10 Krey Boulevard Rensselaer, NY 12144

August 14, 2013

By Electronic Delivery

Kimberly D. Bose, Secretary

Federal Energy Regulatory Commission 888 First Street N.E.

Washington, D.C. 20426

Re: New York Independent System Operator, Inc.’s Compliance Filing in

Docket No. ER11-4338-000

Dear Ms. Bose:

The New York Independent System Operator, Inc. (“NYISO”) hereby submits a

compliance filing to fulfill the directives of the Federal Energy Regulatory Commission

(“Commission”) in its May 16, 2013, Order on Compliance Filing (“May 16 Order”) in the

above-captioned proceeding.1 In an August 19, 2011, filing, the NYISO submitted proposed

revisions to its Open Access Transmission Tariff (“OATT”) and Market Administration and

Control Area Services Tariff (“Services Tariff”) to comply with the Commission’s Order No.

745 requirements (“August 2011 Filing”).2 In the May 16 Order, the Commission accepted the

NYISO’s proposed revisions in part and directed the NYISO to submit a further compliance

filing to make certain tariff revisions and provide additional support for certain portions of the

August 2011 Filing.

The NYISO submits this further compliance filing to address the Commission’s directives in the May 16 Order. Specifically, this filing:

• Provides additional support for the NYISO’s exclusion of off-peak hours in constructing

the supply curve for the reference month used for the NYISO’s net benefits test (“Net

Benefits Test”);3

1 New York Independent System Operator, Inc., 143 FERC ¶ 61,134 (May 16, 2013) (“May 16

Order”). The Commission granted the NYISO an extension to August 14, 2013, for submitting this filing. New York Independent System Operator, Inc., Notice of Extension of Time, Docket No. ER11-4338-000 (June 13, 2013).

2 New York Independent System Operator, Inc., Demand Response Compensation in Organized

Wholesale Energy Markets, Docket No. ER11-4338-000 (August 19, 2011) (“August 2011 Filing”).

3 Capitalized terms not otherwise defined herein shall have the meaning specified in Article 2 of

Kimberly D. Bose, Secretary August 14, 2013

Page 2 of 31

• Provides additional support for the NYISO’s use of the highest point of the representative

supply curve as the net benefits threshold;

• Revises Section 4.2.1.9 of the NYISO Services Tariff to remove the NYISO’s proposed

adjustment to the monthly net benefits threshold price for changes in natural gas prices

that occur after the posting of the threshold;

• Provides additional support for the NYISO’s use of the net benefits threshold price as an

offer floor for the NYISO’s Day-Ahead Demand Response Program (“DADRP”);

• Provides additional support for the NYISO’s use of a cap for the in-day adjustment to a

Demand Side Resource’s Economic Customer Baseline Load (“ECBL”);

• Clarifies that the NYISO’s use of the ECBL for the DADRP does not preclude a

consideration of alternative baseline methodologies;

• Inserts data reporting requirements in Attachment R of the NYISO OATT;

• Revises the methodology for allocating DADRP costs in Attachment R of the NYISO

OATT; and

• Includes certain ministerial changes to the tariff sheets provided with the August 2011

Filing.

Since the May 16 Order, the NYISO has held several discussions with its stakeholders

regarding its compliance obligations. On June 28, 2013, the NYISO described to stakeholders

the eight compliance obligations arising from the May 16 Order.4 On July 25, 2013, the NYISO

and stakeholders discussed the status of all eight compliance obligations, with detailed

discussion on the compliance obligations related to the use of the offer floor and the baseline.5

In addition, on August 6, 2013, the NYISO held follow-up discussions with its stakeholders

regarding the previously discussed material and a detailed review of all compliance obligations.6

the Services Tariff or Article 1 of the OATT.

4 See “FERC Order 745 Compliance Update” presentation, NYISO Market Issues Working Group (June 28, 2013), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/meeting_materials/201

3-06-

28/FERC%20Order%20745%20Compliance%20Update_MIWG_06282013_06242013%20final.pdf.

5 See “FERC Order 745 Compliance Update” presentation, NYISO Market Issues Working Group (July 25, 2013), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/meeting_materials/201

3-07-25/FERC%20Order%20745%20Compliance%20Update_MIWG_07252013_07222013_final.pdf.

6 See “FERC Order 745 Compliance Filing Overview” presentation, NYISO Market Issues Working Group (August 6, 2013), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/meeting_materials/201

Kimberly D. Bose, Secretary August 14, 2013

Page 3 of 31

The NYISO respectfully submits that - with the proposed tariff revisions and additional

support set forth in this further compliance filing - it fully complies with the requirements set

forth in Order No. 745. As described below, the NYISO respectfully requests a flexible effective

date with the proposed tariff revisions to be effective on a date to be designated by the NYISO in

a filing with the Commission within thirty days of the Commission’s acceptance of this filing.

I. DOCUMENTS SUBMITTED

1. This filing letter;

2. Affidavit of Nicole Bouchez (“Attachment I”);

3. Charts for Reference Months of August 2009 through August 2010 as described

in Section IV.A below (“Attachment II”);

4. Charts for Reference Months of August 2009 through August 2010 as described

in Section IV.B below (“Attachment III”);

5. A clean version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment IV”);

6. A blacklined version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment V”);

7. A clean version of the proposed revisions to the NYISO’s OATT (“Attachment

VI”); and

8. A blacklined version of the proposed revisions to the NYISO’s OATT

(“Attachment VII”).

II. COMMUNICATIONS

Communications and correspondence regarding this filing should be directed to:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director of Regulatory Affairs *David Allen, Senior Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-6000

Fax: (518) 356-4702

rfernandez@nyiso.com

*Ted J. Murphy

Hunton & Williams LLP

2200 Pennsylvania Avenue, NW Washington, D.C. 20037

Tel: (202) 955-1500

Fax: (202) 778-2201

tmurphy@hunton.com

Kevin W. Jones

3-08-

06/FERC%20Order%20745%20Compliance%20Filing%20Overview_MIWG_08062013_08012013_fina

l.pdf

Kimberly D. Bose, Secretary August 14, 2013

Page 4 of 31

rstalter@nyiso.com *Michael J. Messonnier, Jr.7

dallen@nyiso.com Hunton & Williams LLP

951 East Byrd Street

Richmond, VA 23219

Tel: (804) 788-8200

Fax: (804) 344-7999

kjones@hunton.com

mmessonnier@hunton.com

III. BACKGROUND

On March 15, 2011, the Commission issued Order No. 745 concerning compensation for demand response resources participating in Energy markets administered by Independent System Operators (“ISOs”) and Regional Transmission Organizations (“RTOs”).8 Order No. 745

provided that when a demand response resource participating in an ISO/RTO-administered

energy market can balance supply and demand as an alternative to generation and when dispatch of the demand response resource is cost-effective as determined by a net benefits test, the

demand response resource must be compensated for its demand reduction in the Energy market at the locational marginal price (“LMP”) for Energy.9 To implement this compensation

approach, Order No. 745 established requirements for a net benefits test, required the review and modification, if necessary, of measurement and verification procedures, and required a method

for allocating the costs of demand response payments among the Loads that benefit from these

resources being scheduled to perform demand reduction.10

On August 19, 2011, the NYISO submitted its compliance filing in response to Order No.

745. The NYISO described how Demand Side Resources are full participants in the NYISO’s

DADRP and are compensated at the locational based marginal price (“LBMP”) for Energy at

which the NYISO’s Day-Ahead Market settles for the relevant hour and location.11 The NYISO

7 The NYISO respectfully requests waiver of 18 C.F.R. § 385.203(b)(3) (2011) to permit service on counsel for the NYISO in both Washington, D.C. and Richmond, VA.

8 Demand Response Compensation in Organized Wholesale Energy Markets, Order No. 745, 134 FERC ¶ 61,187 (March 15, 2011) (“Order No. 745”); reh’g denied, Order No. 745-A, 137 FERC ¶ 61,215 (Dec. 15, 2011); reh’g denied, Order No. 745-B, 138 FERC ¶ 61,148 (2012).

9 Id. at P 2.

10 Id. at PP 4-6.

11 August 2011 Filing at p 2. For purposes of this proceeding, LBMP and LMP are comparable and are referred to interchangeably.

Kimberly D. Bose, Secretary August 14, 2013

Page 5 of 31

proposed a methodology for a Net Benefits Test,12 certain revisions to its verification and

measurement requirements,13 and minor modifications to its existing cost allocation

methodology.14 In the May 16 Order, the Commission accepted the NYISO’s compliance filing in part and directed the NYISO to make certain tariff revisions and to provide further support for certain portions of its compliance filing as described below.15

IV. COMPLIANCE REVISIONS TO NET BENEFITS TEST

Order No. 745 requires ISOs/RTOs to develop a methodology for determining the net

benefits threshold price, which is “the point along the supply stack beyond which the overall

benefit from the reduced LMP resulting from dispatching demand response resources exceeds the cost of dispatching and paying LMP to those resources.”16 Specifically, Order No. 745

requires that the ISO/RTO: (1) develop a representative supply curve for each month based on the previous year’s supply curve, (2) find the net benefits threshold price for each month, based on historical data, (3) update the data for significant changes in resources availability and fuel

prices, and (4) post the result and apply the updated threshold in the bidding and scheduling

processes for the next calendar month.17

In the August 2011 Filing, the NYISO proposed a Net Benefits Test methodology for

calculating the net benefits threshold price.18 In the May 16 Order, the Commission

conditionally accepted the NYISO’s proposed Net Benefits Test and directed the NYISO to

provide additional evidence to support certain portions of the methodology and to make certain

tariff revisions.19 The NYISO’s filing satisfies the Commission’s directives as described below.

