THIS FILING LETTER DOES NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL

INFORMATION. REPORT SECTIONS II AND III DO NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL INFORMATION. THE BODY OF REPORT SECTION I AND

ATTACHMENT II, AND ATTACHMENTS V THROUGH VII DO NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL INFORMATION. ATTACHMENT I, ATTACHMENT III AND ATTACHMENT IV CONTAIN PRIVILEGED AND CONFIDENTIAL

INFORMATION, AND ARE CLEARLY MARKED.

December 15, 2017

Kimberly D. Bose, Secretary

Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426

Re: Annual Report in Docket Nos. ER01-3001-000, ER03-647-000 and

Request for Privileged Treatment of Attachments I, III, and IV

Dear Ms. Bose:

Enclosed for filing in the above-referenced dockets is the New York Independent System

Operator, Inc.’s (“NYISO’s”) Annual Installed Capacity Report on the NYISO’s Capacity Market,

Possible Withholding, New Generation Projects, and Net Revenue Analysis (the “Report”).1 By Order dated February 3, 2010, the Commission directed the NYISO to file this report for informational

purposes only.2

I. List of Documents Submitted

The NYISO submits with this letter, and the below request for confidential treatment, a public version of the Report, with Attachments I, III, and IV redacted. Separately, the NYISO is submitting as confidential, Attachments I, III and IV (the “Confidential Attachments”).

As with prior annual Installed Capacity Reports, the Report is comprised of the following

separate sections: Section I: Capacity Market Report and Withholding Analysis, Section II: Report on New Generation Projects, and Section III: New Generation Projects and Net Revenue Analysis.

1 New York Indepen. Sys. Operator, Inc., 117 FERC ¶ 61,086 (2006); New York Indepen. Sys. Operator, Inc., 103 FERC ¶ 61,201 (2003), 108 FERC ¶ 61,280 (2004), 121 FERC ¶ 61,090 (2007), 123 FERC ¶ 61,206 (2008). In Docket ER03-647, the NYISO files an annual report regarding its Demand Side Management

programs on January 15, and a semi-annual report on its Demand Side Management programs and new

generation projects on June 15 each year.

2 New York Indepen. Sys. Operator, Inc., Order, Docket Nos. ER01-3001 and ER03-647 (Feb. 3, 2010).

II. Request for Confidential Treatment of Attachments I, III, and IV

In accordance with Sections 388.107 and 388.112 of the Commission’s Regulations,3 Article 6

of the NYISO’s Market Administration and Control Area Services Tariff, Sections 1.0(4) and 4.0 of

the NYISO’s Code of Conduct, the NYISO requests Privileged and Confidential treatment of the

contents of the Confidential Attachments. The NYISO also requests that the Confidential Attachments

be exempted from public disclosure under the Freedom of Information Act (“FOIA”), 5 U.S.C. §522.4

The Confidential Attachments contain privileged, commercially sensitive, and trade secret information that is not made public by the NYISO and that could cause competitive harm to the

affected Market Participants,5 and could adversely affect competition in the markets administered by the NYISO, if publicly disclosed. This information includes the identity of Installed Capacity

Suppliers and their respective offering behavior, and the basis therefor. This confidential,

commercially sensitive information is exempt from disclosure under 5 U.S.C. §522(b)(4). For this reason, the NYISO requests that the contents of Confidential Attachments receive Privileged and Confidential treatment and be exempt from FOIA disclosure.

A public version of the contents of Attachment I is set forth in Report Section 1.5.4.2. A public version of Confidential Attachment III, summarizing and masking the contents of Attachment III, is included in the Report as Attachment II. A masked and aggregated version of Confidential Attachment IV is set forth in Report Section 1.5.4.4.

The NYISO requests waiver of any obligation it may have under the Commission’s regulations

or the Secretary’s rules to submit a redacted version of the Confidential Attachments. The NYISO

incorporated into the body of Report Section I a masked or aggregated version of the information that

is contained in the Confidential Attachments and thereby makes publicly available the information

contained in Attachment III that is not confidential and commercially sensitive. In that regard, the

NYISO has provided a redacted version of the information contained in the Confidential Attachments.

The Confidential Attachments are identified and marked in accordance with the Commission’s regulations and rules published by the Secretary’s Office for submitting Privileged information.

3 18 C.F.R. §§ 388.107, 388.112.

4 The information provided by the NYISO for which the NYISO claims an exemption from FOIA disclosure is labeled “Contains Privileged Information - Do Not Release.”

5 Terms with initial capitalization not defined herein have the meaning set forth in the NYISO’s Market Administration and Control Area Services Tariff.

III. Correspondence

Copies of correspondence concerning this filing should be addressed to:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director of Regulatory Affairs *Gloria Kavanah, Senior Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, N.Y. 12144

Tel: (518) 356-6000

Fax: (518) 356-4702

rfernandez@nyiso.com

rstalter@nyiso.com

gkavanah@nyiso.com

* Person designated to receive service.

Respectfully submitted,

/s/ Gloria Kavanah

Gloria Kavanah

Counsel for

New York Independent System Operator, Inc.

cc:Michael Bardee

Anna Cochrane

James Ganly

Jette Gebhart

Kurt Longo

David Morenoff

Daniel Nowak

Larry Parkinson

J. Arnold Quinn

Douglas Roe

Kathleen Schnorf Gary Will

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §385.2010.

Dated at Rensselaer, NY this 15th day of December 2017.

/s/ Joy A. Zimberlin

Joy A. Zimberlin

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, NY 12144 (518) 356-6207

2017 Annual Installed Capacity Report

Report on the NYISO’s Capacity Market, Possible Withholding, New Generation Projects, and Net Revenue Analysis

December 15, 2017

Contents

I. Capacity Market Report.........................................................3

I.2 Overview...................................................................3

I.3 Market Design and Regulatory Developments........................................7

I.3.1. Buyer-Side Mitigation Enhancements.............................................7

I.3.2. Revisions to Pivotal Supplier Rules..............................................7

I.3.3 Annual Updates for the ICAP Demand Curves.......................................7

I.3.4 Locality Exchange Factor......................................................8

I.4. Recent Installed Capacity Auction Results...........................................9

I.5 Capacity Withholding Analysis...................................................21

I.5.1 All Capacity Areas in the NYCA................................................21

I.5.2 Unoffered and Unsold Capacity................................................23

I.5.3 New York City and G-J Localities...............................................26

I.5.4 Rest of State..............................................................30

I.5.4.1 Overview...............................................................30

I.5.4.2 Analysis of ROS Unoffered Capacity...........................................32

I.5.4.3 Analysis of ROS Unsold Capacity..............................................33

I.5.4.4 Monthly Price Impacts......................................................34

II. NYISO Report on New Generation Projects..........................................38

III. New Generation Projects and Net Revenue Analysis..................................39

III.1 Overview.................................................................39

III.2 Market Design Developments to Enhance ICAP Demand Curve Performance...............39

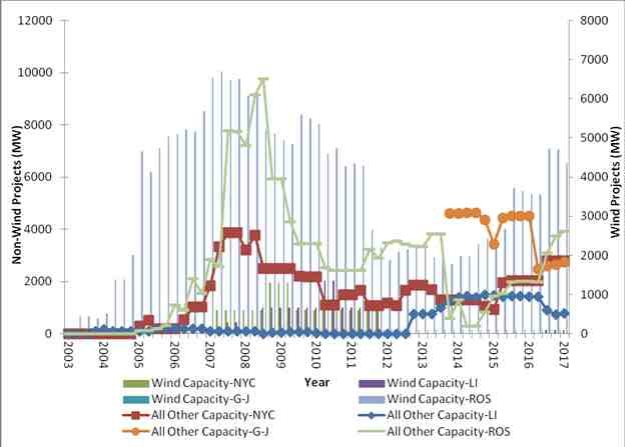

III.3 Interconnection Queue Projects.................................................39

III.4 Proposed Resource Additions..................................................41

III.5 Net Revenue Analysis........................................................44

III.5.1 Quantification of “Need”.....................................................44

Attachments

Attachment I: Confidential. Unoffered Capacity: Market Participant Explanations Attachment II: Unsold Capacity Offers (Masked)

Attachment III: Confidential. Unsold Capacity Offers (Unmasked)

Attachment IV: Confidential. Unsold Capacity Offers: Market Participant Explanations Attachment V: Interconnection Queue

Attachment VI: Status Key for Interconnection Queue

Attachment VII: November 1999 - October 2016 Installed Capacity Auction Activity

2017 Annual Installed Capacity Report |December 15, 2017| I

Tables

Table 1: List of Mothballed and Retired Units..........................................18

Table 2: Minimum Installed Capacity Requirements (%)...................................25

Table 3: Unoffered and Unsold MW.................................................26

Table 4: ROS Unoffered and Unsold Capacity MW by Type of Market Participant................31

Table 5: Maximum Price Impact of ROS Unoffered Capacity (15MW+)........................33

Table 6: Maximum Price Impact of ROS Unsold MW.....................................34

Table 7: Going Forward Cost Definitions..............................................35

Table 8: ROS Unsold MW with reported GFCs costs above ICAP Monthly Auction Prices (15MW+)...35

Table 9: ROS ICAP Spot Auction Price Impact Analysis Results.............................36

Table 10: Capacity Resource Changes since the publication of the 2017 NYISO Gold Book........42

Table 11: Current Status of Tracked Market-Based Solutions and Transmission Owner Plans.......43

Table 12: Summer Available Capacity vs. Required Capacity...............................45

Table 13: Annual Revenue Requirements in UCAP terms ($/MW)...........................46

Table 14: Benchmark Annual Revenues in UCAP terms ($/MW)............................47

Table 15: Revenue Margins.......................................................47

Charts

Chart 1: UCAP Available Reserve and Spot Market Clearing Prices...........................5

Chart 2: NYCA Market Clearing Prices...............................................10

Chart 3: NYCA Offered MW.......................................................11

Chart 4: NYC Market Clearing Prices................................................12

Chart 5: NYC Offered MW........................................................13

Chart 6: G-J Locality Market Clearing Prices...........................................14

Chart 7: G-J Locality Offered MW...................................................15

Chart 8: Long Island Market Clearing Prices...........................................16

Chart 9: Long Island Offered MW...................................................17

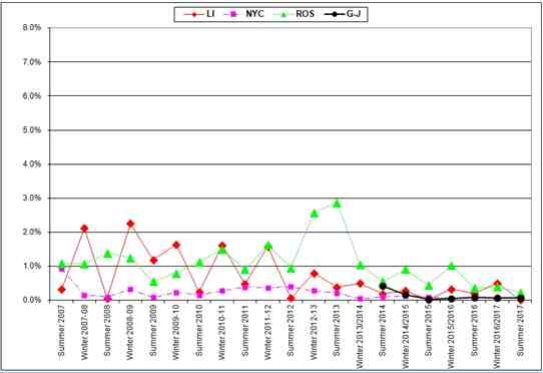

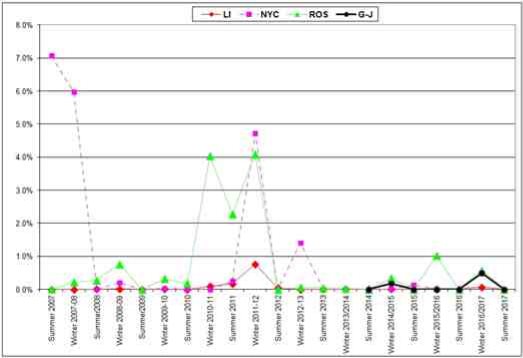

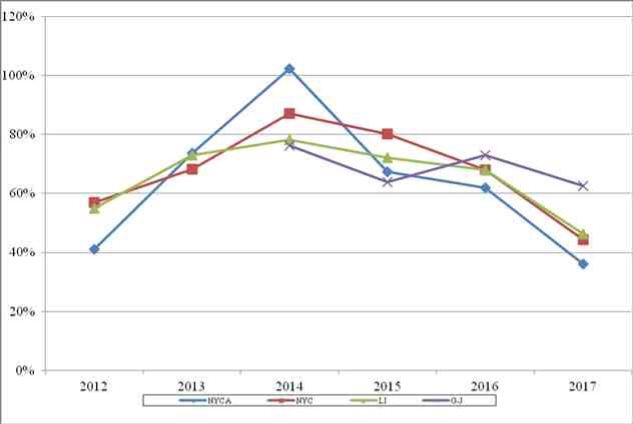

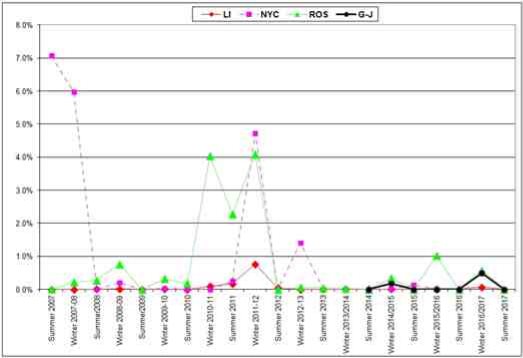

Chart 10: Average Percent of Unoffered MW...........................................23

