10 Krey Boulevard Rensselaer, NY 12144

January 18, 2013

Honorable Kimberly D. Bose Secretary

Federal Energy Regulatory Commission 888 First Street, N.E., Room 1A

Washington, D.C. 20426

Re: Interface Pricing Compliance Filing of the New York Independent System

Operator, Inc.; Docket Nos. ER08-1281-__ and ER13-___-___

Dear Ms. Bose:

Pursuant to the Federal Energy Regulatory Commission’s (“Commission’s”) December

30, 2010 Order on Rehearing and Compliance issued in this proceeding (“December Order”),1

the Commission’s July 1, 2011 Order on Rehearing (“July Order”),2 the Commission’s March

15, 2012 Order on Compliance Filing (“March Order”),3 the Commission’s May 8, 2012 Notice

of Extension of Time,4 and the Commission’s August 22, 2012 Order on Rehearing (“August

Order”),5 the New York Independent System Operator, Inc., (“NYISO”) hereby submits for the

Commission’s review proposed additions to and clarifications of Section 17 of (Attachment B to)

the NYISO’s Market Administration and Control Area Services Tariff (“Services Tariff”). The

1 New York Independent System Operator, Inc., 133 FERC ¶ 61,276 (2010).

2 New York Independent System Operator, Inc., 136 FERC ¶ 61,011 (2011).

3 New York Independent System Operator, Inc., 138 FERC ¶ 61,195 (2012).

4 New York Independent System Operator, Inc., Notice of Extension of Time issued May 8, 2012 in Docket No. ER08-1281-010.

5 New York Independent System Operator, Inc., 140 FERC ¶ 61,140 (2012).

additions and clarifications set forth the NYISO’s proposed interface pricing rules.6 The proposed rules are expected to produce pricing results that are compatible with the results produced by PJM Interconnection, LLC’s (“PJM’s”) interface pricing method.

The Tariff revisions proposed in this filing are consistent with the interface pricing rules that the NYISO proposed in the talking points that it submitted to the Commission on April 10, 2012 in Docket No. ER08-1281. Consistent with that informational material, the NYISO’s proposed tariff revisions address the calculation of interface prices using a “Non-Conforming Scheduling Mode.”7 The impact of the Ontario/Michigan PARs on power flows is captured through the NYISO’s calculation of expected unscheduled power flows (“UPF”). UPF is

discussed in greater detail in Section I.C of this filing letter.

The proposed Tariff revisions do not incorporate any presumptions regarding the efficacy

of the Ontario/Michigan PARs in predictably and continuously adjusting actual power flows to

conform to scheduled power flows. When sufficient data is collected regarding the actual

operation and performance of the Ontario/Michigan PARs, NYISO, PJM and the Midwest

Independent Transmission System Operator, Inc. (“MISO”) will have to collectively consider

whether (and what) changes to any of their respective pricing methods are appropriate to reflect

the operation of the Ontario/Michigan PARs. At this point in time, the PARs at the

Ontario/Michigan border have not conformed actual power flows to scheduled power flows to

6 The NYISO’s proposed Tariff revisions will also permit the NYISO to determine prices for internal NYCA resources in a manner that is consistent with the method proposed for pricing external Proxy Generator Buses. Consistency in pricing is appropriate to avoid creating new “seams.”

7 The Non-Conforming Scheduling Mode anticipates and accounts for the expected deviation between actual and

scheduled power flows. The NYISO’s Security Constrained Unit Commitment (“SCUC”), Real-Time Commitment

(“RTC”) and Real-Time Dispatch (“RTD”) are configured to represent the incremental power distribution around

Lake Erie when computing each resource’s incremental impacts on the New York State Transmission System

(“NYSTS”). In the Non-Conforming Mode, all generator, load and Proxy Generator Bus shift factors and delivery

(penalty) factors are computed in a manner that reflects the expected deviation of scheduled flows from their

contract path. As explained in this filing letter, the NYISO’s implementation of its Non-Conforming Mode is

expected to produce pricing results that are similar to the results produced by the external interface pricing method

that PJM currently employs.

2

the degree that would justify the NYISO re-engaging its “Conforming Scheduling Mode,”8

which assumed that actual power flows were consistent with scheduled power flows.9

The NYISO’s external Market Monitoring Unit, Potomac Economics (the “NYISO

MMU”) has reviewed the market rules that the NYISO’s proposed tariff revisions are designed to implement. The NYISO’s proposed tariff revisions are supported by the NYISO MMU. An affidavit prepared by the President of the NYISO MMU, Dr. David Patton, is included as

Attachment I to this filing. In his attached affidavit, Dr. Patton explains:

The NYISO’s proposed method of determining expected power flows will

produce results similar to PJM’s weighting method, and is a reasonable method of calculating interface prices and schedules.10

and

[T]he NYISO’s path validation process is well adapted to the NYISO’s market design and essential for ensuring efficient market outcomes and transaction scheduling incentives. Therefore, the Commission should accept its continued use as a reasonable method of conforming interface schedules and determining prices that are consistent with the confirmed schedules.11

PJM has indicated that, although the NYISO and PJM external transaction pricing

methods are not identical, the NYISO’s proposed method produces prices at the PJM/New York

border that are consistent with the prices that PJM applies to transactions between the two

Balancing Authority Areas using PJM’s own pricing method. PJM has authorized the NYISO to

8 The Conforming Scheduling Mode incorporates the expectation that power flows will closely match schedules into the NYISO’s pricing. Under the Conforming Scheduling Mode, the NYISO would commit, dispatch and price

generation and interchange transactions in its DAM and RTM by computing each resource’s incremental impacts on the NYSTS assuming that scheduled flows will occur consistent with their contract path. The last time the NYISO used its Conforming Mode was in 2011. The NYISO is not proposing Tariff revisions that would permit it to reimplement its Conforming Mode in this filing.

9 Data addressing Lake Erie unscheduled power flows is publicly available on the NYISO’s web site at:

http://www.nyiso.com/public/markets_operations/market_data/power_grid_data/index.jsp

10 Attachment I at ¶ 13.

11 Id. at ¶ 20.

3

state that it agrees that NYISO’s pricing method is a reasonable implementation, given NYISO’s market design.

The NYISO and the NYISO MMU participated in a number of discussions with PJM’s Market Monitoring Unit, Monitoring Analytics, (the “PJM MMU”)12 in an effort to develop a universally acceptable interface pricing solution. All parties participated in the discussions in good faith and a significant amount of information was exchanged regarding the NYISO and

PJM pricing methods.

I.Explanation of NYISO’s Proposed Interface Pricing Method

A.Introduction

The NYISO’s proposed Tariff revisions are designed to implement a set of interface

pricing rules that are consistent with the NYISO’s market construct, and will produce prices that are similar to the prices produced by PJM’s pricing method. Because there are significant

differences between the market designs employed by the two markets, it is not possible for the NYISO and PJM to employ identical interface pricing methods.

PJM uses a “physical” reservation process to apportion Available Transfer Capability

(“ATC”) and ramp, while the NYISO uses an economic evaluation to determine which resources

to schedule. In the NYISO’s economic evaluation proposed External Transactions13 (Imports,

Exports and Wheels-Through) compete with internal New York resources, and with other

External Transactions, including External Transactions offered at different interfaces, to be

economically awarded a schedule. The NYISO’s economic resource selection process

12 Several of the NYISO/NYISO MMU discussions with the PJM MMU also included PJM representatives.

13 Capitalized terms that are not defined in this filing letter have the meaning assigned to them in the NYISO’s Services Tariff.

4

incorporates expected transmission congestion impacts and permits the NYISO to meet its demand obligations at the lowest production cost.

