ELIAS G. FARRAH

(202) 282-5503

efarrah@winston.com

August 21, 2017

VIA ELECTRONIC TARIFF FILING

Kimberly D. Bose

Secretary

Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426

RE: New York Transco, LLC, et al.

Docket No. ER15-572-000

Offer of Settlement

Dear Secretary Bose:

Pursuant to Rule 602 of the Rules of Practice and Procedure of the Federal Energy Regulatory Commission (“FERC” or “Commission”),1 New York Transco, LLC (“NY Transco”) hereby submits an Offer of Settlement in the above-referenced proceeding on behalf of the signatories to the Settlement.2 The New York Independent System Operator, Inc. (“NYISO”) is submitting this filing in FERC’s e-Tariff system on behalf of the NY Transco in its role as the Tariff Administrator.3 The NYISO takes no position on any substantive aspect of the filing at this time. This Settlement resolves all of the issues set for hearing or pending in requests for rehearing in Docket No. ER15-572-000 with respect to NY Transco’s proposed Alternating Current (“AC”) Transmission Projects.

1 18 C.F.R. § 385.602 (2017)

2 The signatories include NY Transco, Central Hudson Gas and Electric Corporation, Consolidated Edison Company of New York, Inc., Niagara Mohawk Power Corporation d/b/a National Grid, New York State Electric and Gas Corporation, Orange and Rockland Utilities, Inc., Rochester Gas and Electric Corporation, New York Power Authority, Power Supply Long Island, New York Public Service Commission (“NYPSC”), City of New York, Municipal Electric Utilities Association of New York, and Multiple Intervenors (an unincorporated association of approximately 60 industrial, commercial, and institutional energy consumers with manufacturing and other facilities located throughout New York State). Commission Trial Staff, New York State Department of State Utility Intervention Unit, and New York Association of Public Power also actively participated in the settlement discussions but are not signatories to the Settlement.

3 See “Notice of Additional eTariff Type of Filing Codes” for all settlement proceedings, issued by the Commission on December 1, 2016 under Docket No. RM01-5-000.

August 21, 2017

Page 2

In accordance with Rule 602(c)(1),4 this Settlement filing consists of the following documents:

1. Transmittal letter;

2. Explanatory Statement in Support of Offer of Settlement; and

3. Offer of Settlement, which includes Attachments A through D.

NY Transco respectfully requests waiver of Rule 602(c)(2) of the Commission’s

regulations,5 which provides that if an offer of settlement pertains to a tariff filing, the offer must

include any proposed change in a form suitable for inclusion in the tariff. NY Transco is

submitting a Settlement with respect to cost recovery and cost allocation for the

AC Transmission Projects, which were identified as part of a NYISO solicitation for the

development of public policy transmission projects in the State of New York. The NYISO is not

anticipated to select the developer for the AC Transmission Projects until the fourth quarter of

2017 or the first quarter of 2018. Until the NYISO’s selection of developer(s) for the

AC Transmission Projects, no purpose is served by having NY Transco submit hypothetical

revisions to the NYISO’s Open Access Transmission Tariff (“Tariff”). As provided in Section

3.10 of the Settlement, if selected, NY Transco will submit a compliance filing that includes proposed revisions to Schedule 13 (Section 6.13) and Attachment DD (Section 36) of the Tariff within 30 days of the date that the NYISO selects a developer with respect to the AC Transmission Projects.

NY Transco respectfully requests that the Settlement be transmitted to the presiding

officer, Administrative Law Judge Sterner, pursuant to Rule 602(b)(2)(i), for certification.6 In

addition, NY Transco respectfully requests that Judge Sterner certify the Settlement to the

Commission at the earliest possible date and that the Commission promptly approve the

Settlement, without modification or condition, on the grounds that it is in the public interest, it

represents the results of negotiations between NY Transco and the active settlement parties in

this proceeding, and it fully resolves all issues regarding the AC Transmission Projects in the

proceeding.

NY Transco certifies that it is serving a complete copy of the settlement package on all parties to the above-referenced proceedings. In accordance with the comment periods set forth in Rule 602(f)(2),7 comments on the Settlement are due 20 days from the date of this filing, which means comments are due September 11, 2017. Reply comments are due September 20, 2017, or 30 days from the date of this filing.

4 18 C.F.R. § 385.602(c)(1) (2017).

5 18 C.F.R. § 385.602(c)(2) (2017).

6 18 C.F.R. § 385.602(b)(2)(i) (2017).

7 18 C.F.R. § 385.602(f)(2) (2017).

August 21, 2017

Page 3

Please contact the undersigned if you have any questions regarding this filing.

Respectfully submitted,

/s/ Elias G. Farrah

Elias G. Farrah

Winston & Strawn, LLP

1700 K Street N.W.

Washington, D.C. 20006-3817 (202) 282-5503

Counsel to New York Transco, LLC

Attachments

cc: The Honorable Steven L. Sterner (via e-mail)

Commission Trial Staff (via e-mail)

Service List

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Transco, LLC)

New York Independent System Operator, Inc. )

Central Hudson Gas & Elec. Corp.)

Consolidated Edison Co. of New York, Inc.)

Niagara Mohawk Power Corp., d/b/a)

National Grid)

New York State Elec. & Gas Corp.)

Orange and Rockland Utilities, Inc.)

Rochester Gas and Electric Corp.)

EXPLANATORY STATEMENT

Docket No. ER15-572-000

IN SUPPORT OF OFFER OF SETTLEMENT

Pursuant to Rule 602 of the Rules of Practice and Procedure of the Federal Energy Regulatory Commission (“Commission” or “FERC”),1 New York Transco, LLC (“NY Transco”), on behalf of the Active Settling Parties (each a “Settling Party” and collectively the “Settling Parties”),2 submits this explanatory statement in support of an Offer of Settlement (“Settlement” or “Settlement Agreement”) to resolve all of the issues set for hearing or pending in requests for rehearing in Docket No. ER15-572-000 with respect to NY Transco’s proposed Alternating Current (“AC”) Transmission Projects.3

1 18 C.F.R. § 385.602 (2017).

2 The Active Settlement Parties who attended all of the settlement conferences and participated in settlement

negotiations are Central Hudson Gas and Electric Corporation, Consolidated Edison Company of New York, Inc.,

Niagara Mohawk Power Corporation d/b/a National Grid (“National Grid”), New York State Electric and Gas

Corporation, Orange and Rockland Utilities, Inc., Rochester Gas and Electric Corporation, New York Power Authority

(“NYPA”), Power Supply Long Island, New York Public Service Commission (“NYPSC”), City of New York,

Municipal Electric Utilities Association of New York, and Multiple Intervenors (an unincorporated association of

approximately 60 industrial, commercial, and institutional energy consumers with manufacturing and other facilities

located throughout New York State). Commission Trial Staff, New York State Department of State Utility

Intervention Unit, and the New York Association of Public Power participated in the settlement discussions.

3 The AC Transmission Projects are defined in Article 2.1 of the Settlement Agreement.

I.INTRODUCTION

NY Transco is a New York limited liability company that is owned by Consolidated Edison Transmission, LLC, Grid NY LLC, AVANGRID Networks New York Transco, LLC, and Central Hudson Electric Transmission, LLC.4 NY Transco was formed to plan, develop, construct, own, and operate major new high-voltage electric transmission projects in New York. NY Transco owns transmission facilities in New York that are under the operational control of the New York Independent System Operator, Inc. (“NYISO”).

On December 4, 2014, NY Transco submitted a filing (“December 4 Filing”) requesting that the Commission: (1) approve certain incentive rate treatments pursuant to Section 219 of the Federal Power Act (“FPA”) and Order No. 679 for their investment in five high-voltage transmission projects in New York; (2) accept NY Transco’s transmission formula rate, which included a formula rate template and protocols, to be effective on April 3, 2015; (3) approve NY Transco’s requested return on equity (“ROE”); (4) accept NY Transco’s cost allocation method to recover its revenue requirement; and (5) accept NY Transco’s proposed revisions to the NYISO Open Access Transmission Tariff (“OATT”) to include a proposed Transco Facilities Charge as Schedule 13 (Section 6.13) of the OATT and the proposed cost allocation and formula rate as Attachment DD (Section 36) of the OATT.

On April 2, 2015, the Commission issued an order: (1) granting the request for certain pre-

commercial cost recovery incentives,5 request for a 50 basis point adder for NY Transco’s

membership in a regional transmission organization (“RTO”),6 and request for a 50 basis point

4 These entities are affiliates of the six investor-owned utilities in New York State.

5 N.Y. Indep. Sys. Operator, Inc., 151 FERC ¶ 61,004, at PP 76-78, 85 (2015) (“April 2015 Order”).

6 Id. at P 88.

2

adder for the risks and challenges associated with developing the Edic to Pleasant Valley Project,7

including the NY Transco’s cost estimate risk sharing proposal associated with the ROE adders;8

(2) accepting, for filing, NY Transco’s proposed formula rate and protocols, including a proposed

base ROE and the methodology and procedures for tracking the pre-commercial cost recovery

incentives granted by the Commission, but suspending them for a nominal period, subject to

refund, and setting them for hearing and settlement judge procedures;9 (3) declining the NYPSC’s

request for cost recovery to be limited to the preliminary cost estimate identified by the NYPSC

in a New York State proceeding;10 (4) denying the proposed hypothetical capital structure prior to

securing financing for the projects;11 (5) denying the request for a 50 basis point adder for risks

and challenges associated with developing the Transmission Owner Transmission Solution

(“TOTS”) Projects, request for a risks and challenges adder for the Oakdale to Fraser Project, and

a request for a 50 basis point adder for being a Transco;12 and (6) denying the proposed cost

allocation provisions.13

NY Transco, NYPSC, and NYPA filed requests for rehearing of the Commission’s April

2015 Order. NY Transco requested rehearing of the Commission’s cost allocation ruling, the

Commission’s denial of NY Transco’s proposed hypothetical capital structure incentive during the

construction phase of its projects until long-term financing is secured, the Commission’s denial of

additional ROE incentive adders based both on the risks and challenges associated with developing

7 Id. at P 93.

8 Id. at P 99, 111.

9 Id. at PP 140-141.

10 Id. at P 111.

11 Id. at P 84.

12 Id. at PP 92-93. Note that NY Transco is no longer proposing to develop the Oakdale to Fraser Project.

13 Id. at PP 185-188.

3

the projects and for being a “Transco,” as defined in the Commission’s regulations, and the Commission’s denial of NY Transco’s request for waivers of certain accounting regulations.14 NYPA sought rehearing of the Commission’s rejection of NY Transco’s proposed cost allocation.15 The NYPSC’s request for rehearing argued that the Commission should establish a cost recovery mechanism that includes certain cost containment measures, and should reconsider the Commission’s grant of a 50 basis point adder for RTO participation.16 No other Settling Party filed a request for rehearing of the Commission’s April 2015 Order.