12 Id. at pp 3-10.

13 Id. at pp 11-12.

14 Id. at p 10.

15 May 16 Order at P 1.

16 Order No. 745 at P 4.

17 Id. at PP 79-81.

18 August 2011 Filing at pp 3-9.

19 May 16 Order at P 37.

Kimberly D. Bose, Secretary August 14, 2013

Page 6 of 31

A. The NYISO’s Exclusion of Off-Peak Hours to Construct the Supply Curve for the

Reference Month is Reasonable as It Aligns the Supply Curve with the High Load Hours in which Actual Demand Reduction Is Likely to Occur

The first step of the NYISO’s Net Benefits Test methodology is to retrieve the bids and

offers that will be used to construct the supply curve for the reference month. The “reference

month” is the month that is twelve months prior to the “study month” in which the net benefits

threshold price is to be applied. In the August 2011 Filing, the NYISO proposed to analyze only

the high Load, peak hours - Hour Beginning (“HB”) 13 through HB 19 - for all days in the

reference month in constructing the supply curve.20 In the May 16 Order, the Commission

directed the NYISO to demonstrate how excluding low Load, off-peak hours changes the

threshold resulting from the Net Benefits Test and to provide support for why such outcome is

reasonable.21

The NYISO renews its proposal as set forth in the August 2011 Filing to analyze only

peak hours HB13 through HB19 in constructing the supply curve for the reference month and

identifying the net benefits threshold. As directed by the Commission, the NYISO provides

below: (i) information regarding how the exclusion of the low Load hours impacts the threshold

resulting from the Net Benefits Test and (ii) additional support describing why such outcome is

reasonable.

1. Impact of the Exclusion of Low Load Hours on Net Benefits Threshold

As directed by the May 16 Order, the NYISO has calculated the impacts of excluding low Load hours on the net benefits threshold. In Table A-1 below, the NYISO provides data

demonstrating the different thresholds for applying the Net Benefits Test using all hours and

using only peak hours (HB13 through HB19) for the reference months associated with the

thirteen months that were addressed in the August 2011 Filing.

20 August 2011 Filing at p 4.

21 May 16 Order at P 39.

Kimberly D. Bose, Secretary August 14, 2013

Page 7 of 31

Table A-1

Peak Hours (HB13-19)

Peak Hours (HB13-19) Peak Hours (HB13-19) All Hours Heat Rate Dollar Threshold for All Hours Dollar

Reference Heat Rate Threshold All Hours Heat Rate Heat Rate Threshold Threshold Study Month Threshold for Study

Month Study Month (MW) Threshold (MW) (mmBTU/MWh) (mmBTU/MWh) ($/MWh) Month ($/MWh)

Aug-09 Aug-10 27,570 24,620 14.195 12.697 $68.56 $61.33

Sep-09 Sep-10 25,780 24,020 13.593 12.782 $62.80 $59.05

Oct-09 Oct-10 23,910 22,350 12.566 11.942 $53.91 $51.23

Nov-09 Nov-10 25,340 22,990 13.421 12.598 $56.77 $53.29

Dec-09 Dec-10 25,830 23,050 10.696 9.777 $72.73 $66.48

Jan-10 Jan-11 25,430 23,020 10.086 9.227 $81.80 $74.83

Feb-10 Feb-11 24,900 22,340 10.113 9.253 $63.21 $57.83

Mar-10 Mar-11 23,930 21,820 10.918 10.299 $51.31 $48.40

Apr-10 Apr-11 22,550 20,700 11.891 11.265 $53.15 $50.36

May-10 May-11 23,480 21,430 12.881 11.929 $58.99 $54.64

Jun-10 Jun-11 26,850 24,610 12.770 11.594 $61.04 $55.42

Jul-10 Jul-11 24,350 23,130 14.156 12.167 $75.17 $64.61

Aug-10 Aug-11 25,880 24,260 14.288 12.633 $66.01 $58.36

This table sets forth the net benefits thresholds reported in terms of MW, mmBTU/MWh and, translated with the projected natural gas fuel price,22 the dollar ($) net benefits threshold for peak hours (“HB 13-19”) and all hours (“All Hours”). These thresholds were calculated in

accordance with the NYISO’s proposed methodology for conducting the Net Benefits Test23 with the only difference between columns being the set of hours selected.

2. A Net Benefits Threshold that Accurately Represents High Load Hours Is

Reasonable and Consistent with the Purpose of Order No. 745

The NYISO’s proposal to analyze only high Load, peak hours in constructing the supply curve for the reference month is reasonable and consistent with the actual performance of

demand response resources and the purpose of Order No. 745. An accurate representation of the supply curve in peak hours is desirable as these are the hours during which actual demand

reduction is likely to occur.

High Load hours are the periods when actual demand reduction is likely to occur and

where incentives to drive demand reduction in wholesale markets are beneficial. The demand

response that the Commission is seeking to facilitate through Order No. 745 to “help improve the

functioning and competitiveness of those markets”24 occurs in peak hours and is not present in

22 The NYISO converts the heat rate net benefits threshold into the LBMP value by multiplying

the projected natural gas price for the study month by the threshold heat rate for the reference month. The NYISO projects gas prices for the study month using a Henry Hub NYMEX Natural Gas Futures Price

plus a constant three-year basis differential, which is the differential between the Henry Hub daily spot

price and Transco Z6-NY daily spot price averaged over corresponding months of the prior three years.

August 2011 Filing at pp 8-9.

23 See August 2011 Filing at pp 3-9 (describing the NYISO’s proposed Net Benefits Test methodology).

24 Order No. 745 at P 10.

Kimberly D. Bose, Secretary August 14, 2013

Page 8 of 31

the low Load hours.25 In such off-peak hours, when resources to meet Load are plentiful, the

retail rates are generally greater than the wholesale cost of electricity, so there is already ample

incentive for demand response resources to reduce Load regardless of their participation in a

demand response program.26 There is, therefore, no need to subsidize demand response during

these hours. Additionally, in the NYISO’s experience, demand response provided in low Load

hours is likely to be the result of free riders that are being paid for Load reductions relative to

baselines that would have occurred without regard to the demand response program. Concerns

regarding the potential for such free riders in low Load hours led to the NYISO’s implementation

of a DADRP offer floor. In accepting the NYISO’s increase to its DADRP offer floor in 2004,

the Commission stated that the offer floor: “will encourage reduced consumption during peak

periods when demand is high relative to supply and when energy prices rise. We also believe that

it is reasonable to limit payment, as an incentive for reducing demand, when supply is ample,

relative to demand.”27

If the NYISO were to include all hours in the construction of the supply curve for a

reference month, the resulting threshold would more closely align with the NYISO’s supply

25 Since the early application of the DADRP, the NYISO has identified the high Load hours to be

when demand response in the DADRP is likely to be beneficial and reflect real demand reductions. As

the NYISO informed the Commission in 2002 in response to a question on the possibility of gaming its

demand response programs: “Participants in the DADRP have, on a few occasions, submitted zero price

load reduction offers for one- to two-week periods over holidays, effectively acting as a price-taker during

long-duration scheduled outages. While this behavior was not specifically prohibited in the initial

program design, it does not represent a true reduction in consumption based upon price and, therefore, has

no overall market benefit. In response to this behavior, the NYISO is proposing a minimum floor of

$50/MWHr; participants’ average offer price must be at least at this level to be considered for scheduling

in the day-ahead energy market.” See “NYISO Response to FERC Questions on Demand Response,”

NYISO’s Price-Responsive Load Working Group (October 30, 2002), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_prlwg/meeting_materials/200

2-10-30/agenda3_nyiso_ferc_responses.pdf.

26 The NYISO described this scenario in its Semi-Annual Compliance Report on Demand

Response Programs and the Addition of New Generation submitted on December 1, 2003, in FERC

Docket No. ER01-3001-000. The NYISO indicated on page 27 of the report: “Given that most

customers pay a commodity rate that is at least $50/MWH, it is difficult to construct a situation where a customer would curtail at a DADRP price lower than it would otherwise have consumed, except in case where the customer can dispatch on-site generation with a lower fuel cost, and such action is not allowed under DADRP protocols. One explanation for favoring a lower (or no) bid floor is that some customers want to bid curtailments coincident with planned shutdowns, either partial or total facility. Such behaviors are contrary to the objectives of offering DADRP, which is to induce curtailments that otherwise [would] not have occurred at times when the result is a lower DAM price, and forestalling such biding behaviors was the primary motivation for establishing the floor price.”