Despite differences in market design, PJM and NYISO can implement interface pricing methods that produce consistent interface prices under common conditions. The NYISO’s proposed method of developing prices for its Keystone (PJM) and Bruce (Ontario) Proxy

Generator Buses is designed and expected to produce prices that are similar to the prices

produced by the interface pricing method that PJM uses.

There are three key aspects to the NYISO’s interface pricing proposal. First, the NYISO

proposes to model the Michigan/Ontario interface as an uncontrolled/free flowing transmission

path, like PJM does, and to include expected UPF in both its Day-Ahead Market (“DAM”) and

Real-Time Market (“RTM”). The NYISO will continue to monitor power flows around Lake

Erie to determine whether a different interface pricing method or different input assumptions are

necessary to produce prices consistent with expected power flow conditions. Second, the

NYISO proposes to continue to use its scheduling path validation process to ensure that External

Transaction Bids are economically evaluated and scheduled consistent with their expected power

flow impacts. Finally, to calculate prices at its Keystone Proxy Generator Bus that represents a

significant portion of the New York Control Area (“NYCA”)/PJM border, the NYISO proposes

to (a) treat uncontrolled alternating current (“A/C”) transmission lines as free-flowing tie lines,

(b) recognize the expected UPF over the interface facilities in its pricing, and (c) recognize the

demonstrated intermediate- and long-term effectiveness of the ABC, JK and Ramapo PARs in

aligning actual power flows with scheduled power flows on PAR controlled transmission

facilities at the PJM/NYCA border. The NYISO’s proposed pricing treatment of PAR-controlled

transmission facilities at the New York/PJM border aligns expected UPF over the identified

5

PAR-controlled facilities with the expected power flows, and incorporates Commission-accepted tariff obligations and contractual obligations into the NYISO’s development of its Keystone

Proxy Generator Bus prices.14

B. NYISO E-Tag/Path Validation; Compatibility with PJM Source/Sink Pricing

The NYISO’s markets do not rely on express physical reservations of ATC and ramp like

PJM’s markets do. Instead, the NYISO grants transmission reservations based on the NYISO’s

economic evaluation of competing resource and transaction Bids.15 In order for the NYISO to be

able to auction scarce resources (e.g., ATC, Ramp Capacity) and to develop ex ante marginal

prices based on its economic evaluation, the NYISO must identify which set of External

Transactions are eligible to compete to use the scarce ATC and Ramp Capacity at each of its

external Proxy Generator Buses. The NYISO’s e-Tag/path validation process ensures that the

NYISO is evaluating External Transactions with similar network impacts on a comparable basis

(comparing like to like).

NYISO Bid validation occurs as soon as a Bid is submitted to the NYISO’s Market

Information System (“MIS”), and before Bids are made available to be economically evaluated for scheduling by the NYISO’s Day-Ahead or Real-Time Market software. The NYISO’s Bid validation only allows feasible transactions that contain valid NERC e-Tag data, to be

economically evaluated for possible scheduling.

The NYISO’s Bid validation software will not validate Bids submitted to schedule

External Transactions over any of the eight circuitous Prohibited Transmission Paths identified in Section 16.3.3.8 of (Attachment J to) the NYISO Open Access Transmission Tariff

14 See Schedules C and D to Attachment CC to the NYISO’s OATT (the Operating Protocol for the Implementation

of ConEd - PJM Transmission Service Agreements and the PJM/NYISO Market to Market Coordination Process).

15 The NYISO Services Tariff defined term “Bid” includes both offers to sell power and bids to purchase power.

6

(“OATT”).16 The circuitous path scheduling prohibition requires the contract path on a NERC e-

Tag to be consistent with the expected actual path of power flows. This requirement reduces the potential loop flow impacts of External Transactions.

The e-Tag/path validation logic ensures that each External Transaction Bid is consistently

represented in the NYISO’s market and reliability systems for evaluation. Consistent

representation is crucial because the NYISO’s economic evaluation includes consideration of

(a) available Proxy Generator Bus-specific Ramp Capacity, (b) available NYCA Ramp Capacity,

(c) ATC, (d) economic trade-offs between competing users of these services at different Proxy Generator Bus locations, and (e) the power flows (including UPF) that are expected to result from the implementation of each Bid External Transaction schedule.

PJM selects the interface price for settlement for External Transactions based upon the

source or sink information in the associated NERC e-Tag, regardless of the contract or bid path

over which an External Transaction is scheduled, to encourage direct path scheduling. The

NYISO’s e-Tag validation is performed using the same Market Participant supplied NERC e-Tag

data (identifying the source and sink regions) that PJM uses to develop its source/sink prices.

The end result of the NYISO’s path validation logic and economic evaluation is a settlement

price for scheduled transactions that is based upon the expected flows associated with accepted

External Transaction schedules.

16 The implementation of the NYISO’s circuitous scheduling path prohibitions is more complex than it appears. The prohibition extends to any transaction that includes a prohibited path, even if the transaction sources or sinks (or sources and sinks) in control areas that are outside the Lake Erie region. The circuitous scheduling path prohibition will, for example, effectively prohibit each of the following External Transactions:

a. an Export at the NYISO’s IESO Proxy Generator Bus that is scheduled to be wheeled through IESO and

MISO, and to sink in PJM;

b. a Wheel Through New York that sources from the ISO-New England Control Area, that is scheduled to

exit New York at its IESO Proxy Generator Bus to be wheeled through IESO and MISO, and to sink in

PJM; and

c. a Wheel Through New York that sources from the PJM Control Area, that is scheduled to exit New York at

its IESO Proxy Generator Bus to be wheeled through IESO and MISO, and to sink in PJM.

7

In paragraph 16 of his attached affidavit, Dr. Patton, President of the NYISO MMU,

explained why it is appropriate for the NYISO to continue to use its bid validation software:

The NYISO’s path validation process is designed to ensure that the actual power flows associated with the transactions are as consistent with the scheduled flows as possible. Precluding circuitous paths substantial reduces unscheduled loop flows and reduces market participants’ ability engage in patterns of transactions that may constitute manipulation of the RTO’s interface pricing.

The NYISO’s Bid path validation process is designed to ensure that transactions are

scheduled directly, similar to the economic incentives provided by PJM’s source-sink pricing.

Because the NYISO economically evaluates transactions to determine which transactions to

schedule, the NYISO cannot wait until settlement occurs to ensure consistency between

schedules and prices. The NYISO’s path validation process is well adapted to the NYISO’s

market design and the Commission should accept its continued use as a reasonable method of

conforming interface schedules and determining prices that are consistent with the confirmed

schedules.

C.Determining Expected Unscheduled Power Flow

1.Determining Expected Unscheduled Power Flow in the Day-Ahead

Market

In order to account for the expected UPF through the interconnected transmission

systems around Lake Erie, the NYISO proposes to incorporate into each execution of the

NYISO’s DAM Security Constrained Unit Commitment (“SCUC”) the expected UPF. The

expected UPF that the NYISO uses to run its DAM will be calculated based on recently observed historic loop flow data.

Section 17.1.1.1.1 of the Tariff revisions proposed in this filing sets forth the rules the

NYISO proposes to follow to reflect expected UPF in the DAM. The DAM UPF reflects the

expected impact on the New York State Transmission System (“NYSTS”) of UPF caused by

8

generation-to-load dispatch and by External Transaction schedules that do not include New

York. The expected UPF will be determined based on observed, historic, Lake Erie Circulation

less the corresponding estimated power flow contribution associated with NYISO/PJM and

NYISO/IESO scheduled interchange.17 The DAM UPF is ordinarily determined based on 30-

day rolling historical on-peak and off-peak hourly averages. The “on peak” period is currently

Monday - Saturday HB07 - HB22. The “off peak” period is currently Monday - Saturday HB23

- HB06 and Sunday HB00 - HB23. The expected UPF is ordinarily re-calculated on a weekly basis. In cases of known market rule or operational changes that would be expected to cause significant changes in UPF, the frequency and/or period used to determine the historical average that is used to develop the UPF may be modified.

