UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

)

New York Independent System Operator, Inc.)Docket No. ER16-120-003

)

REQUEST FOR LEAVE TO ANSWER AND ANSWER OF

NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

Pursuant to Rule 213 of the Commission’s Rules of Practice and Procedure,1 the New

York Independent System Operator, Inc. (“NYISO”) respectfully submits this request for leave

to answer and answer (“Answer”).2 The Answer responds to the comments and protests of the

NYISO’s second reliability must run (“RMR”) service compliance filing submitted on

September 19, 2016 in the above-captioned proceeding (“Compliance Filing”).3 Comments and

protests were submitted by: (i) the Independent Power Producers of New York, Inc. and Electric

Power Supply Association (collectively, “IPPNY”),4 (ii) Multiple Intervenors and the City of

New York (collectively, “MI/NYC”),5 and (iii) the New York Transmission Owners

(“NYTOs”).6

1 18 C.F.R. § 385.213.

2 Capitalized terms not defined in this Answer shall have the meaning set forth in the NYISO Open

Access Transmission Tariff (“OATT”) and Market Administration and Control Area Services Tariff

(“Services Tariff”), including in the proposed revisions to those tariffs in the NYISO’s compliance filing.

3 N.Y. Indep. Sys. Operator, Inc., Compliance Filing, Docket No. ER16-120-003 (September 20,

2016) (“Compliance Filing”). Due to technical issues in the electronic submission of the Compliance

Filing, the NYISO submitted the compliance filing after 5 PM on September 19, 2016 and requested that the Commission grant any required waivers to accept the compliance filing one day out of time. The Commission noticed the filed date of the compliance filing as September 20, 2016. Combined Notice of Filings #1 (September 20, 2016).

4 Protest of Independent Power Producers of New York, Inc. and Electric Power Supply Association, Docket No. ER16-120-003 (October 25, 2016) (“IPPNY Protest”).

5 Comments and Protest of Multiple Intervenors and the City of New York, Docket No. ER16-120-003 (October 25, 2016) (“MI/NYC Protest”).

6 Comments of the New York Transmission Owners, Docket No. ER16-120-003 (October 25, 2016) (“NYTO Comments”).

1

The NYISO respectfully requests that the Commission accept its Compliance Filing with

only the limited clarifications described below. The NYISO’s proposed revisions to its Open

Access Transmission Tariff (“OATT”) and its Market Administration and Control Area Services

Tariff (“Services Tariff”) were carefully developed to bring the NYISO into full compliance with

the directives of the Commission’s April 21, 2016, Order on Compliance and Rehearing in this

proceeding (“April Order”)7 and the Commission’s initial February 19, 2015 order directing the

NYISO to establish RMR tariff requirements (“Initial RMR Order”).8 Except as noted below, the

Commission should reject the protests of and proposed changes to the Generator Deactivation

Process. The proposed changes would impede the NYISO’s ability to administer RMR services

in New York in a manner consistent with the directives of the April Order and the Initial RMR

Order. Finally, the Commission should reject as clearly beyond the scope of this proceeding the

proposal to use this proceeding to enact broad changes to the NYISO’s capacity market design.

I. REQUEST FOR LEAVE TO ANSWER

The NYISO may answer pleadings that are styled as comments as a matter of right.9 The

Commission has discretion to, and routinely accepts, answers to protests where, as here, they

help to clarify complex issues, provide additional information, are otherwise helpful in the

development of the record in a proceeding, or assist in the decision-making process.10 The

7 N.Y. Indep. Sys. Operator, Inc., Order on Compliance and Rehearing, 155 FERC ¶ 61,076 (2016) (“April Order”).

8 N.Y. Indep. Sys. Operator, Inc., Order Instituting Section 206 Proceeding and Directing Filing to

Establish Reliability Must Run Tariff Provisions, Docket No. EL15-37-000 (February 19, 2015) (“Initial RMR Order”).

9 See 18 C.F.R. § 385.213(a)(3).

10 See, e.g., Southern California Edison Co., 135 FERC ¶ 61,093 at P 16 (2011) (accepting answers to

protests “because those answers provided information that assisted [the Commission] in [its] decision-

making process”); New York Independent System Operator, Inc., 134 FERC ¶ 61,058 at P 24 (2011)

(accepting the answers to protests and answers because they provided information that aided the

Commission in better understanding the matters at issue in the proceeding); New York Independent

2

NYISO’s Answer to the protests in this proceeding satisfies those standards and should be

accepted because it addresses inaccurate or misleading statements, and provides clarification and

additional information that will help the Commission fully evaluate the arguments in this

proceeding. The NYISO, therefore, respectfully requests that the Commission accept this

Answer.

II. BACKGROUND

The Commission issued the Initial RMR Order on February 19, 2015. The order

identified the NYISO as the appropriate entity to administer RMR service in New York pursuant

to Commission-jurisdictional tariffs. The Initial RMR Order directed the NYISO to submit

proposed tariff revisions to govern “the retention of and compensation to generating units

required for reliability, including procedures for designating such resources, the rates, terms and

conditions for RMR service, provisions for the allocation of costs of RMR service, and a pro

forma service agreement for RMR service.”11 On October 19, 2015, the NYISO submitted a

compliance filing proposing revisions to its OATT and its Services Tariff to implement the

directives of the Initial RMR Order (“October 2015 Filing”). On April 21, 2016, the

Commission accepted the October 2015 Filing with its Order on Compliance and Rehearing

subject to a number of compliance directives. On September 19, 2016, the NYISO submitted a

second Compliance Filing to address the directives of the April Order.12

System Operator, Inc., 140 FERC ¶ 61,160 at P 13 (2012) and PJM Interconnection, LLC, 132 FERC ¶ 61,217 at P 9 (2010) (accepting answers to answers and protests because they assisted in the

Commission’s decision-making process).

11 Initial RMR Order at P 11.

12 On June 7, 2016, the NYISO submitted a limited compliance filing in Docket No. ER16-120-002 to remove language from its OATT that was rejected by the April Order. The Commission accepted this

filing on July 1, 2016.

3

III. ANSWER

A.The NYISO’s Proposed Anti-Toggling Measures Address the Directives in the April

Order

MI/NYC argue that the periods of time over which the NYISO proposes to claw-back the

cost of Capital Expenditures and other Above Market Revenues from former RMR Generators

and former Interim Service Providers (“ISPs”) that return to participating in the NYISO’s

markets are too long.13 MI/NYC recommend that the claw-back repayment periods be truncated.

