955 Jefferson Avenue

Valley Forge Corporate Center

Norristown, PA 19403-2497

Jacqulynn B. Hugee

Assistant General Counsel

610.666.8208 Telephone | 610.666.8211 Fax

August 31, 2011

VIA ELECTRONIC FILING

Honorable Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426-0001

Re: RTO/ISO Performance Metrics, AD10-5-000

Dear Secretary Bose:

The six Independent System Operators (“ISOs”) and Regional Transmission Operators

1

(“RTOs”) regulated by the Federal Energy Regulatory Commission (“Commission”) are

pleased to submit the 2011 ISO/RTO Metrics Report. This more than 350-page report

reflects the content outlined in the October 21, 2010 Commission Staff Report on

ISO/RTO Performance Metrics, as applicable and as information is available for each

entity.

The ISOs/RTOs have combined their data and narratives into one report, instead of six separate documents, for the convenience of the readers. This combined report is organized as follows:

• Executive Summary

• ISO/RTO Geography and Operations Statistics

• Performance Metrics and Other Information

o Descriptions - common definitions of metrics and other information

included in each ISO’s/RTO’s section

o California ISO

o ISO New England

o MISO

o New York ISO

o PJM

o Southwest Power Pool

1 The California Independent System Operator Corporation (“California ISO”), ISO New England, Inc. (“ISO-NE”),

Midwest Independent Transmission System Operator, Inc. (“MISO”), New York Independent System Operator

(“NYISO”), PJM Interconnection, L.L.C. (“PJM”), and Southwest Power Pool, Inc. (“SPP”) have each contributed to

this report.

The Hon. Kimberly Bose

RTO/ISO Performance Metrics, Docket No. AD10-5 August 31, 2011

Page 2

Any questions concerning this report should be addressed to the undersigned.

Respectfully submitted,

/s/ Suzanne Daugherty

Suzanne Daugherty

Vice President, Chief Financial Officer & Treasurer

PJM Interconnection, L.L.C. 955 Jefferson Avenue

Norristown, Pennsylvania 19403 (610) 666-4770

daughes@pjm.com

/s/ Jacqulynn B. Hugee

Jacqulynn B. Hugee

Assistant General Counsel - Markets PJM Interconnection, L.L.C.

955 Jefferson Avenue

Norristown, Pennsylvania 19403 (610) 666-8208

hugeej@pjm.com

2011 ISO/RTO Metrics Report

The California Independent System Operator Corporation (California ISO), ISO New England, Inc. (ISO-NE), Midwest

Independent Transmission System Operator, Inc. (MISO), New York Independent System Operator (NYISO), PJM

Interconnection, L.L.C. (PJM), and Southwest Power Pool, Inc. (SPP) assisted in the preparation of this report.