2.Determining Expected Unscheduled Power Flow in the Real-Time

Market

Section 17.1.1.1.1 of the Tariff revisions proposed in this filing sets forth the rules the

NYISO proposes to follow to reflect expected UPF in the RTM. To incorporate the expected

UPF in the NYISO’s RTM Real-Time Commitment and Real-Time Dispatch (“RTC/RTD”) the

NYISO will ordinarily18 measure and incorporate into each execution of the RTC/RTD the

actual, currently observed, Lake Erie circulation value (the difference between scheduled power

flows and actual power flows, measured at the NYISO’s interface with Ontario). In the RTM,

the current, actual UPF will be determined and incorporated directly into the NYISO’s pricing.

17 The NYISO proposes to account for the power flow impacts NYISO/PJM and NYISO/IESO scheduled

interchange separately in each DAM execution, consistent with Section 17.1.1.1.2 of its proposed Tariff revisions. See Section I.D.1 of this filing letter.

18 The PJM MMU inquired about the circumstances under which the NYISO might not use current, observed power flows to reflect expected power flows in its RTM. The NYISO provides the following illustrative examples in

response to the PJM MMU’s inquiry. First, if telemetry temporarily fails, the NYISO might not be receiving current data and might be required to rely on stale data, to use proxy data from a nearby location, or to estimate expected performance, until communications are restored. Second, if the NYISO were to receive notice of the imminent

outage of a major generation or transmission facility that was expected to substantially change observed flows, it might take actions to reflect the expected change, rather than continue to rely on current flows.

9

Using the current, actual UPF to determine RTC/RTD prices produces accurate power flow expectations and prices.

D.Determining Expected Power Flows

1.Determining Expected Power Flows on New York/New Jersey PAR

Controlled Facilities

The NYISO’s Keystone Proxy Generator Bus includes a mix of transmission lines that

are free-flowing and transmission lines that are directly PAR controlled. Section 17.1.1.1.2 of

the NYISO’s proposed tariff revisions require the NYISO to calculate a Keystone price that:

(1) reflects Consolidated Edison Company of New York’s hourly elections under the Operating Protocol for the Implementation Of Con Ed - PJM Transmission Service Agreements (“Con

Edison Operating Protocol”),19 and (2) incorporates expected power flows at its PAR-controlled ABC interface, JK interface and Branchburg-Ramapo interconnection with PJM.

The NYISO’s weighting of the identified PAR-controlled tie lines will reflect historically observed actual power flows relative to expected power flows, and respect existing contractual obligations including the Con Edison Operating Protocol and, commencing in January of 2013, the requirements of the Market-to-Market Coordination Agreement (“M2M Coordination

Agreement”)20 between NYISO and PJM, which improves upon, and replaces the parties’ earlier Unscheduled Transmission Services Agreement21 that addressed Ramapo PAR operation and

transmission service over the Branchburg-Ramapo interconnection. To more accurately reflect

expected operating conditions, the NYISO may also implement a MW offset (into NYISO or

into PJM) on the Branchburg-Ramapo interconnection.

19 The Con Edison Operating Protocol is Schedule C to Section 35 of (Attachment CC to) the NYISO’s OATT.

20 The M2M Coordination Agreement took effect as Schedule D to Section 35 of (Attachment CC to) the NYISO’s OATT on January 15, 2013.

21 The UTS Agreement was submitted by PJM in Docket No. ER01-1115-000 on January 31, 2001.

10

In the DAM, for the purposes of scheduling and pricing, the SCUC expected flows will be established for the ABC interface, JK interface, and Branchburg-Ramapo interconnection based on the following:

a. Consolidated Edison Company of New York’s DAM hourly election under the

Con Edison Operating Protocol;

b. The percentage of PJM-NYISO scheduled interchange that is expected to flow

over the Branchburg-Ramapo interconnection. The expected flow may also be

adjusted by a MW offset (into NYISO or into PJM) to reflect expected

operational conditions;

c. The percentage of PJM-NYISO scheduled interchange (if any) that is expected to

flow over the ABC interface; and

d. The percentage of PJM-NYISO scheduled interchange (if any) that is expected to

flow over the JK interface.

Section 17.1.1.1.2 of the NYISO’s proposed Tariff revisions explains that expected

power flows in the RTC/RTD will be established for the ABC interface, JK interface, and

Branchburg-Ramapo interconnection based on the measured, current flow, modified to reflect

the expected impacts of transaction schedule changes over the forward scheduling horizon.

RTC and RTD expected flows over the forward scheduling horizon will be established for the ABC interface, JK interface, and Branchburg-Ramapo interconnection in a manner that incorporates the same factors that are considered in establishing expected DAM power flows over these facilities. In the RTM, for each of the forward scheduling time horizons, for the

11

purposes of scheduling and pricing, RTC/RTD expected flows will be established for the ABC interface, JK interface, and Branchburg-Ramapo interconnection based on the following:

a. The current level of ABC interface, JK interface, and Branchburg-Ramapo

interconnection measured power flows;

b. Con Edison’s RTM hourly election under OATT Attachment CC, Schedule C;

c. The percentage of PJM-NYISO scheduled interchange adjustments that are

expected to flow over the Branchburg-Ramapo interconnection. The expected

flow may also be adjusted by a MW offset to reflect expected operational

conditions;

d. The percentage of PJM-NYISO scheduled interchange adjustments (if any) that

are expected to flow over the ABC interface; and

e. The percentage of PJM-NYISO scheduled interchange adjustments (if any) that

are expected to flow over the JK interface.

The NYISO illustrates its proposed method of determining prices at its Keystone Proxy Generator Bus in Section I.H.2 of this filing letter.

2. Determining Expected Power Flows on Free Flowing Tie Lines

Section 17.1.1.1 of the NYISO’s proposed Tariff revisions explains that the expected

flows resulting from scheduling interchange on the remaining free flowing tie lines between

NYISO/IESO and NYISO/PJM will be determined consistent with the network impedance

derived shift factors. Shift factors are independently calculated for each time step of the DAM

and RTM scheduling horizon based upon the network topology expected for the relevant time

12

interval, including the operating status of internal and coordinated external transmission facilities.

E. Determining Shift Factors and Incremental System Losses

At PJM’s and NYISO’s common border PJM identifies two pricing nodes (located in

western and eastern New York) and assigns weightings to the pricing nodes that align PJM’s

price calculations with expected locational power deliveries. NYISO achieves the same

objective through the combination of (a) selecting an appropriate location for its Keystone Proxy Generator Bus,22 and (b) weighting assignments applied to specific tie lines (see Section

17.1.1.1.2 of the NYISO’s proposed Tariff revisions). PJM’s and NYISO’s methods were each

developed to ensure external Proxy Generator Bus prices are consistent with expected power

deliveries. Failure to accurately anticipate locational power deliveries when determining prices

could result in incomplete cost recovery and unnecessary uplift allocations to stakeholders.

Differences in implementation methods are necessary due to (a) PJM’s and NYISO’s

fundamentally different market systems that were developed by different software vendors, and

(b) the previously explained differences between NYISO’s economic evaluation of Bids using ex ante prices and PJM’s use of physical reservations and ex post pricing.

External Proxy Generator Buses shift factors and loss delivery (penalty) factors will be

determined such that incremental unscheduled power flows, in addition to the expected value of

UPF or Lake Erie circulation, will be reflected across the NYISO/IESO and NYISO/PJM

interfaces. Shift factors measure the expected incremental flow on a specific line or constraint

that will arise from an injection at the relevant Proxy Generator Bus and a corresponding

22 The locations that the NYISO assigns to Proxy Generator Buses are selected by the NYISO because they effectively represent expected power flows from/to the source/sink external Control Area.