By order dated April 9, 2015, the Chief Judge designated the Honorable Steven L. Sterner

to preside over settlement procedures.17 The Settling Parties engaged in settlement discussions,

and on November 5, 2015, NY Transco filed an offer of partial settlement resolving all issues set

for hearing or pending in requests for rehearing in Docket No. ER15-572-000 with respect to NY

Transco’s proposed TOTS Projects, which the Commission approved on March 17, 2016.18

While the offer of partial settlement did not resolve any outstanding issues with respect to

the AC Transmission Projects, Section 2.5 therein provided that this docket should remain open

but held in abeyance until such time as the NYISO issues a “Viability and Sufficiency Assessment”

with respect to the AC Transmission Projects pursuant to Section 31.4.6.5 of Attachment Y of the

14 N.Y. Indep. Sys. Operator, Inc., Request for Expedited Rehearing of the Applicants, Docket No. ER15-572-002 (filed May 4, 2015).

15 N.Y. Indep. Sys. Operator, Inc., Request for Clarification, or in the Alternative, Rehearing of New York Power Authority, Docket No. ER15-572-002 (filed May 4, 2015).

16 N.Y. Indep. Sys. Operator, Inc., Request for Rehearing of the New York State Public Service Commission, Docket No. ER15-572-002 (filed May 4, 2015). The NYPSC also sought clarification that Applicants would be held to a specific cost estimate and would not be allowed to apply above-estimate costs to an ROE incentive adder for participation in the NYISO.

17 N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-572-000 (April 9, 2015) (unpublished letter order).

18 N.Y. Indep. Sys. Operator, Inc., 154 FERC ¶ 61,196 (March 17, 2016).

4

NYISO OATT.19 On October 27, 2016, the NYISO issued its final Viability and Sufficiency Assessment, which confirmed the NY Transco project submissions20 as viable and sufficient and able to proceed to the next step in the NYISO process, and the Chief Judge subsequently issued an order on November 2, 2016, terminating the abeyance and reinstating settlement procedures with respect to the AC Transmission Projects before Judge Sterner.21

Settlement conferences were held before Judge Sterner on December 12, 2016, March 8,

2017, April 5, 2017, May 15, 2017, June 8, 2017, and July 11, 2017. The Settling Parties engaged

in numerous settlement discussions and settlement conference calls between December 2016 and

July 2017 that have resulted in the Settlement Agreement. The Settlement reflects the agreement

of the Settling Parties to resolve all outstanding issues associated with the AC Transmission

Projects, including issues related to the AC Transmission Projects that were set for hearing and

issues pending on rehearing before the Commission in Docket No. ER15-572-000.

II. SUMMARY OF SETTLEMENT AGREEMENT

The Settling Parties have engaged in settlement negotiations resulting in a Settlement Agreement that comprehensively resolves all issues set for hearing or pending on rehearing concerning the AC Transmission Projects. A summary of the provisions of the Settlement Agreement is included below. The Settlement Agreement binds each of the Settling Parties to the terms and conditions included therein.

Article I sets forth the procedural history of this proceeding.

19 The Chief Judge issued an order holding this proceeding in abeyance until such time. See N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-572-000 (Jan. 27, 2016) (unpublished letter order).

20 NY Transco submitted the AC Transmission Projects jointly with National Grid. If the project is awarded to NY Transco and National Grid, NY Transco will purchase the project from National Grid.

21 N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-572-000 (Nov. 2, 2016) (unpublished letter order).

5

Article II describes the scope of the Settlement Agreement. Article 2.1 provides that, if

approved by the Commission, the Settlement Agreement would resolve all issues set for hearing

and pending on rehearing in Docket No. ER15-572-000 associated with the AC Transmission

Projects, which comprise “Segment A,” the Edic/Marcy to New Scotland segment and the

Princetown to Rotterdam segment, and “Segment B,” the Knickerbocker to Pleasant Valley

segment. In addition, the scope of the Settlement includes “Segment B Additions,” which are

lower voltage projects required to be built as part of the development of Segment B. Article 2.2

clarifies that the financial terms of the Settlement Agreement shall apply only if NY Transco

becomes the selected developer of any one of the segments of the AC Transmission Projects.

Article 2.3 clarifies that certain financial terms set forth in the Settlement (i.e., the base ROE), the

cost of debt, and the capital structure) will apply to the AC Transmission Projects, the Segment B

Additions, as well as Future AC Investments, which include capital repairs, like-kind replacements

or additional investments to the facilities, and Future Projects, which are new NY Transco

transmission projects selected and approved by the NYISO for inclusion in its transmission plan

and are under the operational control of the NYISO or otherwise subject to FERC jurisdiction.

Finally, Article 2.4 describes the expected benefits that will result from the AC Transmission

Projects identified by the NYPSC.

Article III sets forth the terms and conditions of the Settlement Agreement. Article 3.2

establishes the financial terms, including a base ROE, ROE incentive adders, the cost of debt, the

capital structure, treatment of construction work in progress (“CWIP”), abandonment recovery,

and depreciation. Article 3.2(a) establishes that a base ROE of 9.65% will apply to the costs of

the AC Transmission Projects and will remain in effect for a period commencing on January 1,

2018, and continuing for a period of four years thereafter unless or until modified by FERC

6

pursuant to Section 205 or 206 of the FPA. Article 3.2(b) allows a 100 basis point adder for AC

Transmission Project investments incurred up to a cost cap, and requires NY Transco to separately

request FERC ROE incentives for Future Projects on a project-by-project basis, consistent with

Commission requirements. Article 3.2(d) allows all actual costs incurred based upon long-term

debt outstanding to be recoverable through the formula rate. Article 3.2(e) allows for the actual

capital structure of NY Transco, up to 53% equity, to apply to costs associated with the AC

Transmission Projects and this capital structure will remain in effect for a four-year period

commencing on January 1, 2018, and continuing thereafter unless or until modified by FERC

pursuant to Section 205 or 206 of the FPA. Article 3.2(f) clarifies when CWIP will be included in

rate base and Article 3.2(g) provides that to the extent the AC Transmission Projects or Segment

B Additions, or any portion thereof, are abandoned for reasons beyond the control of NY Transco,

all costs incurred prior to such abandonment that are the responsibility of NY Transco will be

recoverable through rates in accordance with the terms of the Commission’s April 2015 Order.

Finally, Article 3.2(h) establishes that the depreciation rates applicable to all classifications of

capital assets associated with the AC Transmission Projects are the stated rates set forth in

Attachment A of the Settlement, and that NY Transco will submit to FERC a limited Section 205

filing to implement any modification to the depreciation rates as a result of a depreciation study in

2026.

Articles 3.3 and 3.4 establish a mechanism for calculating a “Cost Cap” and for applying a

“Cost Containment Mechanism,” whereby certain costs incurred by NY Transco above the Cost

Cap will receive separate financial treatment that results in a “sharing” of these costs between NY

Transco and customers. Under the Cost Containment Mechanism, 20% of certain costs above the

Cost Cap will not receive an equity return, but NY Transco will be allowed to recover the

7

associated depreciation and debt cost, while 80% of these costs above the Cost Cap will be allowed

to earn the base ROE, associated depreciation, and debt, but will not be allowed to earn any ROE

incentive adders. Certain costs, defined as “Unforeseeable Costs,” will receive separate rate

treatment, as described in Article 3.3(d). The Settlement includes several attachments that provide

examples of the interaction of the Cost Cap, the Cost Containment Mechanism, and Unforeseeable

Costs.

Article 3.4(b) of the Settlement sets forth a mechanism whereby NY Transco will earn an

additional ROE adder on prudently incurred costs that are below an “Adjusted Cost Cap.” Article

3.4(c) includes a table that identifies the applicable additional ROE adder that NY Transco will be allowed to earn in proportion to the degree costs are below the Adjusted Cost Cap.

Article 3.5 sets forth the agreement among the Settling Parties with respect to the cost allocation for the AC Transmission Projects, Segment B Additions, and Future AC Investments.

Article 3.6 clarifies that the cost containment and cost allocation provisions of this Settlement shall not be affected by any decision of the Commission in Docket No. ER17-1310-

000, which is pending before the Commission.

In Article 3.7, the Settling Parties agree either to support or not to oppose the Settlement Agreement before the Commission and not to take any position adverse to the express terms of the Settlement Agreement in any proceedings before the Commission or the NYPSC, except that the Settlement cannot bind the NYPSC with respect to any NYPSC proceedings, and the Settlement does not restrict Settling Parties’ ability to question the application of NY Transco’s formula rate template or protocols in response to NY Transco’s annual updates.

8

Article 3.8 limits the ability of the Settling Parties to make any filings pursuant to Sections 205 or 206 of the FPA that relate to the Settlement Agreement and NY Transco that are inconsistent with the terms agreed to in the Settlement.

Article 3.9 requires the Settling Parties to withdraw their pending requests for rehearing in Docket No. ER15-572-000.

Article 3.10 requires NY Transco to make a compliance filing with the Commission to

implement the Settlement Agreement within 30 days of the date that the NYISO selects a developer

with respect to the AC Transmission Projects. The compliance filing will include revisions to

Schedule 13 (Section 6.13) and Attachment DD (Section 36) of the NYISO OATT to implement

this Settlement.

Article 3.11 provides that to the extent the Commission does not approve all aspects of this Settlement Agreement, the Settling Parties will have 30 days to withdraw their support for the Settlement Agreement.

Articles IV, V, VI, and VII address general provisions of the Settlement Agreement.

Article 4.1 states that the Settlement Agreement shall be effective upon Commission approval.

Article 5.1 provides that the Commission’s approval of this Settlement Agreement shall not

constitute precedent nor be used to prejudice any otherwise available rights or arguments of any

Settling Party in a future proceeding, other than to enforce the terms of this Settlement Agreement.

Article 6.1 describes the standard of review to be applied for any proposed modification of the

Settlement Agreement. Article VII includes certain miscellaneous provisions and reservations of

rights.

III. RESPONSES TO REQUIRED QUESTIONS

In accordance with the Chief Administrative Law Judge’s December 15, 2016 Amended

Notice to the Public on Information to be Provided with Settlement Agreement Agreements and

9

Guidance on the Role of Settlement Judges, the Settling Parties provide the following responses to the questions identified by the Chief Administrative Law Judge:

1. Does the settlement affect other pending cases?

No. The Settlement does not affect other pending cases. The Settlement limits the applicability of any Commission order in pending Docket No. ER17-1310-000 to ensure that the terms of this Settlement are unaffected by that proceeding.