2011 ISO/RTO Metrics Report1

Table of Contents

Executive Summary9

ISO/RTO Geography and Operations Statistics11

Performance Metrics and Other Information

Section 1 - Descriptions

ISO/RTO Bulk Power System Reliability

Dispatch Operations12

Load Forecast Accuracy13

Wind Forecasting Accuracy14

Unscheduled Flows14

Transmission Outage Coordination15

Transmission Planning16

Generation Interconnection16

Interconnection / Transmission Service Requests18

Special Protection Schemes18

ISO/RTO Coordinated Wholesale Power Markets

Market Competitiveness19

Market Pricing21

Unconstrained Energy Portion of System Marginal Cost22

Energy Market Convergence22

Congestion Management22

Resources23

Fuel Diversity23

Renewable Resources23

ISO/RTO Organizational Effectiveness

ISO/RTO Administrative Costs25

Customer Satisfaction25

Billing Controls26

2011 ISO/RTO Metrics Report2

Section 2 - California ISO Performance Metrics27

A. California ISO Bulk Power System Reliability

Dispatch Operations31

Load Forecast Accuracy33

Wind Forecasting Accuracy35

Unscheduled Flows36

Transmission Outage Coordination38

Transmission Planning41

Generation Interconnection42

Interconnection / Transmission Service Requests46

Special Protection Schemes49

B. California ISO Coordinated Wholesale Power Markets

Market Competitiveness49

Market Pricing53

Unconstrained Energy Portion of System Marginal Cost55

Energy Market Convergence56

Congestion Management58

Generator Availability59

Fuel Diversity60

Renewable Resources62

C. California ISO Organizational Effectiveness

ISO/RTO Administrative Costs65

Customer Satisfaction66

Billing Controls67

D. California ISO Specific Initiatives68

2011 ISO/RTO Metrics Report3

Section 3 - ISO New England (ISO-NE)72

A. ISO New England Bulk Power System Reliability

Dispatch Operations75

Load Forecast Accuracy77

Wind Forecasting Accuracy80

Unscheduled Flows81

Transmission Outage Coordination81

Transmission Planning85

Generation Interconnection89

Interconnection / Transmission Service Requests97

Special Protection Schemes103

B. ISO New England Coordinated Wholesale Power Markets

Market Competitiveness107

Market Pricing111

System Marginal Cost116

Energy Market Convergence117

Congestion Management118

Resources120

Fuel Diversity123

Renewable Resources126

C. ISO New England Organizational Effectiveness

ISO/RTO Administrative Costs134

Customer Satisfaction137

Billing Controls138

D. ISO New England Specific Initiatives140

2011 ISO/RTO Metrics Report4

Section 4 - MISO144

A. MISO Bulk Power System Reliability

Dispatch Operations148

Load Forecast Accuracy150

Wind Forecasting Accuracy152

Unscheduled Flows153

Transmission Outage Coordination155

Transmission Planning158

Generation Interconnection162

Interconnection / Transmission Service Requests167

Special Protection Schemes171

B. MISO Coordinated Wholesale Power Markets

Market Competitiveness174

Market Pricing178

Unconstrained Energy Portion of System Marginal Cost182

Energy Market Convergence183

Congestion Management184

Resources186

Fuel Diversity190

Renewable Resources191

C. MISO Organizational Effectiveness

ISO/RTO Administrative Costs193

Customer Satisfaction196

Billing Controls197

D. MISO Specific Initiatives198

2011 ISO/RTO Metrics Report5

Section 5 - New York ISO (NYISO)201

A. NYISO Bulk Power System Reliability

Dispatch Operations204

Load Forecast Accuracy207

Wind Forecasting Accuracy210

Unscheduled Flows211

Transmission Outage Coordination214

Transmission Planning216

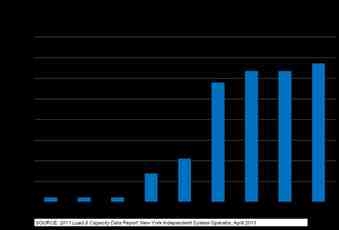

Generation Interconnection220

Interconnection / Transmission Service Requests225

Special Protection Schemes228

B. NYISO Coordinated Wholesale Power Markets

Market Competitiveness231

Market Pricing233

Unconstrained Energy Portion of System Marginal Cost237

Energy Market Convergence238

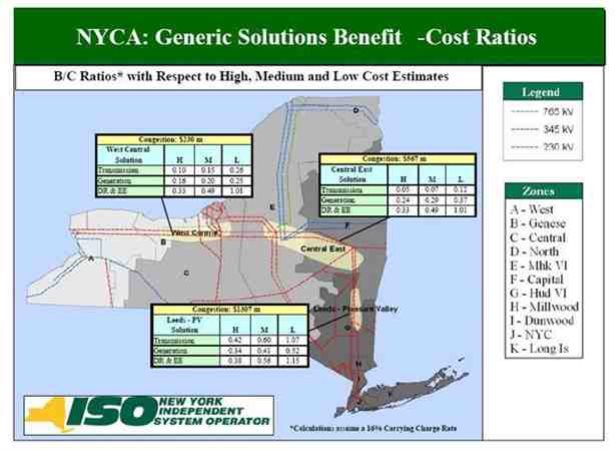

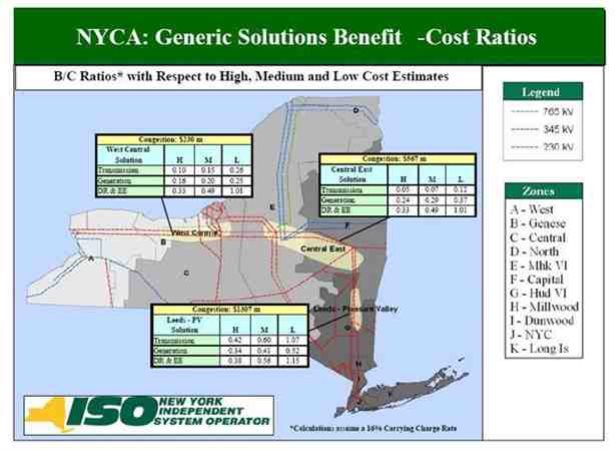

Congestion Management239

Resources241

Fuel Diversity243

Renewable Resources245

C. NYISO Organizational Effectiveness

ISO/RTO Administrative Costs249

Customer Satisfaction252

Billing Controls253

D. NYISO Specific Initiatives255

2011 ISO/RTO Metrics Report6

Section 6 - PJM Interconnection (PJM)261

A. PJM Bulk Power System Reliability

Dispatch Operations264

Load Forecast Accuracy267

Wind Forecasting Accuracy269

Unscheduled Flows270

Transmission Outage Coordination272

Transmission Planning274

Generation Interconnection279

Interconnection / Transmission Service Requests283

Special Protection Schemes286

B. PJM Coordinated Wholesale Power Markets

Market Competitiveness289

Market Pricing294

Unconstrained Energy Portion of System Marginal Cost298

Energy Market Convergence299

Congestion Management301

Resources303

Fuel Diversity306

Renewable Resources308

C. PJM Organizational Effectiveness

ISO/RTO Administrative Costs311

Customer Satisfaction314

Billing Controls315

D. PJM Specific Initiatives316

2011 ISO/RTO Metrics Report7

Section 7 - Southwest Power Pool (SPP)319

A. SPP Bulk Power System Reliability

Dispatch Operations322

Load Forecast Accuracy324

Wind Forecasting Accuracy326

Unscheduled Flows326

Transmission Outage Coordination327

Transmission Planning329

Generation Interconnection332

Interconnection / Transmission Service Requests333

Special Protection Schemes335

B. SPP Coordinated Wholesale Power Markets

Market Competitiveness337

Market Pricing340

Unconstrained Energy Portion of System Marginal Cost343

Energy Market Convergence344

Congestion Management344

Resources344

Fuel Diversity345

Renewable Resources347

C. SPP Organizational Effectiveness

ISO/RTO Administrative Costs349

Customer Satisfaction352

Billing Controls353

D. SPP Specific Initiatives354

2011 ISO/RTO Metrics Report8

Executive Summary

The following report has been prepared by the independent system operators (ISOs) and regional transmission

organizations (RTOs) that are regulated by the Federal Energy Regulatory Commission (FERC). The report provides information on various data points that are common to each of the system operators, and has been prepared at FERC’s direction following the process described below.

The information included, similar to FERC Form 1 information, may be useful to the FERC, stakeholders and the

public at large in compiling information and tracking certain data points that are relevant to ISO and RTO

performance in the areas of reliability, wholesale electricity market performance and organizational effectiveness.

That said, this report does not definitively measure ISO and RTO performance or supplant the various mechanisms

already in place to measure performance. Those include FERC’s triennial market-based rate analysis under Order

No. 697, the respective State of the Market Reports for each ISO/RTO, FERC’s State of the Market Report, or

regional initiatives such as the ―value proposition‖ and other measures developed by ISOs and RTOs.

Moreover, the information provided herein must be assessed in the proper context. For example, the report includes tables comparing forecast accuracy at each of the ISOs and RTOs. However, there are a number of factors that

influence the data and could result in variations among the ISOs/RTOs, including the time of day at which the

forecast is made, the region’s weather variability, data points selected (i.e., hour to hour) and the geographic diversity of the control area. Where possible, and to the extent practicable, this context has been provided along with the data. Absent this context, the data tell an incomplete story.

History of the Initiative

This report originated with a review undertaken by the United States Government Accountability Office in 2008 at the request of the U.S. Senate Committee on Homeland Security and Governmental Affairs.1 To more effectively analyze ISO/RTO benefits and performance, the Government Accountability Office recommended that the FERC work with ISOs/RTOs, stakeholders and other interested parties to standardize measures that track the performance of

ISO/RTO operations and markets, and to report the performance results to Congress and the public.

Accordingly, FERC staff worked with a team composed of personnel from FERC-jurisdictional ISOs and RTOs to

develop the performance metrics that form the basis for this report. As part of this process, FERC held meetings with industry stakeholders for their input and established an open comment period on the proposed metrics which will track the performance of ISO/RTO operations, markets and organizational effectiveness.

1Electricity Restructuring: FERC Could Take Additional Steps to Analyze Regional Transmission Organizations‟ Benefits and Performance,

United States Government Accountability Office, Report to the Committee on Homeland Security and Governmental Affairs, U.S. Senate

(September 22, 2008), GAO-08-987 (http://www.gao.gov/new.items/d08987.pdf).

2011 ISO/RTO Metrics Report9

Information Provided

Following a brief summary of the operations and geographic scope of the reporting ISOs and RTOs, this report

provides information responsive to each of the FERC-proposed metrics. When applicable, the data and information are presented for the period 2006 through 2010.2

These metrics were organized by the FERC, and are presented here, in the categories of reliability, markets, and

organizational effectiveness. The reliability metrics provide information on compliance with and violations of national

and regional reliability standards; dispatch behavior; load forecast accuracy; long-term generation and transmission

planning; and planned outage coordination. Market metrics include pricing; rates for generator availability and forced

outages; statistics on congestion management charges and the amount of charges hedged through congestion

management markets; demand-response amounts as capacity and ancillary services; and the percentage of total

electric energy provided by renewable resources. Organizational effectiveness metrics include ISO/RTO

administrative charges to members compared to budgeted administrative charges and as cents per megawatt hour

(¢/MWh) of load served; customer satisfaction; and the scope and results of audits of billing controls.

Each ISO/RTO provides a brief overview of their region, their data on the FERC metrics and information to the extent applicable and available, and additional information on key initiatives specific to their regional activities.

Emerging Themes

The information provided in this report reinforces the value of ISOs and RTOs. The report illustrates the transparency of ISO/RTO operations and reinforces the value of ISO/RTO operation of the grid and administration of wholesale electricity markets. Specifically, this report shows that:

Balancing authority areas operated by ISO/RTOs function reliably; ISO/RTO organized markets are efficient;

ISO/RTOs are advancing public policy energy objectives; and

ISO/RTOs enable demand response and energy efficiency.

2 The reporting ISOs and RTOs submitted their 2010 ISO/RTO Metrics Report with data and analyses for the period 2005 through 2009 to FERC in December 2010.

2011 ISO/RTO Metrics Report10

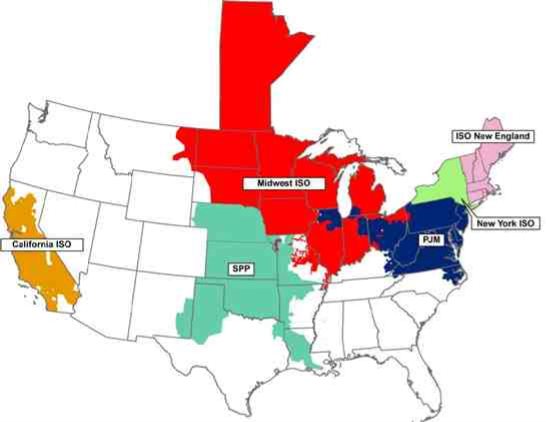

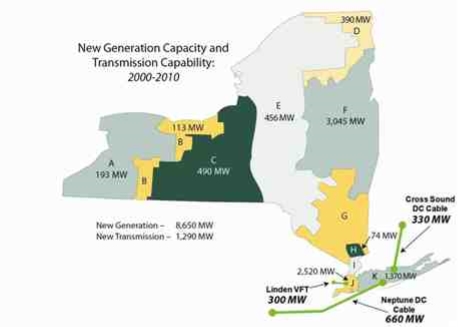

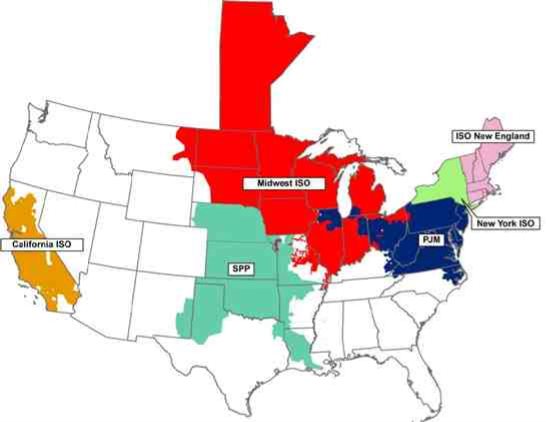

ISO/RTO Geography and Operations Statistics

The map and data below show to the location and breadth of operations for the ISOs/RTOs contributing to this report. These reference points will facilitate understanding some of the similarities and differences amongst the information of ISOs/RTOs in this report.

The table below summarizes the miles of transmission lines, installed generation, and population in each ISO/RTO

region.

