HUNTON & WILLIAMS LLP

1900 K STREET, N.W.

WASHINGTON, D.C. 20006-1109

TEL202 • 955 • 1500

FAX202 • 778 • 2201

TED J. MURPHY

DIRECT DIAL: 202 • 955 • 1588

EMAIL: tmurphy@hunton.com

July 7, 2011FILE NO:

Honorable Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc., Errata to July 7, 2011

Answer in Docket No. EL11-42-000

Dear Secretary Bose:

On July 6, 2011, the New York Independent System Operator, Inc. (“NYISO”)

electronically submitted its Answer in the above-captioned proceeding. Two errors in that filing

have subsequently come to the NYISO’s attention. First, the affidavits of Joshua A. Boles and

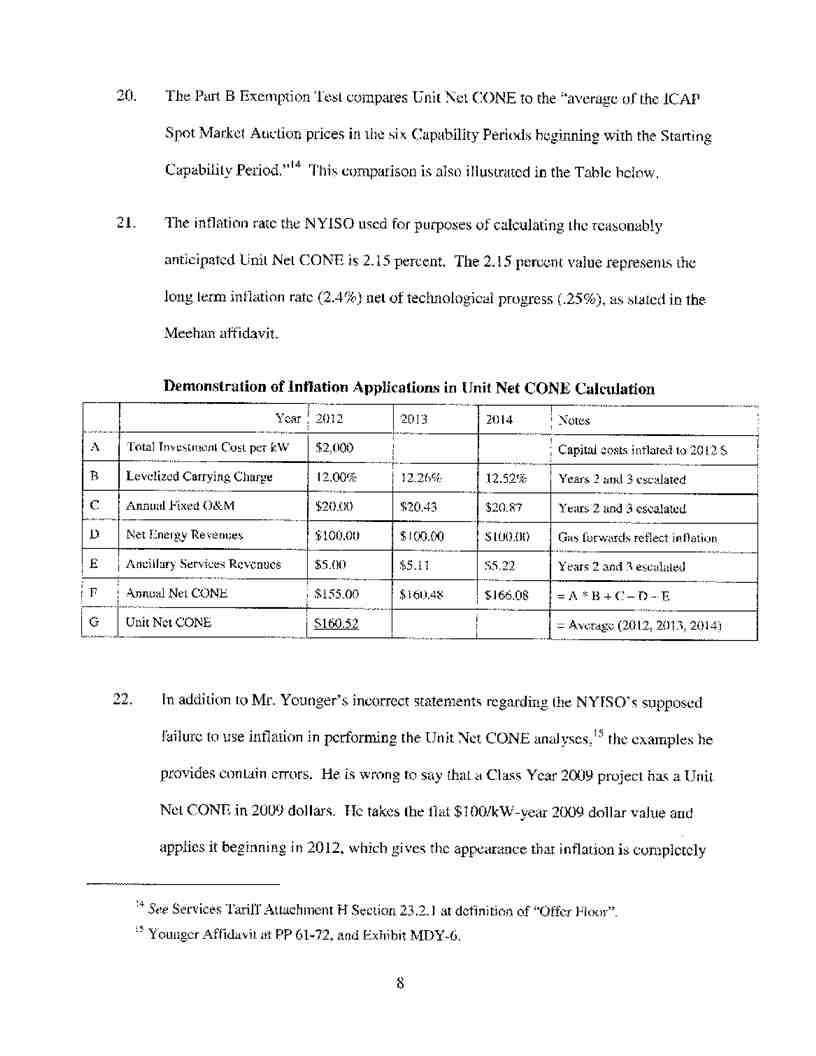

Eugene T. Meehan, Attachments 2 and 3 to the Answer, were included when the NYISO

distributed the Answer to the service list on July 6, 2011, but were inadvertently omitted from

the electronic version of the Answer filed with the Commission. Second, Attachment 1 to the

Answer, i.e., the NYISO’s formal recitation of admissions, denials, and defenses under

Commission Rule 213(c)(2), was inadvertently omitted from both the electronically filed and

served copies of the Answer.

In order to correct these inadvertent omissions the NYISO is re-submitting and serving a complete version of the Answer. The complete version includes: (i) Attachment 1 to the

Answer; and (ii) copies of Attachments 2 and 3 to the Answer as they were distributed to the service list on July 6, 2011.

Respectfully submitted,

s/ Ted J. Murphy________________ Ted J. Murphy

Hunton & Williams, LLP

ATLANTA AUSTIN BANGKOK BEIJING BRUSSELS CHARLOTTE DALLAS HOUSTON LONDON LOS ANGELES

McLEAN MIAMI NEW YORK NORFOLK RALEIGH RICHMOND SAN FRANCISCO TOKYO WASHINGTON

www.hunton.com

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person designated on the official service list compiled by the Secretary in this proceeding in

accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18

C.F.R. § 385.2010.

Dated at Washington, DC this 7th day of July, 2011.

/s/ Ted J. Murphy

Ted J. Murphy

Hunton & Williams LLP 1900 K Street, NW

Washington, DC 20006-1109 (202) 955-1500

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

Astoria Generating Company, L.P., NRG Power Marketing LLC, Arthur Kill Power LLC, Astoria Gas Turbine Power LLC,

Dunkirk Power LLC, Huntley Power LLC, Oswego Harbor Power LLC and TC

Ravenswood, LLC

Complainants,

vs.

New York Independent System Operator,

Inc.

Respondent.

)

)

)

)

)

)

)

)Docket No. EL11-42-000

)

)

)

)

)

)

)

ANSWER OF THE NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

Pursuant to Rule 213 of the Commission’s Rules of Practice and Procedure1 and the Commission’s June 30, 2011, Notice of Extension of Time the New York Independent System Operator, Inc. (“NYISO”) respectfully submits this answer to the June 3, 2011 Complaint Requesting Fast Track Processing (“Initial Complaint”) and the June 16 Amendment to

Complaint and Request for Shortened Comment Period (“Amended Complaint”) (collectively,

the “Complaint”) in this proceeding. As the NYISO explains in the sections that follow, the

Complaint must be denied because the Complainants2 have not met their burden of proof.

Complainants rely on little more than speculation and mischaracterization to support their

claims. They have not shown that they have suffered, or will suffer, any harm. The entire

1 18 C.F.R. § 385.213 (2011).

2 The Complainants are Astoria Generating Company, L.P., the NRG Companies, and TC

Ravenswood, LLC. These entities have participated in recent NYISO proceedings involving capacity market mitigation and ICAP Demand Curve issues as the “New York City Suppliers.”

1

Complaint makes only a single point that touches on a legitimate market design question, and even that relates to a new issue that is not yet ripe for consideration by the Commission. The Complaint includes many more arguments that are no longer ripe for consideration because they constitute impermissible collateral attacks on settled precedent.

The NYISO has complied, and will continue to comply in the future, with all applicable tariff requirements and Commission policies. Indeed, it is the Complainants that are seeking to force the NYISO to take actions that would violate both its tariff and Commission precedent. Similarly, although the Complainants wrongly accuse the NYISO of “cherry-picking” rules and inputs from pending compliance filings to use in its mitigation determinations, it is actually Complainants that selectively seek to implement tariff provisions that have not yet been

accepted, or that have been rejected, by the Commission.

There is no basis for adopting any of the tariff revisions that Complainants would impose

on the NYISO and all other stakeholders in contravention of the shared governance process for

submitting tariff revisions under Section 205 of the Federal Power Act (“FPA”). Complainants

have not shown that the NYISO’s existing tariff revisions are unjust or unreasonable, or that their

proposed vague changes would be just and reasonable as required under FPA Section 206.

There is also no justification for holding the NYISO’s Class Year3 Facilities Study

process in indefinite abeyance. Such a “remedy” would harm both project developers and the

markets without serving any legitimate purpose. As the NYISO has explained in its preliminary

3 Capitalized terms that are not otherwise defined herein shall have the meaning specified in the

NYISO’s Market Administration and Control Area Services Tariff (“Services Tariff”) and if not defined

therein, they shall have the meaning specified in the NYISO’s Open Access Transmission Tariff

(“OATT”).

2

answers in this proceeding,4 and reiterates below, Complainants’ repeated suggestions that such

an extraordinary Commission action is necessary to prevent irreparable harm to themselves or

the market are wrong. Complainants also have not justified the equally extraordinary step of

shifting market power mitigation responsibilities from the NYISO to the independent market

monitoring unit (“MMU”) in contravention of the NYISO tariff and Commission precedent.