2. Does the settlement involve issues of first impression?

No, the Settlement does not involve issues of first impression

3. Does the settlement depart from Commission precedent?

No, the Settlement does not depart from Commission precedent.

4. Does the settlement seek to impose a standard of review other than the

ordinary just and reasonable standard with respect to any changes to the settlement that might be sought by either a third party or the Commission acting sua sponte?

No. The Settlement provides that any changes sought by a third party or the Commission acting sua sponte are subject to the ordinary just and reasonable standard of review.

IV.CONCLUSION

The Settlement Agreement fully resolves all issues regarding the AC Transmission Projects

that were set for hearing or are the subject of pending requests for rehearing in Docket No.

ER15-572-000 in a fair and reasonable manner that is in the public interest. Commission approval

of the Settlement will avoid the expense and risk associated with hearing proceedings and any

subsequent litigation. For these reasons, NY Transco respectfully requests that the presiding

Administrative Law Judge certify the Settlement Agreement to the Commission as soon as possible

following the comment period, and that the Commission approve the Settlement Agreement

without condition or modification at the earliest possible date following certification.

10

Respectfully submitted,

/s/ Elias G. Farrah

Elias G. Farrah

Kimberly Ognisty

Victoria L. Hsia

Winston & Strawn LLP 1700 K St., NW

Washington, DC 20006-3817 Email: efarrah@winston.com

kognisty@winston.com

vhsia@winston.com

Counsel to New York Transco, LLC

Dated: August 21, 2017

11

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Transco, LLC)

New York Independent System Operator, Inc.)

Central Hudson Gas & Elec. Corp.)

Consolidated Edison Co. of New York, Inc.)

Niagara Mohawk Power Corp., d/b/a)

National Grid)

New York State Elec. & Gas Corp.)

Orange and Rockland Utilities, Inc.)

Rochester Gas and Electric Corp.)

OFFER OF SETTLEMENT

To: Honorable Steven L. Sterner

Presiding Administrative Law Judge

Docket No. ER15-572-000

Pursuant to Rule 602 of the Rules of Practice and Procedure of the Federal Energy

Regulatory Commission (“Commission” or “FERC”),1 New York Transco, LLC (“NY Transco”),

on behalf of the Active Settling Parties (each a “Settling Party” and collectively the “Settling

Parties”),2 submits this Offer of Settlement (“Settlement” or “Settlement Agreement”) to resolve

all of the issues set for hearing or pending in requests for rehearing in Docket No. ER15-572-000

with respect to NY Transco’s proposed Alternating Current (“AC”) Transmission Projects.3 As to

the AC Transmission Projects, this Settlement Agreement addresses all outstanding issues,

1 18 C.F.R. § 385.602 (2017).

2 The Active Settlement Parties who attended all of the settlement conferences and participated in settlement

negotiations are Central Hudson Gas and Electric Corporation, Consolidated Edison Company of New York, Inc.,

Niagara Mohawk Power Corporation d/b/a National Grid (“National Grid”), New York State Electric and Gas

Corporation, Orange and Rockland Utilities, Inc., Rochester Gas and Electric Corporation, New York Power Authority

(“NYPA”), Power Supply Long Island, New York Public Service Commission (“NYPSC”), City of New York,

Municipal Electric Utilities Association of New York, and Multiple Intervenors (an unincorporated association of

approximately 60 industrial, commercial, and institutional energy consumers with manufacturing and other facilities

located throughout New York State). Commission Trial Staff, New York State Department of State Utility

Intervention Unit, and New York Association of Public Power actively participated in the settlement discussions.

3 The AC Transmission Projects are defined in Article 2.1 of this Settlement Agreement.

including financial and cost allocation issues, and issues associated with the cost cap and cost containment mechanism.

ARTICLE I

PROCEDURAL BACKGROUND

NY Transco is a New York limited liability company that is owned by Consolidated Edison Transmission, LLC, Grid NY LLC, AVANGRID Networks New York Transco, LLC, and Central Hudson Electric Transmission, LLC.4 NY Transco was formed to plan, develop, construct, own, and operate major new high-voltage electric transmission projects in New York State. NY Transco owns transmission facilities in New York that are under the operational control of the New York Independent System Operator, Inc. (“NYISO”).

On December 4, 2014, NY Transco submitted a filing (“December 4 Filing”) requesting that the Commission: (1) approve certain incentive rate treatments pursuant to Section 219 of the Federal Power Act (“FPA”) and Order No. 679 for their investment in five high-voltage transmission projects in New York; (2) accept NY Transco’s transmission formula rate, which included a formula rate template and protocols, to be effective on April 3, 2015; (3) approve NY Transco’s requested return on equity (“ROE”); (4) accept NY Transco’s cost allocation method to recover its revenue requirement; and (5) accept NY Transco’s proposed revisions to the NYISO Open Access Transmission Tariff (“OATT”) to include a proposed Transco Facilities Charge as Schedule 13 (Section 6.13) of the OATT and the proposed cost allocation and formula rate as Attachment DD (Section 36) of the OATT.

On April 2, 2015, the Commission issued an order: (1) granting certain pre-commercial

cost recovery incentives,5 request for a 50 basis point (“bp”) adder for NY Transco’s membership

4 These entities are affiliates of the six investor-owned utilities in New York State.

5 N.Y. Indep. Sys. Operator, Inc., 151 FERC ¶ 61,004, at PP 76-78, 85 (2015) (“April 2015 Order”).

2

in a regional transmission organization (“RTO”),6 and request for a 50 bp adder for the risks and

challenges associated with developing the Edic to Pleasant Valley Project,7 including NY

Transco’s cost estimate risk sharing proposal associated with the ROE adders;8 (2) accepting, for

filing, NY Transco’s proposed formula rate and protocols, including a proposed base ROE and the

methodology and procedures for tracking the pre-commercial cost recovery incentives granted by

the Commission, but suspending them for a nominal period, subject to refund, and setting them for

hearing and settlement judge procedures;9 (3) declining the NYPSC’s request for cost recovery to

be limited to the preliminary cost estimate identified by the NYPSC in a New York State

proceeding;10 (4) denying the proposed hypothetical capital structure prior to securing financing

for the projects;11 (5) denying the request for a 50 bp adder for risks and challenges associated with

developing the Transmission Owner Transmission Solution (“TOTS”) Projects, request for a risks

and challenges adder for the Oakdale to Fraser Project, and a request for a 50 bp adder for being a

Transco;12 and (6) denying the proposed cost allocation provisions.13

NY Transco, NYPSC, and NYPA filed requests for rehearing of the Commission’s April

2015 Order. NY Transco requested rehearing of the Commission’s cost allocation ruling, the

Commission’s denial of NY Transco’s proposed hypothetical capital structure incentive during the

construction phase of its projects until long-term financing is secured, the Commission’s denial of

6 Id. at P 88.

7 Id. at P 93.

8 Id. at P 99, 111.

9 Id. at PP 140-141.

10 Id. at P 111.

11 Id. at P 84.

12 Id. at PP 92-93. Note that NY Transco is no longer proposing to develop the Oakdale to Fraser Project.

13 Id. at PP 185-188.

3

additional ROE incentive adders based both on the risks and challenges associated with developing the projects and for being a “Transco,” as defined in the Commission’s regulations, and the Commission’s denial of the request for waivers of certain accounting regulations.14 NYPA sought rehearing of the Commission’s rejection of NY Transco’s proposed cost allocation.15 The NYPSC’s request for rehearing argued that the Commission should establish a cost recovery mechanism that includes certain cost containment measures and should reconsider the Commission’s grant of a 50 bp adder for RTO participation.16 No other Settling Party filed a request for rehearing of the Commission’s April 2015 Order.

By order dated April 9, 2015, the Chief Judge designated the Honorable Steven L. Sterner

to preside over settlement procedures.17 The Settling Parties engaged in settlement discussions,

and on November 5, 2015, NY Transco filed an offer of partial settlement resolving all issues set

for hearing or pending in requests for rehearing in Docket No. ER15-572-000 with respect to NY

Transco’s proposed TOTS Projects, and the Commission approved the partial settlement on March

17, 2016.18

While the offer of partial settlement did not resolve any outstanding issues with respect to

the AC Transmission Projects, Section 2.5 therein provided that this docket should remain open

but held in abeyance until such time as the NYISO issues a “Viability and Sufficiency Assessment”

14 N.Y. Indep. Sys. Operator, Inc., Request for Expedited Rehearing of the Applicants, Docket No. ER15-572-002 (filed May 4, 2015).

15 N.Y. Indep. Sys. Operator, Inc., Request for Clarification, or in the Alternative, Rehearing of New York Power Authority, Docket No. ER15-572-002 (filed May 4, 2015).

16 N.Y. Indep. Sys. Operator, Inc., Request for Rehearing of the New York State Public Service Commission, Docket No. ER15-572-002 (filed May 4, 2015). The NYPSC also sought clarification that NY Transco would be held to a specific cost estimate and would not be allowed to apply above-estimate costs to an ROE incentive adder for participation in the NYISO.

17 N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-572-000 (April 9, 2015) (unpublished letter order).

18 N.Y. Indep. Sys. Operator, Inc., 154 FERC ¶ 61,196 (March 17, 2016).

4

with respect to the AC Transmission Projects pursuant to Section 31.4.6.5 of Attachment Y of the NYISO OATT.19 On October 27, 2016, the NYISO issued its final Viability and Sufficiency Assessment, which confirmed the NY Transco project submissions20 as viable and sufficient and able to proceed to the next step in the NYISO process, and the Chief Judge subsequently issued an order on November 2, 2016, terminating the abeyance and reinstating settlement procedures with respect to the AC Transmission Projects before Judge Sterner.21

Settlement conferences were held before Judge Sterner on December 12, 2016, March 8,

2017, April 5, 2017, May 15, 2017, June 8, 2017, and July 11, 2017. The Settling Parties engaged

in numerous settlement discussions and settlement conference calls between December 2016 and

July 2017 that have resulted in this Settlement Agreement. This Settlement reflects the agreement

of the Settling Parties to resolve all outstanding issues associated with the AC Transmission

Projects, including issues related to the AC Transmission Projects that were set for hearing and

issues pending on rehearing before the Commission in Docket No. ER15-572-000.

This Settlement Agreement includes Attachment A, the depreciation and amortization rates

for NY Transco, Attachment B, an example calculation for actual costs above the cost cap,

Attachment C, an example calculation for actual costs below the cost cap, and Attachment D,

examples illustrating the cost containment mechanism operating together with the unforeseeable

costs mechanism.