Chart 11: Average Percent of Unsold MW.............................................24

Chart 12: NYC Mitigation Results...................................................28

Chart 13: NYC Generator and SCR UCAP............................................28

Chart 14: G-J Locality Mitigation Results..............................................29

Chart 15: G-J Locality Generator and SCR UCAP.......................................29

Chart 16: Rest of State Capacity Available, Offered, Sold and Exported.......................30

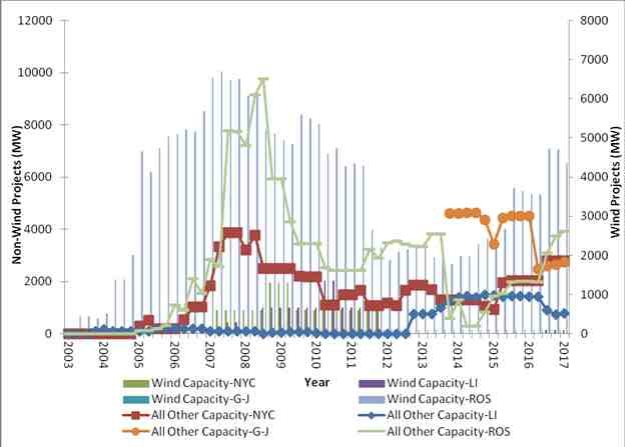

Chart 17: NYISO Interconnection Queue Projects.......................................40

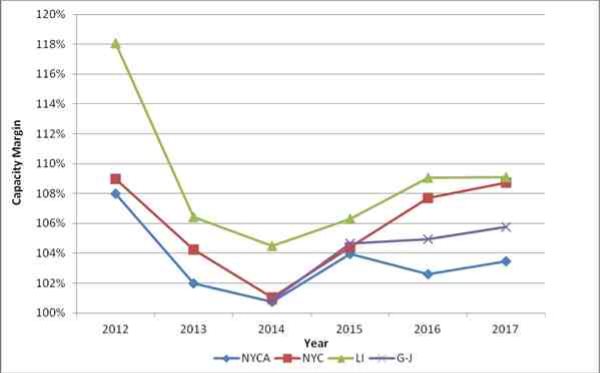

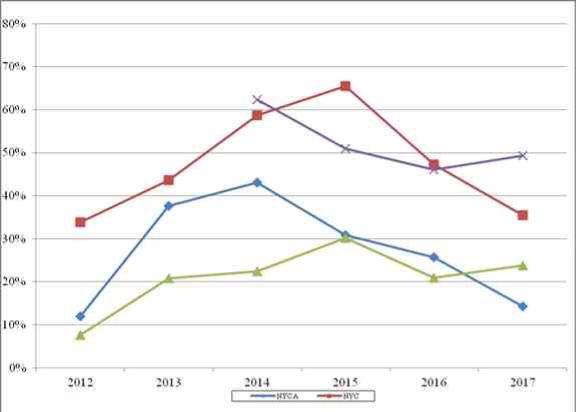

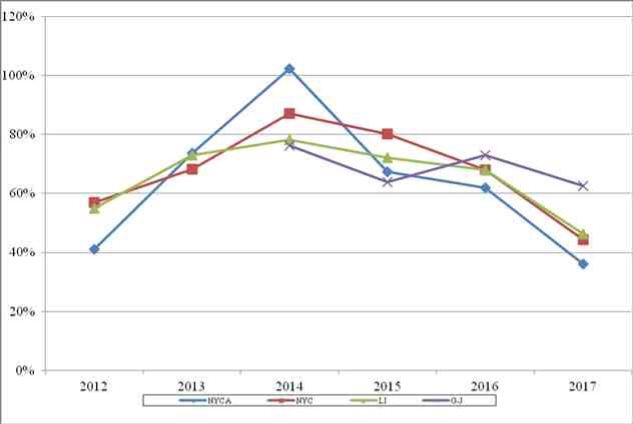

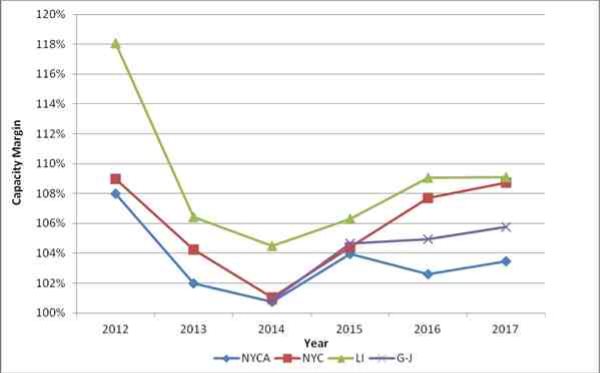

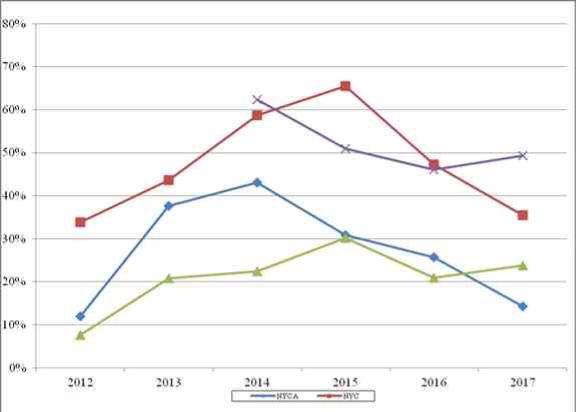

Chart 18: UCAP based Revenue Margins.............................................48

Chart 19: UCAP based Capacity Margins.............................................49

Chart 20: Capacity Market Revenues Relative to CONE Requirements........................49

2017 Annual Installed Capacity Report |December 15, 2017| II

I. Capacity Market Report I.2 Overview

This report (the “December 2017 Report”) reviews the outcomes of the Installed

Capacity (“ICAP”) market administered by the New York Independent System Operator

(“NYISO”); assesses the effectiveness of the ICAP Demand Curves1 (“Demand Curves”) in

attracting investment in new and existing capacity resources; and examines potential

withholding activity in the NYISO-administered Capacity auctions for the New York Control Area

(“NYCA”) within its three Localities, New York City (“NYC”), the G-J Locality (“G-J”), and Long

Island (“LI”), and the remaining area that comprises the NYCA, the Rest of State (“ROS”)

(referred to in this report as “capacity areas”).2 The December 2017 Report covers the Winter

2016-2017 and Summer 2017 Capability Periods, which span from November 2016 through

October 2017. Similar NYISO reports filed in previous years cover earlier periods.

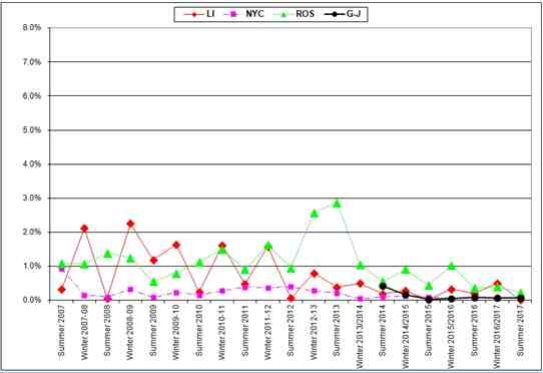

With the exception of the G-J Locality capacity prices, during the Winter 2016-2017

Capability Period capacity prices were lower, on average, than those of the previous Winter

Capability Period. The average ICAP Spot Market Auction (“Spot Market Auction”) prices over the Winter 2016-2017 Capability Period were $0.47/kW-month, $3.48/kW-month, $3.48/kW-

month, and $0.47/kW-month, for NYCA, the G-J Locality, NYC, and LI, respectively. These prices compare with $0.95/kW-month, $3.24/kW-month, $5.97/kW-month and $1.65/kW-month during the previous winter for NYCA, the G-J Locality, NYC, and LI respectively.

Capacity prices during the Summer 2017 Capability Period in NYC and NYCA were

lower on average than those of the previous (2016) Summer Capability Period. The average

Spot Market Auction prices in NYC were $10.04/kW-month compared to $12.24/kW-month, and were $2.35/kW-month compared to $4.09/kW-month for NYCA. The average Spot Market

Auction prices over the Summer 2017 Capability Period were higher for G-J and the LI Locality, i.e., $9.85/kW-month and $6.66/kW-month compared to $9.24/kW-month and $4.63/kW-month respectively during the previous Summer Capability Period.

The average Spot Market Auction prices for Summer 2017 were lower than the Summer 2016 average by $1.74/kW-month in NYCA; by $2.20/kW-month in NYC; and higher by

$0.61/kW-month in the G-J Locality; and by $2.03/kW-month in LI. These price changes were driven primarily by changes in the respective Locational Minimum Installed Capacity

Requirements (“LCRs”), as well as by the changes in available capacity compared to the load forecast throughout NYCA. These dynamics are depicted in Table 1.

1 Terms in upper case not defined herein shall have the meaning set forth in the NYISO’s Market Administration and Control Area Services Tariff (“Services Tariff”), with the exception of Rest of State

(“ROS”) when such term refers to a period before the Summer 2014 Capability Period. Consistent with the Services Tariff revision to establish the G-J Locality beginning with the Summer 2014 Capability

Period and change the definition of Rest of State accordingly, when ROS refers to Winter 2013-2014 or a prior period, it means Load Zones A through I. Any other terms not so defined have the meaning set forth in the Open Access Transmission Tariff (“OATT”).

2 The NYISO’s Capacity auctions have four Market-Clearing Prices: NYCA, New York City, Long Island and the G-J Locality.

2017 Annual Installed Capacity Report |December 15 2017|3

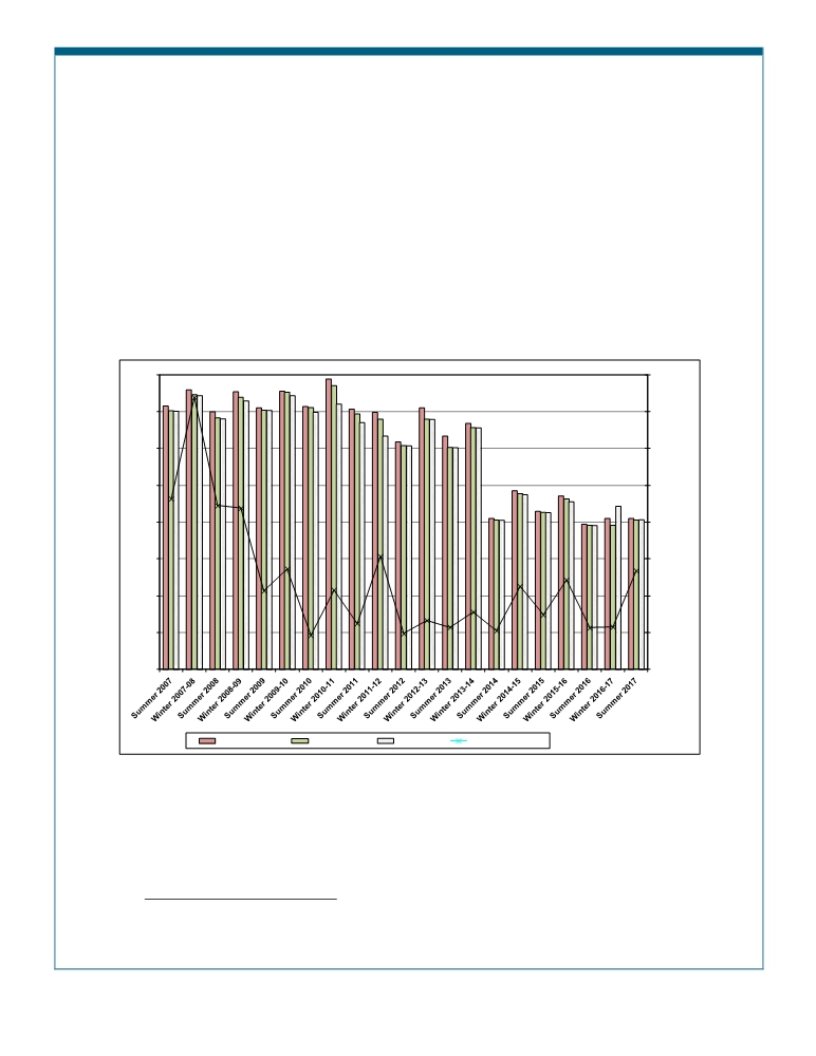

For the Winter 2016-2017 and Summer 2017 Capability Periods, there was minimal

change in the proportion of Load Serving Entity (“LSE”) Unforced Capacity (“UCAP”)

requirements met through purchases in the NYISO-administered capacity auctions versus

bilateral transactions when compared to previous Capability Periods. In the Winter 2016-2017 Capability Period, 34.78% of LSE Capacity requirements were met through bilateral

transactions (35.71% in the previous Winter Capability Period), while the remaining percent of LSE requirements were met through purchases in the NYISO-administered auctions. Similarly, in the Summer 2017 Capability Period, 39.16% of LSE capability requirements were met

through bilateral transactions (36.38% in Summer 2016), while the remaining LSE requirements were satisfied through purchases made in the NYISO-administered auctions.