ISO/RTOHeadquarters

CAISOFolsom, CA

ISO-NEHolyoke, MA

MISOCarmel, IN

NYISORensselaer, NY

PJMValley Forge, PA

SPPLittle Rock, AR

2011 ISO/RTO Metrics Report

InstalledMiles of

GenerationTransmission

(in megawatts)Lines

57,12425,526

32,0008,130

148,45657,453

37,41610,877

164,89556,499

66,17550,575

11

Population

(in millions)

30

14

42

19

54

15

Section 1 - Descriptions of Performance Metrics and Other Information

A. ISO/RTO Bulk Power System Reliability

All ISOs and RTOs are responsible for compliance with North American Electricity Council (NERC) mandatory

standards and any mandatory standards for the Regional Entities (RE) that apply in the region where the ISO/RTO is located and are subsequently adopted by NERC. The mandatory reliability standards only apply to ISO/RTOs based on the NERC functional model categories for which each ISO/RTO has registered.

Therefore, different reliability standards apply to different ISOs and RTOs. For example, each region may have

reliability standards that apply only within that region, given the particular infrastructure, resource mix, topographical and other differences that exist within the region. The main differences between the ISO/RTO applicable standards are the Regional Entity standards. Each region develops standards applicable for their infrastructure, environment and any other regional differences. Each ISO/RTO may also be registered for different functions, causing them to comply with different reliability standards.

Violations of such standards may be identified by an ISO/RTO and self-reported or may be identified by a NERC

and/or Regional Entity audit of the ISO’s/RTO’s standards compliance. Such violations can then be classified as low,

medium or high severity. This metric is a quantification of all NERC and RRO Reliability Standards violations that

have been identified during an audit or as a result of an ISO/RTO self-report and have been published as part of that

process.

Dispatch Operations

Compliance with CPS-1 and CPS-2

Each Balancing Authority (BA) is responsible for helping maintain the steady-state frequency in their interconnection within defined limits. The BAs do this by balancing power demand and supply in real-time. Under NERC standard BAL-001-0.1a - Real Power Balancing Control Performance, NERC has established standard measurements against which to monitor BA performance in meeting this responsibility. Each Balancing Authority (BA) shall achieve a

minimum compliance of 100% for Control Performance Standard 1 (CPS1) (rolling annual average) and a minimum compliance of 90% for CPS2 (monthly average).

CPS-1 (Control Performance Standard 1) is a statistical measure of ACE (Area Control Error) variability. This

standard measures ACE in combination with the Interconnection’s frequency error. It is based on an equation derived from frequency-based statistical theory. CPS-2 (Control Performance Standard 2) is a statistical measure of ACE magnitude. The standard is designed to limit a control area’s unscheduled power flows.

An alternative method of measurement is using the BAAL (Balancing Authority ACE Limit). The purpose of the BAAL

standard is to maintain interconnection frequency within a predefined frequency profile under all conditions, to

prevent frequency-related instability, unplanned tripping of load or generation, or uncontrolled separation or

cascading outages that adversely impact the reliability of the interconnection. This standard requires the balancing

2011 ISO/RTO Metrics Report12

authority to demonstrate real-time monitoring of ACE and interconnection frequency against associated limits and to

balance its resources and demands in real-time so that its ACE does not exceed the BAALs for a time greater than

30 minutes. In addition, this standard limits the recovery period to no more than 30 minutes for a single event.

Transmission Load Relief or Unscheduled Flow Relief Events

Transmission Loading Reliefs (TLRs) are a procedure used in the Eastern Interconnection to relieve potential or actual loading on a constrained facility. In the Western Interconnection, Responsible Entities are required to take actions as requested by Qualified Transfer Path Operators that result in the specified amount of Unscheduled Flow (USF) relief events for the applicable Qualified Transfer Path. The information provided in this section illustrates the TLR level 3 events or greater and UFR activity for each ISO/RTO from 2005 through 2009.

Energy Management System Availability

The Energy Management System (EMS) at each ISO/RTO performs the real-time monitoring and security analysis functions for the entire ISO/RTO region and includes inputs from portions of adjacent control areas. It includes a full complement of monitoring, generation control, state estimation and security analysis software. This metric measures the percentage of minutes each year that the ISO’s/RTO’s EMS was operationally available for use by the

ISO’s/RTO’s dispatch operations staff.

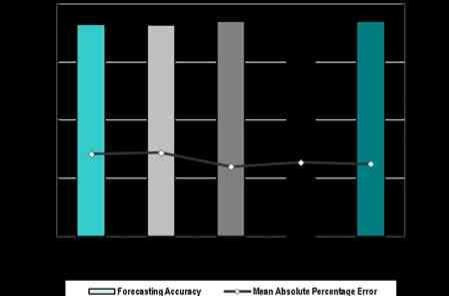

Load Forecast Accuracy

A load forecast is an informed estimate of the future electrical demand on the ISO/RTO’s system. Accurately

forecasting load is critical because the forecast drives the commitment of generation and/or demand response for

future periods. Inaccurate forecasting can manifest itself in either reliability problems (due to under-commitment of

resources) or in additional costs (due to either over-commitment of resources or inefficient commitment of short lead-

time resources).

Each of the ISOs/RTOs generates load forecasts in a number of different time periods ranging from years ahead to minutes ahead of the actual load period. This report focuses on the day-ahead load forecast for each ISO/RTO, as defined by that ISO/RTO. While there is some variation in the time of day in which each company’s day-ahead load forecast is created, the use of the forecasts is similar - this is the forecast used to make day-ahead unit commitments of resources. Since SPP does not have a day-ahead market, the prior day’s medium-term load forecast (MTLF) is used as the load forecast accuracy reference point.

Generally speaking, higher forecasting accuracy is good as it means that the actual load was closer to the forecast

load. The ISOs/RTOs are striving to improve load forecast accuracy. Mean Absolute Percentage Error (MAPE) is

commonly used in quantitative forecasting methods because it produces a measure of relative overall precision; the

lower the MAPE, the more precise the forecast. However, comparisons between regions can be difficult because the

load drivers vary significantly between regions. Also, results can change from one year to the next based on weather

conditions and variations in patterns of customer usage across all sectors of the economy. A sampling of the regional

variations includes:

2011 ISO/RTO Metrics Report13

Weather Patterns - Certain regions experience more extreme weather variations (e.g., storms patterns,

temperature swings). Generally, regions with more extreme weather variations would be expected to have

less accuracy in their load forecasts.

Industrial Loads - Certain regions have higher concentrations of variable industrial loads which can impact

the load forecasts. Generally, regions with variable industrial loads would be expected to have less accuracy

in their load forecasts.

Geography Diversity - Broader ISO/RTO geographies can lead to netting of potential forecast inaccuracies

in the ISO/RTO region for a more accurate total ISO/RTO region load forecast.

Presented in this section are load forecasting accuracy metrics and MAPE for the yearly average for all hours, the yearly average for the peak hour (the highest load hour) of each day, and the yearly average for the valley hour (the lowest load hour) of each day. In each case the metric is based on the simple average of the absolute difference between the forecasted load and the actual load divided by the forecasted load for all relevant hours.

Wind Forecasting Accuracy

This metric measures the accuracy of the wind generation forecast. The electric power industry will continue to see a significant increase in reliance on largely variable energy resources, such as wind and solar generating facilities. This transformation will impose challenges to operating the bulk power system because the magnitude and timing of

variable energy resources output is significantly less predictable than conventional generation. The ability to

accurately forecast variable energy resources output, therefore, becomes critical to manage uncertainty and maintain bulk power system reliability by facilitating the timely commitment and dispatch of sufficient supplemental resources. Wind forecasting is inherently less accurate than energy forecasting because the wind resource has much higher intrinsic variability than the factors which determine energy usage.

The objective of the chart in this section is to quantify the percentage accuracy of the actual wind generation

availability compared with the forecasted wind generation availability as of the close of the prior day’s day-ahead

market.

Unscheduled Flows

Unscheduled flows are energy flows on each ISO’s/RTO’s transmission interface (interties), defined as the difference between net actual interchange (actual measured power flow in real time), and the net scheduled interchange

(planned or pre-scheduled use of transmission). Unscheduled flow may be comprised of both inadvertent interchange and/or parallel flows.

Inadvertent interchange is relevant from an ISO/RTO perspective, not at the individual tie level. Inadvertent interchange is the difference between net actual interchange (actual power flow measured in real time), for all interties connecting the ISO/RTO with other Balancing Authority Areas within the interconnection.

Parallel flow (occasionally referred to as loop flow) is actual power flow within an interconnection that is generated

within one Balancing Authority Area for delivery directly to load within a second Balancing Authority Area along a

specified contract transmission path. In real time, ―parallel‖ transmission lines through a third party Balancing

2011 ISO/RTO Metrics Report14

Authority Area may partially be used because of the interconnection’s operating configuration, line resistance and physics. Parallel flow typically results in an un-scheduled flow of power, in on one intertie and out on another intertie through the third party Balancing Authority Area. Thus, parallel flow is a subset of unscheduled flow as it uses

unscheduled transmission capacity on the respective interties.

