NYISO Tariffs --> Market Administration and Control Area Services Tariff (MST) --> 26 MST Attachment K - Creditworthiness Requirements For Cust --> 26.3 MST Att K Operating Requirement and Bidding Requirement

26.3Operating Requirement and Bidding Requirement

26.3.1Purpose and Function

The Operating Requirement is a measure of a Customer’s expected financial obligations to the ISO based on the nature and extent of that Customer’s participation in ISO-Administered Markets. A Customer shall be required to allocate Unsecured Credit and/or provide collateral in an amount equal to or greater than its Operating Requirement. Upon a Customer’s written request, the ISO will provide a written explanation for any changes in the Customer’s Operating Requirement.

The Bidding Requirement is a measure of a Customer’s potential financial obligation to the ISO based upon the bids that Customer seeks to submit in an ISO-administered TCC or ICAP auction. A Customer shall be required to allocate Unsecured Credit and/or provide collateral in an amount equal to or greater than its Bidding Requirement prior to submitting bids in an ISO-administered TCC or ICAP auction.

26.3.2Calculation of Operating Requirement

The Operating Requirement shall be equal to the sum of (i) the Energy and Ancillary Services Component; (ii) the UCAP Component; (iii) the TCC Component; (iv) the WTSC Component; (v) the Virtual Transaction Component; (vi) the DADRP Component; and (vii) the DSASP Component where:

26.3.2.1Energy and Ancillary Services Component

The Energy and Ancillary Services Component shall be equal to:

(a)For Customers without a prepayment agreement, the greater of either:

Basis Amount for Energy and Ancillary Services x 50 Days in Basis Month

- or -

Total Charges Incurred for Energy and

Ancillary Services for Previous Ten (10) Days x 50

10

(b)For Customers that qualify for a prepayment agreement, subject to the ISO’s credit analysis and approval, and execute a prepayment agreement in the form provided in Appendix W-1, the greater of either:

Basis Amount for Energy and Ancillary Services x 3 Days in Basis Month

or-

Total Charges Incurred for Energy and

Ancillary Services for Previous Ten (10) Days x 3

10

(c)For new Customers, the ISO shall determine a substitute for the Basis Amount for Energy and Ancillary Services for use in the appropriate formula above equal to:

EPL x 720 x AEP

where:

EPL = estimated peak Load for the Capability Period; and

AEP = average Energy and Ancillary Services price during the Prior Equivalent Capability Period after applying the Price Adjustment.

26.3.2.2UCAP Component

The UCAP Component shall be equal to the total of all amounts then-owed (billed and unbilled) for UCAP purchased in the ISO-administered markets.

26.3.2.3TCC Component

The TCC Component shall be equal to the greater of either:

(a)The sum of the amounts calculated in accordance with the appropriate per TCC term-based formula listed below for TCC purchases less the amounts calculated in accordance with the appropriate per TCC term-based formula listed below for TCC sales:

(1)upon initial award of a two-year TCC until completion of the final round of the current one-year TCC auction:

2xthe amount calculated in accordance with the

one-year TCC formula listed below

where:

Pijt=auction price of a one-year TCC in the final round of the one year Sub-Auction in the prior Capability Period Centralized TCC Auction with the same POI and POW combination as the two-year TCC; provided, however, in the event there is no price for a one-year TCC with the same POI and POW combination as the two-year TCC, then “Pijt” shall equal a proxy price, assigned by the NYISO, for a one-year TCC with like characteristics. For Centralized TCC Auctions conducted before May 1, 2010, the “auction price of a one-year TCC in the final round of the one-year Sub-Auction” means the auction price of a one-year TCC in the final Stage 1 round of the one-year TCC auction.

(2)upon completion of the final round of the current one-year Sub-Auction until commencement of year two of a two-year TCC:

2xthe amount calculated in accordance with the one-year TCC formula listed below

where:

Pijt=auction price of a one-year TCC in the final round of the current one-year TCC auction with the same POI and POW combination as the two-year TCC

(3)upon commencement of year two of a two-year TCC:

1xthe amount calculated in accordance with the one-year TCC formula listed below

where:

Pijt=auction price of a one-year TCC in the final round of the most recently completed one-year Sub- Auction with the same POI and POW combination as the two-year TCC.

for one-year TCCs, representing a 5% probability curve:

![]()

+1.909 - .9696 Pijt

for six-month TCCs, representing a 3% probability curve:

+2.565 ![]() - .8166 Pijt

- .8166 Pijt

for one-month TCCs, representing a 3% probability curve:

+2.221 ![]() - .8152 Pijt

- .8152 Pijt

where:

Pijt=auction price of i to j TCC in round t of the auction in which the TCC was purchased;

Zone J=1 if TCC sources or sinks but not both in Zone J, zero otherwise;

Zone K =1 if TCC sources or sinks but not both in Zone K and does not source or sink in Zone J, 0 otherwise;

Summer =1 for six-month TCCs sold in the spring auction, 0 otherwise; and

Month= the following values:

January=0

February=-0.0201

March=0.1065

April=-0.3747

May=0.8181

June=0.2835

July=0.5201

August=0.7221

September =0.242

October=0.32

November=-0.7681

December=-0.3836

Provided, however, for purposes of determining the credit holding requirement for a Fixed Price TCC, the auction price shall be replaced by the fixed price associated with that Fixed Price TCC, as determined in Section 19.2.1 of Attachment M of the OATT.