27 New York Independent System Operator, Inc., Order on Tariff Filing, 102 FERC ¶ 61,313 at P

23 (2003)

Kimberly D. Bose, Secretary August 14, 2013

Page 9 of 31

curve in low Load hours and would not accurately represent the NYISO’s supply curve in high Load hours during which actual demand response is likely to occur. This is clearly illustrated in the charts below using data for the reference month of November 2009. Note that the data for November 2009 is consistent with the data for the other reference months listed in Table A-1 above; charts of the other months are included in Appendix II to this filing.

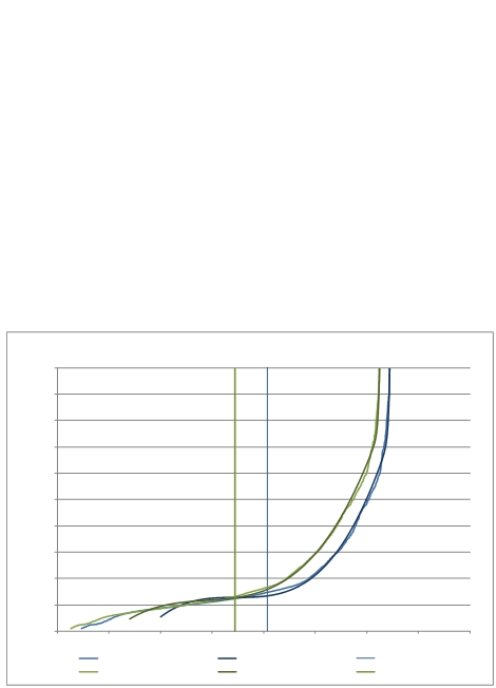

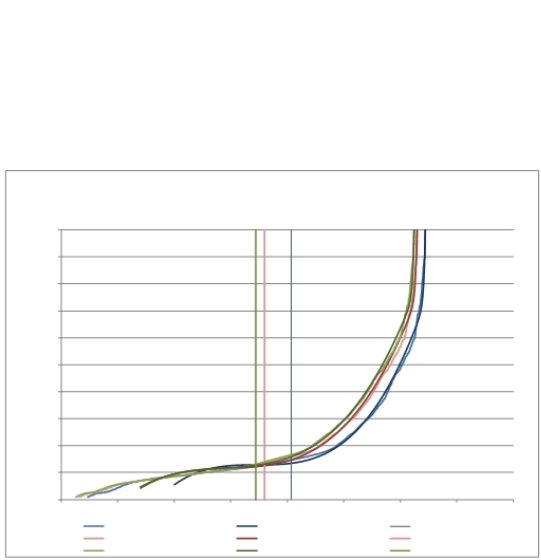

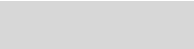

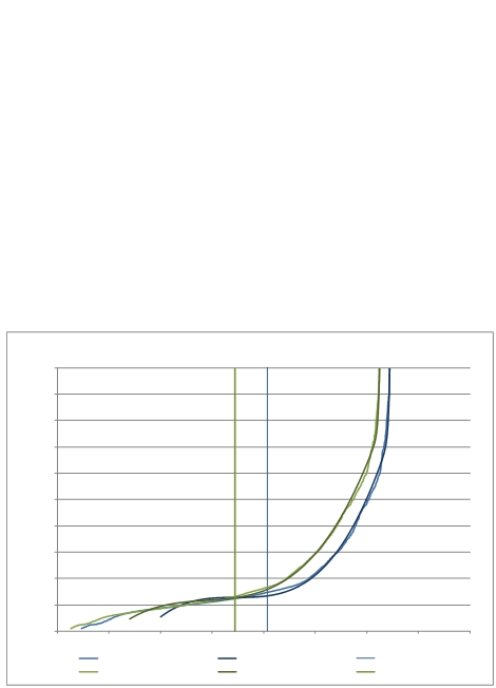

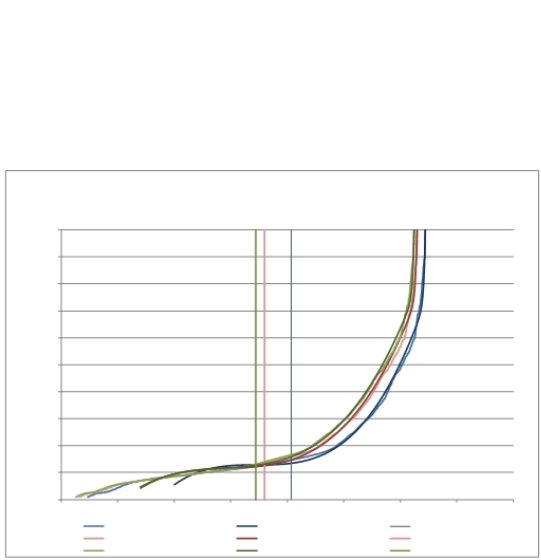

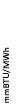

As illustrated in Chart A-2, below, individual supply curves constructed solely from peak

and off-peak hours result in noticeably different supply curves and those translate into noticeably

different net benefits thresholds. When a supply curve for “all hours” is added, as in Chart A-3,

below, it is clear that the “all hours” supply curve that includes both off-peak and peak hours

does not provide a good representation of the supply curve for peak hours. The inclusion of off-

peak hours in the supply curve makes the “all hours” threshold appear more like the “off peak

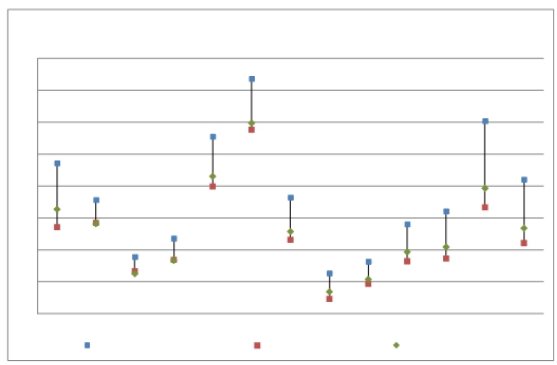

hours” threshold than the “peak hours” threshold. As further demonstrated in Chart A-4, below,

which includes all of the reference months listed in Table A-1, the impact of including off-peak

hours in the determination of the net benefits thresholds drives these thresholds close to or at the

off-peak hour thresholds and away from the peak hour thresholds in all of the months.

Given that actual demand response dispatch is most likely to occur during peak, high

Load hours, the net benefits threshold should most accurately reflect the supply curve in these

hours. To use the depressed off-peak, low Load hour threshold to define the net benefits

threshold for the high Load hours would charge Loads for demand response that does not

actually meet the standard specified by the Commission. This requires that the NYISO exclude

the off-peak, low Load hours from the construction of the supply curve for the relevant reference

month.

Chart A- 2

November 2009

Peak (HB13-19) and Off Peak (HB00-12, 20-23)

100

90

80

70

60

50

40

30

20

10

0

5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000

Peak_Nov09 Fitted Peak_Nov09 Peak Threshold

OffPeak_Nov09 Fitted OffPeak_Nov09 OffPeak Threshold

Kimberly D. Bose, Secretary August 14, 2013

Page 10 of 31

Chart A-3

November 2009

Peak (HB13-19) and Off Peak (HB00-12, 20-23) and

All Hours (HB00-23)

100

90

80

70

60

50

40

30

20

10

0

5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000

Peak_Nov09 Fitted Peak_Nov09 Peak Threshold

All Hours_Nov09 Fitted All Hours_Nov09 All Hours Threshold

OffPeak_Nov09 Fitted OffPeak_Nov09 OffPeak Threshold

Chart A-4

The Effect of Including the Off Peak Hours

on the Dollar ($) Threshold

$85

$80

$75

$70

$65

$60

$55

$50

$45

Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11

Peak (HB13-19) Threshold ($) Off Peak Threshold ($) All Hours Threshold ($)

Kimberly D. Bose, Secretary August 14, 2013

Page 11 of 31

The NYISO is currently developing with its stakeholders revisions to its Special Case

Resource requirements, including a change that would expand the hours that constitute, in that

context peak, high Load hours. These revisions have not yet been approved by the NYISO

stakeholders or filed with or accepted by the Commission. A stakeholder has requested that the

NYISO consider a similar change in the peak hours that the NYISO is proposing to use to

construct the supply curve so it corresponds to the revised requirement for Special Case

Resources. The NYISO has preliminarily reviewed the impact of expanding the peak hours used

in constructing the supply curves in this manner and has not identified any substantial difference

in the resulting peak hours supply curves or resulting net benefits thresholds. However, the

NYISO believes that such a change should be fully reviewed in the stakeholder process and will

explore this issue with its stakeholders after the revisions to the Special Case Resource

requirements have been accepted by NYISO stakeholders and the Commission.