Such unscheduled flow may or may not be detrimental from both an operations and market administration

perspective depending on the direction of prevailing scheduled power flow on each intertie and the direction of the unscheduled flow. Unscheduled flow has the potential to cause path overloads if the power flow contributes to rather than counters the scheduled flow. Unscheduled flows contributing to actual power flow in excess of the system

operating limit adversely impacts scheduled use of the grid, resulting in the need to curtail schedules on the specific intertie and return actual path flows within the system operating limit.

To summarize, unscheduled flow typically has two components, inadvertent energy and parallel flows. Therefore,

unscheduled flow is not necessarily attributable to the ISO/RTO which has its transmission used in an unscheduled

manner by others, due to system resistance, physics and operating configuration. Parallel flow manifests as

unscheduled flow on a tie by tie basis, however, parallel flow ―nets out‖ when considered from a total Balancing

Authority perspective (summation of all ties), and does not contribute to inadvertent interchange. Inadvertent

interchange measures a Balancing Authority’s ability to properly ―cover‖ its load in real time, by regulating with

internal generation or scheduled imports and holding its planned net scheduled interchange through the operating

period.

The unscheduled flow charts in this section reflect the absolute value of the total terawatt hours of unscheduled flows for each ISO/RTO and the absolute value of the total terawatt hours of unscheduled flows for each ISO/RTO as a percentage of total terawatt hours of flows. This section also includes tables reflecting the terawatt hours of

unscheduled flows for the top five interfaces (or fewer if there are not at least five interfaces) for each ISO/RTO. Negative amounts represent unscheduled flows out of the ISO/RTO and positive amounts represent unscheduled flows into the ISO/RTO over the noted interface, except with respect to California ISO and ISO-NE, which have an opposite sign convention with imports being negative and exports being positive.

Transmission Outage Coordination

Centralized transmission outage coordination is an important function of ISOs/RTOs. Each ISO/RTO has procedures

by which planned transmission outages should be noticed to the ISO/RTO by the transmission owner. Then, the

ISO/RTO studies the planned transmission outage to determine whether such an outage request would create any

reliability concerns. Even after approving a transmission outage request, an ISO/RTO can cancel a planned

transmission outage if system conditions have changed such that an outage may create a reliability issue.

The four metrics in this section measure how promptly ISOs/RTOs are receiving planned transmission outage

requests, how effective each ISO/RTO is at processing transmission outage requests, how often each ISO/RTO

cancels previously-approved transmission outages, and the level of unplanned transmission outages in each

ISO/RTO region. Each of these measures addresses transmission lines greater than or equal to 200kV.

2011 ISO/RTO Metrics Report15

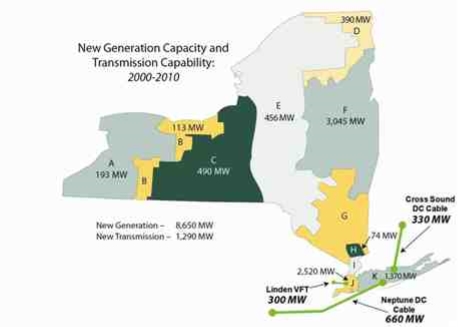

Transmission Planning

ISO/RTO’s take a long-term (generally 10 years or more) analytical approach to bulk power system planning with

broad stakeholder participation to address reliability and economic benefit at intra- and inter-regional levels. By

identifying system reliability and economic needs in advance, the planning process gives market participants time to

propose either a market-based solution (e.g., a merchant transmission line, power plant or demand response) or

regulated solution (e.g., a rate-based transmission line). Essential, large-scale transmission projects spanning the

service territories of multiple transmission system owners have been completed or initiated in every ISO/RTO in the

last 10 years. Supply-side resources and demand response, which are effectively integrated into the system, can

sometimes assist in the resolution of transmission reliability issues, thereby potentially allowing the deferral of

transmission solutions. However, creating new transmission solutions may be necessary to prevent supply-side

resources or demand resources from compromising the deliverability of other existing resources.

The identified transmission planning metric provides an indication of the progress made to address reliability needs

or economic opportunities early enough, to engage a broad set of stakeholders, and to successfully carry the projects

to completion.

Generation Interconnection

One important role ISO/RTO’s have is to facilitate unbiased and open access to all potential electric grid users. This function closely aligns with the transmission planning process, as ISO/RTO’s manage the analytical and

administrative processes of generation and transmission facility interconnections. This entails receiving

interconnection requests, conducting impartial, diligent technical analyses of the system reliability impact, individually and collectively, of their usage and interconnection to the grid, and determining and allocating the costs of

transmission upgrades to connect these facilities to the power system.

Average Generation Interconnection Request Processing Time

Generation interconnection is the process of connecting a generator to the electrical grid. When an entity is

proposing to build a new generation unit or upgrade an existing unit, they apply to the ISO/RTO that manages the

transmission access in that area to assess the availability of transmission capacity to export the energy from that new or upgraded generation facility. This performance metric measures the processing time for generation

interconnection requests from time of access application through the study period to the delivery of final answer on the requirements for connection of the proposed units - including any proposed transmission upgrade requirements and associated costs. This metric is calculated as the simple average of the number of days between when a

generation interconnection application is received and when the final application response is provided to the

requestor - for all responses provided during the calendar year.

Generally speaking, a shorter average study period is preferred. However, wide variation is expected between ISOs/RTOs on this metric. There are several drivers to this variation including:

Number of Applications - There is very wide variation in the number of generation interconnection

applications in the regions. In the past few years, wind-rich regions have received large numbers of

2011 ISO/RTO Metrics Report16

applications from wind generation developers. The number of applications has far outpaced any prior period and as a result has driven the redesign of the application and study processes in wind-rich regions.

Complexity of Applications - Applications requesting system upgrades to support the integration of

renewable resources increase the complexity of the application and thus increase the time required to

complete the study. Also, some wind generator manufacturers have been reluctant to provide detailed

models of their equipment, thus delaying studies and making it more difficult to complete accurate analyses.

Tariff Requirements - There is no consistent study period requirement in the various ISO/RTO tariffs and the

requirements continue to evolve to meet regional needs.

Planned and Actual Reserve Margins 2006 - 2010

Across the various ISO/RTO regions, generation planning reserve margin requirements are set by a variety of entities

(e.g., the ISO/RTO, the regional reliability organization, the state utility commission) normally based on a loss of load

study for the region. Once the standard is established, the generation or demand response resources required to

meet that standard is either committed (by the load serving entities in the region) or acquired (via capacity auction by

the ISO/RTO). This metric compares the planned reserve margin to the actual reserve margin for each region.

Generally speaking, an actual reserve margin at or slightly above the planned reserve margin is desired. An actual

reserve margin less than the planned reserve margin indicates an increase in potential reliability issues during peak

periods or periods of regional emergencies. Some ISOs/RTOs have implemented forward capacity markets which

utilize a variable resource requirement curve to procure capacity up to three years prior to the year for which it is

committed.

This section also discusses the participation of demand response resources in ISO/RTO capacity markets.

Percentage of Generation Outages Cancelled by ISO/RTO

Some ISOs/RTOs do not have the authority to approve planned generation outages, though California ISO does

evaluate and approve all planned generation outages. However, each ISO/RTO may cancel a planned generation

outage if the ISO/RTO assesses a reliability concern with commencing the generation outage. This measure reflects

the percentage of planned generation outages reported to each ISO/RTO that were cancelled by that ISO/RTO.

Generation Reliability Must Run Contracts

Periodically, a generation owner may notify an ISO/RTO that a generating unit is going to retire or be mothballed. The ISO/RTO will complete a reliability assessment of that planned retirement or mothballing. If the results of that study indicate the ISO’s/RTO’s customers cannot be served reliability without that generating unit, then the ISO/RTO may place the generating unit under a reliability must run (RMR) contract until generation and/or transmission

upgrades alleviate the identified reliability concern. The information under this topic reflects the number of generating units and the nameplate generating capacity of any generation units under RMR contracts.

2011 ISO/RTO Metrics Report17

Interconnection / Transmission Service Requests

ISOs/RTOs perform engineering studies of proposed new or upgraded generation to assess the potential

transmission system upgrades required for the incremental generation capacity to interconnect reliably to the

respective ISO’s/RTO’s transmission system. Also, ISOs/RTOs have the responsibility to review and approve or reject, based on the anticipated impact to reliability, requests for both transmission service.

The data in this section reflects the number of interconnection and transmission service requests received and

completed as well as the average aging of incomplete interconnection and transmission service requests and the

average time the ISO/RTO took to complete each study. This section also includes the average costs incurred by

each ISO/RTO to complete each type of engineering study related to an interconnection or transmission service

request.