Finally, the Complainants must not be permitted to usurp the roles of the NYISO and the

MMU in detecting and mitigating market power in the New York City (“In-City”) capacity

market. Allowing them to do so would create a real risk that economic new investments would

be discouraged.

I.EXECUTIVE SUMMARY

The Complaint must be denied because Complainants have not met their burden of proof under FPA Sections 206 and 306 or Commission Rule 206. Instead of presenting clear evidence of NYISO tariff violations that have resulted, or will result, in actual harm to them,

Complainants rely on incorrect and speculative assertions and assumptions, as well as

mischaracterizations of the Services Tariff and the NYISO’s own statements. Many of their

arguments must also fail because they are collateral attacks on earlier Commission orders.5 The critical flaws underlying Complainants’ various claims are summarized below and then refuted in detail in subsequent sections of this Answer.6

4

See Preliminary Answer of the New York Independent System Operator, Inc. (June 6, 2011) at

2-3, Answer to the Amendment to Complaint and Request for Shortened Comment Period (June 17, 2011)

at 2-3, Docket No. EL11-42-000.

5 See Section III.B below.

6 In addition, Attachment 1 to this Answer addresses the formal requirements of Commission Rule 213(c)(2) in order to ensure the NYISO’s compliance with them.

3

Complainants claim that the NYISO’s implementation of the “In-City Buyer Side

Mitigation Measures”7 is not governed by objective tariff criteria and lacks sufficient

transparency. The truth is that Attachment H to the Services Tariff includes detailed rules

governing each facet of the NYISO’s administration of the In-City Buyer Side Mitigation

Measures.8 The NYISO has provided market participants with more information regarding its

implementation of those rules than Attachment H and Commission policy require. At the same

time, it has appropriately limited access to information that, if shared publicly, would violate

tariff and Commission policy requirements that protect confidential information.9 The NYISO

affords similar protection for confidential information when it administers its supplier-side

capacity mitigation measures. Complainants have never objected to that treatment and have

provided no basis for weakening the protection of their competitors’ confidential information.

The NYISO has not cut-off further communication with market participants regarding its

administration of the In-City Buyer Side Mitigation Measures. To the contrary, the NYISO has

told stakeholders that it intends to continue the discussion on a number of issues, including two

that receive considerable attention in the Complaint. The NYISO told stakeholders, prior to the

Complainants’ filing, that it was evaluating the question of whether Offer Floors, once

determined, should escalate, and would follow up on that question with stakeholders.10 The

Complaint obfuscates this issue unnecessarily by incorrectly asserting that the NYISO does not

7 The NYISO uses “In-City Buyer Side Mitigation Measures” to refer to the currently-effective buyer-side capacity market mitigation provisions in Attachment H to its Services Tariff, including those that were accepted by the Commission in its series of orders in Docket ER10-3043.

8 See Sections III.C.1.a.i and iii below.

9 See Sections III.C.1.a.ii and iii below.

10 See Sections II.D and III.C.5.b below.

4

account for inflation when calculating the Offer Floor. In fact, the NYISO does.11 In any event,

the NYISO’s view is that providing for the escalation of Offer Floors after they are determined,

could improve the In-City Buyer Side Mitigation Measures. The Services Tariff, however,

currently does not authorize escalation of an established Offer Floor, specify the escalation rate,

or provide any other guidance as to how escalation should be performed. The NYISO believes

that the necessary design elements should and can be developed through a process that considers

stakeholder input.12

Similarly, the NYISO told stakeholders, prior to the Complainants’ filing, that it intends

to provide a numerical example to demonstrate how the buyer-side Offer Floor is calculated.

The NYISO disagrees with certain aspects of the “benchmarking analysis” that Complainants

assert the NYISO must be compelled to undertake, including their notion that it must be done

before the In-City Buyer Side Mitigation Measures are implemented. Nevertheless, the NYISO

is striving to provide stakeholders with a useful illustration in response to Complainants’ May

2011 request for an analysis. The NYISO intends to do so as soon as reasonably practicable

given the limitations on its resources.13

Complainants assert that greater transparency is needed so that they may review the

NYISO’s implementation of the In-City Buyer Side Mitigation Measures in order to ensure that

the NYISO has complied with its tariff. The role that Complainants envision for themselves is

neither necessary nor appropriate. It is unnecessary because Potomac Economics, Ltd., the

independent MMU for the NYISO, already works closely with the NYISO and assists it in its

implementation of the In-City Buyer Side Mitigation Measures, to the extent permitted by

11 See Section III.C.2 below.

12 See Section III.C.5.b below.

13 See Section II.D below.

5

Commission Order No. 719 and the Services Tariff. If the NYISO were to fail to follow its tariff, the MMU is responsible for referring the matter to the Commission.14 The MMU has authorized the NYISO to state that it has not, to date, identified any tariff compliance concerns with respect to the NYISO's implementation of the In-City Buyer Side Mitigation Measures. Complainants are therefore in effect arguing that the Commission must allow them to second guess both the NYISO’s and the MMU’s determinations.

Complainants’ proposal to appoint themselves as de facto market monitors is also

inappropriate because they lack the independence to be entrusted with market monitoring and

market power mitigation responsibilities. As owners of substantial In-City generating resources,

Complainants have a clear economic incentive to try to discourage new entry that might compete

with them, regardless of whether that entry would be economic. Providing greater

“transparency” in order to enable Complainants to play a larger role in the market monitoring

function, would thus likely discourage new entry, not encourage it as they claim.15

Complainants also accuse the NYISO of “cherry-picking” the rules and inputs used under the In-City Buyer Side Mitigation Measures. Their assertion is exactly backwards. The NYISO is following the Services Tariff’s requirements. Where Commission-accepted tariff language directs the NYISO to use “currently effective” values, that is what the NYISO does. 16

Conversely, where Commission-accepted language requires the use of “reasonably anticipated”

values, the NYISO will use them.17 It is Complainants that would have the NYISO ignore its

14 See Section II.C and below

15 See Section III.C.4.a below

16 See Section III.C.4.a below

17 See Section III.C.4.b below

6

tariff and use not yet accepted ICAP Demand Curve values that would favor their own financial interests.

Complainants fail to demonstrate that the market, or they themselves, would actually be

harmed even if the NYISO were to make the implementation errors that they allege (which the

NYISO does not concede.) Even if one were to accept all of the Complaints’ claims, the

combined impacts of the NYISO’s supposed “errors” would not harm either Complainant that

has disclosed that it has a project that is currently being examined under the In-City Buyer Side

Mitigation Measures.

Complainants have failed to show that the NYISO’s practices are in any way inconsistent with the Services Tariff or Commission policy. They have presented no evidence demonstrating that the tariff is not just and reasonable. They have only offered general concepts for alternative tariff provisions, and they have not even demonstrated that those concepts are just and

reasonable. They have therefore not met the “dual burden” of proof to justify tariff revisions

under Section 206 of the FPA. The mere fact that a NYISO determination results in lower

revenues for Complainants, or in new capacity resources clearing the market before those owned by Complainants, does not mean that the determination is an “error,” a tariff violation, or a

justification for revising the Services Tariff.

Complainants also have not presented any evidence that would justify granting the other

forms of extraordinary relief that they seek. For example, they have not demonstrated that there

is any need to hold the NYISO’s Class Year Facilities Study process in abeyance.18 They have

not even acknowledged the harm that this “remedy” would cause. Similarly, they have fallen far

short of justifying the extraordinary measures of: (i) transferring the responsibility for mitigation

18 See Section III.E below.

7

functions that the NYISO is responsible for performing under its tariff to the MMU;19 or (ii)

overriding the MMU’s discretion to determine what issues warrant its attention and how it

should use its resources. Their requests also would violate the existing Services Tariff.

In short, Complainants have not met their burden of proof and have failed to show that

the NYISO: (i) is calculating Unit Net CONE in a manner that is inconsistent with the Services Tariff or Commission precedent;20 (ii) is impermissibly making mitigation determinations using “outdated” ICAP Demand Curve and Mitigation Net CONE (or Net CONE) data;21 (iii) “does

not plan to adjust Offer Floors;”22 (iv) has erred to the extent that it has not followed PJM’s

example of using the exact same assumptions for ICAP Demand Curve and mitigation

purposes;23 or (v) would fail to review contracts that are necessary for it to make reasonable

Unit Net CONE determinations.24

Accordingly, there is no basis for the Commission to: (i) require the NYISO to “correct”

supposed “flaws” in its implementation of the In-City Buyer Side Mitigation Measures or to

“clarify” the tariff in order to make such “corrections;”25 (ii) direct the NYISO to file tariff

revisions “clarifying” how the mitigation and Offer Floor determinations are made in order to

establish more objective tariff criteria or greater transparency;26 (iii) order the NYISO to file a

“benchmarking analysis;”27 (iv) compel the MMU to file a report regarding the NYISO’s

19 See Section III.G below.

20 See Section III.C.2 below.

21 See Section III.C.4 below.

22 See Section III.C.2 below.

23 See Section III.C.3 below.

24 See Section III.C.6 below

25 See Sections III.B,C and D below.

26 See Section III.C.1 below.

27 See Sections II.D and III.C.1.b below.

8

implementation of the In-City Buyer Side Mitigation Measures;28 or (v) “consider” whether the MMU should implement the In-City Buyer Side Mitigation Measures in the future.29 Instead, the Commission should deny the Complaint in its entirety.