B. The NYISO’s Use of the Highest Point on the Representative Supply Curve as the

Net Benefits Threshold Is Reasonable

To determine the monthly net benefits threshold price, Order No. 745 required that:

The ISOs and RTOs are to select a representative supply curve for the study

month, smooth the supply curve using numerical methods, and find the

price/quantity pair above which a one megawatt reduction in quantity that is paid

LMP would result in a larger percentage decrease in price than the corresponding

percentage decrease in quantity (billing units). Beyond that point, a reduction in

quantity everywhere along an upward sloping supply curve would be cost-

effective. 28

In the August 2011 Filing, the NYISO proposed to use a polynomial equation with

exponential term to derive the representative supply curve using parameters that are estimated

for each month.29 The NYISO opted to use this functional form because it allows the estimated

supply curve to better fit the curved portion of the actual supply curve as well as to accurately

portray the mid-MW range, flatter portion of the supply curve. The NYISO then calculates the

supply elasticity for each price and quantity along the estimated representative average supply

curve. The NYISO determines the threshold as the heat rate at which the elasticity of the

estimated supply curve falls below one and remains below one for higher heat rates. This heat rate is converted into the net benefits threshold price for the study month by multiplying it with the projected natural gas price for that month.

28 Order No. 745 at fn. 161. The “smoothing” is the process of identifying a functional form/equation that provides a good approximation of the representative supply curve.

29 The NYISO’s functional form used to smooth the supply curve is described on pages 6 through

8 of the August 2011 Filing.

Kimberly D. Bose, Secretary August 14, 2013

Page 12 of 31

In the May 16 Order, the Commission found that the NYISO had not provided support for selecting as the threshold point for the Net Benefits Test the highest point on its

representative supply curve at which it becomes inelastic.30 The Commission directed the NYISO to provide support for why this approach is reasonable.31

The NYISO renews its proposal as set forth in the August 2011 Filing to use the highest

point on the representative supply curve at which it becomes inelastic as the net benefits

threshold and provides the following additional support describing why such approach is

reasonable. Consistent with the Commission view “that the threshold point along the supply

stack for each month will fall in the area where the supply curve becomes inelastic, rather than

the extreme steep portion at the peak or in the flat portion of the supply curve”,32 the NYISO

selected a functional form that would have a good fit in the range between the flat, linear portion

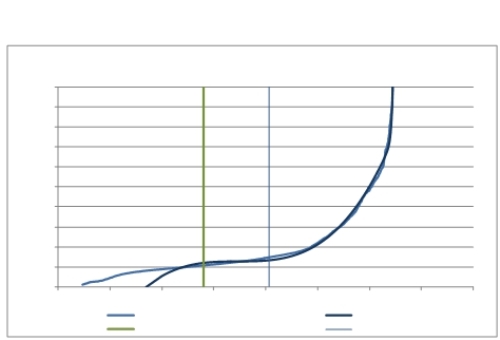

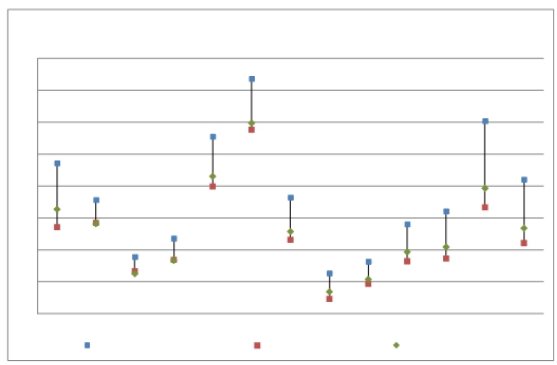

of the curve to the extremely steep high priced portion of the curve.33 This is illustrated in Chart

B-1, below.

Chart B-1

November 2009 Average Supply Curve and Estimated Supply Curve

Peak Hours (HB13-19)

100

90

80

70

60

50

40

30

20

10

0

5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000

Peak_Nov09 Fitted Peak_Nov09

Lower Threshold Upper Threshold

30 May 16 Order at P 40.

31 Id.

32 Order No. 745 at P 80.

33 August 2011 Filing at pp. 6-8.

Kimberly D. Bose, Secretary August 14, 2013

Page 13 of 31

Chart B-2

November 2009 Elasticity

25

20

15

10

5

0

5,000 10,000 15,000

Elasticity_Nov09

Peak Hours (HB13-19)

20,000 25,000 30,000

Lower Threshold

35,000 40,000 45,000

Upper Threshold

The functional form that the NYISO proposed to use to estimate the fitted supply curve has the property that there will be two points with unitary elasticity.34 As a result, as illustrated in Chart B-2, above:

(i) in the range above the higher point, the fitted supply curve is inelastic and the Net Benefits Test would be satisfied;

(ii) in the range between the two points, the fitted supply curve is elastic and the Net Benefits Test would not be satisfied; and

(iii) in the range below the lower point, the fitted supply curve is inelastic and the Net Benefits Test would be satisfied.

If the NYISO were to use the lower threshold as the offer floor to dispatch demand response,

demand response would continue to be scheduled (and Loads would have to pay for it) above

this lower threshold, even though the Net Benefits Test would not be satisfied for a substantial

number of hours and Load levels because the range between the lower and higher thresholds is

the range in which the Net Benefits Test is not satisfied. Hence, there would be hours in which

demand response would be scheduled and when the cost of such demand response was greater

than the benefits to Load of scheduling the demand response. If the lower threshold were to be

34 In some extreme cases, there could be one or no points of unitary elasticity depending on the

bids and offers that constitute supply curves. The NYISO have not observed any such extreme cases.

Kimberly D. Bose, Secretary August 14, 2013

Page 14 of 31

used in a manner consistent with Order No. 745, it would be used as a ceiling with prices below the lower threshold deemed to satisfy the Net Benefits Test. However, as discussed below, the lower threshold is an artifact of the estimation methodology and does not accurately reflect the elasticity of supply at low Load levels.

As explained above, the functional form of the estimated representative supply curve was

chosen to specifically fit the region where the flat, linear portion of the curve transitions to the

extremely steep portion of the curve. It does not provide a good representation of the actual

supply curve in the lower part of the curve (along the flat portion of the supply curve) where

actual demand reductions are unlikely to occur.35 This disconnect is clearly visible in the lower

Load portion of Chart B-1 in which the estimated representative supply curve is much more

steeply sloping and quite different from the actual supply curve.36 Moreover, the representative

supply curve is constructed assuming that all units would be committed, which is a reasonable

assumption in the high Load hours. This assumption is not accurate, however for low Load

hours as the NYISO’s security constrained unit commitment would not commit resources that

would be uneconomic on a production cost basis. The actual elasticity of supply is therefore

higher than portrayed by the representative supply curve in these low Load hours. Therefore, the

lower unitary elasticity point is an artifact of the functional form rather than a reflection of the

underlying supply curve. Thus, it does not identify a range in which the Commission’s Net

Benefit Test would be satisfied and should not be used to establish a threshold below which the

test is satisfied.

C. Removal of NYISO’s Proposed Adjustment to the Monthly Net Benefits Threshold

Price after Posting of Monthly Price

In the August 2011 Filing, the NYISO proposed that it would monitor forward natural

gas prices after the posting date of the monthly net benefits threshold price and post an adjusted

threshold price if there is a significant change (increase or decrease) in natural gas prices

between the posting date and the first day of the study month.37 Specifically, the NYISO

proposed to include as part of its revisions to Section 4.2.1.9 of the Services Tariff the following

language:

Following the posting of the Monthly Net Benefit Offer Floor, the ISO shall

35 Because the flat portion of the supply curve continues below even the lowest Load levels

experienced in a given month, and because estimating this portion of the curve reduces the accuracy of the estimated of the area where the curve transitions from flat to steep, the NYISO did not seek to

estimate the supply curve at Loads lower than the lowest Load in that month.

36 The data for November 2009 is consistent with the data for the twelve other reference months from August 2009 through August 2010 evaluated by the NYISO. The related data for these other

months are included in Appendix III to this filing.

37 August 2011 Filing at p 9.

Kimberly D. Bose, Secretary August 14, 2013

Page 15 of 31

monitor the gas prices utilized in the Net Benefits Test and recalculate the

Monthly Net Benefit Offer Floor in the event that such prices vary by more than

$0.75/mm BTU, as measured on the last gas trading day that is no less than 4

business days prior to the first day of the Study Month. The ISO shall post any

recalculated Monthly Net Benefit Offer Floor to its website in accordance with

ISO Procedures.

In the May 16 Order, the Commission found this proposed revision to be inconsistent

with Order No. 745 because it required adjustments to the threshold price after the 15th of the

month preceding the effective date. The Commission directed the NYISO to submit revised

tariff revisions to remove the related tariff language from Section 4.2.1.9 of the Services Tariff.38

Pursuant to this directive, the NYISO submits with this compliance filing revisions to Section

4.2.1.9 that remove this language.