Special Protection Schemes

The North American Electric Reliability Corporation defines a Special Protection System (SPS) as an automatic

protection system designed to detect abnormal or predetermined system conditions, and take corrective actions other than and/or in addition to the isolation of faulted components to maintain system reliability. Such action may include changes in demand, generation output, or system configuration to maintain system stability, acceptable voltage, or power flows. An SPS does not include (a) underfrequency or undervoltage load shedding or (b) fault conditions that must be isolated or (c) out-of-step relaying (not designed as an integral part of an SPS). A Special Protection System may also be referenced as a Remedial Action Scheme.

In comparison with planning and constructing new transmission facilities, SPSs can be placed in service relatively

quickly and inexpensively to increase power transfer capability. The identified SPS metric provides an indication as

the extent to which SPSs are relied upon in RTO regions, either on a permanent or interim basis until a transmission

planning solution can be implemented. This metric also indicates the effectiveness of SPS operations by indicating

the number of SPS activations in which the SPS operated as expected as well as number of SPS activations that

were not intended.

Though SPS data has been presented for 2010 solely, there have been no material changes in the SPS levels of the ISOs/RTOs in this report during the period 2006 through 2010.

2011 ISO/RTO Metrics Report18

B. ISO/RTO Coordinated Wholesale Power Markets

Organized markets offer diverse power products and services, as well as an array of markets that can be used to hedge against price risks. Because average real-time energy prices correlate to short-term forward bilateral prices, ISO/RTO markets foster forward contracting that can stabilize prices. Increased and more accurate price

transparency means better contract pricing.

By using advanced technologies and market-driven incentives, the commitment and dispatch of the generators within

regional markets is more efficient than those absent regional markets. The centralized market commitment and

dispatch allows the most cost effective unit in the region to be fully utilized before the next most cost effective unit,

etc. Also the market incentives motivate generation owners to keep their plants available particularly during peak

periods.

Security-constrained economic dispatch of generators performed by ISOs/RTOs also allows the transmission system to be more fully utilized and congestion to be managed on an economic basis as opposed to the strict ―rights‖ based Transmission Loading Relief methodology. ISOs/RTOs are well-equipped to analyze and actively manage the

reliability and economic considerations of congestion on the power grid and identify more efficient investment

opportunities for upgrades and new facilities.

Market Competitiveness

Each ISO’s/RTO’s independent market monitor (IMM) analyzes measures of market structure, participant conduct

and market performance to assess the competitiveness of the ISO’s/RTO’s markets. A subset of such measures

monitored by the IMMs is included in this section of the report - price cost markup, generator net revenues, and

required mitigation.

Price Cost Markup

Price cost markup percentages represent the load weighted average markup component of dispatched generation

divided by the load weighted average price of dispatched generation. The markup component of price is based on a

comparison between the price-based offer and the cost-based offer of each actual marginal unit on the system.

Relatively low price cost markup percentages are strong evidence of competitive behavior and competitive market

performance.

2011 ISO/RTO Metrics Report19

Generator Net Revenues

Net revenue quantifies the contribution to total fixed costs received by generators from ISO/RTO energy, capacity and ancillary service markets and from the provision of black start and reactive services. For ISOs without central capacity markets, these revenues do not include any revenues from bilateral capacity contracts. Net revenue is the amount that remains, after short run variable costs have been subtracted from gross revenue, to cover total fixed costs which include a return on investment, depreciation, taxes and fixed operation and maintenance expenses. Total fixed costs, in this sense, include all but short run variable costs.

When compared to total fixed costs, net revenue is an indicator of generation investment profitability and thus is a

measure of overall market performance as well as a measure of the incentive to invest in new generation and in

existing generation to serve ISO/RTO markets. Net revenue quantifies the contribution to total fixed costs received by generators from all markets in an ISO/RTO.

Although it can be expected that in the long run, in a competitive market, net revenue from all sources will cover the

total fixed costs of investing in new generating resources when there is a market based need, including a competitive

return on investment, actual results are expected to vary from year to year. Wholesale energy markets, like other

markets, are cyclical. When the markets are long, prices will be lower and when the markets are short, prices will be

higher.

As available for each ISO/RTO, the data in this section reflects the estimated generator net revenues per megawatt

year for a new entrant Combustion Turbine unit fueled by gas and for a new entrant Combined Cycle plant fueled by

natural gas.

Mitigation

The approach to market power mitigation in ISOs/RTOs has focused on market designs that promote competition (a structural basis for competitive outcomes) and on limiting market power mitigation to instances where the market structure is not competitive and thus where market design alone cannot mitigate market power. In ISO/RTO energy markets, this occurs generally in the case of local market power. When a transmission constraint creates the

potential for local market power, the ISO/RTO applies a structural test to determine if the local market is competitive, applies a behavioral test to determine if generator offers exceed competitive levels and applies a market performance test to determine if such generator offers would affect the market price.

ISOs/RTOs have clear rules limiting the exercise of local market power. The rules provide for the capping of offers

when conditions on the transmission system create a structurally noncompetitive local market (generally measured

by the three pivotal supplier test), when units in that local market have made noncompetitive offers and when such

offers would set the price above the competitive level in the absence of mitigation. Offer caps are set at the level of a competitive offer. Offer-capped units receive the higher of the market price or their offer cap. Thus, if broader market conditions lead to a price greater than the offer cap, the unit receives the higher market price. The rules governing

the exercise of local market power recognize that units in certain areas of the system would be in a position to extract uncompetitive profits, but for these rules.

2011 ISO/RTO Metrics Report20

The metric in this section reflects the percentage of generator unit hours prices were capped in the respective ISO’s/RTO’s real-time energy market due to mitigation.

Market Pricing

Market pricing includes three separate metrics: the average annual load-weighted wholesale energy prices for each

of the ISOs/RTOs, the fuel-adjusted wholesale prices and a breakdown of the components of wholesale total power

costs.

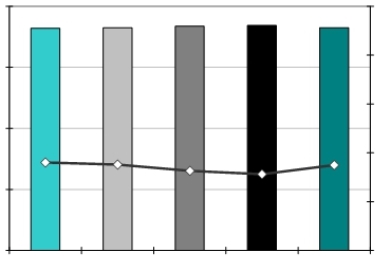

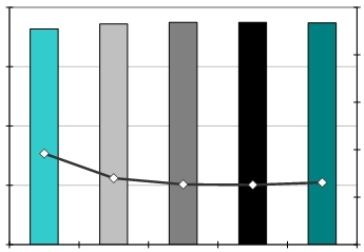

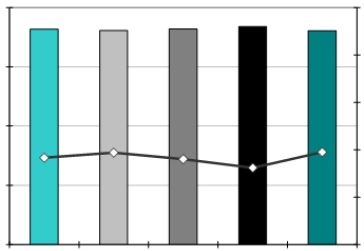

The first chart in this section shows the average annual load-weighted wholesale electricity energy spot prices in

ISOs/RTOs with no adjustment for fuel cost changes or for different fuel mixes in different regions. These prices

frequently do not reflect the prices actually paid by utilities and other load-serving entities to purchase power, as the

purchase prices may be set by longer-term contracts. The prices are the spot prices that are paid for power not

covered by such contracts or supplied by the load-serving entities’ own generation. Also, these prices do not reflect

all costs incurred to meet electric load, as load-serving entities may need to pay additional amounts for ancillary

services and capacity market charges, or may need to recover the cost of the generation they own and use to meet

all or a portion of their load.

The second chart in this section shows the average annual load-weighted wholesale electricity energy spot prices,

adjusted for changes in fuel costs. Fuel costs comprise the majority of the costs of providing power. These data are

useful for comparing spot prices within a given RTO over time, but not for comparisons across ISOs/RTOs. Because

the various ISOs/RTOs began operations at different points in time, they have different base years for the fuel

adjustments, making the figures non-comparable across ISOs/RTOs. The different ISOs/RTOs also use different

fuels or fuel mixes based for the fuel adjustment based on their different markets and generation mixes.

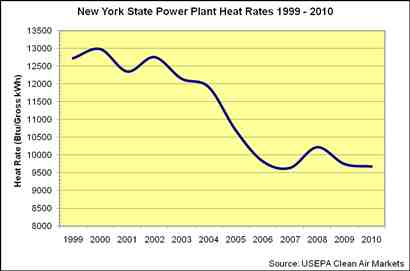

Changes in fuel-adjusted power prices within ISO/RTO areas, relative to the levels that would otherwise have

prevailed, reflect a number of factors including: the cost reductions made possible through security-constrained

economic dispatch, incentives for improved generator availability, investments in new more efficient generating units,

changes in relative fuel prices, changes in demand levels and retirement of uneconomic facilities. Fuel adjusted price

models are not complex and do not discount the impacts of fuel-price changes for normalizing costs. For instance,

small changes in fuel adjusted prices from year to year may be the result of uncertainty in the methodology, rather

than changes in the market fundamentals. In addition, the models and methodology used in each of the regions,

while applied consistently in each region, are unique. As such, the tables included in each of the chapters are

incomparable across the regions. The actions of individual market participants, acting under the decentralized

incentives of wholesale market pricing, have resulted in higher power-plant availability, lower outage rates, the

development of demand response programs, and new plant construction when and where needed, all of which have

contributed to lower power prices.