The seasonal average quantities of unoffered capacity constituted less than 0.7% of

available supply in the NYC, LI, and the G-J Locality (see Chart 10). The seasonal average

quantities of unsold capacity (i.e., capacity that was offered but went unsold) was below 1% for

each of the three Localities (see Chart 11).3 Total unsold and unoffered capacity quantities from

ROS resources were at or below 1% in the Winter 2016-2017, and at or below 0.5% in Summer

2017. The UCAP offered and purchased in NYCA and each of the three Localities exceeded

the LCRs; therefore, prices were below the base reference point on the respective ICAP

Demand Curves.

Overall, the Market-Clearing Prices in the ICAP Spot Market Auctions support the

conclusion that the ICAP Spot Market Auctions continue to be attractive to Installed Capacity

Suppliers. Previously the NYISO stated that it is difficult to correlate the effect of the ICAP

Demand Curves on the level of investment in the NYCA, partially because in the past NYC has

had capacity in excess of the LCR, and partially due to the lead-time required to site, develop,

and construct a new generator. The ICAP Demand Curves provide transparent capacity market

price signals that developers consider in their projections of anticipated future revenues when

making near-term investment decisions. Capacity market outcomes are reviewed to ensure

market signals are aligned with reliability needs. When market changes are identified, the

NYISO works with its stakeholders on prioritizing the need for and developing a suitable market

rules.

The NYISO continues to monitor potential reliability risks and other issues that may

affect the reliability outlook for New York’s bulk electric system. On October 18, 2016, the

NYISO Board of Directors approved the 2016 Reliability Needs Assessment (“RNA”) Report

(“2016 RNA Report”),4 which is the first step in preparing the 2016 Comprehensive Reliability

Plan. The 2016 RNA Report’s key findings identified two transmission security needs in portion

of the Bulk Power Transmission Facilities beginning in 2017. On April 11, 2017issued the

Comprehensive Reliability Plan Final Report (“CRP”).5 The CRP concluded that the Bulk

3 Section I.5.2 of this report provides information and analysis of the unoffered and unsold

capacity.

4 The 2016 RNA Report is available at:

<http://www.nyiso.com/public/webdocs/media_room/press_releases/2016/Child_2016_RNA/2016RNA_Fi

nal_Oct18_2016.pdf>.

5 See New York Independent System Operator, “2016 Comprehensive Reliability Plan issued on April 11, 2017, available at:

<http://www.nyiso.com/public/webdocs/markets_operations/services/planning/Planning_Studies/Reliabilit

y_Planning_Studies/Reliability_Assessment_Documents/2016CRP_Report_Final_Apr11_2017.pdf>.

2017 Annual Installed Capacity Report |December 15 2017|4

Power Transmission Facilities will meet all applicable Reliability Criteria over the 2017 through 2026 Study Period, and confirms that the initially identified in RNA were resolved.

The NYISO is preparing for the next Reliability Planning Process, which will begin in January 2018, for the New York Control Area Bulk Power Transmission Facilities based on updated assumptions including risk factors and other reliability issues

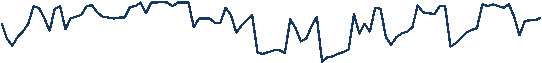

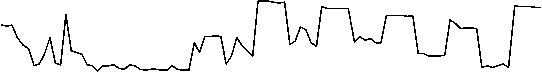

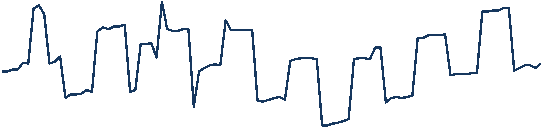

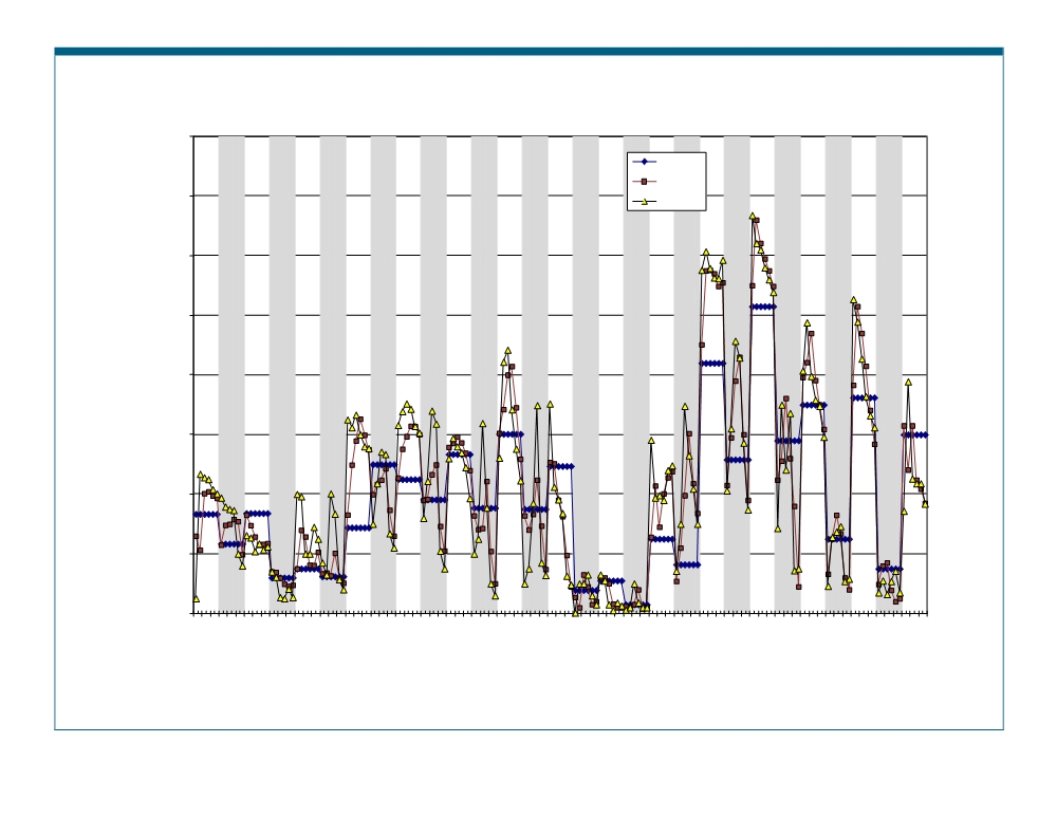

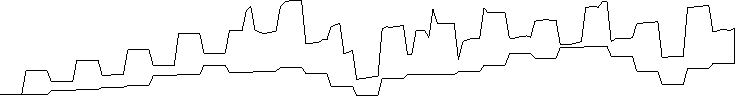

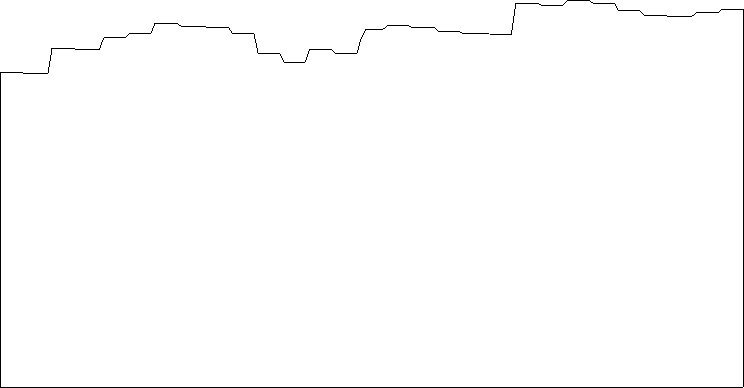

Chart 1: UCAP Available Reserve and Spot Market Clearing Prices

NYCA UCAP Available vs. NYCA Requirement

125%$20

NYCA UCAP Available as

120%Percentage of NYCA Requirement$16

NYCA Market Clearing Price

115%$12

110%$8

105%$4

100%$0

LI UCAP Available vs. LI Requirement

125%

120%

115%

110%

105%

100%

$20

LI UCAP Available as

Percentage of LI Requirement

$16

LI Market Clearing Price

$12

$8

$4

$0

2017 Annual Installed Capacity Report |December 15 2017|5

G-J Locality UCAP Available vs. G-J Locality Requirement

125%

120%

115%

110%

105%

100%

G-J UCAP Available as

Percentage of G-J Requirement G-J Market Clearing Price

$20

$16

$12

$8

$4

$0

NYC UCAP Available vs. NYC Requirement

125%

120%

115%

110%

105%

100%

NYC UCAP Available as

Percentage of NYC Requirement NYC Market Clearing Price

$20

$16

$12

$8

$4

$0

2017 Annual Installed Capacity Report |December 15 2017|6

I.3 Market Design and Regulatory Developments

Over the past year there have been several ICAP market design initiatives and

regulatory developments pertaining to the NYISO’s Installed Capacity market. The significant developments are described below.

I.3.1. Buyer-Side Mitigation Enhancements

On July 14, 2017, NYISO filed proposed Services Tariff revisions to include: (i)

enhancements to the rules governing the forecasts determined and used by the NYISO in the

course of making determinations under the Buyer-Side Mitigation (“BSM”) Rules; and (ii)

improvements to rules governing the use of escalation factors and inflation rates under the BSM

Rules. Federal Energy Regulatory Commission (“FERC”) accepted the revisions on September

11, 2017.

I.3.2. Revisions to Pivotal Supplier Rules

On February 6, 2017, NYISO filed revisions to the Services Tariff to apply across all

Mitigated Capacity Zones uniform rule by which a “Pivotal Supplier” can rebut the presumption

of control of unforced capacity. Under the revisions, Control of Unforced Capacity will no longer

be rebuttable in Zone J through forward capacity sales, such as sales in Strip or Monthly

auctions. These revisions are necessary to eliminate incongruities in the rebuttal standard

between Mitigated Capacity Zones and that, in so doing, all suppliers will be treated the same,

irrespective of the Mitigated Capacity Zone in which they are selling. FERC accepted revisions,

effective April 7, 2017.

I.3.3 Annual Updates for the ICAP Demand Curves

FERC accepted proposed revisions to the NYISO’s rules to move from a triennial ICAP Demand Curve reset to a quadrennial reset period with annual updates. The ICAP Demand

Curves will be updated formulaically for each of the remaining three years of each reset period. The three components of the ICAP Demand Curve input parameters that will be updated

annually are the (i) winter-to-summer ratio, (ii) gross cost of new entry for peaking plants using

an escalation factor, and iii) Net Energy and Ancillary Services revenue offset. The updates to the winter-to-summer ratio and the Energy and Ancillary Services revenue will be based on

rolling three years of data. On November 2, 2017, the NYISO posted the first annual update for each of the ICAP Demand Curves. The tariff provision for a collar was triggered for the New

York City and Long Island Demand Curves.