D. NYISO’s Use of the Monthly Net Benefits Threshold Price as an Offer Floor for the

DADRP Is Reasonable

In the August 2011 Filing, the NYISO proposed to replace the current, static $75/MWh threshold for the DADRP offer floor with the monthly net benefits threshold price to ensure that the dispatch of Demand Side Resources remains cost-effective.39 In the May 16 Order, the

Commission indicated that Order No. 745 does not require the Net Benefits Test to be used as an offer floor and stated that the NYISO had not provided sufficient justification for its proposal.40 The Commission directed the NYISO to provide further justification or to submit revised tariff sheets eliminating the DADRP offer floor.41

The NYISO renews its proposal to retain the DADRP offer floor. As described below, as

previously accepted by the Commission, the NYISO’s use of an offer floor reduces free-ridership

opportunities and improves the DADRP’s net social welfare42 impacts. If the floor were

eliminated, the NYISO would be required to develop a new compensation methodology for

Demand Side Resources that are dispatched below the net benefits threshold price and are,

38 May 16 Order at PP 41-42.

39 August 2011 Filing at p 9.

40 May 16 Order at P 46.

41 Id.

42 Net social welfare” is the change in consumer and producer surplus. The consumer surplus is the benefit to consumers because they can purchase MW at a price less than their maximum willingness to pay. The producer surplus is the benefit to producers because they can sell MW at a price higher than the lowest price they would be willing to sell for. The sum of the consumer and producer surplus is the social welfare derived from that market.

Kimberly D. Bose, Secretary August 14, 2013

Page 16 of 31

therefore, not cost-effective. The Commission has accepted the similar offer floor proposed by ISO-NE.

1. Use of Offer Floor Reduces Free-Ridership and Improves the DADRP’s Net

Social Welfare Impacts

The NYISO’s DADRP offer floor, as accepted by the Commission on multiple occasions, reduces free-ridership opportunities and improves the DADRP’s net social welfare impacts. The elimination of the offer floor could harm consumers by permitting the dispatch of, and charging consumers for, the costs associated with Load reduction that does not provide an actual demand response benefit to the New York Control Area.

Under the NYISO’s DADRP, a Demand Side Resource may offer its Load curtailment capability into the NYISO’s Day-Ahead Market for Energy. If its offer is selected, the Demand Side Resource is paid the LBMP for Energy at which the Day-Ahead Market settles for the

relevant hour and location.

The NYISO proposed in 2002 an offer floor of $50/MWh for the DADRP.43 The

purpose of the offer floor was to reduce potential free-ridership in the DADRP by minimizing opportunities for a Demand Side Resource to receive a payment for Load reduction in

circumstances in which it could not provide an actual Demand Reduction benefit to the New York Control Area.44 The Commission accepted the offer floor finding:

We anticipate that NYISO’s proposal to set a zonal floor bid of $50/MWh for all

Day-Ahead Demand Response Program Resources that bid into the Day-Ahead

Energy Market, like the floor bid currently in use by ISO New England, Inc. for

its Day-Ahead Demand Response Program, will encourage reduced consumption

during peak periods when demand is high relative to supply and when energy

prices rise. We also believe that it is reasonable to limit payment, as an incentive

for reducing demand, when supply is ample, relative to demand.45

43 New York Independent System Operator Inc.’s Filing of Services Tariff Revisions to Extend and/or Amend the NYCA Demand Response Programs and Request for Waiver of Notice Period to Prevent a Lapse of the Emergency Demand Response Program, FERC Docket No. ER03-303-000 at p 5 (December 20, 2002) (“December 20 Filing”).

44 See foot notes 25 and 26, above. The NYISO’s Market Monitoring Unit identified the issue of free riders in the DADRP as a serious one and recommended that stakeholders adopt the offer floor.

“MMU’s Position on DADRP ‘Free-Rider’ Issue” presentation, NYISO’s Price-Responsive Load

Working Group (October 5, 2003), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_prlwg/meeting_materials/200

2-03-05/agenda2.pdf.

45 New York Independent System Operator, Inc., Order on Tariff Filing, 102 FERC ¶ 61,313 at P

23 (2003).

Kimberly D. Bose, Secretary August 14, 2013

Page 17 of 31

While the NYISO had referenced in its 2002 filing particular concerns with Demand Side

Resources submitting low bids for periods when the resource’s Load would already be off-line

for maintenance or regularly scheduled shutdowns,46 the offer floor served a broader purpose of

reducing the opportunities of any Demand Side Resources to receive payments for Load

reduction that did not provide an actual Demand Reduction benefit to the New York Control

Area.

In 2004, the NYISO proposed an increase to the level of the offer floor from $50/MWh to

$75/MWh.47 The NYISO had reviewed the effectiveness of the DADRP offer floor through an

analysis of the net social welfare impacts associated with DADRP offers.48 Specifically, the

NYISO reviewed whether the overall efficiency savings provided by the dispatch of Demand

Side Resources were more or less than the financial settlements paid to these resources.49 The

NYISO determined that the overall efficiency savings under its existing $50/MWh offer floor

were less than the financial settlements paid to Demand Side Resources resulting in a negative

net social welfare, and that opportunities to be a free-rider in the DADRP could be further

minimized by raising the bid floor to $75/MWh without harming the effectiveness of the

program. The Commission accepted the $75/MWh offer floor, where it has remained.50

The NYISO’s implementation of its proposed Net Benefits Test methodology does not

eliminate these concerns. The Net Benefits Test simply provides for the payment of LBMP to

Demand Side Resources that are scheduled at the net benefits threshold. Applying the Net

Benefits Test, without an offer floor, opens up opportunities for the return of inefficient dispatch of Demand Side Resources by again permitting a Demand Side Resource to be scheduled in

periods in which Load reduction will not provide an actual Demand Reduction benefit to the

New York Control Area. That is, absent the offer floor, consumers may be subject to charges for unneeded Load reduction, resulting in the free-ridership and net social welfare impacts that the

offer floor had been installed to address.

46 December 20 Filing at p 5.

47 New York Independent System Operator, Inc.’s Filing of Services Tariff Revisions to Extend and Modify its Incentivized Day-Ahead Economic Load Curtailment Program, FERC Docket No. ER04-

1188-000 (September 1, 2004) (“September 2004 Filing”).

48 September 2004 Filing at p 3. The NYISO’s analysis was not limited to resource’s submitting offers when its Load would already be off-line for maintenance or regularly scheduled shutdowns.

49 September 2004 Filing at pp 3-4.

50 FERC Letter Order, FERC Docket No. ER04-1188-000 at P 5 (October 29, 2004).

Kimberly D. Bose, Secretary August 14, 2013

Page 18 of 31

2. Removal of the Offer Floor Would Require New Compensation Mechanism for

DADRP Resources Scheduled Below the Net Benefits Threshold Price

Since the inception of the DADRP, the NYISO has paid Demand Side Resources that

participate in the Day-Ahead Market the LBMP for Energy at which the market settles for the relevant hour and location. The NYISO does not have separate compensation rules for Demand Side Resources that are scheduled below the DADRP offer floor. Removal of the offer floor

would require the NYISO to develop a new compensation mechanism for Demand Response

Resources scheduled below the DADRP net benefits threshold. It is unclear what compensation might be appropriate for such a scenario.

The Commission has not provided guidance regarding what would be just and reasonable compensation for a demand response resource that is scheduled below the net benefits threshold price. Order No. 745 solely establishes that a demand response resource that is shown to be costeffective by the Net Benefits Test be paid LMP. Order No. 745 states that:

when a demand response resource has the capability to balance supply and

demand as an alternative to a generation resource, and when dispatching and

paying LMP to that demand response resource is shown to be cost-effective as determined by the net benefits test described herein, payment by an RTO or ISO of compensation other than the LMP is unjust and unreasonable. When these

conditions are met, we find that payment of LMP to these resources will result in just and reasonable rates for ratepayers.51

Order No. 745 does not consider how, if at all, a demand response resource should be

compensated if it is not shown to be cost-effective as determined by the Net Benefits Test, nor does it direct ISO/RTOs to develop such a compensation mechanism.

3. The Commission Accepted a Similar Offer Floor in ISO-NE

As with the NYISO, ISO-NE has had an existing offer floor that the Commission has

previously accepted.52 In its Order No. 745 compliance filing, ISO-NE proposed to retain a bid

floor pursuant to which a “Demand Reduction Offer” must be equal to or greater than the

“Demand Reduction Threshold Price.”53 The Commission accepted the bid floor54 in response

to ISO-NE’s provision of justifications for the use of the offer floor, including certain

51 Order No. 745 at P 47.

52 See ISO New England, Inc., Order on Compliance Filing, 138 FERC ¶ 61,042 at P 25 (2012).

53 Id.

54 ISO New England, Inc., FERC Letter Order, Docket No. ER11-4336-005 (May 29, 2012).

Kimberly D. Bose, Secretary August 14, 2013

Page 19 of 31

justifications that are equally applicable to the NYISO.55 Similar to ISO-NE’s concerns, the

NYISO has concerns that scheduling demand response below the level of the Net Benefits Test

reintroduces the potential for the free-ridership issue that the offer floor was designed to reduce.

