PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

Astoria Generating Company, L.P. and)

TC Ravenswood, LLC)

)

Complainants)

)

v.)Docket No. EL11-50-000

)

New York Independent System Operator, Inc.)

)

Respondent)

ANSWER TO MOTION TO STRIKE AND

REQUEST FOR LEAVE TO SUBMIT ANSWER AND ANSWER OF

THE NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

In accordance with Rule 213 of the Commission’s Rules of Practice and Procedure the

New York Independent System Operator, Inc. (“NYISO”) respectfully submits this answer to the Motion to Strike and Motion for Leave to Answer of the NRG Companies (“Motion to Strike”). The NYISO also requests leave to answer and answers the Complainants’ Answer in Support of Motion to Strike (“Complainants’ October 31 Answer”).

NRG’s and Complainants’ statements regarding the alleged disclosure of confidential information contained in the NYISO’s October 12, 2011 answer (“October Answer”)1 are

inaccurate and unsupported. The NYISO did not disclose any confidential information in the October Answer and has not violated its tariffs. Therefore, there is no basis for the Motion to Strike, and it should be denied.

1 New York Independent System Operator, Inc. Request for Leave to Submit Answer and Answer to Pleadings Opposing Exemptions and Answer to Motion to Lodge, Docket No. EL11-50-000 (filed October 12, 2011) (“October Answer”).

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

This answer also responds to one new argument by NRG against the NYISO’s mitigation

exemption determination for the Bayonne Energy Center (“BEC”). The fact that the NYISO has

elected not to respond to other aspects of NRG’s or the Complainants’ other arguments, or to the

Complainants’ Motion for Leave to Answer and Answer should not be construed as agreement

with them or as an admission of fault or error. To the contrary, the Complainants and NRG have

again failed to demonstrate that the NYISO’s mitigation exemption determinations were

unreasonable.

I.REQUEST FOR LEAVE TO ANSWER

The NYISO may answer the Motion to Strike as a matter of right.2 The NYISO also

requests leave to answer the portion of NRG’s pleading that is styled as an answer and, to the

extent that the Commission deems necessary, the Complainants’ October 31 Answer.3 The

Commission has discretion to accept answers to answers when they help to clarify complex

issues or to facilitate the resolution of a proceeding.4 The NYISO’s answer will help the

Commission’s resolution of this matter as it will clarify factual and legal misrepresentations and

errors in Complainants’ October 31 Answer and the portion of NRG’s pleading that is styled as

an answer.

2 18 C.F.R. 213(a)(3) (2011).

3 Because the Complainants’ October 31 Answer supports the Motion to Strike by making a wholly different allegation, it is arguably a distinct motion itself that the NYISO would be entitled to answer as of right.

4 See e.g., New York Independent System Operator Inc., 133 FERC ¶ 61,178 at P 11 (2011)

(allowing answers to answers and protests “because they have provided information that have assisted [the Commission] in [its] decision-making process”); Morgan Stanley Capital Group, Inc. v. New York Independent System Operator, Inc., 93 FERC ¶ 61,017 at 61,036 (2000) (accepting an answer that was “helpful in the development of the record…”).

2

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

II.ANSWER

A.The October Answer Did Not Disclose Confidential Information

The Motion to Strike incorrectly claims that the NYISO disclosed material that

“constituted confidential market information entitled to protection.”5 Further, NRG’s assertion

that that the NYISO disclosed information entitled to protection “willfully and intentionally”6

has no support in the record of this proceeding. NRG refers to excerpts from a letter it sent to the NYISO which reflected NRG’s view that the Pre-Amendment Rules7 allow the NYISO to make final mitigation exemption determinations for a new entrant before the conclusion of the new entrant’s Class Year. That NRG reading, which is identical to the NYISO’s and the independent MMU’s, directly contradicts NRG’s litigation position in this proceeding. NRG’s statements are thus relevant and material because they underscore the unreasonableness of the novel tariff

interpretation that NRG offered for litigation purposes.