19 The Chief Judge issued an order holding this proceeding in abeyance until such time. See N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-572-000 (Jan. 27, 2016) (unpublished letter order).

20 NY Transco submitted the AC Transmission Projects jointly with National Grid. If the project is awarded to NY Transco and National Grid, NY Transco will purchase the project from National Grid.

21 N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-572-000 (Nov. 2, 2016) (unpublished letter order).

5

ARTICLE II

SCOPE OF SETTLEMENT

2.1 This Settlement resolves all outstanding issues pertaining to NY Transco in Docket No.

ER15-572-000 associated with the AC Transmission Project proposals, as referenced in ordering

clauses 8 and 9 in the NYPSC’s Order Finding Transmission Needs Driven by Public Policy

Requirements,22 and submitted in response to the NYISO’s February 29, 2016 AC Transmission

Solicitation (“Solicitation”) whereby National Grid and NY Transco submitted to the NYISO on

April 29, 2016, proposed solutions, which for purposes of this settlement, consists of the AC

Transmission Projects (Segment A and Segment B) and Segment B Additions, as described below.

a. For purposes of this settlement, the AC Transmission Projects consist of two (2) segments. “Segment A” includes the Edic/Marcy to New Scotland segment and the Princetown to Rotterdam segment and “Segment B” includes the Knickerbocker to Pleasant Valley segment, each of which is described in Appendix A of the Solicitation. (“Segment A” and “Segment B” are referred to collectively as the “AC Transmission Projects”).

b. “Segment B Additions” are projects required to be built as part of the development of Segment B and are referred to in Appendix A of the Solicitation as “Upgrades to the Rock Tavern Substation” and “Shoemaker to Sugarloaf.”

2.2 This Settlement shall apply only if NY Transco becomes the selected developer of any one

or both of the segments of the AC Transmission Projects described in Article 2.1 above and to the

extent this Settlement is approved by the Commission. Segment B Additions are applicable only

if NY Transco is selected as the developer for Segment B and only to the extent NY Transco

22 NYPSC, Cases 12-T-0502, et al., Examination of Alternating Current (“AC”) Transmission Upgrades (issued December 17, 2015) (“December 2015 Order”).

6

becomes the physical or financial owner of the Segment B Additions, and the Segment B Additions are under the operational control of the NYISO or otherwise subject to FERC jurisdiction.

2.3 Articles 3.2(a), 3.2(d), and 3.2(e) of this Settlement shall apply to the AC Transmission

Projects, the Segment B Additions, Future AC Investments, and Future Projects. “Future AC

Investments” are comprised of necessary capital repairs, like-kind replacements or additional investments to the facilities comprising the AC Transmission Projects that are consistent with good utility practice. “Future Projects” are new NY Transco transmission projects that are selected or approved by the NYISO for inclusion in its transmission plan and are under the operational control of the NYISO or otherwise subject to FERC jurisdiction.

2.4 As described in the NYPSC’s December 17, 2015 Order, the AC Transmission Projects

are expected to reduce transmission congestion and production costs; reduce capacity resource

costs; improve electricity market competition and liquidity; enhance electric system reliability,

flexibility and efficiency; improve preparedness for and mitigation of the impacts of generator

retirements; enhance resiliency/storm hardening; avoid refurbishment costs of aging

infrastructure; take better advantage of existing fuel diversity; increase the diversity of supply,

including renewable resources; promote job growth and the development of new efficient

generation resources in upstate New York; reduce environmental and health impacts through

reductions in less efficient generation; reduce the costs of meeting renewable resource standards;

increase tax receipts from increased infrastructure investment; enhance planning and operational

flexibility; obtain synergies with other future transmission projects; and relieve natural gas

transportation constraints.

7

ARTICLE III

TERMS OF SETTLEMENT

3.1The Settling Parties agree, subject to Commission approval, to be bound by the terms of

this Settlement Agreement with respect to NY Transco’s AC Transmission Projects.

3.2The following financial terms shall apply to the AC Transmission Projects:

a.Base ROE - 9.65%. The Base ROE will apply to all AC Transmission Project-

related investments, including Segment B Additions, Unforeseeable Costs in excess of five (5)

percent of the Cost Cap (defined in Article 3.3(a) below), Third Party Costs, Project Development

Costs (defined below in Articles 3.2(b)(i) and 3.2(b)(ii), respectively), Future AC Investments, and

Future Projects. This Base ROE will remain in effect for a period commencing on January 1,

2018, and continuing for a period of four years through December 31, 2021. After the four-year

period, the Base ROE shall continue in effect, except with respect to Future Projects, unless or

until modified by FERC pursuant to Sections 205 or 206 of the FPA. For Future Projects, after

the end of the four-year period, no ROE under this Settlement will be applicable and NY Transco,

will be required to make a Section 205 filing regarding the ROE to be applied.

b. ROE Incentive Adders. For the AC Transmission Projects, a 100 bp adder will

apply to project investment incurred up to the Cost Cap. A 100 bp adder shall also apply to

Unforeseeable Costs in excess of five (5) percent of the Cost Cap, Third Party Costs, and Project

Development Costs. The 100 bp consists of a 50 bp incentive adder to account for benefits to

customers, including congestion relief, and a 50 bp incentive adder for risks and challenges in

developing the AC Transmission Projects. The Segment B Additions, if under NYISO operational

control, and Future AC Investments, if under NYISO operational control, will receive a 50 bp

incentive adder for providing benefits to customers, including congestion relief.

8

i.“Third Party Costs” are costs that result from: (i) NYISO modifications or

further NYISO requirements, including interconnection costs and upgrades resulting from the NYISO interconnection study process; or (ii) real estate-related costs incurred in any lease arrangements or purchases related to the acquisition of rights-of-way or access to rights-of-way or purchases of rights to access utility facilities. These Third Party Costs are not included in the Capital Cost Bid (defined below in Article 3.3(a)) submitted to the NYISO, are not subject to the Cost Cap or Cost Containment Mechanism, and are recoverable in the formula rate using the financial parameters in this Article 3.2.

ii. “Project Development Costs” are costs incurred for the AC Transmission

Projects prior to the selection of one or more transmission developer(s) by the NYISO Board of Directors and are not included in the Capital Cost Bid submitted to the NYISO, are not subject to the Cost Cap or Cost Containment Mechanism, are to be included in Construction Work in Progress (“CWIP”) in accordance with the FERC Uniform System of Accounts, and are recoverable in the formula rate using the financial parameters in this Article 3.2.

c. Consistent with FERC policy, NY Transco will separately request FERC ROE incentives for Future Projects on a project-by-project basis.

d.Cost of Debt. All actual costs incurred based upon long-term debt outstanding shall

be recoverable through the formula rate.

e. Capital Structure. NY Transco’s actual capital structure, up to 53% equity, shall

be used in the formula rate for a four (4)-year period commencing on January 1, 2018, and

continuing thereafter unless or until modified by FERC pursuant to Section 205 or 206 of the FPA.

f. Construction Work In Progress. CWIP for the AC Transmission Projects, Segment

B Additions, Unforeseeable Costs in excess of five (5) percent of the Cost Cap, Third Party Costs,

9

Project Development Costs and Future AC Investments shall be included in rate base as provided by FERC in the April 2015 Order. This settlement does not address the treatment of CWIP for Future Projects.

g. Abandonment. To the extent that the AC Transmission Projects and Segment B Additions, or any portion thereof, are abandoned for reasons beyond the control of NY Transco, all costs incurred prior to such abandonment that are the responsibility of NY Transco shall be recoverable through rates in accordance with the terms of the Commission’s April 2015 Order. This settlement does not address or constitute any precedent with regard to recovery of costs related to abandonment of Future Projects. The costs of Future AC Investments will not be subject to this abandonment provision.

h. The depreciation rates applicable to all classifications of capital assets associated with the AC Transmission Projects are set forth in Attachment A to this Settlement. By January 1, 2026, NY Transco shall submit to FERC a limited Section 205 filing to implement any modification to depreciation rates as a result of a depreciation study.

i.This Settlement does not address or constitute any precedent with regard to cost

containment or cost caps for any Future Projects.

3.3The following cost cap terms shall apply to the AC Transmission Projects:

a.The “Cost Cap” shall be comprised of the sum of the following:

i.The capital cost bid submitted by National Grid and NY Transco to the

NYISO on April 29, 2016, for the AC Transmission Projects (“Capital Cost Bid”). The Capital Cost Bid for Segment A or Segment B will apply even if NYISO selects NY Transco for only Segment A or Segment B;

10

ii.As shown in Attachment B, the Capital Cost Bid multiplied by an 18%

contingency in lieu of the generic 30% contingency outlined and provided for in the cost spreadsheet submitted in the Capital Cost Bid to the NYISO (“Contingency”);

iii. Also, as shown in Attachment B, the sum of the Capital Cost Bid and the

Contingency, multiplied by an inflation factor of 2.0% per year for the period of time from April 29, 2016, through the date of the NYISO Board of Directors’ selection of the AC Transmission Projects developer(s); and

iv. Allowance for Funds Used During Construction (“AFUDC”) accrued prior

to inclusion of CWIP in rate base, as provided for in Article 3.2(f).

b. The Parties recognize that there are costs NY Transco may incur, or savings NY Transco may realize, that are in addition to those costs included in the Capital Cost Bid. These costs and savings, referred to herein collectively as “Unforeseeable Costs,” are costs and savings that, with the exercise of commercially reasonable due diligence, could not have been anticipated at the time that the Capital Cost Bid was submitted to the NYISO on April 29, 2016. The rate treatment applicable to such Unforeseeable Costs is set forth in Articles 3.3(c) and 3.3(d) below. Unforeseeable Costs are costs:

i. Associated with material modifications to the routing or scope of work of

the AC Transmission Projects that result from a NYPSC order, negotiations or settlement agreements within the siting process, or are imposed or required by any other governmental agency. For the avoidance of doubt, non-material and/or foreseeable obligations agreed to or imposed upon NY Transco as a normal part of the siting process shall not be deemed to be Unforeseeable Costs;

ii. Associated with changes in applicable laws and regulations; or

11

iii.As a result of orders of courts or action or inaction by governmental

agencies.

c. All prudently incurred costs below the Cost Cap are fully recoverable, including with respect to such costs the Base ROE, ROE Incentive Adders, depreciation, and debt costs, as provided for in Article 3.2 above. The ratemaking treatment of all prudently incurred costs above the Cost Cap is addressed in Article 3.4(a).

d. Unforeseeable Costs in an aggregate amount up to 5% of the Cost Cap shall be

considered project costs that are part of the 18% contingency described in Article 3.3(a)(ii) and

subject to the Cost Containment Mechanism set forth in Article 3.4(a) below. Unforeseeable Costs

that are more than 5% of the amount of the Cost Cap are not subject to the Cost Cap or Cost

Containment Mechanism and are recoverable in the formula rate using the financial parameters in

Article 3.2. NY Transco will provide updates of Unforeseeable Costs as part of project cost

updates in its annual June informational filing, including information demonstrating that any such

Unforeseeable Costs have been determined in accordance with Article 3.3(b).