- or -

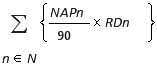

(b)The projected amount of the Primary Holder’s payment obligation to the NYISO, if any, considering the net mark-to-market value of all TCCs in the Primary Holder’s portfolio, as defined for these purposes, according to the formula below:

where:

NAP = the net amount of Congestion Rents (positive or negative) between the POI and POW composing each TCCn during the previous ninety days

RD = the remaining number of days in the life of TCCn; provided, however, that in the case of Grandfathered TCCs, RD shall equal the remaining number of days in the life of the longest duration TCC sold in an ISO-administered auction then outstanding; and

N =the set of TCCs held by the Primary Holder.

26.3.2.4WTSC Component

The WTSC Component shall be equal to the greater of either:

Greatest Amount Owed for WTSC During Any

Single Month in the Prior Equivalent Capability Period x 50

Days in Month

- or –

Total Charges Incurred for WTSC Based Upon the Most

Recent Monthly Data Provided by the Transmission Owner x 50

Days in Month

26.3.2.5Virtual Transaction Component

The Virtual Transaction Component shall be equal to the sum of the Customer’s (i) Virtual Supply credit requirement (“VSCR”) for all outstanding Virtual Supply Bids, plus (ii) Virtual Load credit requirement (“VLCR”) for all outstanding Virtual Load Bids, plus (iii) net amount owed to the ISO for settled Virtual Transactions.

Where:

VSCR=∑ (VSGMWh x VSGCS)

VLCR=∑ (VLGMWh x VLGCS)

Where:

VSGMWh=the total quantity of MWhs of Virtual Supply that a Customer Bids for all Virtual Supply positions in the Virtual Supply group

VSGCS=the amount of credit support required in $/MWh for the Virtual Supply group

VLGMWh=the total quantity of MWhs of Virtual Load that a Customer Bids for all Virtual Load positions in the Virtual Load group

VLGCS=the amount of credit support required in $/MWh for the Virtual Load group

The ISO will categorize each Virtual Supply Bid into one of the 72 Virtual Supply groups set forth in the Virtual Supply chart below, as appropriate, based upon the season, Load Zone, and time-of-day of the Virtual Supply Bid. The amount of credit support required in $/MWh for a Virtual Transaction in a particular Virtual Supply group shall equal the price differential between the Energy price in the Day-Ahead Market and the Energy price in the Real-Time Market, at the 97th percentile, based upon all possible Virtual Supply positions in the Virtual Supply group for the period of time from April 1, 2005, through the end of the preceding calendar month.

The ISO will categorize each Virtual Load Bid into one of the 30 Virtual Load groups set forth in the Virtual Load chart below, as appropriate, based upon the season, Load Zone, and time-of-day of the Virtual Load Bid. The amount of credit support required in $/MWh for a Virtual Transaction in a particular Virtual Load group shall equal the price differential between the Energy price in the Day-Ahead Market and the Energy price in the Real-Time Market, at the 97th percentile, based upon all possible Virtual Load positions in the Virtual Load group for the period of time from April 1, 2005, through the end of the preceding calendar month.

If a Customer submits Bids for both Virtual Load and Virtual Supply for the same day, hour, and Load Zone, then for those Bids, until such time as those Bids have been evaluated by SCUC, only the greater of the Customer’s (i) VLCR for the total MWhs Bid for Virtual Load, or (ii) VSCR for the total MWhs Bid for Virtual Supply will be included when calculating the Customer’s Virtual Transaction Component. After evaluation of those Bids by SCUC, then only the credit requirement for the net position of the accepted Bids (in MWhs of Virtual Load or Virtual Supply) will be included when calculating the Customer’s Virtual Transaction Component.