II.BACKGROUND

A.Overview of the In-City Buyer Side Mitigation Measures

The In-City capacity markets are organized around a series of NYISO-administered

ICAP auctions. Because the In-City capacity market has traditionally been highly concentrated, it has been subject to market power mitigation measures since the NYISO’s inception in 1999.30 The current capacity mitigation regime was developed through multiple rounds of proceedings before the Commission31 beginning in 2007, and went into effect in 2008. The mitigation

measures include an ICAP Spot Market Auction offer cap and a must-offer provision to mitigate withholding by Pivotal Suppliers of ICAP. The In-City ICAP mitigation measures also include a set of buyer-side mitigation measures which are designed to guard against the exercise of buyerside market power in the In-City ICAP markets.32

28 See Section III.G below.

29 See Section III.G below.

30

See Consol. Edison Co. of New York, Inc., 84 FERC ¶ 61,287 (1998) (accepting a $105/kW-

year offer and revenue cap on ICAP sales by New York City generators divested by Consolidated Edison

Company of New York, Inc.)

31

The existing mitigation structure was most recently addressed by the Commission in its May

2010 Order, New York Independent System Operator, Inc., 131 FERC ¶ 61,170 (2010), and in its

subsequent orders addressing the NYISO’s proposed enhancements to the In-City Buyer Side Mitigation

Measures, New York Independent System Operator, Inc., 133 FERC ¶ 61,178 (2010) (November 2010

Order); New York Independent System Operator, Inc., 134 FERC ¶ 61,083 (2011); New York

Independent System Operator, Inc., Letter Order, Docket No. ER10-3043-003 (March 17, 2011).

32 Id. at P 2.

9

Unless exempt from the buyer-side mitigation measures, ICAP Suppliers (other than

Special Case Resources (“SCRs”))33 that enter the In-City Capacity market are required to offer

UCAP into the ICAP Spot Market Auctions and must do so at a price no lower than the Offer

Floor. An ICAP’s Supplier’s Offer Floor is set at the lower of Unit Net CONE or 75% of

Mitigation Net CONE.34 To prevent circumvention of the Offer Floor, capacity that is subject to

an Offer Floor can only be offered into the ICAP Spot Market Auction;35 it cannot be certified

towards bilateral capacity transactions or sales in a Capability Period or Monthly Auction. The

Offer Floor is thus a deterrent to uneconomic entry because an Installed Capacity Supplier that is

subject to it would only receive capacity revenue in months when its Offer Floor was below the

ICAP Spot Market Auction Market-Clearing Price. A new Installed Capacity market entrant is

exempt from the Offer Floor if it passes the NYISO’s mitigation exemption tests set forth in

Services Tariff Attachment H.

B. Recent Enhancements to the In-City Buyer Side Mitigation Measures

33

The Complaint, with the sole exception of the Affidavit of William Hieronymus (“Hieronymus

Affidavit”) does not raise issues regarding mitigation measures applicable to Special Case Resources

(”SCRs”) or the NYISO’s implementation thereof. Nor does it appear to propose to modify existing, or

propose new, provisions applicable to SCRs. Accordingly, references herein to Installed Capacity

Suppliers, the mitigation of capacity suppliers, and similar terms do not refer to SCRs. However, should

Complainants argue, or the Commission consider Complainants’ statement regarding SCRs, through Mr.

Hieronymus, to be at issue in this proceeding, the NYISO denies any such claim and wiould respectfully

seek to supplement this Answer. See Hieronymus Affidavit at 13 (referring to “the substantial amount of

demand-side capacity and capacity bids from renewable resources that may be subsidized or compelled to

be built for public policy reasons.”)

34 The NYISO proposed to add “Mitigation Net CONE” to the definition section of Attachment H in its compliance with the Commission’s May 20, 2010 order, New York Independent System Operator, Inc., 131 FERC ¶ 61,170 (2010) (“May 2010 Order”). See New York Independent System Operator,

Inc., Compliance Filing, Docket No. ER10-2210-000, et al (August 12, 2010) (“August 2010 Compliance Filing”). The August 2010 Compliance Filing is currently pending before the Commission; however, the Commission has already accepted the use of the term “Mitigation Net CONE” in Attachment H. See

Services Tariff Attachment H Section 23.4.5.7.3.2.

35 See Attachment H, Section 23.4.5.7.1. The Services Tariff provides that an Installed Capacity Supplier subject to an Offer Floor shall cease to be subject to it for that portion of its UCAP that has cleared for any twelve, not-necessarily consecutive, months (the “Duration Rule”). See Services Tariff Attachment H Section 23.4.5.7.

10

Prompted by its experience implementing the In-City buyer-side mitigation measures,

and by stakeholder comments, the NYISO began exploring possible improvements to the

measures in 2009. The effort became more focused after the MMU issued its 2009 State of the

Market Report36 in April 2010. That report concluded that the In-City supply-side mitigation

measures appeared to be working well but that it was too early to evaluate whether the buyer-

side Offer Floor had been effective. The MMU noted that it had reviewed the “detailed

thresholds and testing procedures used to implement the offer floor” and recommended that the

NYISO review “the thresholds and procedures used to implement the offer floor, and identify

those that may: cause uneconomic entry to be exempted from the floor; or erect an inefficient

barrier to economic entry.”37

Subsequently, in May 2010, the NYISO proposed a number of improvements to the In-

City buyer-side mitigation measures for stakeholders to consider.38 Over the course of several

months, and six stakeholder meetings, the NYISO’s preliminary suggestions evolved into

proposed tariff enhancements that were approved in its stakeholder process and filed under

Section 205 of the FPA on September 27, 2010.39 Notwithstanding Complainants’ suggestions

36 See Potomac Economics, LLC, April 2010. 2009 State of the Market Report. Available at:

http://www.nyiso.com/public/webdocs/documents/market_advisor_reports/2009/2009_NYISO_SOM_Fina

l_4-30-2010.pdf.

37 Id. at 180.

38 By contrast, the NYISO did not propose any changes to its supplier-side capacity mitigation rules, in part because the MMU did not recommend any such changes.

39

See Proposed Enhancements to In-City Buyer-Side Capacity Mitigation Measures, Request for

Expedited Commission Action, and Contingent Request for Waiver of Prior Notice Requirement, Docket

No. ER10-3043-000 (September 27, 2010) (“September Filing”) The September Filing was clear that

“any exemption or Offer Floor determinations” under the version of Attachment H effective prior to the

effectiveness of the revisions that it proposed “would not be altered or affected by the amendments

proposed in this filing.” See September Filing at 14. See also, Request for Leave to Answer and Answer

of the New York Independent System Operator, Inc., filed November 1, 2010 (“November Answer”) at 14,

n. 39, Docket No. ER10-3043-000.

11

to the contrary,40 the enhancements were carefully designed to “increase transparency to all

Market Participants, provide potential new entrants with greater certainty at the time that they must make critical investment decisions, and prevent new entrants from facing either under- or over-mitigation while protecting the market from the consequences of both.”41 With the single exception of the proposed duration for which a mitigated Installed Capacity Supplier would be subject to the Offer Floor, the MMU supported the NYISO’s entire package of proposed

enhancements finding that they “improved clarity to how the various tests will be applied and how the mitigation will be implemented.”42

On November 26, 2010, the Commission issued an order that generally accepted the

NYISO’s proposed tariff enhancements, subject to conditions.43 Contrary to Complainants’

mischaracterizations, the November 2010 Order was not a rebuke to what they depict as a

NYISO attempt to “significantly cut short the duration of the Offer Floor” in order to “water

down” the In-City buyer-side mitigation measures.44 In reality, the Commission rejected one

component of the NYISO’s proposed enhancements to the Offer Floor duration rule45 (the

40

See Initial Complaint at 22-23.; Younger Affidavit at 9-12, 30-31.

41

See September Filing at 1.