13

withdrawal at the Reference Bus. The calculation of shift factors is performed in the same manner across all scheduling horizons and between the DAM and RTM.

F. Determining Expected Power Flows and Prices for Scheduled Lines and

Chateauguay Interconnection with Hydro Quebec

In Section 17.1.1.1.3 of the proposed Tariff revisions the NYISO proposes to determine prices for Scheduled Lines, and for its direct current interconnection with neighboring Control Area Hydro Quebec, based on the expectation that actual power flow will be equal to scheduled power flows on those facilities. Scheduled Lines have historically demonstrated the ability to control actual power flows to scheduled power flows. PJM’s pricing treatment of Scheduled Lines is very similar to the NYISO’s proposal.

G. Posting of Interface Pricing Determinants

In Section 17.1.1.1.1 of its proposed Tariff revisions the NYISO proposes to publicly

post the on-peak and off-peak DAM UPFs on its web site. In Section 17.1.1.1.2 of the proposed Tariff revisions the NYISO proposes to publicly post the percentage values it is currently using to establish expected ABC interface, JK interface and Branchburg-Ramapo interconnection

flows in the DAM and RTM on its web site.

H. Examples of How NYISO’s Pricing Methods Will Operate in Practice

Because there has not been significant controversy about how NYISO or PJM necessarily

develop their DAM prices based on expected power flows, the focus of the NYISO’s examples is

on its RTM (RTC/RTD) pricing. The NYISO starts the scheduling and price calculation process

for each five-minute real-time interval by re-initializing its real-time network model using

observed actual power flows over the NYCA tie lines that comprise the NYISO/PJM and

NYISO/IESO borders. In real-time, expected Lake Erie circulation will be established by

14

measuring, via telemetry, the difference between NYCA/Ontario scheduled interchange and

actual power flows. Prices for the Keystone (PJM) and Bruce (Ontario) Proxy Generator Buses,

and for internal NYCA locations, will reflect the measured value of Lake Erie circulation, and

any additional impact of incremental unscheduled power flows resulting from changes in the

NYISO/PJM and NYISO/IESO interchange over all relevant RTC and RTD intervals. Observed

tie line flows and adjustments due to interchange schedule changes are all accounted for in

determining transmission congestion and the marginal cost of relieving the congestion. All

external Proxy Generator Bus prices and internal NYCA prices that the NYISO develops

dynamically capture the impact of real-time power flows on constraint costs as constraints are

affected by changes in actual real-time power flows. The process by which this is accomplished

is illustrated in the examples below.

Consistent with the Commission’s instruction in paragraph 25 of the March Order and

paragraph 21 of the Commission’s August Order, the NYISO provides seven illustrated

examples to better explain the pricing method proposed in its Tariff revisions. To provide clear,

targeted examples, the pricing examples set forth below focus on transmission congestion and

UPF, and do not expressly incorporate or address the impact of system losses on pricing.

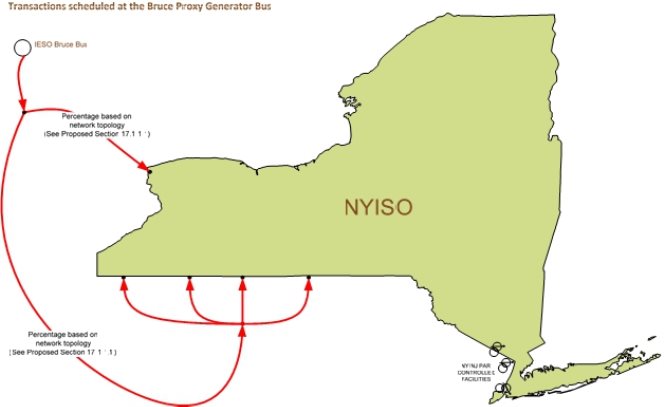

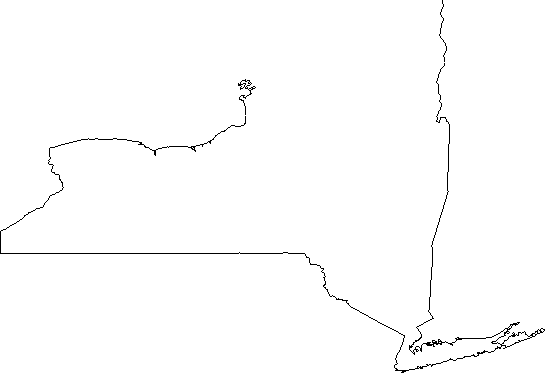

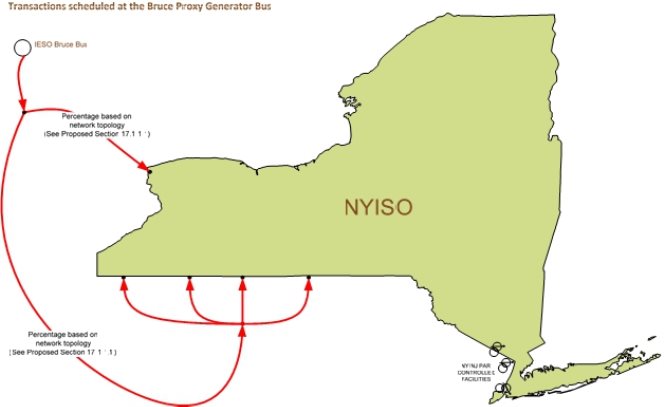

1.Bruce Proxy Generator Bus (Ontario)

External Transactions scheduled between the NYCA and Ontario at the NYISO’s Bruce (Ontario) Proxy Generator Bus will be reflected in the NYISO’s pricing in the manner described and illustrated below.

15

Illustration of Example 1: NYISO’s Method of Modeling Power Flows for External Transactions

Scheduled at the Bruce Proxy Generator Bus

The majority of the power scheduled between Ontario and the NYCA will be expected to

flow over the direct tie lines between the NYCA and Ontario. However, the NYISO’s pricing

and scheduling for the Bruce Proxy Generator Bus will reflect a portion of the power that is

scheduled at that Proxy Generator Bus as entering or exiting the NYCA via the free-flowing A/C

tie lines between Pennsylvania (PJM) and western New York. In order to produce appropriate

prices, the NYISO’s expected power flows must be closely aligned with actual power flows.

In real-time the NYISO will determine the portion of the scheduled flow that enters/exits New York via the Pennsylvania tie lines based on actual system conditions. In the DAM, the NYISO uses expected power flows and the expected system configuration. The NYISO has the

16

ability to adjust the power flow expectations used in its DAM pricing if they prove to be inaccurate in practice.

As illustrated in Example 3 below, key aspects of the NYISO’s power flow expectations, such as the impact of transmission facility outages, are dynamically reflected in the power flow expectations the NYISO uses to determine its scheduling and pricing.

The Ramapo, ABC and JK PARs have all demonstrated the ability to conform the

average delivery of power, over time, to the desired power flow.23 As Dr. Patton explains in

paragraph 19 of his attached Affidavit, it is appropriate to incorporate the operation of PARs into the development of interface prices in order to ensure that prices accurately reflect expected

power flows:

Phase Angle Regulators (“PARs”) can cause the expected power flows associated

with two transactions with identical sources and sinks, but that are scheduled over

different paths, to be very different. Ultimately, therefore, I believe it may be

necessary for all RTOs’ interface pricing to distinguish between transactions that

may have the same source and sink, but different transmission paths, when one or

both paths include PARs whose operation is affected by the transaction schedule.