The last chart in this section breaks down the components of the wholesale power costs relative to the various tariffs

administered by each ISO/RTO. The breakdown may include the cost of energy, transmission, capacity, ancillary

products and the administrative costs of the ISO/RTO, and regulatory fees depending on the regional tariff structure.

Energy is typically the largest component, sometimes accounting for more than 70% of the wholesale cost.

2011 ISO/RTO Metrics Report21

Unconstrained Energy Portion of System Marginal Cost

The average, non-weighted, unconstrained energy portion of the system marginal cost measures the marginal energy price in dollars per megawatt hour exclusive transmission constraints and transmission losses.

Energy Market Price Convergence

Good convergence between the day-ahead and real-time prices is a sign of a well-functioning day-ahead market.

Since the day-ahead market facilitates most of the energy settlements and generator commitments, good price

convergence with the real-time market helps ensure efficient day-ahead commitments that reflect real-time operating

needs. In general, good convergence is achieved when participants submit price-sensitive bids and offers in the day-

ahead market that accurately forecast real-time conditions. The two charts below reflect the absolute value and

percentage of the average annual difference between real-time energy market prices and the day-ahead energy

market prices. Data on price convergence in this section does not include SPP, because SPP does not operate a

day-ahead energy market.

Better convergence is indicated by a smaller dollar spread or a smaller percentage difference. Although day-ahead and real-time price differences can be large on an hourly or daily basis, it is more valuable to evaluate convergence over longer timeframes. Participants’ day-ahead market bids and offers should reflect their expectations of market conditions on the following day, but a variety of factors can cause real-time prices to be significantly higher or lower than expected. While a well-performing market may not result in prices converging on a daily basis, it should lead prices to converge well on an annual basis.

Differences between ISO/RTO regions can be driven by several factors including differences in transmission congestion, market rules, virtual market participation and concentration of intermittent resources.

Congestion Management

Congestion occurs when the physical limits of a line, or inter-tie, prevent load from being served with the least cost energy. The costs associated with congestion can be hedged by load serving entities with financial rights available through an ISO/RTO. To assess the performance of an ISO/RTO with respect to the cost of congestion it is important to first quantify the total costs with respect to load served in the system and second to quantify the percentage of congestion costs that were hedged by load served in the system.

The first congestion measure is calculated as the annual congestion costs of each ISO/RTO region divided by the megawatt hours of load served in that ISO/RTO. The second measure is calculated as the percentage of congestion revenues paid divided by the actual congestion charges. While nominal congestion charges may vary from year-to-

year, congestion hedging rights at ISOs/RTOs provide an opportunity for market participants to hedge their exposure to congestion charges before such congestion occurs.

2011 ISO/RTO Metrics Report22

Resources

Generator Availability

Competitive wholesale power markets have provided incentives for generation owners to take actions to achieve

higher power plant availability and lower forced outage rates, particularly during peak demand periods. This has

reduced the cost of producing electricity. The first chart in this section shows the actual average annual generator

availability for each ISO/RTO calculated as one minus the Equivalent Demand Forced Outage Rate. This is a

measure of generator responsiveness when the generator owner has indicated the generation should be available.

It is important to note that another advantage of ISO/RTO coordinated wholesale power markets is that more

accurate data on unit deliverability and performance is required in order to participate in resource adequacy markets

or constructs. This includes rigorous testing and measurement and verification requirements for units that traditionally

have not provided performance data or testing results. This increased scrutiny and data accuracy, in order to ensure

an ―apples to apples‖ comparison, must be measured over time and during periods when ISO/RTO standards

applied.

Demand Response Availability

A tool available to ISOs/RTOs to balance customer demand and available generation is to call upon committed

Demand Response resources to reduce customer demand in times of high usage. Some ISOs/RTOs have begun to

test the availability of Demand Response resources, even if those resources were not called upon by the ISO/RTO.

Where data is available, the second chart in this section shows what percentage of committed Demand Response

resources were either available when called upon by the ISO/RTO or were available via testing performed by the

ISO/RTO.

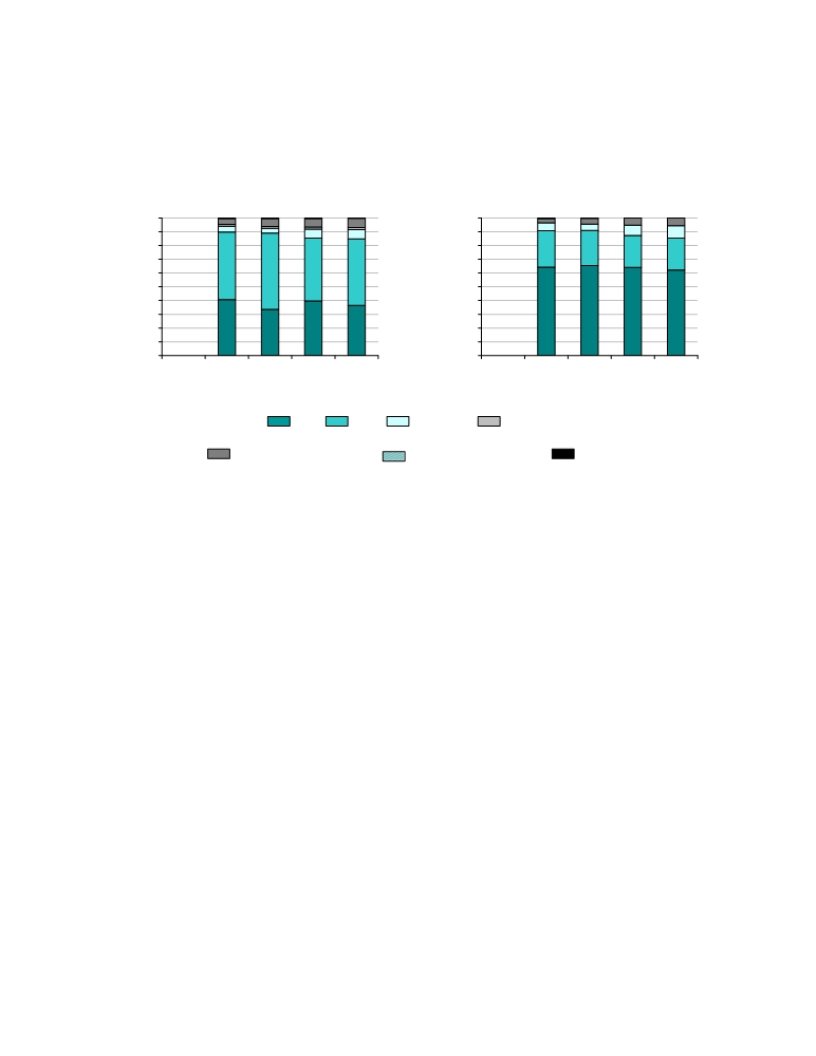

Fuel Diversity

Fuel Diversity is the mix of fuel types installed and available (capacity) or used (generation) to produce electricity in

each ISO/RTO. The breakdown among ISOs/RTOs is expected to vary widely, due to the availability of resources in

the area, along with political, economic and environmental factors associated with producing electricity from various

fuel types.

Renewable Resources

ISOs/RTOs accommodate and facilitate the development of renewable resources, including wind, solar, hydro,

geothermal and biomass. In recent years, many states within ISO/RTO regions have established renewable portfolio standards that stimulate investment in renewable generation. Several ISOs/RTOs have experienced rapid

development of intermittent renewable resources such as wind generation. Further accelerated development is

expected as the state renewable requirements ramp up and may gain further momentum if proposed federal

requirements are implemented. ISOs/RTOs are facilitating the integration of renewable resources through advances in system planning, system operations and market operations.

2011 ISO/RTO Metrics Report23

Key benefits that ISOs/RTOs provide for the integration of renewable resources, such as wind generation, are onestop shopping for interconnection to the system, access to a spot market for energy, reliance on financial

mechanisms such as financial transmission rights and day-ahead market schedules to define transmission system entitlements, and coordination of dispatch over a broad region with many dispatchable resources.

This performance metric measures the installed renewable capacity (MWs) as a percentage of total capacity (MWs) and renewable energy production (MWhs) as a percentage of total energy (MWhs). For purposes of the charts in this section, renewables are defined to include wind, wood, methane, refuse and solar.

Some jurisdictions consider hydroelectric power to be a type of renewable generation and some distinguish between small and large hydroelectric generating units. Data on total energy from hydroelectric power (including pumped storage) is included in the charts in this section.

The renewable and hydroelectric capacity data is based on either generator nameplate capacity, which is the

maximum rated output of a generator under conditions designated by the manufacturer, or based on seasonal ratings

as a result of capability audits by the regional ISO/RTO. Also included in this section are charts showing data on

capacity from renewable and hydroelectric power resources. The capacity data is based on generator nameplate

capacity, which is the maximum rated output of a generator under conditions designated by the manufacturer.