42

See Motion to Intervene and Comments of the New York ISO’s Market Monitoring Unit filed

October 22, 2010, Docket No. EL10-3043-000, at 2. Complainants are therefore at best disingenuous

when they state that the September 27 Filing was made “over the objections of .the MMU... ” See

Initial Complaint at 15.

43

See November 2010 Order at PP 49-52, 71-74. The aspects of the proposed tariff

enhancements that the November 2010 Order required the NYISO to revise or further justify are not the

subject of the Complaint: e.g., the rules governing the duration of mitigation and the application of the previously effective “reasonably anticipated entry date rule” when examining a project in a Class Year prior to 2009 for which a mitigation determination had not yet been issued.

44 Initial Complaint at 15. Indeed, the NYISO proposed, over the objections of load interests, to maintain a then-existing tariff rule establishing a three year minimum Offer Floor duration. That

proposal, which is hardly consistent with Complainants’ misleading depiction of the NYISO’s purpose, was rejected by the November 2010 Order. See November 2010 Order at P 51.

45 See Services Tariff Attachment H Section 23.4.5.7.

12

“Duration Rule”) because it concluded that an alternative to the NYISO-proposed rule would, with one modification, be superior.46 Complainants’ objections to other NYISO-proposed

enhancements were generally rejected and the NYISO’s objective of fostering greater

transparency, certainty, and consistency with other rules was satisfied. Complainants submitted a request for rehearing of the November 2010 Order, which is still pending, but which raised

only relatively narrow issues.47

When it made the September Filing, the NYISO indicated that action on identified

additional potential enhancements to the In-City Buyer Side Mitigation Measures was being

deferred to allow more time for further stakeholder consideration, in some cases as a result of

stakeholder votes48 expressly asking the NYISO to do so, and in others, as a result of NYISO

46

See November 30 Order at P 48 (“Under the current rules, mitigation will be lifted after the

later of when the capacity surplus (included that created by the new entry) is expected to be absorbed

(based on historical load growth) or three years. NYISO proposes to maintain this approach in its first

methodology option in its proposed Services Tariff section 23.4.5.7(a), but proposes to use forecasted

instead of historical load growth in the determination... We find that, although the capacity absorption

concept that we previously accepted conceptually is a reasonable one for determining when new resources

are likely to become economic, actually observing that the new capacity is accepted in the market at a

price approximating its cost of entry, as reflected in NYISO’s second duration methodology in proposed

section 23.4.5.7(c) discussed below, is not subject to the ambiguities and complexities inherent in a

method that relies on forecasts of load growth and other factors to estimate when the absorption of surplus

capacity has occurred. Therefore, we reject the first offer floor duration methodology in proposed section

23.4.5.7(a).”)

47

See Request for Clarification or in the Alternative Rehearing of the New York City Suppliers,

Docket No. ER10-3043-002 (December 22, 2010) (seeking clarification or rehearing with respect to the

timing of exemption testing.)

48

The NYISO’s stakeholder Business Issues Committee voted to hold additional discussions

regarding the appropriate treatment of facilities that are “repowered” or that uprate their Capacity. See

<http://www.nyiso.com/public/webdocs/committees/bic/meeting_materials/2010-08-

04/Final_Motions_revised.pdf> (Motions 4 and 4A). The stakeholder Management Committee likewise

voted for additional discussions regarding the timing and manner of Offer Floor determinations for a

facility initially found to be only partially deliverable (and therefore initially permitted to sell only the

deliverable portion of its Capacity) that subsequently seeks permission to sell additional capacity. See

<http://www.nyiso.com/public/webdocs/committees/mc/meeting_materials/2010-08-

25/082510_final_Motions.pdf> (Motion 5).

13

Board of Directors’ decision.49 As with any other tariff revision proposal, the NYISO will

present it first to stakeholders for their review and vetting at ICAP Working Group meetings, and if there is support for a proposal, present it for a vote in the NYISO’s stakeholder process.

C. The NYISO’s Administration of the In-City Buyer-Side Mitigation Measures

The NYISO diligently fulfills its market monitoring and mitigation responsibilities,

including those regarding the In-City Buyer-Side Mitigation Measures. The NYISO recognizes

the necessity of both supply-side and buyer side mitigation rules and is not an “enthusiastic

proponent”50 of one relative to the other. There is no evidence or precedent suggesting that the

NYISO is more diligent-, or aggressive in its implementation of supplier-side measures. As

noted above, the NYISO proposed enhancements to the buyer-side measures, but not its supplier-

side capacity mitigation rules, because there was a clear basis for improving the former but not

the latter. Further, when the Commission asked the NYISO to evaluate the narrowing of the

supplier-side capacity mitigation exemption, the NYISO conducted an analysis and concluded

that it should not be narrowed.51 The NYISO has pursued, and will continue to pursue, the

design of well-balanced rules. It has implemented, and will continue to implement, the rules

impartially.

The NYISO strives to implement all of its mitigation measures with as much

transparency as reasonably practicable, consistent with its obligation to preserve the

confidentiality of a supplier’s commercially sensitive information, the limits on its resources, and

the dictates of administrative efficiency. Balancing the need for transparency against these other

49 The Board of Directors instructed the NYISO to explore several further possible enhancements to the In-City Buyer-Side Mitigation Measures with stakeholders. See Section IV, below.

50 See Initial Complaint at 2

51 See August 2010 Compliance Filing at 15-16.

14

factors is not the simple task that Complainants would have the Commission believe it is. The importance of both promoting transparency and protecting the confidentiality of commercially sensitive information is well established.52

The NYISO tariffs likewise include a number of provisions that require it to preserve

confidentiality, regardless of whether the “owner” of the information is a proposed new entrant

or an incumbent generator.53 The NYISO’s protection and treatment of confidential information

is evidenced by: (i) its practices regarding the determination of Going Forward Costs;54 (ii) and

the manner in which it seeks confidential treatment for, and masks information regarding,

potential capacity withholding behavior.55 Likewise, the NYISO was not required to disclose

whether or when it made a determination, and if so, whether a proposed project was determined to be exempt or subject to an Offer Floor, under the version of the buyer-side mitigation tariff provisions that were in effect prior to the November 2010 Order. Therefore, it would not have disclosed such information. To the best of the NYISO’s knowledge, no party sought to include in the previously effective version of the NYISO’s buyer-side mitigation tariff provisions a provision that would require the disclosure of such information.

There can be no question that the entrant-specific cost information for Offer Floor and

mitigation exemption analyses warrants confidential treatment.56 Even Complainants do not

claim a right to access such information or that it is needed even under their concept of what

52 See, e.g., Order No. 719 at P 424.

53 See, e.g., sections 30.6.2.1, 30.6.4of the NYISO Market Monitoring Plan, Article 6 of the

Services Tariff, and the Code of Conduct rules in NYISO OATT Attachment F, Section 12.4.

54 See Section III.C.1.a.iibelow.

55 See New York Independent System Operator, Inc., 129 FERC P 61,103 (2009). As an example

of the NYISO’s treatment of confidential information, see the NYISO’s Annual Report on ICAP Demand

Curves and New Generation Projects, Docket Nos. ER01-3001-000 and ER03-647-000, filed December

20, 2010, at 2.

56 See, e.g., Order No. 719 at PP 423-24.

15

transparency entails.57 Indeed, they profess that they “are not seeking access to confidential

information that new entrants provide to the NYISO in the course of the mitigation process58 or

the “disclosure of confidential cost data about any particular new entrant.”59

The NYISO’s tariff establishes objective mitigation criteria that constrain its discretion. Far from seeking to expand that discretion, the September Filing’s enhancements to the In-City Buyer-Side Mitigation Measures further limited it by adopting more detailed language and

specifying inputs and parameters for the individual unit exemption and Offer Floor

determinations. For example, the revisions specify the timing of the examination60 and specific

inputs into the forecast.61

Moreover, the NYISO does not implement the In-City Buyer-Side Mitigation Measures

in isolation. Attachment H provides that “the ISO shall seek comment from the Market

Monitoring Unit on matters relating to the determination of price projections and cost

calculations.”62 The scope of the MMU’s role, and the appropriateness of the various

responsibilities that it and the NYISO’s internal Market Mitigation and Analysis Department

(“MMA”) perform was reaffirmed in the Commission proceeding on the NYISO’s Order No.

719 compliance filing.63 The Affidavit of Joshua A. Boles that is Attachment 2 to this filing (the

57 See Initial Complaint at pgs. 22-25. The NYISO understands that its concern for

confidentiality with respect to buyer-side mitigation measures is not unique among ISOs/RTOs.