For example, if PARs on a particular path are operated to conform actual flows

over an interface to the net schedules (i.e., to reduce loop flows), then the

expected power flows for transactions over that path may be materially different

than the expected power flows for transaction from the same source that is

scheduled over other paths. However, this improvement in the interface pricing

should be addressed in the future once the performance of relevant PARs has been

fully evaluated.

The NYISO’s pricing method reflects the demonstrated ability of these PARs to block unscheduled power flows in both the DAM and RTM.

23 Desired power flow between the NYCA and PJM is not necessarily identical to scheduled interchange because the Ramapo PARs have historically been, and will continue to be operated by the NYISO and PJM to provide

congestion relief. Historically, the Ramapo PARs have been operated to provide congestion relief pursuant to the

UTS Agreement. Commencing January 15, 2013, PJM and NYISO replaced the UTS Agreement with the more

precise M2M rules. The Commission ultimately accepted the joint PJM/NYISO M2M proposal (including the

incorporation of the operation of the Ramapo PARs into the M2M rules) in a letter order issued on December 12,

2012 in Docket No. ER12-718-002.

17

In addition to reflecting the expected path over which scheduled interchange will travel,

the NYISO proposes to incorporate expected UPF, including Lake Erie loop flow, into its prices

and schedules. For its DAM, NYISO proposes to determine UPF on a weekly basis for “on

peak” and “off peak” periods using the average actual power flows the NYISO has observed in

real-time over the past 30 days on a rolling basis.24 The NYISO’s proposed Tariff revisions also

permit the NYISO to adjust the UPF to anticipate changes in market rules, system topology, or

other factors that are expected to significantly influence UPF. In the RTM, UPF is determined

by comparing current power flows measured at the NYISO/Ontario interface to the interface

schedule. Any delta between the two values is UPF. As illustrated in Example 6, below, UPF

can aggravate or alleviate system congestion, and can impact the prices determined at the

NYISO’s Proxy Generator Buses via its impact on NYCA transmission congestion.

2.Example Illustrating Price Calculation at Bruce Under Normal

System Conditions

The NYISO offers the following example to illustrate how an interface price would be

determined using the NYISO’s proposed pricing method under a specified set of system

conditions.

24 The NYISO has been using a 30 day rolling average to predict UPF for several years. The NYISO’s experience

indicates that using a 30 day rolling average produces reasonable UPF expectations. See Attachment I at ¶ 14.

18

INTERFACE PRICING EXAMPLE ‐ NORMAL SYSTEM CONDITIONS (ILLUSTRATIVE ONLY)

NYISO LBMP for

IESO BRUCE NODE

$34.00

IESO-NYISO

100MW e-Tag

Path

80%

Michigan/Ontario

PARs$30

NYISO

$50

20%

NY/NJ PAR

CONTROLLED

FACILITIES

Expected Actual Flow

E-Tag Path

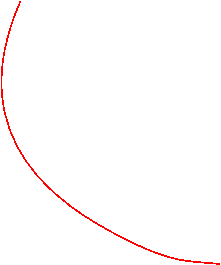

Illustration of Example 2: Interface Pricing Example - Normal System Conditions

The above example illustrates how the NYISO’s proposed interface pricing method will

produce prices that are consistent with the value of actual power deliveries to New York. The

example assumes that, based on system topology, the NYISO expects that 80% of an Ontario to

New York schedule will flow across the direct interties between New York and Ontario. The

example assumes that the NYISO similarly determines that the remaining 20% of the power is

expected to loop through MISO and PJM, and enter New York via the A/C ties between western

New York and Pennsylvania (PJM). The example includes a NYCA transmission constraint that

is separating the Bruce Proxy Generator Bus and a portion of NYCA Zone A from the rest of the

19

NYCA. The LBMP on the low-side of the transmission constraint is $30/MWh and the LBMP on the high-side of the constraint is $50/MWh.

Under these assumptions, 80% of an Import to New York scheduled at Bruce would be

expected to flow from Ontario to New York over the NYISO’s ties with Ontario, and would have a value of $30/MWh. The remaining 20% of the imported power would be expected to loop

through MISO and PJM and enter New York via the 230 kV ties with Pennsylvania. Because this power is expected to enter New York on the high-side of the transmission constraint, it has a value of $50/MWh. Under the power flow assumptions used to develop this simplified example, the NYISO would calculate a $34/MWh price at the Bruce Proxy Generator Bus based on how power scheduled at the proxy would be expected to enter New York, consistent with the average value of the expected power flow of $30/MWh * 0.8 + $50/MWh * 0.2 = $34/MWh. The

posited 100 MW import scheduled from Ontario would receive $3,400.

3.Example Illustrating the Pricing/Scheduling Impact of a Transmission

Facility Outage

The NYISO offers the following example to illustrate how the NYISO dynamically

reflects NYCA transmission facility outages, (and outages of coordinated transmission facilities in neighboring Control Areas), in its interface prices.

20

INTERFACE PRICING EXAMPLE ‐ WITH BECK‐PACKARD BP‐76 TRANSMISSION LINE OUT OF SERVICE (ILLUSTRATIVE ONLY)

NYISO LBMP for

IESO BRUCE NODE

$35.40

IESO-NYISO

100MW e-Tag

Path

73%

Michigan/Ontario

27%

NY/NJ PAR

CONTROLLED

FACILITIES

Expected Actual Flow

E-Tag Path

Transmission Line

Out of Service Transmission Line

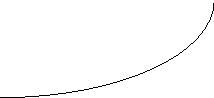

Illustration of Example 3: Interface Pricing Example - with Beck-Packard BP-76 Transmission Line

Out of Service

Example 3 builds on Example 2, above. The example illustrates how the NYISO’s

calculation of the price for its Bruce Proxy Generator Bus would change if the Beck-Packard BP-

76 transmission line were out-of-service. In Example 2, the NYISO relied on real-time system

topology to develop its expectation that approximately 80% of an Ontario to New York schedule

would flow across the direct interties between New York and Ontario, and the remaining 20%

would loop through MISO and PJM, and enter New York via the A/C ties between western New

York and Pennsylvania (PJM). In Example 3, the outage of the Beck-Packard BP-76

transmission line increases resistance to power flowing directly into New York from Ontario,

21

which changes the system topology and distribution of both actual power flows, and the expected

power flows that the NYISO uses to determine the price at the Bruce Proxy Generator Bus to

73% of the power flowing directly over the New York/Ontario ties and 27% of the power

looping through MISO and PJM and entering New York via the 230 kV ties with Pennsylvania.

Example 3 includes the same transmission constraint as Example 2. As a result, the 73% component of the power that flows from Ontario to New York over the scheduled path and the NYISO’s ties to Ontario has a value of $30/MWh, while the 27% of the power that is expected to loop through MISO and PJM and enters New York via the 230 kV ties with Pennsylvania has a value of $50/MWh. Under the facts assumed in this example, the $34/MWh Bruce Proxy

Generator Bus price that the NYISO calculated in Example 2 would be increased to

$35.40/MWh because more of the interchange scheduled at Bruce would be expected to enter

New York on the high-side of the transmission constraint. The posited 100 MW import

scheduled from Ontario would receive $3,540.

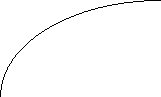

4.Keystone Proxy Generator Bus (PJM)

External Transactions scheduled between the NYCA and PJM at the Keystone Proxy

Generator Bus will be reflected in the NYISO’s pricing in the manner described and illustrated

below.

