UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

Astoria Generating Company, L.P., NRG Power Marketing LLC, Arthur Kill Power LLC, Astoria Gas Turbine Power LLC,

Dunkirk Power LLC, Huntley Power LLC, Oswego Harbor Power LLC and TC

Ravenswood, LLC

Complainants,

vs.

New York Independent System Operator,

Inc.

Respondent.

)

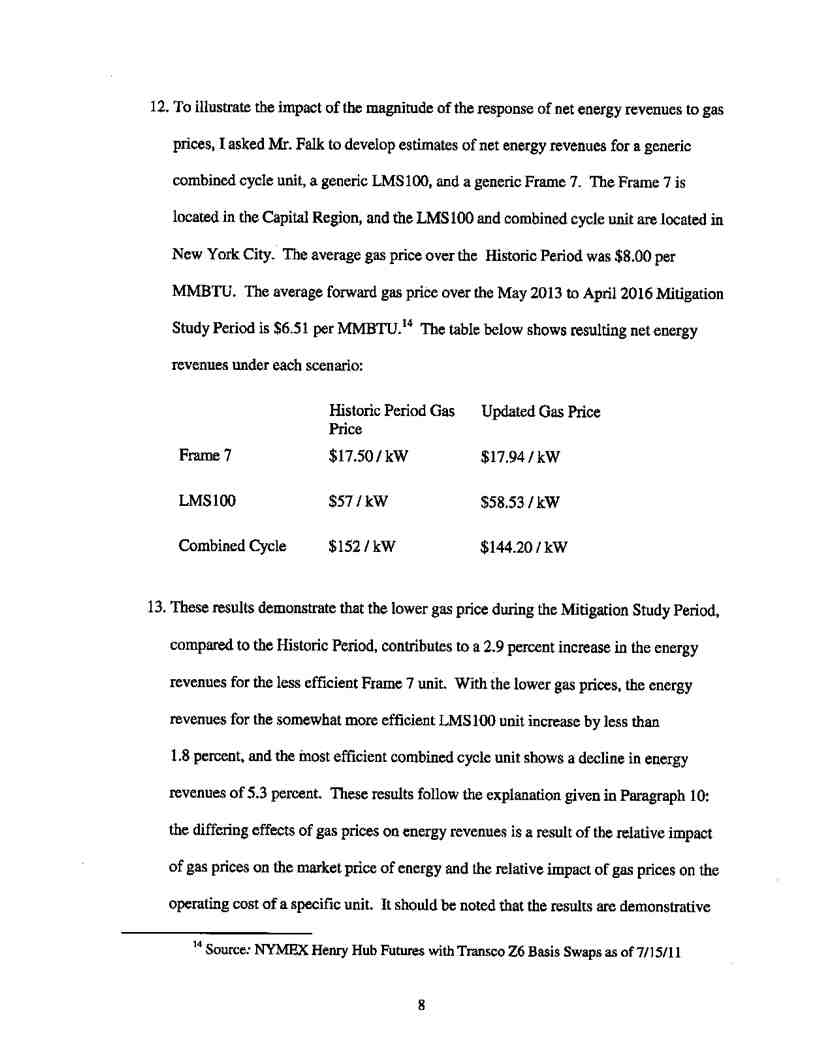

)

)

)

)

)

)

)Docket No. EL11-42-000

)

)

)

)

)

)

)

REQUEST FOR LEAVE TO SUBMIT SUPPLEMENTAL ANSWER

AND SUPPLEMENTAL ANSWER OF THE

NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

In accordance with Rules 212 and 213 of the Commission’s Rules of Practice and

Procedure,1 the New York Independent System Operator, Inc. (“NYISO”) respectfully requests

leave to submit and submits this Supplemental Answer in response to the: (1) Answer of the New

York ISO’s Market Monitoring Unit (“MMU Answer”); and (2) Complainants’ Motion for Leave

to Answer and Answer (“Complainants Answer”) filed on July 21, 2011 in the above captioned

proceeding regarding the NYISO’s implementation of the “In-City Buyer-Side Mitigation

Measures.”2

1 18 C.F.R. §§ 385.212, 385.213 (2011).

2 Consistent with the NYISO’s other filings in this proceeding, the NYISO uses “In-City Buyer-

Side Mitigation Measures” to refer to the currently-effective buyer-side capacity market mitigation

provisions in Attachment H to its Market Administration and Control Area Services Tariff (“Services

Tariff”), including those that were accepted by the Commission in its series of orders in Docket No.

ER10-3043.

The MMU Answer states that the independent MMU3 has “reviewed and provided

comments on the In-City Buyer-Side Mitigation Exemption Tests performed by NYISO” and

that “[t]hrough the course of this review, we have not identified any compliance concerns with

respect to the NYISO’s implementation of the In-City Buyer Side Mitigation Measures.”4 It also

states that the Commission should not hold the NYISO’s implementation of the In-City Buyer-

Side Mitigation Measures, or the related Class Year Facilities Study allocation process, in

abeyance. The NYISO is submitting its Supplemental Answer in response to the MMU’s

recommendation that it: (i) disclose certain information regarding mitigation exemption

determinations; and (ii) escalate Offer Floors after they are established.5

The Complainants’ Answer opposes the NYISO’s Answer and makes a new allegation regarding a supposed additional flaw in the NYISO’s administration of its tariff. The NYISO is requesting that the Commission reject the Complainants’ Answer as it does nothing to justify or substantiate the Complaint, but instead confuses the record through repeated

mischaracterizations of fact and law. To the extent that the Commission accepts Complainants’

Answer, the NYISO requests that it accept this Supplemental Answer, in order to clarify the

record.

I. REQUEST FOR REJECTION OF COMPLAINANTS’ ANSWER

Given the multiple inaccuracies in the Complainants’ Answer, the NYISO believes that

the best course of action for the Commission would be to reject it pursuant to Rule 213(a). The

Commission has made it clear many times that it will accept answers to answers only when they

3 The independent MMU for the NYISO is Potomac Economics, Ltd.

4 MMU Answer at 2.

5 Capitalized terms that are not otherwise defined herein shall have the meaning specified in the NYISO’s Services Tariff and if not defined therein they shall have the meaning specified in the NYISO’s Open Access Transmission Tariff (“OATT”).