In the April Order, the Commission instructed the NYISO to develop rules to claw-back Capital Expenditures over time in a manner that does not discourage an otherwise efficient

generator from continuing to operate.14 The April Order states that the Commission’s goal is to

balance the competing objectives of (1) ensuring repayment of Capital Expenditures (and also,

presumably, other Above Market Revenues), and (2) giving RMR Loads the opportunity to

receive the full value of service from the upgrades for which they have paid by not discouraging

otherwise efficient generators from continuing to operate. The NYISO’s proposed claw-back

rules were developed to achieve this balance.15

13 MI/NYC Protest at 7-11.

14 April Order at P 127.

15 The NYISO has requested rehearing of certain aspects of the April Order that relate to the

implementation of anti-toggling rules. In its Compliance Filing, the NYISO submitted revisions to its anti-toggling rules that it developed to comply with the Commission’s instructions in PP 122-128 of the April Order. As the NYISO explained on page 45 of its Compliance Filing, its submission of compliance tariff revisions is not intended as, and should not be construed as, a withdrawal or waiver of any argument raised in the NYISO’s May 23, 2016 request for rehearing. See New York Independent System Operator, Inc., Request for Rehearing and Clarification of the New York Independent System Operator, Inc.,

Docket No. ER16-120-001 (May 23, 2016) (“Rehearing Request”). The same is true for this Answer. Because the Commission has not yet ruled on its Rehearing Request, the NYISO finds itself defending proposed rules that it developed and submitted to comply with the April Order.

4

1.The NYISO’s Proposed Recovery Term for Capital Expenditures

Appropriately Balances the Competing Objectives Identified in the April

Order

In proposed Section 15.8.7.1.1 of Rate Schedule 8 to the Services Tariff, the NYISO

proposes to claw-back the cost of Capital Expenditures16 over the shorter of (a) the major

maintenance cycle, in years, of the Generator, or (b) the Average Remaining Life of the

cumulative Capital Expenditures that RMR Loads paid for. The NYISO used the major

maintenance cycle to time-bound the Capital Expenditure repayment period because it is a point in time at which an owner would have to elect to make a significant additional expenditure in order to continue operating its Generator.17

MI/NYC argue that the cost of Capital Expenditures should instead be clawed-back over “perhaps no more than two or three years.”18 The repayment period MI/NYC propose is likely to be shorter (sometimes significantly shorter) than the repayment period the NYISO’s proposed Tariff revisions will produce. A shorter repayment period increases the amount that must be

repaid to the NYISO on a pro rata basis each month. An extremely short payback period could discourage an otherwise efficient former RMR Generator or former ISP from returning to

participate in the ISO Administered Markets.19

MI/NYC state that a Generator that proposed to deactivate is not likely to continue

operating for very long. MI/NYC further state that the NYISO’s proposed repayment term will

not result in the former RMR Generator or ISP fully repaying the capital investments that were

16 NYISO proposes to apply the same repayment period to the Capital Expenditure component of Above Market Revenues.

17 In implementing Tariff-required processes including the buyer-side and supplier-side capacity

market power mitigation rules and performing withholding analyses, the NYISO has observed major

maintenance cycle vary with use, but typically last no more than 8 years and are usually much shorter.

18 MI/NYC Protest at 8.

19 See April Order at P 127.

5

funded by consumers before it finally retires. MI/NYC’s protest also suggests that implementing

a shorter repayment period may cause older, less efficient Generators to retire, which it argues is

consistent with the New York State and Federal policy goals of reducing greenhouse gas

emissions.20 On the other hand, implementing a significantly abbreviated claw-back period for

Capital Expenditures that RMR Loads already paid for may prevent the NYISO from recouping

for the benefit of RMR Loads at least some of the funds supplied to purchase the capital asset.

The NYISO’s proposed claw-back rules were developed to achieve the balance described in paragraphs 126 and 127 of the April Order. The rules the NYISO filed are more likely to

permit a former RMR Generator or former ISP to return to, or to continue to operate in, the ISO

Administered Markets after the Generator Deactivation Reliability Need has been addressed,

than the shorter Capital Expenditure repayment period MI/NYC propose. The NYISO requests

that the Commission confirm that it struck the appropriate balance.

2.Response to MI/NYC Concern that NYISO’s Proposed Recovery Term for

Above Market Revenues is Too Long

In proposed Section 15.8.7.2 of Rate Schedule 8 to the Services Tariff, the NYISO

proposes to claw-back the cost of Above Market Revenues that are not Capital Expenditures

from former RMR Generators21 over the shorter of (a) three years, or (b) twice the duration of

the applicable RMR Agreement. MI/NYC argue that the NYISO’s proposed repayment period

for Above Market Revenues that are not Capital Expenditures is too long and should be

truncated to the shorter of (a) two years, or (b) the duration of the applicable RMR Agreement.

MI/NYC express concern that the NYISO’s proposed repayment period for Above Market Revenues that are not Capital Expenditures from former RMR Generators “create a

20 See MI/NYC Protest at 11-13.

21 MI/NYC did not protest the NYISO’s proposed one year period for former ISPs to repay Above Market Revenues that are not Capital Expenditures.

6

window of opportunity during which a former RMR generator can earn revenue in the

marketplace, make only a partial repayment, and then shut down (or toggle back to RMR

status22) to avoid full repayment.” MI/NYC also argue that it is not equitable to give a former RMR Generator longer to repay its Above Market Revenues (other than Capital Expenditures) than the period over which the revenues were received from consumers.

So long as the change only affects repayment by former RMR Generators of Above Market Revenues that are not Capital Expenditures, the NYISO does not support, but is not strongly opposed to, the shorter repayment period that MI/NYC propose. If the Commission were to direct the NYISO to adopt the shorter repayment period proposed by MI/NYC, the NYISO would implement the change by modifying the proposed definition of “mAMR” that appears in Section 15.8.7.2 of Rate Schedule 8 to the Services Tariff.

3. The Commission Should Reject MI/NYC’s Recommendation that the NYISO

Should Recover the Salvage Value of Former RMR Generators as Impractical and Harmful to Non-RMR Loads

MI/NYC argue that the NYISO should be required to obtain an unspecified type of

security interest in RMR Generators,23 to carefully track what happens to former RMR

Generators after they cease participating in the ISO Administered Markets, and to recover an

unspecified portion of the former RMR Generator’s salvage value for the benefit of RMR Loads

when that Generator is, eventually, dismantled and salvaged.24 In essence, MI/NYC contend that

the NYISO should position itself as a senior secured creditor in these transactions with preferred

22 MI/NYC do not explain in their protest either how a hypothetical Generator would “toggle back to RMR status” or how their proposal prevents this behavior. The NYISO has explained several times in this Docket how its proposed rules prevent or deter toggling. See, e.g., October 2015 Filing at 43-44, Rehearing Request at 11-14.