NRG asserts that its interpretation of the Pre-Amendment Rules constitutes “Protected

Information” under Attachment O to the Services Tariff. The support that NRG offers for its

claim is a selective excerpt of the tariff’s definition of “Protected Information.” NRG quotes the

phrase “information that has been designated as such in writing by the party supplying the

information to the ISO.... “8 However, NRG omits the definition’s limiting language which

5 Motion to Strike at 3. Specifically NRG takes issue with the October Answer at 11-12 and its Attachment I - Affidavit of Joshua A. Boles at Section V (“Boles Supplemental Affidavit”).

6 Id.

7 The “Pre-Amendment Rules” were the buyer-side capacity market power mitigation rules that existed in Attachment H to the NYISO Services Tariff prior to the November 27, 2010 effective date of the current In-City Buyer-Side Capacity Mitigation Measures. The NYISO’s mitigation exemption determination for BEC was made pursuant to the Pre-Amendment Rules.

8 Motion to Strike at 4.

3

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

clearly states that information so designated only constitutes “Protected Material” if the “designation is consistent with the ISO’s tariffs and this [Market Monitoring] Plan.” The complete definition defines “Protected Information” as

(a) information that is confidential proprietary, commercially valuable or

competitively sensitive or trade secret, (b) information that is Confidential

Information under Attachment F to the ISO OATT, (c) information that the

Market Monitoring Unit or the ISO is obligated by tariff, regulation or law to

protect, (d) information which, if revealed, would present opportunities for

collusion or other anticompetitive conduct, or that could facilitate conduct that is

inconsistent with economic efficiency, (e) information relating to ongoing

investigations and monitoring activities (including the identity of the person or

Market Party that requested or is the subject of an investigation, unless such party

consents to disclosure), (f) information subject to the attorney-client privilege, the

attorney work product doctrine, or concerning pending or threatened litigation, or

(g) information that has been designated as such in writing by the party supplying the information to the ISO or its Market Monitoring Unit, or by the ISO or its Market Monitoring Unit, provided that such designation is consistent with the ISO’s tariffs and this Plan.

The statements quoted in the October Answer do not fall into any of the categories of

Protected Information. The NYISO quoted only language articulating NRG’s legal

interpretation of the Pre-Amendment Rules. NRG’s tariff interpretation is not commercially

sensitive or valuable, does not present opportunities for parties that learn it to engage in anti-

competitive conduct, and is not otherwise eligible for confidential treatment for any reason. The

NYISO did not submit NRG’s letter, which included other information that was confidential, or

reveal anything about the letter that might inadvertently disclose NRG’s business strategies or

trade secrets.

Complainants are likewise wrong to assert that the NYISO’s very general response to

their October 7, 2011 Motion to Lodge disclosed confidential information concerning either or

4

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

both of them.9 Complainants’ Motion to Lodge claimed that the NYISO was not responsive to

supplier requests related to market power mitigation issues. That claim is factually incorrect, and the NYISO’s October Answer sought to correct this inaccuracy. Complainants have offered no explanation of how the NYISO’s general language reveals any confidential information. Their unsupported assertion that it did so should be rejected by the Commission.

In short, NYISO takes seriously its obligations to enforce its tariffs including the

obligation to not disclose Protected Information. The NYISO carefully prepared the October

Answer to avoid revealing Protected Information. NRG and Complainants have not shown that the NYISO violated its tariff. The Motion to Strike and the Complainants’ October 31 Answer should therefore be denied.

B.The Motion to Strike Is Overbroad

It is not clear whether NRG is asking the Commission to strike the October Answer in its

entirety, as appears to be the case from its opening pages, or is making a request limited to

specific portions of the October Answer. In the event that NRG is requesting the former, its

requested remedy is overbroad and should be rejected.10 Under Commission precedent, there is

no basis to strike any portion of, let alone the entire, October Answer. As the Commission has

previously held “[m]otions to strike are not favored, and objectionable material will not be struck

unless the matters sought to be omitted from the record have no possible relationship to the

9 Complainants’ Answer at 2.

10 Motion to Strike at 1 (moving to “strike the [NYISO Answer]” filed on October 12, 2010 in this proceeding).

5

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

controversy, may confuse the issues, or otherwise prejudice a party.”11 The NYISO has

established the relevance of the information from the NRG letter; therefore, there is no basis to strike that portion of the October Answer. Neither NRG nor Complainants have provided a basis for striking any other portion of the October Answer, and there is no basis to do so.