2

correct inaccuracies, clarify complex issues, provide additional information, or are otherwise

helpful in the development of the record in a proceeding.6 The Complainants’ Answer satisfies none of these criteria, and, in fact, has the opposite effect. It obscures complex issues even more than the Complaint, provides no helpful additional information, and otherwise does not

contribute to the development of a useful record.7 Accordingly, the NYISO requests that the Commission summarily reject the Complainants’ Answer.

II. REQUEST FOR LEAVE TO ANSWER

The Commission has discretion to accept answers to answers when they are helpful to its

decision-making process.8 To the extent that the Commission accepts the Complainants’

Answer, the NYISO respectfully requests leave to answer in order to correct the numerous

factual and legal misrepresentations set forth therein, as well as to allow the development of a

more complete record.9 The NYISO should also be permitted to answer that pleading so that it

may respond to an argument that was raised for the first time therein. In addition, the

Commission should accept the NYISO’s answer to the MMU Answer because it will help to

clarify the issues and the record.

6 See e.g., New York Independent System Operator Inc., 133 FERC ¶ 61,178 at P 11 (2011)

(allowing answers to answers and protests “because they have provided information that have assisted [the Commission] in [its] decision-making process”); Morgan Stanley Capital Group, Inc. v. New York Independent System Operator, Inc., 93 FERC ¶ 61,017 at 61,036 (2000) (accepting an answer that was “helpful in the development of the record ”).

7 Complainants’ Answer misstates the law regarding competitive suppliers’ entitlement to recover their costs and their burden of proof under section 206 of the Federal Power Act, see Complainants’

Answer at 7-8 and 21. It misstates the facts regarding past communications with the NYISO, the

NYISO’s use of inflation in its calculations, and the NYISO’s past statements concerning gas pricing adjustments, see Complainants’ Answer at 5-7, 10-11, and Second Supplemental Affidavit of Mark D. Younger at PP 5-8 (“Younger Second Supplemental Affidavit”).

8 See supra n. 6.

9 To the extent the Commission deems Rule 213(d) applicable to this answer, the NYISO respectfully seeks permission to file this answer one business day out-of-time.

3

III.ANSWER TO THE INDEPENDENT MMU

The MMU Answer states that “the final determination of whether a resource is subject to,

or exempt from, an offer floor would be beneficial”10 and the release of “the final exempt/non-

exempt determinations” would not raise competitive concerns.11 It further asserts that

publicizing future exemption determinations would be warranted to resolve issues of

“information asymmetry” that could provide “suppliers that receive the determinations a

substantial advantage over other participants.”12 The MMU Answer acknowledges that

“transparency must necessarily be limited by requirements to hold a participant’s information

confidential.”13 The NYISO has made its position on the release of confidential information

clear in its filings and would have no objection if the Commission accepted the MMU’s proposal

that the Commission require the NYISO to disclose the identity of the project and the final

exempt/non-exempt determination.

The MMU Answer states that the Services Tariff can reasonably be read to allow for the escalation of established Offer Floors.14 The NYISO Answer stated that “the escalation of

established Offer Floors could be an improvement to the current In-City Buyer Side Mitigation Measures.”15 Subject to the concens the NYISO expressed in the NYISO Answer,16 the MMU’s proposed market design appears to be an appropriate framework.

10 MMU Answer at 3.

11 Id. at 3-4.

12 Id. at 4.

13 Id. at 2-3.

14 Id. at 6.

15 NYISO Answer at 53.

16 Id. at 53-54.

4

IV.ANSWER TO COMPLAINANTS

Consistent with Commission precedent urging parties that respond to answers to limit the scope of their responses, the NYISO has confined this Supplemental Answer to addressing new arguments, and its most substantial disagreements with the Complainants’ Answer. The

NYISO’s silence on other issues should not be construed as agreement with, or an admission to, any of the other statements made in the Complainants’ Answer. Those statements have either already been refuted by the NYISO Answer or do not require a response.

A. The Complainants Have Not Shown that the NYISO Violated, or Will

Violate, the In-City Buyer-Side Mitigation Measures or that those Measures Are Unjust and Unreasonable

As stated in the NYISO’s Answer, and as confirmed by the MMU Answer,17 the NYISO

has complied with its tariff in its implementation of the In-City Buyer-Side Mitigation Measures.

Complainants argue that the NYISO has not complied with its tariff but have not shown that this

is the case. They also did not respond to the MMU’s statement that it has reviewed the NYISO’s

determinations and detected no compliance concerns.18 Complainants have likewise not

provided support for their allegation that the In-City Buyer-Side Mitigation Measures are not just

and reasonable. The fact remains that Complainants have not met their burden of proof under

sections 206 and 306 of the FPA, and the Complaint must therefore be rejected.

Complainants’ references to the decline in ICAP Spot Market Auction Clearing prices from the June to July auctions are irrelevant to any determinations under the In-City Buyer-Side Mitigation Measures. The NYISO has not yet made final determinations under the In-City

Buyer-Side Mitigation Measures, which are the subject of the Complaint, and the projects as to

which those measures are presently being implemented, have not yet entered the market.

17 MMU Answer at 2.

18 See NYISO Answer at 2.

5

Moreover, there is no merit to Complainants’ allegations that the price decline was the result of the mis-implementation or violation of earlier tariff provisions19 or, even if the decline were

consistent with the tariff, that it somehow indicates that the Pre-Amendment Rules20 were unjust, unreasonable, or otherwise unlawful.21 Complainants have acknowledged that this proceeding and Docket No. EL11-50-000, which has to do with the implementation of the Pre-Amendment Rules, concern entirely different questions.22 Therefore, the Commission should disregard

references pertaining to earlier tariff provisions and focus in this proceeding solely on questions concerning the In-City Buyer-Side Mitigation Measures.

1. The NYISO’s Approach to Gas Futures Prices is Reasonable,

Consistent with Attachment H, and Does Not Need to Be “Confirmed” by Market Participants

The new arguments in the Complainants’ Answer concern the use of gas price

adjustments in Unit Net CONE calculations. Complainants contend that the NYISO “made

adjustments for natural gas prices to the energy and ancillary services offset used in the Unit Net

CONE calculation” that were rejected by its consultants in the most recent ICAP Demand Curve

reset process.23 They ask that the Commission direct the NYISO to provide information to

19 See Answer and Request for Expedited Action of the New York Independent System Operator, Inc., Docket No. EL11-50-000 at 4 (filed August 3, 2011) (referring to such earlier tariff provisions as the “Pre-Amendment Rules) (“EL11-50 Answer”).