23 The MI/NYC Protest does not address former ISPs. The NYISO does not negotiate an RMR

Agreement with an ISP, so it would be difficult for the NYISO to obtain a security interest in the salvage value of such a Generator.

24 MI/NYC Protest at 13-14.

7

access to an RMR Generator’s assets. The NYISO considers this proposal to be commercially unrealistic and impractical. The NYISO also believes that the complexities of such an approach would unfairly shift to all New York Loads a category of transaction costs that (assuming any of this were possible) would benefit only the RMR Loads.

On the commercial side, it seems certain that most RMR Generators will be subject to

significant secured financing. It seems very unlikely that an RMR Generator will hold the assets

to which the protest refers free and clear of liens. Consequently, for the NYISO to occupy the

position MI/NYC describe, the NYISO would first need to undertake a detailed analysis of each

RMR Generator's debt structure. Because this analysis almost certainly would reveal the

existence of preexisting secured debt, the NYISO would need to obtain from the holders of this

debt waivers, exceptions, or subordinations sufficient to put the NYISO in a first-lien position

(which in most cases would be the only position that would carry value given the financial

difficulties to which the RMR Generator presumably already is subject). This would take time -

almost certainly longer than the 60-90 days contemplated for negotiation of an RMR Agreement.

In most cases, this would be unsuccessful, given that a preexisting secured creditor likely would

have little incentive to subordinate its right of recovery when the asset is already troubled and

facing liquidation.

It would also carry significant expense. While the NYISO operates a credit department,

the NYISO’s primary business is not secured credit, or participation in bankruptcy or salvage

proceedings. The NYISO would have to hire and pay outside lawyers and other experts to

manage these matters on its behalf. At the same time, the NYISO’s costs of operation, including

the legal fees it incurs, are paid by all New York Loads, not just by RMR Loads. Accordingly,

the transactional and other costs associated with the approach advocated by MI/NYC - one that,

8

again, is unlikely to yield real economic value in most cases - would be spread across all New

York loads. The value (if any) actually generated by this approach, on the other hand, (i) would go only to the RMR Loads, and (ii) in the aggregate, very likely would be less than the total costs incurred. This would be unfair to the non-RMR Loads. The Commission should not accept

MI/NYC’s proposed change.

B. The Commission Should Reject, with the Exception of One Limited Clarification,

the NYTOs’ Proposed Changes to the NYISO’s Proposed Solution Selection Process

In paragraph 73 of its April Order, the Commission stated:

While we emphasize that RMR agreements should only be used as a last-resort

measure, we also have an interest in minimizing costs. It would be unreasonable,

as NYISO states, to ask NYISO to ignore uncertainty factors associated with a

non-generation solution and automatically dismiss the generation solution, when

the non-generation solution may turn out to be the more expensive option.

The NYISO’s solution selection process balances the competing concerns that the

Commission recognized in the April Order. The execution of an RMR Agreement with a

Generator should be a last resort. However, the NYISO should not be required to select a

transmission solution when a far less expensive generation solution is available.

The solution selection process the NYISO developed strongly favors selecting market-

based and transmission solutions over executing an RMR Agreement with a Generator. The

NYISO’s proposed rules recognize that selecting a permanent transmission solution may be the

least-cost choice for consumers in the long run. Proposed Section 38.10.1.1 of the OATT states

“If the ISO determines that there is a Viable and Sufficient permanent transmission solution that

completely satisfies the Generator Deactivation Reliability Need, the ISO may select the

solution.” For reliability needs that arise on non-Bulk Power Transmission Facilities due to a

Generator deactivation, the NYISO is required to select a permanent transmission solution, even

9

if the NYISO has to first execute an RMR Agreement with a Generator as a temporary solution to allow for the implementation of the transmission solution.25

The NYTOs’ comments propose several changes to the NYISO’s resource selection process that might prevent the NYISO from selecting a far less expensive generation solution and instead require the NYISO to select a significantly more expensive transmission solution. Because the NYISO’s proposed resource selection process satisfies the requirements that the Commission specified in paragraph 73 of its April Order and achieves an appropriate balance, the Commission should accept the NYISO’s resource selection process without requiring the NYISO to make the modifications that the NYTOs request, except that the NYISO does not object to the clarification proposed in Section III.B.2 of this Answer.

1. The Proposed Generator Deactivation Process Reasonably Treats RMR

Agreements as a Last Resort while Considering the Cost of Generation and Transmission Alternatives

The NYTOs argue that the NYISO’s tariff does not absolutely require RMR Agreements

to be implemented as temporary solutions and as a last resort.26 They state that “the NYISO’s

compliance filing could be interpreted as allowing for the selection of an RMR agreement as a

permanent solution.”27 The NYTOs further argue that although the NYISO’s filing letter

“repeatedly emphasizes that its selection process is consistent with the principles that RMR

agreements will be used as a temporary, last-resort measure . . . relying on the OATT language

alone, the proposed selection process could be applied such that RMR agreements are not used as

25 See proposed OATT Section 38.10.1.2; Compliance Filing at 28-29.

26 NYTO Comments at 2-3.

27 NYTO Comments at 3.

10

a temporary measure of last resort but rather as an alternative to permanent transmission solutions.”28

The NYISO’s Generator Deactivation Process establishes that an RMR Agreement will

not be used as a permanent solution to a reliability need. The NYTOs err by ignoring language

in the OATT that explicitly states that the solution selection process “is designed to ensure that

executing an RMR Agreement with a Generator is a last resort to addressing a Generator

Deactivation Reliability Need.”29 The OATT provides that the term of RMR Agreements is

limited by the in-service date of the conceptual permanent solution to the reliability need

provided by the Responsible Transmission Owner and modifications to the scope and timing of

the need arising from state agency action, information on other Transmission Owner projects,

other RMR Agreements and from the entry of market-based solutions into service.30 RMR

Service Offers must limit the term of service to the duration of the time for which the NYISO

determines the Generator is viable and sufficient to meet the reliability need.31 Finally, the pro

forma RMR Agreement provides that the NYISO may unilaterally terminate an RMR Agreement

with an RMR Generator if it determined that it “is no longer or will no longer be needed to meet

a Reliability Need.”32

28 NYTO Comments at 4.

29 Proposed OATT § 38.10.2.1.

30 Proposed OATT § 38.11.2.

31 Proposed OATT § 38.9.3 (term of RMR Service Offers determined by duration of period Generator

is viable and sufficient to meet the Generator Deactivation Reliability Need); proposed OATT § 38.9.4(D)

(RMR Service Offers shall “state the duration for which the Generator is being made available to provide

the RMR service (which shall be no longer than the duration the ISO determined the Generator is a viable

and sufficient solution), and specify whether the offer would be the same for any shorter period of time”) .

