UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Transco, LLC

Central Hudson Gas & Electric Corp. Consolidated Edison Company of

New York, Inc.

Niagara Mohawk Power Corporation d/b/a

National Grid

New York State Electric & Gas Corp. Orange & Rockland Utilities, Inc.

Rochester Gas and Electric Corp.

)

)

)

)

)Docket No. ER15-___-000

)

)

)

)

)

APPLICATION FOR ACCEPTANCE OF

TRANSMISSION FORMULA RATE AND

APPROVAL OF TRANSMISSION RATE INCENTIVES AND

COST ALLOCATION METHOD

December 4, 2014

TABLE OF CONTENTS

Page

I.INTRODUCTION AND EXECUTIVE SUMMARY........................................................1

1.Summary of Incentives for Five New High Voltage Transmission

Projects Totaling Over $1.7 Billion.............................................................2

2.Formula Rate and Protocols.........................................................................7

3.Base Return on Equity.................................................................................7

4.Relationship to the NYISO..........................................................................8

5.Cost Allocation Methodology......................................................................8

II.BACKGROUND.................................................................................................................9

A.NY Transco and the New York Transmission Owners...........................................9

B.Historical Congestion, Aging Infrastructure and Reliability Concerns Due

to Generation Retirements.....................................................................................12

1.The STARS Phase II Report......................................................................13

2.The New York Energy Task Force and the Governor’s Energy

Blueprint....................................................................................................14

3.NYPSC Proceedings..................................................................................15

4.NYISO Studies Identifying Congestion and Reliability Concerns............20

III.DESCRIPTION OF PROJECTS.......................................................................................22

A.The Three TOTS Projects Are Designed to Address Historical Congestion

and Future Reliability Concerns Stemming From the Potential Closing of

Indian Point and Other Plants, and Were Approved by the NYPSC

Through a Competitive Solicitation Prior to the Effective Date of the

NYISO’s Order No. 1000-Compliant Planning Process........................................22

B.The Two AC Projects Are Also Designed to Address Historical

Congestion Problems and Future Reliability Concerns Stemming From

Resource Adequacy Needs Previously Highlighted By the Commission.............25

IV.INCENTIVES REQUESTED............................................................................................26

A.Legal Standard.......................................................................................................27

i

B.The Projects Are Eligible for Incentives................................................................31

1.The TOTS Projects have been selected by the NYPSC through a

fair, open and competitive solicitation proceeding....................................32

2.The AC Projects are undergoing a fair, open and competitive

solicitation proceeding before the NYPSC to select projects to

solve historical congestion and future reliability concerns and must

be approved by the NYPSC and included in the NYISO

Transmission Plan......................................................................................34

3.Regardless of the rebuttable presumption, the record shows that the

TOTS and AC projects resolve historical congestion at major New

York transmission interfaces and will support reliable transmission

service in the future....................................................................................36

C.The Projects Satisfy the Nexus Test for Incentives...............................................37

1.NY Transco’s projects serve a combined purpose.....................................37

2.NY Transco will construct projects that address statewide needs.............39

3.Permitting and construction risks and challenges remain..........................39

4.Financing Risks..........................................................................................40

D.ROE Incentives......................................................................................................41

a.Risk-reducing incentives: CWIP, pre-construction development

costs, hypothetical capital structure and abandonment..............................41

b.The risk-reducing incentives do not fully mitigate NY Transco’s

risks............................................................................................................43

c.The ROE risk adder satisfies the Incentives Policy Statement..................47

d.NY Transco qualifies for the ROE incentive available to

“Transcos.”................................................................................................52

e.RTO/ISO Adder.........................................................................................53

E.Alternatively, New York Transco’s Request for Incentives Meets the

Requirements for Incentives Under Section 205...................................................53

F.Technology Statement...........................................................................................55

V.THE FORMULA RATE AND PROTOCOLS ARE JUST AND REASONABLE.........56

A.The Proposed Formula Rate..................................................................................57

ii

B.Formula Rate Protocols..........................................................................................58

C.Base Return on Equity...........................................................................................60

D.Accounting Treatment: Regulatory Assets and PBOPs.........................................64

E.Filing Requirements for 100% CWIP Recovery...................................................65

VI.COST ALLOCATION PROPOSAL.................................................................................65

VII. REQUEST FOR WAIVERS...............................................................................................69

VIII. CORRESPONDENCE AND COMMUNICATIONS........................................................71

IX.LIST OF APPENDICES AND EXHIBITS.......................................................................72

X.EFFECTIVE DATE...........................................................................................................73

XI.REQUEST FOR CONFIDENTIAL TREATMENT.........................................................75

XII. CONCLUSION...................................................................................................................76

iii

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Transco, LLC

Central Hudson Gas & Electric Corp. Consolidated Edison Company of

New York, Inc.

Niagara Mohawk Power Company d/b/a

National Grid

New York State Electric & Gas Corp. Orange & Rockland Utilities, Inc.

Rochester Gas and Electric Corp.

)

)

)

)

)Docket No. ER15-___-000

)

)

)

)

)

APPLICATION FOR ACCEPTANCE OF

TRANSMISSION FORMULA RATE AND

APPROVAL OF TRANSMISSION RATE INCENTIVES AND

COST ALLOCATION METHOD

I. INTRODUCTION AND EXECUTIVE SUMMARY

Pursuant to Sections 205 and 219 of the Federal Power Act (“FPA”),1 and Part 35 of the

Federal Energy Regulatory Commission’s (“FERC” or “Commission”) regulations,2 New York

Transco, LLC (“NY Transco”), Consolidated Edison Company of New York, Inc. (“Con

Edison”), Orange & Rockland Utilities, Inc. (“O&R”), Niagara Mohawk Power Corporation

d/b/a National Grid (“National Grid”), New York State Electric & Gas Corp. (“NYSEG”),

Rochester Gas and Electric Corp. (“RG&E”), and Central Hudson Gas & Electric Corp.

(“Central Hudson”) (collectively, the “Applicants”)3 submit this application to establish: (1) the

rate incentives described and supported below for the initial portfolio of five interrelated high-

voltage transmission projects that NY Transco will build, own and operate in New York State;

1 16 U.S.C. §§ 824d and 824s.

2 18 C.F.R. §§ 35.13 and 35.35 (2014).

3 Con Edison, O&R, National Grid, NYSEG, RG&E and Central Hudson are sometimes referred to herein as the “New York Transmission Owners,” or more simply, the “NYTOs.”

(2) NY Transco’s transmission formula rate and protocols, to be effective on April 3, 2015,

which is 120 days after the date of this filing;4 (3) NY Transco’s return on equity (“ROE”); (4)

proposed Attachment DD and Rate Schedule 13; and (5) the cost allocation method that will

apply to NY Transco’s initial portfolio of projects under the New York Independent

Transmission System Operator, Inc.’s (“NYISO”) open access transmission tariff (“OATT”).5

1.Summary of Incentives for Five New High Voltage Transmission

Projects Totaling Over $1.7 Billion.

It is well known that New York’s transmission grid is in need of upgrades to improve the

flow of electricity between upstate and downstate New York in order to ensure reliability and

reduce congestion, lower the cost of delivering power to customers and increase the efficiency of

generation dispatch, facilitate existing and new renewable generation, prepare for the potential

retirement of existing generation, and enable continued reliable supplies in the decades ahead.

As explained in the attached testimony of Messrs. Paul Haering of Central Hudson and Richard

Allen of National Grid, New York’s history of under-investment in high voltage transmission

lines has produced persistent transmission congestion along corridors like the Upstate New

York/Southeastern New York (“UPNY/SENY”) interface in the Hudson River Valley near

Albany that are among the most congested in the Nation.6 Indeed, the Commission found that

4 As discussed more fully herein, due to the timing of asset transfers to NY Transco from the NYTOs, following

receipt of regulatory approvals, the Applicants anticipate that NY Transco will initially collect the revenue

requirement under its formula rate beginning on January 1, 2016, following the completion of its initial formula rate template and distribution to stakeholders on or about September 30, 2015.

5 Applicants are filing, contemporaneously herewith, a separate request for Commission approval pursuant to

Section 203 of the FPA to transfer from individual NYTOs to NY Transco certain inactive transmission facilities, and related books, records and accounts, in connection with the development of the five projects.