20 Consistent with the NYISO’s other filings in this proceeding The “Pre-Amendment Rules” are the buyer-side capacity market power mitigation rules that existed in the Attachment H prior to the

effective date of the In-City Buyer-Side Capacity Mitigation Measures.

21 EL11-50 Answer at 4.

22 Formal Complaint of Astoria Generating Company, L.P., et. al., Docket No. EL11-50-000 at

49 (filed July 7, 2011).

23 Complainants’ Answer at 18.

6

enable the Commission and Market Participants the ability to “confirm that adjustment to gas pricing will not skew its Unit Net CONE calculations.”24

However, as the NYISO Answer explained, and the Complainants have not refuted,

“there are material differences between the purposes and natures of the ICAP Demand Curve

Unit Net CONE and In-City Buyer-Side Mitigation Measures analyses.”25 Those differences

justify the use of different assumptions, such as the use of gas futures prices in the In-City

Buyer-Side Mitigation Measure determinations. Although it did not specify a particular

methodology, the MMU did recommend to the NYISO and NERA that 3 years of forward gas

prices be used in the NERA model to compute the net energy revenues in the Unit Net CONE

analysis. Further, the Affidavit of Eugene T. Meehan26 in the NYISO Answer explained and

demonstrated the reasonableness of the NYISO’s use of gas futures prices in the In-City Buyer-

Side Mitigation Measures.

The Meehan Affidavit explained that the NYISO derived energy revenues using

projected gas prices based on gas future prices because the intent of determining Unit Net CONE

for the In-City Buyer-Side Mitigation Measures “is to capture whether the entry decision is

economic as of a specified time.”27 Therefore, “even with the judgments that are implicit in the

gas price adjustment, it can be done with sufficient accuracy so that it more accurately represents

24 Id. at 19-20, see also Younger Second Supplemental Affidavit at P 19. Complainants have thus

demanded a chance to “confirm” NYISO calculations in a manner that would appear to both: (i) be

inconsistent with their representations that they are not seeking confidential information, See

Complainants’ Answer at 3; and (ii) validate the NYISO’s concern that the Complainants are seeking to

impermissibly usurp market monitoring functions that should only be performed by independent entities.

25 NYISO Answer at 35.

26 Id. at Attachment 3 Affidavit of Eugene T. Meehan (“Meehan Affidavit”).

27 Meehan Affidavit at P 17.

7

the economic entry decision as of a specified time than calculating the energy net revenues without the gas price adjustment.”28

Mr. Younger’s objections to the NYISO’s use of gas futures are unreasonable.

Mr. Younger incorrectly argues that the NYISO did not specify the number of years of gas

futures prices used;29 however, the Affidavit of Joshua Boles, also submitted as part of the

NYISO Answer, clearly indicated that “the calculation of net energy revenues uses an average of

forward gas prices for the years of the Mitigation Study Period.”30 Additionally, as explained in

the Meehan Affidavit, energy revenues are “not computed over the life of the unit but are

estimates of energy revenues for a three-year period starting with initial entry.”31 As to

Complainants’ assertion that the NYISO did not “explain why near term gas prices would dictate

whether a unit entry is economic,”32 the Meehan Affidavit explained that because the timing of

the development of a unit is largely discretionary, “only energy revenues in the near-term period

after entry, rather than energy revenues over a longer period are germane to the decision on when

to develop [a] unit.”33

The NYISO answers the confusion created in the record by Complainants’ Answer in the

attached Supplemental Affidavit of Eugene T. Meehan (hereinafter the “Supplemental Meehan

Affidavit”).34 The Supplemental Meehan Affidavit also explains that Mr. Younger’s Second

Supplemental Affidavit is “generally misleading with respect to the impact of gas prices on

28 Id. at P 17.

29 Younger Second Supplemental Affidavit at P 6.

30 NYISO Answer Attachment 2 Affidavit of Joshua Boles at P 18 (“Boles Affidavit”).

31 Meehan Affidavit at P 22.

32 Younger Second Supplemental Affidavit at P 6.

33 Meehan Affidavit at P 22.

34 Supplemental Meehan Affidavit at P 7

8

energy prices and net energy revenues in the NERA econometric model, and that, stated clearly in the NERA/S&L Demand Curve Report ‘the regression results with respect to gas prices are quite sensible generally.’”35

The Supplemental Meehan Affidavit further explains that Mr. Younger is incorrect to

assert that the Meehan Affidavit did “not even acknowledge the counterintuitive results that the

NERA model produced when this approach was examined in the 2010 Demand Curve Reset

process.”36 As explained in the Supplemental Meehan Affidavit, the Meehan Affidavit

incorporated by reference the explanations provided in the NERA/Sargent & Lundy Demand

Curve Report, which is part of the record in Docket No. ER11-2224,37 regarding the

“counterintuitive results.”38 The only counterintuitive result explained in the NERA/S&L

Demand Curve Report, i.e., the observation that the regression results for November off peak

LBMPs did not respond to gas prices, was not significant, despite Mr. Younger’s suggestion that

it was.39

Mr. Younger’s statement “when NERA attempted to fold lower futures gas pricing

assumptions into its modeling assumptions, NERA’s 2010 Demand Curve Reset Process

econometric model counter-intuitively produced net energy revenues for new entrants that

actually increased,” which implies that this is evidence of an anomaly in the NERA model, is

also incorrect. The Supplemental Meehan Affidavit demonstrates in an example that higher gas

35 Id. at P 6.

36 Younger Second Supplemental Affidavit at P 4.

37 See New York Independent System Operator, Inc., Tariff Revisions to Implement ICAP Demand Curves for Capability Years 2011/2012, 2012/2013, and 2013/2014, Docket No. ER11-2224-000 (filed

November 30, 2010), at Attachment 2 (Meehan Affidavit) Exhibit B “Independent Study to Establish

Parameters of the ICAP Demand Curve for the New York Independent System Operator” (“NERA/S&L Demand Curve Report”).

