10 Krey Boulevard Rensselaer, NY 12144

October 14, 2010

ELECTRONICALLY SUBMITTED

Kimberly D. Bose

Secretary

Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426

Re: New York Independent System Operator, Inc.’s Supplemental Submission of Analysis of

the Expected Impact of Buy-Through of Congestion Charges;

Docket Nos. ER08-1281-004 and ER08-1281-005.

Dear Secretary Bose:

In its August 16, 2010 response to a question posed by the Federal Energy Regulatory

Commission (“Commission”), the New York Independent System Operator, Inc. (“NYISO”) committed

to supplement its response to the Commission’s second question by providing an additional analysis

prepared by Dr. David Patton of Potomac Economics. Consistent with that commitment, the NYISO

submits herewith the presentation that Dr. Patton gave at the September 27, 2010 Broader Regional

Markets technical conference that PJM Interconnection, LLC hosted in Philadelphia. Pennsylvania. The

attached analysis includes a discussion of the impact to the economic viability and risk exposure of

historic Ontario-Midwest ISO-PJM transactions with the application of a NYISO Buy-Through of

Congestion charge.

Respectfully submitted,

/s/ Alex M. Schnell

Alex M. Schnell

New York Independent System Operator, Inc.

Analysis of the Broader Regional

Markets Initiatives

Presented to:

Joint NYISO-IESO-MISO-PJM Stakeholder

Technical Conference on Broader Regional Markets

David B. Patton, Ph.D.

Potomac Economics

September 27, 2010

1

Introduction

• This presentation summarizes our assessment of the potential benefits of some

of the Broader Regional Market (“BRM”) initiatives.

•In particular, we estimate the production cost savings that may be achieved by:

Coordinating flows around Lake Erie through:

-Coordinated congestion management between RTOs; and

–The “buy-through congestion”initiative for transaction scheduling); and

Improving the utilization of interfaces between MISO, PJM, NYISO, Ontario,

and New England.

•We report production cost savings because it is the most accurate measure of

the improvement in economic efficiency.

In most cases, the short-term consumer savings would be substantially higher

(which is based on the price effects of the initiatives).

Inefficient Pricing of Loop Flows

•To estimate the benefits of better coordination of flows around Lake Erie, we first

estimate:

The quantity of loop flows across each of the ISOs’ flowgates; and

The inefficient pricing of the estimated loop flows;

-The inefficiency is reflected in the difference between the value of the flowgate

capability and the charges to transactions that cause the loop flows.

-This difference provides insight about the potential efficiencies from

coordinated congestion management and buy-through congestion provisions.

•For this analysis, we analyzed November 2008 through October 2009.

•The value of flowgate capability used by the loop flows depends on the marginal cost

of re-dispatch for the monitoring ISO (the ISO on whose system the flowgate is on).

For example, if a flowgate is constrained with a $200/MWh shadow price and 150

MW of flowgate capability is used by loop flows in the forward direction, the

economic value of capability used by the loop flows is $30,000/hour.

This is equal to the congestion charges that would be collected if the 150 MW of flow

resulted from transactions scheduled internally.

Inefficient Pricing of Loop Flows

• Transmission Line Loading Relief (“TLR”) is often called when loop flows

are contributing to congestion on the flowgate.

However, inefficiencies exist whether or not a TLR is called and the broader

regional market initiatives will address these inefficiencies.

• When no TLR is called, loop flows are not charged (or paid) for their use of

the flowgate. In this case, the BRM initiatives will enhance efficiency by:

Providing efficient scheduling incentives for transactions by charging

transactions that cause forward loop flows (contribute to congestion), and by paying transactions that cause negative loop flows (relieve congestion).

Reducing re-dispatch costs in the monitoring ISO.

• When a TLR is called, the costs incurred by transactions and the non-

monitoring ISOs may be substantially higher (or lower) than the marginal redispatch cost in the monitoring ISO. In this case, the BRM will:

Ensure that transactions that cause loop flows are charged (or paid) consistent

with the cost of re-dispatch in the monitoring ISO.

Minimize the redispatch costs of the monitoring and non-monitoring ISOs.

Estimating the Quantity of Loop Flows

•We estimated forward and reverse loop flows resulting from:

Inter-control area transactions where the monitoring ISO is not on the contract

path; and

Native generation-to-load impacts from the other three ISOs.

•We first used Powerworldsoftware to estimate distribution factors relative to

the key flowgateson each ISO’s system based on NERC planning cases.