Virtual Supply Groups

Summer | Load Zones A–F | Load Zones G–I | Load Zone J | Load Zone K |

HB07–10 | VSG-1 | VSG-7 | VSG-13 | VSG-19 |

HB11–14 | VSG-2 | VSG-8 | VSG-14 | VSG-20 |

HB15–18 | VSG-3 | VSG-9 | VSG-15 | VSG-21 |

HB19–22 | VSG-4 | VSG-10 | VSG-16 | VSG-22 |

Weekend/ Holiday (HB07–22) | VSG-5 | VSG-11 | VSG-17 | VSG-23 |

Night (HB23–06) | VSG-6 | VSG-12 | VSG-18 | VSG-24 |

|

|

|

|

|

Winter |

|

|

|

|

HB07–10 | VSG-25 | VSG-31 | VSG-37 | VSG-43 |

HB11–14 | VSG-26 | VSG-32 | VSG-38 | VSG-44 |

HB15–18 | VSG-27 | VSG-33 | VSG-39 | VSG-45 |

HB19–22 | VSG-28 | VSG-34 | VSG-40 | VSG-46 |

Weekend/ Holiday (HB07–22) | VSG-29 | VSG-35 | VSG-41 | VSG-47 |

Night (HB23–06) | VSG-30 | VSG-36 | VSG-42 | VSG-48 |

|

|

|

|

|

Rest-of-Year |

|

|

|

|

HB07–10 | VSG-49 | VSG-55 | VSG-61 | VSG-67 |

HB11–14 | VSG-50 | VSG-56 | VSG-62 | VSG-68 |

HB15–18 | VSG-51 | VSG-57 | VSG-63 | VSG-69 |

HB19–22 | VSG-52 | VSG-58 | VSG-64 | VSG-70 |

Weekend/ Holiday (HB07–22) | VSG-53 | VSG-59 | VSG-65 | VSG-71 |

Night (HB23–06) | VSG-54 | VSG-60 | VSG-66 | VSG-72 |

Where:

Summer = May, June, July, and August

Winter = December, January, and February

Rest-of-Year = March, April, September, October, and November

HB07–10= weekday hours beginning 07:00–10:00

HB11–14= weekday hours beginning 11:00–14:00

HB15–18= weekday hours beginning 15:00–18:00

HB19–22= weekday hours beginning 19:00– 22:00

Weekend/Holiday = weekend and holiday hours beginning 07:00–22:00

Night = all hours beginning 23:00– 06:00

Virtual Load Groups

Summer | Load Zones A–F | Load Zones G–I | Load Zone J | Load Zone K |

HB07–10 | VLG-1 | VLG-4 | VLG-8 | VLG-12 |

HB11–14 | VLG-2 | VLG-5 | VLG-9 | VLG-13 |

HB15–18 | VLG-2 | VLG-6 | VLG-10 | VLG-14 |

HB19–22 | VLG-1 | VLG-4 | VLG-8 | VLG-15 |

Weekend/ Holiday (HB07–22) | VLG-3 | VLG-4 | VLG-8 | VLG-16 |

Night (HB23–06) | VLG-1 | VLG-7 | VLG-11 | VLG-12 |

|

|

|

|

|

Winter |

|

|

|

|

HB07–10 | VLG-17 | VLG-19 | VLG-21 | VLG-23 |

HB11–14 | VLG-17 | VLG-20 | VLG-21 | VLG-23 |

HB15–18 | VLG-18 | VLG-19 | VLG-22 | VLG-24 |

HB19–22 | VLG-17 | VLG-20 | VLG-21 | VLG-24 |

Weekend/ Holiday (HB07–22) | VLG-17 | VLG-20 | VLG-21 | VLG-23 |

Night (HB23–06) | VLG-17 | VLG-20 | VLG-21 | VLG-23 |

|

|

|

|

|

Rest-of-Year |

|

|

|

|

HB07–10 | VLG-25 | VLG-26 | VLG-27 | VLG-29 |

HB11–14 | VLG-25 | VLG-26 | VLG-28 | VLG-29 |

HB15–18 | VLG-25 | VLG-26 | VLG-28 | VLG-30 |

HB19–22 | VLG-25 | VLG-26 | VLG-27 | VLG-30 |

Weekend/ Holiday (HB07–22) | VLG-25 | VLG-26 | VLG-27 | VLG-30 |

Night (HB23–06) | VLG-25 | VLG-26 | VLG-27 | VLG-29 |

Where:

Summer = May, June, July, and August

Winter = December, January, and February

Rest-of-Year = March, April, September, October, and November

HB07–10= weekday hours beginning 07:00–10:00

HB11–14= weekday hours beginning 11:00–14:00

HB15–18= weekday hours beginning 15:00–18:00

HB19–22= weekday hours beginning 19:00– 22:00

Weekend/Holiday = weekend and holiday hours beginning 07:00–22:00

Night = all hours beginning 23:00– 06:00

26.3.2.6DADRP Component

The DADRP Component shall be equal to the product of: (i) the Demand Reduction Provider’s monthly average of MWh of accepted Demand Reduction Bids during the prior summer Capability Period or, where the Demand Reduction Provider does not have a history of accepted Demand Reduction bids, a projected monthly average of the Demand Reduction Provider’s accepted Demand Reduction bids; (ii) the average Day-Ahead LBMP at the NYISO Reference Bus during the prior summer Capability Period; (iii) twenty percent (20%); and (iv) a factor of four (4). The ISO shall adjust the amount of Unsecured Credit and/or collateral that a Demand Reduction Provider is required to provide whenever the DADRP Component increases or decreases by ten percent (10%) or more.