38 Supplemental Meehan Affidavit at P 8.

39 Id.

9

prices can result in higher net revenues for some units and lower for others, depending on the

rates and other unit-specific characteristics. As explained in the Supplemental Meehan Affidavit,

the result is not counterintuitive, nor is it evidence of an anomaly in the NERA model.

Mr. Younger is correct to the limited extent that energy prices are highly correlated with gas

prices; however, new operating unit costs are also tightly correlated with gas prices and are much

more directly correlated as the new units burn gas. Thus the correlation between net revenues

and gas prices “depends on the relative impact of gas prices on the market price of energy and

the relative impact of gas prices on the operating cost of the unit.”40 That is neither a

counterintuitive result nor evidence that there is an anomaly in the NERA model.

The Supplemental Meehan Affidavit responds to a number of other points in

Mr. Younger’s Affidavit in detail. It continues to demonstrate the reasonableness of the gas

price adjustment in the determination of energy revenues for the Unit Net CONE. Mr. Meehan’s

explanations show that Complainants are wrong to claim that the NYISO’s approach to gas

pricing adjustments in calculating Unit Net CONE is “a mistake” with the potential to incorrectly

“influence” or “dictate” exemption determinations.41 There is no more need, and it is no more

appropriate, for Complainants’ to “confirm” the NYISO’s MMU-reviewed determinations in this

area than in any other.

2. The NYISO’s Approach to Reviewing Contracts Is Reasonable,

Consistent with Attachment H, and Consistent With the Overall Design of In-City Buyer-Side Mitigation Measures

Complainants argue that the NYISO’s review of contracts is too narrow and thus will

supposedly not “effectively protect against uneconomic entry... ” In their view, the NYISO

has asserted that “any out-of-market payments received under contracts are irrelevant to the Unit

40 Supplemental Meehan Affidavit at P 9.

41 Complainants’ Answer at 20.

10

Net CONE calculation.”42 Complainants assert that “such contracts remain an important check to determine if suppliers have an incentive or ability to understate their costs,” and that these kinds of subjective evaluations must be performed.43

The NYISO does evaluate contracts when doing so is necessary to validate identified

costs and also to determine whether a cost is appropriate to use in a project’s Unit Net CONE.44

The NYISO reviews contracts on an objective basis, to evaluate whether the decision to enter is

economic based on ICAP Spot Market Auction payments. Any “incentive or ability” to

understate costs is addressed through the NYISO’s verification of claimed costs and the

determination of appropriate costs. This evaluation is in keeping with the overall design of the

In-City Buyer-Side Mitigation Measures. Complainants’ would depart from a principal purpose

for the tariff revisions, which were designed to increase objectivity.45 Complainants would

instead have the NYISO divine the purpose and intent of the contracting parties, rather than

evaluate objective facts. By injecting new subjectivity and ambiguity into the In-City Buyer-

Side Mitigation Measures, the Complainants’ proposal would foster uncertainty and disputes. It

should therefore be rejected. The MMU indicated to the NYISO that its approach to focus on the

true entry costs for the new resource relative to the forecasted capacity market prices is correct

and consistent with the intent of the buyer-side mitigation provisions.

42 Id. at 17-18.

43 Id. at 18.

44 NYISO Answer at 54.

45 See, e.g., New York Independent System Operator, Inc., 136 FERC ¶ 61,077 at P 20 (2011)

(“requiring that all mitigation determinations be made prior to the decision to construct would undermine NYISO’s efforts with the Three-Year Rule to avoid discretionary determinations about when a developer had technically started construction.”).

11

B.The NYISO’s Implementation of the In-City Buyer-Side Mitigation

Measures Properly Balances Transparency and Confidentiality Considerations

Despite Complainants’ assertions to the contrary, the NYISO has demonstrated that it is applying its In-City Buyer-Side Mitigation Measures in a manner that provides more

transparency than required by the measures, while still complying with its obligations to protect confidential information.

1. The NYISO Communicated Extensively with Market Participants and

Provided Greater Transparency Regarding its Implementation of the In-City Buyer-Side Mitigation Measures Than its Tariffs or

Commission Policy Requires

Complainants continue to question the NYISO’s implementation of the In-City Buyer-

Side Mitigation Measures, renewing their claims that the measures have been implemented in an

“opaque and unreasonable manner,”46 and again base these claims on nothing but unjustified and

misleading assertions. Remarkably, Complainants object that the NYISO Answer’s

comprehensive refutation of the testimony of Mr. Craig Hart of the US Power Generating

Company (“USPG”), parent of Complainant Astoria Generating Company, engages in

“semantics.” In reality, it is Complainants who resorted to “semantics” and who rely on

“misleading wordplay.”47 Mr. Hart inaccurately implies that the scope and number of the

NYISO’s communications with USPG were much narrower and fewer than they actually were.

In fact, the NYISO and USPG engaged in numerous communications, including NYISO

inquiries, despite Mr. Hart’s inaccurate assertion that “we [i.e., USPG] received just one, very

limited, inquiry from the NYISO.”48 Complainants’ Answer, which expressly concedes that

46 Complainants Answer at 2.

47 Id. at 5.

48 NYISO Answer at 39, see also Complaint at Affidavit of Craig Hart at P 13 (“Hart Affidavit”).

12

USPG had many communications with the NYISO,49 is difficult to reconcile with Mr. Hart’s Affidavit.

Additionally, Complainants’ again suggest that Mr. Hart’s “experiences” were

representative of other projects’ interactions with the NYISO but offer no evidence to support their claim. Rather, they simply repeat conclusory statements from the Complaint that NRG encountered a similar lack of transparency regarding its Berrians III project.50 The NYISO and its consultants have had, and continue to have, extensive communications with, NRG and the other developers of new projects.

Similarly, Complainants point to the Hudson Transmission Project’s (“HTP”) comments in this proceeding in an attempt to bolster their argument.51 HTP, however, has sought leave to withdraw those comments in large part because it found that its desire for more information

regarding its mitigation determination had been satisfied over the course of ongoing

communications with the NYISO. HTP also made it clear that its arguments in this proceeding were “in support of open access and more market competition, so that ratepayers get the most reliable energy and capacity at more competitive prices” and not “general support for the

[Complainants’] claims.”52 Indeed, HTP specifically emphasized that it did “not agree with the Generators’ assertions regarding the intent of the NYISO.”53

Additionally, as explained in the NYISO’s July 21 Answer, and as evidenced by the HTP Withdrawal of Comments, challenges to the extent of the NYISO’s communications with

49 Complainants’ Answer at 5.

50 See id. at 6 which merely references Complaint at 23, n. 61.

51 Id. at 6-7.

52 Withdrawal of Comments of Hudson Transmission Partners, LLC at 3, Docket No. EL11-42-

000 (filed July 29, 2011).

