UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Independent System Operator, Inc.)Docket No. ER11-2224-000

REQUEST FOR LEAVE TO ANSWER AND ANSWER OF THE NEW YORK

INDEPENDENT SYSTEM OPERATOR, INC

Pursuant to Rules 212 and 213 of the Federal Energy Regulatory Commission’s

(“Commission”) Rules of Practice and Procedure,1 the New York Independent System Operator,

Inc. (“NYISO”) submits this request for leave to answer, and its answer to, the protests submitted

in this proceeding. For the reasons set forth below, the protests should be rejected and the

Commission should issue an order accepting the NYISO’s proposed amendments to

Section 5.14.1.2 of its Market Administration and Control Area Services Tariff (“Services

Tariff”) without any modifications and without a refund condition by January 28, 2011.

I.REQUEST FOR LEAVE TO ANSWER

The pleadings to which the NYISO seeks to respond are styled as both “comments” and

“protests.” The Commission’s regulations allow answers to “comments” as a matter of right.

The Commission has discretion2 to accept answers to protests and has done so when they help to

clarify complex issues, provide additional information, or are otherwise helpful in the

Commission’s decision-making process.3 The Commission should follow its precedent and

1 18 C.F.R. §§ 385.212 and 385.213 (2010).

2 See 18 C.F.R. § 385.213(a)(2).

3 See Black Oak Energy, L.L.C. v. PJM Interconnection, L.L.C., 125 FERC ¶ 61,042 at P 14

(2008) (accepting answer to rehearing request because the Commission determined that it has “assisted us

in our decision-making process.”); FPL Energy Marcus Hook, L.P. v. PJM Interconnection, L.L.C.,

123 FERC ¶ 61,289 at P 12 (2008) (accepting “PJM’s and FPL’s answers [to rehearing requests], because

they have provided information that assisted us in our decision-making process”); New York Independent

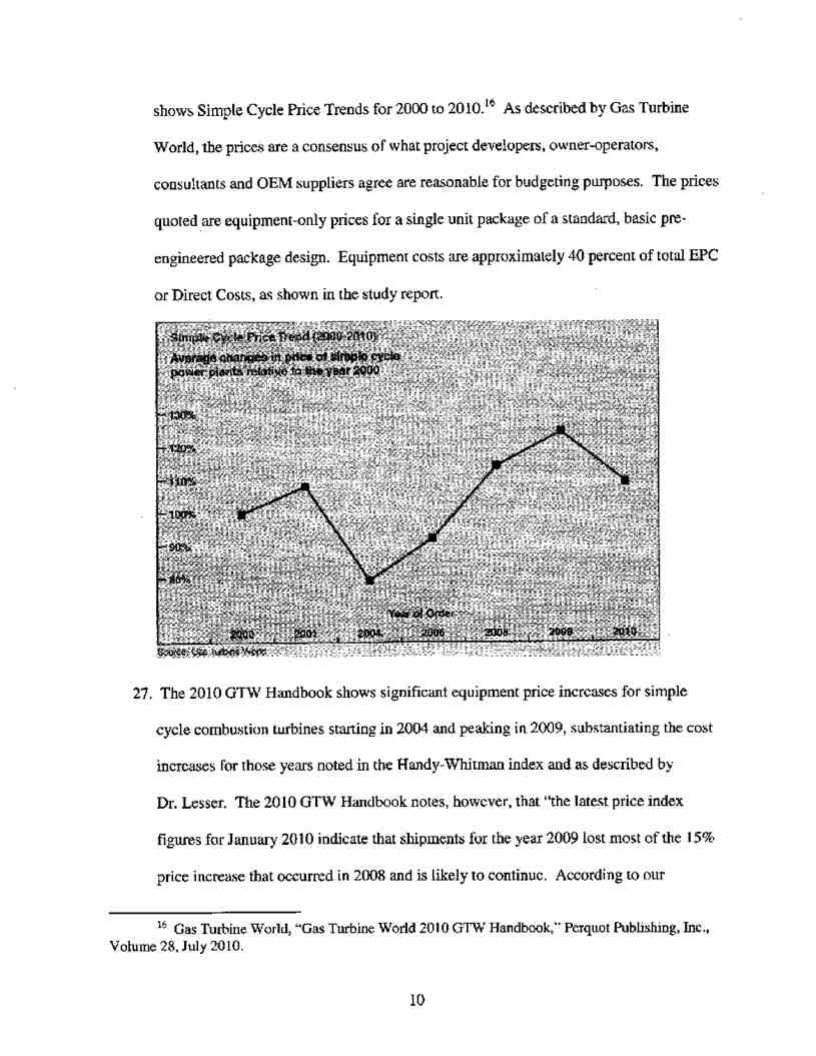

System Operator, Inc., 123 FERC ¶ 61,044 at P 39 (2008) (accepting answers to answers because they

accept the NYISO’s answer in this instance.4 The issues in this proceeding are complex and will

have a significant impact on the Installed Capacity (“ICAP”) Demand Curves5 and thus on both

Capacity markets and consumers. This answer will help the Commission to better understand

the issues and the consequences of its decisions. In addition, this answer corrects a number of

mischaracterizations and misstatements and thus will help the Commission with the benefit of an

accurate record.

II.ANSWER

A.The NYISO Has Supported its Proposed ICAP Demand Curves with

Substantial Evidence and the Commission Should Accept Them Without Requiring Any Modifications

The NYISO’s November Filing6 proposed tariff amendments to define the ICAP Demand

Curves for Capability Years 2011/2012, 2012/2013, and 2013/2014. A number of the November

Filing’s proposed amendments have been the subject of protests by: (i) the Independent Power

Producers of New York, Inc. (“IPPNY”); Astoria Generating Company, the NRG Companies,

and TC Ravenswood which filed jointly (“In-City Incumbent Generators”); and other generation

owners (IPPNY, In-City Incumbent Generators, and other generator owners, together, the

“Generator Interests”), on the one hand; and (ii) the New York Transmission Owners

provided information that aided the Commission’s decision-making process); Morgan Stanley Capital Group, Inc. v. New York Independent System Operator, Inc., 93 FERC ¶ 61,017 at 61,036 (2000)

(accepting an answer that was “helpful in the development of the record.. ”).

4 In addition, if the Commission deems Rule 385.213(d)(1) to be applicable, the NYISO

respectfully requests that the Commission exercise its discretion and accept this Answer one day out-of-

time.

5 Terms with initial capitalization herein have the meaning set forth in the Services Tariff and if

not defined therein, the meaning set forth in the NYISO’s Open Access Transmission Tariff (“OATT”).

6 New York Independent System Operator, Inc., Tariff Revisions to Implement Revised ICAP

Demand Curves for Capability Years 2011/2012, 2012/2013, and 2013/2014, Docket No. ER11-2224-000 (November 30, 2010) (“November Filing”).

2

(“NYTOs”)7, the New York State Consumer Protection Board (“NYCPB”), the City of New

York (the “City”), the New York State Public Service Commission (“PSC”), and the Multiple

Intervenors (for ease of reference when their comments on an issue are aligned, referred to herein

collectively as the “Load Interests”), on the other hand. The Generator Interests criticize

elements of the November Filing that they assert would make the new ICAP Demand Curves too

low.8 The Load Interests criticize elements that they assert would make the curves too high.9

The NYISO’s proposed ICAP Demand Curves are based on the facts and analyses

developed by its staff and Consultant10 as well as the NYISO’s own independent analysis and

expert judgment. The NYISO’s staff and independent Board of Directors (“Board”) have

undertaken an extensive stakeholder process to develop the proposed new ICAP Demand Curves

and the contents of the November Filing were informed by stakeholder input. As was

demonstrated by the November Filing, and as is further illustrated by the affidavits attached to

this Answer, the NYISO’s proposals are well-reasoned and satisfy all applicable Services Tariff

requirements. They are properly calculated to send the appropriate price signals to both existing

7 The NYTOs as defined in their pleading are Central Hudson Gas & Electric Corporation,

Consolidated Edison Company of New York, Inc., Long Island Power Authority, Niagara Mohawk Power Corporation, d/b/a Nation Grid plc, New York Power Authority, New York State Electric & Gas

Corporation, Orange & Rockland Utilities, Inc., and Rochester Gas & Electric Corporation.

8 See, e.g., In-City Incumbent Generators at 2 (stating that “[a]t every turn, the NYISO’s

unsupported judgment calls have lowered the ICAP Demand Curves”); IPPNY at 4-5 (stating that “the NYISO’s proposed Demand Curves are significantly understated below the cost of new entry for a peaking unit in each capacity region”).

9 See, e.g., City of New York at 7-11 (arguing that the ICAP Demand Curves should not be

increased); Multiple Intervenors at 16 (claiming that the NYISO has a “myopic preoccupation with

preserving generator revenues”); NYTOs at 16 (arguing that the proposed winter-summer adjustment will result in setting the ICAP Demand Curve “too high”).

10 As in the November Filing, for convenience, all references to “the Consultant” encompass the

team of NERA Economic Consulting (“NERA”), and Sargent & Lundy (“S&L”) as a subcontractor to

NERA.

3

Installed Capacity Suppliers and potential new entrants in order to encourage efficient investment in Capacity.11

Given the rhetorical excesses of certain protestors, it is worth emphasizing that the

NYISO is a not-for-profit, impartial, and independent entity with no financial stake in the

outcome of this proceeding. The NYISO’s only interest is that the ICAP Demand Curves are set

at a level at which they will “improve system and resource reliability by valuing the ICAP

resources available above the system’s required levels, and provid[e] more effective economic

signals for new investment.”12 Achieving these objectives requires the NYISO to exercise

judgment to avoid setting the ICAP Demand Curves too low or too high. It is therefore ironic, at

best, that some Generator Interests seeking to move the proposed curves to suit their interests13

accuse the NYISO of practicing a “results oriented” approach to defining the curves.