2017 Annual Installed Capacity Report |December 15 2017|7

I.3.4 Locality Exchange Factor

On November 30, 2016, NYISO filed revisions to its Services Tariff to correct a pricing inefficiency that could arise in the event of capacity exports from certain Localities in the NYCA. The methodology recognizes that an exporting generator continues to operate within its Locality, which would be reflected in the ICAP Spot Market Auction clearing prices by accounting for the portion of exported capacity that can be replaced by capacity located in Rest of State. FERC accepted the revisions, effective January 29, 2017.

2017 Annual Installed Capacity Report |December 15 2017|8

I.4. Recent Installed Capacity Auction Results

Capacity committed through self-supply, bilateral transactions, and the NYISO-

administered auctions (referred to herein as “committed” capacity) remains above the NYCA

Minimum Installed Capacity Requirement and above each Locality’s LCRs. In general, the

amount of capacity available from many generators in the NYCA increases in the Winter

Capability Period because of higher possible output at lower ambient temperatures. Capacity

imports from External Control Areas fluctuate both seasonally and monthly. The NYCA

Demand Curve price can decline to zero when supply exceeds the NYCA Minimum Installed

Capacity Requirement by 12 percent or more. Accordingly, the NYCA Market-Clearing Prices

have been consistently at or above ten percent of the NYCA ICAP Demand Curve reference

price6, particularly in the Winter Capability Period when prices were consistently below $1/kW-

month on average.

The amount of Capacity committed to the NYCA, including imports, continues to be high relative to the minimum requirements established with the Installed Reserve Margin of 18

percent. The monthly average import levels into the entire NYCA were about 2,440 MW in the Winter 2016-2017 Capability Period and about 3,070 MW in the Summer 2017 Capability

Period. Those values represent approximately a 460 MW increase in the monthly average over the amount imported in the previous Winter Capability Period and a 390 MW monthly average increase relative to the 2016 Summer Capability Period.

ICAP Market-Clearing Prices and auction activity levels from November 1999 through October 2017 for the NYCA, G-J Locality, NYC, and LI are summarized in tabular form in

Attachment VII. Market-Clearing Prices are depicted graphically in Chart 2, Chart 4, Chart 6 and Chart 8; and the amount of capacity committed, MW that were offered, and unsold MW are depicted in Chart 37, Chart 5, Chart 78, and Chart 9.

6 The reference price when the ICAP Demand Curve is translated to UCAP.

7 Previous years’ Reports presented only ROS unsold data in Chart 3. This year’s Report presents in Chart 3 the NYCA-wide unsold data.

8 The previous year’s Report presented only Load Zone G, H and I unsold data in Chart 5. This year’s Report presents in Chart 5 the Zones G, H, I, and J unsold data.

2017 Annual Installed Capacity Report |December 15 2017|9

Chart 2: NYCA Market Clearing Prices

$8.00

Strip

Monthly

$7.00

$6.00

$5.00

$4.00

$3.00

$2.00

$1.00

$-

Winter Capability

Periods

Shaded Grey

Spot

2017 Annual Installed Capacity Report |December 15 2017|10

Chart 3: NYCA Offered MW

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

NYCA RequirementNYCA ExcessNYCA Unsold

2017 Annual Installed Capacity Report |December 15 2017|11

Chart 4: NYC Market Clearing Prices

$25.00

$22.50

$20.00

$17.50

$15.00

$12.50

$10.00

$7.50

$5.00

$2.50

$-

Winter Capability

Periods

Shaded Grey

Strip

Monthly

Spot

2017 Annual Installed Capacity Report |December 15 2017|12

Chart 5: NYC Offered MW

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

NYC RequirementNYC ExcessNYC Unsold

2017 Annual Installed Capacity Report |December 15 2017|13

Chart 6: G-J Locality Market Clearing Prices

$25.00

$22.50

Winter CapabilityStrip

Periods

Shaded GreyMonthly

$20.00Spot

$17.50

$15.00

$12.50

$10.00

$7.50

$5.00

$2.50

$-

2017 Annual Installed Capacity Report |December 15 2017|14

Chart 7: G-J Locality Offered MW

16,000

15,000

14,000

13,000

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

G-J RequirementG-J ExcessG-J Unsold

2017 Annual Installed Capacity Report |December 15 2017|15

Chart 8: Long Island Market Clearing Prices

$25.00

$22.50

$20.00

$17.50

$15.00

$12.50

$10.00

$7.50

$5.00

$2.50

$-

Winter Capability

Periods

Shaded Grey

Strip

Monthly

Spot

2017 Annual Installed Capacity Report |December 15 2017|16

Chart 9: Long Island Offered MW

6,500

6,000

5,500

5,000

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

LI RequirementLI ExcessLI Unsold

2017 Annual Installed Capacity Report |December 15 2017|17

Table 1 summarizes amount of generating capacity throughout the NYCA that has

deactivated during the Winter 2009/2010 through November 2017. Over this period, 58

generators (counted by PTID) accounted for 63 instances of generators (counted by PTID)

entering or switching between a retired, laid-up, IIFO, or mothballed state. These instances total 4,319.7 MW. Of the 58, 3 generators exited the market (i.e., entered one of the preceding states) and reentered the market, and again exited the market; and 10 generators exited the market one time and reentered and remain in the market. These 13 generators total 967.8 MW. A net of 3,351.9 MW exited the Capacity Market during this timeframe.

Table 1: List of Mothballed and Retired Units

Organization NameUnit NameZoneMW1Status2Period

AES Eastern Energy LPAES Greenidge Unit 3C52.80RWinter 2009-2010

AES Eastern Energy LP

Emera Energy U.S.

Subsidiary No. 1, Inc.

AES Greenidge Unit 4

AES Greenidge Unit 4

C106.10M

C (106.10) RTS

Winter 2010-2011

Winter 2016-2017

AES Eastern Energy LPAES Westover Unit 7C43.50RWinter 2009-2010

NRG Power Marketing, LLCAstoria GT 05J16.00IIFOWinter 2015-2016

NRG Power Marketing, LLCAstoria GT 07J15.50IIFOWinter 2015-2016

NRG Power Marketing, LLCAstoria GT 08J15.30MSummer 2016

NRG Power Marketing LLCAstoria GT 10J24.90MSummer 2012

NRG Power Marketing LLCAstoria GT 10J(24.90)RTSSummer 2013

NRG Power Marketing, LLCAstoria GT 10J24.90MSummer 2016

NRG Power Marketing LLCAstoria GT 11J23.60MSummer 2012

NRG Power Marketing LLCAstoria GT 11J(23.60)RTSSummer 2013

NRG Power Marketing, LLCAstoria GT 11J23.60MSummer 2016

NRG Power Marketing, LLCAstoria GT 12J22.70IIFOWinter 2015-2016

NRG Power Marketing, LLCAstoria GT 13J24.00IIFOWinter 2015-2016

Astoria Generating Company, LPAstoria 2J177.00MWinter 2011-2012

Astoria Generating Company, LPAstoria 2J(177.00)RTSWinter 2014-2015

Astoria Generating Company, LPAstoria 4J375.60MSummer 2012

Innovative Energy Systems, Inc.Auburn LFGC0.0IIFOSummer 2016

Innovative Energy Systems, Inc.Auburn LFGC0.0IIFO to RWinter 2016-2017

Erie Blvd. Hydro - Seneca OswegoBaldwinsville 2C0.20RSummer 2012

Erie Blvd. Hydro - Seneca OswegoBaldwinsville 2C(0.20)RTSWinter 2013-2014

National Grid Generation LLCBarrett 07K17.30RWinter 2011-2012

Rochester Gas & Electric Corp.Beebee GTB15.00RWinter 2011-2012

Binghamton BOP, LLCBinghamton Cogen PlantC43.80RWinter 2011-2012

Binghamton BOP, LLCBinghamton Cogen PlantC(43.80)RTSWinter 2014-2015

Dynegy Danskammer, LLCDanskammer 1G67.00R3Winter 2012-2013

Danskammer Energy, LLCDanskammer 1G(67.00)RTSSummer 2014

2017 Annual Installed Capacity Report |December 15, 2017|18

Organization NameUnit NameZoneMW1Status2Period

Dynegy Danskammer, LLCDanskammer 2G62.70R3Winter 2012-2013

Danskammer Energy, LLCDanskammer 2G(62.70)RTSSummer 2014

Dynegy Danskammer, LLCDanskammer 3G137.20R3Winter 2012-2013

Danskammer Energy, LLCDanskammer 3G(137.20)RTSWinter 2014-2015

Dynegy Danskammer, LLCDanskammer 4G236.20R3Winter 2012-2013

Danskammer Energy, LLCDanskammer 4G(236.20)RTSWinter 2014-2015

Dynegy Danskammer, LLC

NRG Energy, Inc.

(Dunkirk Power LLC)

NRG Power Marketing, LLC

NRG Energy, Inc.

(Dunkirk Power LLC)

NRG Energy, Inc.

(Dunkirk Power LLC)

Danskammer Diesel (5&6)

Dunkirk 1

Dunkirk 2

Dunkirk 3

Dunkirk 4

G5.00R

A96.20M

A97.20MO

A201.40M

A 199.10 M

Summer 2012

Summer 2013

Winter 2015-2016

Summer 2012

Summer 2012

Energy Systems North East LLCEnergy Systems North EastA82.00RWinter 2010-2011

National Grid Generation LLCFar Rockaway_4K110.60RSummer 2012

Freeport Electric MunicipalityFreeport ElectricK0.00RSummer 2013

National Grid Generation LLCGlenwood 4K118.70RSummer 2012

National Grid Generation LLCGlenwood 5K122.00RSummer 2012

Erie Blvd. Hydro - North SalmonHogansburgD0.30RWinter 2014-2015

NRG Power Marketing, LLCHuntley 67A196.50RWinter 2015-2016

NRG Power Marketing, LLCHuntley 68A198.00RWinter 2015-2016

Erie Blvd. Hydro - Lower HudsonJohnsonville 2F0.00RWinter 2010-2011

Erie Blvd. Hydro - Lower Hudson

New York Power Authority

Johnsonville 2

Kensico Hydro Project

(Units 1, 2, 3)

F(0.00)RTS

I 3.00 R

Winter 2013-2014

Summer 2012

National Grid Generation LLCMontauk 2K2.00RSummer 2013

National Grid Generation LLCMontauk 3K2.00RSummer 2013

National Grid Generation LLC

Niagara Generation, LLC

Niagara Generation, LLC

Niagara Power Marketing, LLC

Montauk 4

Niagara Generation

Biomass Facility

Niagara Generation

Biomass Facility

Niagara Generation

Biomass Facility

K2.00R

A50.50M

A(50.50)RTS

A 50.50 IIFO

Summer 2013

Summer 2013

Winter 2013-2014

Winter 2015-2016

New York Power AuthorityPoletti 1J891.00RWinter 2009-2010

Project Orange AssociatesProject Orange 1C43.60RWinter 2010-2011

Project Orange Associates

ReEnergy Chateaugay LLC

ReEnergy Chateaugay LLC

Rochester Gas & Electric

Project Orange 2

ReEnergy Chateaugay

Biomass-to-Energy

ReEnergy Chateaugay

Biomass-to-Energy

Rochester Station 9

Unit 2 CT

C44.00R

D18.60M

D18.60M to R

B 15.80 R

Winter 2010-2011

Summer 2013

Summer 2016

Winter 2013-2014

Erie Blvd. Hydro - Seneca OswegoSeneca Oswego Fulton 1C0.70RSummer 2013

Erie Blvd. Hydro - Seneca OswegoSeneca Oswego Fulton 2C0.30RSummer 2013

Syracuse Energy CorporationSyracuse Energy ST1C11.00RSummer 2013

Syracuse Energy CorporationSyracuse Energy ST2C58.90RSummer 2013

TC Ravenswood, LLCTC Ravenswood GT 04J15.20MOSummer 2016

2017 Annual Installed Capacity Report |December 15, 2017|19

Organization NameUnit NameZoneMW1Status2Period

TC Ravenswood, LLCTC Ravenswood GT 3-3J37.70MSummer 2014

TC Ravenswood, LLCTC Ravenswood GT 3-4J35.80RSummer 2011

TC Ravenswood, LLCTC Ravenswood GT 3-4J(38.60)RTSSummer 2014

TC Ravenswood, LLCTC Ravenswood GT05J15.70MOSummer 2016

TC Ravenswood, LLCTC Ravenswood GT06J16.70MOSummer 2016

TC Ravenswood, LLCTC Ravenswood GT07J16.50MWinter 2013-2014

AES Eastern Energy LPWestover Unit 8C83.80MWinter 2010-2011

AES ES Westover LLCWestover LESRC0.00RSummer 2013

Helix Ravenswood, LLCRavenswood GT09J16.30IIFOWinter 2017-2018

Notes to Table 1:

Note 1: The capacity values listed are the CRIS MW values stated in the NYISO’s Load and Capacity Data Report

(referred to as the “Gold Book”).