53 Comments of Hudson Transmission Partners, LLC at 2, Docket No. EL11-42-000 (filed July 7,

2011).

13

developers under the In-City Buyer-Side Mitigation Measures are premature.54 Because the

exemption determination process is still ongoing, communications between developers and the NYISO concerning projects under review are not complete.

Finally, there is no merit to Complainants’ suggestion that the NYISO’s administration of

the In-City Buyer-Side Mitigation Measures somehow lacked transparency because the NYISO

did not previously have stakeholder discussions regarding its approach to gas pricing

adjustments.55 Complainants’ own witness, Mr. Younger, acknowledges in his affidavit that this

point was in fact mentioned during the stakeholder process.56 In summary, the NYISO has

explained its administration of the In-City Buyer-Side Mitigation Measures at a level of detail

greater than that required under the tariff, and has also agreed to provide a numerical example in

the near future. Complainants’ “transparency” concerns are not driven by their lack of

understanding of the NYISO’s methodology. Rather they are an attempt to insert themselves

into NYISO’s mitigation determinations concerning specific projects which the Commission

should summarily reject.

2. The NYISO Did Not Make Inconsistent Statements Regarding the

Escalation in the Computation of a Project’s New Entrant Offer Floors Compared to Established Offer Floors

Complainants confuse the record by pointing to a purported inconsistency in the

NYISO’s statements regarding its use of inflation in computing a new entrant’s Offer Floor and

54 Answer of the New York Independent System Operator, Inc. To Comments at 3-4, Docket No. EL11-42-000 (filed July 22, 2011).

55 See New England Power Pool and ISO New England, Inc. 103 FERC ¶ 61,304 at P 48 (2003) (“We do not require complete transparency of ISO-NE's mitigation, as some of the information is

competitively and commercially sensitive.”); see also NSTAR Electric & Gas Corporation v. Sithe Edgar LLC, 101 FERC ¶ 61064 (2002) (rejecting demands for greater transparency in ISO-NE monitoring and mitigation procedures).

56 See Younger Affidavit at 7.

14

in the escalation of established Offer Floors.57 However, as explained in the NYISO Answer,

Complainants have drawn incorrect inferences and conflate two distinct concepts that require

separate consideration.58 The NYISO has clearly demonstrated through the use of a numerical

example that it accounts for inflation in the computation of an Offer Floor for a new entrant,59

which is a distinct issue from the escalation of established Offer Floors. The NYISO’s statement

that it does not escalate Unit Net CONE refers to the issue of whether established Offer Floors

should be escalated. The NYISO has not changed its position with respect to escalation of

established Offer Floors and the Complainants’ mischaracterizations of the NYISO’s statements

should be disregarded.

C. The Potential Impact of New Entry on ICAP Spot Market Auction Prices Is

Not a Legally Cognizable Harm to the Complainants

Complainants assert that their filing of the Complaint was justified, despite its admittedly

speculative nature, because they have been, or will be harmed by, the supposed flaws in the

NYISO’s administration of the In-City Buyer-Side Mitigation Measures.60 They point to the

results of the July 2011 In-City ICAP Spot Market Auction to try to support their claim.

As stated above, and in the NYISO’s answer in Docket No. EL11-50-000, the NYISO has not yet made any determinations under the In-City Buyer-Side Market Mitigation Measures, and projects to which those measures are being applied have not entered the market. The results of the July 2011 ICAP Spot Market Auctions therefore have nothing to do with the

implementation of the In-City Buyer-Side Mitigation Measures and fall within the scope of

57 Complainants’ Answer at 10.

58 NYISO Answer at 44.

59 Id. and Boles Affidavit at PP 12-23.

60 Complainants’ Answer at 7.

15

Docket No. EL11-50-000. Even if it were relevant here, Complainants’ unhappiness with current market conditions is not a legally cognizable harm.61

The NYISO also disputes Complainants’ suggestion that they are entitled to capacity

prices that are sufficiently high so as to “provide enough revenue not only for operating expenses

but also for the capital costs of the business” and to allow a competitive seller to “maintain its

credit and to attract capital.”62 The NYISO also disagrees with Complainants’ asserted

entitlement to ICAP revenues that would effectively guarantee their economic viability under all

circumstances. The ICAP Demand Curves are designed to result in capacity revenues over time,

based on an assumed level of excess capacity, that are sufficient to attract new generation and

retain existing generation needed to maintain reliability.63 Intermittent, market-driven price

changes do not by themselves demonstrate that revenues from the ICAP Sport Market Auction

are inadequate for an individual Installed Capacity Supplier to meet the objective stated above.

As the Commission recently emphasized, the establishment of competitive markets has resulted in a fundamental paradigm shift in the way that the Commission regulates electricity

61 Furthermore, the cases cited in the Complainants’ Answer do not support their request for

extraordinary Commission action in this proceeding. Nevada Power Co. v. Duke Energy Trading and

Mktg, LLC, 99 FERC ¶ 61,047 (2002) involved a dispute over contracts that had been negotiated using

market prices that had already been found to be unjust and unreasonable. Mirant Energy Trading, LLC v.

PJM Interconnection, LLC, 122 FERC ¶ 61,007 (2008) was a case where an ISO agreed that future prices

would be unjust and unreasonable and agreed that a hearing was warranted, unlike here where the NYISO

strongly opposes Complainants’ request for relief. PSEG Power Connecticut LLC v. ISO New England,

Inc., 132 FERC ¶ 61,022 (2010) and TransCanada Power Mktg. Ltd. v. ISO New England Inc., 122 FERC

¶ 61,010 (2008) are distinguishable because they involved whether parties would be able to take part in

auctions, not the impact of other market participants’ entry on future auctions. H-P Energy Res., LLC,

115 FERC ¶ 61,216 (2006) concerned developers’ eligibility for auction revenue rights with respect to

upgrades proposed under an interconnection agreement. Finally, Wisconsin Power Inc. v. FERC, 493 F.3d

239 (D.C. Cir. 2007) is inapplicable because it had nothing to do with section 206 complaints and its

holding regarding the justiciability of issues in the Court of Appeals is irrelevant to the question of when

the Commission may act on complaints.