The NYISO also believes that rejecting Demand Reduction offers that are lower than the net

benefits threshold is appropriate, since schedules related to these offers increase consumer costs

because Demand Reductions that would have occurred for reasons other than benefitting from

wholesale market price or in response to a retail rate provide no benefit to the market. Finally,

the outcome of establishing an offer floor does not incent Demand Reductions when the level of

the net benefits threshold price is below the LMP, further signaling to demand response

resources that Demand Reductions below this level do not provide a market benefit. The

NYISO’s experience with DADRP since the implementation of an offer floor has demonstrated

that the offer floor is an effective way to allow demand response to participate in the wholesale

market when it provides a benefit to the market.

V. COMPLIANCE REVISIONS TO MEASUREMENT AND

VERIFICATION PROCEDURES

In the August 2011 Filing, the NYISO proposed a small number of revisions to its

measurement and verification procedures to ensure that appropriate baselines are set for Demand Side Resources and to improve verification procedures.56 In the May 16 Order, the Commission generally accepted the NYISO’s proposed revisions and directed the NYISO to provide

additional support regarding certain procedures and to make certain tariff revisions.57 The

NYISO’s filing satisfies the Commission’s directives as described below.

A. NYISO’s Continued Use of Its Existing In-Day Adjustment Cap Is Reasonable

In the August 2011 Filing, the NYISO proposed a revised methodology for calculating a

Demand Side Resource’s baseline Load, which retained the existing in-day adjustment process

and cap.58 In the May 16 Order, the Commission accepted the revised baseline calculation

methodology, but directed the NYISO to provide justification for the necessity of the cap for the

in-day adjustment.59 The NYISO renews its proposal to retain the cap for the existing in-day

adjustment and provides the following additional support for why such approach is reasonable.

55 ISO New England, Inc., Compliance Filing, Docket No. ER11-4336-005 at pp. 2-10 (March 26,

2012).

56 August 2011 Filing at pp. 11-12.

57 May 16 Order at PP 67-71.

58 See August 2011 Filing at p. 11.

59 May 16 Order at P 68.

Kimberly D. Bose, Secretary August 14, 2013

Page 20 of 31

The NYISO measures reductions in demand by reference to an estimated baseline. The

NYISO has historically used the Customer Baseline Load (“CBL”) methodology to calculate a

Demand Side Resource’s estimated baseline Load. Market participants may make weather-

sensitive adjustments to the CBL of the Demand Side Resource based on conditions that exist for two hours within the four hours prior to the start of a schedule to reduce Load. The adjustment to account for weather-sensitivity is subject to a twenty percent increase, or decrease, cap. Since

2002 when the in-day adjustment mechanism was approved as a procedure by the stakeholders,60 this in-day adjustment cap has been a part of the Energy CBL for all of the NYISO’s demand

response programs, including the DADRP.61

In developing its compliance with the Order No. 745 requirements, the NYISO

anticipated that the implementation of the Net Benefits Test could lead to an increase in the

frequency of scheduling for Demand Side Resources in the DADRP. The NYISO was

concerned that this increased frequency would limit the number of days when Load reduction

was not used by the resources, which would degrade the NYISO’s ability to calculate an accurate

estimate of the resource’s baseline using the CBL methodology. For this reason, the NYISO

developed a new methodology - the Economic Customer Baseline Load (“ECBL”) - to

determine a better estimate of the baseline of resources that are scheduled more frequently.

The design of the ECBL proposes that the in-day adjustment be applied to all DADRP

resources. In revising this baseline calculation methodology, the NYISO elected not to make any change to the existing in-day adjustment process or cap. Stakeholders participated in the

development of the cap, were familiar with its application, and the cap has been widely applied

in all of the NYISO demand response programs for over a decade without protest. Since the inday adjustment went into effect in 2002 as an ISO Procedure documented in the EDRP and

DADRP manuals,62 the NYISO has deployed reliability demand response resources for up to 184 hours, depending on location, and DADRP resources for a total 15,176 hours. Throughout that

period of data submissions for Energy payments for those deployments and Energy market

schedules, the NYISO is not aware of any market participant coming forward to challenge the

cap on the in-day adjustment as impacting the amount of payment received for any Load

reduction in the NYISO’s demand response programs.

60 For example, the revisions to the NYISO’s Emergency Demand Response Program Manual and

Day-Ahead Demand Response Program including the in-day adjustment process and cap were approved

by stakeholders in the NYISO’s Business Issues Committee meeting on March 20, 2002, available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic/meeting_materials/2002-03-

20/rev_edrp_manual.pdf.

61 The requirements for the in-day adjustment cap for the DADRP are currently set forth in Section 5.1.II of the NYISO’s Day-Ahead Demand Response Program Manual.

62 Special Case Resources are also eligible for Energy payments. The Installed Capacity Manual includes a reference to the CBL calculation defined in the EDRP Manual.

Kimberly D. Bose, Secretary August 14, 2013

Page 21 of 31

The NYISO’s analysis in 2011 evaluated three alternatives to the existing CBL, both with

and without the in-day adjustment mechanism. The results of that analysis indicated that the

ECBL with the in-day adjustment showed the lowest mean absolute error.63 Stakeholder

comments regarding the cap were discussed at that time, but stakeholders did not provide any

evidence of the benefit that removal of the in-day adjustment cap would have on producing a

better estimate of the Load. Nor did they provide any reasoning for applying a separate cap for

the DADRP than what is being used for the NYISO’s other demand response programs.

Upon enrollment, market participants indicate for each Demand Side Resource whether

or not the in-day adjustment applies. This allows the market participant to specify whether or not

the Load of the Demand Side Resource is weather-sensitive. The in-day adjustment is

administered by the market participant as part of the calculation of the CBL. Recognizing that

the market participants would calculate the CBL and the in-day adjustment themselves,

stakeholders determined that a cap was needed to reduce the risk to the market associated with

self-administered unlimited adjustments and the opportunity for overstated demand reductions.

The NYISO is currently in the process of a detailed review of its baseline methodologies,

which will provide it with an opportunity to explore with its stakeholders whether there is

empirical support for, among other possible changes to baselines, amending the existing 20%

cap. DNV KEMA is performing an analysis of the NYISO’s Customer Base Load (energy

baselines) and Average Coincident Load (“ACL”) (capacity baseline) performance evaluation

methodologies. The study is reviewing eleven (11) CBL methodologies (inclusive of the current

NYISO CBL and the ECBL) and three ACL methodologies (including the NYISO’s current

ACL). The CBL methodologies are being evaluated with and without in-day adjustments. In-

day adjustments will include the current symmetric adjustment capped at 20%, an uncapped

symmetric adjustment and an additive adjustment. The study began in the fall of 2012 with a

data collection phase, and the analysis design was presented to stakeholders in May of this

year.64 The study will not be completed until the end of 2013, making it unavailable to inform

this compliance filing. The NYISO will discuss with its stakeholders the results of the study and

explore with them any revisions to the CBL methodologies, including to the in-day adjustment

process and its cap. The Commission should permit the NYISO to continue to apply the in-day

63 The ECBL with the weather adjustment performed better than the other CBL alternatives. See NYISO August 9, 2011, Market Issues Working Group presentation entitled “NYISO’s Compliance

Filing to Order 745: Demand Response Compensation in Organize Wholesale Energy Markets” at slides 46- 49 (ECBL is referred to as CBL4), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/meeting_materials/201

1-08-09/Compliance_Filing_on_Order_745.pdf.

64 See May 22, 2013, “Analysis Design for SCR Baseline Study” presentation, available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/meeting_materials/20

13-05-

22/SCR%20Baseline%20Study%20Update%20PRLWG_ICAPWG%20May222013%2005152013.pdf.

Kimberly D. Bose, Secretary August 14, 2013

Page 22 of 31

adjustment cap and to explore with its stakeholders based on the empirical evidence provided in the DNV KEMA study whether changes to the cap are appropriate.

B. NYISO Clarifies that It Does Not Preclude Review of Alternative Baseline

Methodologies

In the August 2011 Filing, the NYISO proposed the revised ECBL methodology

described above to calculate a Demand Side Resource’s baseline for purposes of the DADRP. In the May 16 Order, the Commission found the ECBL methodology to be just and reasonable, but directed the NYISO to justify why the use of alternative baselines methodologies to the

ECBL are not acceptable.65 Although not explicitly specified in its August 2011 Filing, the

NYISO does not preclude a stakeholder from proposing an alternative baseline methodology and is amenable to considering such alternatives with stakeholders.