32 Proposed OATT § 38.26, Appendix C - Form of Reliability Must Run Agreement, §2.2.1 “Conclusion of Reliability Need.”

11

The NYTOs further overlook tariff language stating that a Generator operating under an

RMR Agreement will not be included in the base case of the NYISO’s biennial Reliability Needs

Assessment. Specifically, the tariff states that “the ISO shall not include in the RNA Base Case

an RMR Generator . . . selected by the ISO pursuant to Attachment FF of the ISO OATT.”33 As

explained in the Compliance Filing, the NYISO will exclude RMR Generators from inclusion in

its reliability planning process: (i) to allow for the identification of Reliability Needs in the

Reliability Needs Assessment that take into account the Generator Deactivation Reliability Need,

and (ii) provide for the NYISO’s consideration of permanent market-based and, if necessary,

regulated solutions to those needs in its Comprehensive Reliability Plan.34

The NYISO’s proposed solution selection process balances a strong preference for

implementing market-based and transmission solutions, instead of entering into RMR

Agreements, with the Commission’s clear mandate that the NYISO must consider the cost to

consumers in its selection process. The Commission should not instruct the NYISO to revise its

solution selection process in a manner that would require the NYISO to select a Viable and

Sufficient transmission solution even though a far less expensive generation solution is available

based on blind adherence to an absolute requirement that RMR Agreements may only be entered

into as a “last resort.”

2. The NYISO Does Not Object to Language Clarifying the Application of the

Requirement that to be Eligible for Selection a Generator Must Have a

Distinctly Higher Net Present Value than All of the Transmission Solutions under Consideration

The NYTOs further assert that the NYISO’s selection process “narrows the field of

eligible projects by discarding generation options, but only if all of the generation options are

33 Proposed OATT § 31.2.2.3.2.

34 Compliance Filing at 35.

12

more costly than at least one of the proposed transmission solutions.”35 Although the NYTOs’

interpretation does not align with the NYISO’s intent, the NYISO does not object to making the

following redlined change to the language of proposed Section 38.10.2.1 of the OATT to clarify

that when there are multiple Viable and Sufficient transmission solutions available to address an

identified Generator Deactivation Reliability Need, the NYISO will only continue to evaluate

Viable and Sufficient generation solutions that have a “distinctly” higher net present value than

all the Viable and Sufficient transmission solutions that are being considered. Specifically:

This solution selection process is designed to ensure that executing

an RMR Agreement with a Generator is a last resort to addressing

a Generator Deactivation Reliability Need. The ISO will select a

Viable and Sufficient transmission solution to address the

Generator Deactivation Reliability Need if: (i) there is one or more

Viability and Sufficient transmission solutions, and (ii) none of the

Viable and Sufficient generation solutions have a “distinctly higher

net present value” than a transmission solution. The ISO shall

cease evaluating a Viable and Sufficient generation solution if it

does not have a “distinctly” higher net present value than all of the

Viable and Sufficient transmission solutions that the ISO is

considering. If the ISO is selecting between and among Viable and

Sufficient transmission solutions, the ISO will perform its selection

based on the degree to which each transmission solution satisfies

the metrics set forth in Section 38.10.4.36

This revision is consistent with the method the NYISO intends to use to perform its solution

selection process and should address the NYTOs’ concern.

3. The NYISO’s Solution Selection Proposal Permits it to Consider the Broad

Range of Benefits that Transmission Solutions Can Provide

In Sections II.B and II.C of their comments, the NYTOs argue that the NYISO’s

proposed net present value (“NPV”) calculation does not adequately recognize the economic

benefit of transmission solutions because it does not fully account for benefits, such as reduced

35 NYTO Comments at 3.

36 Proposed OATT § 38.10.2.1.

13

congestion or improved efficiency of dispatch, that a transmission solution may provide.

Generation solutions can also reduce congestion and improve the efficiency of dispatch. The NYISO’s proposed NPV calculation does not explicitly take all system efficiency benefits into account for generation or transmission solutions.37 This is appropriate given the role that the NPV analysis plays in the NYISO’s resource selection process.

The NYISO’s proposed NPV calculation does not include broad-ranging system benefits of the sort the NYTOs suggest because the NYISO only proposes to use the NPV analysis:

(a) when there is no transmission solution and the NYISO is selecting between and among

competing generation solutions in accordance with proposed Section 38.10.3, (b) as a gateway to determine which generation solutions, if any, the NYISO will consider when it employs the more comprehensive resource selection criteria set forth in proposed Section 38.10.4, or (c) in

conjunction with the more comprehensive resource selection metrics set forth in proposed

Section 38.10.4 of the OATT. The NYISO’s determination that a generation solution has a

“distinctly” higher NPV than a transmission solution does not require the NYISO to select the

generation solution and execute an RMR Agreement. It merely requires the NYISO to consider the generation solution when it applies the broader metrics set forth in Section 38.10.4 to select a solution to an identified Reliability Need.

The NYISO’s NPV analysis is appropriately designed to act as a gateway when

generation solutions are being compared to transmission solutions. Proposed Section 38.10.2.2

explains that a Viable and Sufficient generation solution has a “distinctly” higher net present

37 Proposed OATT Section 38.10.2.2 states that the net present value (“NPV”) of a generation

solution is the present value of the difference between the generation solution’s offered costs and its

expected market revenues for the expected duration of an RMR Agreement. The NPV of a transmission solution is the present value of the difference between the transmission solution’s estimated costs and its expected market revenues (if any).

14

value than a Viable and Sufficient transmission solution if, after accounting for the accuracy

range of each transmission project cost estimate and generation revenue estimate, the NYISO

determines that the range of net present values of the generation solution is higher than the range

of the net present values of the transmission solution. If there is any overlap between the ranges

of net present values between a generation solution and a transmission solution, then the

generation solution does not have a distinctly higher net present value than the transmission

solution, and the generation solution will be dropped from consideration. If there is no overlap

between the ranges of the net present values of the generation and transmission solution, and the

range of net present values of the generation solution is above those of the transmission solution,

then the NYISO will select from among the generation and transmission solutions in the manner

explained below.