62 Complainants Answer at 7-8.

63 New York Independent System Operator, Inc., 134 FERC ¶ 61,058 at P 118 (2011) (“Therefore,

it is reasonable to establish demand curve parameters that produce revenues over time that allow a new

entrant a reasonable opportunity to recover its costs in light of an assumed level of excess capacity.”).

16

service. There is no question that competitive suppliers must have a “reasonable opportunity to recover their costs” but the Commission does not guarantee full cost recovery to them. As the Commission recently stated:

Rather than requiring utilities and their customers to remain locked into a business relationship in perpetuity, we have endorsed -- and been upheld by courts in

endorsing -- competition among utilities to serve customers as a mechanism to

bring about just and reasonable rates. And, as in all markets, regardless of what

‘investment-backed expectations’ a resource may have had at the time that it

chose to enter the ISO-NE markets, each market entrant was aware of the

possibility that at some times, it might earn substantially more than a traditional

cost-based rate, but that at other times, it might earn less than its costs. The

Commission has made clear that ‘in a competitive market, the Commission is

responsible only for assuring that [a resource] is provided the opportunity to

recover its costs, not a guarantee of cost recovery.64

Thus, the fluctuation of prices in a competitive market, by itself, is not sufficient to

establish that a generator lacks the opportunity to recover its costs. Indeed, it is fully expected

that where prices are set by competitive forces, rather than by regulatory order, prices will go up

and down as market conditions change and new entry and retirements occur. The fact that In-

City ICAP Spot Market Auction clearing prices for July and August were lower than those in

June, or during Summer 2010, is fully consistent with the Commission’s reliance on competitive

forces to regulate prices, and does not prove that generators are not able to recover their costs in

the NYISO-administered markets.65 Nor is it evidence that a “regulatory taking” has occurred.66

64 ISO New England, Inc. and New England Power Pool Participants Committee, 135 FERC ¶ 61,029 at P 254 (2011).

65 See also EL11-50 Answer at 11-16.

66 In order to prove a “regulatory taking,” generators would also have to show, in addition to establishing that they are being deprived of a reasonable opportunity to recover their costs -- that the market rules “amount to a deprivation of all or most economic use or a permanent physical invasion of property ” Full Value Advisors, LLC v. Securities and Exchange Commission, 633 F.3d 1101, 1109 (D.C. Cir. 2011) (citing Lingle v. Chevron U.S.A. Inc., 544 U.S. 528 (2005)). Complainants have not come close to establishing that such a deprivation of property rights has occurred.

17

D.It Is Complainants’ Who Fail to Correctly Articulate the Burden of Proof

Applicable to Parties Proposing Tariff Revisions Under Section 206 of the

FPA

Complainants’ allege that the NYISO has misstated the law regarding the burden of proof

applicable to tariff changes proposed under section 206 of the FPA. Under section 206, a

complainant must “satisfy a dual burden in order to obtain the relief it seeks in a complaint. The

complainant must establish that the current rate is unjust and unreasonable and the complainant

must then establish that its alternative rate proposal is just and reasonable.”67 Complainants’ cite

as support for their attempt to rewrite decades of well-established Commission precedent a per

curiam opinion of the Court of Appeals of the D.C. Circuit.68 However, Maryland Public

Service Commission v. FERC does not overturn the “dual burden” standard. Instead, the Court’s

statement, contained in a footnote, indicates that it is the Commission that ultimately bears the

responsibility to determine a just and reasonable rate, if complainants do not propose one.69 The

67 Arkansas Public Service Commission v. Entergy Corporation, et al., 128 FERC ¶ 61,020 at P

23 (2009); see also, Louisiana Public Service Commission v. Entergy Corporation, et al., 132 FERC

¶ 61,003 (2010) (same) Calpine Corporation, et al. v. California Independent System Operator

Corporation, 128 FERC ¶ 61,271 at P 39 (same) (2009); NRG Energy, Inc. v. Entergy Services, Inc.,

126 FERC ¶ 61,053 at P 31 (stating that “Section 206 of the FPA requires the complainant to satisfy a

dual burden in order to obtain the relief it seeks in a complaint. The complainant must establish that the

current rate in unjust and unreasonable and the complainant must then establish that its alternative rate

proposal is just and reasonable”); Ameren Services Co. and Northern Indiana Public Service Co. v.

Midwest Independent Transmission System Operator, Inc., 121 FERC ¶ 61,205 at P 32 (2007) (finding

that “[i]n a section 206 matter, the party seeking to change the rate, charge or classification has a dual

burden - it must first provide substantial evidence that the existing rate is unjust, unreasonable or unduly discriminatory, and then demonstrate through substantial evidence that the new rate is just, reasonable and not unduly discriminatory,” citing, FPC v. Sierra Pacific Power Co., 350 U.S. 348 (1956); Michigan

Electric Transmission Co., LLC, 116 FERC ¶ 61,164 at P 12 (2006)).

68 See Complainants’ Answer at 21, n. 85, citing, Maryland Pub. Serv. Comm’n v. FERC, 632 F.3d 1283, 1285 n.1 (D.C. Cir. 2011), Tennessee Gas Pipeline Co. v. FERC, 860 F.2d 446, 454 (D.C. Cir. 1988).

69 Maryland Pub. Serv. Comm’n v. FERC, 632 F.3d 1283, 1285 n.1 (D.C. Cir. 2011). Tennessee Natural Gas Pipeline v. FERC is also distinguishable, as it addresses the question of whether the

Commission could impose a new rate on a finding that a proposed rate is unjust and unreasonable.

Tennessee Gas Pipeline Co. v. FERC, 860 F.2d 446, 453-454 (D.C. Cir. 1988).

18

Court’s statement does not alter the Commission’s long-standing precedent70 requiring

complainants, to the extent that they propose a rate, to provide support proving such proposal is

just and reasonable.71 Thus, Complainants’ incorrectly articulate the applicable legal precedent.