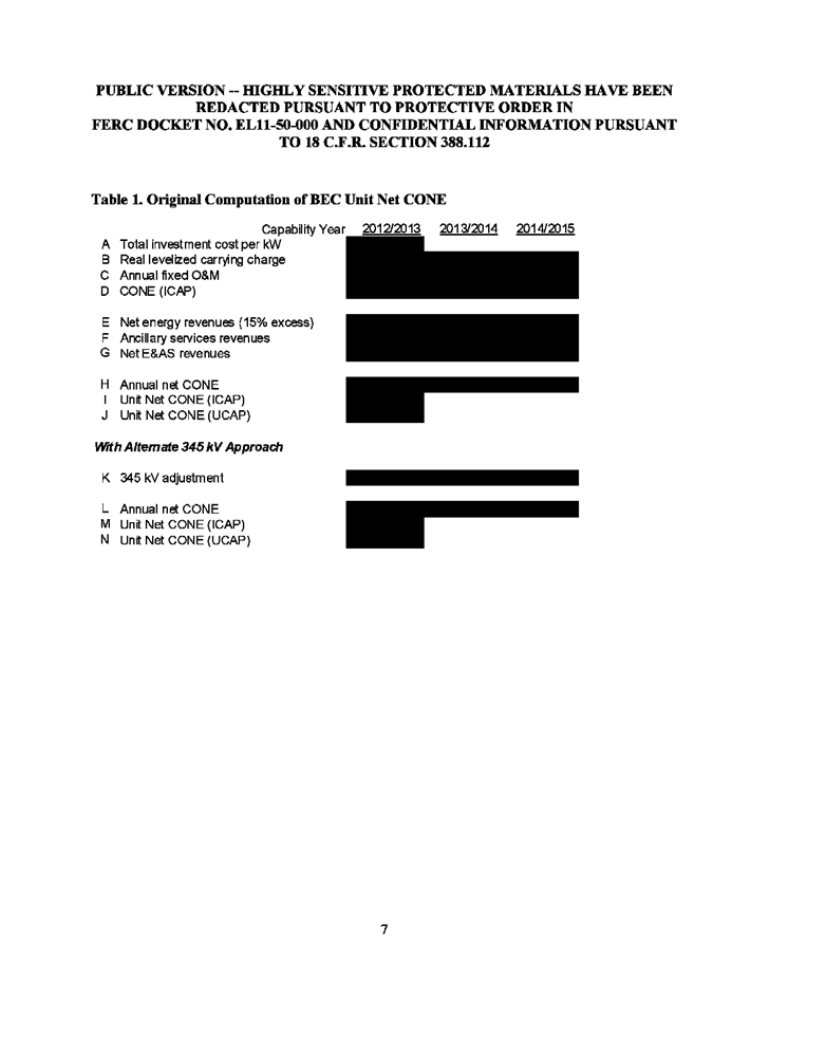

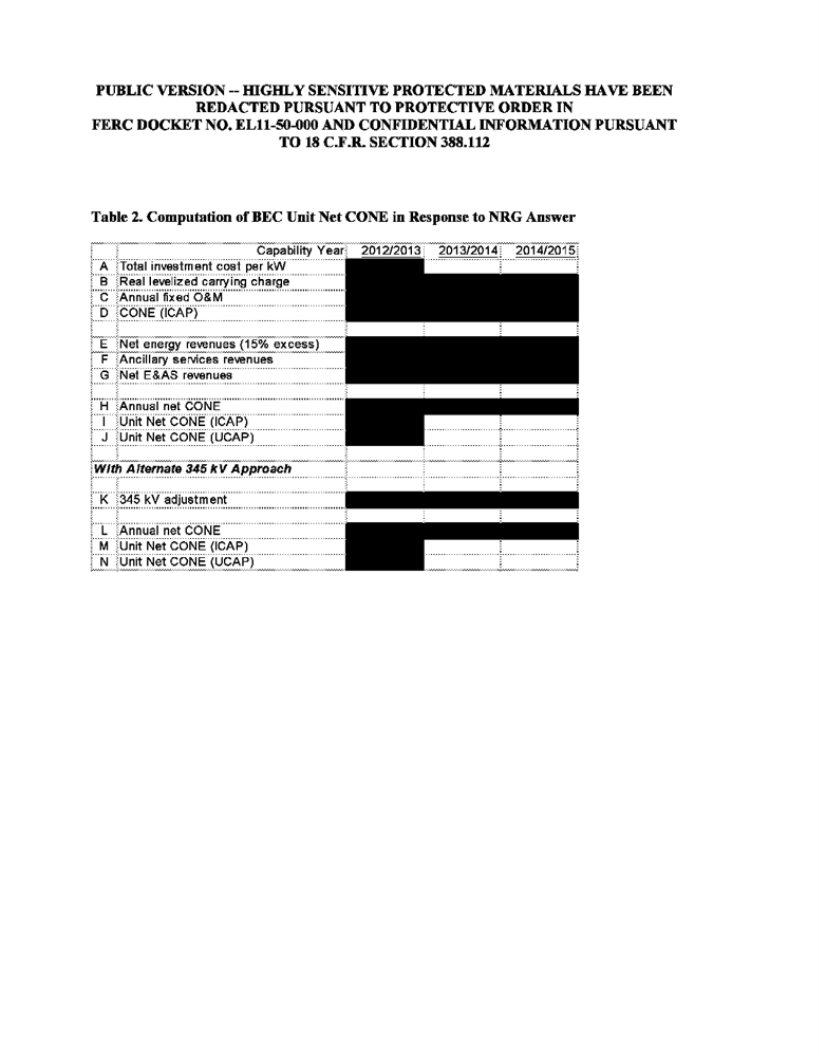

C.The NYISO Properly Calculated Revenues When Making the Mitigation

Exemption Determination for BEC

NRG asserts that because BEC’s air permit limited the facility to running a maximum of

4,748 hours per year, the NYISO used an incorrect number of run hours producing a “highly

unreasonable” estimate of BEC revenues. NRG submits the Reply Affidavit of Johannes P.

Pfeifenberger as support for the proposition that the reduced run hours would lead to a change in

revenues that would result in the imposition of an Offer Floor on BEC. However, as explained

in the attached Confidential Supplemental Affidavit of Joshua A. Boles Regarding Bayonne

Energy Center, even if BEC’s net energy revenues were calculated by the NERA econometric

model using 4,478 run hours, or even fewer, BEC would still pass the “Part B Test”12 and be

exempt from the Offer Floor. As Mr. Boles explains, BEC would be granted an Offer Floor

mitigation exemption even if a lower number of run hours were used, with and without the

345 kV adjustment.

11 See Power Mining, Inc., 45 FERC ¶ 61,311 at 61,972 n.1 (1988)); see also San Diego Gas &