Some of the protests complain that the NYISO should not have departed from the

Consultant’s recommendations regarding excess Capacity level estimates and the escalation

factor.14 Such arguments overlook the fact that the Consultant did not object to those variations

and believed that the NYISO’s proposal as a whole was “reasonable and consistent with the

underlying objectives of the ICAP Demand Curves.”15 The Affidavit of Mr. Eugene T. Meehan,

NERA Senior Vice President (the “Meehan Affidavit,” Attachment 1 to this Answer),

re-emphasizes that the Consultant’s opinion is that the NYISO’s escalation factor

11 It should be noted that Demand Side Resources are both already ICAP Suppliers and expected new entrants in the NYISO-administered ICAP markets.

12 New York Independent System Operator, Inc., 122 FERC ¶ 61,064 at P 2 (2008) (“Second DCR

Order”).

13 The In-City Incumbent Generators’ protest is the most unfortunate example of this tendency. In Section B below, the NYISO responds briefly to its assorted mischaracterizations and histrionic insinuations regarding alleged biases.

14 In-City Incumbent Generators at 12.

15 November Filing at 4.

4

recommendations were reasonable.16 Moreover, the independent Market Monitoring Unit

(“MMU”) specifically concluded that the NYISO’s adjustments to the Consultant’s

recommendations, with one exception, were reasonable.17 The Commission has previously

accepted NYISO ICAP Demand Curve proposals that differed from its Consultant’s

recommendations when the NYISO concluded that modifications were warranted.18 The NYISO has offered more than sufficient support for the Commission to do so again in this proceeding in the form of the affidavits and reports that accompanied the November Filing and the affidavits submitted with this Answer.

The Generator Interests essentially take the position that the NYISO’s judgment cannot

support any departure from the Consultant’s recommendations and indeed should have no

weight,19 at least when it would result in lower Capacity prices. The In-City Incumbent

Generators go so far as to contend that Mr. Lawrence’s affidavit has no evidentiary value, in part

because his views are the same as the NYISO’s.20 Such arguments are absurd on their face. The

16 See, e.g., Attachment 1, Affidavit of Eugene T. Meehan at P 15 (“In my opinion, NYISO has

made reasonable decisions with respect to escalation both in 2007 and in the instant reset.”) It is therefore false for the In-City Incumbent Generators to suggest that the November Filing’s description of the

Consultant’s view was not accurate. See In-City Incumbent Generators at n. 50.

17 November Filing, Affidavit of Dr. David B. Patton at P 8 (“Many of the NERA/S&L Report’s specific assumptions incorporate a measure of independent judgment. I believe that the assumptions used, as adjusted in the NYISO Report and as included in the NYISO’s filing, fall within a reasonable range for such assumptions with one exception ”).

18 See, e.g., Second DCR Order at PP 26, 31, 60-61 (accepting NYISO modifications to excess

Capacity level estimates recommended by NERA based on an analysis by Mr. David Lawrence and

accepting the NYISO’s judgment not to include an additional risk factor that NERA had recommended).

19 In-City Incumbent Generators at 14-15.

20 See In-City Incumbent Generators at n. 80 (“Mr. Lawrence does not appear to be offering, or

purporting to offer, his expert opinion, but rather appears merely to be reporting the views of his

employer, the NYISO.”) Mr. Lawrence’s lead role in the design and implementation of the NYISO’s

ICAP product, including in the development of the current and prior ICAP Demand Curve reset

proposals, makes him as an impartial and credible expert on the subject. The NYISO Report that was

adopted by the Board largely reflects his judgment regarding the appropriate level of various ICAP

Demand Curve parameters, including the appropriate excess Capacity level estimate. Moreover, Mr.

5

NYISO is the independent, impartial, and expert administrator of the New York Capacity

markets. Its independence enhances its credibility, and that of its employees, rather than

diminishing it. Moreover, the Services Tariff presumes that the NYISO will exercise its

judgment in accepting or rejecting the various recommendations of its Consultant, MMU, and

stakeholders regarding the ICAP Demand Curves.21 Had the NYISO simply accepted all of its

Consultant’s recommendations it presumably would have been challenged by protestors for

allegedly failing to discharge a tariff obligation to exercise judgment. The Commission itself has

acknowledged that the establishment of key ICAP Demand Curve parameters is “essentially a

judgment...”22

In short, the NYISO has supported the assumptions underlying the November Filing with

substantial evidence demonstrating that the revised ICAP Demand Curves are both just and

reasonable and consistent with the underlying objectives of the ICAP Demand Curves. The

protests, notwithstanding the length and acerbity of some of their arguments, fail to show that the

revised ICAP Demand Curves are unjust or unreasonable. It is possible that ICAP Demand

Curves produced using alternative assumptions might also be just and reasonable but that does

not make the proposals set forth in the November Filing unjust, or unreasonable, or “outside the

Lawrence’s testimony in the November Filing does not consist “entirely of legal argument” and the single

example proffered to support the allegation is incorrect: Mr. Lawrence’s description of the NYISO’s

obligation to estimate excess Capacity levels based on conditions “equal to or in slight excess of the

minimum required Capacity” is a statement of fact that was clearly established by the Second DCR Order.

If Mr. Lawrence’s affidavit constitutes a legal argument, which the NYISO disputes, then the same would

unquestionably be true of various affidavits submitted by the Generator Interests. See, e.g., In-City

Incumbent Generators, Joint Affidavit of Richard L. Levitan, et. al at P 17 (arguing that they have

developed recommendations that are “just and reasonable”); and IPPNY Protest, Affidavit of Jonathan A.

Lesser at PP 6, 48, 54 (arguing that accepting the NYISO’s proposals would amount to a “regulatory

taking”).

21 See Services Tariff §§ 5.14.1.2.7, 5.14.1.2.8.

22 Second DCR Order at P 54 (“we note that the choice of escalation factor is essentially a judgment informed by analysis of cost and inflation trends”).

6

zone of reasonableness” mandated by the Federal Power Act.23 The Commission should

therefore issue an order accepting the NYISO’s proposed tariff amendments by January 28, 2011

without requiring any modifications and without establishing a paper hearing or a refund

condition.24

B.False Claims of Bias Should Not Distract the Commission from the

Magnitude of the Unwarranted Capacity Price Increases that the Generator

Interests Propose

The In-City Incumbent Generators repeatedly make inaccurate and unsubstantiated

allegations that the NYISO is biased against them.25 They offer no explanation of why the

NYISO might harbor such a bias and the facts in this proceeding, in which the NYISO has made

determinations some which have the effect of moving the ICAP Demand Curves higher and

other which move them lower, contradicts their claim.26 Their allegation also conflicts with the

fact that the November Filing included a number of proposals that have drawn protests from

Load Interests, and this Answer likewise objects to a number of Load Interest proposals that

would unreasonably decrease the ICAP Demand Curves. The NYISO made these

23 See, e.g., Second DCR Order at P 14, n. 12 (“The Commission does not need to show that other

proposals that arguably fall within a zone of reasonableness are not just and reasonable and indeed, we

must approve NYISO’s proposals if supported as just and reasonable even if there are other just and

reasonable proposals.”) Citing Midwest Indep. Trans. Sys, Operator, 118 FERC ¶ 61,209 at P 67 (2007);

FPC v. Conway Corp., 426 U.S. 271, 278 (1976) (“there is no single cost-recovering rate, but a zone of

reasonableness.”).

24 See Section II.L.2 below for a discussion of the problems that setting a refund condition would

bring.

25 See, e.g., In-City Incumbent Generators at 40.

26 The In-City Incumbent Generators repeatedly point to an outlier 2003 Initial Decision on cost

allocation issues. See In-City Incumbent Generators’ at 39. As demonstrated in this pleading, their

several uses of quotes from the Initial Decision are unsubstantiated. Additionally, however, their

reference to that document is misleading. The findings of the 2003 Initial Decision were never accepted

by the Commission, and all parties to the underlying proceeding agreed to ask the Commission to vacate

them. This is hardly “evidence” of bias today. Such references only clutter the record and create a

distraction from both the issues at hand and the fact that there is clear support for the NYISO’s ICAP

Demand Curves.

7

determinations, as well as those that the Generator Interests oppose, based on the principled exercise of its independent judgment.

Similarly, the In-City Incumbent Generators wrongly imply that the NYISO

inappropriately instructed the Consultant not to opine on the policy dimension of the

deliverability and tax abatement questions.27 That request was made because, in contrast to the host of economic and technical issues that the Consultant was engaged to address, those two

questions involve additional legal and government administration considerations. The NYISO properly asked the Consultant to provide information on the cost impacts including and

excluding SDU and property tax costs could have but then made its own judgment on the legal and administrative questions.

Allegations of bias by the In-City Incumbent Generators ring especially hollow because

they failed to raise a number of the concerns included in their protest during the stakeholder

process or even in their written or oral presentations to the NYISO Board. After stakeholders

worked diligently for nearly a year in the stakeholder process, the NYISO (and presumably

stakeholders other than the Generator Interests) only learned that the following issues were of

concern to the In-City Incumbent Generators and IPPNY: (i) New York City SDU costs,28

(ii) In-City System Upgrade Facility (“SUF”) costs; (iii) the purported relevance of tax

assessments on generators in Upstate New York municipalities on New York City tax

abatements; (iv) several of the econometric issues described by Dr. Carlson; and (v) the LMS100

peaking unit qualification under the technical standards of New York City’s Third Amended and

Restated Uniform Tax Exemption Policy (“UTEP”). Stakeholders are not required to flesh out

27 In-City Incumbent Generators, at 11, n. 50 and Levitan Affidavit at P 54.

28 For ease of comprehension “SDU costs” are sometimes referred to as “deliverability costs” throughout this Answer.

8

all of their legal and technical arguments during the extensive stakeholder process associated

with the ICAP Demand Curve reset but they should be expected to identify all of their concerns so that the NYISO staff and Board may consider them.