The NPV analysis is also a useful adjunct to the metrics proposed in Section 38.10.4 of

the OATT. The broad set of metrics proposed in Section 38.10.4 allows the NYISO to consider

all of the benefits that the NYTOs state that transmission solutions can provide in choosing a

solution to a Generator Deactivation Reliability Need. The NYTOs state that the NYISO’s

solution selection process will not take into account “the full economic benefits of transmission

solutions on energy and capacity markets”38 including reduced congestion and increased

efficiency of dispatch.39 Proposed Section 38.10.4.5 of the OATT explicitly requires the NYISO

to consider “how the proposed solution may affect the utilization of the transmission system (e.g.

interface flows, percent loading of facilities).” Proposed Section 38.10.4.4 of the OATT requires

the NYISO to consider “how the proposed solution may affect additional flexibility in operating

the system, such as dispatch of generation, access to operating reserves, access to ancillary

38 NYTO Comments at 6.

39 Id. at 5.

15

services” and “how the proposed solution may affect the cost of operating the system, such as how it may affect the need for operating generation out of merit for reliability needs … or

providing more balance in the system to respond to system conditions that are more severe than design conditions.” The NYISO’s proposed solution selection process already requires the

NYISO to consider a broad range of the economic benefits that transmission solutions (and other solutions) can provide to energy and capacity markets.

The NYISO’s proposed solution selection process does not require it to select an RMR

Agreement over a less costly, permanent transmission solution. The process requires the NYISO

to take a broad range of system-wide and long-term benefits into account when choosing

between a permanent transmission solution and a temporary RMR Agreement. The

modifications to the solution selection process that the NYTOs propose in sections II.B and II.C

of their comments (on pages 5-7) are not necessary or appropriate and should not be adopted.

C.Response to NYTOs Proposed Corrections and Revisions to the Claw-Back

Repayment Obligation Rules

1. The Commission Should Reject the NYTO’s Proposed Change to the

Treatment of Depreciation in the Claw-back Calculation

The NYTOs argue that the NYISO should not consider depreciation that occurs while a

former RMR Generator or former ISP is deactivated when calculating the Generator’s repayment

obligation (claw-back).40 The NYISO disagrees with the NYTOs position for the following

reasons.

It is appropriate to deduct all depreciation that may occur to a Capital Expenditure that is purchased by RMR Loads to enable a Generator to provide service during the term of an RMR Agreement from the claw-back repayment obligation that applies when the former RMR

40 NYTOs Comments at 8-9.

16

Generator returns to the ISO Administered Markets. If a former RMR Generator enters a

Mothball Outage or an ICAP Ineligible Forced Outage (“IIFO”) following the conclusion of its

RMR Agreement (or if the former RMR Generator becomes Retired and then returns as a new

Generator following the conclusion of its RMR Agreement) and the Capital Expenditure is one

that continues to depreciate even though it is not being used,41 then the fact that the Capital

Expenditure had to be made to permit the Generator to provide RMR Service before the

Generator entered its Mothball Outage or IIFO means that the additional depreciation that occurs

during the Mothball Outage or IIFO was the direct result of the Generator making the Capital

Expenditure earlier than it otherwise would have in order to provide RMR service. If the

Generator had refused to provide RMR service, it could have avoided the depreciation by

purchasing the Capital Expenditure at the end of its Mothball Outage or IIFO instead of prior to

commencing the outage.

The NYTOs’ proposal could require a former RMR Generator that returns to the ISO

Administered Markets following a Mothball Outage to reimburse the cost of a Capital

Expenditure (that was made to permit the Generator to provide RMR service) after that Capital

Expenditure’s useful life has expired. In this case the former RMR Generator would have to re-

incur the same Capital Expenditure to return to service. The NYISO’s proposed rules avoid

charging former RMR Generators for the cost of Capital Expenditures that the Generator could

have avoided by declining the opportunity to execute an RMR Agreement with the NYISO. The

Commission should accept the rules proposed in the NYISO’s compliance filing.

41 Many types of Capital Expenditures only depreciate when they are used. Capital Expenses that

depreciate based on run-hours or the number of times a Generator starts-up are examples of Capital

Expenses that depreciate based on use. The difference in opinion between the NYISO and the NYTOs is

only relevant when considering Capital Expenditures that depreciate even when they are not being used.

17

2.The NYISO Agrees with Many, But Not All, of the NYTOs’ Proposed

Technical Corrections to the Claw-Back Calculations in Rate Schedule 8 of the Services Tariff

The NYISO agrees with many, but not all, of the technical corrections to the claw-back calculations that the NYTOs propose in Section II.D.2 of their comments.42 Several of the

NYTOs’ proposed changes help to better accomplish the intended purpose of the claw-back

calculation. The NYISO would not object to the Commission directing it to make the changes that it agrees are appropriate.

The NYISO concurs with the proposal on page 10 of the NYTOs’ comments to modify the calculation of the RVi variable that is defined in Section 15.8.7.1.1 of Rate Schedule 8 of the Services Tariff. The NYTOs’ proposed change accurately takes into account the summation of the individual Capital Expenses after depreciation.

The NYISO also agrees with the NYTOs’ proposed changes to clearly explain that the

NYISO will use a proportionate share of the Capital Expenditures and of the Other Revenues

when determining the correct dollar amount an entity must repay each month to satisfy the

“Above Market Revenues” repayment obligation included in Section 15.8.7.2 of Rate Schedule 8

of the Services Tariff. In particular, the NYISO agrees with the high-level explanation on page

10 of the NYTOs’ comments, with the additional language that the NYTOs propose to add to

Section 15.8.7.2 starting at the bottom of page 10 of their comments, and with all of the redlined changes to the equation and defined terms that appear on pages 11 and 12 of the NYTOs’

comments, except the NYTOs’ proposed changes to the term RMRCapExRecoveryg.