•Loop flow impacts were calculated for each inter-control area transaction:

For each transaction, the Transmission Distribution Factor (“TDF”) was

calculated based on the source and sink of the transaction.

• Native generation-to-load impacts were calculated for each generator:

For each generator, the Generation-to-Load Distribution Factor (“GLDF”) was

calculated as the difference between the generator’s Generation Shift Factor

(“GSF”) and the ISO’s load-weighted average Load Shift Factor (“LSF”).

These GLDFs were used to calculated the market flows across each flowgate.

Estimating the Pricing Inefficiencies

•To identify pricing inefficiencies for the loop flows, the difference between the value

of the flowgate and the costs incurred by the source of the loopflows is estimated.

•The value of flowgate depends on the marginal redispatchcost to manage the

congestion on the flowgate by the monitoring ISO.

For the MISO, NYISO, and PJM, this is the flowgate’s real-time shadow price.

For IESO, this is implied by the real-time nodal prices that are produced by its real-

time security-constrained dispatch software.

•The pricing inefficiencies can be placed in two categories:

1.Under-priced Congestion: this occurs when transactions are not charged for their

loop flows, or where the value of the flowgate exceeds the costsincurred by non-

monitoring ISOsto help manage it.

2.Over-priced Congestion: this occurs when transactions that are more valuable than

the flowgate capability are curtailed (not estimated due to lackof data), or when non-

monitoring ISOsincur higher redispatchcosts to help manage the congestion than

the value of the flowgate.

• The following tables show these pricing inefficiencies. They report the difference

between the value of flowgate capability in the monitoring ISO and the charges (or payments) to sources of the loop flows.

-6-

Under-Priced Loop Flows

Monitoring ISO (in $millions):

Direction/Source of Loop FlowsNYISOONTMISOPJM

ForwardNYISO GTL$3$1$17

ONT GTL$7$16$16

MISO GTL$7$10

PJM GTL$57$15

ONT - NYISO$1$4

MISO - ONT$6

PJM - MISO$2$1

NYISO - PJM$2

Total$79$30$19$37

ReverseNYISO GTL$2$2$15

ONT GTL$9$16$14

MISO GTL$9$10

PJM GTL$40$16

ONT - NYISO$1$3

MISO - ONT$1

PJM - MISO$2$1

NYISO - PJM$3

Total$61$32$19$33

Over-Priced Loop Flows

Monitoring ISO:

Direction/Source of Loop FlowsONT

Forward MISO GTL$25

PJM GTL$27

PJM - MISO$1

NYISO - PJM$6

Reverse MISO GTL$29

PJM GTL$23

PJM - MISO$5

NYISO - PJM$1

Conclusions of Loop Flow Analysis

• Forward and reverse loop flows are significant through each of the four ISOs.

The total gross value of the over-priced and under-priced loop flows is almost

$430 million.

The BRM initiatives would capture some portion of this value by providing efficient

incentives to schedule transactions and dispatch resources internally to minimize

costs throughout the four ISOs’ systems.

-The portion of the value that would be captured by the BRM is very difficult to

estimate. It is based on the ability of other ISOsor schedulers to relieve the

monitoring ISO’s constraints at a lower cost than the ISO’s real-time dispatch.

-We believe a reasonable range for this portion is 10 to 20 percent.

•These result may be understated for the following reasons:

Fuel prices were very low during the period studied, which reduces the value of

congestion.

We did not have data on TLR-based curtailments and, therefore, have not

identified cases where transactions were curtailed whose value exceed the value of the flowgate.

It does not identify the potential efficiency gains of scheduling transactions to

relieve a constraint that was not scheduled under current rules.

-9-

Analysis of External Interface Utilization

• In addition to the benefits of better coordination of transactions and internal

dispatch to lower the costs of managing congestion in the region, the BRM addresses improving scheduling between ISO markets.

• Improved scheduling would more fully utilize the transmission interfaces

between the markets and generate significant benefits.

These benefits are best measured as reduced production costs.

Production costs are reduced as lower-cost resources in one market displace

higher-cost resources in the adjacent market.

The result of this process is improved price convergence between the markets. • We performed an econometric analysis estimate the benefits that are available

from optimal scheduling of the interfaces between the markets.

• The portion of the savings that are ultimately realized depend on the actions

taken by the ISOs.

Real-time coordination of the net scheduled interchange (“NSI”) (or intra-hour

scheduling) would likely capture most of the savings.

Simply shortening the scheduling timeframes for participants would capture a

much smaller share of the potential benefits.