Failing to raise issues in a timely manner weakens the stakeholder process and is unfair to those that participate fully. It also contravenes more than a decade of Commission precedent

discouraging parties from making “end runs” around ISO/RTO governance mechanisms by

raising issues at the Commission for the first time.29 Accusing the NYISO of bias because it did not agree with positions that were never presented is not acting in good faith.30 The same is true of the In-City Incumbent Generators’ tendency to attack the NYISO for moving away from

preliminary positions that were clearly taken for discussion purposes during stakeholder

meetings.31 The fact that the NYISO’s thinking has evolved over time demonstrates its attention and responsiveness to stakeholders, not bias.

The Commission should not allow the Generator Interests’ repeated allegations to

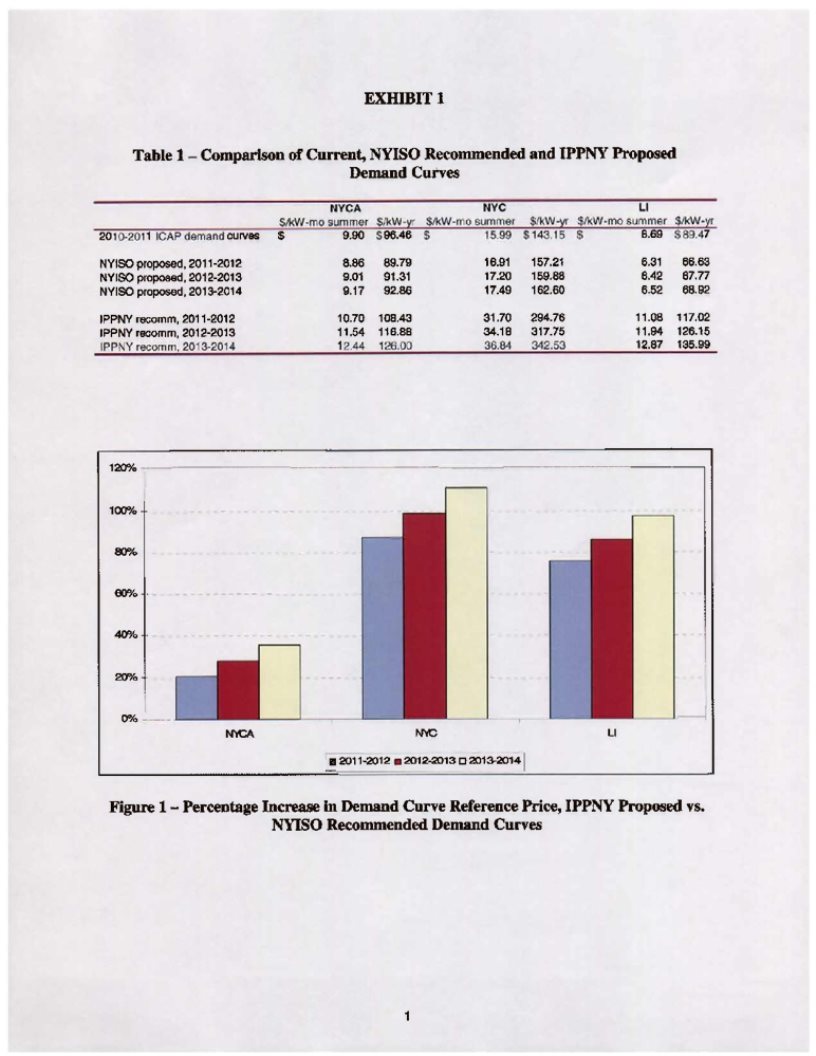

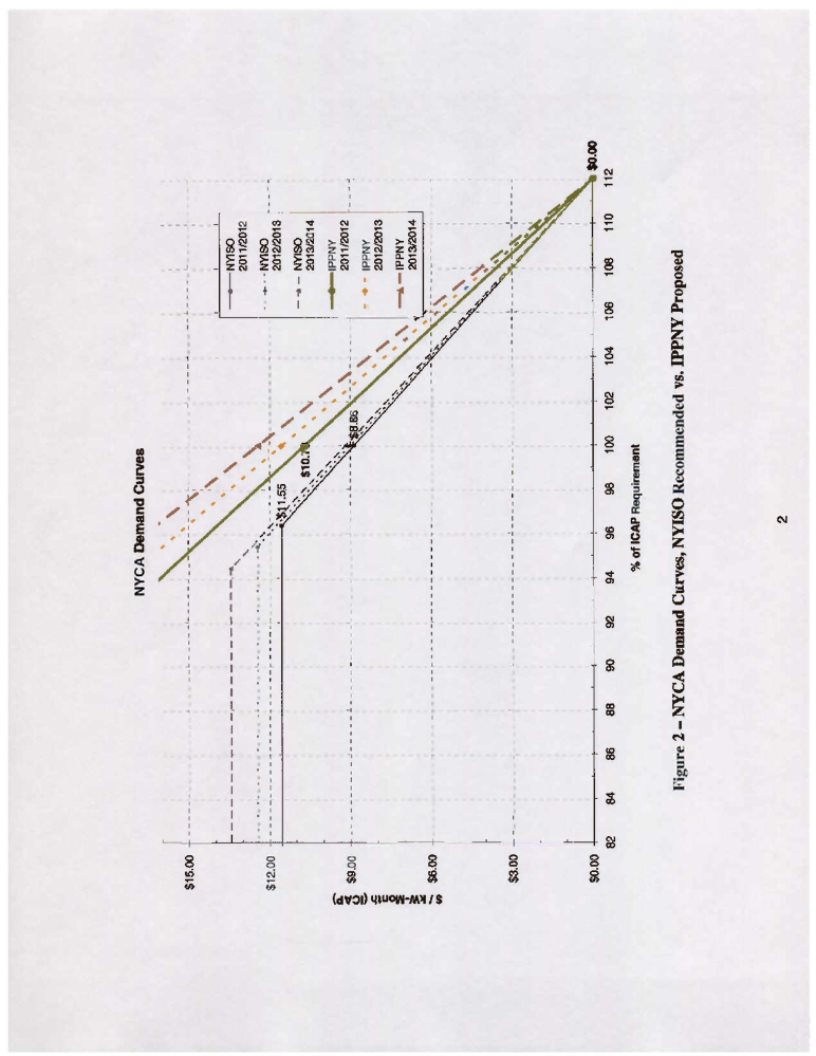

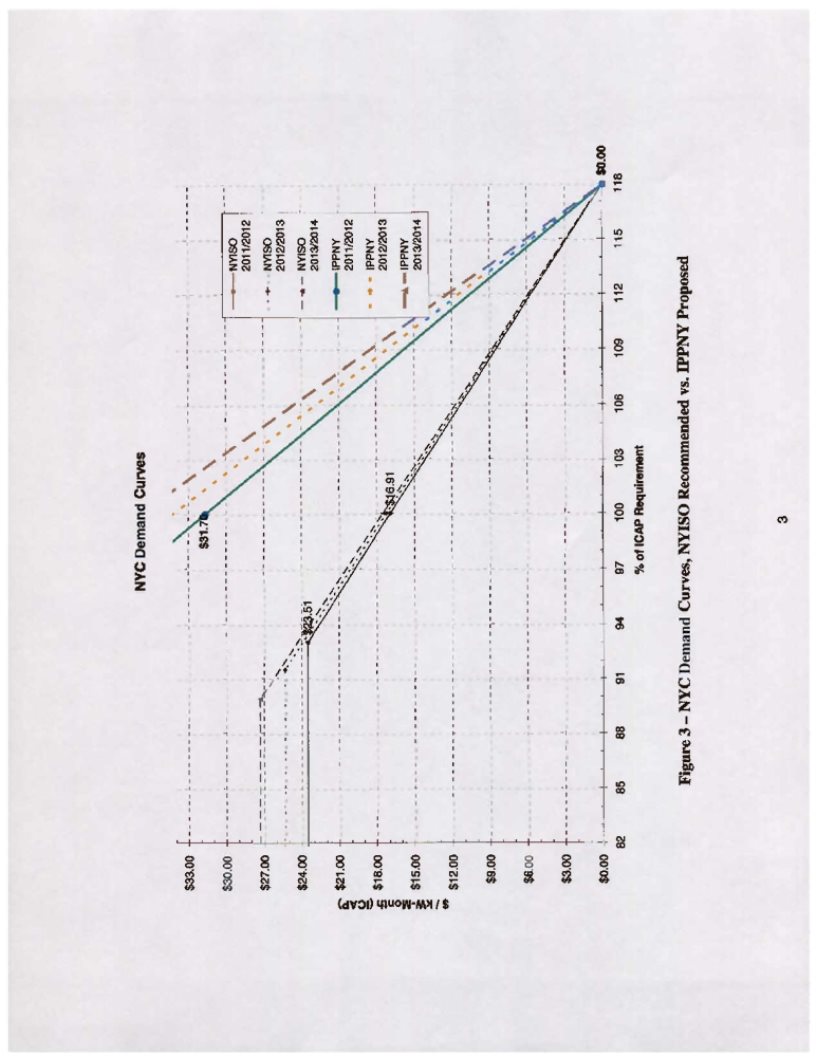

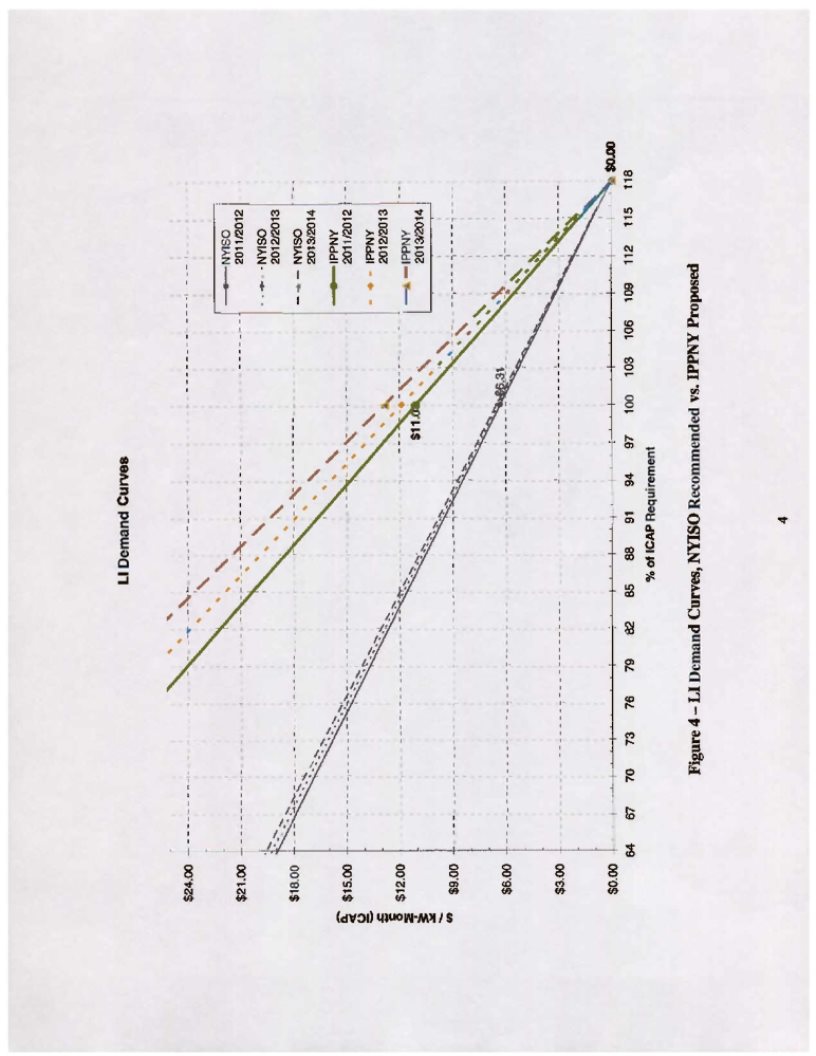

obscure the magnitude of the increases that they are proposing to the ICAP Demand Curves. As

discussed in the attached affidavit of Mr. David Lawrence (“Lawrence Affidavit,” Attachment 2

hereto) and depicted in the Exhibits to the Lawrence Affidavit, if the Commission were to accept

IPPNY’s proposals the result would be an increase in the 2011-2014: (1) NYCA Demand Curve

29 See, e.g., ISO New England, 128 FERC ¶ 61,266 at P 55 (2009) (declining to grant a party’s

specific request for relief because the Commission “will not ... circumvent that stakeholder

process”); New York Independent System Operator, Inc., 126 FERC ¶ 61,046 at PP 54 (2009) (stating that

while a proposal “may have merit” the proposal should be “presented to and discussed among ...

stakeholders”); New York Independent System Operator, Inc., 122 FERC ¶ 61,209 at PP 24, 26 (2008)

(declining to direct requested revisions without “giving other stakeholders an opportunity for comment”

because it “would inappropriately circumvent [the] stakeholder process”); New England Power Pool,

107 FERC ¶ 61,135 at PP 20, 24 (2004) (declining to accept changes proposed for the first time in a

FERC proceeding by an entity that participated in the stakeholder process because the “suggested

revisions have not been vetted through the stakeholder process and could impact various participants”).

30 The NYISO addresses and refutes these points in subsequent sections of this answer.

31 See, e.g., In-City Incumbent Generators at n. 71, Levitan Affidavit at P 48.

9

by between 20 and 36 percent; (2) the LI Demand Curve by between 76 and 97 percent; and

(3) the NYC Demand Curve by between 87 and 111 percent.32

Increasing the ICAP Demand Curves to reflect cost increases that the ICAP Demand

Curve peaking units are reasonably expected to incur is appropriate. However, increasing them based on erroneous and unreasonable assumptions, and misleading information, is unwarranted, as demonstrated in Sections C, D, F, G, H, and J, below.

C.The November Filing’s Peaking Unit Choices and Related Determinations

Were Reasonable

1.It Is Reasonable to Use a Frame 7A Unit to Set the NYCA Demand

Curve

The November Filing proposed to use a Frame 7A unit in the Capital Zone as the peaking unit for purposes of setting the ICAP Demand Curve for the NYCA. Load Interests erroneously assert that the ICAP Demand Curve for the NYCA should instead be based on the net cost of

developing, constructing, and operating a LMS100 on Long Island. They claim that their

recommendation is consistent with the Services Tariff, and that the NYISO’s proposal is not, on the theory that a Frame 7A unit located in the Capital Zone is not economically viable on a

NYCA-wide basis.33 Further, the Load Interests contend that language in the NYISO’s ICAP

Manual which affirms that a Rest-of-State (“ROS”) peaking unit is to be used to set the NYCA

Demand Curve, is inconsistent with the Services Tariff’s economic viability requirement and

must therefore be revised to conform to the tariff.34

The Commission should reject these arguments because the Services Tariff does not

permit the NYCA Demand Curve to be set using a Long Island (or New York City) peaking unit.

32 See Lawrence Affidavit at P 8.

33 See, e.g., NYTOs at 2-6; NYCPB at 6-7.

34 NYTOs at n. 11.

10

As was explained in the November Filing, the Services Tariff requires that the NYCA Demand Curve be based on the costs of a peaking unit located in the ROS area.35 This point is clarified and confirmed by the ICAP Manual which is in no way inconsistent with the Services Tariff.36 In fact, it is the Load Interests who would effectively nullify tariff language by construing away the ROS limitation. As further shown in the November Filing, the Consultant’s analysis

indicated that a Frame 7FA unit in the Capital Zone would cost less on a $/kW basis than other alternatives in the ROS and is therefore economically viable.

The Commission should also reject Generator Interests’ arguments that if the NYISO is

not required to include SDU costs in the peaking unit’s costs, then the NYCA peaking unit must