22

NYISO’s method of modeling power flows for External

Transactions scheduled at the Keystone Proxy Generator Bus

NYISO

Percentage based on

network topology

(See Proposed Section 17.1.1.1)

Percentage based on

network topology

(See Proposed Section 17.1.1.1)

100% less the Percentage of

PJM-NY Scheduled Interchange

expected to flow over

NY/NJ PARs

PJM Keystone Bus

NY/NJ PAR

CONTROLLED

FACILITIES

Percentage of PJM-NY

Scheduled Interchange

expected to flow over

NY/NJ PARs

(See Proposed Section 17.1.1.1.2)

Illustration of Example 4: NYISO’s Method of Modeling Power Flows for External Transactions

Scheduled at the Keystone Proxy Generator Bus

The NYISO’s proposed pricing method will reflect a publicly posted percentage of

interchange that is directly scheduled between PJM and the NYCA as flowing over the

Branchburg-Ramapo (5018) interconnection. This is appropriate because a primary purpose of the Ramapo PARs is to support the use of the Branchburg-Ramapo interconnection to achieve the PJM/NYISO interchange schedule.

The 1000 MW capability of the Branchburg-Ramapo line is 40 percent of the Keystone

Proxy Generator Bus’s (approximately) 2,500 MW ATC. The NYISO has observed that

historically, on average, approximately 40% of interchange schedules between PJM and the

23

NYCA flow on the Branchburg-Ramapo transmission line. For the foregoing reasons, the

NYISO’s pricing currently projects that 40% of scheduled interchange with PJM flows over the Branchburg-Ramapo interconnection. The NYISO consistently uses the 40% estimate to

determine prices in both its DAM and RTM.

On January 15, 2013 the NYISO implemented M2M Coordination with PJM. M2M

Coordination provides more precise market incentives to achieve (or deviate from) Branchburg-

Ramapo target flows. The M2M rules allow the Branchburg-Ramapo line to carry 61%, or more,

of PJM/NYISO scheduled interchange. The NYISO is gathering data to review the impact that

M2M Coordination has on Branchburg-Ramapo power flows. The NYISO is prepared to revise

its expectation of Branchburg-Ramapo power flows to incorporate changes it observes in actual

power deliveries.

Consistent with changes to the Con Edison Operating Protocol that took effect on March 15, 2012, the NYISO intends to implement its proposed interface pricing method using the

assumption that 0% of PJM/NYISO scheduled interchange will flow over the ABC and JK

interfaces. However, it is possible for up to 13% of PJM/New York scheduled interchange to

flow over each of the ABC and JK interfaces at times when the Branchburg-Ramapo

interconnection is at or near its 1000 MW scheduling limit.25 The proposed Tariff revisions

permit the NYISO to calculate prices based on expected power flows that include flows over the ABC and JK interfaces. If the NYISO determines that it is appropriate to incorporate an

expectation that a portion of scheduled interchange will flow over the ABC or JK interfaces, the NYISO will publicly post the percentage of interchange that it anticipates will flow over the

ABC and JK interfaces for pricing and scheduling purposes.

25 See Appendix 3 to the Con Edison Operating Protocol (Schedule C to Attachment CC to the OATT); M2M Coordination Agreement (Schedule D to Attachment CC to the OATT) at § 7.2.1.

24

Section 17.1.1.1.2 of the proposed Tariff revisions requires the NYISO to publicly post the percentage of scheduled PJM/NYISO interchange it expects to flow over each of the ABC interface, JK interface and Branchburg-Ramapo interconnection, and to provide notice to

stakeholders before NYISO changes the power flow expectations that it uses to determine prices.

The component of Keystone scheduled interchange that is not expected to flow over the ABC interface, JK interface or Branchburg-Ramapo interconnection is expected to flow

primarily over the free-flowing ties between Pennsylvania and western New York, and

secondarily over the ties between New York and Ontario. The exact percentages of power flows assigned to specific lines will be determined based on system topology, the UPF that has been determined for each hour and, in the RTM, actual system conditions.

5. Example Illustrating Price Calculation at Keystone Under Normal

System Conditions, Including References to Section 17.1.1 of Attachment B to the Services Tariff

The NYISO offers the following example to illustrate how an interface price would be determined at the Keystone Proxy Generator Bus using the NYISO’s proposed pricing method under a specified set of system conditions.

25

INTERFACE PRICING EXAMPLE - NORMAL SYSTEM CONDITIONS (ILLUSTRATIVE ONLY)

$30

Percentage based on

network topology

(See Proposed Section 17.1.1.1)

Percentage based on

network topology

(See Proposed Section 17.1.1.1)

100% less the Percentage of

PJM-NY Scheduled Interchange

expected to flow over

NY/NJ PARs

NYISO

$50

NY/NJ PAR

CONTROLLED

FACILITIES

Percentage of PJM-NY

Scheduled Interchange

expected to flow over

NY/NJ PARs

(See Proposed Section 17.1.1.1.2)

NYISO LBMP for

PJM KEYSTONE NODE

$38.00

Illustration of Example 5: Interface Pricing Example - Normal System Conditions

Example 5 illustrates the NYISO’s calculation of a real-time (RTC or RTD) price at its

Keystone Proxy Generator Bus at a time when the NYCA is not subject to any UPF.26 The

example incorporates the NYISO’s currently effective pricing assumption that approximately

40% of the incremental (i.e. marginal) PJM to New York scheduled interchange flows over the

Branchburg-Ramapo interconnection. The power entering New York over the Branchburg-

Ramapo interconnection has a value of $50/MWh because it enters New York on the high-side

of the transmission constraint that is illustrated in the example. For the purpose of this example,

26 The effect UPF has on pricing is explained in Example 6, below.

26

assume the remainder of the schedule (60%), flows primarily (47%) across the 230 kV A/C ties between Pennsylvania and western New York, and secondarily (13%) across the NYISO’s ties with Ontario. In practice, these breakdowns will be determined from the expected network

topology and resulting impedance model developed at each execution of the RTC/RTD. Because there is no transmission congestion between western New York and Ontario in the example, the power flowing over the Pennsylvania to western New York ties, and the power flowing into New York from Ontario has a uniform value of $30/MWh.

The calculation of LBMPs at external Proxy Generator Buses is comparable to the

calculation of LBMPs for internal NYCA pricing nodes. Example 5 presents a scenario where

the system marginal price at the Reference Bus (λR) = $30.00/MWh and the Congestion

Component (γC) = $20.00.27 Assuming the Shift Factor for a generator near the Branchburg-

Ramapo interconnection (that is representative of the expected impact of power flows over

Branchburg-Ramapo) on the constraint (GF1) = 0.5, then the corresponding Shadow Price of the

Constraint (µ1) = $40.00/MWh. The resulting LBMP for the Branchburg-Ramapo

interconnection is LBMP = λR + γC = λR + GF1 *µ1 = $30.00 + 0.5 * 40.00 = $50.00,28 as shown

in the above illustration. The equivalent calculation for the Keystone Proxy Generator Bus is

based upon the following:

• System Marginal Price: λR = $30.00/MWh

• Shadow Price of the Constraint: µ1 = $40.00/MWh

• Shift Factor for Keystone node on Constraint: GF1 = 0.20

The System Marginal Price and Shadow Price of Constraint 1 are the same for the Keystone Proxy Generator Bus as for internal NYCA resources.

27 Section 17.1.1 of (Attachment B to) the Services Tariff defines each of the symbols used in this example.

28 To provide a clear, targeted explanation, the impact of system losses is excluded from Example 5.

27

The shift factor for the Keystone Node on Constraint 1 is specific to the Keystone Proxy

Generator Bus and reflects Keystone’s impact on the constraint. The Keystone shift factor is

equivalent to the combination of the percentage of power flowing from the Keystone Proxy

Generator Bus to the node that represents the Branchburg-Ramapo interconnection (40%) and

the shift factor of Branchburg-Ramapo flows on the constraint (50%), for a combined effect of

0.5 * 0.4 = 0.20.