E. The NYISO Is Not Seeking “Blind Deference” to its In-City Buyer-Side

Mitigation Determinations and Is Prepared to Fully Address Any Questions that the Commisison May Have

Complainants’ contention that the “Commission cannot defer blindly to the NYISO”72 is

irrelevant because the NYISO has never suggested that the Commission should do so. In Docket

No. EL11-50-000, the NYISO acknowledged that parties should be able to challenge NYISO

buyer-side mitigation determinations. The NYISO also proposed that the Commission strike a

balance between the confidentiality concerns of new entrants, the interests of other market

participants, and the Commission’s own interests in promoting economic investment, and

conserving its resources, by using its standard investigatory procedures to consider such

challenges. There is a large gap between Complainants’ claim that the NYISO is seeking the

Commission’s blind deference, and the reality that the NYISO has invited Commission review --

including the initiation of Part 1b investigations -- to consider past buyer-side exemption

determinations.

Nor is the NYISO suggesting that the Commission should “blindly defer” to the

NYISO’s position in this proceeding. Rather, the NYISO Answer asked that the Complaint be

rejected because Complainants had failed to meet their burden of proof or to justify the

extraordinary relief that they sought. It also emphasized that Complainants’ stated concerns that

the NYISO’s implementation of the In-City Buyer-Side Mitigation Measures would be flawed

70 California Municipal Utilities Association, et al. v. California Independent System Operator

Corporation, 126 FERC ¶ 61,315 at P 71 (2009) (delineating the long standing Commission precedent).

71 NYISO Answer at 20 (internal citations omitted).

72 Complainants’ Answer at 8.

19

was belied by the involvement of the independent MMU in the process as well as by the various

responses to Complainants’ claims that were included in the NYISO Answer.73 There is nothing

in the Complainants’ Answer that should cause the Commission to reach a different conclusion

now.

If the Commission were to decide, however, that it needs additional information

regarding determinations under the In-City Buyer-Side Mitigation Measures, notwithstanding the fact that they have not yet been completed, the NYISO would be prepared to submit the

necessary information to the Commission on a confidential basis. The Commission could then proceed in a manner similar to what the NYISO outlined in Docket No. EL11-50-000. Given the Complainants’ representation that they “do not seek” and have not sought “the confidential cost information or other data that the NYISO has received regarding any other supplier”74 they

should have no objection to this proposed procedure.

As discussed in the NYISO Answer, the Commission should not adopt a process that

converts the Complainants, or other market participants, into redundant de facto market

monitors.75 Complainants profess that they are not seeking to usurp roles properly left to the

NYISO and the MMU and merely seek to better understand the NYISO mitigation procedures.

Such representations are belied by their Complainants’ past statements,76 statements previously

made by their supporters,77 and by the Complainants’ Answer itself, which demands that the

NYISO “be directed to provide detailed information necessary for . . . market participants to

73 Complainants Answer at 8.

74 See id. at 3.

75 See NYISO Answer at 8, 67.

76 Complaint at 46 (stating that their objective is to be in a position to “confirm that the NYISO is, in fact, complying with the requirements of the Services Tariff”).

77 See IPPNY Comments at 7, 9, 11.

20

confirm that adjustments to gas pricing will not skew its Unit Net CONE calculations.”78

Indeed, Complainants appear at times to be unwilling to rely even on the Commission itself to oversee the NYISO’s mitigation determinations.79 The fact remains that allowing Complainants to routinely second-guess market power mitigation determinations made by independent entities is inappropriate and threatens to discourage economic entry.

V.CONCLUSION

For all of the reasons specified above, the Commission should accept this Supplemental Answer and deny all relief sought by the Complainants.

Respectfully submitted,

/s/ Gloria Kavanah

Gloria Kavanah

Senior Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144 518.356.6103

gkavanah@nyiso.com

August 8, 2011

78 Complainants’ Answer at 20.

79 See id. at 9-10 (“Moreover, as explained in the Complaint, even though the Commission could and should act to address the effects of uneconomic entry even after such entry has occurred, the

Commission’s demonstrated reluctance to do so made it imperative for Complainants to ensure that the Buyer-Side Market Power Rules were correctly implemented prior to the finalization of the NYISO’s

mitigation determinations.”)

21

CERTIFICATE OF SERVICE

I hereby certify that I have this day caused the foregoing document to be served on the official service list compiled by the Secretary in this proceeding.

Dated at Washington, DC, this 8th day of August, 2011.

/s/ Vanessa A. Colón

Hunton & Williams LLP

2200 Pennsylvania Avenue, NW Washington, DC 20037

(202) 955-1500

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Independent System Operator, Inc.Docket Nos. EL11-42-000

SUPPLEMENTAL AFFIDAVIT OF JOSHUA A BOLES

Mr. Joshua A. Boles declares:

1.I have personal knowledge of the facts and opinions herein and if called to testify

could and would testify competently hereto.1

I.Purpose of this Affidavit:

2.I submit this affidavit in support of the NYISO’s Answer to the Comments submitted

by Hudson Transmission Partners (the “HTP Comments”) in response to the

Complaint filed by Astoria Generating Company, L.P., the NRG Companies, and TC Ravenswood, LLC (collectively, the “Complainants”).

3. I provided an Initial Affidavit in this proceeding. In the Initial Affidavit, I refuted the

claims made by the Complainants that the NYISO’s implementation of the “In-City Buyer-Side Mitigation Measures,”2 has been flawed or will be flawed in the future. I demonstrated that the NYISO’s implementation adheres to all aspects of Attachment H and Attachment O to the Services Tariff and Commission Orders.

1

My professional and educational qualifications were summarized in PP 4-8 of my Initial

Affidavit in this proceeding which I incorporate here by reference.

2

As the NYISO does in the Answer, I use the term “In-City Buyer-Side Mitigation Measures” to

refer to the currently-effective buyer-side capacity market mitigation provisions in Attachment H to its

Market Administration and Control Area Services Tariff (“Services Tariff”), including those that were

accepted by the Commission in its series of orders in Docket ER10-3043.

4.The purpose of this Supplemental Affidavit is to confirm that the NYISO does

account for differences between generators and Unforced Capacity Deliverability

Right3 (“UDR”) projects when conducting Unit Net CONE calculations. My

Supplemental Affidavit also demonstrates that the methodology the NYISO uses to

determine Unit Net CONE for UDR projects is consistent with Attachment H and

Commission Orders.