The NYISO has previously presented to its stakeholders for their consideration

alternative CBL methodologies for its demand response programs. When the NYISO or

individual stakeholders have previously proposed the use of alternative baseline methodologies, stakeholders have approved the use of a single methodology and have not pursued the

application of alternative performance evaluation methodologies for a single program.66

In December 2000, the NYISO proposed the use of additional CBLs in its Price-

Responsive Load Working Group meeting. The NYISO proposed that “CSPs could select from

any existing approved means already in use in NYS” to measure performance,67 which included

65 May 16 Order at P 69.

66 The NYISO has an alternative baseline procedure for groups of Demand Side Resources that

participate in direct Load control or other similar mass-market demand side management programs where the cost of installing interval metering at that scale would create a barrier to entry. In late 2001, the

NYISO and its stakeholders developed a procedure whereby a market participant could propose an

alternative performance evaluation methodology for these types of mass-market programs. See “Proposal for 25 MW Limited Small Customer Aggregation Program,” NYISO Business Issues Committee

(December 13, 2001), available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic/meeting_materials/2001-12-

13/agenda6_aggregation_proposal.pdf. The process uses the stakeholder process to present to

stakeholders a proposal that describes the control technology, measurement and verification procedures to estimate the baseline and calculate the Load reduction, followed by approval of Chairs and Vice Chairs of the NYISO stakeholder committees. Since 2002, this alternative methodology has been used by two

Transmission Owners with direct Load control programs and, more recently, other stakeholders have

made presentations to propose their concepts for eligibility of this type of alternative baseline status.

Those subsequent proposals, brought to stakeholders in 2008 and 2009, were either rejected by

stakeholders or withdrawn by the proposers.

67 See “PRL Performance SubGroup Issues & Recommendations” presentation, available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_prlwg/meeting_materials/200

0-12-14/perform_recom_121400.pdf.

Kimberly D. Bose, Secretary August 14, 2013

Page 23 of 31

any method approved by the NYISO, the New York Public Service Commission (“NYPSC”), or

other regulatory bodies for entities outside the jurisdiction of the NYPSC. Stakeholders did not

want multiple baseline methodologies at that time, and the proposal was dropped. In 2009 and

2010, the NYISO proposed to the Installed Capacity Working Group alternative baseline

methodologies for Special Case Resources (“SCR”).68 Stakeholder input and alternatives were

reviewed through the governance process, and stakeholders agreed on a single CBL

methodology to allow for consistency across all resources participating in the SCR program.

In developing its compliance with Order No. 745, the NYISO proposed the ECBL along

with three other methodologies as replacements for the DADRP CBL. Stakeholders did not

propose any alternatives. The NYISO’s proposed ECBL was designed to reflect the product and

service of a Demand Side Resource that would be accepted and scheduled more frequently in the

Energy market under the monthly Net Benefit Test than under the existing DADRP rules. While

similar to the current CBL, this methodology was determined through statistical analysis to

provide the lowest mean absolute error, in comparison to the alternative methodologies presented

to stakeholders.

The NYISO’s use of the ECBL methodology does not preclude the consideration of

alternative baseline methodologies going forward. As it has demonstrated, the NYISO is

amenable to providing a stakeholder’s proposed alternative methodology for a demand response

program to stakeholders for their consideration, but has not received any stakeholder proposals

for an alternative methodology to the ECBL. To evaluate proposed alternative methodologies,

the NYISO would need to establish procedures through its stakeholder process for proposals and

develop tools to support the evaluation of such methodologies to ensure fair, non-discriminatory,

and best-fit processes. The NYISO believes that proposals for alternative performance

evaluation methodologies should adhere to NAESB WEQ-015 criteria for Performance

Evaluation Methodologies to ensure that when the NYISO and its stakeholders review a

methodology, all proposals can be equally evaluated and provide assurance that each would be comprehensive, accurate, flexible, and reproducible.

As described above, the NYISO is currently in the process of a detailed review of the

baseline methodologies for its demand response programs. As part of this process, DNV KEMA is reviewing eleven (11) CBL methodologies (inclusive of the current NYISO CBL and the

ECBL) and three ACL methodologies (including the NYISO’s current ACL). Based on the

results of this study, the NYISO may explore changes to baseline methodologies and/or

expanding the use of alternatives.

68 See August 2009 ICAPWG “Alternatives to and Improvements in Baseline Methodology for SCRs,” available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/meeting_materials/20

09-08-21/Performance_Evaluation_for_SCR-ICAPWG-Final.pdf; see also December 2010 ICAPWG

“NYISO Proposal for Changes to Measurement and Performance to SCRs,” available at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/meeting_materials/20

10-12-13/NYISO_Revised_Proposal_for_Changes_to_SCR_Program.pdf.

Kimberly D. Bose, Secretary August 14, 2013

Page 24 of 31

C. Inclusion of Data Reporting Requirements in NYISO OATT

In the August 2011 Filing, the NYISO inserted a new Section 24.3 of Attachment R of its

OATT to provide it with explicit authority to verify Demand Reduction and to require Demand

Reduction Providers to report both their metered Load data and the data they use in making their

ECBL calculations in accordance with NYISO data reporting procedures to be developed. In the

May 16 Order, the Commission directed the NYISO to include the data reporting requirements in

Attachment R.69

In response to the Commission’s directive, the NYISO has reviewed its and other

ISO/RTOs’ proposed and existing data reporting requirements and developed a list of reporting requirements for inclusion in the NYISO OATT. The NYISO has reviewed this proposed list with its stakeholders and revised it based on their input.

The NYISO proposes to remove the references to ISO Procedures and the specific data

reporting requirements in Section 24.3 of Attachment R of the NYISO OATT and to insert a new Section 24.4 that includes a list of the data reporting requirements. Specifically, Section 24.4 will include data reporting requirements for: (i) the enrollment of Demand Side Resources

participating in the DADRP, (ii) the verification of reductions scheduled in the NYISO’s Energy market; (iii) additional data required upon the NYISO’s request to verify participation in the

DADRP and the NYISO’s Energy market, and (iv) references to the market monitoring reporting requirements set forth in Attachment O of the NYISO OATT.

VI. COMPLIANCE REVISIONS TO COST ALLOCATION METHODOLOGY

Order No. 745 requires that each ISO/RTO demonstrate that “its current cost allocation

methodology appropriately allocates costs to those that benefit from the demand reduction or

proposes revised tariff provisions that conform to this requirement.”70 The NYISO’s existing

DADRP cost allocation rules set forth in Attachment R of the NYISO OATT allocate the costs of

Demand Reduction to Transmission Customers on the basis of their Load Ratio Shares while

taking into account the probability that any particular Demand Reduction will benefit them,

given historical patterns of congestion on the New York State Transmission System.71 In its

August 2011 Filing, the NYISO proposed to continue to use its existing DADRP cost allocation

rules with minor revisions.72

69 May 16 Order at P 70.

70 Order No. 745 at P 102.

71 August 2011 Filing at p. 10.

72 Id.

Kimberly D. Bose, Secretary August 14, 2013

Page 25 of 31

In the May 16 Order, the Commission determined that the NYISO had failed to

demonstrate how its existing cost allocation methodology appropriately allocates DADRP costs “to entities purchasing in NYISO’s energy market that benefit from the lower prices produced by dispatching demand response.”73 The Commission specifically referenced the allocation of

DADRP costs to end-users taking power through bilateral contracts with the New York Power Authority (“NYPA”) under its Replacement Power and Expansion Power programs that do not purchase energy in the relevant NYISO energy market.74

The NYISO proposes the following compliance revisions to its existing cost allocation

methodology for DADRP costs set forth in Attachment R: (i) the NYISO proposes to allocate

DADRP costs on an hourly, rather than daily, Load Ratio Share basis; (ii) the NYISO renews its

proposal from its August 2011 Filing, which the Commission did not address in the May 16

Order, to clarify how costs will be allocated when multiple interfaces are constrained; and (iii)

the NYISO proposes to exclude from the allocation of DADRP costs the Load associated with

NYPA’s customers taking service through a bilateral contract under NYPA’s Replacement

Power and Expansion Power programs. With these proposed revisions, the NYISO’s DADRP

cost allocation methodology complies with the May 16 Order’s directive and appropriately

allocates costs to those that benefit from lower prices in the NYISO’s Energy market produced

by the dispatch of demand response.

1. NYISO Proposes to Allocate DADRP Costs on an Hourly Load Ratio Share

Basis

In its August 2011 Filing, the NYISO proposed to continue to allocate DADRP costs to

Loads that are deemed to benefit based upon the historic congestion patterns using an adjustment

on a daily Load Ratio Share basis. Following additional discussions with its stakeholders, the

NYISO has concluded that allocating such costs on an hourly basis will more appropriately

allocate costs to those that benefit from the lower prices produced by dispatching demand

response in the Energy market. The NYISO’s proposed hourly approach will align the costs with

the occurrence of the Demand Reduction and is consistent with how costs are allocated for its

other demand response programs. To implement this change, the NYISO proposes to change the

word “daily” where it appears in Section 24.1 of Attachment R to “hourly.”