6 The U.S. Department of Energy has included southeastern New York in its designation of the Mid-Atlantic region

as a National Interest Electric Transmission Corridor (“NEITC”) under FPA Section 216 through studies that are

available at: http://energy.gov/oe/downloads/2009-electric-transmission-congestion-study. DOE’s 2014 draft study

making the same determination is available at: http://www.energy.gov/oe/downloads/national-electric-transmission-

congestion-study-draft-public-comment-august-2014. The NEITC designation makes new transmission investment in southeastern New York a congressional priority. 16 U.S.C. § 824s(a)(4)(B).

2

these lines have “been overloaded since 2008” and continue to raise “long-term reliability

concerns” that require price signals to encourage new transmission and generation investment.7

The New York Transmission Owners and the State’s leading policy makers have been working hard for several years to develop an effective plan to address the need. As Governor Cuomo’s 2012 New York Energy Highway Task Force’s Request for Information (“RFI”) stated: “[w]e must modernize the transmission system and eliminate the bottlenecks.”8 To do so, the State’s Energy Highway Blueprint (“Energy Blueprint”) called for the expansion of transmission facilities in order to transmit electricity from upstate to downstate including renewable energy; address the potential retirement of large generating stations; and promote economic development activity to create additional jobs as well as providing an increased opportunity for exiting

generators to remain in service, thereby preserving existing energy jobs.9

The NY Transco represents an historic effort by the investor-owned utilities in New

York. As explained by NY Transco’s president, Mr. Stuart Nachmias,10 NY Transco is a

partnership of New York State’s investor-owned utilities which will facilitate the planning,

development, construction, and ownership of new transmission projects that will enhance the

current capabilities of the bulk power system across New York State. The five projects that are

the subject of this filing involve additions to or modifications of the individual transmission

systems of the NYTOs and are currently estimated to cost approximately $1.7 billion (in nominal

dollars) to complete.

7 New York Indep. Sys. Operator, Inc., 147 FERC ¶ 61,152, at P 13 (2014) (emphasis added). The problem is so

severe that the Commission worried about the risk of “a 1,431 MW capacity reserve shortage during the upcoming summer in Southeast New York under extreme weather conditions, in part due to the constrained UPNY/SENY transmission constraint.” Id. at P 17 (emphasis added).

8 RFI, p. 5. The RFI is available at: http://nyenergyhighway.com.

9 Energy Highway Blueprint at p. 27, available at: http://nyenergyhighway.com/PDFs/Blueprint/EHBPPT/. A copy

is attached as Exhibit No. NYT-2.

10 Testimony of Stuart Nachmias, Exhibit No. NYT-1, at p. 5.

3

The New York Public Service Commission (“NYPSC”) has already reviewed and

approved three of NY Transco’s projects in proceedings to implement the Governor’s Energy

Blueprint. It used a statewide competitive process to select projects to provide a “contingency

reliability plan” in the event that the 2,040 MW Indian Point Energy Center (“IPEC”) retires at

the end of 2015.11 As the NYPSC has found, the three “Transmission Owner Transmission

Solutions,” or “TOTS Projects” described below, will provide long-term benefits to consumers

through a more reliable and efficient transmission grid.12 The TOTS Projects are expected to

enter service by June 2016, and are included in the base case of the latest NYISO Reliability

Needs Assessment (“RNA”).13

Also in response to the Energy Blueprint, Applicants have proposed two 345 kV

transmission projects that are in early stages of review by the NYPSC in its competitive

solicitation siting proceeding to identify “alternating current” solutions to the State’s

transmission congestion. The “AC Projects” described herein will provide significant relief to

UPNY/SENY, Central East, and other congested corridors. The AC Projects will also upgrade

or replace existing transmission infrastructure, which will improve its resiliency and reliability.

If selected by the NYPSC next year, and included by the NYISO in its transmission plan for cost

allocation purposes, the NY Transco will seek to place them into service as early as the Summer

of 2019.

11 NYPSC Case 12-E-0503 - Proceeding on Motion of the Commission to Review Generation Retirement

Contingency Plans (issued Nov. 4, 2013) (“Reliability Contingency Plan Order”) (attached as Exhibit No. NYT-7).

12 The NYPSC found that “the TOTS projects . . . provide a significant portion of the resources needed to address

the potential reliability needs in the event IPEC is retired in December 2015” and do so through a “least-cost and

least-risk portfolio........” Id. at p. 7.

13 New York Independent System Operator 2014 Reliability Needs Assessment, Final Report, at p. 14 (Sept. 16, 2014) (available at:

http://www.nyiso.com/public/webdocs/markets_operations/services/planning/Planning_Studies/Reliability_Planning

_Studies/Reliability_Assessment_Documents/2014%20RNA_final_09162014.pdf ) (“NYISO 2014 RNA”). A copy is attached at Exh. No. NYT-10.

4

The projects being proposed are eligible for all of the transmission rate incentives

afforded under the FPA and the Commission’s regulations for transmission infrastructure

investment.14 NY Transco is requesting the following risk-reducing incentives for its initial five

projects: preauthorization to recover prudently incurred abandoned plant costs to the extent the

abandonment is due to circumstances beyond NY Transco’s control; a hypothetical capital

structure pending permanent financing with 60% equity and 40% debt; and regulatory asset

treatment to allow for the recovery of all project costs that are not capitalized and included in

Construction Work in Progress (“CWIP”). In addition, NY Transco is requesting 100% of CWIP

in rate base for its two AC Projects. NY Transco is not requesting 100% of CWIP recovery for

the three TOTS Projects because, as shown below, due to timing and other issues, this incentive

will not provide meaningful cash flow to mitigate the financing risks associated with the three

TOTS projects.

Because the Commission’s “risk reducing” incentives do not fully offset the risks and

challenges faced by NY Transco in pursuing these projects, ROE adders are justified. Indeed,

the ROE incentives are appropriate under the Commission’s policies because NY Transco will:

(1) turn over operational control of its projects to the NYISO, (2) build “projects to relieve

chronic or severe grid congestion that has had demonstrated cost impacts to consumers” and

“projects that unlock location constrained generation resources that previously had limited or no

access to the wholesale electricity markets,”15 (3) address public policy needs, including

facilitating the ability of the State to meet long-term Federal and State clean energy goals and aid

economic development throughout the state, and (4) encounter significant development,

construction, regulatory and financing risks. Moreover, NY Transco is eligible for an ROE

14 18 C.F.R. § 35.35(d)(1) (2014).

15 Promoting Transmission Investment Through Pricing Reform, Policy Statement, 141 FERC ¶ 61,129, at P 21 (2012) (“Incentives Policy Statement”).

5

adder as a “Transco” that is solely focused on developing new transmission investment both in the near term and the decades ahead.16

NY Transco has tailored its requests for incentives narrowly to offset the risks and

challenges of developing the projects, provide cash flow and remove disincentives to investment.

NY Transco has followed the Commission’s guidance in its policy statement on transmission

investment by requesting risk-reducing incentives before requesting return on equity incentives

to compensate for the construction and financing risks of the projects.17 The specific incentives

requested by the NY Transco are described and supported by the testimonies of Applicants’

witnesses Ms. Ellen Lapson, which is attached as Exhibit No. NYT-18, and Messrs. Paul

Haering and Richard Allen, which is attached as Exhibit No. NYT-4.

It has become possible for the NYTOs to pursue the five transmission projects described herein in large part because they were able to agree to coordinate them through a new joint

entity, NY Transco, resolve joint development issues, and achieve a fair allocation of costs to all

customers across the State. The lack of alignment of these issues has stymied past development

efforts, but now, with the help of the Commission, the State of New York, and this structure, we

are turning the corner. In fact, the NYTOs are also hopeful that a similar structure could be used

for future development of gas transmission facilities that would support electric system needs.

While this will require additional discussion, the collaboration that has resulted in the formation

of the NY Transco may open the door to additional future cooperation and innovation.

16 18 C.F.R. § 35.35(d)(2) (2014).