Note 2: “IIFO” means ICAP Ineligible Forced Outage, “R” indicates “retired” (including “Retired,) “M” indicates

“mothballed”, MO means “Mothball Outage”, and “RTS” indicates returned to service after being M, MO, or

R. RTS” Changes in status of generators that were IIFO and subsequently changed their status are indicated on this table. Services Tariff provisions defining the terms ICAP Ineligible Force Outage, Mothball, and Retire apply to outages pursuant to the rules effective May 1, 2015.

Note 3: Helios Power Capital, LLC, et al., Joint Petition for Expedited Approval for the Lease, Sale and Operation of

the Danskammer Generating Facility Under Lightened Regulation and for Related Relief, PSC Case No. 14-

E-0117 (Jun. 27, 2014).

2017 Annual Installed Capacity Report |December 15, 2017|20

I.5 Capacity Withholding Analysis

I.5.1 All Capacity Areas in the NYCA

This section of the report addresses potential withholding issues in the NYISO-

administered capacity auctions for all four capacity areas during the period of November 2016 to

October 2017: ROS, NYC, the G-J Locality, and LI. For purposes of this report, in order to

identify whether any potential withholding occurred, the NYISO analyzed the differences

between available capacity9 and the supply committed through self-supply, bilateral

transactions, and the NYISO-administered auctions. In particular, the NYISO examined:

The NYCA capacity that was available to be offered into the ICAP Spot Market Auctions,

but was not offered (“unoffered capacity”),

Available NYCA capacity that was offered into the ICAP Spot Market Auctions but was

not sold (“unsold capacity”),

Unoffered capacity as a percentage of available capacity, and Unsold capacity as a percentage of offered capacity.

When capacity is available but not offered, it is an indication that physical withholding

may have occurred. Similarly, if available capacity is offered at a price that causes it to not

clear, it is an indication of possible economic withholding. The amounts of unoffered and unsold

capacity are determined from the ICAP Spot Market Auction results because this auction is the

last opportunity for an Installed Capacity Supplier to sell its capacity. The existence of unoffered

and unsold capacity, however, does not necessarily imply the intent to manipulate market

prices.

As reflected in the NYISO’s previous reports on the Installed Capacity Demand Curves,

patterns of unsold capacity have varied across the three Localities and the NYCA. For the

entire NYCA there generally has been more unsold capacity in Winter months than Summer

months, due in part to lower prices in the Winter months. The monthly average of unsold MW

for the Winter 2016-2017 Capability period in relation to the Winter 2015-2016 Capability Period

was as follows: NYC 51 MW compared to 2 MW, G-J Locality 31 MW compared to 2 MW, Long

Island 4 MW compared to 1 MW, and NYCA-wide 227 MW compared to 187 MW. The

seasonal monthly average amount of unsold MW for the Summer 2017 Capability Period for all

of the NYCA was zero MW, while it was near zero (0.46) MW in the Summer 2016 Capability

Period.

In Long Island, there was a monthly average of 4 MW of unsold capacity in the Winter 2016-2017 Capability Period, compared to near 1 MW in the Winter 2015-2016 Capability Period; and 0 MW in the Summer 2017 Capability Period compared to near 1 MW in the

Summer 2016 Capability Period.

In NYC, there was a monthly average of 51 MW of unsold capacity in the Winter 2016-

2017 Capability Period, compared to 2 MW in the Winter 2015-2016 Capability Period; and 0

9 Available capacity is defined as the lesser of the NYISO-accepted DMNC and the Capacity

Resource Interconnection Service (“CRIS”) MW value, with the Equivalent Demand Forced Outage Rates (“EFORd”) reduction applied.

2017 Annual Installed Capacity Report |December 15, 2017|21

MW in the Summer 2017 Capability Period compared to near 0 MW in the Summer 2016 Capability Period.

In the G-J Locality, there was a monthly average of 31 MW of unsold capacity in the

Winter 2016-2017 Capability Period, compared to 2 MW in the Winter 2015-2016 Capability

Period; and 0 MW in the Summer 2017 Capability Period compared to near 0 MW in the

Summer 2016 Capability Period. The increase in unsold capacity in NYC and the G-J Locality

from the prior Capability Year is due in part to offers from particular resources that cleared in

prior years but did not clear in Winter 2016-2017 due to lower Spot Market Auction clearing

prices.

There are three types of capacity auctions in each Capability Period: a Capability Period

Auction (also referred to as the “strip auction”), six Monthly Auctions, and six ICAP Spot Market

Auctions. Available capacity may be offered into any or all of the auctions. There are three

distinct minimum ICAP requirements: one each for the NYC, G-J, and LI Localities, as well as

one for the NYCA as a whole. LSEs with Load in NYC, G-J, or LI Localities are required to

procure minimum levels of capacity that is electrically located within the respective Locality - the

“LCRs” in terms of Unforced Capacity, i.e., the Locational Minimum Unforced Capacity

Requirement. Such capacity is also credited toward each NYC and Long Island LSE’s overall

NYCA obligation. The NYISO establishes the NYCA Minimum Installed Capacity Requirement

and the LCRs annually.

The Services Tariff does not require Installed Capacity Suppliers to offer UCAP into the

ICAP markets except for certain suppliers in Mitigated Capacity Zones (i.e., NYC and the G-J

Locality). Until the implementation of the ICAP market power mitigation measures set forth in

Attachment H of the Services Tariff, which were effectuated in May 2008, the majority of

capacity in NYC - that of the “Divested Generation Owners” - had been subject to Commission-

approved ICAP mitigation measures that imposed bid caps and required the units’ capacity to

be offered into the ICAP auctions. The Commission’s March 7, 2008 Order10 removed the

requirements unique to the Divested Generation Owners and approved mitigation measures

applicable to all In-City capacity. The March 7, 2008 Order effectuated new In-City mitigation

measures, based on Pivotal Supplier determinations combined with offering conduct and price

impact thresholds, to determine whether market power had been exercised. ICAP market

power mitigation measures became effective for the G-J Locality concurrent with its

implementation. These measures for NYC and G-J Locality are set forth in Section 23.4.5

(Attachment H) of the Services Tariff (as revised over time, “Supply-side Mitigation Measures”).

In developing the information for this report, the NYISO examined auction outcomes of the Capability Periods from Summer 2007, which began May 1, 2007, through Summer 2017, which ended October 31, 2017. Since the capacity product transacted in the NYISO-

administered ICAP auctions is UCAP, the following information was examined:

Certification data, reflecting the certified MW of UCAP from all the Resources physically

located within New York available to supply capacity to the NYCA. The analysis did not

include resources physically located outside of the NYCA.

10 See New York Independent System Operator, Inc., Docket No. EL07-39-000, Order Conditionally Approving Proposal, 122 FERC ¶ 61,211 (2008).

2017 Annual Installed Capacity Report |December 15, 2017|22

Certification data, reflecting the certified MW of UCAP from all the Resources within the

G-J Locality (Load Zones G, H, I, and J) available to supply capacity to the NYCA. The

analysis did not include resources physically located outside of the NYCA.

The amount of UCAP supplied, which includes UCAP sold in any of the NYISO ICAP

auctions, UCAP certified as self-supplied against an LSE’s Unforced Capacity obligation, and UCAP committed through bilateral transactions.