The results between ISOs/RTOs are expected to vary widely, because the growth of renewable resources in each region will be driven largely by the availability of the renewable resources in the area and the economics associated with harnessing that resource.

2011 ISO/RTO Metrics Report24

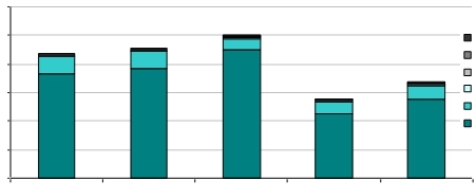

C. ISO/RTO Organizational Effectiveness

The members of ISOs/RTOs are looking for services to be rendered by the ISO/RTO in a cost effective manner while addressing members’ needs and billing transactions accurately. The data in this section reflect those three aspects of how well each ISO/RTO is managing these objectives.

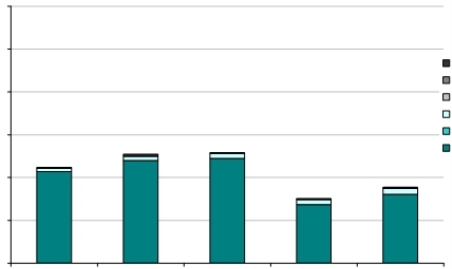

ISO/RTO Administrative Costs

Administrative costs are costs associated with carrying out the services and responsibilities to members and

customers under each entity’s FERC approved tariff. The ISO/RTO is entitled to recover 100% of its total expenses through this charge up to specified caps per megawatt hour (MWh) for all service under the tariffs or a dollar cap for the total revenue requirement in the case of the California ISO.

The costs are comprised of budgeted capital investment (capital charges, debt service, interest expense,

depreciation expense), as applicable to each ISO/RTO’s budgeting practice and operating and maintenance

expenses, net of miscellaneous Income. The metrics compare annual actual costs incurred by the ISO/RTO to the approved administrative fees and budgeted costs (net revenue requirement). Generally speaking, a percentage of actual expenses to budgeted expenses as close to 100% as possible is favorable. On an annual basis a small variance from 100% means that the ISO/RTO is forecasting the financial needs of the organization and effectively managing the business to the budget. Taking a longer term view will provide a trend analysis that indicates the relative stability of the organizations’ cost performance.

The first chart in this section reflects each ISO’s/RTO’s actual non-capital expenses as a percentage of their respective approved budgets. Specifically, the comparison below includes compensation, non-employee labor, technology expenses, etc. but excludes depreciation, interest, and debt service costs.

The second chart in this section reflects each ISO’s/RTO’s actual recovery of capital investment costs as a

percentage of their respective approved budgets for capital investment costs. The majority of ISO/RTO capital

investment relates to the hardware and software used to support ISO/RTO reliability and market administration

functions.

The third chart in this section includes each ISO’s/RTO’s total administrative charges per megawatt hour of load

served.

Customer Satisfaction

Customer satisfaction is a standard indicator of performance used in most industries, including the electric power

industry and by each ISO/RTO. Customer satisfaction indicators are used by the ISOs/RTOs to better understand the

customer satisfaction landscape and to develop specific actions in response to customer feedback. Although

numerical customer satisfaction indicators are useful in determining general areas for possible improvements, the

detailed responses provided by each ISO/RTO member afford the greatest information for developing action plans. It

is this action-planning phase where the value lies in any customer satisfaction program, not simply in the numerical

assessment of overall performance. This is why each ISO/RTO asks its own set of unique questions of its customers.

2011 ISO/RTO Metrics Report25

Billing Controls

One significant ISO/RTO function is processing and issuing timely and accurate bills to its members for transmission

service, market transactions and associated fees. In order to enhance customer confidence in the ISO/RTO controls

surrounding these billing processes and to assist public companies that are ISO/RTO members, each ISO/RTO in

this report has committed to independent audits of their billing functions under Statement of Auditing Standard 70

(SAS 70).

There are two types of SAS 70 audits: Type 1 audits which assess the adequacy of the control design and Type 2

audits which both review the adequacy of the control design and whether the controls are being followed. The table in this section that summarizes the type of SAS 70 audit undertaken by each ISO/RTO and what type of opinion was issued by the independent auditor for each year’s SAS 70 audit.

An unqualified opinion indicates that the independent auditor found the control objectives for each of the areas

covered by the audit to be adequately designed and operated for the audit period. A qualified opinion means the

independent auditor found the design and/or the operation of one or more of the control objectives inadequate.

Specific inadequate control objective(s) are identified; the remaining control objectives covered by the audit are

deemed adequate.

2011 ISO/RTO Metrics Report26

California Independent System

Operator Corporation (California ISO)

2011 ISO/RTO Metrics Report27

Section 2 - California ISO Performance Metrics

The California ISO strives to be a world-class electric transmission organization built around a globally recognized and inspired team providing cost-effective and reliable service, well-balanced and transparent energy market

mechanisms and high-quality information for the benefit of our customers. Our company was created in September 1996 as a nonprofit public benefit corporation with the passage of California Assembly Bill 1890 that restructured the state’s power market following the passage of the federal Energy Policy Act of 1992, which introduced competition into the wholesale market. The California ISO incorporated in May 1997 and in March 1998 began serving 80 percent of the state, or 30 million people, with the purpose of managing the state’s transmission grid, facilitating the spot

market for power and performing transmission planning functions.

The California Power Exchange operated the state’s competitive wholesale power market and customer choice

program until the 2000-2001 energy crisis forced it into bankruptcy in January 2001. The exchange ultimately ceased

operation leaving the state without a day-ahead energy market until the ISO opened a nodal market in spring 2009.

During and immediately after the energy crisis, the ISO began addressing underlying infrastructure challenges —

specifically transmission and generation deficiencies — and, with FERC approval, started a comprehensive market

redesign and technology upgrade program. State regulators implemented a resource adequacy obligation in 2004

that prevents under-scheduling so that utilities now must procure in advance 100 percent of their total forecast load

as well as an additional 15 percent margin. Approximately 20,000 megawatts of mainly gas-fired generation have

been built in California since the energy crisis. In 2010, developers added approximately 500 MW of renewable

generation to the system. The ISO remains focused on interconnecting a significant amount of proposed renewable projects. In addition, the ISO has studied and approved significant transmission expansions, including the critical Path 15 link between southern and northern California, as well as enough upgrades (under current conditions) to meet the state’s 33 percent renewables portfolio standard.

The new ISO market design includes a day-ahead market, locational marginal pricing and a full network model of the

grid that analyzes day-ahead energy schedules and potential choke points on the system before they occur. The new

fully integrated forward market allows the ISO to manage the right mix of energy, standby power and transmission

capacity to meet demand in three time frames — day ahead, hour ahead and real time. The new market’s locational

marginal pricing feature reflects the true cost of delivering power, including the cost to deliver power to those areas

with transmission constraints, better enabling the ISO and load serving entities to run the right power plants to meet

local needs. This pricing approach also provides more granular information about the areas that can benefit most

from new infrastructure, which gives developers better information on which to base their economic decisions.

Since the ISO implemented the nodal market in 2009, wholesale energy costs and ancillary services costs have

declined, in part because of better optimization of the system, greater market liquidity, lower demand and lower

natural gas prices. The new market allows generators to bid all their output into the energy and ancillary services

markets at the same time. This increases the supply of bids, enabling the market software to find the most cost-

effective way to use each unit’s capacity. The frequency of mitigating suppliers’ bids and the impact on prices has

2011 ISO/RTO Metrics Report28

been generally low and dropped significantly in the day-ahead market during 2010 according to the ISO’s

Department of Market Monitoring. The new market also reflects increased activity as annual billings have

dramatically risen. Contributing to this robust activity is the new day-ahead market optimization approach, which has created additional opportunities for buying and selling, as has the introduction of new market products.

Since implementing the new market, the California ISO has been taking strategic steps to identify where to add

market functionality or refine the market functions that already exist. In 2009 and 2010, the ISO delivered several

major market enhancements that facilitate the participation of emerging technologies and demand resources in

wholesale markets. In addition, the ISO has focused on ensuring reliable integration of the resources necessary to

meet California’s energy policies by making comprehensive changes to its transmission planning and interconnection

processes. This year, California Governor Jerry Brown signed into law a renewable portfolio standard that requires

load-serving entities to deliver 33 percent of their electricity from renewable resources by the year 2020. Renewables

integration touches nearly all of the core functions of the ISO, including operations, markets and infrastructure

requirements. While several states are pursuing their own renewables goals, California is recognized as a leader in

developing the rules and processes that enable the electric industry to build clean power plants and the transmission

to deliver renewable energy. To this end, the ISO has approved major transmission projects, including the

unprecedented Tehachapi Renewable Transmission Project and Sunrise Powerlink as well as other transmission

upgrades (e.g., reconductoring projects) that have the capacity to handle the influx of thousands of megawatts of

renewable energy.