17 The Applicants believe that requesting all incentives in a single filing is an appropriate approach to reconcile the Commission’s statement in the Incentives Policy Statement that it expects applicants to request risk reducing

incentives before requesting an ROE adder (Incentives Policy Statement at P 16) with its holding in Order No. 679-

B: “Though we encourage applicants to seek all requested incentives in the same proceeding (whether in a request for declaratory order or a section 205 filing), we do not require it.” Promoting Transmission Investment Through Pricing Reform, Order on Rehearing, 119 FERC ¶ 61,062, at P 12 (2007).

6

2.Formula Rate and Protocols.

NY Transco’s formula rate will be included in a new proposed Attachment DD to the

NYISO OATT which will provide: (a) a statement of the basis for NY Transco’s annual

transmission revenue requirement to be charged to transmission service customers; (b) a table for

each project showing the cost allocation factors; (c) the formula rate and protocols (together, the

“formula rate”) that, among other things, governs how NY Transco will update the formula each

year, and describes the customer review and challenge procedures. Attachment DD also

describes the procedures that NY Transco will follow under the formula rate to track CWIP

expenses recovered through the formula rate pursuant to Commission orders authorizing

recovery of CWIP as an incentive. These protocols are modeled after protocols recently adopted

by the Commission in other proceedings as well as recent guidance provided by FERC Staff.18

The costs associated with NY Transco’s projects will be billed and collected by the NYISO

under a new Rate Schedule 13 proposed herein. NY Transco’s proposed forward-looking

formula rate in Attachment DD is described generally below and in more detail in the supporting

testimony of Mr. Alan Heintz at Exhibit No. NYT-41. Rate Schedule 13 is explained in the

testimony of Ms. Marie Berninger, and Messrs. Raymond Kinney and Bart Franey, and attached

as Exhibit No. NYT-40.19

3.Base Return on Equity.

The NY Transco Formula Rate includes a base ROE value of 10.60%. The base ROE is

supported by the analysis and testimony of Dr. William E. Avera and Mr. Adrien M. McKenzie,

18 FERC Staff’s Guidance on Formula Rate Updates (issued July 17, 2014).

19 Since the tariff provisions proposed herein governing the collection of NY Transco’s revenue requirement will

become part of the NYISO tariff, the NYISO is submitting this filing in FERC’s e-Tariff system on the Applicants’

behalf solely in its role as the Tariff Administrator. However, the burden of demonstrating that this filing and

proposed tariffs and schedules are just and reasonable rests on NY Transco and the NYTOs as the filing parties.

NYISO takes no position on any aspect of the filing and reserves the right to comment on any issue in the

proceeding.

7

whose testimony is attached as Exhibit NYT-24. As explained by Dr. Avera and Mr. McKenzie,

the requested base ROE of 10.60% is well within the zone of reasonableness of 6.25% and

11.63% or 6.45% and 13.59% established by the Commission’s two-step discounted cash flow (“DCF”) methodology applied using IBES and Value Line growth rates, respectively.

4.Relationship to the NYISO.

NY Transco will join the NYISO and will sign the appropriate NYISO enabling agreements and comply with all applicable NYISO tariffs. It will turn over operational control of its facilities to the NYISO and service over these facilities will be subject to the terms and conditions of the NYISO OATT. The NY Transco’s revenue requirement will be billed and collected by the NYISO pursuant to the terms of the NYISO OATT.

5.Cost Allocation Methodology.

As more fully described herein, the agreement to form NY Transco and the related

agreement on cost allocation will address a longstanding obstacle to new transmission in the

State. The NYTO parties to this filing provide electric service to approximately 85% of the

customers in the State. They have worked hard to arrive at a methodology that fairly allocates

costs to customers in a manner that is commensurate with the benefits received. And, as

explained in more detail below and by Ms. Marie Berninger, and Messrs. Raymond Kinney and

Bart Franey, NY Transco proposes a cost allocation plan that allocates more of the costs for NY

Transco’s initial five transmission projects to “downstate” consumers than would be allocated

under the NYISO load ratio share default method. The load ratio share method would allocate

60% of NY Transco’s costs to downstate consumers, and 40% to those located upstate, but under

NY Transco’s proposal downstate consumers will bear about 75% of the costs and upstate

consumers will pay about 25%. This adjustment to the default method under Attachment Y to

the NYISO tariff is intended to recognize that the projects benefit the entire State but provide

8

substantial economic benefits to downstate consumers. The cost allocation proposal is consistent with the Commission’s cost allocation principles in Order Nos. 890 and 1000. The cost allocation was also endorsed by the NYPSC in approving the three TOTS Projects due to the statewide benefits they will provide. As demonstrated herein, the AC Projects will provide similar statewide benefits as well.

II.BACKGROUND

A.NY Transco and the New York Transmission Owners.

NY Transco

NY Transco is a New York limited liability company that is owned by the following affiliates of the New York Transmission Owners:

Consolidated Edison Transmission, LLC Grid NY LLC

Iberdrola USA Networks New York Transco, LLC Central Hudson Electric Transmission, LLC

NY Transco’s sole business focus will be to plan, develop, construct, and own major new

high voltage electric transmission projects in the State, and to operate and maintain those

projects under the functional and operational control of the NYISO. Initially, NY Transco will

complete the development and construction of five transmission projects that, among other

things, are necessary to address persistent congestion on major transmission lines that move

power between northern and western New York and southeastern New York. Service over NY

Transco’s transmission facilities will be provided through the NYISO’s OATT. NYISO will

9

collect NY Transco’s FERC-authorized revenue requirement from load serving entity (“LSE”) transmission customers taking service under NYISO’s OATT.20

Con Edison/O&R

Con Edison and O&R are wholly-owned subsidiaries of Consolidated Edison, Inc., an investor-owned utility holding company. Con Edison has approximately 1,180 circuit miles of transmission lines, and provides electric service to more than 3.3 million customers in New York City and most of Westchester County. Con Edison also provides natural gas service in parts of New York City. O&R and its utility subsidiaries, Rockland Electric Company and Pike County Light and Power Company, serve a 1,350-square-mile area in Orange, Rockland, and part of Sullivan counties in New York State, and in parts of Pennsylvania and New Jersey. O&R

provides electric service to approximately 300,000 customers.

Con Edison and O&R have transferred functional control over their transmission

facilities to NYISO. Transmission service over Con Edison’s and O&R’s transmission facilities is provided pursuant to NYISO’s OATT. Con Edison’s and O&R’s retail and distribution sales are regulated by the NYPSC. Retail service and distribution provided by O&R in Pennsylvania and New Jersey are regulated by the Pennsylvania Public Utility Commission and the New

Jersey Board of Public Utilities, respectively.

National Grid

Niagara Mohawk Power Corporation d/b/a National Grid is a New York corporation and

an indirect wholly-owned subsidiary of National Grid USA, which is a public utility holding

company with other subsidiaries engaged in the generation of electricity for sale at wholesale,

and the transmission, distribution and sale of both natural gas and electricity. National Grid

USA is an indirectly-owned subsidiary of National Grid plc, a public limited company

20 More information about NY Transco is available at: http//www.nytransco.com.

10

incorporated under the laws of England and Wales. In New York, National Grid owns over

6,000 circuit miles of electric transmission lines and over 700 substations to provide service to

approximately 1.6 million electric customers in eastern, central, northern and western parts of the State. National Grid has transferred functional control over its transmission facilities in New

York to NYISO. Transmission service over National Grid’s transmission facilities in New York is provided pursuant to NYISO’s OATT. National Grid’s retail and distribution sales in New York are regulated by the NYPSC.

NYSEG/RG&E

NYSEG and RG&E are wholly-owned subsidiaries of Iberdrola USA, Inc., which in turn

is a subsidiary of Iberdrola, S.A., an international energy company listed on the Madrid Stock

Exchange. NYSEG owns approximately 4,583 miles of electric transmission lines, 32,881 miles

of distribution lines and 444 substations. NYSEG provides electric service to about 878,000

customers in 42 counties in New York. RG&E owns approximately 1,017 miles of electric

transmission lines, 7,597 miles of electric distribution lines, and 177 substations. RG&E

provides electric service to about 367,000 customers in nine counties in New York. NYSEG and

RG&E have transferred functional control over their transmission facilities to NYISO.

Transmission service over NYSEG’s and RG&E’s transmission facilities is provided pursuant to

NYISO’s OATT. NYSEG’s and RG&E’s retail and distribution sales are regulated by the

NYPSC.