-10-

Analysis of External Interface Utilization

• The largest source of benefits we estimated derives from improving the utilization of the

interfaces between markets. The analysis is described below.

Ontario, MISO, and PJM Interfaces

• We first estimated how prices in each ISO respond to changes in the scheduled

interchange (“NSI”) over the interface, recognizing that this price response varies as prices increase or when there is congestion leading to the interface.

Our model also controls for changes in the NSI over other interfaces.

We used the estimates to simultaneously optimize the interchange over each of the

four inter-ISO interfaces around Lake Erie each 5 minutes, given the interface limits.

New England Interface

• To estimate the optimal NSI each 5-minutes for the NE interface, our analysis uses the

generator offers in both markets and recognizes congestion leading to the interface.

Long Island Ties to CT and NJ

• Benefits for these ties were only calculated when congestion separated LI, CT or NJ from

the broader RTO markets to avoid double-counting benefits from the primary interfaces.

• In these intervals, we estimate the optimal NSI adjustment, given transmission limits and

scheduling restrictions.

HQ-NY Interface

•We have not estimated the benefits from dynamic dispatching the HQ interface, but

estimated the reduction in uplift costs and balancing congestion costs that BRM could

achieve.

Summary of Estimated BRM

Production Cost Savings

•The potential savings we estimate address two aspects of the BRMinitiations.

•Both show significant potential economic efficiencies, although the benefits of

improved utilization of the external interfaces is larger.

•The following table summarizes the estimated annual benefits in the two areas,

which totals:

$160 million in savings for the NYISO interfaces and constraints; and

$297 million in savings on all interfaces and constraints.

•In total, the benefits may be understated due to:

The low load and high surplus capacity that prevailed in 2009; and

The relatively low fuel prices in 2009.

• The low fuel prices in 2009 can be addressed by adjusting the benefits to

correspond to a more typical natural gas price.

The benefits should be highly correlated to natural gas prices because gas-fired

units are on the margin in most periods in New York and the adjacent markets.

The table shows that at a $6 per MMBTU gas price, the benefits would rise to:

-$193 million on the NYISO interfaces and constraints;

– $362 million for all interfaces and constraints.

Summary of Estimated BRM

Production Cost Savings

EstimatedFuel-Price

Coordination of Scheduled InterchangeBenefitsAdj. Benefits*

New York - Ontario$66$81

New York - PJM$46$57

New York - New England$10$12

Ontario - MISO$61$75

MISO - PJM$48$59

New York - HQ (Balancing Congestion Reduction)$8$8

New York - HQ (Uplift Reduction)$11$11

Long Island Ties to CT and NJ$5$6

$255$309

AssumedEstimatedFuel-Price

Coordinated Congestion ManagementTotalSavingsBenefitsAdj. Benefits*

Under-priced Congestion

NYISO Forward Loop Flows$7910%$8$10

NYISO Reverse Loop Flows$6110%$6$8

PJM Forward Loop Flows$3710%$4$5

PJM Reverse Loop Flows$3310%$3$4

MISO Forward Loop Flows$1910%$2$2

MISO Reverse Loop Flows$1910%$2$2

Ontario Forward Loop Flows$3010%$3$4

Ontario Reverse Loop Flows$3210%$3$4

Over-Priced Congestion

Ontario Forward Loop Flows$5910%$6$7

Ontario Reverse Loop Flows$5810%$6$7

$427$43$53

Total Estimated Savings - All Interfaces/Constraints$297$362

* Adjusted to a $6 per MMBTU Natural Gas Price-13-

BTC Charges and Transaction Scheduling

• Some object to Buy Through Congestion (“BTC”) charges because they believe BTC

charges would shut-down inter-control area transaction scheduling.

• We evaluate this concern by quantifying the effects of BTC charges on the

profitability of schedules around Lake Erie.

• We evaluate the IESO → MISO → PJM path from Nov 2008 to Oct 2009. This is a

common path that would likely be subject to higher BTC charges than other paths.

The first analysis examines how BTC charges might affect the profitability of

transaction scheduling.

The second analysis discusses the risks posed by BTC charges relative to the risks

posed by the TLR process.

• Based on the results of the analyses, we find that:

BTC charges would generally reduce but not eliminate the incentives to schedule.

BTC charges would not significantly increase the volatility of profits from

scheduling. Rather, it would add one additional factor to the set of uncertainties that participants currently face when forecasting the profitability of a schedule.

The BTC proposal may reduce physical uncertainty because participants that elect to

pay BTC charges are less likely to be curtailed by a TLR.