58 Initial Complaint at 46.

59 Initial Complaint at 45.

60 Attachment H Section 3.4.5.7.3.3.

61 Attachment H Section 23.4.5.7.3.2.

62 Attachment H Section 23.4.5.7.3.3.

63 See New York Independent System Operator, Inc., 129 FERC ¶ 61,164 (2009); order on reh’g., New York Independent System Operator, Inc., 131 FERC ¶ 61,114 (2010), order denying reh’g. and

granting clarification, New York Independent System Operator, Inc., 133 FERC ¶ 61,123 (2010).

16

“Boles Affidavit”) confirms that the NYISO fulfills its tariff obligations.64 The NYISO works

closely with the MMU as part of its effort to ensure that all assumptions regarding CONE,

energy and ancillary services net revenues, and capacity prices are reasonable and that the

resulting exemption determinations are sound. If the MMU were to ever have any concerns with the NYISO’s approach it would have all of the information needed, and every opportunity, to raise them with the NYISO or with the Commission.

Complainants’ attack on the NYISO’s practices is another facet of their untimely effort to

challenge the Commission’s determinations in the November 2010 Order. In spite of their

submission of multiple pleadings65 on the proposed tariff revisions, including a petition for

rehearing, the Complaint represents the first time that Complainants have challenged the

reasonableness of the Attachment H provisions delineating what and when information must be

provided.66 As discussed below, this aspect of the Complaint is part of a broader collateral attack

on earlier Commission orders. It is also an attempt to circumvent the NYISO stakeholder

process to the extent that they seek to further increase - beyond the level of detail added by the

September Filing - Attachment H’s requirements regarding the amount and timing of

information disclosures.

D. The NYISO Responded Reasonably to Complainants’ Questions Regarding

the NYISO’s Implementation of the In-City Buyer-Side Mitigation Measures

64 See Boles Affidavit at P 12

65 Complainants have thus filed a total of eight pleadings addressing the In-City Buyer Side Mitigation Measures.

66 The Initial Complaint does not accuse the NYISO of violating any of the other In-City Buyer

Side Mitigation Measures or its market monitoring related tariff provisions. Nor does it appear to make

any challenge related to the buyer-side capacity mitigation measures that were in place prior to the

November 27, 2010 effective date of the tariff enhancements accepted by the November 2010 Order.

17

As is discussed in Section ___, below, and in earlier NYISO filings,67 considerations

regarding commercially sensitive information and a Commission determination on certain

proposed tariff revisions necessitated some delay in the NYISO’s response to the questions that

Complainants reference in the Complaint. Although the NYISO responded to all of

Complainants’ questions, the confidential nature of certain information prevented the NYISO

from answering all of Complainants questions to their satisfaction. Nevertheless, the NYISO has provided more information than is required under its tariffs and will provide still more in the

future as it has stated it would do.

The NYISO informed stakeholders that it would be continuing the discussion of

implementation questions involving the In-City Buyer Side Mitigation Measures. Specifically,

with respect to the question of whether the Offer Floor, once determined, should be escalated, the

NYISO informed stakeholders at the May 16, 2011 ICAP Working Group meeting that it was

evaluating the issue and would communicate further with them. The NYISO also informed

stakeholders at that same meeting that it would review and respond to the request for a

“benchmarking analysis,” which was first made at the May 2, 2011 ICAP Working Group

meeting. At the May 16, 2011 ICAP Working Group meeting, the NYISO informed

stakeholders it would provide a numerical example to demonstrate how the buyer-side Offer

Floor is calculated. The NYISO indicated the example would be prepared when staff time

permitted given other obligations in relation to the ICAP market. Complainants’ decision to file

the Complaint before the NYISO could respond does not mean that the NYISO will not provide

the analysis in the future.

67 See Request for Leave to Answer and Answer o the New York Independent System Operator,

Inc., Docket No. ER10-3043-002, filed January 7, 2011 and Request for Leave to Answer and Answer o

the New York Independent System Operator, Inc., Docket No. ER10-3043-004, filed March 14, 2011.

18

The amount and type of information the NYISO is to make available, and the date by which it is to be made available, were addressed by the September Filing. These issues were vetted in the stakeholder process that culminated in that filing. Prior to the Commission’s acceptance of the September Filing, the tariff did not require that the NYISO disclose any information to stakeholders regarding the administration of the In-City buyer-side mitigation exemption and Offer Floor examinations.68

The NYISO has thus made available to Complainants and all stakeholders more

information than is required, and it will provide additional information. There is no need to

revise the tariff to require still greater disclosures. As discussed below and in the Boles

Affidavit, Complainants are not disinterested, independent entities but market participants that

have In-City capacity resources.69 They do not have a legitimate need for more information to

“confirm” the NYISO’s mitigation determinations because they are not, and should not, be permitted to function as “extra” market monitors.

III.ANSWER

A. COMPLAINANTS HAVE NOT MET THEIR BURDEN OF PROOF UNDER

RULE 206 AND SECTIONS 206 AND 306 OF THE FPA

68 See Boles Affidavit at P 36

69 As Mr. Boles notes, the NYISO prepared an additional exhibit to his Affidavit which

addressed the extent to which Complainants would be expected to benefit from the exclusion of

new entrants into the New York City capacity market. See Boles Affidavit at __. The NYISO

has chosen not to submit this exhibit because doing so would result in the disclosure of

Complainants’ confidential information. The NYISO does not believe that it is necessary to

make such a disclosure, even recognizing that it could be limited to the non-competitive duty

personnel of parties that signed a protective agreement, because there is more than a sufficient

basis in the record for dismissing the Complaint. The NYISO is therefore prepared to have this

Answer be considered by the Commission without using the additional exhibit. Nevertheless, if

the Commission were to request the information, or if the Complainants.were to consent to its

disclosure (perhaps subject to a protective agreement), the NYISO would submit the additional

evidence along with an appropriate form of protective agreement.

19

The Commission has repeatedly held that complainants bear the burden of proof under

Rule 206, which governs complaints submitted under both Sections 206 and 306 of the FPA.

Complainants must offer “clear and convincing” evidence to support their requests for relief.70

Among other things, Rule 206 requires complainants to: (1) “[c]learly identify the action or

inaction which is alleged to violate applicable statutory standards or regulatory requirements;”

and (2) “explain how the action or inaction violates applicable statutory standards or regulatory

requirements.”71 The Commission rightly looks with disfavor on “poorly supported” complaints

based on nothing but speculation and “broad allegations” of violations.72 To the extent that a

complaint seeks to compel changes to a respondent’s tariff it must also satisfy the “dual burden”

established under Section 206 of the FPA. Specifically, the complainant must demonstrate both

that the existing tariff provision is unjust and unreasonable and that the revisions complainant

proposes are just and reasonable.73

Complainants have failed to satisfy the mandated burden of proof or even meet the

informational requirements. The Complaint offers nothing but speculation, mischaracterization,

and inaccurate assertions to support its claims. For example, as discussed in Section III.C.1.c,

70 See Astoria Gas Turbine Power LLC v. New York Independent System Operator, Inc., 131 FERC ¶ 61,205 at P 19 (2010) (“NRG, as the complainant, bears the burden of proof in this case, but failed to demonstrate with clear and convincing evidence that it met that burden.”)

71 See 18 C.F.R. 206(b)(1) and (2) (2011).

72 See, e.g., Arena Energy, LP v. Sea Robin Pipeline Company, LLC, 133 FERC ¶ 61,140, at P 59

(2010) (denying a request to remove provisions from a tariff because the claims regarding the misuse of

certain tariff provisions were speculative and unsupported and the tariff was not shown to be unjust and

unreasonable); Public Service Company of New Mexico, 95 FERC ¶ 61,481, at 62,715 (2001) (rejecting a

claim that Public Service Company of New Mexico (PSNM) will reap windfall profits because [it] will

not likely lay off generation at times of over-deliveries as speculative and unsupported, because there was

no showing that PSNM has engaged in such a practice historically and therefore such an argument has no

merit); Trans-Allegheny Interstate Line Company, 119 FERC ¶ 61,219, at P 62 (2007) (finding that

concerns over discrimination were unsupported and speculative, and there was no evidence that would

cause the Commission to suspect that a holding company would favor one affiliate over another).