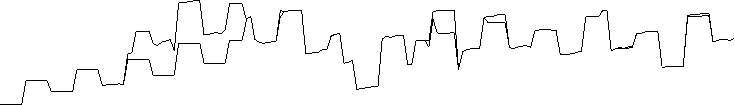

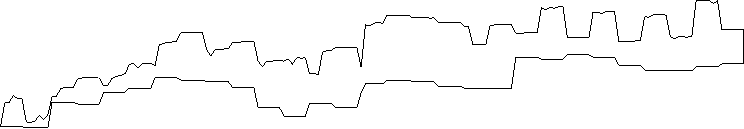

I.5.2 Unoffered and Unsold Capacity

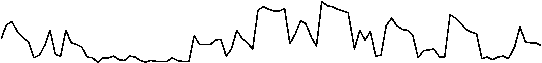

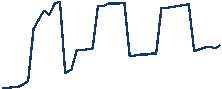

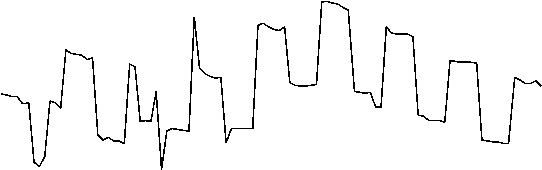

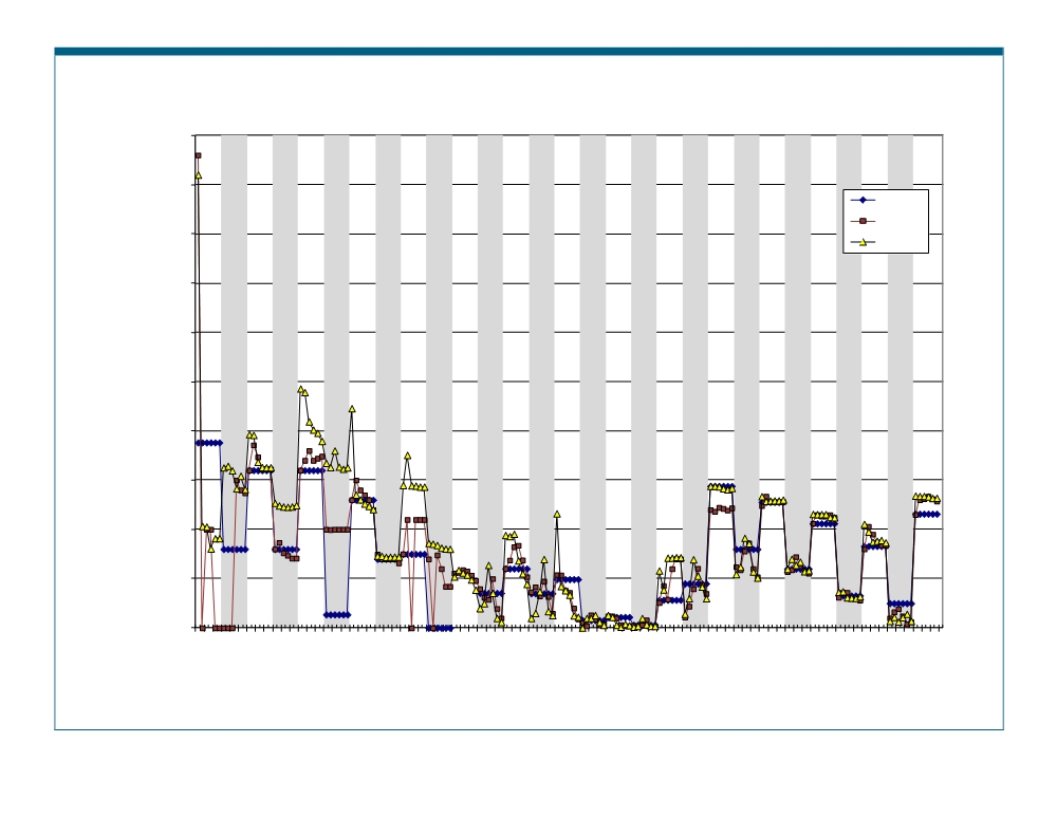

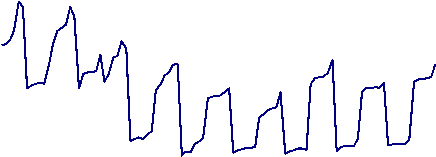

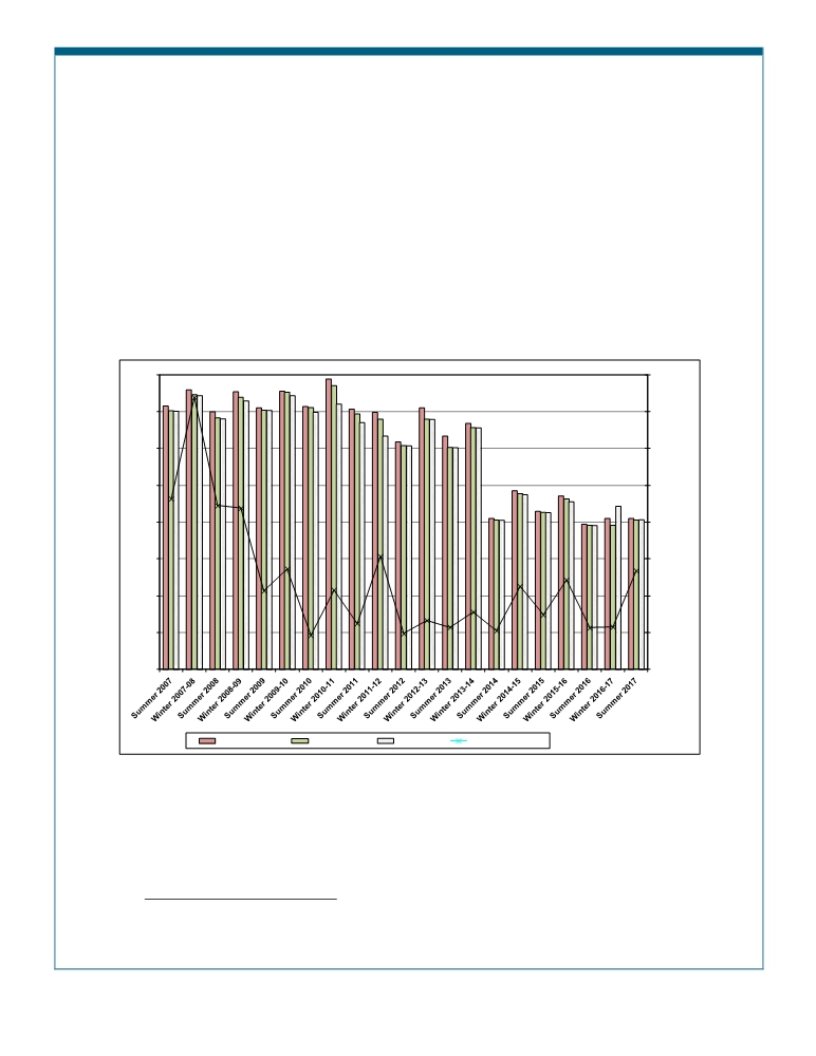

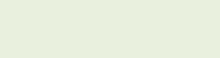

Chart 10 presents seasonal averages of unoffered capacity as a percentage of available Capacity for each of the three capacity areas.

Chart 10: Average Percent of Unoffered MW

The Long Island Locality has fairly consistent seasonal fluctuations in the amounts of

unoffered capacity, which can be seen in Chart 10. The LI Locality is characterized by

procurement chiefly through bilateral transactions and self-supply. The amount of unoffered

capacity in the LI Locality fluctuates between 0.02% and 2.3%. A portion of that unoffered

capacity is not actually available due, in some instances, to site permit restrictions. Another

portion arises from purchases due to bidders for NYCA capacity (i.e., not requiring capacity

located in Long Island) in the Capability Period and Monthly Auctions.11 The NYISO has

observed that these NYCA bidders sometimes fail to offer the Long Island capacity in the ICAP

Spot Market Auction.

11 When the Market Clearing Price in these auctions is the same for NYCA and Long Island capacity, offers of capacity located in the Long Island Locality is used to meet NYCA bids.

2017 Annual Installed Capacity Report |December 15, 2017|23

In the NYC Locality, prior to the Summer 2008 Capability Period, the low level of

unoffered capacity was principally due to the offer requirement applicable to the Divested

Generation Owners. Beginning with the Summer 2008 Capability Period, the near absence of

unoffered capacity can be attributed to the Supply-side Mitigation Measures effectuated in 2008.

The G-J Locality became effective beginning in May 2014. Initially, the level of unoffered capacity was at the level of that in ROS, but fell to near zero.

In ROS the unoffered MW for the Winter 2016-2017 and Summer 2017 Capability Periods was consistently below 0.5%.12

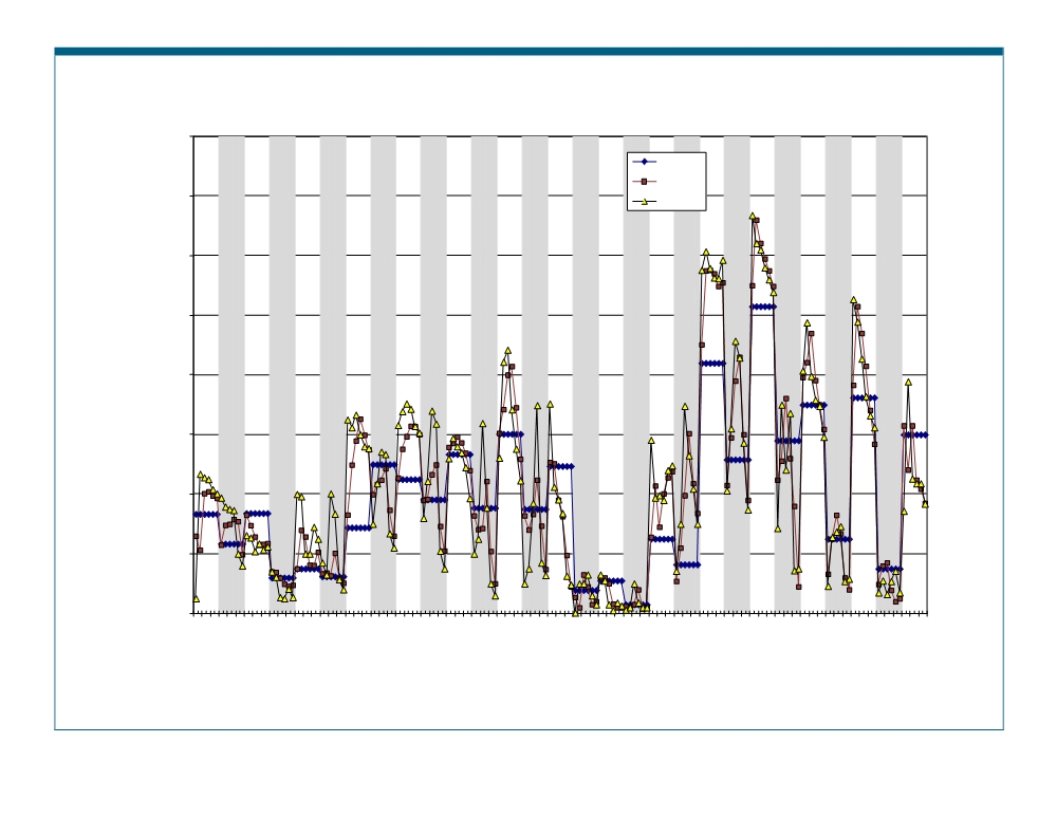

Chart 11 displays unsold capacity as a percent of available UCAP in each of the four capacity areas, which has been below 1% for the past nine Capability Periods.13

Chart 11: Average Percent of Unsold MW

For all Capability Periods beginning with the Summer 2007 Capability Period, nearly all

Long Island offered capacity was sold. In NYC, the average amount of unsold capacity as a

percentage of available capacity trended at near zero levels from the start of the Summer 2008

Capability Period, except for the Winter 2011-2012, and Winter 2012-2013 Capability Periods

when some offered capacity did not clear because it was offered at a price greater than the

UCAP Offer Reference Level. The UCAP Offer Reference Level is the price at which the ICAP

Spot Market Auction would clear if all available capacity was offered and sold. For the Winter

12 As noted in n. 1, the definition of Rest of State prior to the Summer 2014 Capability Period was

Load Zones A though I, and beginning with the Summer 2014 Capability Period is Load Zones A through

F.

13 Section I.5.4.3 of this report provides information and analysis of the unsold capacity in ROS.

2017 Annual Installed Capacity Report |December 15, 2017|24

2016-2017 and Summer 2017 Capability Periods, nearly all of the capacity offered in NYC

auctions was sold. The G-J Locality had less than 0.5% unsold MW in the 2016-2017 Capability Year. The increase in unsold capacity in NYC and the G-J Locality from the prior Capability

Year is due in part to offers from particular resources that cleared in prior years but did not clear in Winter 2016-2017 due to lower Spot Market clearing prices.

The NYCA Minimum Installed Capacity Requirement and LCRs increased for each capacity area since last Capability Year. .

Table 2 summarizes these values for NYC, G-J, LI, and the NYCA over the past eleven

years.

Table 2: Minimum Installed Capacity Requirements (%)14

Capability YearNYCG-JLINYCA

2007/200880-99116.5

2008/200980-94115

2009/201080-97.5116.5

2010/2011 (May)80-102118

2010/2011 (June-April)80-104.5118

2011/201281-101.5115.5

2012/201383-99116

2013/201486-105117

2014/20158588107117

2015/201683.590.5103.5117

2016/201780.590102.5117.5

2017/201881.591.5103.5118

Table 3 displays the breakdown of unsold capacity for each Locality and NYCA. These

unsold MW were not cleared in the NYC, G-J, LI, or NYCA spot auctions. As part of the

NYISO’s August 24, 2010 ICAP compliance filing,15 the NYISO stated that it would include

unoffered and unsold capacity in the NYC Locality in its annual Installed Capacity Demand

Curves reports. Table 3 also displays the unoffered capacity values for MWs that came from

NYC, GHI, LI, and ROS to give a full representation of the data that underlies this report.

Beginning with November 2016, the amount of unoffered MW stayed very low in NYC,

LI, and G-J Locality, totaling 256 MW in the Winter 2016-2017 and 57 MW in the Summer 2017.

14 The New York State Reliability Council issues an annual IRM Study Report, which presents the lowest feasible amount of capacity for the NYCA. Each report includes a comparison of the IRM and LCR values to the previous year along with an explanation of each parameter that contributed to the changes. The NYISO determines the actual LCRs for each Locality taking into consideration changes that have occurred since the Reliability Council approved the IRM Study Report. The 2016 IRM Study Report

covering the period of May 2017 through April 2018 is available at:

˂http://www.nysrc.org/NYSRC_NYCA_ICR_Reports.html˃.

15 See New York Independent System Operator, Inc., Resubmittal of August 24, 2010 Filing, Docket Nos. ER10-2210-000, EL07-39-000, and ER08-695-0004 at p. 16.

2017 Annual Installed Capacity Report |December 15, 2017|25

The total amount of unsold MW in NYC, G-J and LI was 137.6 MW in the Winter 2016-2017, and zero MW in the Summer 2017.

Section I.5.4.2 discusses explanations provided by Market Participants for unoffered MW in ROS in Winter 2016-2017. There was no unsold MW in ROS in the Summer 2017. Section I.5.4.3 presents the Market Participant explanations for and an analysis of unsold MW in ROS in the Winter 2016-2017.

Table 3: Unoffered and Unsold MW

UnofferedUnsold

MonthNYCGHILIROSNYCG-JLINYCA

Nov-1617.32.228.194.340.430.84.20408.80

Dec-165.48.119.182.152.430.84.2251.8

Jan-174.83.519.3150.252.430.88.3221.9

Feb-174.80.126.297.357.330.84.175.9

Mar-173.7464.799.252.430.81.1180.8

Apr-1713.31.430.4177.352.430.83.8224.6

May-174.60.20101.60000

Jun-172.10.50118.30000

Jul-171.10.70.735.20000

Aug-171.21.50930000

Sep-1736.50.3167.80000

Oct-175.30.51.137.50000

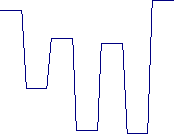

I.5.3 New York City and G-J Localities

To administer the Supply-side Mitigation Measures, the NYISO identifies Pivotal

Suppliers by examining the NYC UCAP and G-J Locality UCAP that each ICAP Supplier, along

with its Affiliated Entities, Controls in excess of the pivotal control threshold.16 The UCAP under

the Control of Pivotal Suppliers (“Mitigated UCAP”) must be offered into the ICAP Spot Market

Auction at a price at or below the lesser of the UCAP Offer Reference Level or the ICAP

Supplier’s Going-Forward Costs determined by the NYISO (“GFCs”). Chart 12 and Chart 14

illustrate the effects of the Supply-side Mitigation Measures. The UCAP Offer Reference Level,

as shown in these Charts, becomes the price cap that the Pivotal Supplier must offer at or

below in the ICAP Spot Market Auction, unless the Pivotal Supplier’s GFCs are higher.