Finally, participants always have the option to not pay the BTC charges and be

curtailed as they are today.

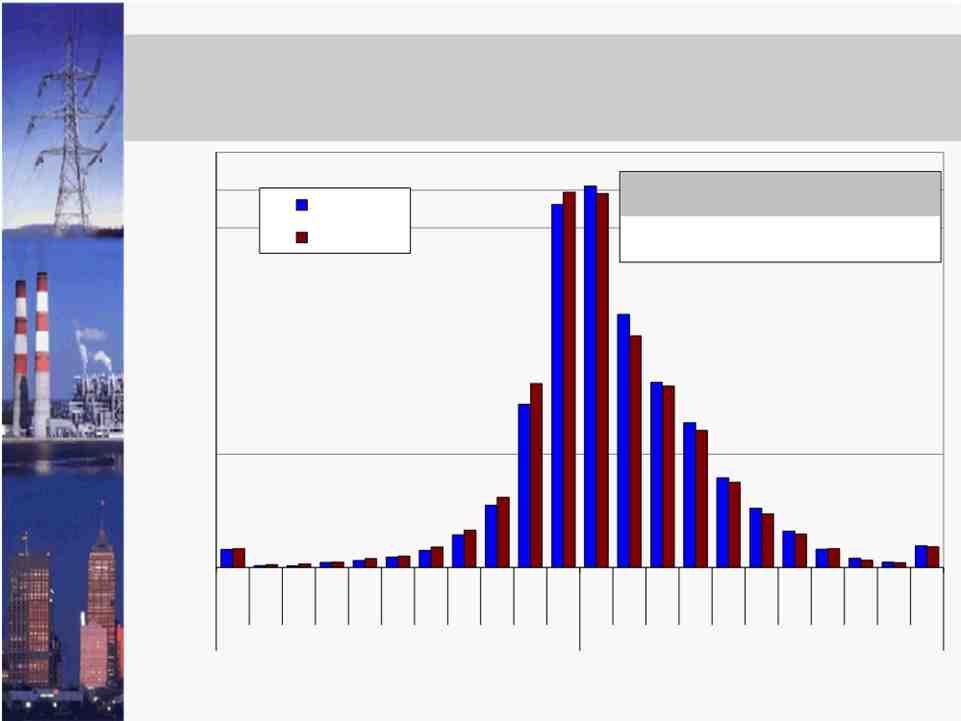

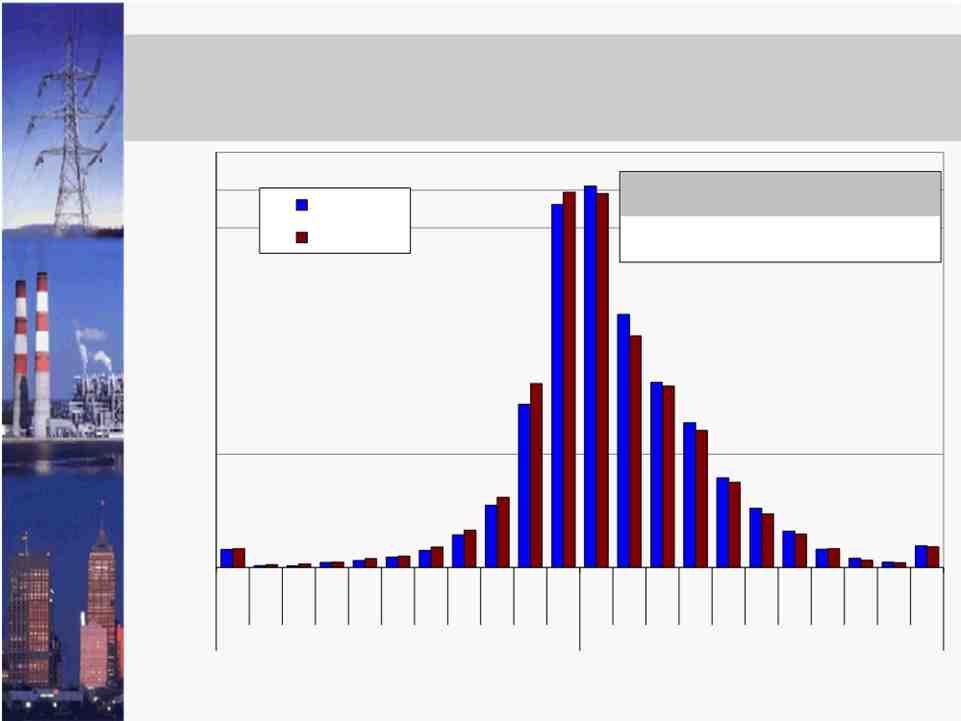

Transaction Profitability -

With and Without BTC Charges

• The following figure summarizes the profitability of scheduling on the IESO to PJM

path during the study period. We assume $5/MWh of scheduling charges.