42 NYTO Comments at 9-12.

18

The proposed edits that the NYISO agrees with properly reflect the NYISO’s intent and

are consistent with the NYISO’s presentations to its stakeholders - in particular, the RMR

Capital Expenditure presentation made to working groups on September 1, 2016.43

The NYISO disagrees with the NYTOs’ proposed redlined additions to the variable

RMRCapExRecoveryg that appear on page 11 of their comments. Consistent with paragraph 126

of the April Order, Section 15.8.7 of Rate Schedule 8 of the Services Tariff requires the NYISO

to claw-back the “higher of” two possible repayment obligations, either: (i) the residual value of

the remaining Capital Expenditures at the time the former RMR Generator or former ISP would

return to the market or (ii) the total “above-market payments” the former RMR Generator or

former ISP received.

To calculate AboveMarketRevenueg in Section 15.8.7.2, the NYISO proposes to add the

reimbursed Capital Expenditures to the Other Revenues it paid to the Generator, and then to

subtract the revenues that the Generator would have earned by participating in the NYISO’s

markets. The NYTOs propose to modify the definition of RMRCapExRecoveryg in a manner that would require the NYISO to ignore the depreciation of Capital Expenditures when it calculates

the Generator’s Above Market Revenues. The NYTOs’ proposal is inconsistent with the

Commission’s instruction that Capital Expenditures should be repaid “less depreciation,”44 and it would produce an inequitable result.

Including the NYTOs’ proposed addition “…except that the depreciation term Pik shall

not be subtracted when making this determination…” would require the NYISO to ignore

43 See Revised RMR Clawback Rules: Updated Presentation, NYISO ICAP Working Group (September 1, 2016), available at

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/meeting_materials/20

16-09-01/Clawback%20Presentation%20Updated.pdf.

44 See April Order at P 126.

19

depreciation expense for Capital Expenditures when the NYISO calculates Above Market

Revenues.45 The proposal is inconsistent with the language the NYISO proposed in Section

15.8.7.1.1, which requires the NYISO to include depreciation expense in its calculation of the

repayment obligation that applies to Capital Expenditures. The NYTOs’ proposal to ignore

depreciation in one of the two “higher of” calculations, even though it is required to be included

in the other calculation, would inequitably over-weight the Above Market Revenue claw-back

calculation. To fairly determine the “higher of” the two values and the total amount of claw-

back owed, the NYISO must use the same value (Capital Expenditures minus depreciation) and

apply it in a consistent manner when calculating both the Capital Expenditure repayment

obligation (Section 15.8.7.1) and the Above Market Revenue repayment obligation (Section

15.8.7.2).

In sum, the NYISO agrees with all of the corrections and revisions the NYTOs propose in Section II.D.2 of their comments (pages 9-12), except the NYTOs’ proposed edits to the

definition of the RMRCapExRecoveryg variable.

E.IPPNY’s Recommendation that NYISO Should Adopt a Forward Capacity Market

Falls Outside the Scope of the Commission’s Orders and the NYISO’s Compliance

Filings

IPPNY’s proposal to have the NYISO implement a Forward Capacity Market (“FCM”) is

beyond the scope of this proceeding.46 The NYISO’s second Compliance Filing properly

focused on implementing the directives of the April Order. IPPNY’s proposal to require the

NYISO to implement a FCM is far broader than both: (a) the Commission’s directives to the

NYISO in the Initial RMR Order and the April Order, and (b) the NYISO’s compliance filings.

45 The term Pik is defined in Section 15.8.7.1 of Services Tariff Rate Schedule 8. It is “the annual depreciation expense, determined by the ISO, for Capital Expenditure i in year k”.

46 See IPPNY Protest at 4-7.

20

Commission precedent is clear that a protest may not expand the scope of a compliance

proceeding.47 The Commission should reject IPPNY’s proposal for the same reason it rejected

Entergy’s market enhancement proposals in paragraph 133 of its April Order. The NYISO does

not substantively respond in this Answer to the FCM aspects of IPPNY’s protest because they

fall outside the scope of the compliance directives in the Initial RMR Order and the April Order.

If IPPNY wishes to pursue the market design changes that it has proposed in this

proceeding, it should do so through the NYISO stakeholder process in the first instance. The

Commission should not allow consideration of these matters to delay action on the Compliance

Filing.

F. IPPNY’s Proposal to Align the NYISO’s Generator Deactivation Process with its

Gap Solution Process Falls Outside the Scope of the Commission’s Orders and NYISO’s Compliance Filings

IPPNY argues that the Commission should order the NYISO to align the NYISO’s Gap

Solution process with its proposed Generator Deactivation Process.48 It asserts that the NYISO

should be required to modify its Gap Solution process to provide that only the NYISO may select

and provide cost allocation and recovery for a Generator to resolve a Reliability Need in that

process, and only as a last resort.49 The NYISO agrees that consistent treatment of generation

solutions in all of the NYISO’s long term planning processes, including the Gap Solution process

and regular biennial Attachment Y reliability planning process, is logical. Nevertheless,

IPPNY’s argument is beyond the scope of the instant compliance filing because the Commission

did not direct the NYISO to amend the Attachment Y reliability planning process or the Gap

47 See, e.g., Consolidated Edison Company of New York, 97 FERC ¶ 61,241 at 62,092 (2001); Entergy

Services, Inc., 52 FERC ¶ 61,317 (1990); Louisiana Power & Light Co., 50 FERC ¶ 61,040 at 61,062

(1990).

48 IPPNY Protest at 8-13.

49 IPPNY Protest at 11-13.

21

Solution process in the manner that IPPNY suggests in this proceeding. The NYISO’s

Compliance Filing complies with the Commission’s directives in the April Order that the NYISO address reliability needs arising out of Generator deactivations and provide for cost allocation and recovery for solutions to these needs in its tariff separately from its Gap Solution process and other planning processes.50

G. The Commission Should Reject IPPNY’s Proposed Changes to the Timing of

Generator Deactivation That Do Not Take Into Account the Administrative Actions Necessary to Deactivate a Generator

On pages 15 and 16 of its protest, IPPNY argues that, once the NYISO determines that an Initiating Generator is not needed for reliability and can deactivate, the NYISO should be

required by its Tariff to complete all administrative processes that are necessary to permit the

Generator to deactivate within 10 days of reaching that determination. IPPNY’s request appears to be premised on several inaccurate assumptions about why the NYISO allows itself time to

complete administrative processes.