3.4 The following cost containment provisions apply to the AC Transmission Projects and do

not create any precedent with respect to any transmission project undertaken by NY Transco other

than the AC Transmission Projects; however, no Settling Party is prohibited from seeking cost

containment for any Future Project. Examples illustrating the Cost Containment Mechanism are

included herewith as Attachments B and C. Attachment D contains examples illustrating the Cost

Containment Mechanism operating together with the Unforeseeable Costs provision in Article 3.3.

For the AC Transmission Projects, the Cost Containment Mechanism applies as follows:

12

a.Prudently Incurred Actual AC Transmission Costs Above Cost Cap

i.20% of any prudently incurred project costs above the Cost Cap that are

subject to the Cost Containment Mechanism will not earn an equity return, but NY Transco will

be allowed to recover the associated depreciation and debt cost.

ii.80% of any prudently incurred costs above the Cost Cap that are subject to

the Cost Containment Mechanism will not earn any ROE Incentive Adders on the equity portion

of such costs, but NY Transco will be allowed to earn the Base ROE, associated depreciation, and

debt cost.

b.Additional ROE Adder for Certain Costs Below Adjusted Cost Cap

i.For purposes of providing an incentive to NY Transco to reduce AC

Transmission Project costs, the Parties agree to provide an additional ROE adder when the actual project costs are below the “Adjusted Cost Cap.”

ii. As shown in Attachment C, the Adjusted Cost Cap shall be comprised of

the sum of the following: (a) the Capital Cost Bid; (b) the Capital Cost Bid multiplied by 5%

(“5% Adder”); (c) the sum of the Capital Cost Bid and the 5% Adder, multiplied by an inflation factor of 2.0% per year for the period of time from April 29, 2016, through the date of the NYISO Board of Directors’ selection of the AC Transmission Projects’ developer(s); and (d) any AFUDC accrued prior to the inclusion of CWIP in rate base, as provided for in Article 3.2(f).

c. NY Transco will receive an additional ROE adder as set forth in Table A below when the AC Transmission Project costs, inclusive of Unforeseeable Costs in an amount up to 5% of the Adjusted Cost Cap, are less than the Adjusted Cost Cap:

13

TABLE A

Actual Costs Below Adjusted CostROE Adder

Cap

0% to <=5%0.05%

>5% to <=10%0.17%

>10% to <=15%0.30%

>15% to <=20%0.45%

>20% to <=25%0.62%

>25%0.71%

3.5The cost allocation for the revenue requirement of the AC Transmission Projects, Segment

B Additions, and Future AC Investments shall be allocated as set forth in Table B:

TABLE B

ZoneAllocation %

UpstateA2.450

B1.525

C2.525

D0.750

E1.300

F1.950

DownstateG4.425

H2.300

I9.500

J69.675

K3.600

NYCA100

a. Future Projects are not presumed to have been driven by the same public policy

need as the need driving the construction of the AC Transmission Projects and, therefore, the cost

allocation set forth in Article 3.5 will not apply to any Future Projects. The appropriate allocation

14

for recovery of costs for any Future Projects will be established in a Section 205 filing with FERC, or as set forth in the NYISO’s tariffs.

3.6 The Cost Containment and Cost Allocation provisions of this Settlement shall not be affected by any decision of the Commission in Docket No. ER17-1310-000, which is pending before the Commission.

3.7 The Settling Parties agree either to support or not to oppose this Settlement before the

Commission and agree not to take any position adverse to the terms of this Settlement in any

proceedings before the Commission or the NYPSC that relate to this Settlement and NY Transco.

Notwithstanding the foregoing, this Settlement does not bind the NYPSC with respect to any

NYPSC proceedings. This Settlement does not restrict any Settling Party’s ability to question NY

Transco’s application of the formula rate template or protocols or the actual costs proposed to be

recovered related to the AC Transmission Projects, the Segment B Additions, Future AC

Investments, and Future Projects, whether through annual updates to NY Transco’s formula rates

or otherwise.

3.8 The Settling Parties agree not to make any filings pursuant to Sections 205 and 206 of the

FPA that relate to this Agreement and to NY Transco that are inconsistent with the terms of this

Settlement.

3.9 Within thirty (30) days of the Commission’s approval of this Settlement, the Settling

Parties agree to withdraw their pending requests for rehearing in Docket No. ER15-572-000. Any

such withdrawal is without prejudice to the same arguments being raised in other proceedings.

3.10 Within thirty (30) days of the date that the NYISO selects a developer with respect to the

AC Transmission Projects, NY Transco will make a compliance filing with the Commission, to

15

the extent necessary to implement the terms of this Settlement, which will include revisions to Schedule 13 (Section 6.13) and Attachment DD (Section 36) of the NYISO OATT.

3.11 To the extent the Commission does not approve all aspects of this Settlement, the Settling Parties will have thirty (30) days from the date the Commission issues an order approving this Settlement to withdraw their support for the Settlement.

ARTICLE IV

SETTLEMENT EFFECTIVE DATE

4.1 This Settlement shall be effective on the date on which a Commission order approving this Settlement is issued (“Settlement Effective Date”). The Settlement shall bind the Settling Parties as of the Settlement Effective Date.

ARTICLE V

NO PRECEDENTIAL EFFECT

5.1 Except as expressly provided for in this Settlement, this Settlement will not constitute a

precedent in any future proceedings. This Settlement Agreement shall not be used as evidence

that a particular method is a “long-standing practice” as that term is used in Columbia Gas

Transmission Corp. v. FERC, 628 F.2d 578 (D.C. Cir. 1979), or a “settled practice” as that term is

used in Public Service Comm. of New York v. FERC, 642 F.2d 1335 (D.C. Cir. 1980).

ARTICLE VI

STANDARD OF REVIEW

6.1 The standard of review for any change to this Settlement proposed by a Settling Party shall

be the “public interest” application of the just and reasonable standard set forth in United Gas Pipe

Line Co. v. Mobile Gas Serv. Corp., 350 U.S. 332 (1956), and Fed. Power Comm’n v. Sierra

Pacific Power Co., 350 U.S. 348 (1956), as clarified in Morgan Stanley Capital Grp., Inc. v. Pub.

Util. Dist. No. 1 of Snohomish Cnty., Wash., 554 U.S. 527 (2008), and refined in NRG Power Mktg.

v. Maine Pub. Utils. Comm’n, 558 U.S. 165 (2010). The ordinary just and reasonable standard of

16

review (rather than the “public interest” standard), as clarified in Morgan Stanley Capital Grp., Inc. v. Pub. Util. Dist. No. 1 of Snohomish Cnty., Wash., 554 U.S. 527 (2008), applies to any changes to this Settlement sought by the Commission acting sua sponte or at the request of a nonSettling Party or a non-party to this proceeding.

ARTICLE VII

MISCELLANEOUS

7.1 Final Resolution. This Settlement Agreement shall be a final and complete resolution of all issues concerning the AC Transmission Projects in this proceeding.

7.2 Binding. This Settlement Agreement is binding upon and for the benefit of the Settling Parties and their successors and assigns.

7.3 Entire Agreement. This Settlement Agreement, including the attachments hereto,

constitutes the entire agreement between the Settling Parties with respect to the subject matter

addressed herein, and supersedes all prior or contemporaneous understandings or agreements, oral

or written, between the Settling Parties with respect to the subject matter of this Settlement.

7.4 Interpretation. All Settling Parties participated in the drafting of this Settlement Agreement. No Settling Party shall be deemed the drafter of this Settlement Agreement, and this Settlement Agreement shall not be construed against any Settling Party as the drafter.

7.5 Conflict. In the event of a conflict between terms contained in this Settlement Agreement

and those of the attached Explanatory Statement, the terms of this Settlement Agreement shall

control.

7.6 Admissibility of Settlement. This Settlement is submitted pursuant to Rule 602(e) of the

Commission’s Rules of Practice and Procedure, 18 C.F.R. § 385.602(e) (2017). Unless and until

the Settlement becomes effective pursuant to its terms, the Settlement shall have no effect. The

Settlement Agreement shall not be admissible in evidence before any court or regulatory body

17

(except as related to enforcement of its terms). The discussions that resulted in this Settlement

were conducted with the explicit understanding, pursuant to Rule 602(e), that all offers of

settlement and any discussions relating thereto are and shall be privileged, shall be without

prejudice to the position of any Settling Party, and are not to be used in any manner in connection

with this or any other proceeding except as specifically noted in this Settlement or in an action to

enforce this Settlement.

7.7 Titles and Headings. The titles and headings of the Settlement Agreement are for reference

and convenience purposes only. They are not to be construed or taken into account in interpreting

the Settlement Agreement and do not qualify, modify, or explain the effects of the Settlement

Agreement.

7.8 Enforceability and Waiver. Any failure of any Settling Party (i) to enforce any of the

provisions of this Settlement Agreement or (ii) to require compliance with any of its terms at any

time during the term of this Settlement Agreement shall in no way affect the validity of this

Settlement Agreement, or any part hereof, and shall not be deemed a waiver of the right of such

Settling Party thereafter to enforce any and each such provision. Commission approval of this

Settlement Agreement shall constitute a grant of any waivers of the Commission’s regulations that

may be necessary to effectuate all of the provisions of this Settlement Agreement.

7.9 Waiver. No provisions of this Settlement Agreement may be waived as to any Settling Party, except through a writing signed by an authorized representative of the waiving Settling Party. Waiver of any provision of this Settlement Agreement by a Settling Party shall not be deemed to waive any other provision or to be a waiver of the other Settling Parties.

7.10 Authorization. Each person executing this Settlement Agreement on behalf of a Settling

Party represents and warrants that he or she is duly authorized and empowered to act on behalf of,

18

and to authorize this Settlement Agreement to be executed on behalf of, the Settling Party that he or she represents.

7.11 Ambiguity. This Settlement Agreement is the result of negotiations among the Settling

Parties and has been subject to review by each Settling Party and its respective counsel. Therefore,

this Settlement Agreement shall be deemed the product of each Settling Party and no ambiguity in

this Settlement Agreement shall be construed in favor of, or against, either Settling Party.