Central Hudson

Central Hudson is a public utility within the meaning of the FPA and is a corporation

organized under the laws of the State of New York. Central Hudson is a wholly-owned

subsidiary of CH Energy Group, Inc., and an indirect wholly-owned subsidiary of Fortis, Inc., a

11

publicly traded Canadian utility holding company.21 Central Hudson is engaged in the

transmission and distribution of electric power and natural gas, and provides electric service to 300,000 customers within eight counties of New York State. Central Hudson has transferred functional control over its transmission facilities to NYISO. Transmission service over Central Hudson’s facilities is provided pursuant to NYISO’s OATT. Central Hudson’s distribution of power for sale at retail is regulated by the NYPSC.

B.Historical Congestion, Aging Infrastructure and Reliability Concerns Due to

Generation Retirements.

New York has long-standing needs to upgrade its transmission networks to relieve

historical congestion, replace aging infrastructure, support continued reliable transmission

service in the future, and support the development of clean renewable energy sources. New

transmission lines will also help improve the operational efficiencies of existing generation by

allowing dispatch of generating units that might have been otherwise constrained, and reduce the

output of more costly generation supplies. These needs have been documented through a series

of transmission studies performed by the NYTOs, the NYISO and the NYPSC in recent years,

and have been outlined in the Governor’s Energy Blueprint. The risk that major generating

stations may retire in the near future has added urgency to the search for solutions to these well-

known problems. NY Transco’s five transmission projects result from studies that led to the

Governor’s Energy Blueprint, which in turn led to the NYPSC proceedings whereby the three

TOTS projects were selected to meet these needs, and where the two AC Projects are pending

approval. The Applicants briefly review the major studies and the common transmission needs

they identified.

21 Fortis, Inc., 140 FERC ¶ 62,004 (2012).

12

1.The STARS Phase II Report.

New York has a reliable transmission grid, but it is in need of new investment to continue

to achieve both near-term and longer-term reliability, congestion and other public policy

objectives. The New York grid needs additional transmission investment that can reduce

transmission congestion and enable more competitive energy prices by reducing the need to rely

on higher-cost, less efficient generation during many hours each year. This will provide benefits

to all New Yorkers, including downstate customers as well as upstate customers, with the latter

seeing more indirect benefits of stabilized generation resources, and the potential additional

benefit of new renewable energy sources.22 As Messrs. Haering and Allen explain, the last major

statewide 345 kV transmission line was built in the 1980s, while 85 percent of the State’s high

voltage transmission lines were built before 1980.23 According to the NYISO, the result has

been transfer capability limitations along congested transmission pathways between upstate and

downstate that in recent years has cost New Yorkers between $765 million24 and $1.1 billion a

year.25 Looking ahead, the costs may be compounded by generation retirements driven by

environmental regulations or inadequate revenues because of dispatch limitations, and the

potential retirement of the Indian Point nuclear generating station, which provides baseload

energy to New Yorkers.

The New York Transmission Owners have not sat idly by. With input from NYISO and

stakeholders in New York, on April 30, 2012, the NYTOs published the results of a second

22 There are seven major well-known constrained transmission interfaces in the New York Control Area: (1) West Central interface, (2) Volney East interface, (3) Central East interface, (4) Zone F-to-G interface, (5) Moses South interface, (6) Total East interface, and (7) UPNY/SENY interface.

23 Testimony of Haering and Allen at 6-7.

24 Id. at 7.

25 Id. (citing 2013 Congestion Assessment and Resource Integration Study (“2013 CARIS Report”) at pp. 15-16 (attached as Exh. No. NYT-6) and 2011 Congestion Assessment and Resource Integration Study (“2011 CARIS Report”) at p. 43, available at:

http://www.nyiso.com/public/webdocs/markets_operations/services/planning/Planning_Studies/Economic_Planning

_Studies_(CARIS)/Caris_Final_Reports/2011_CARIS_Final_Report__3-20-12.pdf ).

13

phase of their comprehensive transmission planning assessment known as the New York State

Transmission Assessment and Reliability Study (“STARS Phase II Report”).26 The STARS

Phase II Report was the culmination of a multi-year analysis of the State’s long-term

transmission needs that was performed with the technical support of the NYISO and consulting

firm ABB Ltd. The STARS Phase II Report looked beyond the NYISO’s 10-year planning

horizon to identify $25 billion of transmission upgrades that may be necessary over the next 30

years to replace aging transmission infrastructure, and identified $2.5 billion of near-term

projects that include both new lines and upgrades to existing lines that will reduce transmission

congestion, improve system reliability, improve the environment and boost New York’s

economy.

The STARS Phase II Report summarizes a series of analyses to assess the condition of

the transmission grid, the upgrades that would be needed to achieve an unconstrained grid, and a

benefit-to-cost analysis to identify the most economically beneficial projects. The initial

“condition assessment” identified about 4,700 miles of transmission lines that will reach the end

of their useful service lives within the next 30 years and require replacement. The Report

identified a number of transmission projects to address these congestion and age-related

concerns. NY Transco’s projects are derived from the recommendations contained in the

STARS Phase II Report.

2.The New York Energy Task Force and the Governor’s Energy

Blueprint.

The STARS Phase II Report initially envisioned three phases of analysis, but the third

phase was overtaken by the State Governor’s initiative to improve grid reliability, reduce the cost

26 The STARS Phase II Report is posted on the NYISO website and is attached as Exhibit No. NYT-5. The report is

available at: http://www.nyiso.com/public/webdocs/markets_operations/services/planning/Documents_

and_Resources/special_Studies/STARS/Phase_2_Final_Report_Attachments_4_30_2012.pdf.

14

of delivering energy to consumers, and to promote renewable energy and other public policy objectives. On April 11, 2012, Governor Cuomo’s New York Energy Highway Task Force

issued its RFI inviting parties to submit transmission proposals to meet the State’s policy goals, which are to “modernize the transmission system and eliminate the bottlenecks.”27 The

invitation drew responses from 85 private developers, investor-owned utilities, financial

institutions and other entities. 28 The NYTOs responded to the RFI with a proposal to construct transmission projects identified through the STARS Phase II Report, and ranked them in priority according to whether they solved New York’s most pressing needs.29

The Energy Blueprint considered the proposals submitted in response to the RFI in

setting an ambitious plan “to solve a decades-old problem: the limitations of the State’s electric

grid to transmit available, cheaper upstate power to downstate when demand is high.”30 It

identified transmission lines traversing the Central East and UPNY/SENY interfaces as the area

in need of the most immediate attention where the Central East-New Scotland-Leeds-Pleasant

Valley corridor has long had the most heavily congested facilities in the State.31 In addition, the

Energy Blueprint took note of the reliability risks to the transmission grid in the event that the

Nuclear Regulatory Commission does not renew the license for the 2,040 MW IPEC plant near

New York City.32

3.NYPSC Proceedings.

The NYPSC implemented the Energy Blueprint by initiating two proceedings. These are the Proceeding on Motion to Examine Alternating Current Transmission Upgrades (“AC

27 RFI at p. 5.

28 According to the Energy Highway Blueprint, the RFI resulted in 130 proposals from 85 private developers,

investor-owned utilities, financial institutions and other entities that represent more than 25,000 MW of potential new generation and transmission capacity. Id. at p. 27.

29 Available at: http://www.nyenergyhighway.com/Content/documents/68.pdf.

30 Energy Highway Blueprint at p. 13.

31 Id. at pp. 40-41. As noted at n.6, DOE has included this area in its NEITC designation under FPA Section 216.

32 Id. at pp. 48-49. The Blueprint assumed IPEC capacity will need to be replaced by the summer of 2016.

15

Proceeding”) in Case 12-T-0502, and the Proceeding on Motion of the Commission to Review

Generation Retirement Contingency Plans (“Reliability Contingency Plan Proceeding”) in Case

12-E-0503.