2011 ISO/RTO Metrics Report29

A. California ISO Bulk Power System Reliability

The California ISO has submitted registrations under the Reliability Functional Model of the North American Electric Reliability Corporation. This model defines the set of functions that must be performed to ensure the reliability of the bulk electric system. NERC’s reliability standards establish the requirements of the responsible entities that perform the functions defined in this model. The table below identifies which NERC Functional Model registrations the

California ISO has submitted as of the end of 2010. The Regional Entity for the ISO is the Western Electricity

Coordinating Council (WECC).

At this time, WECC is the Interchange Authority and Reliability Coordinator for the Western Interconnection.

Typically, transmission owners serve as Transmission Planners and load-serving entities serve as Resource

Planners. The ISO performs its Planning Authority functions in accordance with its FERC approved Order No. 890 compliant tariff. As the Planning Authority, much of the ISO’s core function involves transmission expansion planning related activities, most notably producing the annual California ISO Transmission Plan.

Neither NERC nor FERC published any reliability standard violation for the California ISO during the 2006-2009

period covered by this report. On February 1, 2010, however, NERC published a Notice of Penalty recommending a $0 penalty with a sanction letter for an incident self-reported by the California ISO on November 30, 2007. This

incident, which took place on October 2, 2007, related to possible noncompliance with IRO-STD-006-0 for a

deficiency of providing off-path curtailments of 2.6 MW and 1.7 MW on a 2900 MW rated path. The recommendation was accepted by FERC in a notice dated March 3, 2010.

NERC Functional Model Registration

Balancing Authority

Interchange Authority

Planning Authority

Reliability Coordinator

Resource Planner

Transmission Operator

Transmission Planner

Transmission Service Provider

California

ISO

2011 ISO/RTO Metrics Report30

Dispatch Operations

Balancing authority areas must maintain interconnection frequency within defined limits by balancing power demand and supply in real time. This requirement is measured by Control Performance Standards 1 and 2. Balancing

authority areas are required to maintain compliance of at least 100 percent for CPS-1 over a 12-month period. The California ISO has complied with CPS-1 for each of the calendar years from 2006 through 2010, having exceeded the minimum standard in each of the five years during this period.

California ISO CPS-1 Compliance 2006-2010

200%

180%

160%

140%

120%

100%

80%

20062007200820092010

Balancing authority areas are also required to maintain compliance of at least 90% for CPS-2 during each month in a

12-month period. The California ISO complied with CPS-2 from 2006 through February 2010. Effective March 1,

2010, the ISO began participating in the Reliability Based Control (RBC) proof-of-concept field trial that includes a

waiver from CPS-2 requirements. See, http://www.nerc.com/filez/standards/Project2010-

14_Balancing_Authority_RBC-RF.html. Therefore, the chart below only reflects CPS-2 compliance for the months of

January and February in the 2010 record period.

California ISO CPS-2 Compliance 2006-2010

100%

95%

90%

85%

80%

20062007200820092010

2011 ISO/RTO Metrics Report31

The California ISO is the path operator for Path 66 - the California Oregon Intertie. California ISO data reflects the

number of unscheduled flow relief events from June 18, 2007 through December 31, 2010. These events included (1) ―no impact‖ events (i.e., no tag curtailment actions required); (2) on path tag curtailment actions only; and (3) on and off path tag curtailment actions. The large variability in ISO events during this period is primarily attributable to

substantially different annual hydro and system conditions throughout the Western Interconnection.

California ISO Transmission Load Relief or Unscheduled Flow Relief Events 2007-2010

2,000

1,500

1,000

500

0

2007200820092010

The California ISO maintains an energy management system to perform real-time monitoring. Availability is measured as the percentage of hours that the energy management system is operationally available.

California ISO Energy Management System (EMS) Availability

100%

95%

90%

85%

80%

20062007200820092010

2011 ISO/RTO Metrics Report32

Load Forecast Accuracy

A significant portion of the load in California is centered along the coast in the areas around San Francisco, Los

Angeles and San Diego. During the summer period, particularly during peaks, these regions can experience

significant changes in temperature from what was predicted in the day-ahead timeframe because of the sudden and intense marine influence of the Pacific Ocean. On average, the ISO day-ahead load forecast from a reference point of 9:00 a.m. is 98% accurate. Prior to the day-ahead market that started on April 1, 2009, the load forecast was not used by the ISO to make market commitments and therefore the results are not reported. The data structure prior to that date was also different so the results are not directly comparable.

California ISO Average Load Forecasting Accuracy 2009 - 2010 (1)

100%5%

4%

95%

3%

90%

2%

85%

1%

80%0%

20062007200820092010

Mean Absolute Percentage Error

(1)California ISO data represents the period April 1, 2009 through December 31, 2010.

2011 ISO/RTO Metrics Report33

California ISO Peak Load Forecasting Accuracy 2009-2010 (1)

100%5%

4%

95%

3%

90%

2%

85%

1%

80%0%

20062007200820092010

Mean Absolute Percentage Error

(1) California ISO data represents the period April 1, 2009 through December 31, 2010

California ISO Valley Load Forecasting Accuracy 2009-2010 (1)

100%5%

4%

95%

3%

90%

2%

85%

1%

80%0%

20062007200820092010

Mean Absolute Percentage Error

(1)California ISO data represents the period April 1, 2009 through December 31, 2010.

2011 ISO/RTO Metrics Report34

Wind Forecasting Accuracy

The California ISO has forecasted output from wind resources since 2007 and improved its wind forecast accuracy to manage increasing penetration of these resources to meet California’s renewables portfolio standard. The data

reported below for 2006 through 2009 uses the mean absolute error percentage, which is a method that the ISO believes softens the true error in forecasting by smoothing out the positive and negative deviation spikes that may occur during power production. For 2010, the ISO used the root mean square error to evaluate performance. The ISO believes this method is superior because it does not cancel out positive and negative deviations from different intervals and, therefore, does not mask deviation magnitudes over a large sample. This approach more accurately represents the variance between forecast and actual energy production.

California ISO Average Wind Forecasting Accuracy 2007-2010

100%

95%

90%

85%

80%

75%

70%

65%

60%

55%

50%

20062007200820092010

2011 ISO/RTO Metrics Report35

Unscheduled Flows

The ISO transmission system is part of the Western Interconnection, which is a geographically large, circular 345/500

kV AC system that inherently has loop flow attributable to the use of contract path historical transmission rights as

opposed to a power flow solution dispatch methodology. The absolute value of unscheduled flow as a percentage of

total flows reported by the ISO is sufficiently insignificant such that it does not register on the second chart below.

California ISO Absolute Value of Total Unscheduled Flows 2006-2010

(terawatt hours)

120

100

80

60

40

20

0

20062007200820092010

2011 ISO/RTO Metrics Report36

California ISO Absolute Value of Unscheduled Flows

as a Percentage of Total Flows 2006-2010

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

20060.08%

20070.01%

20080.01%

20090.01%

20100.04%

20062007200820092010

The table below reflects terawatt hours of unscheduled flows for the top five California ISO interfaces. Positive

amounts represent unscheduled flows out of the ISO and negative amounts represent unscheduled flows into the

ISO, which is the standard in the Western Interconnection.

California ISO Unscheduled

Flows by Interface

Arizona Public Service Co.

Bonneville Power Administration

Los Angeles Department of Water

and Power

Sacramento Municipal Utility District

Salt River Project

2011 ISO/RTO Metrics Report

(terawatt hours)

20062007200820092010

(3)(3)(3)(3)(3)

11011

(7)(8)(10)(10)(10)

(2)(3)(2)(2)(2)

34444

37

Transmission Outage Coordination

This group of metrics looks at whether long duration outages are submitted well in advance so the California ISO

may better plan for reliable and efficient operations. There are many variables involved in performing an outage

study. Most studies can be performed in the time allowed for planned outage submission, but some outages and

combinations of outages can result in more complex studies that require additional time to complete and validate.

Therefore, not having 100% of the planned outages studied within established timeframes is not necessarily

indicative of a failure.

ISO timeframes for approving outages changed with the introduction of the new market design in April 2009. Since that time, outages need to be studied prior to the day-ahead market. In addition, several of the metrics reference a specific voltage level for the outage that could not be systematically determined until an advanced grid topology tool was put in place concurrent with the new market. Accordingly, comparable data is not available for years 2005-2008, and only the period since April 2009 is reported here.

The first metric measures transmission owner performance, not ISO performance.

California ISO Percentage of > 200kV planned outages of 5 days or more that are submitted to ISO/RTO at

least 1 month prior to the outage commencement date 2009-2010

100%

80%

60%

40%

20%

0%

20062007200820092010