be located in the Lower Hudson Valley, which would in turn require the use of an LMS100 for

environmental reasons.37 As is explained in Section II.D below, SDU costs are not properly

included in the peaking unit’s cost. The Frame 7FA unit had a lower fixed cost on a $/kW basis

than other technologies and the Commission has previously accepted it as the peaking unit for

the NYCA.38 It is true that the Consultant provided estimates for a peaking unit in the Lower

Hudson Valley. The Generator Interests’ arguments based on those estimates are actually

arguments for the creation of a Lower Hudson Valley Capacity zone, a question that is outside

the scope of this proceeding.39 The Services Tariff’s ICAP Demand Curve provisions provide

35 November Filing at 9, and Services Tariff at § 5.14.1.2.

36 See November Filing at n. 26, citing, ICAP Manual at § 5.5(1).

37 IPPNY at 41-42, GenOn at 8.

38 New York Independent System Operator, Inc., 122 FERC ¶ 61,064 at P 22 (2008) (accepting the use of a Frame 7FA unit for the NYCA in the 2008-2011 Demand Curve Reset process).

39 See Section II.E for further discussion of this issue.

11

only for the NYISO to define three ICAP Demand Curves for its three existing Capacity zones.40 The case for considering new Capacity zones in this proceeding is especially weak given that the NYISO has just made a compliance filing in Docket No. ER04-449-023 to establish criteria

governing the possible future creation of new zones.

2.The NYISO’s Proposal Regarding Site Remediation and Lease Costs

Are Reasonable

The City and the NYCPB asserted that the NYISO unreasonably proposed: (1) a

“50 percent adder to the land costs of the NYC [Demand Curve]… peaking unit to account for an assumption that the owner of such unit, as lessee, would accept full responsibility for all site

remediation costs;”41 and (2) a cost adder to the lease rate for the NYC peaking unit.42 They further argued that any adder to the site remediation costs must be offset by a reduction in lease costs.43 However, the NYISO’s proposal did not include either a fifty percent site remediation adder to land costs or a lease rate adder for such costs. Also, neither the City nor NYCPB has presented any evidence to justify a reduction of lease costs.

The concern regarding site remediation costs appears to be based on a misunderstanding

of the NYISO’s proposal. As is explained in the attached affidavit of Mr. Christopher D. Ungate

(“Ungate Affidavit,” Attachment 3 hereto), the misunderstanding may stem from the fact that

site remediation costs amount to a fifty percent adder to the amount of site preparation costs

without site remediation costs.44 As noted in the Ungate Affidavit, site remediation costs

40 Services Tariff § 5.14.1.2 (stating that “[t]hree ICAP Demand Curves will be established”). The existing Capacity zones are the New York Control Area (“NYCA”), New York City (“NYC”), and Long Island (“LI”).

41 City of New York at 11.

42 City of New York at 11-12, NYCB at 6.

43 Id.

44 Ungate Affidavit at P 14.

12

account for less than one percent of the total engineering procurement and construction cost for the New York City peaking unit. The City’s and the NYCPB’s concern, even if not based on a misunderstanding, is thus greatly overstated.

Contrary to the City’s and NYCPB’s assertions, the November Filing’s proposal did not

include an explicit cost adder to the lease rate for site remediation that can be separated from the

site remediation amount, as site leasing costs in NYC were based on market data.45 Additionally,

the City’s and NYCPB’s assertion that a reduction in the lease rate must be made to account for

the NYISO’s inclusion of site remediation costs in land costs should be rejected. No evidence

has been submitted that shows that a developer would obtain a reduction in lease costs for site

remediation. Even if the Commission were to find that a reduction is necessary, no data have

been provided which would allow the NYISO to determine the amount of such reduction. The lease cost used for the November Filing’s proposal is reasonable, as it is based on market data that reflects the costs that would have to be paid by a developer to lease the land on which the peaking unit would be built.

3.The November Filing’s Proposed Estimates of New York City

Interconnection Costs Are Reasonable

The NYISO’s proposal included SUF costs in the peaking unit’s costs based on the most

recently available (at the time the estimates were completed)46 historical data from three 2001

New York City generator interconnection projects.47 The Generator Interests claim that the

NYISO’s analysis underestimated NYC Demand Curve peaking unit interconnection costs,

because more recently available cost allocation data reflects higher SUF costs for In-City

45 Id. at P 16.

46 Id. at PP 18, 22.

47 As explained further in the Ungate Affidavit, the 2001 costs were escalated to 2010 dollars. Ungate Affidavit at P 20. The Ungate Affidavit provides an estimate of the effect of using the Class Years 2009 and 2010 project data. Id. at P 22.