On November 30, 2012, the NYPSC issued an order in Case 12-E-0502 (“AC Order”) adopting several recommendations contained in the Energy Blueprint and requesting:

written public Statements of Intent from developers and transmission owners

proposing projects that will increase transfer capacity through the congested

transmission corridor, which includes the Central East and UPNY/SENY

interfaces as described above, and meet the objectives of the Energy Highway

Blueprint.33

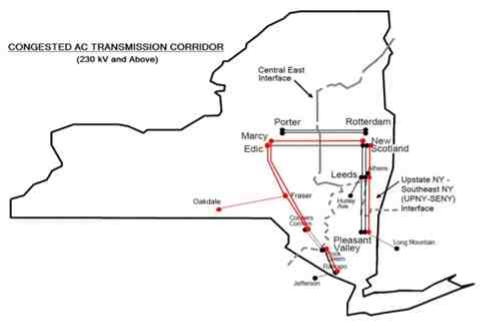

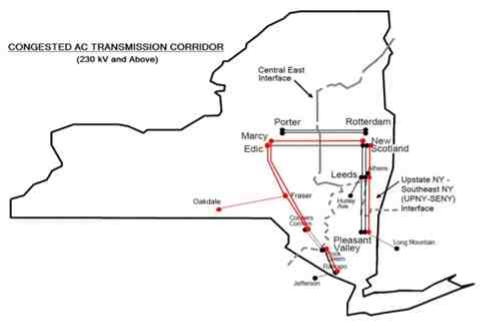

As the AC Order explained, this congested corridor “includes facilities connected to Marcy, New Scotland, Leeds, and Pleasant Valley substations,” and four major electrical interfaces (i.e.,

groups of circuits) that are often referred to as Central East and UPNY/SENY.34 The major

choke points are identified in the following illustration:

33 Proceeding on Motion to Examine Alternating Current Transmission Upgrades, Order Instituting Proceeding, NYPSC Case 12-t-0502 (issued Nov. 30, 2012) at p. 2.

34 Id. at pp. 1-2.

16

The NYPSC found that “[u]pgrading this section of the transmission system has the potential to bring a number of benefits to New York’s ratepayers,” including:

enhanced system reliability, flexibility, and efficiency, reduced environmental and health impacts, increased diversity of supply, and long-term benefits in terms of job growth, development of efficient new generating resources at lower cost in upstate areas and mitigation of reliability problems that may arise with expected generator retirements.35

On January 25, 2013 in response to the AC Order, the NYTOs (which at the time of that

filing included the New York Power Authority (“NYPA”) and the Long Island Power Authority

(“LIPA”)) on behalf of NY Transco, submitted a Statement of Intent (“SOI”) to construct new

AC transmission projects.36 Those projects were identified in the SOI as: (1) the Marcy South

Series Compensation and Fraser-to-Coopers Corners Reconductoring (“MSSC”) project; (2) the

Second Ramapo-to-Rock Tavern (“RRT”) 345 kV line; (3) the UPNY/SENY Interface Upgrade

Project; (4) the Second Oakdale-to-Fraser 345 kV line project; and (5) the Marcy-to-New

Scotland 345 kV line project. To build these and other transmission assets in New York State, the NYTOs stated that they were planning to form the NY Transco to pursue the planning, development, construction, and ownership of new transmission projects.

Reliability Contingency Plan Proceeding

The NYPSC became increasingly concerned with the reliability impacts that could arise

if IPEC retires at the end of 2015. As a result, in the Reliability Contingency Plan Proceeding,

the NYPSC ordered Con Edison, with the assistance of NYPA, to develop a contingency plan in

case IPEC is shut down at the end of its license term. Con Edison and NYPA responded on

February 1, 2013, by submitting a proposal which, among other things, called for the

construction of the RRT and MSSC projects as well as the Staten Island Unbottling (“SIU”)

35 Id. at p. 2.

36 NYPA and LIPA have not received the necessary legislative permission to participate in NY Transco.

17

project. These are the Transmission Owner Transmission Solutions, or “TOTS Projects” referred

to above. Con Edison and NYPA advised the NYPSC that these three projects would also be

transferred to NY Transco. The NYPSC approved the TOTS Projects in an order issued on

November 4, 2013 (“Reliability Contingency Plan Order”). The NYPSC relied on the NYISO’s

base case system analysis in its 2012 Reliability Needs Assessment and load flow sensitivities

performed by Con Edison and NYPA, and by the NYPSC’s independent consultant, The Brattle

Group. The NYPSC took note of the NYISO’s finding that “reliability violations would occur in

2016 if the Indian Point Plant were to be retired by the end of 2015.”37 The NYPSC explained

that modeling sensitivities to NYISO’s base case “showed a deficiency of approximately 1,000

MW” in southeastern New York, “making the total deficiency approximately 1,450 MW” if the

500 MW Danskammer generating facility is unavailable.38 Brattle confirmed these estimates.39

The NYPSC determined that it could not rely on normal transmission planning to solve the problem because “NYISO’s process currently assumes that IPEC will remain available, and therefore, it is not conducting the reliability contingency planning that we are conducting now.”40 If the NYPSC did not act, it found “there would unlikely be sufficient time to address the

reliability needs.”41 The NYPSC, therefore, determined to proceed with the selection of projects

proposed in its competitive process, and found that “[i]mplementing the three TOTS Projects is

expected to contribute at least 600 MW toward the reliability relief which may be necessary if

IPEC is shut down.”42 Moreover, the NYPSC found that even if IPEC is not shut down, the

TOTS Projects “would still provide economic benefits by supplying lower cost energy from

37 Reliability Contingency Plan Order at p. 18.

38 Id. at p. 20.

39 Id.

40 Id. at p. 21.

41 Id.

42 Id. at p. 24.

18

upstate sources to downstate consumers” and the Staten Island unbottling project, in particular,

“will also allow certain generators to run more, saving system resource costs.”43 Accordingly,

the NYPSC found that the TOTS Projects will provide “net benefits for ratepayers . . . even if

IPEC is not retired.”44 The NYPSC staff quantified the benefits from the TOTS Projects as

follows:

for the first 15 years of asset life, DPS Staff estimated net benefits to have a net

present value (NPV) of approximately $260 million in 2016 dollars. For the full

40 years of rate recovery, the NPV of net benefits was estimated to be approximately $670 million. DPS Staff indicates that if IPEC were retired, the estimated net benefits of the TOTS projects are expected to be higher.45

The Reliability Contingency Plan Order contemplated construction of the TOTS Projects to “meet a firm in-service deadline of June 1, 2016,”46 and directed Con Edison and NYSEG

(which has been working to develop its portion of a TOTS Project)47 to make a rate filing with FERC as soon as possible to further the development of the approved projects.48 This

Application is that filing.

AC Proceeding

The NYPSC continues to evaluate proposals for projects that will further relieve

congested pathways and support the broader policy goals in the Energy Blueprint. The AC

Proceeding began with a competitive solicitation for alternating current transmission projects to

increase the UPNY/SENY interface transfer capability by 1,000 MW and also to increase the

Central East interface transfer capability, as this Commission has observed.49 As Messrs.

43 Id. at pp. 24-25.

44 Id. at p. 25.

45 Id. at p. 24.

46 Id. at p. 21. The Order directed Con Edison and NYSEG “to use their best efforts to undertake and timely complete their projects ” Id. at p. 47 (Ordering Paragraph 3).

47 Since NYPA is not part of the NY Transco, only the portion of the MSSC project that is being developed by NYSEG is included as a NY Transco project in this filing.

48 Reliability Contingency Plan Order at p. 48.

49 New York Indep. Sys. Operator, Inc., 147 FERC ¶ 61,152, at P 18 & n.32 (2014).

19

Haering and Allen explain, public reaction to the AC Proceeding transmission proposals was

strongly negative in the middle Hudson Valley area based on concerns about right of way

expansion. This opposition prompted the NYPSC to issue an order in February 2014 inviting

alternative project proposals that could be constructed within existing utility rights of way. In

August 2014, NYPSC advisory staff proposed a comparative review process to assess all

proposals and to integrate the AC Proceeding with the NYISO’s “Public Policy Transmission

Planning Process.” The NYPSC is expected to rule on the advisory staff proposal in 2015.

The NYTOs have two projects pending in the AC Proceeding on behalf of NY Transco.50 These projects are a second Oakdale-to-Fraser 345 kV line and a new Edic-to-Pleasant Valley 345 kV line. These two projects are competing against projects submitted by three other

transmission developers. Therefore, NY Transco’s two AC Projects are pending before the

NYPSC and are contingent upon selection and approval by the NYPSC and inclusion by the

NYISO in its transmission plan for cost allocation purposes. NY Transco’s TOTS and AC

projects are described in greater detail below.