Electric Co. 114 FERC ¶ 61,070 at P 20 (2006) (quoting Central Hudson Gas & Electric Corp., 92 FERC ¶ 63,004 (2000) and Power Mining, Inc., 45 FERC ¶ 61,311 at 61,972 n.1 (1988).

12 The “Part B Test” is the mitigation exemption test performed pursuant to the Pre-Amendment Rules in Services Tariff Attachment H Section 23.4.5.7.2(b).

6

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

III.CONCLUSION

For the reasons set forth above, and in the attached Supplemental Affidavit of Joshua A. Boles Regarding Bayonne Energy Center, the NYISO respectfully requests that the Commission deny the Motion to Strike and accept the NYISO’s answer as described above.

Respectfully submitted,

/s/ Ted J. Murphy

Counsel to the

New York Independent System Operator, Inc.

7

PUBLIC VERSION - HIGHLY SENSITIVE PROTECTED MATERIALS HAVE BEEN

REDACTED PURSUANT TO PROTECTIVE ORDER IN

FERC DOCKET NO. EL11-50-000 AND CONFIDENTIAL INFORMATION PURSUANT

TO 18 C.F.R. SECTION 388.112

CERTIFICATE OF SERVICE

I hereby certify that I have this day caused the foregoing document to be served on the official service list compiled by the Secretary in this proceeding.

Dated at Washington, DC, this 9th day of November, 2011.

/s/ Ted J. Murphy

Ted J. Murphy

Hunton & Williams LLP

2200 Pennsylvania Avenue, NW Washington, DC 20037

(202) 955-1500