HUNTON & WILLIAMS LLP

1900 K STREET, N.W.

WASHINGTON, D.C. 20006-1109

TEL202 • 955 • 1500

FAX202 • 778 • 2201

TED J. MURPHY

DIRECT DIAL: 202 • 955 • 1588

EMAIL: tmurphy@hunton.com

October 29, 2010

Submitted Electronically

Kimberly D. Bose, Secretary

Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc., Proposed Tariff Revisions

Regarding Credit Requirements for Holding TCCs; Docket No. ER11-___

Dear Secretary Bose:

In accordance with Section 205 of the Federal Power Act,1 the New York Independent

System Operator, Inc. (“NYISO”) respectfully submits proposed revisions to its Market

Administration and Control Area Services Tariff (“Services Tariff”) to allow the NYISO to

adjust the credit requirements for holding transmission congestion contracts (“TCCs”) at

specified points during the term of the TCC.2 The proposed tariff revisions are described in

detail in Section V below. These revisions would better align the credit requirements for holding

TCCs with the actual TCC market risk as that risk fluctuates over the TCC term.

I.Documents Submitted

1.This filing letter;

2.A clean version of the proposed revisions to Attachment K to the Services Tariff

(Attachment I); and

1 16 U.S.C. § 824d (2010).

2 Capitalized terms that are not otherwise defined herein shall have the meanings specified in Article 2 of the Services Tariff.

Hon. Kimberly D. Bose, Secretary October 29, 2010

Page 2

3.A blacklined version of the proposed revisions to Attachment K to the Services

Tariff (Attachment II).

II.Communications and Correspondence

All communications and services in this proceeding should be directed to:

Robert E. Fernandez, General Counsel

Ray Stalter, Director of Regulatory Affairs

*Mollie Lampi, Assistant General Counsel

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-8875

Fax: (518) 356-7678

rfernandez@nyiso.com

erobinson@nyiso.com

mlampi@nyiso.com

* Persons designated for receipt of service.

III.Service

*Ted J. Murphy

Hunton & Williams LLP 1900 K Street, NW

Washington, DC 20006 Tel: (202) 955-1500

Fax: (202) 778-2201

tmurphy@hunton.com

*Kevin W. Jones3

Hunton & Williams LLP 951 East Byrd Street

Richmond, VA 23219

Tel: (804) 788-8200

Fax: (804) 344-7999

kjones@hunton.com

This filing will be posted on the NYISO’s website at www.nyiso.com. In addition, the

NYISO will email an electronic link to this filing to the official representative of each of its

customers, to each participant on its stakeholder committees, to the New York Public Service

Commission, and to the electric utility regulatory agencies of New Jersey and Pennsylvania. The

NYISO will also make a paper copy available to any interested party that requests one.

IV.Background

The NYISO’s credit requirements for holding TCCs require a TCC customer to provide,

upon award of a TCC, sufficient credit support to cover the payments that customer will owe the

3 The NYISO respectfully requests waiver of 18 C.F.R. § 385.203(b)(3) (2010) to permit service on counsel for the NYISO in both Washington, D.C. and Richmond, VA.

Hon. Kimberly D. Bose, Secretary October 29, 2010

Page 3

NYISO over the term of the TCC.4 With the exception of two-year TCCs, the current credit requirements for holding TCCs remain constant throughout the TCC term. For example, the credit requirement for holding a one-year TCC is not adjusted when that one-year TCC reaches the last six months of its term and effectively becomes a six-month TCC. Likewise, the credit requirement for holding a six-month TCC is not adjusted when that six-month TCC reaches the last month of its term and effectively becomes a one-month TCC. As a result, the NYISO’s credit requirements for holding these TCCs may differ from the actual market risk because the credit requirements do not reflect current market activity and data.

Earlier this year, the Commission approved the NYISO’s proposed methodology for calculating

the credit requirements for holding two-year TCCs.5 Under this methodology, upon expiration

of the first year of the TCC term, the NYISO revalues the two-year TCC as a one-year TCC

awarded in the most recently completed Centralized TCC Auction with the same source and sink

combination as that two-year TCC.6 The NYISO will then adjust the credit requirement for that

TCC accordingly. This adjustment better aligns the credit requirements for holding two-year

TCCs with the actual TCC market risk as that risk fluctuates over the TCC term. For similar

reasons, Market Participants have requested that the NYISO revise its tariffs to allow the NYISO

to adjust the credit requirements for holding TCCs of durations exceeding one-month at specified

points during the term of the TCC.