The blue bars show the share of transaction MWs in each range of profitability

excluding BTC charges for NYISO flowgates.

The maroon bars show the share of transaction MWs in each range of profitability

including BTC charges for NYISO flowgates.

The table summarizes the transaction MW-weighted profitability as well as the

share of transaction MWs that would be profitable with and without BTC charges.

• The figure illustrates that although the BTC charges would reduce the profitability

of these schedules, they would remain profitable. During the study period,

Transactions earned an average of $2.89/MWh if BTC charges are included and

$3.73/MWh if BTC charges are excluded.

The share of transaction MWs that are profitable was 61 percent if BTC charges are

included and 64 percent if BTC charges are excluded.

• The small difference in the two profitability distributions implies that including

BTC charges would not significantly change the overall variability of payoffs.

Hence, participants would not face substantially higher uncertainty about the

profitability of scheduling in a particular hour than they do currently.

-15-

Transaction Profitability -

With and Without BTC Charges

22%

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

w/o BTC

w/ BTC

Unprofitable

w/o BTC

w/ BTC

Profitability ($/MWh)

Profitability % of Profitable

($/MWh) Transactions

$3.7364%

$2.8961%

Profitable

Note: The figure assumes a transaction fee of $5/MWh

-16-

Transaction Profitability and TLR Events

• The next figure illustrates the how profitability of scheduling was related to the

frequency of TLRs (level 3A and above) called by the NYISO.

The TLR frequencies are shown according to the profitability of transaction

scheduling on the path during the study period.

-For example, a TLR was called in 21 percent of the hours when the profit from

scheduling would have been between $0 and $10/MWh.

The table in the chart reports: (i) the share of hours when a TLR was called, (ii) the

share of profitable hours when a TLR was called, and (iii) the share of unprofitable

hours when a TLR was called.

•TLRswere called more frequently in the hours when transactions would have been

profitable than when they would have been unprofitable.

TLRs were called in 25 percent of the profitable hours and 18 percent of the

unprofitable hours.

This implies that the TLR process is not just a source of uncertainty, but also

reduces the overall profitability of scheduling this path.

The current TLR process may generate greater than the risk and uncertainty than

would result from BTC charges.

Transaction Profitability and TLR Events

35%

% of Hrs

30%

25%

20%

15%

10%

5%

0%

TLR 3A+ in All Hrs

TLR 3A+ in Profitable Hrs

TLR 3A+ in Unprofitable Hrs

>$40-$30-$20-

$50$50$40$30

Unprofitable

23%

25%

18%

$10-$0-$0-$10-

$20$10$10$20

Profitablity ($/MWh)

$20-$30-$40->

$30$40$50$50

Profitable

Note: The figure assumes a transaction fee of $5/MWh, excludes BTC charges, and excludes hours before March 15, 2009 when NYISO did not actively use the TLR process.

Conclusions and Recommendations

•The BRM initiates promise substantial efficiency benefits to themarkets in the

eastern interconnect.

• The congestion coordination proposals will likely achieve efficiency benefits and

should not be a significant barrier to scheduling between and through the RTOs.

• However, the largest source of benefits are the efficiency savings achievable by fully

utilizing the inter-RTO interfaces.

We would recommend this element of the BRM be the highest priority.

Simply shortening the scheduling timeframes would not likely capture a large share

of the potential benefits.

Real-time coordination of the net scheduled interchange (“NSI”) (or intra-hour

scheduling) would likely capture most of the savings.

-This does notconstitute the ISOs participating in the market, just usingbids and

offers in each market to establish the optimal NSIin the same way RTOsestablish

optimal power flows across each transmission interface inside themarkets.

Alternatively, participants could submit “spread bids and offers” indicating their

willingness to import or export power for 15-minutes based on the RTOs’ short-term

forecast of the real-time price difference between the RTOs.

-If the RTOs’forecasts are accurate, participants’bids and offers should approach

zero, allowingprices to converge almost completely.

-19-

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person designated on the official service lists compiled by the Secretary in this proceeding in accordance with the

requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. § 385.2010.

Dated at Rensselaer, New York this 14th day of October, 2010.

/s/ Alex M. Schnell

Alex M. Schnell

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, New York 12144 518-356-8707