The $38/MWh price calculated for Keystone is equivalent to the flow weighted average

value of power, illustrated in the example as $30/MWh * 0.6 + $50/MWh * 0.4 = $38/MWh.

6.Example Illustrating Impact of 300 MW of Counter-Clockwise Lake

Erie Loop Flow on NYISO’s Pricing

Example 5 explained how the NYISO proposes to calculate a RTM price for the

Keystone Proxy Generator Bus assuming zero UPF. Example 6 illustrates how the NYISO

proposes to incorporate UPF into its development of its interface prices. In Example 6, 300 MW of counter-clockwise Lake Erie loop flow is added, and the effect of UPF on the NYISO’s

pricing is explained.

28

INTERFACE PRICING EXAMPLE ‐ WITH 300MW COUNTER CLOCKWISE LAKE ERIE LOOP FLOW (ILLUSTRATIVE ONLY)

Lake Erie

Loop Flow$32

300MW

CCW

Percentage based on

network topology

(See Proposed Section 17.1.1.1)

Percentage based on

network topology

(See Proposed Section 17.1.1.1)

100% less the Percentage of

PJM-NY Scheduled Interchange

expected to flow over

NY/NJ PARs

NYISO

$45

NY/NJ PAR

CONTROLLED

FACILITIES

Percentage of PJM-NY

Scheduled Interchange

expected to flow over

NY/NJ PARs

(See Proposed Section 17.1.1.1.2)

NYISO LBMP for

PJM KEYSTONE NODE

$37.20

Illustration of Example 6: Interface Pricing Example - with 300MW Counter Clockwise Lake Erie

Loop Flow

As explained in Section I.D.1 of this filing letter, RTC and RTD initiate their real-time

pricing determinations based on the current, measured power flow. If the NYCA is experiencing

Lake Erie loop flow (UPF), the impact of that loop flow will be captured by RTC and RTD and

reflected in NYCA system congestion. Comparing Example 6 to Example 5 above, the

introduction of 300 MW of counter-clockwise Lake Erie loop flow relieves West to East

transmission constraints in New York and permits additional western New York resources to

serve load in eastern New York. As a result, the LBMPs on either side of the transmission

constraint converge.

29

In Example 5, the LBMP on the high-side of the transmission constraint is $50/MWh and the LBMP on the low-side of the transmission constraint is $30/MWh. In Example 6, the

counter-clockwise loop flow that is introduced reduces the LBMP on the high-side of the

transmission constraint from $50/MWh to $45/MWh, and increases the LBMP on the low-side of the transmission constraint from $30/MWh to $32/MWh.29

The incorporation of the 300 MW of counter-clockwise loop flow into Example 6

reduces the NYISO’s overall cost to serve load. The price that the NYISO is willing to pay for

power purchased at the Keystone Proxy Generator Bus is correspondingly reduced from

$38/MWh in Example 5 (equivalent to a flow weighted average value of power of $30/MWh *

0.6 + $50/MWh * 0.4 = $38/MWh) to $37.20/MWh in Example 6 (equivalent to a flow weighted

average value of power of $32/MWh * 0.6 + $45/MWh * 0.4 = $37.20/MWh). The method used

to calculate the incremental Keystone Proxy Generator Bus price did not change due to the

presence of UPF in Example 6, but the price changed consistent with the actual, observed power

flows.

7. Example Illustrating How NYISO’s Proposed Pricing/Scheduling

Method Uses NERC E-Tags to Predict Expected Power Flows

As the NYISO explained in Section I.B of this filing letter, and as Dr. Patton explains in

paragraphs 15 - 20 of his attached affidavit, the NYISO’s bidding and scheduling system uses

the NERC e-Tag source and sink to identify the physical path over which transactions are

expected to flow. When the source and sink of a NERC e-Tag do not align with the expected

physical path, the proposed External Transaction will not be closely aligned with the NYISO’s

pricing expectations and will generate more loop flow than a directly scheduled External

29 The increased price in western New York is appropriate because more western New York resources are being employed to serve eastern New York load.

30

Transaction would. The NYISO’s implementation of the circuitous scheduling prohibition set forth in Section 16.3.3.8 of (Attachment J to) the NYISO’s OATT improves the accuracy of the NYISO’s pricing and reduces unnecessary Lake Erie loop flow by precluding the use of a

circuitous contract path to schedule External Transactions that can be scheduled directly between neighboring Control Areas around Lake Erie.

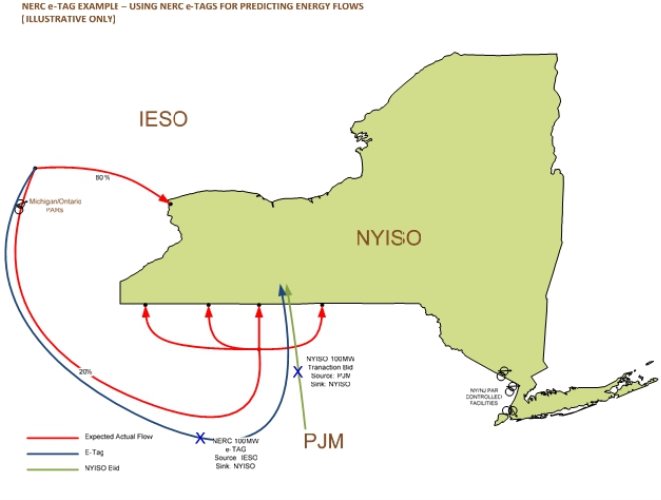

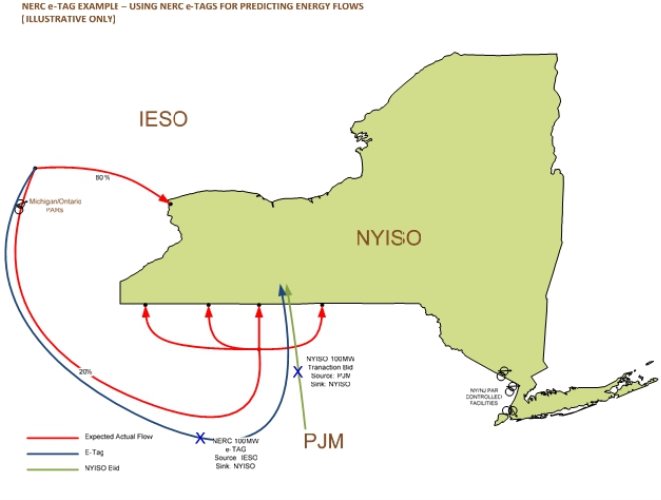

Illustration of Example 7: NERC e-Tag Example - Using NERC e-Tags for Predicting Energy Flows

Example 7 illustrates how the NYISO’s review of NERC e-Tag data and circuitous

scheduling path prohibition supports the NYISO’s economic evaluation process for External

Transactions. In the example a hypothetical 100MW Import has been offered into the NYCA at

31

the Keystone Proxy Generator Bus. The NERC e-Tag indicates that the source of the proposed External Transaction is Ontario, and that the contract path for the proposed External Transaction is a wheel that flows from Ontario, through MISO and PJM, ultimately sinking in the NYCA. The proposed External Transaction would not pass Bid validation in New York because it

violates the NYISO’s circuitous scheduling prohibition. The posited transaction would not be economically evaluated for possible scheduling in New York.

Incorporating the source, sink and scheduling path information included in the NERC e-

Tag associated with each External Transaction Bid into the NYISO’s Bid validation process will

enable the NYISO to identify and reject transactions that are offered in a manner that is

inconsistent with expected power flows. If the NYISO’s market evaluation relied solely on the

PJM Import Bid that the Market Participant submitted, without separately examining the source

and sink identified in the NERC e-Tag, the NYISO’s RTC and RTD would develop prices based

on the erroneous expectation that the vast majority of the proposed 100 MW External

Transaction schedule would be entering New York across the PJM interface, which is not what

would be expected to occur if the IESO to NYISO Import was scheduled directly between the

adjacent source and sink Control Areas, at the Bruce Proxy Generator Bus.