V.Description of Proposed Revisions

The NYISO is proposing to revise Section 26.3.2.3 of Attachment K to the Services

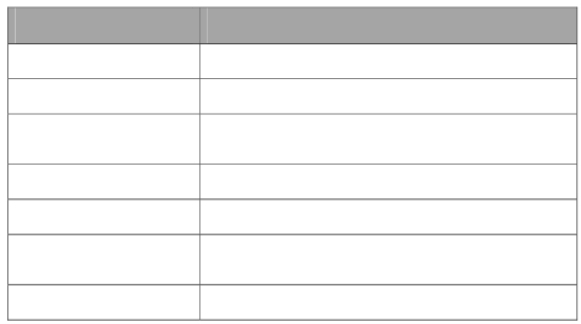

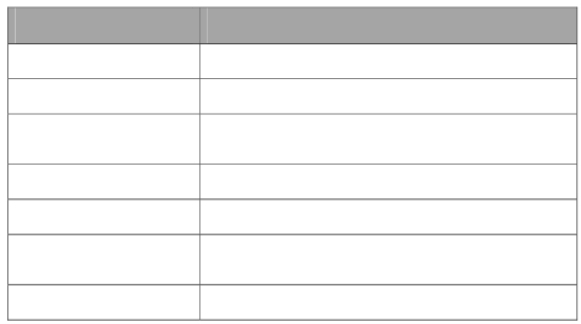

Tariff to enhance its methodology for calculating the credit requirements for holding TCCs by revaluing TCC credit requirements at specified points during the term of a TCC as summarized in the chart below:

4 The holding requirement calculation is based on TCC path-specific characteristics and is designed to result in a

97% probability for one-month and six-month TCCs, and a 95% probability for one-year TCCs, that the amount of credit support provided by the customer to hold the TCC will cover the payments due the NYISO over the term of

the TCC. See New York Independent System Operator, Inc.’s Filing of Proposed Tariff Revisions Regarding the

Credit Requirements for Holding Transmission Congestion Contracts and Request for Expedited Treatment, Docket No. ER08-778 (April 2, 2008).

5 See New York Independent System Operator, Inc.’s Filing of Proposed Tariff Revisions to Establish Credit

Requirements for Two-Year Transmission Congestion Contracts, Docket No. ER10-721 (February 4, 2010).

6 Services Tariff, Attachment K, Section 26.3.2.3(a).

Hon. Kimberly D. Bose, Secretary October 29, 2010

Page 4

Initial TCC Duration

2 years

2 years

1 year

1 year

1 year

6 months

6 months

Proposed Revaluation Point and Methodology

Final six-months of term based on six-month TCC formula Final month of term based on one-month TCC formula

Final round of current one-year TCC Sub-Auction based on one-year TCC formula

Final six-months of term based on six-month TCC formula Final month of term based on one-month TCC formula

Final round of current six-month TCC Sub-Auction based on six-month TCC formula

Final month of term based on one-month TCC formula

Under the proposed tariff revisions, the NYISO would use the same source and sink combination as the initial TCC award when revaluing the credit requirements for holding that TCC at the subsequent revaluation points. The adjusted credit requirements would become effective upon commencement of the revalued TCC term.

When assessing the benefits of the proposed tariff revisions, the NYISO engaged an

economic consultant to analyze data from one-year TCCs sold in Centralized TCC Auctions

between 2006-2008. This analysis revealed that if the proposed tariff revisions would have been

in place during the 2006-2008 time period, then the credit requirements for holding one-year

TCCs, after revaluing those TCCs as six-month TCCs for the final six-months of the TCC term,

would have decreased by $27 million from $172 million to $145 million. In addition, the

NYISO’s credit exposure for these one-year TCCs under the 95% probability curve applied to

one-year TCCs, would have decreased by $2.5 million from $4.8 million to $2.3 million.7

VI.Effective Date

The NYISO respectfully requests that this filing become effective on January 19, 2011,

which date is the targeted date for deployment of enhancements to the NYISO’s credit

management software that are required for the NYISO to implement the proposed tariff

revisions. The proposed effective date complies with the Commission’s notice requirements.8

7 See footnote 4.

8 18 C.F.R. § 35.3 (2010).

Hon. Kimberly D. Bose, Secretary October 29, 2010

Page 5

VII. Requisite Stakeholder Approval

The NYISO’s Business Issues Committee unanimously approved, with abstentions, the

tariff revisions proposed in this filing at its meeting on August 4, 2010. The NYISO’s

Management Committee unanimously approved, with abstentions, these proposed revisions at its

meeting on August 25, 2010. On October 19, 2010, the NYISO’s Board of Directors approved a

motion directing the NYISO to file the proposed tariff revisions approved by the Management

Committee.

VIII. Conclusion

Wherefore, for the foregoing reasons, the New York Independent System Operator, Inc.

respectfully requests that the Commission accept the proposed tariff revisions described in this

filing.

Respectfully Submitted,

/s/ Ted J. Murphy

Counsel to the

New York System Operator, Inc.

cc:Michael A. Bardee

Gregory Berson

Connie Caldwell

Anna Cochrane

Jignasa Gadani

Lance Hinrichs

Jeffrey Honeycutt

Michael McLaughlin

Kathleen E. Nieman

Daniel Nowak

Rachel Spiker