4Terms Used in this Attachment J

The terms used in the formulas in this Attachment J shall be defined as follows:

h is the hour that includes interval i;

| = | the Day-Ahead Margin Assurance Payment attributable in any hour h to any Supplier u; | ||

| = | the contribution of RTD interval i to the Day-Ahead Margin Assurance Payment for Supplier u; | ||

| = | the Energy contribution of RTD interval i to the Day-Ahead Margin Assurance Payment for Supplier u; | ||

| = | the Regulation Service contribution of RTD interval i to the Day-Ahead Margin Assurance Payment for Supplier u; | ||

| = | the Operating Reserve contribution of RTD interval i to the Day-Ahead Margin Assurance Payment for Supplier u determined separately for each Operating Reserve product p; | ||

| = | Day-Ahead Energy schedule for Supplier u in hour h; | ||

| = | Day-Ahead schedule for Regulation Service for Supplier u in hour h; | ||

| = | Day-Ahead schedule for Operating Reserve product p, for Supplier u in hour h; | ||

| = | Day-Ahead Energy Bid cost for Supplier u in hour h, including the Minimum Generation Bid and Incremental Energy Bids; | ||

| = | Day-Ahead Regulation Capacity Bid price for Supplier u in hour h; | ||

| = | Day-Ahead Availability Bid for Operating Reserve product p for Supplier u in hour h; | ||

| = | real-time Energy scheduled for Supplier u in interval i, and calculated as the arithmetic average of the 6-second AGC Base Point Signals sent to Supplier u during the course of interval i; | ||

| = | real-time schedule for Regulation Service for Supplier u in interval i. | ||

| = | real-time schedule for Operating Reserve product p for Supplier u in interval i. | ||

| = | real-time Regulation Capacity Bid price for Supplier u in interval i. | ||

| = | real-time Energy Bid cost for Supplier u in interval i, including the Minimum Generation Bid and Incremental Energy Bids. | ||

| = | real-time Regulation Movement Bid price for Supplier u in interval i. | ||

| = | real-time Regulation Movement MWs for Supplier u in interval i; | ||

| = | either, (1) when | ||

| = | real-time price of Energy at the location of Supplier u in interval i; | ||

| = | real-time price of Regulation Capacity at the location of Supplier u in interval i; | ||

| = | real-time price of Operating Reserve product p at the location of Supplier u in interval i; | ||

| = | real-time Regulation Movement Market Price at the location of Supplier u in interval i; | ||

| = | When the Day-Ahead Energy schedule is to inject, given that | ||

|

| (a) | ||

|

| (b) | ||

|

| When the Day-Ahead Energy schedule is to withdraw, given that

| ||

|

|

|

|

|

|

|

|

|

|

| = | When the Day-Ahead Energy schedule is to inject, or the Day-Ahead Energy schedule is zero MW and the real-time Energy schedule is to inject, given that | ||

|

| (a) (b) otherwise, then | ||

|

| When the Day-Ahead Energy schedule is to withdraw, or the Day-Ahead Energy schedule is zero MW and the real-time Energy schedule is to withdraw, given that

| ||

| = | the Economic Operating Point of Supplier u in interval i calculated without regard to ramp rates; | ||

| = | number of seconds in interval i | ||

| = | the factor derived from the Regulation Service Performance index for Resource u for interval i as defined in Rate Schedule 3 of this Services Tariff. | ||

25.4Exception for Generators Lagging Behind RTD Base Point Signals

If an otherwise eligible Generator’s average Actual Energy Injection in an RTD interval (i.e., its Actual Energy Injections averaged over the RTD interval) is less than or equal to its penalty limit for under-generation value for that interval, as computed below, it shall not be eligible for Day-Ahead Margin Assurance Payments for that interval.

The penalty limit for under-generation value is the tolerance described in Section 15.3A.1 of Rate Schedule 3-A of this ISO Services Tariff, which is used in the calculation of the persistent under-generation charge applicable to Generators that are not providing Regulation Service.