7.17 Counterparts. This Settlement Agreement may be executed in any number of counterparts, and each executed counterpart shall have the same force and effect as an original instrument.

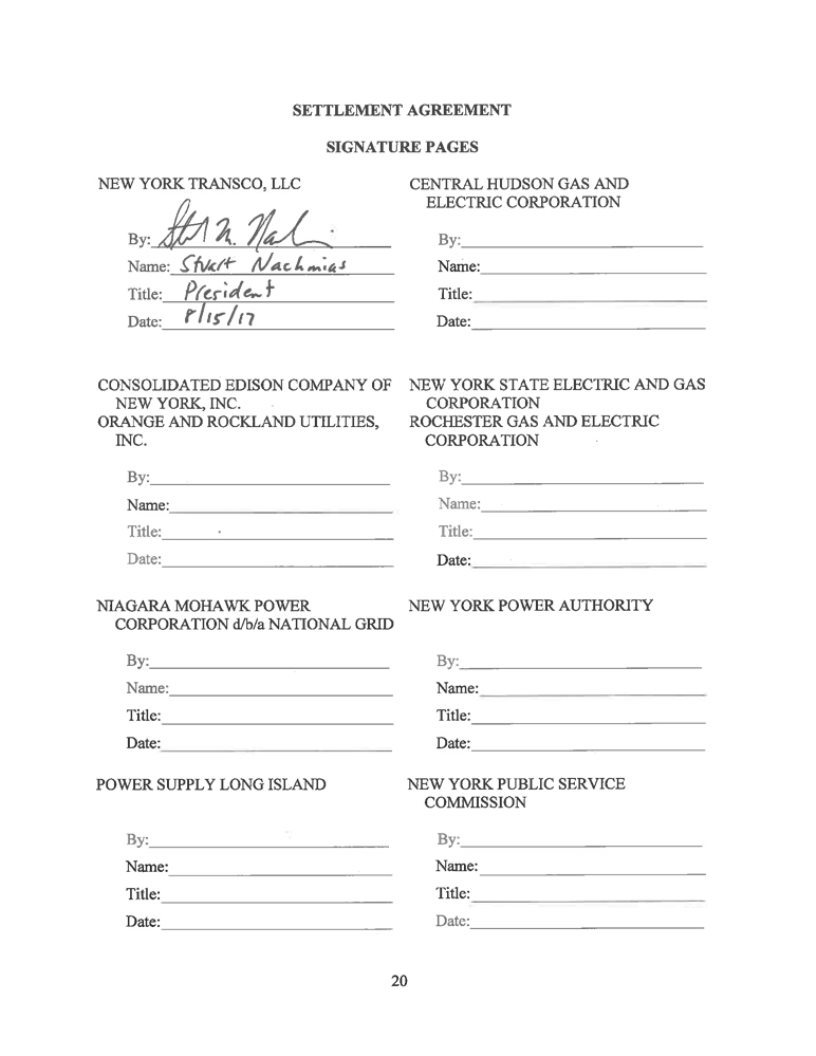

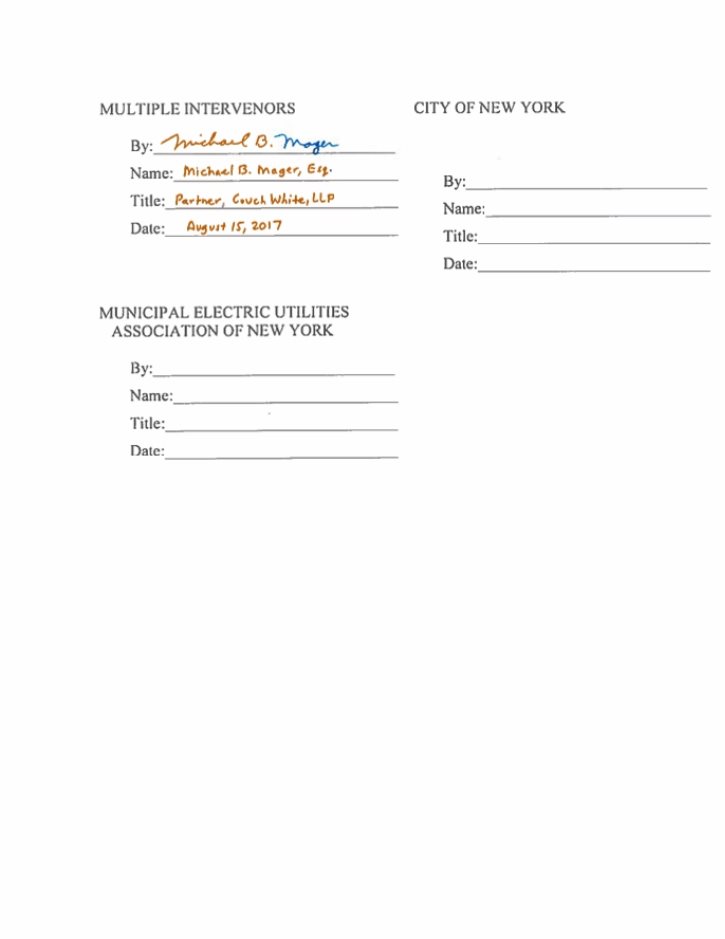

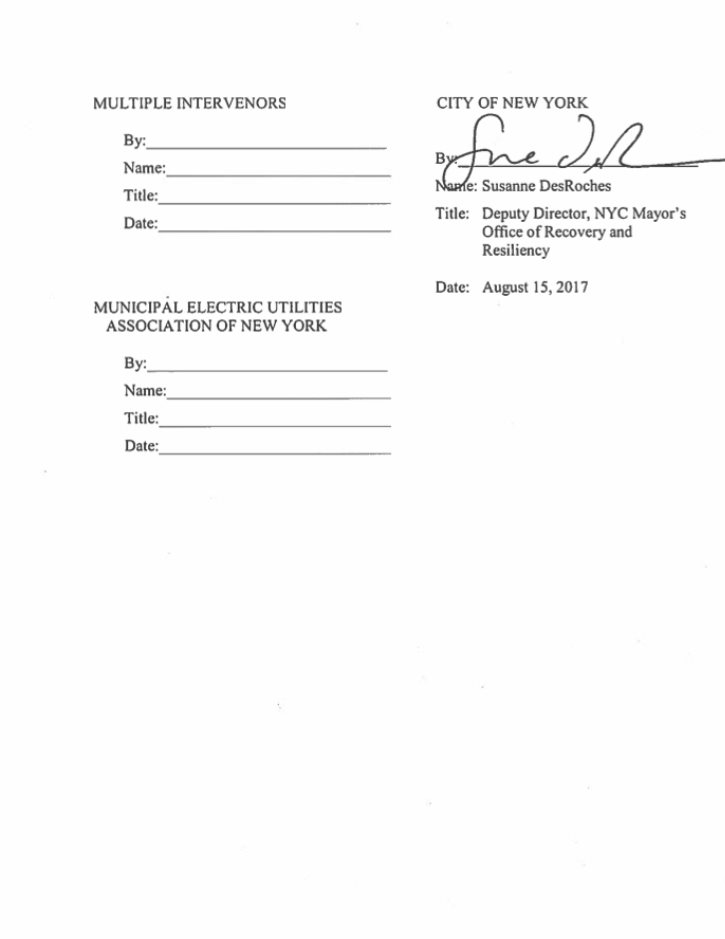

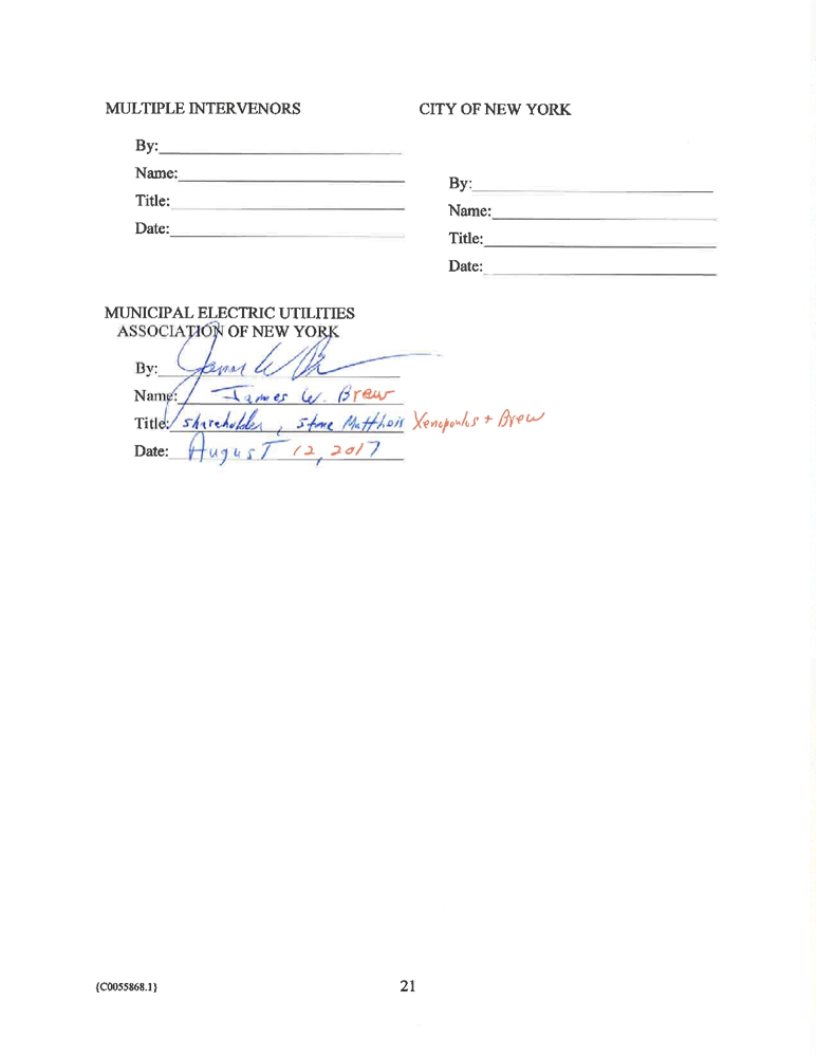

IN WITNESS WHEREOF the Settling Parties, each acting on its own behalf or through an authorized representative, have caused this agreement to be executed.