(MORE)

73 Ark. PSC v. Entergy Corp., 128 F.E.R.C. P61,020 at P 23 (2009) (footnotes omitted).

20

Mr. Hart’s affidavit contains numerous inaccurate and misleading statements. The Complaint,

and its supporting affidavits, repeatedly qualifies their assertions by noting that they are

addressing assumptions and procedures that the NYISO “appears” to be following or supposedly

“intends” to follow.74 Complainants state that the NRG Companies’ have experienced a lack of

transparency in the NYISO’s administration of the In-City Buyer Side Mitigation Measures without offering any evidentiary support.75

The Hieronymus Affidavit does not demonstrate that the In-City Buyer-Side Mitigation Measures are not just and reasonable. The Hieronymus Affidavit consists of generalized

criticisms of the In-City ICAP market, which he incorrectly describes as being “systematically revenue inadequate as a result of exempting buyer-side sponsored units built before 2008 from mitigation”76 This erroneous allegation of systematic revenue inadequacy is belied by the fact that there are five capacity projects that are proposed or that have begun construction in New York City,77while In-City retirements have been rare. Complainants’ opinion that the New York City market is “systematically revenue inadequate” is also contradicted by Complainants’

statements that two of them are seeking to invest in new In-City projects.

74 See, e.g., Initial Complaint at 2, 4, 5, 35; Younger Affidavit at .

75 See Initial Complaint at n. 61 (asserting with absolutely no support that “[t]he NRG

Companies’ experience with the NYISO’s mitigation process in the course of developing the Berrians GT III project has similarly been characterized by a lack of transparency.”)

76 Hieronymus Affidavit at p. 5 If this statement were to be taken as true, then to address the rootcause, it would seem to follow s that Mr. Hieronymus would support eliminating the buyer-side

mitigation exemption for Complainants’ existing units because the construction of those units was

sponsored by a buyer-side Load Serving Entity and the units were built before 2008.

77 The 2011 Load and Capacity Data Report at Goldbook Table IV-1, p. 61 (commonly referred to as the “Gold Book”, available at

<http://www.nyiso.com/public/webdocs/services/planning/planning_data_reference_documents/2011_Go

ldBook_Public_Final.pdf >

21

At the same time, Complainants’ claim that 2,500 MW of new entry is about to be

evaluated under the In-City Buyer Side Mitigation Measures, and their arguments based on that claim are speculative. There are a host of factors that could result in proposed projects never entering the capacity market. For example, a proposed project could decide not to accept its SDU and SUF project cost allocations. Complainants also simply assume that the cumulative impact of the “errors” they allege would be great enough to change the outcome of the NYISO’s determinations. This assumption is not necessarily valid.78

Moreover, Complainants assume that none of the projects they include in their 2,500 MW

entry estimate have already been analyzed under the previously-effective version of the buyer-

side mitigation measures. Previous NYISO filings have clearly indicated that any such

determinations would not be impacted by the tariff enhancements that were proposed in the

September Filing and that are now part of the In-City Buyer Side Mitigation Measures.79

Because Offer Floor and mitigation exemption determinations are afforded confidential treatment, Complainants do not, and should not, have actual knowledge of the NYISO’s

determinations for other entities’ projects. Complainants attempt to characterize the NYISO’s

protection of confidential information as evidence that its mitigation processes are impermissibly

“opaque.” They suggest that it would somehow be “patently unfair and unreasonable” if the

78 The additional confidential exhibit to the Boles Affidavit that is referenced above also addressed this point. As was noted above, however, the NYISO will not disclose this

information unless it is requested by the Commission, or if the Complainants consent to

disclosure subject to a protective agreement.

79 See Proposed Enhancements to In-City Buyer-Side Mitigation Measures, Docket No. ER10-

3043-000, filed September 27, 2010; Request for Leave to Answer and Answer of New York

Independent System Operator, Inc., Docket No. ER10-3043-000, filed November 1, 2010. In addition, the

In-City Buyer-Side Mitigation Measures prohibit retesting of projects for which a determination has been

made except under the limited specified circumstances. See Services Tariff Attachment H Section

23.4.5.7.3.5.

22

NYISO were allowed to use its obligation to protect confidential information as a “defense”

against the Complaint.80 Such arguments are absurd and should be rejected by the Commission.

As discussed below , it is not reasonable to draw general inferences regarding the

NYISO’s interactions with each project, or the level of diligence that the NYISO applies to its

examination of any project, based on the extent of its direct communications with an individual

developer. Complainants resort to supporting their pleading with what they acknowledge and

describe as “educated guesses” and concede that the allegations they have made against the

NYISO may not reflect its actual practices.81 There is nothing in the Amended Complaint that

corrects these evidentiary deficiencies. Even Complainants’ predictions regarding the timing of

Class Year cost allocation determinations are highly speculative and, in one case, have already

proven wrong.

Complainants have thus fallen far short of what Rule 206 requires. They have not even

met the threshold requirement to identify an actual violation that has harmed them. Their case is

still weaker to the extent that they seek tariff changes under Section 206. Complainant’s

admission that the alleged “problems” they perceive “stem not from the mitigation rules in the

Services Tariff itself.... ” but from supposed defects in the NYISO’s implementation of them

shows that they cannot meet the “dual burden” test for the simple reason that they do not

demonstrate that the existing tariff is unjust and unreasonable. Complainants’ one sentence

suggestion “in the alternative” that if the NYISO’s practices are found to be consistent with the

tariff then the tariff should be changed to invalidate them, is obviously insufficient under Section

206.

80 See Initial Complaint at n. 49.

81 Initial Complaint at n. 46.

23

Finally, Complainants’ citation of the Commission’s market manipulation precedents82 is misplaced. Those cases are irrelevant because Complainants have not claimed, and could not possibly show, that the NYISO’s independent administration of its tariff amounts to market

manipulation under Section 222 of the FPA.83

B COMPLAINANTS ARE IMPERMISSIBLY ATTEMPTING TO

COLLATERALLY ATTACK EARLIER COMMISSION ORDERS

In addition to the Complainants’ total failure to satisfy the burden of proof under Rule 206 and Section 206 of the Federal Power Act, the Complaint constitutes an improper collateral attack on, and untimely petition for rehearing of, two different series of Commission orders. Commission precedent does not allow collateral attacks on previous orders84 or untimely

requests for rehearing dressed in other guises.85

Presumably aware of these restrictions, Complainants contend that their Complaint “is

narrowly focused on the defects in the NYISO’s implementation of these rules, and is therefore

outside the scope of the Docket No. ER10-3043 Proceeding.”86 That statement is contradicted

by what the Complainants are actually attempting. First, by its very nature, the Complaint is a

82 Initial Complaint at 19 and n.51.

83 Among other things, market manipulation claims require a demonstration that a party acted

fraudulently or deceptively with the requisite degree of scienter. See, e.g., Richard Blumenthal, Attorney

General of the State of Connecticut, et al. v. ISO New England, Inc., 135 FERC ¶ 61,211 (2011). at PP 37,

39 (explaining that Section 222 of the FPA is governed by different standards, including the scienter requirement, than FPA sections 205 and 206).

84 See, e.g., San Diego Gas & Electric Co. v. Sellers of Energy and Ancillary Services, et al.,134 FERC P 61,229 at P 15 (2011) (“[c]ollateral attacks on final orders and relitigation of applicable

precedent by parties that were active in the earlier cases thwart the finality and repose that are essential to administrative efficiency and are strongly discouraged.”) citing Entergy Nuclear Operations, Inc. v.

Consolidated Edison Co., 112 FERC ¶ 61,117, at P 12 (2005); see also EPIC Merchant Energy NJ/PA,

L.P. v. PJM Interconnection, L.L.C., 131 FERC ¶ 61,130 (2010) (dismissing as an impermissible

collateral attack a complaint that merely sought to re-litigate the same issues as raised in the prior case

citing no new evidence or changed circumstances).

85 See, e.g., Order No. 719-A at P 11 (rejecting request for clarification that the Commission deemed to be “in essence, an untimely request for rehearing.”)

86 Initial Complaint at 52.

24

collateral attack on previously-accepted tariff rules. Complainants assert that the tariff is

susceptible to mis-implemenation and must therefore be revised. As discussed above, however,

they articulate no genuine support for their suspicion that the NYISO has failed, or will fail, to

faithfully follow the requirements of Attachment H and Commission policy. Second, they

attempt to circumvent the NYISO stakeholder process to modify rules that were specifically

vetted in it and were subsequently determined to be just and reasonable.87 They attempt this

despite the fact that the September Filing revisions added greater objectivity and transparency to the In-City Buyer Side Mitigation Measures.