Using the power flow assumptions employed in Example 2 above, 80% of a directly scheduled 100 MW Import sourcing from Ontario (or 80MWs) would be expected to flow into the NYCA across the Ontario/NYCA interface. Only 20% of a directly scheduled 100 MW Import sourcing from Ontario (or 20MWs) would be expected to enter the NYCA across the PJM interface. While the dispatch of generation and operation of PARs around Lake Erie to achieve scheduled interchange would be expected to affect power flows, it would not be

32

appropriate to price a circuitously scheduled import that sources at Ontario the same way the NYISO prices a directly scheduled import from PJM.

Because the NERC tag indicates the source of this transaction is IESO, and the sink is NYISO, the NYISO is able to forecast the expected power flow associated with this proposed External Transaction and to determine that the expected power flow is not consistent with the power flow that would be expected for a NYISO Import from PJM. The NYISO’s

implementation of its circuitous scheduling path prohibition helps align prices with schedules and helps reduce Lake Erie loop flow.

II.Stakeholder Involvement

The NYISO discussed interface pricing with its stakeholders at its Market Issues

Working Group on May 26, 2011, September 16, 2011, January 19, 2012, and January 10, 2013.

The NYISO discussed interface pricing with its stakeholders at its Business Issues Committee on

June 15, 2011, November 9, 2011, April 18, 2012, May 16, 2012, June 13, 2012, and September

20, 2012.

III. Description of Proposed Tariff Revisions

In paragraph 25 of its March Order the Commission directed the NYISO to file “detailed tariff provisions specifying a revised pricing methodology…”30 Attachments II and III to this filing letter contain the required additions and revisions to the NYISO’s Tariffs. All of the

proposed additions and revisions submitted in this compliance filing are to Section 17 of

(Attachment B to) the NYISO’s Services Tariff.

The proposed addition of Sections 17.1.1.1, 17.1.1.1.1, 17.1.1.1.2 and 17.1.1.1.3 to

(Attachment B to) the Services Tariff is explained in detail above. The NYISO has also

30 New York Independent System Operator, Inc., 138 FERC ¶ 61,195 at P 25.

33

identified a small number of clarifying changes to the existing provisions of Section 17 of

(Attachment B to) the NYISO’s Services Tariff that are appropriate to ensure that the NYISO’s

Tariffs accurately describe how the NYISO will calculate interface prices.

There are three components to the prices that the NYISO calculates at its external

interfaces: Energy, the Congestion Component, and Marginal Losses. While proposed new

Section 17.1.1.1 provides additional details about how loss delivery factors will be calculated, it

does not specify how to calculate losses. Section 17.1.1 of (Attachment B to) the Services Tariff

currently addresses the calculation of losses at internal NYCA buses. Section 17.1.6.6 of

(Attachment B to) the Services Tariff currently addresses the calculation of losses at external

Proxy Generator Buses. The NYISO proposes to clarify, simplify and consolidate these two

tariff sections.

Proxy Generator Buses are, by definition, located outside the NYCA.31 The NYISO does not include losses that occur outside its Control Area in its calculation of LBMPs.32 The key difference between the loss calculations set forth in Section 17.1.1 and 17.1.6.6 is that the loss equation used for Proxy Generator Buses must exclude losses incurred to deliver power from the Proxy Generator Bus to the NYCA border. The NYISO proposes to amend Section 17.1.1 to accomplish this goal, and to delete Section 17.1.6.6 as superfluous.

In Section 17.1.1, the NYISO proposes to clarify that the Marginal Loss Component of

the LBMP at any bus, be it internal to the NYCA or a Proxy Generator Bus, will be calculated in

accordance with the equation set forth in that Section of the Services Tariff. The NYISO also

31 Section 2 of the Services Tariff defines a Proxy Generator Bus as “A proxy bus located outside the NYCA that is

selected by the ISO to represent a typical bus in an adjacent Control Area and for which LBMP prices are

calculated.”

32 It is the responsibility of each Control Area to deliver the full amount of an agreed upon net energy schedule to the appropriate point(s) of interconnection.

34

proposes to clarify that the “L” variable in the LBMP bus price equation in Section 17.1.1 only includes NYCA losses, and does not include losses that would be sustained moving power from a Proxy Generator Bus to the NYCA border. With the proposed revisions, the method of

calculating the marginal loss component of the LBMP that is described in Section 17.1.1 is a clear, accurate explanation of how the NYISO calculates the marginal loss component of LBMPs at internal NYCA buses, and at Proxy Generator Buses.

The NYISO proposes to delete Section 17.1.6.6 from (Attachment B to) the Services

Tariff it its entirety. The mechanics of calculating delivery factors on a line-by-line basis for

Proxy Generator Buses that are described in Section 17.1.6.6 are outdated. The calculation

method for internal Buses that is described in Section 17.1.1 applies to Proxy Generator Buses as well. Although the loss calculation that the NYISO performs for its Proxy Generator Buses

today is not performed on a line-by-line basis, it is functionally equivalent to the method

described in Section 17.1.6.6. Hence, the proposed revisions to Sections 17.1.1 and 17.1.6.6 will improve the accuracy of the NYISO’s Tariffs, but will have no substantive impact on the

NYISO’s calculation of losses at Proxy Generator Buses, or at internal buses.

IV.Proposed Effective Date

The NYISO requests that the Tariff revisions proposed in this filing be permitted to

become effective on Wednesday, March 20, 2013, 61 days after the date of this filing.

V.Documents Enclosed

The NYISO submits with this transmittal letter:

1. The Affidavit of Dr. David Patton supporting the NYISO’s proposed Tariff revisions

(Attachment I);

2. A clean version of the NYISO’s proposed revisions to Section 17 of (Attachment B

to) its Market Services Tariff (Attachment II);

35

3. A blacklined version of the NYISO’s proposed revisions to Section 17 of

(Attachment B to) its Market Services Tariff (Attachment III); and

4. A certificate of service in Docket No. ER08-1281.

VI.Communications

Communications and correspondence regarding this filing should be directed to:

Rana Mukerji, Senior Vice President of Market Structures

Robert E. Fernandez, General Counsel

*Robert Pike, Director of Market Design

Emilie Nelson, Director of Operations

Raymond Stalter, Director of Regulatory Affairs *Alex M. Schnell

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, N.Y. 12144

Tel: (518) 356-8707

Fax: (518) 356-7678

rpike@nyiso.com

aschnell@nyiso.com

*Persons designated for receipt of service.

VII. Service

This filing will be posted on the NYISO’s website at www.nyiso.com. In addition, the

NYISO will e-mail an electronic link to this filing to the official representative of each party to

this proceeding, to each of its customers, to each participant on its stakeholder committees, to the

New York State Public Service Commission, and to the New Jersey Board of Public Utilities.

36

VIII. Conclusion

Wherefore, for the foregoing reasons, the NYISO respectfully requests that the

Commission accept the attached, proposed Tariff additions and revisions for filing in satisfaction of the Commission’s compliance directives in the December Order, the July Order, the March Order and the August Order.

Respectfully submitted,

/s/ Alex M. Schnell

Robert E. Fernandez, General Counsel Alex M. Schnell

New York Independent System Operator, Inc.

37

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §385.2010.

Dated at Rensselaer, NY this 18th day of January, 2013.

/s/ Joy A. Zimberlin

Joy A. Zimberlin

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, NY 12144 (518) 356-6207