[THE NEXT PAGE IS THE SIGNATURE PAGE]

19

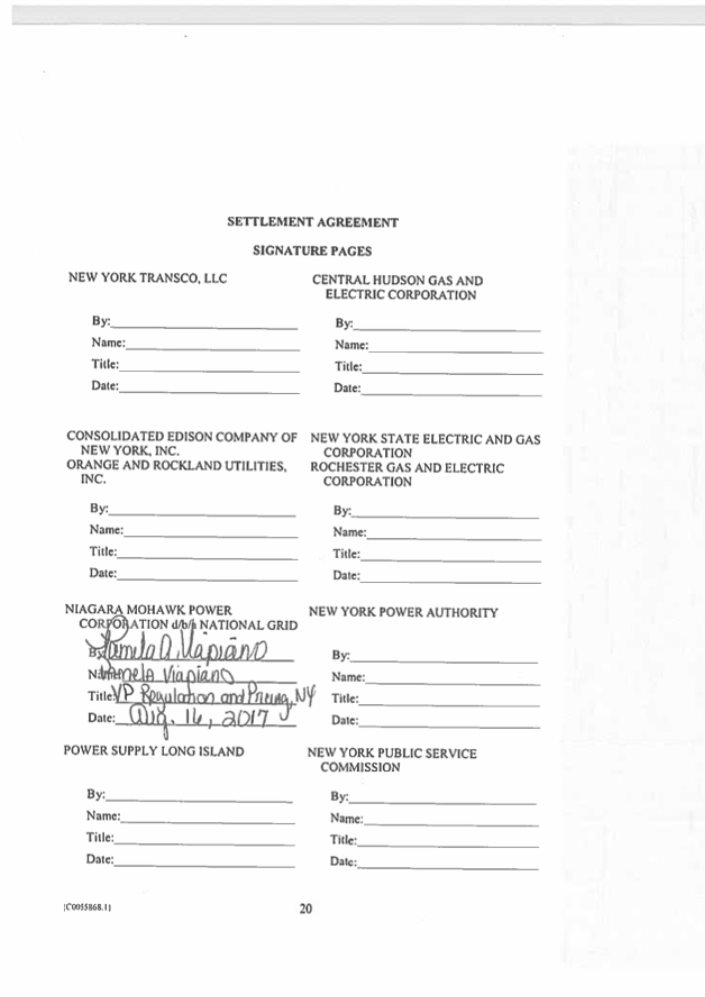

SETTLEMENT AGREEMENT

SIGNATURE PAGES

NEW YORK TRANSCO, LLC

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

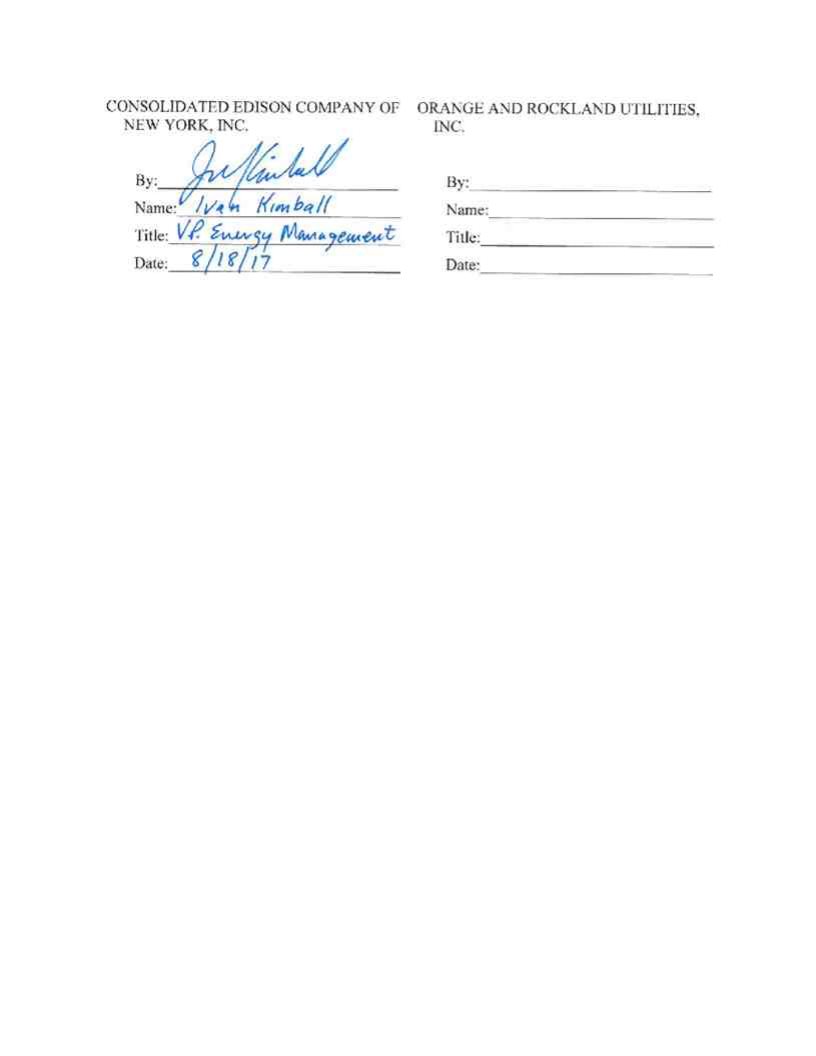

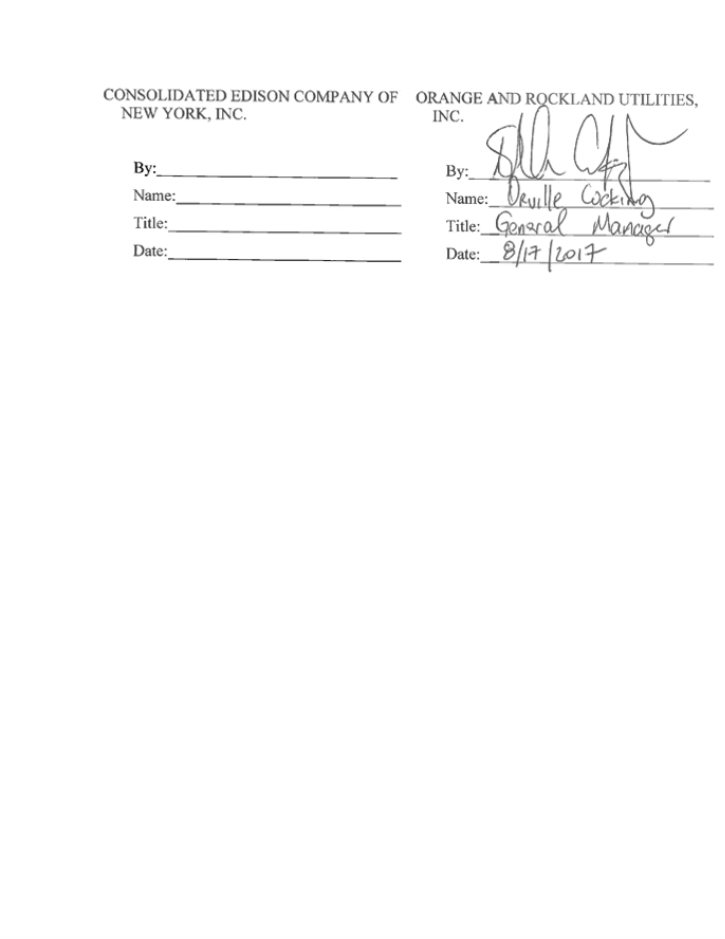

CONSOLIDATED EDISON COMPANY OF

NEW YORK, INC.

ORANGE AND ROCKLAND UTILITIES,

INC.

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NIAGARA MOHAWK POWER

CORPORATION d/b/a NATIONAL GRID

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

POWER SUPPLY LONG ISLAND

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

CENTRAL HUDSON GAS AND

ELECTRIC CORPORATION

By:___________

Name:_Paul A. Colbert________________

Title:_Associate General Counsel-Regulatory Affairs Date:_August 15, 2017________________