2. NYISO Proposes to Clarify How Costs Will Be Allocated When Multiple

Interfaces Are Constrained

As described above, the NYISO’s existing DADRP cost allocation methodology allocates

the costs of Demand Reduction to Transmission Customers on the basis of their Load Ratio

Shares while taking into account the probability that any particular Demand Reduction will

benefit them, given historical patterns of congestion on the New York State Transmission

73 May 16 Order at P 92.

74 Id.

Kimberly D. Bose, Secretary August 14, 2013

Page 26 of 31

System. The NYISO is responsible under Attachment R of the NYISO OATT for identifying a list of frequently constrained New York Control Area (“NYCA”) interfaces, and then calculating a set of coefficients to represent the expected fraction of time when these interfaces are

constrained. When none of the interfaces are constrained, Transmission Customers in all Load Zones benefit from the Demand Reduction. When one or more of the interfaces are constrained, the distribution of benefits depends on the location of the Transmission Customers as well as the location of the Demand Reduction (i.e. upstream or downstream of the constraint). Attachment R identifies the congested interfaces and the coefficients that the NYISO applies in calculating a Transmission Customer’s share of DADRP costs.

In the August 2011 Filing, the NYISO proposed to clarify how costs should be allocated

when multiple interfaces are constrained. In the May 16 Order, the Commission did not address

this proposed change. The NYISO, therefore, renews its proposed revisions to refine its cost

allocation process by adding four additional coefficients in the formula set forth in Section 24.1

of Attachment R of the NYISO OATT.75 This change will enable the NYISO to more

appropriately allocate costs to the beneficiaries of demand response when more than one

interface is constrained. Taken together, these revisions will more accurately reflect the impacts

of NYCA system congestion, which limit the LBMP benefits of Demand Reduction scheduled in

the NYISO’s Energy markets.

3. Exclusion of Load Served Under NYPA Replacement Power and Expansion

Power Programs from Allocation of DADRP Costs

In response to the NYISO’s August 2011 Filing, Occidental Chemical Corporation

(“OxyChem”) protested that it receives power to cover virtually all of its power needs under

NYPA’s Replacement Power and Expansion Power programs pursuant to a bilateral contract

with NYPA.76 OxyChem argued that these are long-term contracts which rates are based on a

number of factors that can only be impacted minimally by changes in LBMP in the NYISO’s

Energy market.77 OxyChem, therefore, argued that participants in the Replacement Power and

Expansion Power programs do not purchase power in the NYISO’s Energy market and will not

benefit from changes in LBMP that result from the dispatch of Demand Side Resources. In the

75 As discussed above, the NYISO’s proposed revisions to insert four additional coefficients in the DADRP costs allocation formula were previously included in the NYISO’s August 2011 Filing. For e-Tariff purposes, the NYISO has accepted all of the track changes in the August 2011 Filing to the

Attachment R tariff Sections to serve as the base for the tariff revisions proposed in this further

compliance filing. For this reason, the tariff revisions for the NYISO’s renewed proposal to include the four additional coefficients in the DADRP cost allocation formula are already included in the base tariff Sections and do not appear as blacklines.

76 New York Independent System Operator, Inc., Motion to Intervene and Protest of Occidental Chemical Corporation, Docket No. ER11-4338-000 (September 9, 2011).

77 Id. at pp 9-16.

Kimberly D. Bose, Secretary August 14, 2013

Page 27 of 31

May 16 Order, the Commission concluded that “purchasers of NYPA Replacement Power and Expansion Power do not purchase energy in the relevant NYISO energy market.”78

The NYISO has previously sought rehearing of this determination.79 It continues to

believe that customers with bilateral contracts under NYPA’s Replacement Power and

Expansion Power program, the successor to that program,80 or any comparable program, benefit

from changes in LBMP that result from the dispatch of Demand Side Resources. Nevertheless,

the May 16 Order requires the NYISO to exclude from the allocation of DADRP costs the Load

associated with NYPA customers taking service under Replacement Power and Expansion

Power programs based on the Commission’s explicit determination that these customers do not

benefit from the lower prices produced by dispatching demand response. Therefore, as is

described in subsection “a,” below, the NYISO is proposing compliance tariff revisions to

exclude such customers from cost allocation. For the reasons set forth in subsection “b”, the

NYISO is not proposing to exclude other customers from cost allocation.

a. Exclusion of Load Served Under NYPA’s Western New York Power

Contracts

NYPA is an instrumentality of the State of New York that generates, transmits, and sells

electric power and related energy services throughout New York State. NYPA supplies electric

power and related energy services to a broad array of retail energy consumers, including to

businesses under certain energy-based economic development programs. NYPA supplies these

consumers through both its hydropower units and power purchased in the NYISO’s Energy

market. NYPA does not possess sufficient generation to serve all of its retail Load solely by

means of its own generation resources. NYPA acts as a Load Serving Entity to purchase power

from the NYISO Energy market to serve its retail Load beyond its hydropower units’ capacity

and to replace the power generated by its hydropower units when such units are off-line or when

it is more economical to purchase power in the NYISO’s Energy market. Through such market

purchases, NYPA benefits when there is a lower LBMP in the NYISO’s Energy market as a

result of the dispatch of a Demand Side Resource. As a general matter, the NYISO does not

have visibility into how NYPA uses its hydropower units and market purchases to supply its

retail Load under its different programs. The NYISO charges, and is paid by, NYPA for the

charges associated with NYPA’s purchases in the NYISO’s Energy market. The NYISO does

78 May 16 Order at P 92.

79 New York Independent System Operator, Inc., Request for Rehearing and Alternative Requests for Expedited Clarification and Compliance Waiver of the New York Independent System Operator, Inc., ER11-4338-000 (June 17, 2013) (“NYISO Rehearing Request”).

80 As is discussed in subsection “a,” below, NYPA’s Replacement Power and Expansion Power program was recently replaced by its “Western New York program.” The NYISO interprets the May 16 Order’s directive regarding the Replacement Power and Expansion Power program as applying to the Western New York program.

Kimberly D. Bose, Secretary August 14, 2013

Page 28 of 31

not generally have visibility into and does not play a role with regard to how NYPA further

assesses such charges to retail Load taking service under bilateral contracts with NYPA.

Under the NYISO’s current DADRP cost allocation methodology in Attachment R of the

NYISO OATT, the NYISO allocates the DADRP costs to NYPA for its retail Load, including its

retail Load served under NYPA’s Replacement Power and Expansion Power programs.81 In

response to the May 16 Order, the NYISO has had discussions with NYPA regarding its

Replacement Power and Expansion Power programs, which were recently replaced by NYPA’s

Western New York Power program. Unlike many bilateral transactions in New York, the

NYISO is able to track the contract path of specific bilateral transactions under the Western New

York Power program in its Market Information System from: (i) the supply offers that NYPA

makes on an hourly basis in the NYISO’s Energy market for specific NYPA hydropower units

supplying Western New York Power program participants to (ii) the point of consumption at

Load buses that are specific to the customers participating in the Western New York Power

program.

In compliance with the May 16 Order, the NYISO proposes to revise Section 24.1 of

Attachment R of the NYISO OATT to exclude the Load associated with NYPA customers taking

service under the Western New York Power program. That is, the NYISO proposes to exclude

the Load associated with NYPA’s Western New York Power program from the hourly Load

Ratio Shares that NYPA would otherwise be responsible for under this methodology. The

NYISO proposes to cap this exclusion of Load to the output of the specific hydropower units

associated with the Western New York Power contracts. That is, if NYPA purchases power

from the NYISO’s Energy market, rather than using its hydropower units, to satisfy some or all

of the bilateral contracts under the Western New York Power program, NYPA will clearly be

benefitting from any lower prices in the NYISO’s Energy market as a result of the dispatch of

demand response scheduled in those hours and will be allocated the DADRP costs associated

with that purchase. The NYISO does not take a position as to what extent NYPA will pass such

costs through to its retail customers, which requirements are set forth in NYPA’s bilateral

contracts.

b. Proposed Treatment of Load Served by Bilateral Contracts that Are Not

Part of NYPA’s Western New York Program

The NYISO is not proposing tariff revisions to exclude any other bilateral contracts from

the DADRP cost allocation. The May 16 Order did not determine, and there is little record in

this proceeding showing, that Load served under bilateral contracts outside of the Western New

York Program will not benefit from the lower prices produced by dispatching demand response.

As was noted above, the NYISO continues to believe that all Load Serving Entities in New York

81 It is the NYISO’s understanding that NYPA has not passed these charges on to its retail

customers under the Replacement Power and Expansion Power programs, but will begin to pass through such costs as part of the new Western New York Power program.

Kimberly D. Bose, Secretary August 14, 2013

Page 29 of 31

benefit from the scheduling of DADRP resources. The NYISO, as a general matter, does not

have visibility into and is not aware of the contractual terms of each of the bilateral contracts in

New York. It therefore cannot assess the extent to which particular Loads would benefit more or

less than other Loads from any price impacts of demand response under Order No. 745.82 The

NYISO is generally not aware of whether the Load under a particular bilateral contract with a