The level of unoffered and unsold MW can be inferred from Chart 12 and Chart 14 by

comparing the Locality Spot Market Auction price to the UCAP Offer Reference Level, while

Chart 13 and Chart 15 depict the levels of available generator and SCR UCAP in the Locality.

The difference between the ICAP Spot Market Auction clearing price and UCAP Offer

Reference Level can be attributed to Locality capacity that is either not offered or is offered at a

price above the UCAP Offer Reference Level. Note that the Locality Spot Market Auction price

will diverge from the UCAP Offer Reference Level when the NYCA ICAP Spot Market Auction

16 See Market Services Tariff Sections 23.2.1 and 23.4.5.

2017 Annual Installed Capacity Report |December 15, 2017|26

sets the Locality ICAP Spot Market Auction price.17 This divergence is the result of the auction rules, and is not caused by unoffered or unsold Locality Capacity.

17 In the 2015/2016 Capability Year, the NYCA ICAP price set the Long Island ICAP price in May 2016 and June 2016.

2017 Annual Installed Capacity Report |December 15, 2017|27

Chart 12: NYC Mitigation Results18

$202,000

$181,800

$161,600

$141,400

$121,200

$101,000

$8800

$6600

$4400

$2200

$-0

NYC Spot Auction PriceUCAP Offer Reference LevelPivotal Control Threshold

Chart 13: NYC Generator and SCR UCAP

11,000600

10,500

500

10,000

400

9,500

9,000300

`

8,500

200

8,000

100

7,500

7,0000

NYC Generator UCAPNYC SCR UCAP

18 Per Services Tariff Section 23.2, a “Pivotal Supplier” in NYC needs to control at least 500 MW of Unforced Capacity, and a specified portion of the capacity necessary to meet the NYC LCR in an ICAP Spot Market Auction.

2017 Annual Installed Capacity Report |December 15, 2017|28

Chart 14: G-J Locality Mitigation Results19

$202,000

$181,800

$161,600

$141,400

$121,200

$101,000

$8800

$6600

$4400

$2200

$-0

G-J Locality Spot Auction PriceUCAP Offer Reference LevelPivotal Control Threshold

Chart 15: G-J Locality Generator and SCR UCAP

16,000600

15,000

500

14,000

13,000400

12,000

300

`

11,000

10,000200

9,000

100

8,000

7,0000

G-J Locality Generator UCAPG-J Locality SCR UCAP

19 Per Services Tariff Section 23.2, a “Pivotal Supplier” in the G-J Locality needs to control at least 650 MW of Unforced Capacity, and a specified portion of the capacity necessary to meet the G-J Locality LCR in an ICAP Spot Market Auction.

2017 Annual Installed Capacity Report |December 15, 2017|29

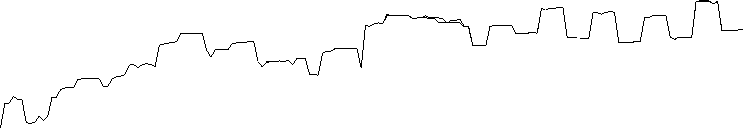

I.5.4 Rest of State

I.5.4.1 Overview

This section of the report addresses possible withholding of Capacity located in the Rest of State20 from November 2016 through October 2017. For this review, the NYISO conducted a detailed analysis of unoffered and unsold capacity. This section of the report pertains primarily to the NYCA but also contains some explanations for unoffered capacity in NYC, the G-J

Locality, and Long Island.

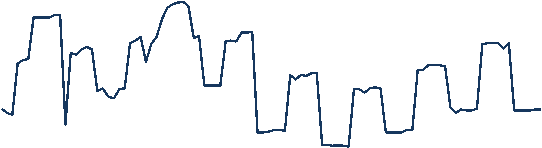

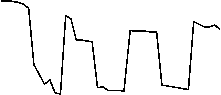

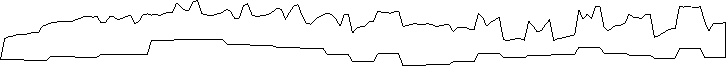

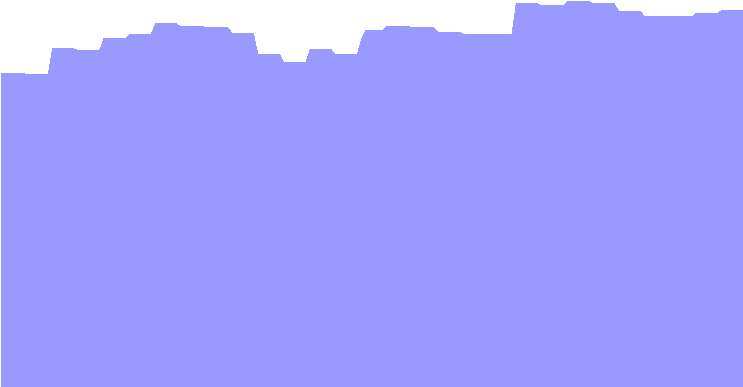

Chart 16 shows the monthly average values over each Capability Period for four ROS capacity types: available, offered, sold, and exported MW.

Chart 16: Rest of State Capacity Available, Offered, Sold and Exported

25

1,258

23

21

19845

817

17

15

13

11

9

807

610

560

473

471

338

289

1,350

Starting with Summer 2014, ROS

is comprised of Load Zone s A-F

1,200

1,050

900

750

600

552

489514

450

350384372320

322323

308300

296

150

ROS AvailableROS OfferedROS SoldCapacity Exports

Examination of Rest of State capacity data pertaining to individual Market Participants revealed general patterns in unsold and unoffered capacity. The patterns suggest a three-way classification of suppliers by market sector: all generation-owning transmission owners, ROS generation owners, and other suppliers (a category which includes SCRs.) Table 4 of this

December 2017 Report summarizes the monthly averages of unoffered and unsold capacity for each Capability Period since the Summer 2008.

20 Prior to the Summer 2014 Capability Period, ROS consisted of transmission zones A through I; starting May 2014, ROS is defined as transmission zones A through F.

2017 Annual Installed Capacity Report |December 15, 2017|30

Table 4: ROS Unoffered and Unsold Capacity MW by Type of Market

Participant

ROS Monthly Average Unoffered Capacity MW by Type of Market Participant

GenCo% of GenCoOthers% OtherTO% TOCapability Period Monthly Average

Summer 2008114.232.74%30.328.69%204.3758.57%348.9

Summer 200949.241.06%1.421.18%69.2557.76%119.9

Summer 201098.137.13%7.872.98%158.2259.90%264.2

Summer 201154.125.80%76.7036.56%78.9737.64%209.8

Summer 201260.129.48%75.3236.96%68.4033.56%203.8

Summer 2013486.678.28%64.2010.33%70.7711.39%621.5

Summer 201458.962.03%24.2325.52%11.8212.45%95.0

Summer 201521.326.97%30.7338.98%26.8534.05%78.9

Summer 20166.610.81%15.525.42%38.863.77%60.9

Summer 201745.259.75%18.424.39%12.015.85%75.6

ROS Monthly Average Unoffered Capacity MW by Type of Market Participant

GenCo% of GenCoOthers% OtherTO% TOCapability Period Monthly Average

Winter 2008-2009236.878.54%0.60.19%64.121.27%301.5

Winter 2009-201093.348.14%9.54.88%91.046.98%193.7

Winter 2010-2011212.657.39%30.48.19%127.534.41%370.4

Winter 2011-2012138.536.98%93.725.00%142.438.02%374.6

Winter 2012-2013437.373.43%21.03.52%137.323.05%595.5

Winter 2013-2014118.250.12%54.122.94%63.626.94%235.9

Winter 2014-201570.641.63%47.027.72%52.030.65%169.6

Winter 2015-201682.557.83%9.26.41%51.035.76%142.7

Winter 2016-201738.232.70%32.527.86%46.139.45%116.7

ROS Monthly Average Unsold Capacity MW by Type of Market Participant

GenCo% of GenCoOthers% OtherTO% TOCapability Period Monthly Average

Summer 200861.699.49%0.30.51%00%61.9

Summer 200900%00%00%0

Summer 201015.435.56%27.864.44%00%43.2

Summer 2011479.991.01%44.98.52%2.50.47%527.3

Summer 201200%00%00%0

Summer 201311.6100%00%00%11.6

Summer 201400%00%00%0

Summer 201500%00%00%0

Summer 201600%00%00%0

Summer 201700%00%00%0

ROS Monthly Average Unsold Capacity MW by Type of Market Participant

GenCo% of GenCoOthers% OtherTO% TOCapability Period Monthly Average

Winter 2008-2009178.797.65%4.32.35%00%183.0

Winter 2009-201073.495.30%3.64.70%00%77.0

Winter 2010-2011895.689.53%104.710.47%00%1000.3

Winter 2011-2012811.386.49%88.49.43%38.44.09%938.0

Winter 2012-20138.360.98%5.339.02%00%13.7

Winter 2013-201400%7.0100%00%7.0

Winter 2014-20155.07.79%59.092.21%00%64.0

Winter 2015-2016127.567.86%17.69.38%42.823%187.9

Winter 2016-2017172.188.39%22.611.61%0.00.00%194.7

2017 Annual Installed Capacity Report |December 15, 2017|31

Salient facts from the above tables are:

The group of all ROS generation-owning Transmission Owners consistently had

unoffered capacity which ranged from 11% to 65% of total unoffered capacity.

The group of all ROS generation-owning Transmission Owners had up to 23% of offered

and unsold capacity.

The group of generation owners consistently had unoffered capacity which ranged from

25% to 79% of total unoffered capacity.

The group of generation owners had unsold capacity which accounted for 0% to 100% of

total capacity that was offered and unsold capacity.

The group of all others including SCRs consistently had unoffered capacity that ranged

from 0% to 39% of total unoffered capacity.

The group of all others including SCRs had capacity that was offered and unsold

capacity that ranged from 0% to 100%.

I.5.4.2 Analysis of ROS Unoffered Capacity

This section provides a detailed analysis of the unoffered capacity located in the ROS.

The section also presents the maximum price impact of the unoffered capacity, in each month

and averaged over the six months of each Capability Period. Market Participants with a

significant amount of unoffered capacity were provided an opportunity to justify their unoffered

MW. Generally, responses suggest that the Installed Capacity Suppliers’ reasons for not

offering the Capacity were benign, and none of the instances evidenced behavior intended to

artificially raise prices.

Instances of unoffered capacity in Mitigated Capacity Zones are potentially subject to a non-discretionary penalty assessment (Services Tariff Section 23.4.5.4.2), and are not included in this section.

The NYISO contacted each Installed Capacity Supplier with at least 15 MW of unoffered

capacity in any one month during the period November 2016 through October 2017 for an

explanation of why it did not offer all of its capacity. There were eleven Market Participants with

15 MW or more of unoffered capacity in any given month in ROS, and the NYISO sought and received explanations from each of them.21

Eight Market Participants reported that their failure to offer capacity into the ICAP market

was due to an administrative oversight. Six of the instances failed to offer in just one month

over the two capability periods. One instance failed to offer in two consecutive months and the

remaining instance had several months in which they failed to offer. Out of the eight Market

Participants that had reported that the failure to offer was due to an administrative oversight

reason, five indicated that new procedures would be put in place to avoid failing to offer capacity

in the future. One of the eight also indicated its offering pattern as part of its explanation.

Three Market Participants reported environmental and/or physical conditions as cause for not offering capacity. These responses detailed causes including conservative operating strategies, SCR aggregation changes, and planned maintenance.

21 Confidential Attachment I provides a detailed summary of the Market Participants’ explanations for having unoffered capacity.

2017 Annual Installed Capacity Report |December 15, 2017|32

Table 5 shows the maximum price impact of the unoffered capacity (15 MW or higher

per incident) based on the slopes of the ICAP Demand Curves for the relevant Capability

Periods. The maximum price impact is calculated as the lesser of (1) the product of the monthly

unsold MW and the slope of the ICAP Demand Curve and (2) the ICAP Spot Market Auction

Market-Clearing Price, since the price impact cannot exceed the auction price. Monthly values

and seasonal averages of the maximum price impact are reported. The maximum price impact

of the unoffered capacity, averaged over the six months of the Winter 2016-2017 and Summer

2017 Capability Periods, was $0.17/kW-month (ranging from $0.06/kW-month to $0.25/kW-

month) and $0.08/kW-month (ranging from $0.00/kW-month to $0.21/kW-month), respectively.