26.3.2.7DSASP Component

The DSASP Component is calculated every two months based on the Demand Side Resource’s Operating Capacity available for the scheduling of such services, the delta between the Day-Ahead and hourly market clearing prices for such products in the like two-month period of the previous year, and the location of the Demand Side Resource. Resources located East of Central-East shall pay the Eastern reserves credit support requirement and Resources located West of Central-East shall pay the Western reserves credit support requirement. The DSASP Component shall be equal to:

(a)For Demand Side Resources eligible to offer only Operating Reserves, the product of (i) the maximum hourly Operating Capacity (MW) for which the Demand Side Resource may be scheduled to provide Operating Reserves, (ii) the amount of Eastern or Western reserves credit support, as appropriate, in $/MW per day, and (iii) three (3) days.

Where:

The amount of Eastern reserves credit support ($/MW/day) for each two-month period | = | Eastern Price Differential for the same two-month period in the previous year * the higher of two (2) or the maximum number of daily Reserve Activations for the same two-month period in the previous year

|

The amount of Western reserves credit support ($/MW/day) for each two-month period | = | Western Price Differential for the same two-month period in the previous year * the higher of two (2) or the maximum number of daily Reserve Activations for the same two-month period in the previous year

|

Two-month periods: | = | January and February March and April May and June July and August September and October November and December

|

MCPSRh | = | Hourly, time-weighted Market Clearing Price for Spinning Reserves

|

Eastern Price Differential | = | The hourly differential at the 97th percentile of all hourly differentials between the Day-Ahead and Real-Time MCPSRh for Eastern Spinning Reserves for hours in the two-month period of the previous year when the Real-Time MCPSRh for Eastern Spinning Reserves exceeded the Day-Ahead MCPSRh for Eastern Spinning Reserves

|

Western Price Differential | = | The hourly differential at the 97th percentile of all hourly differentials between the Day-Ahead and Real-Time MCPsSRh for Western Spinning Reserves for hours in the two-month period of the previous year when the Real-Time MCPSRh for Western Spinning Reserves exceeded the Day-Ahead MCPSRh for Western Spinning Reserves

|

Reserve Activations | = | The number of reserve activations at the 97th percentile of daily reserve activations for days in each two month period of the previous year that had reserve activations. |

(b)For Demand Side Resources eligible to offer only Regulation Service, or Operating Reserves and Regulation Service, the product of (i) the maximum hourly Operating Capacity (MW) for which the Demand Side Resource may be scheduled to provide Regulation Service and Operating Reserves, (ii) the amount of regulation credit support, as appropriate, in $/MW per day, and (iii) three (3) days.

Where:

The amount of regulation credit support ($/MW/day) for each two-month period

| = | Price Differential for the same two-month period in the previous year * 24 hours |

Two-month periods: | = | January and February March and April May and June July and August September and October November and December

|

MCPRegh | = | Hourly, time-weighted Market Clearing Price for Regulation Services

|

Price Differential | = | The hourly differential at the 97th percentile of all hourly differentials between the Day-Ahead and Hour-Ahead MCPRegh for hours in the two-month period of the previous year when the Real-Time MCP exceeded the Day-Ahead MCP |

26.3.3Calculation of Bidding Requirement

The Bidding Requirement shall be an amount equal to the sum of:

(i) the amount of bidding authorization that the Customer has requested for use in an upcoming ISO-administered TCC auction, which shall account for all positive bids to purchase TCCs and the absolute value of all negative offers to sell TCCs; provided, however, that the amount of credit required for each TCC that the Customer bids to purchase, whether positive, negative, or zero shall not be less than (a) (2 x $/MW for one-year TCCs) per MW for two-year TCCs, (b) $1,500 per MW for one-year TCCs, (c) $2,000 per MW for six-month TCCs, and (d) $600 per MW for one-month TCCs;

(ii) the approximate amount that the Customer may owe following an upcoming TCC auction as a result of converting expired ETAs into TCCs pursuant to Section 19.2.1 of Attachment M to the OATT, which shall be calculated in accordance with the provisions of Section 19.2.1 regarding the purchase of TCCs with a duration of ten years;

(iii) the amount of bidding authorization that the Customer has requested for use in an upcoming ISO-administered ICAP auction; and

(iv) five (5) days prior to any ICAP Spot Market Auction, the maximum amount that the Customer may be required to pay for UCAP in the auction.

Effective Date: 6/30/2010 - Docket #: ER10-1657-000 - Page 1