13

generation projects.48 The Generator Interests provide an analysis which includes SUF costs

incurred by four In-City generators in Class Years 2009 and 2010. The Generator Interests’

protest on this point should be rejected because they have not shown that the November Filing’s proposal is unreasonable.

The reasonableness of the data used in the Consultant’s report is not undermined by the

mere existence of the additional more recent project specific data. Consistent with other ICAP

Demand Curve inputs, the costs used were not derived from incurred cost data, but rather were

based on estimates developed utilizing the best available project data at the time the estimates

were made. It would not be appropriate to use the Class Year 2009 and 2010 data relied on by

the Generator Interests because those costs are still subject to the approval of the NYISO’s

stakeholder Operating Committee and will not be considered final until they are approved.49 In

addition, as stated in the Ungate Affidavit, the not-yet-approved cost estimates proffered by

IPPNY “shows considerable variation in SUF costs on a $/kW basis.”50 Thus, Mr. Younger’s

affidavit and the NYISO draft reports to which it refers51 only serves to demonstrate that, just

like the 2001 data used by the Consultant to establish the peaking unit’s costs, the SUF costs

vary widely. The data also demonstrate that SUF costs will vary based on the voltage level of

the interconnection or the location of the interconnection point. It does not, however,

demonstrate that the data used by the Consultant are unreasonable. Therefore, the Commission

should reject the Generator Interests’ protests. The costs relied on by the Consultant for its

48 IPPNY at 51-52, and Exhibit 2 - Affidavit of Mark Younger at PP 88-89.

49 Those project cost allocations will not be presented to the Operating Committee until a date

sometime in 2011 that will be after January 28, 2011, the date requested by the NYISO for a Commission order regarding these Demand Curves. As discussed in Section II.L.2, below, it is imperative for the ICAP Demand Curves to be established well before the start of the 2011/2012 Capability Year.

50 Ungate Affidavit at P 19.

51 IPPNY at Affidavit of Mark Younger n. 7.

14

estimates provide a sound basis for the SUF costs for the NYC peaking unit and are thus reasonable.

D. The November Filing’s Proposal to Exclude SDU Costs from the Peaking

Unit’s Cost of New Entry Was Both Reasonable and Consistent with the NYISO Tariffs

The November Filing proposed to exclude SDU costs from the peaking unit’s cost of new

entry. Including SDU costs would not be an efficient means of encouraging development in

areas where units would be deliverable. In addition, it would provide existing generators that

were “grandfathered” under the Deliverability tariff provisions when they were established, and

thus not required to pay for SDU costs, with a windfall from the resulting higher Capacity prices

at the expense of all customers.52 The November Filing further explained that even if the

Commission were to conclude that the inclusion of deliverability costs would be appropriate, it

would be premature to include such costs in the peaking unit’s cost of entry, without considering

their relation to the question of the establishment of a new Capacity zone in the NYCA.

The Generator Interests argue that exclusion of SDU costs is unreasonable because those costs were supposedly previously included in the peaking unit’s costs, the NYISO’s tariffs

allegedly require their inclusion, and because a new generator in the NYC Capacity zone would

necessarily incur SDU costs. The NYISO addresses each of these arguments in the following

sections.

52 The Commission has previously evaluated the effect of price increases to customers against

“uncertain potential benefits” that “may encourage new economic entry” when determining not to include additional costs in the ICAP Demand Curves. See Independent Power Producers of New York, et. al v. New York Independent System Operator, Inc., 125 FERC ¶61,311 at P 35 (2008) (finding against

reopening the ICAP Demand Curves because “the adverse affect [sic] of price increases on customers in the current market for existing capacity must be weighed against the uncertain potential benefit to the market that such price increases may encourage new economic entry”).

15

1.The Peaking Unit’s Cost of Entry Did Not Previously Include SDU

Costs

Any suggestions that including SDU costs in the peaking unit’s cost of entry is required

by NYISO cost allocation requirements or is consistent with the NYISO’s past practices are

simply incorrect. Additionally, it is not accurate to assert that “many, if not most, existing

generators in New York City have incurred deliverability upgrade-related costs... ”53 Such

assertions are based on a false premise that what would be classified as SDU costs today would necessarily have been classified as SUF costs in the past.54 The contention that some portion of SUFs prior to the introduction of a deliverability requirement included the costs of facilities that would now be classified as SDUs is fundamentally misleading.

Prior to the implementation of the deliverability tariff provisions,55 the NYISO’s

interconnection process did not include a deliverability standard and did not require upgrades to

address deliverability.56 The Generator Interests’ assert that after the implementation of

deliverability “the NYISO needed to modify and narrow the definition of ‘System Upgrade

Facilities,’ which had previously covered all interconnection-related network upgrades … .”57 In

fact, no such modification or narrowing was necessary. The scope of facilities defined to be

SUFs did not change as a result of the implementation of deliverability. Instead, the

53 In-City Incumbent Generators at 29.

54 Id. at 37.

55 New York Independent System Operator, Inc., 126 FERC ¶61,046 at P 120 (2009) (accepting

the deliverability tariff provisions effective October 5, 2008) (“January 2009 Deliverability Order”).

56 See New York Independent System Operator, Inc., 111 FERC ¶61,347 at PP 13 (2005)

(ordering the NYISO to include a second level of interconnection service that includes a deliverability component).

57 In-City Incumbent Generators at 37. Further, Generator Interests’ assertions in n. 129 that

Network Access Interconnection Service included a deliverability component are false. See January 2009

Deliverability Order at P 4 (noting that “Network Access Interconnection Service did not address whether

energy injected by the new interconnection can actually be delivered by the transmission system”).

16

deliverability tariff revisions expanded the interconnection-related network upgrades defined by

the NYISO process by adding the deliverability requirement and the term “System Deliverability

Upgrades.” 58 This addition created an entirely new category of required facilities that is distinct

from SUFs. 59 Since the NYISO did not require the identification of SDUs before these

modifications, prior ICAP Demand Curves could not have included SDU costs in the peaking

unit’s costs.

The Generator Interests rely on statements regarding the deliverability of the system

made prior to the full deliverability test being finalized60 to support their argument that SUFs

funded by generators grandfathered from deliverability, must have contributed to the

deliverability of the system. The argument fails for two primary reasons. First, the existing

system was shown to have deliverability issues in Class Year 2008, which was the first Class

Year Deliverability Study based on the full set of deliverability test assumptions.61 Second, it

does not follow that because generators funded SUFs and there is some level of deliverability on

the existing system, SUFs necessarily contributed to the deliverability of the system. The

Generator Interests provided no support for this assertion. As the Generator Interests

58 See New York Independent System Operator, Inc., Joint Compliance Filing at 4-6, Docket No. ER04-449-017 (filed August 5, 2008) (“Deliverability Compliance Filing”).

59 See Deliverability Compliance Filing at Attachment I, blacklined Sheet No. 658A and 659.

60 The statements by the NYISO and NYTOs cited by the In-City Incumbent Generators at n. 148

were made before the resolution of the Quebec/Existing Transmission Capacity for Native Load

(“ECTNL”) import issue. Also, the Generator Interests’ contention at n. 148 that the Class Year 2007

Study shows that the system was deliverable prior to Class Year 2008 is misleading. The Class Year 2007

Deliverability Study was performed using assumptions, applied only to that Class Year, that did not

model any megawatt level of external emergency assistance (i.e., ECTNL 1080 MW and Quebec (via

Chateauguay 1090 MW imports). The Class Year 2008 Deliverability Study, which used the final

assumptions, including the modeling of those imports, showed that the system was not deliverable in Rest

of State.

61 See, Class Year 2008 Facilities Studies - Part 2 Studies (Sections 11, 12, 13 only):

Deliverability Study and System Deliverability Upgrade Facilities (SDU), November 2009 available at <

http://www.nyiso.com/secure/webdocs/committees/oc/meeting_materials/2009-11-

12/CY08_Facilities_Study_Part2_Deliverability_Study_Draft3_clean.pdf>.

17

acknowledge, existing generators were grandfathered, because their prior investments were made relying on provisions found in the then-current tariff provisions, which did not include a

deliverability component.62

Past determinations of SUF costs in Class Year studies are irrelevant to the issue of the

inclusion of SDU costs in the peaking unit’s costs. Prior to Class Year 2007 the NYISO did not

conduct the analyses necessary and now required to identify SDUs and no SUF was required for

purposes of increasing deliverability or transfer capability. The first such final determination

identifying SDUs and their associated costs was made in the Class Year 2008 Facilities Study,

approved by the Operating Committee in accordance with NYISO OATT requirements in

November 2009. Thus, no SDU costs could have been included in the peaking unit’s costs for prior ICAP Demand Curves, as such costs did not exist and were not identified by the NYISO prior to Class Year 2008.

2.The NYISO’s Tariffs Do Not Require the Inclusion of SDU Costs in

the Peaking Unit’s Cost of Entry

The Generator Interests are also wrong to claim that the NYISO’s proposed exclusion of

SDU costs contravenes the NYISO’s tariffs. The Services Tariff does not prohibit the

Commission from deciding that excluding SDU costs would be appropriate for the reasons that

were articulated in the November Filing. As was noted above, SDU costs did not exist at the

time of prior ICAP Demand Curve Reset proceedings, as the OATT provisions creating them,

and attendant obligations, were not implemented until the Commission’s order approving the

deliverability tariff provisions.63 Further, because those tariff provisions, including the cost

allocation methodology for SDUs, were designed to provide proper signals to interconnection

62 Id. at n. 148.

63 See January 2009 Deliverability Order at P 120.

18

customers to encourage siting of generation in areas where Capacity would be deliverable, the

NYISO’s proposal to exclude such costs from the peaking unit’s costs is consistent with the

Commission’s orders in the proceeding concerning the deliverability tariff provisions.64

3. The Generator Interests Have Failed to Counter the NYISO’s

Argument that Including SDU Costs May Dampen the Incentive to Choose Efficient Generator Locations

Finally, the Commission should reject Generator Interests’ argument that there is no

merit to the NYISO’s concern that including SDU costs would distort signals for efficient

location, particularly when applied to units in New York City (“NYC”).65 The Generator

Interests indicate that only a “fantasy unit” in NYC would not incur SDU costs.66 Contrary to the Generator Interests’ misleading assertion, two actual projects in successive Class Years

located in NYC were evaluated for deliverability did not incur SDU costs, i.e., the Hudson

Transmission Partners (“HTP”) project in Class Year 2008 and the Bayonne Energy Center

(“BEC”) project in Class Year 2009.