1. The Complaint Is a Collateral Attack on Commission Orders

Establishing the In-City Buyer-Side Mitigation Measures

The Complaint constitutes a collateral attack on the series of Commission orders that

accepted the In-City Buyer-Side Mitigation Measures as part of the NYISO’s Services Tariff.88

The tariff’s rules for performing exemption and Offer Floor determinations were vetted in the

stakeholder process. Complainants appealed the stakeholder vote approving the rules to the

NYISO’s Board of Directors, and the Board denied their appeal. Complainants then filed two

protests against the proposed rules with the Commission, and then filed a request for rehearing.

Complainants’ attempt to raise these same issues yet again must therefore be rejected as

an impermissible collateral attack.89 Complainants also attack the Commission’s acceptance of

tariff provisions which specify the inputs the NYISO is to use when performing its exemption

87 As discussed elsewhere in this Answer, the only market design component that was not vetted

was the question of whether the Offer Floor, once established, should be escalated, and if so what rules

should govern its escalation. However, Complainants do not propose a tariff provision (i.e., the escalation

factor, its parameters, or the mechanics), nor do they demonstrate that the In-City Buyer Side Mitigation

Measures are unjust and unreasonable absent a provision by which an Offer Floor should be escalated.

88 See New York Independent System Operator, Inc., 133 FERC ¶ 61,178 (2010); New York Independent System Operator, Inc., 134 FERC ¶ 61,083 (2011).

89See Request for Clarification or, in the Alternative, Rehearing of the New York City Suppliers, Docket No. ER10-3043-004, filed March 4, 2011.

25

and Offer Floor analyses. Those provisions will provide considerably increased transparency

and objectivity over the measures that were effective prior to the November 2010 Order.

Complainants’ collateral attack also encompasses the Duration Rule fashioned by the November 2010 Order.90 They argue that the Offer Floor must move “in tandem with demand curves that are in place for any given month’s Spot Market Auction.”91 Complainants are, in effect, attempting to revise the tariff so that entrants will be given a new Offer Floor each time the ICAP Demand Curves are reset. They would thereby effectively revise the Duration Rule, under which a new entrant that is not initially exempt from mitigation will cease to be mitigated to the extent that its capacity clears the market at the Offer Floor price for twelve not -

necessarily-consecutive, monthly auctions.92 The November 2010 Order gave no indication that

the Duration Rule was meant to be impacted by changing Offer Floor values. Indeed, it seems

impossible to square a continuously shifting Offer Floor with the November 2010 Order’s dictate

that “only the consistently-cleared portion of the capacity of a given resource over a total of 12

monthly auctions should have its offer floor mitigation lifted.” (Emphasis Added). A test based

on “consistent-clearing” would have no meaning if the Offer Floor that is used to determine

whether a resource clears fluctuates over time. If Complainants objected to this feature of the

Duration Rule, the proper course would have been for them to seek rehearing or clarification.

2. The Complaint Is an Impermissible Collateral Attack on the

Commission’s 2011 ICAP Demand Curve Reset Orders

90 See November 2010 Order at PP 47-51.

91 See Younger Affidavit at P 110. See also Younger at P 112, Initial Complaint at 36.

92 See November 2010 Order at P 50.

26

The Complaint also collaterally attacks the series of orders in Docket No. ER11-2224

considering the NYISO’s proposed revised ICAP Demand Curve, including orders specifying the timing of the NYISO’s compliance filings.93

For example, Complainants allege that the NYISO did not comply with the Services

Tariff because it is not applying an escalation factor to the “currently effective demand

curves.”94 The “currently effective” ICAP Demand Curves do not include an inflation factor - as

the Commission has explicitly stated;95 therefore, it would be inappropriate for the NYISO to

apply one. Thus, the Complaint is a collateral attack on the initial order as well as the order on

rehearing.

Complainants also claim that NYISO’s Class Year Facilities Study process, “and,

correspondingly, the exemption and mitigation determinations” should be held in “abeyance” pending “Commission action on this Complaint and the NYISO’s implementation of the final Demand Curves in compliance with Commission orders ”96 Complainants thus are

attempting to utilize this proceeding as an additional forum to have the NYISO adopt revised

ICAP Demand Curves, and the escalation factor that might be applicable to them, in making its

exemption and Offer Floor determinations. However, Complainants’ request for revisions to the

“currently effective demand curves” was already rejected. For example, the Commission denied

Complainants’ request for rehearing in which they requested that higher ICAP Demand Curves

be established for the period prior to the implementation date of the revised ICAP Demand

Curves that the Commission may approve in Docket No. ER11-2224. The Commission also

93 See New York Independent System Operator, Inc., 134 FERC ¶ 61,058, order on reh’g.,, 134 FERC ¶ 61,178, order on reh’g., 135 FERC ¶ 61,170 (2011).

94 See Initial Complaint at 29.

95 See 134 FERC ¶ 61,178 at PP 14-15.

96 Initial Complaint at 34.

27

rejected Complainants’ attempts to persuade it to apply an escalation rate to the “currently

effective demand curves.” Complainants’ seek to delay the Class Year Facilities Study process and the issuance of buyer-side mitigation determinations so that a higher ICAP Demand Curve, and a higher escalation rate, may be available to set a higher Mitigation Net CONE or a higher Offer Floor for a potential new entrant. This constitutes exactly the kind of self-interested

selectiveness that they accuse the NYISO of engaging in.

C.COMPLAINANTS HAVE FAILED TO SHOW THAT THE NYISO HAS,

OR WILL IN THE FUTURE, VIOLATE ITS TARIFF OR COMMISSION

POLICY

1. The NYISO Has Satisfied the Commission’s Requirements that

Market Mitigation Be Conducted Pursuant to Objective Tariff-Based Criteria and in a Transparent Manner

Complainants wrongly suggest that the NYISO has made its Offer Floor and mitigation

exemption calculations with insufficient transparency. Notwithstanding their colorful

mischaracterizations, the NYISO has fully complied with its tariff and with Commission policy.

In addition, the NYISO has also kept the commitment that it made in Docket No. ER10-3043 to

respond to the Complainants’ questions. Complainants have therefore not met their burden of

proof, which requires that they demonstrate that the NYISO’s implementation of the In-City

Buyer-Side Mitigation Measures violates its tariff. Nor have they shown that the NYISO’s is

administering the In-City Market Mitigation Measures in a manner that is inconsistent with any

Commission policy.

a. The NYISO’s Administration of the In-City Buyer-Side

Mitigation Measures Has Been and Is Consistent with Commission Policy and the Tariff

(i) The NYISO’s Tariff Establishes Clear and Objective Criteria

Governing the NYISO’s Implementation of the In-City Buyer Side Mitigation Measures

28

Complainants suggest that the “NYISO has violated the Commission’s policy requiring

that mitigation determinations be made on the basis of transparent and objective tariff criteria

(i.e., rather than on the basis of unfettered discretion)”97 The Commission has also been clear

that market mitigation must be governed by objective tariff standards and that market monitors may not operate with unlimited discretion.98

The Commission has approved the allocation of responsibilities between the NYISO’s

MMA and the MMU as consistent with the requirements of Order No. 719.99 Consistent with the

Order No. 719 framework, the NYISO is ultimately responsible for the implementation of the In-

City Buyer Side Mitigation Measures.100 The MMU does not directly participate in their

administration.101 The MMU may, and does, assist the NYISO in its “efforts to develop, the

inputs required to conduct mitigation.... ”102 The MMU also performs its normal monitoring

function with regard to the NYISO’s implementation of the In-City Buyer Side Mitigation

Measures. Thus, it reviews and evaluates the NYISO’s “imposition of appropriate measures for

97 Initial Complaint at n. 49.

98 See, e.g., Marketing Monitoring Units in Regional Transmission Organizations and

Independent System Operators, 111 FERC P 61,267, at P 5 (2005) (declaring that "ISO/RTOs may

administer compliance with tariff provisions only if they are expressly set forth in the tariff" and "involve objectively identifiable behavior"); PJM Interconnection, L.L.C., 119 FERC P 61,318, at P 180 (2007)

(finding that "[b]ecause this discretion [with regard to the Minimum Offer Price Rule would allow the

Market Monitor to use its sole judgment to determine inputs that can ultimately set the market clearing

price, we reaffirm our determination that such discretion is not appropriate" and "[i]nstead of relying on

the Market Monitor's discretion, objective criteria should be developed for use in such instances so that

predictable results will emerge.")

99 See New York Indep. Sys. Operator, Inc., 131 FERC ¶ 61,225 (2010); 129 FERC ¶ 61,164

(2009).

100 See NYISO Services Tariff, Attachment O, Section 30.8.3.

101 See NYISO Services Tariff, Attachment O, Section 30.4.4 (specifying that the MMU “shall not participate in the administration of the ISO’s Tariffs, except for performing its duties under this

Attachment O.”)