First, IPPNY’s protest assumes that all Initiating Generators will be asking to leave at the

earliest possible date (91 days). In fact, the NYISO has already received multiple Generator

Deactivation Notices that provided the NYISO far more than 91 days advance notice of a

planned deactivation. It is not possible for the NYISO to complete “all administrative processes”

50 See April Order at P 31 (“we reject NYISO’s proposal to situate the RMR process within the

existing Gap Solution process and require NYISO to submit … a compliance filing with a proposed RMR

process separate from NYISO’s existing Gap Solution process, under which NYISO evaluates and selects

solutions to identified reliability needs caused by generator deactivations.”), P 41 (“we reject the

NYISO’s proposal and require NYISO to establish an RMR process separate from its Gap Solution

process, under which NYISO evaluates and selects solution to identified reliability needs caused by

generator deactivations, whether market-based solutions, generation solutions, or non-generation

solutions. In developing a separate RMR process, NYISO should develop additional tariff revisions to

clarify when its separate RMR process will be triggered, as opposed to its existing Gap Solution

process”); P 112 (“we require NYISO to include in the compliance filing ordered herein a proposed cost

allocation method as part of its RMR process that is separate from its Order No. 1000-compliance

regional transmission cost allocation method”).

22

to deactivate an Initiating Generator while that Generator is continuing to participate in the ISO Administered Markets.

Second, IPPNY’s protest assumes that all Initiating Generators will actually be prepared to exit the ISO Administered Markets on their requested deactivation date, even though the

NYISO’s proposed rules do not strictly require this. Before the NYISO turns off an Initiating Generator’s bid flags and takes other actions to remove the Generator from its markets, the

NYISO needs to receive a confirming notice from the Generator of the date on which that

Generator actually wants to deactivate. The actual deactivation date may be a different date

from the date specified in the Generator Deactivation Notice. For example, a Generator might have noticed its intent to deactivate by a specific date, but later determines that it needs to remain in service for a few additional days to consume remaining fuel stock.

The time the NYISO requires to deactivate a particular Initiating Generator will depend

on Generator-specific facts and circumstances. The most important criteria are that the

deactivating Generator (1) timely ceases participating in the ISO Administered Markets,

(2) provides sufficient advance notice of its actual deactivation date to the NYISO, and

(3) timely responds to NYISO questions and completes any required tasks. Because the

Initiating Generator’s actions can impact both the NYISO’s ability to permit the Generator to

deactivate and the time the NYISO requires to complete necessary administrative tasks, it is not appropriate to impose a strict time limit on the NYISO’s completion of administrative tasks related to the deactivation of an Initiating Generator.

23

H.The NYISO’s Proposed 365-Day Notice Period Is the Minimum Period Feasible to

Allow It to Address Bulk Power System and Local Reliability Needs in Coordination with all Market Participants and Stakeholders.

In the Compliance Filing, the NYISO emphasized that the 365 day notice period

“scarcely provides the NYISO with the time necessary to evaluate the reliability impacts of a

Generator deactivation, to solicit and evaluate alternatives to an RMR Agreement that could

address the reliability need, and to select among proposed solutions to address the need.”51

IPPNY counters that “the proposed 365-day notice period is unnecessarily long” for several

reasons.52 First, IPPNY asserts that the notice period does not “account for the time that will be

saved by eliminating the New York State Public Service Commission’s (“NYPSC”) role of

evaluating and selecting potential solutions to Generator Deactivation Reliability Needs from the

process.”53 IPPNY overlooks the fact that functions that were to be carried out by the NYPSC

will now be performed by the NYISO. These additional functions will take the NYISO

considerable time to administer.54 Moreover, as requested by IPPNY and other interested parties

in the stakeholder process, the 365-day period also includes an additional 30 days for interested

parties to propose Generator Deactivation Solutions, increasing the solicitation period from 30 to

60 days.55

51 Compliance Filing at 14; see proposed OATT § 38.3.1 (establishing that a Market Participant must provide the NYISO with a minimum of 365 days prior notice, following the NYISO’s determination that the Generator Deactivation Notice is complete, before its Generator may be Retired or enter into a

Mothball Outage).

52 IPPNY Protest at 18.

53 Id. at 18.

54 Compliance Filing at 14 (“Although the NYPSC’s role in reviewing and identifying non-generation alternatives has been removed, the NYISO needs that time to step into this role itself and to evaluate and select from among the available generation and transmission alternatives.”)

55 Proposed OATT § 38.4.1.

24

Second, IPPNY argues that the NYISO “should be better equipped to expedite its review than the NYPSC” “[g]iven its greater experience and resources and the fact that it will be

directly familiar with the scope of the need and the state of the system.”56 IPPNY provides no

support for its claim that the NYISO can perform the responsibilities previously assigned to the NYPSC faster than the NYPSC could or the time periods identified by the NYISO’s subject-

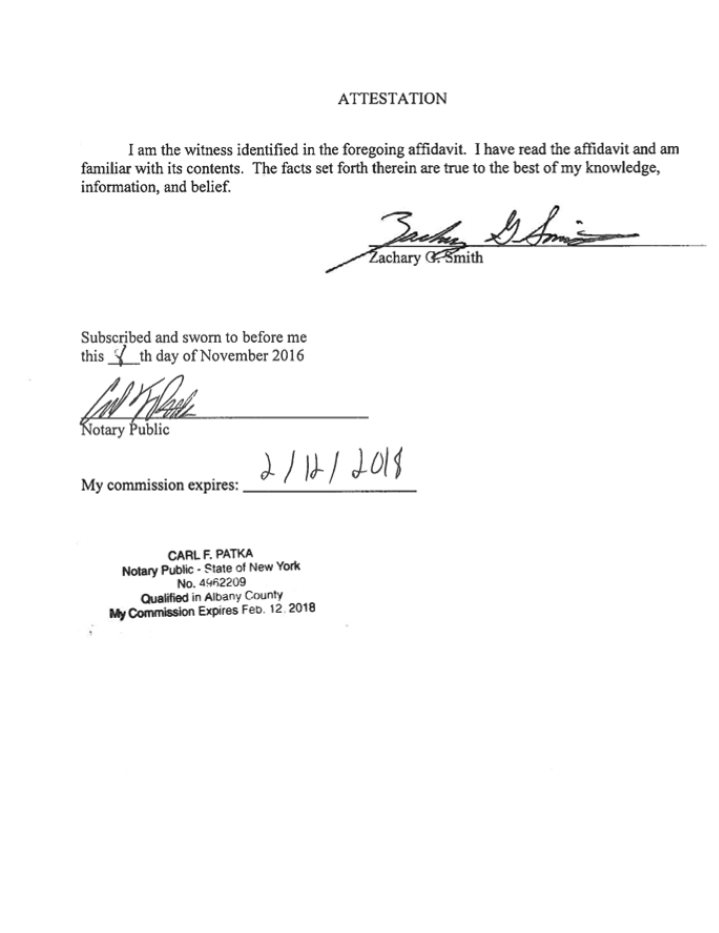

matter experts based on their long experience in performing similar studies and responsibilities. As the NYISO states in the Compliance Filing and in Attachment I to this Answer, the affidavit of Zachary G. Smith, NYISO Vice President of System and Resource Planning (“Smith