II.Unit Net CONE Methodology for a UDR Project

5.The HTP Comments use the more general phrase “merchant transmission facility” to

describe the HTP project when expressing concerns regarding the NYISO’s analysis of a

merchant transmission facility. I will use the phrase UDR projects in my affidavit because

that is the term used in the In-City Buyer-Side Mitigation Measures which specify the

projects the NYISO is to examine.4 My Affidavit will only address UDR projects, such as the HTP project, that connect a neighboring Control Area to New York City.

6. Attachment H to the Services Tariff defines Unit Net CONE for purposes of the In-City

Buyer-Side Mitigation Measures as the “localized levelized embedded costs of a specified

Installed Capacity Supplier, including interconnection costs, and for an Installed Capacity

Supplier located outside the New York City Locality including embedded costs of

transmission service, in either case net of likely projected annual Energy and Ancillary

Services revenues, as determined by the ISO, translated into a seasonally adjusted monthly

3 Capitalized terms that are not otherwise defined herein shall have the meanings specified in the Services Tariff.

4 See, for example, Services Tariff Attachment H § 23.4.5.7.3.

UCAP value using an appropriate class outage rate.”5 The NYISO applies this definition in determining the Unit Net CONE for UDR projects.

7. The methodology the NYISO uses to determine Unit Net CONE for a UDR project has been

reviewed and commented on by the Independent Market Monitoring Unit (“MMU”) for the

NYISO, Potomac Economics, Ltd. The MMU has not identified any compliance concerns

with respect to the NYISO’s implementation of the In-City Buyer Side Mitigation Measures.

8. The NYISO’s approach to Unit Net CONE calculations for a UDR project is similar to its

approach for a new generation project in a number of ways. Both classifications of projects

are evaluated based on their reasonably anticipated costs minus their reasonably anticipated

revenues to determine if they are exempt or subject to an Offer Floor. For a UDR project

that connects to a neighboring Control Area, the costs and revenues associated with a UDR

project will be different from a new generator located within the New York Control Area.

9. The NYISO’s methodology includes looking at the levelized embedded costs of the

transmission facility, including the required upgrades necessary to make the facility

deliverable in New York City, and the costs of upgrades in the neighboring Control

Area that are required to export firm energy. The project is evaluated for the amount

of MW for which CRIS rights have been awarded at the NYCA interconnection point.

10. Costs, if any, for the project to be deliverable to the NYCA interface are a component

of Unit Net CONE because establishing deliverability is a prerequisite to obtaining

UDRs. The Services Tariff provides that “[t]o the extent the NYCA interface is with

an External Control Area the Unforced Capacity associated with UDRs must be

5 See Attachment H§23.2.1 at definition of Unit Net CONE.

deliverable to the Interconnection Point."6 In addition, a project must be deliverable

to qualify as an In-City capacity resource: “[t]o be counted towards the locational

component of the LSE Unforced Capacity Obligation, Unforced Capacity owned by

the holder of UDRs or contractually combined with UDRs must be deliverable to the

NYCA interface with the UDR transmission facility pursuant to NYISO requirements

and consistent with the election of the holder of the rights to the UDRs set forth in

this Section."7

11. In addition to the costs of the transmission facility itself, the NYISO’s analysis of a

UDR project connecting to a neighboring Control Area takes into account the cost of the capacity in the neighboring Control Area. This analysis is required because the In-City Buyer-Side Mitigation Measures are utilized to make determinations for InCity capacity resources. Without procuring capacity, a transmission line is not

capable of receiving ICAP revenues in the NYC capacity market. The NYISO would use a reasonable estimate of the cost of capacity in the neighboring Control Area

based on that Control Area’s capacity market clearing prices for the respective

location from which the capacity could be withdrawn.

12. To determine Unit Net CONE, the NYISO subtracts from the costs identified above,

the reasonably anticipated energy and ancillary services revenues. The model used to

determine energy revenues for a UDR project takes into account the price spread

between the respective locations in the Control Areas from which the power is

6 See Services Tariff§2.21 at definition of Unforced Capacity Deliverability Rights.

7 SeeServices Tariff §5.11.4.

exported and the location to which it is imported. In order to determine the price

spread that would induce arbitrage, the NYISO also considers the associated fees a

market participant pays to export energy from the neighboring Control Area. This fee

is used as the “hurdle rate” for when the model assumes a transaction will be

scheduled to flow and when it will not. In the hours in which the energy spread

exceeds the hurdle rate, this rate is subtracted from the spread to calculate the net

energy revenues. Because arbitraging prices between Control Areas does not occur

optimally in 100 percent of the hours when there is a price spread greater than the

transaction costs, the energy revenues must also be discounted to capture the

percentage of time that arbitrage can reasonably be expected to occur.

13. As stated in my Initial Affidavit, the NYISO contracted with NERA Economic

Consulting (“NERA”) to perform the energy revenue estimates for all Unit Net

CONE determinations. NERA uses its econometric model to estimate NYISO energy

prices at the expected excess capacity level used in the In-City Buyer-Side Mitigation

Measures. For a UDR project, instead of comparing those prices to the variable

operating costs of the unit, the NERA model compares them to the hourly energy

prices in the neighboring Control Area. NERA uses the econometric model to adjust

historic NYISO hourly prices for the applicable excess capacity level and then

compares the adjusted NYISO prices to those in the neighboring Control Area.

14. NERA has authorized the NYISO to state that they believe the analysis described in

this Supplemental Affidavit for UDR project net revenues provides reasonable net revenue estimates.

15.The NYISO’s analysis takes into account the other costs and revenues that the UDR

project would be reasonably anticipated to incur or receive under the neighboring Control Area’s tariff. For example, for a UDR project that connected PJM to New York City, the NYISO would consider whether Auction Revenue Rights (“ARRs”) are available to a project.

Conclusion

16. This Affidavit demonstrates that the NYISO’s methodology to implement the In-City

Buyer-Side Mitigation Measures for UDR projects that connect to the NYCA from a neighboring Control Area is consistent with all aspects of Attachment H to the

Services Tariff.

This concludes my affidavit.