4. NYISO Studies Identifying Congestion and Reliability Concerns.

The congestion relief and other benefits expected to be achieved through NY Transco’s projects have been confirmed through several studies performed by the NYISO, as discussed in the testimony of Messrs. Haering and Allen.

In 2012, NYISO conducted a “Reliability Needs Assessment” that identified the

UPNY/SENY and Central East constraints as major choke points that drive energy costs higher

and impede reliability by limiting access by consumers in southeastern New York to generating

50 On October 1, 2013, the NYTOs submitted (1) Edic-Pleasant Valley 345 kV line, (2) Oakdale-Fraser 345 kV line,

(3) MSSC, and (4) Ramapo - Rock Tavern to the NYPSC in the AC Proceeding. Subsequently, the MSSC and RRT project were approved by the NYPSC in the Generator Contingency Proceeding and were recently withdrawn from the AC Proceeding.

20

capacity located in western New York. Indeed, looking ahead to the potential retirement of

IPEC, NYISO predicted that “reliability violations will occur in 2016 if the Indian Point Plant were to be retired by the end of 2015.”51 The NYPSC relied in part on this study in selecting the TOTS Projects, as discussed above.

NYISO also performed studies in 2011 and 2013 to document congestion costs and the

constraints that cause them. The most recent one, the 2013 CARIS Report, examined congestion

costs in 2012 and noted potential transmission solutions to relieve the UPNY/SENY and Central

East constraints.52 As Messrs. Haering and Allen explain, that report identified $765 million in

statewide congestion costs for 2012 (much of which is attributable to UPNY/SENY and Central

East).53 This was a decrease from the $1.1 billion NYISO reported for 2010 in the 2011 CARIS

Report, and is at least partially attributable to declining electricity prices as a result of falling

natural gas prices, which are at inflation-adjusted lows.54 The 2013 CARIS report also

forecasted $1.4 billion per year in potential congestion cost savings on a ten-year net present

value basis that could be achieved by relieving major constraints, as well as other benefits such as reduced load payments, reduced line losses, savings to capacity costs, and reduced emissions through the dispatch of more efficient generation, including renewable resources that will be able to locate upstate and deliver energy to downstate load centers.

NYISO built on these studies in 2014 with a further Reliability Needs Assessment, this

time taking the three TOTS Projects into account because the NYPSC had approved them.

NYISO found that the TOTS Projects will relieve transmission congestion on the UPNY/SENY

51 New York System Operator 2012 Reliability Needs Assessment, Final Report, at p. 42 (Sept. 18, 2012) at:

http://www.nyiso.com/public/webdocs/markets_operations/services/planning/Planning_Studies/Reliability_Planning

_Studies/Reliability_Assessment_Documents/2012_RNA_Final_Report_9-18-12_PDF.pdf.

52 2013 CARIS Report at pp. 15-16 (Exh. No. NYT-6).

53 Testimony of Haering and Allen, Exh. No. NYT-4 at 7.

54 Id.

21

interface by approximately 450 MW (without accounting for the effects that IPEC’s retirement would have), stating:

[A]nalysis [] showed that UPNY-SENY remains among the most constraining interfaces,

consistent with the conclusion from the previous RNAs. This indicates that increasing

the total resources downstream of UPNY-SENY or increasing the UPNY-SENY transfer

limit will be among the most effective options to resolve the LOLE violations.......

Increasing the limit on UPNY-SENY by 1,000 MW showed the most movement in

[Statewide] LOLE and the individual Load Zone LOLE. Zonal LOLE went down for all

Zones G-K.55

NY Transco’s five transmission projects will contribute significantly to relieving

chronically congested interfaces in New York as the NYPSC has already found with respect to

the TOTS Projects. As such, the TOTS Projects are eligible for transmission rate incentives

under the Commission’s policies. The NYPSC’s proceeding to consider the AC Projects is

conducting a similar analysis, making these projects similarly eligible for incentives. Before

explaining why in more detail, we first provide a more detailed description of each project.

III.DESCRIPTION OF PROJECTS

A.The Three TOTS Projects Are Designed to Address Historical Congestion

and Future Reliability Concerns Stemming From the Potential Closing of

Indian Point and Other Plants, and Were Approved by the NYPSC Through a Competitive Solicitation Prior to the Effective Date of the NYISO’s Order No. 1000-Compliant Planning Process.

As more fully described in the testimony of Messrs. Haering and Allen, the three TOTS

Projects are: (1) a second Ramapo to Rock Tavern 345 kV Line (the “RRT Project”), (2)

transmission upgrades to Con Edison’s interconnecting 345 kV transmission line with

Cogeneration Technologies Linden Venture, L.P. (“Linden”) to allow generating facilities

located on Staten Island to export power into the rest of the New York power grid (the “Staten

55 NYISO 2014 RNA at p. 31. NYISO’s finding that the TOTS will contribute 450 MW of congestion relief differs from the NYPSC’s finding that they will provide 600 MW of relief because NYISO did not consider the effects of IPEC’s retirement in its assessment whereas the NYPSC did, as Messrs. Haering and Allen point out. Testimony of Haering and Allen, Exh. No. NYT-4 at 18.

22

Island Unbottling Project”), and (3) the addition of series compensation on the Fraser-to-Coopers Corners transmission line and the reconductoring of the 21.8-mile Fraser-to-Coopers Corners

345 kV transmission line (the “MSSC Project”). Additional details concerning the three TOTS Projects are as follows:

RRT Project. The RRT Project will add a second 345 kV transmission line from the Con

Edison Ramapo 345 kV Substation to Central Hudson’s Rock Tavern 345 kV Substation by

constructing three upgrades. First, 11.8 miles of overhead 345 kV transmission line will be

installed between the Sugarloaf Substation and the Rock Tavern Substation using the existing

double circuit towers. Second, a 138 kV line between Ramapo and the Sugarloaf 138 kV

Substation owned by Orange & Rockland Utilities, Inc. (“O&R”) will be converted from its

current operating voltage of 138 kV to 345 kV. Finally, a new 345 kV/138 kV step-down

transformer and associated 345 kV switching equipment and ancillary facilities will be installed

in the vicinity of the existing 138 kV Sugarloaf Substation. The current estimated cost of the

project is $121 million.

The RRT project will increase import capability into southeastern New York, including

New York City, during normal and emergency conditions. The project will be physically located

in Orange and Rockland Counties in New York along the existing right-of-way of the existing

Con Edison 345-kV line 77. The transmission terminals are located in NYISO Zone G.

The RRT Project has already received its NYPSC siting certificate as well as its

Environmental Management and Construction Plan (“EM&CP”) approval and is expected to be in service in the Summer of 2016. A system impact study for this project was completed and approved by the NYISO Operating Committee on August 16, 2012.

23

Staten Island Unbottling Project. The Staten Island Unbottling (“SIU”) Project is

anticipated to occur in two phases. Phase 1 will mitigate a reliability issue within New York

City by separating a common pipe double leg feeder into two separate feeders with independent positions at the Goethals and Linden Substations. Phase 2 increases transmission capacity by

adding forced cooling to existing 345 kV transmission lines between the Goethals, Gowanus, and Farragut substations. The SIU project will add approximately 440 MW of transfer capability off of Staten Island using these transmission lines. The project will be located on Staten Island and Brooklyn, New York and Union County (Linden), New Jersey. The transmission facilities

between Staten Island and Linden, New Jersey, cross the Arthur Kill Waterway, which is a 10-

mile channel used by ocean-going ships to transport cargo to and from Port Newark. These

projects are expected collectively to cost about $262 million.

MSCC Project. The MSSC project will add switchable series compensation at the Fraser

Substation to increase power transfer by reducing series impedance over the existing 345 kV

Marcy South lines. There are two components to this project. The first component will add 25%

series compensation to the Fraser-Coopers Corners 345 kV line through the installation of

capacitors. It also includes the re-conductor of approximately 21.8 miles of the Fraser-Coopers

Corners 345 kV line owned by NYSEG using existing towers. The cost of the work for the first

component is currently estimated to be $66 million. The second component of MSSC is the

addition of series compensation on the Marcy-Coopers Corners 345 kV line and the Edic-to-

Fraser 345 kV line. This equipment will be added at the Fraser Substation and it is to be

developed by NYPA; the NYPA portion of the project is not part of this filing, and will not be a

NY Transco developed project.