Table 5: Maximum Price Impact of ROS Unoffered Capacity (15MW+)22

Total

MonthUnoffered

MW

MonthlySeasonal

MaximumAverage

PriceMaximum

Impact Price Impact

Nov-1643.7$0.10

Dec-1625.0$0.06

Jan-17110.9$0.25

Feb-1766.2$0.15

Mar-1768.2$0.16

Apr-17142.6$0.33

May-1784.2$0.20

Jun-1788.0$0.21

Jul-170.0$0.00

Aug-1721.2$0.05

Sep-170.0$0.00

Oct-17 0.0 $0.00

$0.17

$0.08

I.5.4.3 Analysis of ROS Unsold Capacity

This section analyzes and reports on ROS unsold capacity in the ICAP Spot Market Auction. It also presents the maximum price impact of the ROS unsold capacity, in any one month and the price impact average for the six months of the Capability Period. Attachment II summarizes masked unsold capacity offers.23

For each Installed Capacity Supplier that had 15 MW or more of unsold capacity in a

given month, the NYSIO (a) requested and received its explanation of its behavior; and (b)

performed a unit-specific GFC analysis if the aggregated monthly average price impact over the

capability period was greater than or equal to $0.20/kW-month, or $0.35/kW-month in any

month.

The process utilized by the NYISO in performing this analysis only requires the

development of a unit-specific GFC if the generator had an ICAP Spot Market Auction offer that

22 The price impact of all ROS unoffered capacity average $0.25/kW-month for the Winter 2016-

2017 (ranging from $0.19/kW-month to $0.35/kW-month), and $0.18/kW-month for the Summer 2017 (ranging from $0.08/kW-month to $0.28/kW-month). The monthly price impact cannot exceed the ICAP Spot Market Auction clearing price for that month.

23 Attachment II is a redacted version of the unsold capacity offers

2017 Annual Installed Capacity Report |December 15, 2017|33

was greater than the generator’s class average Net GFC with half net revenues.24 In order to comply with the requirement in the Analysis Plan while making the analysis more useful to the Commission and stakeholders, this report is using unit-specific GFCs. The unit-specific GFC data utilized represents an increase in accuracy when compared to class average Net GFCs, and is used in place of the class average NET GFC with half net revenue step.

I.5.4.4 Monthly Price Impacts

includes the average monthly maximum price impact of unsold capacity for each

Capability Period. The average price impacts were $0.33/kW-month in Winter 2016-2017 and

$0.00/kW-month in the Summer 2017. The Capability Period impact threshold of $0.20/kW-

month was exceeded for Winter 2016-2017. Additionally, monthly maximum price impact

exceeds the $0.35/kW-month threshold for months of November 2016, December 2016, and

April 2017.

Table 6: Maximum Price Impact of ROS Unsold MW

Month

Total Unsold

MW

Monthly Maximum

Price

Impact

Seasonal

Average

Maximum

Price Impact

Jan-17188.2

Feb-1744.3

$0.32

$0.10

$0.33

Jul-170.0

Aug-170.0

$0.00

$0.00

$0.00

Oct-170.0$0.00

In addition to calculating the monthly maximum and average maximum price impacts,

price impacts of unsold capacity offered at varying levels of Going Forward Costs (“GFCs”), as

described in

Table 7, were estimated. For the purpose of this report, the GFCs are defined as costs

that could be reasonably expected to be avoided if the plant was mothballed for at least one

year less projected net revenues from energy and ancillary services markets. These GFCs may

24 Going Forward Cost terminology and elements for purposes of ROS unsold capacity analysis were discussed in detail at Table 7 in the 2012 Annual Installed Capacity Report. See 2012 Annual

Report at Table 7, filed in FERC Docket Nos. ER01-3001-000, E03-647-000 (Feb. 14, 2013) (see also, New York Indep. Sys. Operator, Inc. Docket Nos. ER01-3001-000, E03-647-000, “Updated Status Report on Stakeholder Discussions Regarding Annual Installed Capacity Demand Curve Reports and Plan for Further Reports at Attachment A (Nov 12, 2009) (“Analysis Plan”).

2017 Annual Installed Capacity Report |December 15, 2017|34

provide insight into why a generator offered its capacity at a non-zero offer price. In this analysis, GFCs are calculated for the entire capacity of the plant.

Generators face uncertainty about net revenues, among other things, which may

influence the prices at which they offer capacity. To account for this uncertainty, the calculated GFCs including varying levels of net revenues: full, half, and no net revenues. Confidential Attachment IV to this report shows the specific generator’s costs and/or SCR’s heuristic

methods for ICAP Suppliers with at least 15 MW of unsold capacity in any one month during November 2016 - April 2017 time period less the varying levels of net revenues.

Table 7 describes and defines the GFCs.

Table 7: Going Forward Cost Definitions

Avoidable Costs (ACs)

Net energy and ancillary services revenues (net revenues)

GFCs with full net revenues

GFCs with half net revenues

GFCs with no net revenues

Costs that would be avoided or deferred if a generator was mothballed for a year or more, based on the calculation of the industry average cost data for the type of generator.

Estimated energy plus ancillary services revenues minus

estimated production costs, with a minimum value of zero.

ACs minus net revenues. This value is used to represent Net GFCs with certainty of net revenues.

ACs minus 0.5 times net revenues. This value is used to represent Net GFCs with some uncertainty.

ACs. This value is used to represent Net GFCs without certainty of net revenues.

The Winter 2016-2017 ICAP Strip Auction Price in ROS is $0.75/kW-month, while the ICAP Monthly Auction Price for the upcoming auction month varied between $0.20/kW-month and $0.85/kW-month for Winter 2016-2017 Capability Period. Table 8 below shows the amount of unsold capacity by month for which calculated GFCs with full net revenue were exceeding the ICAP Monthly Auction Price for the upcoming auction month.

Table 8: ROS Unsold MW with reported GFCs costs above ICAP

Monthly Auction Prices (15MW+)

Month

Total Unsold

MW (15+)

Total Unsold with GFCs

ICAP Monthly Auction Priceabove ICAP Monthly

Auction Price (15MW+)

Apr-17189.3$0.25189.3

There are three generators associated with unsold capacity and two SCR resources. Attachment IV contains the confidential information provided by the Market Participants in

response to the NYISO’s request for information regarding their bidding strategy and cost data for the months in which there was unsold capacity.

All Market Participants responded to the NYISO’s information request with the following information regarding their behavior for months in which they had unsold capacity.

2017 Annual Installed Capacity Report |December 15, 2017|35

• Three generators submitted avoidable cost estimates in support of a calculated

GFC value.

• Two SCRs submitted heuristic strategies in support of a GFC value, citing

approximate shutdown costs or administrative and operational costs.

The NYISO performed ICAP Spot Market Auction simulations for a more detailed

understanding of how the non-zero price offers may have affected Market Clearing Prices. The NYISO simulated auction outcomes under three scenarios: GFCs with full net revenues, GFCs with half net revenues and GFCs with no net revenues. These scenarios are labeled scenarios 1, 2, and 3 in Table 9. The NYISO performed the simulations by replacing offers that originally did not clear with the unit-specific GFC at varying levels of net revenues. It is important to note that offers were only replaced with the GFCs value if the offers were not awarded any MW. If

the offer was marginal and only cleared a portion of its MW, or if the offer was inframarginal, the specific offers at the original offer prices were used. The offers that were analyzed for purposes of the simulations are provided in Attachment II.25

Table 9 shows the results of the auction simulations in each of the scenarios, for each

month of the analysis period (Winter 2016/2017). For comparison, the original ROS ICAP Spot

Market Auction prices are reported, in addition to the simulated ROS ICAP Spot Auction Prices

under each of the scenarios. The simulation price deltas relative to the original clearing prices

should not be positive because only entire offers that did not clear and which were originally

priced above the ICAP Monthly Auction clearing price were replaced with GFCs. The amount of

the price reduction shown in the simulations is static or decreasing as half or no revenues are

recognized in the GFC calculations. That outcome is consistent with what would be expected.

Table 9: ROS ICAP Spot Auction Price Impact Analysis Results

MonthROS Spot PricesS1[1]S2[2]S3[3]S1 deltaS2 deltaS3 delta

Nov-16$0.35$0.35$0.35$0.35$0.00$0.00$0.00

Dec-16$0.55$0.55$0.55$0.55$0.00$0.00$0.00

Jan-17$0.32$0.32$0.32$0.32$0.00$0.00$0.00

Feb-17$0.54$0.54$0.54$0.54$0.00$0.00$0.00

Mar-17$0.71$0.71$0.71$0.71$0.00$0.00$0.00

Apr-17$0.35$0.35$0.35$0.35$0.00$0.00$0.00

Notes to Table 9:

Note 1: GFCs with full net revenues

Note 2: GFCs with half net revenues

Note 3: GFCs with no net revenues

The results of the simulations shown in Table 9 indicate that the NYCA ICAP Spot

Market Auction prices likely would not have been lower if the entire offers did not clear were

offered at their respective GFC values. In all three scenarios, there would be no price impact.

As noted earlier, the simulations were performed by replacing only entire offers that did not clear

25 The unmasked unsold capacity offers are provided in Confidential Attachment III.

2017 Annual Installed Capacity Report |December 15, 2017|36

with their respective GFCs. The associated potential zero price impacts do not indicate that economic withholding occurred.

The analysis shows that no economic withholding occurred over the Winter 2016-2017.

During this period, the ICAP Spot Market Auction Market-Clearing Price for the NYCA was

below the Capability Period Market-Clearing Price and both above and below the Monthly

Auction clearing prices for the NYCA. The Capability Period and Monthly Auctions reflect market

place expectations for upcoming Spot Auction Market-Clearing Prices. In addition the Winter

2016-2017 ICAP Spot Market Auction Market-Clearing Price for the NYCA was below the

estimated Going Forward Costs for all of the ROS generators with unsold capacity.

2017 Annual Installed Capacity Report |December 15, 2017|37

II. NYISO Report on New Generation Projects

In its October 23, 2006 order, the Commission ordered the NYISO to submit “a list of

investments in new generation projects in New York (including a description and current status of each such project), regardless of the stage of project development at the time of the filing.”26 The NYISO keeps a list of Interconnection Requests and Transmission Projects for the New

York Control Area that includes information about all generation projects in the State that have requested interconnection.

The NYISO interconnection process for generators and Merchant Transmission Facilities

is described in two attachments of the NYISO OATT: OATT Attachment X entitled, “Standard

Large Facility Interconnection Procedures,” and OATT Attachment Z entitled, “Small Generator

Interconnection Procedures.” OATT Attachment X applies to Generating Facilities that exceed

20 MW in size and to Merchant Transmission Facilities, collectively referred to as “Large

Facilities.” OATT Attachment Z applies to Generating Facilities no larger than 20 MW.

Under OATT Attachment X, Developers of Large Facilities must submit an

Interconnection Request to the NYISO. The NYISO assigns a Queue Position to all valid

Interconnection Requests. Under OATT Attachment X, proposed generation and Merchant Transmission Facility projects undergo up to three studies: the Feasibility Study, the System Reliability Impact Study, and the Class Year Interconnection Facilities Study. The Class Year Interconnection Facilities Study is performed on a Class Year basis for a group of eligible projects pursuant to the requirements of OATT Attachment S. Under OATT Attachment Z, proposed small generators undergo a process that is similar, but with different paths and

options that are dependent on the specific circumstances of the project.

Proposed generation and transmission projects currently in the NYISO interconnection process are listed on the list of Interconnection Requests and Transmission Projects for the New York Control Area (“NYISO Interconnection Queue”). The generation projects on that list are shown in Attachment IV to this report, which is dated November 30, 2017. The NYISO updates the NYISO Interconnection Queue on at least a monthly basis and posts the most recent list on the NYISO’s public web site27 at the “Planning Documents and Resources”,

underneath the “Interconnection Studies” section.

The status of each project on the NYISO Interconnection Queue is shown in the column

labeled “S.” An explanation of this column is provided in Attachment V to this report. Also, note

that the proposed In-Service Date for each project is the date provided to the NYISO by the

respective Owner/Developer, is updated only on a periodic basis, and is subject to change.

26 See New York Independent System Operator Inc., 117 FERC ¶ 61,086, at P 14 (2006).

27 See <http://www.nyiso.com/public/markets_operations/services/planning/documents/index.jsp>.

2017 Annual Installed Capacity Report |December 15, 2017|38

III. New Generation Projects and Net Revenue Analysis III.1 Overview