102 Id.

29

the mitigation of market power” and would be responsible for reporting any failure by the

NYISO to comply with the In-City Buyer Side Mitigation Measures.103

Accordingly, the NYISO’s administration of the In-City Buyer-Side Mitigation Measures

in no way resembles instances in which the Commission found that other ISOs/RTOs were

conducting market mitigation without objective limitations. For example, the decisions cited in

the Complaint as the basis for the policy against “unfettered discretion” involved an earlier PJM

proposal to eliminate its “Minimum Offer Price Rule” (“MOPR”) and leave buyer-side

mitigation in PJM solely to the discretion of its Independent Market Monitor (“IMM”). In this

case, the In-City Buyer-Side Mitigation Measures provide for the NYISO a detailed set of rules

that establish objective criteria governing exemption and Offer Floor determinations.

(ii) The NYISO Has More than Satisfied Tariff and Commission

Requirements Regarding the Transparency of Market Power Mitigation Measures

Commission policy favors market transparency so long as confidential information is

protected. As discussed above, the NYISO’s tariffs also require it to protect confidential

information.

The In-City Buyer-Side Mitigation Measures describe the information that the NYISO is

required to disclose and the timing of the disclosure.104 The NYISO more than satisfied these

requirements by posting a spreadsheet including all of the required information on November 12,

2010,105 which it updated and reissued on June 8, 2011, before the anticipated Initial Decision

103 See NYISO Services Tariff, Attachment O, Section 30.1.1.

104 See Services Tariff Attachment H Section 23.4.5.7.3.2.

105 See< http://www.nyiso.com/public/webdocs/products/icap/incity_mitigation/In-

City_ICAP.pdf>.

30

Period of 2009 and 2010 Class Years,106 again exactly as required by Attachment H.107 The

spreadsheet also delineates how the NYISO computes certain inputs. The NYISO also provided

a narrative description, in writing and orally at the May 2, 2011 and May 16, 2011 ICAP

Working Group meetings, to stakeholders, as further described below and in the Boles Affidavit.

These additional efforts went beyond what is required by the NYISO tariffs.

The tariff provisions establishing the In-City Buyer Side Mitigation Measures likewise do not require the NYISO to inform stakeholders of exemption and Offer Floor determinations

made for other entities. Treating that information as confidential is consistent with the NYISO’s

approach to Going Forward Costs. Establishing Going Forward Costs is very similar to a buyer-

side mitigation exemption or Offer Floor determination in that the process sets a parameter for a

mitigated Installed Capacity Supplier’s offers into the ICAP Spot Market Auctions.108 Going

Forward Costs are comprised of data similar to those used to determine a project’s Unit Net

CONE.109 The NYISO treats as confidential and does not disclose its determination of an

Installed Capacity Supplier’s Going Forward Costs - or even the fact that a Going Forward Cost

determination has been requested or made. To the NYISO’s knowledge, Complainants have

never objected to the NYISO’s confidential treatment of that information.

Incumbent generators have previously requested that that the NYISO not disclose

information regarding potential withholding behavior. The NYISO seeks to protect such

106 As discussed in Section E, the NYISO had expected the Initial Decision Period to commence

on June 9, 2011 because the Class Year Facilities Studies were on the Operating Committee agenda for

that date.

107 See< http://www.nyiso.com/public/webdocs/products/icap/incity_mitigation/In-

City_ICAP_Buyer-side_Mitigation_Test_Data.pdf>.

108 See Attachment H §23.4.5.2.

109 See Attachment H§23.2.1.

31

information, and data from which confidential information could be derived, in its annual capacity withholding report.110

Not disclosing the exemption and Offer Floor determination is also consistent with

Commission precedents requiring measures to protect against market participant collusion by

keeping energy reference level determinations confidential. As in those cases, if an ICAP

Supplier knew - or could derive -- the costs or Offer Floor of its competitors, it could modify its

offer behavior in a way that would raise prices above competitive levels. The NYISO’s

approach is likewise consistent with Commission precedents confirming that market power

monitoring and mitigation processes should not provide a level of “complete transparency” that

would inappropriately disclose confidential information.111 Commission precedent also indicates

that providing too much information regarding the implementation of market power mitigation

measures creates the risk of better enabling market participants to evade mitigation.

Complainants have attempted to twist the Commission’s policy favoring transparency into a requirement that market participants play an active role in mitigation decisions involving

110 Complainants’ representatives made this request at the NYISO’s August 21, 2009 ICAP

Working Group meeting. In recognition of their concern, when the NYISO next presented to the ICAP

Working Group the planned revisions to the annual ICAP withholding report on October 8, 2009, the

NYISO stated that “[a]ny inclusion of plant specific information in the report to FERC would protect

confidential information.” At p. 4. NYISO October 8, 2009 presentation available at

<http://www.nyiso.com/public/webdocs/committees/bic_icapwg/meeting_materials/2009-10-

08/ICAPWG10_08_09_ROS_Reporting_FINAL.pdf>. In addition, in its filing with the Commission on

the confidentiality of Installed Capacity Supplier information in the annual ICAP withholding report, the

NYISO stated that “any confidential data and information, and the results of analyses from which Market

Participant data can be gleaned, will be submitted to FERC in confidential appendices, and with a request

for confidential treatment.” See New York Independent System Operator, Inc., Updated Status Report on

Stakeholder Discussions Regarding Annual Installed Capacity Demand Curve Reports and Plan for

Future Reports, Docket Nos. ER01-3001-02,ER01-3001-022, ER03-647-012, ER03-647-013, at

Attachment A, p. 4, Section III.

111 See New England Power Pool and ISO New England, Inc. 103 FERC ¶ 61,304 at P 48 (2003) (“We do not require complete transparency of ISO-NE's mitigation, as some of the information is

competitively and commercially sensitive.”) See also NSTAR Electric & Gas Corporation v. Sithe Edgar LLC, 101 FERC ¶ 61064 (2002) (rejecting demands for greater transparency in ISO-NE monitoring and

mitigation procedures,)

32

potential competitors. As is discussed below, their attempt is not appropriate. Demands for

“transparency” should not be allowed to disguise attempts by market participants to inject

themselves into market monitoring and market power mitigation functions that properly belong

solely to independent entities. Commission precedent is clear that market power mitigation

must strike “an appropriate balance between the need to protect consumers from the exercise of

market power and the goal of avoiding over-mitigation that may keep capacity out of the

market”112 If market participants are empowered to “confirm the accuracy” of NYISO

determinations under the In-City Buyer Side Mitigation Measures, there is a great risk that the

balance will be disrupted and that the measures would then become unreasonable barriers to

entry.

(iii) The NYISO’s Recently Approved Tariff Enhancements Made

its Administration of the In-City Buyer Side Mitigation Measures More Objective and Transparent

The Commission has recently determined that the NYISO’s In-City Buyer-Side

Mitigation Measures are just and reasonable. In the November 2010 Order, the Commission

accepted buyer-side mitigation tariff enhancements that the NYISO had proposed in order to

make the exemption and Offer Floor determination process and rules more transparent and

objective. There should be no question that the In-City Buyer-Side Mitigation Measures satisfy

the requirement for transparent and objective criteria. For self-interested reasons, Complainants

apparently wish to insert or read additional criteria into the In-City Buyer-Side Mitigation

Measures, under the guise that their suggestions will provide needed transparency and

objectivity. Their desire to achieve this end does not mean that adequate transparency and

objectivity are absent now.

112 Midwest Independent Transmission System Operator, Inc., 123 FERC ¶61,297 at P 63 (2008).

33

The In-City Buyer-Side Mitigation Measures that were accepted by the November 2010

Order and subsequent orders in that proceeding add considerably more transparency and

objectivity than the Commission-approved NYISO tariff rules previously in place. During the

extensive vetting of the current tariff provisions, stakeholders discussed objectivity and

transparency. Consistent with those discussions, the NYISO’s September Filing, and subsequent

filings in that proceeding explained that the proposed tariff revisions substantially improved the

then-existing tariff in that regard. No party requested that the Commission reject or modify the

proposed rules to add even more transparency or objectivity after the issuance of the November

2010 Order. Each of the Complainants was actively involved throughout the stakeholder process

vetting the proposed buyer-side mitigation tariff revisions, and they filed numerous pleadings in

the docket considering the tariff revisions. If they genuinely believed that additional

transparency was necessary, they should have raised the issue before or pursued additional

measures in the stakeholder process prior to seeking relief from the Commission. .

b. The NYISO Responses to Complainants’ Questions Were as

Timely and as Complete as Practicable