24

The MSSC project will increase thermal transfer limits across the Total East interface and the UPNY/SENY interface and will also provide a partial solution for system reliability if IPEC retires. The project has an NYISO queue position and the development of the System Impact Study is currently underway.

B. The Two AC Projects Are Also Designed to Address Historical Congestion

Problems and Future Reliability Concerns Stemming From Resource Adequacy Needs Previously Highlighted By the Commission.

The NYTOs, on behalf of NY Transco, submitted two AC Projects in the NYPSC’s AC

Proceeding, which seeks to address the short-term and long-term reliability and congestion relief concerns stemming from the UPNY/SENY and Central East constraints. As more fully

described by Messrs. Haering and Allen, NY Transco’s two AC Projects are: (1) the 2nd

Oakdale-to-Fraser 345 kV transmission line and (2) a new 345 kV Edic-to-Pleasant Valley

transmission line. These projects are targeted to provide significant relief to the two major

constrained transmission interfaces, UPNY/SENY and Central East.

2nd Oakdale-to-Fraser Line. The second Oakdale-to-Fraser 345 kV Line project will establish a second 345 kV line from the Oakdale 345 kV Substation to the Fraser 345 kV

Substation. The project will increase the import capability into southeastern New York during

normal and emergency conditions. The project will be located in Broome, Chenango and

Delaware Counties in New York. Approximately 57 miles will parallel NYSEG’s existing 345

kV Line 32 along the existing right-of-way. The transmission line terminals are located in

NYISO Zones C and E. The estimated cost is $246 million.

Edic-to-Pleasant Valley Line. The Edic-to-Pleasant Valley 345 kV Line project as

initially proposed is a new 345 kV transmission line that will connect National Grid’s Edic

Substation in Oneida County, New York to Con Edison’s Pleasant Valley Substation in Dutchess

County, New York, a total distance of approximately 153 miles. The project includes three new

25

substations: (i) Princetown Substation in the Town of Princetown; (ii) Knickerbocker Substation in the Town of Schodack; and (iii) Churchtown Substation in the Town of Claverack. In

addition, approximately 75 miles of two existing 80 mile 230 kV transmission lines, the #30

Porter-Rotterdam line and the #31 Porter-Rotterdam line, will be removed to allow for the

construction of the new 345 kV line on existing rights-of-way. The replacement of the 30 and 31 lines and the remaining five miles of each of these transmission lines will be rebuilt to address

age-related condition issues. This project will provide over 1,000 MW of additional transfer

capability across UPNY/SENY and a significant increase to the Central East interface transfer

capability. The estimated cost is $1.022 billion.

IV.INCENTIVES REQUESTED

As stated by Mr. Nachmias and supported by the testimony of Ms. Ellen Lapson, Messrs.

Haering and Allen, and Mr. Heintz, the Applicants respectfully request that the Commission

exercise its authority under Sections 205 and 219 of the FPA to grant NY Transco the following

rate incentives:

Current recovery of 100% of CWIP for the two AC Projects;

Regulatory asset treatment to allow for the collection of all project related costs

(including NY Transco formation costs) that are not capitalized and included in CWIP (each regulatory asset to be recovered over a five-year period with carrying costs on the unamortized balance);

A hypothetical capital structure of 60% equity and 40% debt during the construction

phase but no longer than five years after the formation of NY Transco (after which NY Transco’s revenue requirement will reflect the actual capital structure);

Pre-authorization to recover 100% of costs prudently incurred in the development and

construction of the projects if they are abandoned through no fault of the Applicants; and

A 150 basis point adder to NY Transco’s base ROE: 50 basis points as an incentive for

the risks and challenges in constructing the projects; 50 basis points for forming a

Transco that will be focused exclusively on constructing the projects described herein and

26

major additional transmission projects in the future; and 50 basis points for joining the

NYISO and turning over operational control of NY Transco’s projects to the NYISO.

The Applicants show below that NY Transco qualifies for each of these incentives, consistent

with Sections 205 and 219, and the Commission’s implementing regulations, precedents and

policies.

A.Legal Standard.

Dissatisfied with the decline of the Nation’s power grid, in 2005 Congress directed the

Commission to adopt rules to provide incentives for public utilities to build transmission lines

and thereby benefit consumers “by ensuring reliability and reducing the cost of delivered power

by reducing transmission congestion.”56 Congress directed that the rules “shall,” among other

things, “provide a return on equity that attracts new investment in transmission facilities

(including related transmission technologies).”57 Congress also required the Commission to

“promote reliable and economically efficient transmission and generation by promoting capital

investment in the enlargement, improvement, maintenance, and operation of all facilities for the

transmission of electric energy in interstate commerce, regardless of the ownership of the

facilities.”58

Other directives required the Commission to “encourage deployment of transmission

technologies . . . to increase the capacity and efficiency of existing transmission facilities . . .,”

allow recovery of “all prudently incurred costs related to transmission infrastructure

development pursuant to section 216” (dealing with National Interest Electric Transmission

56 16 U.S.C. § 824s(a). As the Commission explained, Section 219 was adopted to address “a national problem that requires a national solution” by stimulating greater “capital investment in energy infrastructure.” Promoting

Transmission Investment Through Pricing Reform, Order No. 679, FERC Stats. & Regs. ¶ 31,222 (2006) (“Order No. 679”), order on reh’g, Order No. 679-A, FERC Stats. & Regs. ¶ 31,236 at P 9 (2006) (“Order No. 679-A”), order on reh’g, Order No. 679-B, 119 FERC ¶ 61,062 (2007) (“Order No. 679-B”).

57 16 U.S.C. § 824s(b)(2).

58 Id. § 824s(b)(1).

27

Corridors), and to “provide for incentives to each transmitting utility or electric utility that joins a

Transmission Organization” (e.g., a regional transmission organization like NYISO).59

The Commission recognized that Section 219 “reflects Congress’ determination that the Commission’s traditional ratemaking policies may not be sufficient to encourage new

transmission infrastructure.”60 Consequently, the Commission issued regulations offering a

series of rate and non-rate incentives targeted specifically to new transmission investment based

on the facts of each case.61

In Order No. 679, the Commission required that an applicant seeking incentive

transmission rates demonstrate that the project for which it seeks incentives either promotes reliability or reduces the cost of delivered power by reducing transmission congestion.62 The Commission established a rebuttable presumption that this requirement is met if: “(i) the

transmission project results from a fair and open regional planning process that considers and evaluates projects for reliability and/or congestion and is found to be acceptable to the

Commission; or (ii) a project has received construction approval from an appropriate state

commission or state siting authority.”63

The Commission stated that an applicant seeking rate incentives must demonstrate a

nexus between the package of incentives requested and the proposed investment.64 The nexus

test is met when an applicant demonstrates that incentives requested are “tailored to address the

demonstrable risks or challenges faced by the applicant.”65 Applicants, however, need not

59 Id. §§ 824s(b)(3),(b)(4) and (c).

60 Order No. 679 at P 5.

61 Id.

62 Order No. 679 at P 37; Order No. 679-A at P 5.

63 Order No. 679 at P 58; see also Potomac-Appalachian Transmission Highline, 122 FERC ¶ 61,188, at P 29 (2008) (“PATH”).