The Generator Interests’ examples from the current Class Year simply show that those

specific projects’ interconnection at those locations in New York City will incur some

deliverability costs and do not refute the argument that the inclusion of SDU costs may distort

signals for efficient location. The Generator Interests have failed to provide any analysis

considering whether those projects could have avoided incurring those costs by changing certain

aspects of the project (e.g., such as interconnecting at a different point or voltage level). Also,

64 See New York Independent System Operator, Inc., 122 FERC ¶61,267 at PP 42-49 (2008)

(accepting the proposed cost allocation for SDUs because it allocates all of the costs necessary to make a

project deliverable to interconnection customers, and only allocates a small percentage of costs of SDUs

for highway facilities that create more system Capacity than required to make a project deliverable to

LSEs).

65 In-City Incumbent Generators at 40.

66 Id.

19

unlike the determination for HTP which is final, the cost allocations relied on by the In-City Incumbent Generators have not yet been approved by the NYISO’s Operating Committee. Those project cost allocations will not be presented to the Operating Committee until later in 2011 and should not be relied on for this ICAP Demand Curve reset.

E. Requests for the Creation of A New Capacity Zone or a New ICAP Demand

Curve Are Beyond the Scope of this Proceeding

GenOn argues that the NYISO should be directed to establish a new Capacity zone for

the Lower Hudson Valley region. It also requests that the NYISO be compelled to create an

ICAP Demand Curve for its proposed new Capacity zone in time for the 2011/2012 Capability

Year.67

Both requests are beyond the scope of the Services Tariff’s ICAP Demand Curve

provisions, for the reasons specified in Section II.C.1 above. Furthermore, because the Services Tariff does not currently include any provisions related to a Lower Hudson Valley Capacity zone establishing a separate ICAP Demand Curve for that area would be meaningless. The NYISO

currently lacks the tariff authority, or any kind of tariff framework, to implement an ICAP

Demand Curve for that area.

F.The November Filing Reasonably Assumed that the New York City Peaking

Unit’s Property Taxes Would Be Fully Abated

The November Filing explained that it was reasonable to assume that the New York City

Industrial Development Agency (“NYCIDA”) would grant tax abatements to the New York City

Demand Curve peaking unit. It is reasonably foreseeable that imposing such taxes on a Demand

67 GenOn at 8-9.

20

Curve peaking unit would increase In-City Capacity prices more than they would increase tax

revenues and thus would harm New York City’s interests more than it would help them.68

Generator Interests challenge this assumption and argue that the NYISO must assume that In-City generators will be assessed property taxes in all cases, or that failing, in a substantial percentage of them. They have failed, however, to offer any rationale for rejecting or modifying the November Filing’s proposal on this issue. The ICAP Demand Curves should not be based on an assumption that the NYCIDA, a governmental entity, would exercise its discretion to act in a manner that is contrary to: (i) its constituents’ economic interests; (ii) its own statutory

mandate;69 and (iii) its own public statements of willingness to confer significant tax benefits on

generators that qualify for them under New York City’s UTEP.70 The NYISO should not be

required to provide additional evidence demonstrating the obvious proposition that an entity will

act in its own interest. Nor must the Commission require such unnecessary analyses before

approving a reasonable proposal.71

The Generator Interests are likewise wrong to contend that the NYISO must include in

the peaking unit’s cost of entry the “reasonable costs” of “property taxes” that “new entrants” are

expected to incur.72 As an initial matter they have framed the issue inaccurately. It is only the

cost of the peaking unit, not the costs of all new entrants, that is considered for purposes of

setting the ICAP Demand Curves. The fact that some generators may have paid property taxes

68 See November Filing at 15.

69 See Babis Affidavit at P 13 (“the NYCIDA’s statutory mandate is to promote and encourage economic development, industrial expansion, and job retention and growth”).

70 See, e.g., Babis Affidavit at 14.

71 See Associated Gas Distributors v. FERC, 824 F.2d 981, 1008 (D.C.Cir.1987) (“Agencies do

not need to conduct experiments in order to rely on the prediction that an unsupported stone will fall.”)

72 In-City Incumbent Generators at 27-28.

21

in the past73 is irrelevant for the same reason and also because: (i) the ICAP Demand Curve reset exercise is forward-looking; and (ii) including past taxes in the peaking unit’s cost entry would contradict the Generator Interests’ arguments that the cost of entry must only reflect prospective costs that new generators are reasonably expected to incur.74 The NYISO has in fact accounted for the peaking unit’s reasonably anticipated property tax costs since it is reasonable to assume that the peaking unit would not be subjected to property taxes.

Mr. Perri’s affidavit does not demonstrate that the New York City Demand Curve

peaking unit would be ineligible for a property tax exemption under the UTEP’s “objective”

criteria. As is explained in the Ungate Affidavit, the peaking unit would satisfy the UTEP

Article 1(e)(ii) subsection bb heat rate requirement.75 The In-City Incumbent Generators’ related

claims that the In-City peaking unit would not meet the UTEP’s so-called “subjective” criteria76

must also fail because their claims is founded upon the implausible assumption that the NYCIDA

would exercise its discretion in a manner that would be inconsistent with its own interests.

Similarly, the In-City Incumbent Generators’ assertion that the Commission not “credit

speculation” about how the NYCIDA will exercise its discretion is itself based on speculation

that the NYCIDA would act in a manner that contravenes its interests, statutory mandate, and

public statements.

73 In-City Incumbent Generators at 29.

74It is disingenuous at best for the In-City Incumbent Generators to argue that they should receive

windfall payments attributable to SDU costs that certain new entrants might face, but they themselves are

exempt from, on the ground that new entrants’ costs are the only relevant consideration, while

simultaneously contending that the ICAP Demand Curves should be set to allow all generators to recover

tax costs. See generally, In-City Incumbent Generators’ Protest Section B, including the assertion at p. 50

that: “Because the reset is forward-looking, rather than backward-looking, generators will never recover

what is lost during this cycle in any case.” It is clear from that statement that the In-City Incumbent

Generators are arguing in this case for their own revenues and not regarding the appropriate level for the

Demand Curve Peaking unit.

75 See Ungate at P 9.

76 In-City Incumbent Generators at 48.

22

The Hiscock & Barclay (“H&B”) letter77 does not counter the November Filing’s

reasoning in any way and should be disregarded. As a preliminary matter, it is not a proper

affidavit. It is simply an outside law firm’s speculation to its individual client. In addition, it’s

speculation that New York City’s tax abatement policies may parallel those followed by other

municipalities in New York State is a fundamentally flawed assumption because the other

municipalities referenced in the letter are not governed by the UTEP and thus cannot reasonably

be used to predict how the UTEP would be applied. There is no evidence that any of the

Industrial Development Authorities that entered into the payment-in-lieu-of-tax agreements

mentioned by H&B did so pursuant to specific policies with guidelines for granting a specific

type of generation project tax abatement. No other New York State municipality is similarly

situated to New York City because no other municipality’s or Industrial Development Agency’s

borders are the same as a NYISO Capacity zone. Thus, no other municipality’s tax abatement

decisions are as directly linked to the Capacity prices that the municipality’s agencies, and

constituents would pay. In short, there is no evidentiary value to extrapolating how one

governmental entity would behave based on the behavior of unrelated governmental entities

operating under different legal requirements and facing vastly different circumstances. H&B’s

letter provides no support whatsoever for its conclusion that “it is far more likely that any new

project would realize a tax burden consistent with those imposed in other jurisdictions,

throughout the State...”78

The Generator Interests’ remaining arguments can be disposed of briefly. Their allusions

to the canons of statutory construction79 are irrelevant because the NYISO is not disputing that

77 See In-City Incumbent Generators at Attachment D.

78 See H&B Letter at 2.

79 In-City Incumbent Generators at 45.

23

the UTEP allows the NYCIDA to exercise some discretion. Instead, the NYISO is contending

that it is reasonable to assume that the NYCIDA will exercise that discretion consistent with

New York City’s interests. The In-City Incumbent Generators are wrong to equate a government

entity’s pursuit of policies with a private entity’s hypothetical market manipulation scheme.80

Finally, assuming that the NYCIDA would grant full tax abatement would not distort the In-City

Buyer Side Mitigation Measures81 because the ICAP Demand Curves would be set based on the

reasonable assumption that the peaking unit’s property taxes would be abated.82

G. The November Filing’s Adjustments to the Consultant’s Recommended

Excess Capacity Level Estimates Were Reasonable

The November Filing explained the NYISO’s reasons for revising the Consultant’s

recommended excess Capacity levels. The Load Interests question the NYISO’s justification

and argue, as a preferred position, that the ICAP Demand Curves “should be developed under the

assumption that there is no surplus Capacity, consistent with the intent of the Demand

Curves.... ” which they state is “to ensure that the revenues provided by the ICAP market are

sufficient to induce entry when the NYCA or a Locality is at the minimum Capacity

requirement.”83 The Generator Interests take the opposite view and argue that the NYISO’s

revisions have made the excess Capacity estimates unrealistically low because they differ from

80 Id. at 49.

81 The In-City Buyer-Side Mitigation Measures are mitigation rules contained in Attachment H of the NYISO’s Services Tariff that guard against the exercise of buyer-side market power in the In-City

ICAP markets.