25.5Rules Applicable to Supplier Derates

Suppliers that request and are granted a derate of their real-time Operating Capacity, but that are otherwise eligible to receive Day-Ahead Margin Assurance Payments may receive a payment up to a Capacity level consistent with their revised Emergency Upper Operating Limit or Normal Upper Operating Limit, whichever is applicable. The foregoing rule shall also apply to a Generator otherwise eligible for a Day-Ahead Margin Assurance Payment in hours in which the ISO has derated the Generator’s Operating Capacity in order to reconcile the ISO’s dispatch with the Generator’s actual output, or to address reliability concerns that arise because the Generator is not following Base Point Signals. If a Supplier’s derated real-time Operating Capacity is lower than the sum of its Day-Ahead Energy, Regulation Services, and Operating Reserve schedules then when the ISO conducts the calculations described in Section 25.3 above, the DASen, DASeg and DASresp variables will be reduced by REDen, REDreg and REDresp respectively. REDen, REDreg and REDresp shall be calculated using the formulas below:

| = |

|

| = |

|

| = |

|

| = |

|

| = |

|

| = |

|

| = |

|

where:

| = | The real-time Emergency Upper Operating Limit or Normal Upper Operating Limit whichever is applicable of Supplier u in interval i |

| = | The total amount in MW that Day-Ahead schedules need to be reduced to account for the derate of Supplier u in interval i |

| = | The amount in MW that the Day-Ahead Energy schedule is reduced for the purposes of calculating the Day-Ahead Margin Assurance Payment for Supplier u in interval i |

| = | The amount in MW that Supplier u’s Day-Ahead Regulation Service schedule is reduced for the purposes of calculating the Day-Ahead Margin Assurance Payment in interval i |

| = | The amount in MW that Supplier u’s Day-Ahead Operating Reserve schedule for Operating Reserves product p is reduced for the purposes of calculating the Day-Ahead Margin Assurance Payment in interval i |

| = | The potential amount in MW that Supplier u’s Day-Ahead Energy schedule could be reduced for the purposes of calculating the Day-Ahead Margin Assurance Payment for Supplier u in interval i |

| = | The potential amount in MW that Supplier u’s Day-Ahead Regulation Service schedule could be reduced for the purposes of calculating the Day-Ahead Margin Assurance Payment for Supplier u in interval i |

| = | The potential amount in MW that Supplier u’s Day-Ahead Operating Reserve Schedule for Operating Reserve product p could be reduced for the purposes of calculating the Day-Ahead Margin Assurance Payment for Supplier u in interval i |

All other variables are as defined above.

25.6Import Curtailment Guarantee Payments

25.6.1 Eligibility for an Import Curtailment Guarantee Payment for an Import Curtailed by the ISO

In the event that the Energy injections for an Import scheduled by RTC or RTD at a Proxy Generator Bus, other than a CTS Enabled Proxy Generator Bus, are Curtailed at the request of the ISO, and (i) the real-time Energy Profile MW is equal to or greater than the Day-Ahead Energy Schedule for that interval, and (ii) the real-time Decremental Bid is less than or equal to the default real-time Decremental Bid amount as established by ISO procedures, then the Supplier or Transmission Customer that is subjected to the Curtailment, in addition to the charge for Energy Imbalance, shall be eligible for an Import Curtailment Guarantee Payment as determined in Section 25.6.2 of this Attachment J. Suppliers scheduling Imports at CTS Enabled Proxy Generator Buses shall not be eligible for Import Curtailment Guarantee payments for those Transactions.

25.6.2 Formula for an Import Curtailment Guarantee Payment for a Supplier Whose Import Was Curtailed by the ISO

A Supplier eligible under Section 25.6.1 of this Attachment J shall receive an Import Curtailment Guarantee Payment for its curtailed Energy injections that is equal to the daily sum of the hourly payments which, for each hour of Import t, is calculated as the greater of the interval payments determined for the hour or zero as seen in the formula below.

Import Curtailment Guarantee Payment to Supplier u in association with Import t =

![]()

Where

N= the number of hours in the Dispatch Day

H= the number of intervals in hour h

i=the relevant interval in hour h;

Si=number of seconds in interval i;

![]() =the real-time LBMP, in $/MWh, for interval i at the Proxy Generator Bus which is the source of the Import t.

=the real-time LBMP, in $/MWh, for interval i at the Proxy Generator Bus which is the source of the Import t.

![]() = the Day Ahead Decremental Bid price associated with the Day-Ahead energy schedule, in $/MWh, for Import t in hour h containing interval i;

= the Day Ahead Decremental Bid price associated with the Day-Ahead energy schedule, in $/MWh, for Import t in hour h containing interval i;

![]() =the Day Ahead scheduled Energy injections, in MWh, for Import t in hour h containing interval i as determined by Security Constrained Unit Commitment (SCUC); and

=the Day Ahead scheduled Energy injections, in MWh, for Import t in hour h containing interval i as determined by Security Constrained Unit Commitment (SCUC); and

![]() =the scheduled Energy injections, in MWh, for Import t in interval i as determined by Real-Time Dispatch (RTD).

=the scheduled Energy injections, in MWh, for Import t in interval i as determined by Real-Time Dispatch (RTD).

Effective Date: 12/31/9998 - Docket #: ER20-1696-000 - Page 1