64 Order 679 at P 27; see Order No. 679-A at P 27 (clarifying that the nexus test applies to the package of incentives).

65 Order No. 679-A at P 40. See 18 C.F.R. § 35.35(d) (2014).

28

satisfy a “but for” test by showing that a project will proceed only if it receives rate incentives,66

nor are applicants required to support incentive requests with cost-benefit analyses in part

because the Commission can take into account non-cost factors when it acts on incentive rate

requests.67

The Commission subsequently provided guidance through the Incentives Policy

Statement in which it “reframe[d] the nexus test to focus more directly on the requirements of Order No. 679.”68 The Commission stated that it will no longer evaluate requests in light of whether the applicant’s projects are routine, but instead will consider “how the total package of incentives requested is tailored to address the demonstrable risks and challenges.”69

Further, for requests seeking ROE incentives, the Commission stated that it “expects applicants to take all reasonable steps to mitigate the risks of a project, including requesting those incentives designed to reduce the risk of a project, before seeking an incentive return on equity (ROE) based on the project’s risks and challenges ”70 These “risk reducing”

incentives include recovery of 100% of CWIP, recovery of pre-commercial development costs

not included in CWIP as a regulatory asset, a hypothetical capital structure, and recovery of

prudently incurred costs if the project is abandoned through no fault of the applicant. The

Commission stated that it expects applicants to explain how the total package of incentives is

tailored to the risks and challenges of each project, and stated that if some incentives reduce the

66 Order 679-A at P 26 (“The Commission therefore reaffirms its rejection of the ‘but for’ test as the appropriate test for applying section 219. It would erect a barrier that is nearly impossible to meet and is thereby fundamentally incompatible with Congressional intent in enacting section 219.”).

67 Id. at PP 35, 39.

68 Incentives Policy Statement at P 1.

69 Id. at P 10.

70 Id. at P 1; but see Order No. 679-B at P 12. (“Though we encourage applicants to seek all required incentives in

the same proceeding (whether in a request for declaratory order or a section 205 filing), we do not require it.”).

29

risk of the project, the Commission will take that into account in evaluating any request for an ROE incentive.71

For example, the Commission stated that the CWIP incentive provides “up-front

regulatory certainty, rate stability and improved cash flow, which in turn can result in higher credit ratings and lower capital costs.”72 The ability to use accelerated recovery of pre-

commercial costs “can reduce interest expense, improve coverage ratios, and assist in the

construction of transmission projects.”73 The Commission also stated that pre-authorization to recover prudently-incurred abandoned plant costs provides “companies with more certainty during the pre-construction and construction periods.”74

The Commission also announced four new substantive requirements that applicants must

address to support ROE incentives requests. First, the Commission stated that applicants must

“demonstrate that the proposed project faces risks and challenges that are not either already

accounted for in the applicant’s base ROE or addressed through risk-reducing incentives.”75 The

non-exhaustive list of the types of investments that fall into this category include “projects to

relieve chronic or severe grid congestion that has had demonstrated cost impacts to consumers,”

“projects that unlock location constrained generation resources that previously had limited or no

access to the wholesale electricity markets,” and “projects that apply new technologies to

facilitate more efficient and reliable usage and operation of existing or new facilities.”76

71 Incentives Policy Statement at P 10. The Incentives Policy Statement did not state how the Commission will

determine the effect that “risk-reducing” incentives have on the way it will “rebalance” investor and consumer

interests to achieve Section 219’s mandate to increase transmission investment. Order No. 679 at PP 21-29.

72 Incentives Policy Statement at P 12.

73 Id. at P 13.

74 Id. at P 14.

75 Id. at P 20. Order No. 697-A acknowledged (at P 15) the inherent difficulty in such a showing because “it may be difficult to meaningfully distinguish between an ROE that appropriately reflects a utility’s risk and ability to attract capital and an ‘incentive’ ROE to attract new investment.” The Commission stated that it would take into account financial and regulatory risks in resolving this difficulty.

76 Incentives Policy Statement at P 21.

30

Second, the Commission stated that an applicant must “demonstrate that it is taking

appropriate steps and using appropriate mechanisms to minimize its risks during project

development.”77 In this regard, the Commission “encourages incentives applicants to participate

in joint ownership arrangements and agrees with commenters to the NOI that such arrangements

can be beneficial by diversifying financial risk across multiple owners and minimizing siting

risks.”78

Third, the Commission stated that applicants must demonstrate that “alternatives to the

project have been, or will be, considered in either a relevant transmission planning process or

another appropriate forum.”79 This requirement can be met through an Order No. 890 or Order

No. 1000 compliant transmission planning process, or a proceeding where a state utility

commission evaluated alternatives and determined that the proposed project is preferable to

alternatives.80

Lastly, the Incentives Policy Statement expected applicants to “commit to limiting the application of the incentive ROE based on a project’s risks and challenges to a cost estimate.”81 The Commission suggested a way to manage cost uncertainty is to use a dead-band limit on any ROE incentive adder, such as a percentage range above or below the cost estimate.82

B.The Projects Are Eligible for Incentives.

As explained below, NY Transco’s projects fall squarely within the Incentives Policy

Statement’s interpretation of Order No. 679, and qualify for all of the incentives, including ROE

adders for participation in NYISO, for the risks and challenges of the projects, and for forming a

“Transco.” NY Transco’s projects will relieve the UPNY/SENY and Central East corridors,

77 Id. at P 24.

78 Id.

79 Id. at P 25.

80 Id. at P 26.

81 Id. at P 28.

82 Id. at P 30.

31

which the Commission has already found to have constraints that raise reliability and congestion

concerns.83 The NYPSC has concurred with the Commission’s findings, as has the NYISO in

the reports summarized above. The NYPSC’s open and competitive proceedings to evaluate the

TOTS Projects and the AC Projects confirm their eligibility for the rate incentives sought herein.

1. The TOTS Projects have been selected by the NYPSC through a fair,

open and competitive solicitation proceeding.

The Commission established a rebuttable presumption that projects are eligible for rate incentives if they are selected through a fair and open regional planning process, or through a state siting process that takes into account reliability or congestion needs.84 The Commission explained that it established this presumption because “[w]e do not wish to repeat the work of state siting authorities, regional planning processes, or the DOE in evaluating these issues.”85 The TOTS Projects are eligible for incentives under this standard.

As shown above, the UPNY/SENY, Central East and other major constraints have had

demonstrated cost impacts on consumers for many years. NYISO recently found in the 2013

CARIS Report that eliminating congestion in the UPNY/SENY and Central East corridors will

provide a ten-year present value benefit to consumers of about $1.4 billion in avoided congestion

charges.86 The same report estimated that consumers paid hundreds of millions of dollars in

congestion charges in 2012 for service across these corridors.87 Messrs. Haering and Allen

explain that consumers to the southeast of the constraints are also expected to pay over $200

million in new capacity charges in 2014 alone that could be avoided if these constraints did not

exist.88

83 New York Indep. Sys. Operator, Inc., 147 FERC ¶ 61,152, at P 13.

84 Order No. 679 at P 58; Order No. 679-A at P 49.

85 Order No. 679-A at P 46.

86 2011 CARIS Report” at p. 42.

87 Exh. No. NYT-6 at pp. 15-16.

88 Testimony of Haering and Allen at 20.

32

The Energy Blueprint responded to these concerns by tasking the NYPSC to initiate

proceedings to identify and select projects that will improve reliability, reduce energy costs, meet

various policy goals (including development of more renewable energy), and support long-term

economic growth.89 The NYPSC explained that the TOTS Projects were proposed and selected

as part of a statewide “competitive process,”90 and that “the cost estimates provided by Con

Edison, NYSEG, and NYPA for these projects were provided so that the projects could compete

with the other projects....... As such, the TOTS projects were proposed in a competitive

environment, which . . . should have induced Con Edison, NYSEG, and NYPA to propose the most competitive price possible.”91

The NYPSC found that the TOTS Projects will provide net benefits both with and

without IPEC in service,92 and noted NYPSC staff’s opinion that “it is in the public interest to

pursue these projects, regardless of the contribution they make to the IPEC Reliability

Contingency Plan.”93 In reaching its decision, the NYPSC determined that a critical reliability

need exists because of potential generation retirements and other factors, and this need must be

addressed by June 1, 2016.94 More specifically, after IPEC’s retirement the loss of load

probability will be nearly five times the accepted standard of 0.1 days per year.95 The NYISO

cannot take this possibility into account in its transmission planning model in the absence of a

notice that IPEC is retiring (or that its license has not been renewed), and the NYPSC found that,

as a result, there will not be sufficient time to address reliability needs if IPEC retires.96

Accordingly, the NYPSC found based on record evidence that the TOTS Projects will provide

89 Nachmias Testimony at 14.

90 Reliability Contingency Plan Order at 25.

91 Id.

92 Nachmias Testimony at 15 (citing Reliability Contingency Plan Order at 32).

93 Reliability Contingency Plan Order at 22.

94 Testimony of Haering and Allen at 15.