82 The Generator Interests appear to attach substantial weight to the NYCEDC’s statements that

tax abatement decisions will be made with an eye towards lowering Capacity prices. See In-City

Incumbent Generators at 46. The NYISO would respectfully submit that they cannot have it both ways. If

Generator Interests are prepared to assume that a governmental entity would seek to lower Capacity

prices for purposes of their argument regarding the market power mitigation measures then they cannot

reasonably deny that the same entity should be expected to grant full tax abatements because of the

impact on Capacity prices.

83 See, e.g., NYTOs at 7.

24

the estimates approved in the last ICAP Demand Curve reset. They also note that the Consultant recommended that the NYISO use higher estimates and that the MMU has argued that two of NYISO’s three estimates are too low.

In reality, the Services Tariff authorizes the NYISO to review the “localized levelized

embedded cost a peaking unit … to meet minimum capacity requirements”84 and to set the ICAP Demand Curves based on an assumption that actual ICAP levels will “slightly exceed” minimum requirements. The Commission has clearly upheld the NYISO’s reading of the Services Tariff

on this point.85 The Load Interests may not ignore the Commission’s interpretation any more

than they may read the “equal or slightly exceed the minimum [ICAP] requirement” language

out of the Services Tariff. Similarly, the Generator Interests’ suggestion that the “equal or

slightly exceed” language is only applicable to Energy and Ancillary Services revenues fails in the face of the Commission’s precedent.86

The Generator Interests resort to claiming that because the Commission found a four

percent excess Capacity level for the NYC Capacity Zone to be appropriate in the Second DCR

Order it necessarily follows that the NYISO’s revised excess Capacity levels are too low. The

flaw in their reasoning is the fact that the NYISO has proposed to refine its analysis since the last

ICAP Demand Curve reset. Specifically, as Mr. Lawrence’s affidavit in support of the

November Filing noted, the NYISO has determined that it would be better to compute excess

Capacity levels using the peaking unit, rather than a combined cycle plant as was done in 2007.

84 Services Tariff at § 5.14.1.2(i).

85 Second DCR Order at P 31 (“The Commission agrees that some small level of expected

capacity over the minimum requirement is appropriate.”) and n. 21 (“In an April 21, 2005 order accepting NYISO’s previous ICAP Demand Curve parameters, the Commission accepted NYISO’s proposal to determine the parameters based on energy and ancillary service revenue estimates that would arise when supply conditions are near, but slightly higher than, the minimum capacity requirement. The reason was to create incentives for capacity investment not to fall below the minimum requirement”).

86 See, e.g., IPPNY at 24.

25

The advantage is greater consistency with the other parameters used to establish the ICAP

Demand Curves, all of which are tied to the peaking unit. The fact that a combined cycle plant

was used for the NYISO’s 2007 ICAP Demand Curve proposal does not, and should not,

preclude the NYISO from proposing to use the peaking unit now.87

The Generator Interests and the MMU miss the point when they argue that the NYISO’s excess Capacity estimates might not reflect actual market conditions. As the November Filing explained,88 the Services Tariff directs the NYISO to set excess Capacity levels on conditions “equal to or in slight excess of the minimum required Capacity” not based on evaluations of what conditions are most likely to exist at any given time. The Consultant agreed with the NYISO’s assessment of the nature of the exercise noting that the “[e]xcess adjustment is clearly not

designed to compensate for actual excesses, but only for excesses that will occur near the

minimum installed capacity requirement.”89 The NYISO has fulfilled its tariff obligation by

assuming an average level of excess equal to one half the size of the peaking unit, an amount that

both reflects conditions that could exist (and that thus are not in fact “unrealistic”) and that

slightly exceeds the minimum requirements. The fact that a higher level of excess, derived from

the use of a combined cycle unit, was accepted in the Second DCR Order does not mean that a

lower estimate is unjust, unreasonable, unlawful, or unsupported now.90 Likewise, the fact that

certain protestors and, with respect to NYC and LI, the MMU, believe that higher excess

87 The NYISO would also note that the MMU does not object to this aspect of the NYISO’s

excess Capacity factor analysis. See November Filing, Affidavit of Dr. David B. Patton at P 27.

88 November Filing at 17.

89 Id. at 18.

90 As was noted the November Filing, the NYISO conducted sensitivity analyses regarding its proposed excess capacity estimates. See November Filing at 18. The Commission has previously accepted the NYISO’s proposed excess capacity estimates that differed from the Consultant’s based principally on a sensitivity analysis. See Second DCR Order at PP 31-34.

26

estimates are more likely to reflect actual market conditions does not make those estimates

consistent with the Services Tariff or necessitate the rejection of the November Filing’s proposal.

Finally, IPPNY argues that the NYISO’s proposed revisions to the Consultant’s excess Capacity estimates constitute a “regulatory surprise” that will create uncertainty and discourage new entry.91 The ICAP Demand Curves are not designed solely for new entrants. All

stakeholders have an interest in them. The Services Tariff puts all Market Participants on notice

that the stakeholder process and the reset will occur every three years. There is stability in the

level of key ICAP Demand Curve parameters and it is predictable that the ICAP Demand Curves

will be periodically re-examined and the value at which they are reset may change. The

Commission has recognized that the need to periodically adjust the Demand Curves outweighs

any possible uncertainty that might result from triennial adjustments.92 There is thus no merit to

IPPNY’s concerns regarding market certainty. On the other hand, as is discussed in Section

II.I.3 below, making the ICAP Demand Curves effective subject to refund, as proposed by

certain of IPPNY’s members, would create harmful market uncertainty.

H. The Consultant’s Econometric Analysis of Expected Energy and Ancillary

Services Revenues (“Net Revenue Offsets”) Was Reasonable

The November Filing adopted the Consultant’s Net Revenue Offset recommendations.

The In-City Incumbent Generators argue that the Consultant’s independent econometric analysis

includes two flaws that allegedly caused it to overstate projected Energy and Ancillary Services

revenues and thus to understate the reference point price. They propose that the analysis be

91 IPPNY at 28.

92 See New York Independent System Operator, Inc., 103 FERC ¶61,201 at P 61 (2003), reh’g

denied, 105 FERC ¶61,108 (2003) (accepting the three-year reset process, finding that it is “reasonable to expect that the [Demand Curve] parameters may need adjustment over time” and “the amount of

uncertainty caused by any potential adjustment” that “reflected stakeholder input and independence” is outweighed by “employing a demand curve based on irrelevant or outdated parameters.”).

27

“corrected” in a manner that would significantly increase the ICAP Demand Curves. The

attached affidavit of Jonathan Falk (“Falk Affidavit”, Attachment 4 hereto) explains that In-City

Incumbent Generators’ proposed “corrections” would yield unreasonable and unjustifiable

results.93 The Falk Affidavit also explains why: (i) the Consultant’s use of a three year historical

period to estimate model parameters was reasonable;94 (ii) the In-City Incumbent Generators’

contentions regarding serial correlation and heteroskedascity are flawed;95 and (iii) their proposal

to use one-day lagged LBMP as a regressor to “correct” serial correlation is fundamentally

misplaced.96

I. The November Filing’s Proposal to Retain the Slope and Length of the

Current Demand Curves Was Reasonable and Consistent with Services Tariff Requirements

The November Filing proposed no modifications to the existing Demand Curve slopes or

zero crossing points. The NYISO and the Consultant agreed that there was no “compelling

reason” for change, citing the same reasons that were accepted in the Second DCR Order.97

Load Interests protest that the slope of the NYCA Demand Curve should be steeper and that its

zero crossing point should be reduced from 112 to 110 percent. They also complain that the

NYISO did not study these questions to the extent that the Services Tariff allegedly demands.98

As the November Filing explained, the Consultant’s and NYISO’s analyses indicated that current market conditions of excess Capacity and anticipated low load growth supported

93 Falk Affidavit at P 8.

94 Id. at PP 14-20.

95 Id. at PP 21-31.

96 Id. at PP 32-27.

97 See November Filing at 21.

98 See, e.g., NYTOs at 11-15.

28

retaining the current Demand Curve slope and zero crossing points.99 The consequences of

adjusting the slope of the curves would be unpredictable but could be expected to include lower

Capacity compensation, greater perceived risk by investors, significant increases to the levelized

costs of entry, and the introduction of new market power issues. Contrary to what the Load

Interests claim, the NYISO’s position does not represent a permanent refusal to consider

adjustments that would lower Capacity revenues. The NYISO has no objection to proposing

such changes when they are warranted. In this instance, however, the NYISO and its Consultant

reached the conclusion that changes were not justified, and could even be harmful. The Services

Tariff requires only that a periodic assessment and review of ICAP Demand Curve shapes,

slopes, and zero crossing points be undertaken. The NYISO has conducted such an assessment

and review.

The extent of the NYISO’s future reviews of the slope and length of the ICAP Demand

Curves will likewise be driven by its assessment of whether prevailing economic conditions

necessitate changes and that analysis will be the subject of the next Demand Curve reset

proceeding.

J. The November Filing’s Proposed Escalation Factor Was Reasonable

The November Filing proposed to use several inflation forecasts instead of the historic

Handy-Whitman Index to determine a proposed ICAP Demand Curve escalation rate. Generator

Interests argue that the NYISO should have continued to use the Handy-Whitman Index because:

(i) the Commission has approved its use in the PJM Interconnection (“PJM”) and ISO New

99 In the 2007 Demand Curve Reset, the Commission found that the analysis conducted by the NYISO did adequately examine the effects of alternative zero-crossing points, because the methodology “recognizes the interdependence of the assumptions determining the reference and zero-crossing points and the slope of the demand curves” … so “[w]ith a given reference point, evaluating different demand curve slopes is equivalent to considering zero-crossing points.” New York Independent System Operator, Inc., 122 FERC ¶61,064 at P 62 (2008) (rejecting contentions that the NYISO did not adequately analyze slope and zero-crossing point adjustments).

29

England, Inc. (“ISO-NE”) Capacity markets; (ii) the NYISO supported the use of the HandyWhitman Index and the Commission approved it in the Second DCR Order; and (iii) using the Handy-Whitman Index would ostensibly result in a more accurate assessment of the rate at which gas turbine generator costs will escalate.100 None of these objections have any merit and the Commission should accept the November Filing’s proposal.