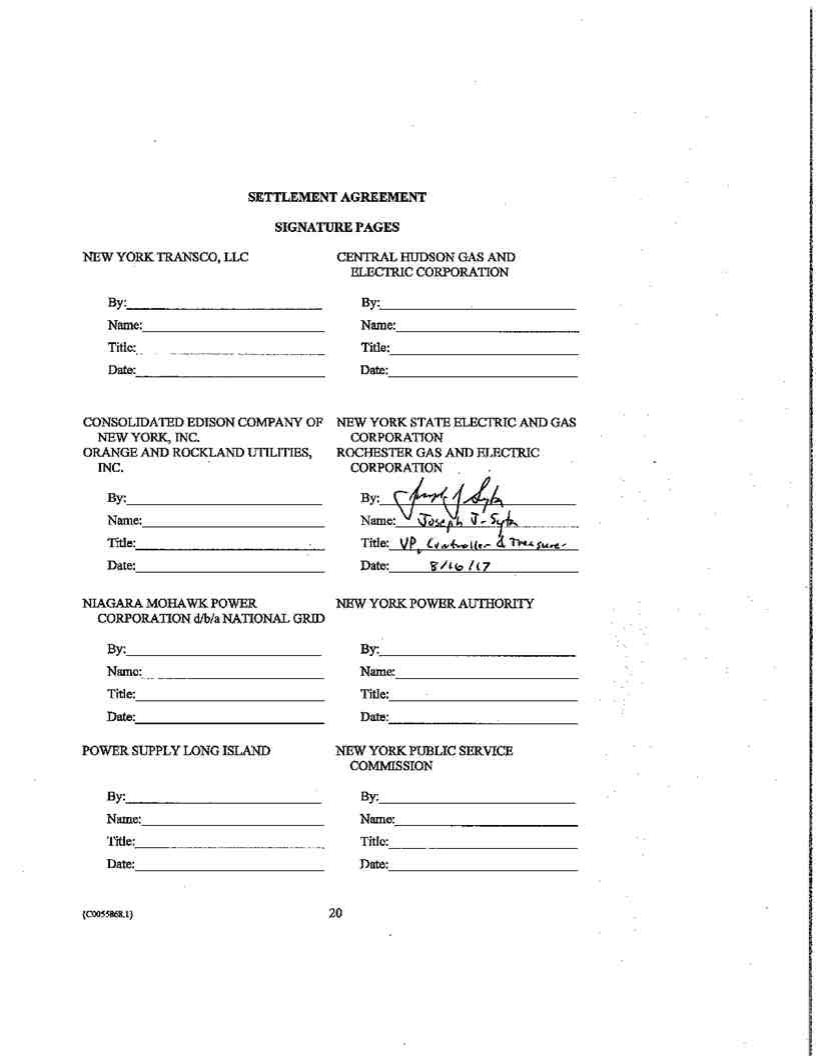

NEW YORK STATE ELECTRIC AND GAS

CORPORATION

ROCHESTER GAS AND ELECTRIC

CORPORATION

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NEW YORK POWER AUTHORITY

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NEW YORK PUBLIC SERVICE

COMMISSION

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

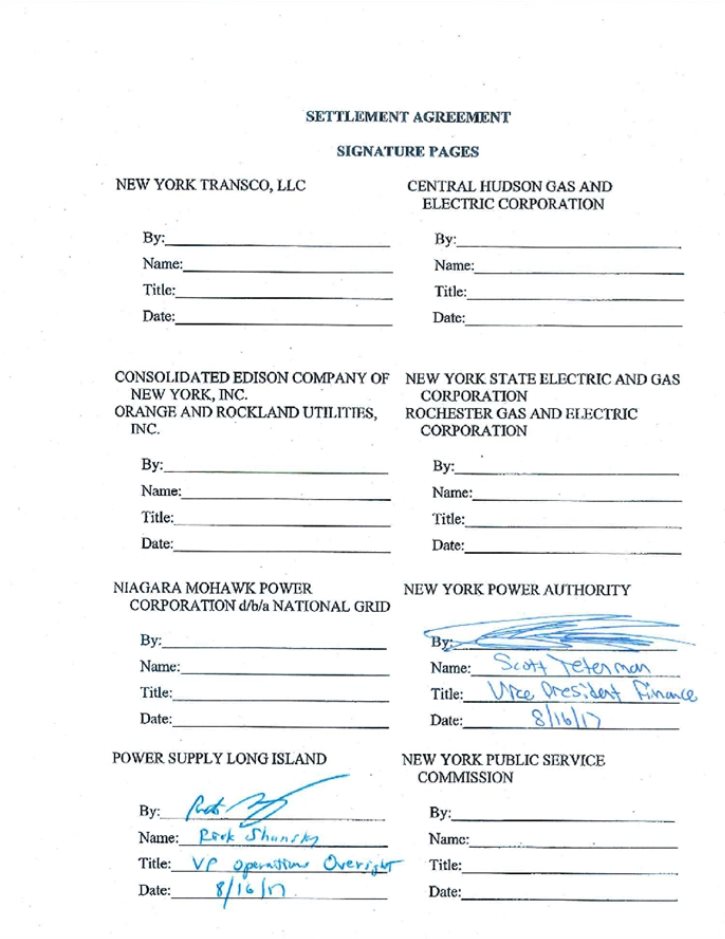

SETTLEMENT AGREEMENT

SIGNATURE PAGES

NEW YORK TRANSCO, LLC

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

CONSOLIDATED EDISON COMPANY OF

NEW YORK, INC.

ORANGE AND ROCKLAND UTILITIES,

INC.

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NIAGARA MOHAWK POWER

CORPORATION d/b/a NATIONAL GRID

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

POWER SUPPLY LONG ISLAND

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

CENTRAL HUDSON GAS AND

ELECTRIC CORPORATION

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NEW YORK STATE ELECTRIC AND GAS

CORPORATION

ROCHESTER GAS AND ELECTRIC

CORPORATION

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NEW YORK POWER AUTHORITY

By:______________________________

Name:____________________________

Title:_____________________________

Date:_____________________________

NEW YORK PUBLIC SERVICE

COMMISSION

By:_/s/ Paul Agresta________________

Name:_Paul Agresta _______________

Title:__General Counsel_____________

Date:_August 16, 2017______________

ATTACHMENT A

Attachment 9 - Depreciation and Amortization Rates

New York Transco LLC

Account Number

TRANSMISSION PLANT

1 350.1

2 352

3 353

4 354

5 355

6 356

7 357

8 358

9 359

10 PRODUCTION PLANT

11 DISTRIBUTION PLANT GENERAL PLANT

12 390

13 391

14 392

15 393

16 394

17 395

18 396

19 397

20 398

INTANGIBLE PLANT

21 303

FERC Account

Land Rights

Structures and Improvements Station Equipment

Towers and Fixtures

Poles and Fixtures

Overhead Conductor and Devices Underground Conduit

Underground Conductor and Devices Roads & Trails

All Accounts

All Accounts

Structures & Improvements Office Furniture & Equipment Transportation Equipment

Stores Equipment

Tools, Shop & Garage Equipment Laboratory Equipment

Power Operated Equipment

Communication Equipment

Miscellaneous Equipment

Miscellaneous Intangible Plant 5 Yr

7 Yr

10 Year

15 year

Transmission facility Contributions in Aid of Construction

Rate (Annual)Implied Life

Percent(Years)

(See Note 1)

1.0298

2.0549

2.2644

2.0449

2.2445

2.2245

2.0549

2.3942

1.1786

0.00

0.00

3.3630

5.2419

9.7810

3.9126

4.6821

3.7527

7.6213

3.8226

4.5522

20.005

14.297

10.0010

6.6715

Note 2

Note 1: Implied Life is calculated using the Depreciation Rate (100 divided by the depreciation rate).

Note 2: In the event a Contribution in Aid of Construction (CIAC) is made for a transmission facility, the transmission

depreciation rates above will be weighted based on the relative amount of underlying plant booked to the accounts shown in lines 1-7 above and the weighted average depreciation rate will be used to amortize the CIAC. Once determined for a particular

CIAC, the rate will not change for that CIAC absent Commission approval.

ATTACHMENT B

Example Calculation for Actual Costs Above Cost Cap

No Unforeseeable Costs

Financial Assumptions: Capital Cost Bid

Contingency (18%)

Inflation at 2.0% per year for 24 months Cost Cap:

Capital Cost Over Cost Cap:

Prudently Incurred Capital Cost:

Capital Structure: (Equity %) Base Rate of Return on Equity: Incentive Rate Adders:

Debt Rate:

Federal Income Tax Rate: State Tax Rate:

Tax Gross Up: 1 - (((1 - 7.1%) * 35%) + 7.1%) = 60.385% Depreciation Rate:

Risk-share % - Base ROE

Gain-share % - No ROE

Scenario

$100

$18

1.0404

$123

$50

$173

53%

9.65%

1%

3.28%

35%

7.10%

60.385%

2%

80%

20%

The first year Base Revenue Requirement Related to Capital would be as follows:

Debt Spend within Cost Cap$123 M * 47% * 3.28%$1.896 M

Equity Spend within Cost Cap$123 M * (53%/60.385%) * 10.65%$11.50 M

Recovery on Debt Overspend Recovery of Equity Overspend without ROE Incentives

Customer “Value” of

Unrecovered Equity Overspend

$50 M * 47% * 3.28%$0.771 M

$50 M * 80% * (53%/60.385%) * 9.65%$3.388 M

$50 M * 20% * (53%/60.385%) * 10.65% $0.935 M

Calculated ROE on Overspend$3.388 M * 60.385% / ($50 M * 53%)7.72%

Debt Return on Project3.28%

ATTACHMENT C

Example Calculation for Actual Costs Below Cost Cap

No Unforeseeable Costs

Financial Assumptions:Scenario

Capital Cost Bid$100

5% Adder$5

Inflation at 2.0% per year for 24 months1.0404

Adjusted Cost Cap:$109

Capital Savings below Adjusted Cost Cap:$10

Prudently Incurred Capital Cost:$99

Capital Structure: (Equity %)53%

Base Rate of Return on Equity:9.65%

Incentive Rate Adders:1%

Debt Rate:3.28%

Federal Income Tax Rate:35%

State Tax Rate:7.10%

Tax Gross Up: 1 - (((1 - 7.1%) * 35%) + 7.1%) = 60.385%60.385%

Depreciation Rate:2%

The first year Base Revenue Requirement Related to Capital would be:

Debt Spend within Cost Cap$99 M * 47% * 3.28%$1.526 M

Equity Spend within Cost Cap$99 M * (53%/60.385%) * 10.65%$9.254 M

Sharing on Debt Savings

ROE Adder for Capital Savings Below Adjusted Cost Cap

Customer “Value” or Savings

(Equity, debt, and depreciation)

$0

$10 M/$109 M = 9.2%

Table A for >5% to <=10%0.17 %

[$10 M * 80% * (53%/60.385%) *

10.65%] + [$10 M * 47% * 3.28%]+[$10M$1.102 M

* 2%]

Base ROE of 9.65%, ROE Incentive

Calculated ROE on ProjectAdders of 1%, and Table A ROE Adder of10.82%

Debt Return on Project3.28%

ATTACHMENT D

Examples Showing Cost Containment Operating Together with the Unforeseeable Costs Mechanism

1. Assume $15 M of Unforeseeable Costs added to Attachment B

Prudently Incurred Capital Cost$188 M$173 M + $15 M

Cost Cap$123 MNo change

Unforeseeable Costs included in$6.2 M$123 M * 5%

Capital Cost for Cost Containment

Unforeseeable Costs recoverable$8.8$15 M - $6.2 M

(excluded from Cost Containment)

Prudently Incurred Capital Cost for$188 M - $8.82 M

Cost Containment$179.2 M(Recoverable Unforeseeable

Cost with full return)

Amount Subject to Risk Sharing$56.2 M$179.2 M -$123 M

2. Assume $15 M of Unforeseeable Costs added to Attachment C

Prudently Incurred Capital Cost Cost Cap

Adjusted Cost Cap

Unforeseeable Costs included in

Capital Cost for Cost Containment

Prudently Incurred Capital Cost for Additional ROE Adder

Amount Subject to Additional ROE Adder

Recoverable Unforeseeable Cost

$114 M$99 M + $15 M

$123 MNo change

$109 MNo change

$6.2$123 M * 5%

$99 M + $6.2 M $105.2 M

$(3.8) M or 3.5% of$105.2 M -$109 M or

Adjusted Cost Cap; 0.05 %$3.8 M/$109 M ROE Adder

$8.8 M$15 M - $6.2 M

3. Assume $8 M of Unforeseeable Costs with no other cost variations

Prudently Incurred Capital Cost$131 M$123 M + $8 M

Unforeseeable Costs included in$6.2 M$123 M * 5%

Capital Cost for Cost Containment

Unforeseeable Costs that are$1.8 M$8 M - $6.2 M

Recoverable (excluded from Cost

Prudently Incurred Capital Cost for$131 M - $1.8 M (Recoverable

Cost Containment$129.2 MUnforeseeable Cost with full

return)

Amount Subject to Cost$6.2 M$129.2 M -$123 M

Containment Sharing

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person designated on the official service list in this proceeding in accordance with the requirements of Rule 2010 of the Commission’s Rules of Practice and Procedure.

Dated at Washington, D.C. this 21st day of August, 2017.

/s/ Carlos L. Sisco

Carlos L. Sisco

Senior Paralegal

Winston & Strawn LLP

1700 K Street, N.W.

Washington, DC 20006-3817 202-282-5000