The Commission’s determinations with respect to PJM and ISO-NE should not be

binding here. The Commission has never required that the three system operators adopt identical

Capacity market structures.101 Each uses different demand curves that are based on different sets

of complex and interrelated assumptions.102 The Commission has specifically held that setting

demand curve escalation factors is essentially a matter of judgment, which also militates against

the protestors’ notion that the Handy-Whitman Index is the only possible “correct” basis for

setting them. In addition, PJM proposed to use the Handy-Whitman Index nearly two years ago,

closer in time to the NYISO’s November 30, 2007 ICAP Demand Curve reset filing than the

pending proposal. As the November Filing explained, economic circumstances and the

likelihood of carbon emissions regulation have changed materially since then. The very purpose

of the reset process is to ensure that these kinds of changed circumstances are reflected in

updated ICAP Demand Curves.103

100 See, e.g., In-City Incumbent Generators at 54-56.

101 See also Wholesale Competition in Regions with Organized Electric Markets, Order No. 719, FERC Stats & Regs. ¶ 31,281 at PP 59 (2008), order on reh’g, Order No. 719-A, 74 Fed. Reg. 37,776 (Jul. 29, 2009), FERC Stats & Regs. ¶ 31,292 (2009), order on reh’g, Order No. 719-B, 129 FERC ¶ 61,252 (2009) (following the Commission’s established policy of allowing different ISOs/RTOs to have market designs that best suit their regional circumstances by declining to develop standardized

requirements for demand response resources, instead allowing “each RTO and ISO, in conjunction with its stakeholders, to develop its own minimum requirements”).

102 See In-City Incumbent Generators, Levitan Affidavit at P 73.

103 See New York Independent System Operator, Inc., 103 FERC ¶61,201 at P 61 (2003), reh’g

denied, 105 FERC ¶61,108 (2003) (accepting the three-year reset process, finding that it is “reasonable to

30

The November Filing’s proposal to use general inflation forecasts104 is consistent with the

criteria that the Commission’s PJM Capacity market orders actually employed to evaluate the

reasonableness of using the Handy-Whitman Index. In all cases, the objective is to develop a

forecast of equipment escalation, using historical data to inform the decision but ultimately

relying on future expectations for equipment and installation costs. The NYISO’s approach

“supplies a known and unbiased adjustment factor to change CONE values in years that are not

subject to a full review.... ” It “is supported by a wide range of [NYISO] stakeholders . . . ,” as

evidenced by the support of Load Interests in this proceeding. It allows CONE values “to be determined based upon a known and unbiased formula,” so that market participants will have a higher degree of certainty regarding forecasted CONE values.105

The Meehan and Ungate Affidavits further demonstrate that it was reasonable and in no

way inconsistent with the NYISO’s position in the prior ICAP Demand Curve reset for the

NYISO to propose to use general inflation forecasts to establish the escalation factor for

Capacity Years 2011-2014. Mr. Meehan explains that it was appropriate for the NYISO to look

to the Handy-Whitman Index in late 2007, a time of instability in combustion turbine equipment

costs when it was reasonable to expect continued near term increases in those costs.106 Hindsight

has demonstrated that the 2007 proposal was correct given the circumstances that existed then.

The Ungate Affidavit explains that circumstances today are different, that there is not an upward

expect that the [Demand Curve] parameters may need adjustment over time” and “the amount of

uncertainty caused by any potential adjustment” that “reflected stakeholder input and independence” is outweighed by “employing a demand curve based on irrelevant or outdated parameters.”).

104 In the first triennial review process the Commission approved the NYISO’s proposed

escalation factor, which was derived based on the general inflation rate at the time. See New York

Independent System Operator, Inc., 111 FERC ¶ 61,117 (2005) and New York Independent System

Operator, Inc., Tariff Revisions To Implement Revised ICAP Demand Curves - Attachment IV at 6 (filed January 7, 2005).

105 See PJM Interconnection, L.L.C., 129 FERC ¶ 61,090 at P 38 (2009). 106 Meehan Affidavit at P 16.

31

trend in combustion turbine equipment prices, and that it is reasonable at this time to anticipate stability in combustion turbine equipment prices.107 Both the Meehan and Ungate Affidavits

confirm that the November Filing’s escalation factor proposal, including its revision to the

Consultant’s recommendations on the subject, were reasonable.108 Finally, the Meehan Affidavit explains the close relationship between the relatively short term escalation assumptions used to adjust the ICAP Demand Curves, which is at issue in this proceeding, and the longer term

escalation assumptions used to define the economic carrying charge. As supported by the

conclusion of Mr. Meehan, if the Commission were to require the NYISO to use the Handy-

Whitman Index it would be necessary to adjust the economic carrying charge in a manner that would likely result in lowering the proposed ICAP Demand Curves.

K.The November Filing’s Proposed Winter/Summer Capacity Sales Ratios

Were Reasonable

The Commission should reject the Load Interests’ proposal to increase the NYISO’s

proposed winter-to-summer Capacity sales ratios.109 The ratios that were proposed in the

November Filing were determined using “available Capacity,” i.e., the amount that the NYISO

concluded could be offered into the ICAP Spot Market Auctions, in accordance with the

requirements of the Services Tariff.110 The NYTOs’ proposal would instead calculate the

adjustment based upon the levels of Capacity actually sold over a certain period. The NYISO

and the Consultant have previously considered this approach and concluded that it was

107 Ungate Affidavit at P 27-30.

108 Meehan Affidavit at P 17, Ungate Affidavit at P 30. 109 See NYTOs at 15-17.

110 November Filing at 22-23.

32

inconsistent with the Services Tariff, as it reflects only Capacity that was actually offered in an auction and thus would understate the amount of available Capacity.111

L.Other Issues

1.There Is No Need for the Commission to Mandate a “Comprehensive

Review” of the NYISO’s Capacity Market Design

The NYTOs suggest that there should be a “fundamental reassessment” of the ICAP

Demand Curve reset process that would encompass a variety of foundational Capacity market

issues. They ask the Commission to require the NYISO to file a report addressing these issues

within one year of the issuance of an order on the November Filing.112 The NYTOs also indicate that the Commission should not take up the recent compliance filing to establish criteria

governing the creation of new Capacity zones in isolation from the core Capacity market design issues that they have identified.113

There is no need for the Commission to mandate that the NYISO consider these issues

because the NYISO is already open to discussing them with stakeholders. In particular, the

NYISO has already committed to explore the possible use of a Demand Side Resource as the

Demand Curve peaking “unit” in the next ICAP Demand Curve reset process.114 Moreover, the

issues that the NYTOs raise are outside the scope of this proceeding, since they have nothing to

do with the ICAP Demand Curve reset proposed by the November Filing. Finally, it would not

111 The Commission has previously found that the NYISO’s interpretation of “available Capacity”

is consistent with the tariff. New York Independent System Operator, Inc., 122 FERC ¶61,064 at PP 64-

66 (2008) (rejecting contentions that available Capacity should be based on Capacity expected to be cleared in the market, not Capacity that can be offered).

112 NYTOs at 25-27.

113 Id. at 27.

114 See November Filing at 6, citing, NYISO Report at 6.

33

be appropriate to tie action on new Capacity zones to a re-examination of core Capacity market design questions that are beyond the scope of that proceeding.

2.Accepting the Demand Curves Subject to a Refund Condition Would

Create Harmful Market Uncertainty

The NYISO’s 2011/2012 Capability Year will begin on May 1, 2011. In the months

leading up to that date the NYISO and Market Participants will be making a number of

preparations that would be greatly complicated if the revised ICAP Demand Curves are not

known with certainty. Most notably, the first-come, first-serve requests for import rights are

scheduled for February 17, 2011, enrollment for new Special Case Resources begins on

March 16, 2011, and the 2011 Summer Capability Period Auction offer period commences on

March 28, 2011.

All of the parties in this proceeding appear to recognize the importance of having clearly

defined ICAP Demand Curves in place in time for these preparations to be completed. No party,

regardless of the extent of its disagreement with the November Filing, has suggested that the

Commission ought to set any issue for a traditional administrative hearing. To the extent that

protestors seek to modify the November Filing’s proposals they generally request that the

Commission impose specific modifications. The only exception is the In-City Incumbent

Generators, who ask, in the event that their suggested changes are not summarily imposed, that

the Commission “institute expedited paper hearing procedures” and consider allowing the ICAP

Demand Curves “to take effect, subject to refund, pending the outcome of the paper hearing.”115

The NYISO respectfully requests that the Commission not, under any circumstances, make any element of the ICAP Demand Curve effective subject to refund based on the outcome of a paper hearing or on any other contingency. The Commission has correctly recognized that

115 See In-City Incumbent Generators at 5.

34

the stability and certainty of the ICAP Demand Curves is of paramount importance.116 IPPNY, whose members include the In-City Incumbent Generators, has made a similar point in its

protest, which contends that even changes from one triennial review to the next should be

avoided if they would upset Market Participant expectations.117 Market Participants must make important business decisions that depend upon the timely establishment of ICAP Demand Curves that are not subject to revision. Leaving the final level of the 2011/2012, 2012/2013, and

2013/2014 ICAP Demand Curves unsettled, potentially for an extended period of time, would interfere with those decisions and introduce harmful market uncertainty.

116 See, e.g., Independent Power Producers of New York, et. al v. New York Independent System Operator, Inc., 125 FERC ¶61,311 at P 35 (2008) (stating that “the ICAP Demand Curve process is based on the premise that price stability and certainty are important to the market.” when declining to order an out of cycle adjustment); New York Independent System Operator, Inc., 112 FERC ¶61,283 at P 39 (2005) (stating that “the entire ICAP Demand Curve process is based on the premise that it is important to the market to have price stability and certainty” noting that “[s]tability and certainty would be sacrificed” if refunds were ordered, when declining to order an out of cycle adjustment).