Affidavit”), it has streamlined process steps where possible, but “will still be compressing into

365 days many of the steps included in its reliability planning process, which in the normal

course requires at least two years to perform.”57

Based on its unsupported assertions, IPPNY concludes that the NYISO “should,

therefore, be able to accommodate a 270-day notice period.”58 IPPNY provides no indication of

the basis for selecting a 270-day period, nor does IPPNY explain how the NYISO will complete

all of the tasks it will be required by its Tariffs to perform in 95 fewer days. One hundred and

fifty days of the deactivation process are taken up by the Generator Deactivation Assessment (90

days) and the NYISO’s solicitation of solutions (which was extended from 30 days to 60 days at

the request of stakeholders).59 IPPNY’s proposal would leave the NYISO a scant 120 days to

56 IPPNY Protest at 18-19.

57 Compliance Filing at 14. See OATT § 31.1.8.2 (stating that the reliability planning process will normally be conducted over a two-year planning cycle.)

58 IPPNY Protest at 19.

59 Proposed OATT Sections 38.3.4.3 (establishing 90 day period for Generator Deactivation

Assessment) and 38.4.1 (establishing 60 day period for interested parties to submit proposed Generator Deactivation Solutions).

25

complete all of the remaining steps of the Generator Deactivation Process set forth in the NYISO’s Tariffs as described below.

In the Compliance Filing and the accompanying affidavit from Zachary G. Smith, the

NYISO explained that it requires at least 215 days before the Initiating Generator may deactivate to complete all of the following tasks set forth in the tariff:

• Evaluate the Viability and Sufficiency of potential alternative Generator Deactivation

Solutions to satisfy the identified Generator Deactivation Reliability Need (OATT §§

38.1, 38.6.1);

• Coordinate with the Responsible Transmission Owner in performing the evaluation of

solutions to both Bulk Power System and local transmission system reliability needs (OATT § 38.6.1);

• Evaluate the conceptual permanent solution proposed by the Responsible Transmission

Owner to determine that it is viable and sufficient to use as a benchmark for identifying the term of an RMR Agreement (OATT § 38.6.1);

• Review, verify and/or validate cost information provided to the NYISO by proposed

Generator Deactivation Solutions pursuant to OATT §§ 38.3, 38.4, 38.5 and Attachment F, Appendix B (OATT § 38.7);

• Determine the net present values of the Viable and Sufficient Generator Deactivation

Solutions that have been offered to the NYISO, including validating developers’ cost

information and determining an accuracy range for each solution’s costs (OATT §

38.10.2.2);

• Determine whether market based solutions and Transmission Owners’ Local

Transmission Owner Plans will satisfy the Generator Deactivation Reliability Need or whether a regulated solution is needed (OATT § 38.6.2);

• Administer study application and fees and deposits for all Viable and Sufficient

Generator Deactivation Solutions the NYISO evaluates (OATT § 38.4.6);

• Select from among regulated Viable and Sufficient generation and transmission solutions

using the net present value analysis and all of the criteria set forth in the NYISO’s tariff , including cost per MW ratio, expandability, operability, performance, property rights, risk of project delay and impact of other pending Generator Deactivation Reliability

Needs (OATT § 38.10);

• If the Initiating Generator plans to deactivate immediately after the 365th day of the

notice period and the Generator Deactivation Reliability Need arises either immediately

upon deactivation or in a future year, the NYISO must negotiate and enter into a

Development Agreement with a Developer if the NYISO selects a transmission solution

26

(OATT §§ 38.12.3, 31.7, Appendix C), or negotiate and enter into an RMR Agreement

with the Initiating Generator or another Generator if selected by the NYISO (OATT §

38.11.2 and Attachment F, Appendix C), or enter into several different agreements. The NYISO must also file the necessary RMR Agreements (OATT §§ 38.11.3 - 38.11.5) and or Development Agreements (OATT § 38.12.3) before their effective dates for

acceptance by the Commission; and

• Arrange for service from and compensation to Generators as Interim Service Providers

during the 365 day notice period (OATT §§ 38.1, 38.13).

Many of these tasks are normally associated with the NYISO’s two-year reliability planning

process.60 The Generator Deactivation Process adds further steps to enter into and file necessary agreements to secure solutions to address the Generator Deactivation Reliability Need.61 Given the scope and depth of the requirements of the Generator Deactivation Process, the NYISO’s proposal to complete these tasks in 215 days of the 365 day notice period is reasonable and

IPPNY’s proposal to shorten the 365 day period to 270 days should be rejected.

I. The Commission Should Reject IPPNY’s Proposed Changes to Generator

Compensation During the 365 Day Generator Deactivation Notice Period

IPPNY argues that the NYISO should start paying a Generator that submitted a Generator

Deactivation Notice the Initiating Generator’s choice of an Availability and Performance Rate

including Availability Incentives and Performance Incentives (“APR”) or an Owner Developed

Rate (“ODR”) that the owner files and the Commission accepts, commencing 91 days after the

Generator Deactivation Assessment Start Date.62 IPPNY states “Once the NYISO determines

that a Reliability Need prevents a Generator’s deactivation, that Generator is providing reliability

service. Until such time as the NYISO affirmatively identifies another solution, the deactivating

Generator should be compensated for that service [at the APR or ODR].”63 The Commission

60 Smith Affidavit at ¶¶ 8-9.

61 Smith Affidavit at ¶ 9.

27

should accept the compensation rules for Interim Service Providers (“ISPs”) that the NYISO

proposed in its Compliance Filing64 and reject IPPNY’s proposed changes.

The NYISO proposes to pay ISPs an APR that does not include Availability Incentives or Performance Incentives commencing 181 days after the Generator Deactivation Assessment Start Date. Implementing a rate that permits ISPs to recover their incremental and avoidable costs

commencing 181 days after the Generator Deactivation Assessment Start Date is appropriate for all of the following reasons:

(a) requiring the NYISO to pay a deactivating Generator a guaranteed rate that may

significantly exceed the Generator’s expected market-based rate compensation as soon as the

Generator Deactivation Assessment is completed, before the NYISO has the opportunity to

solicit or consider alternative solutions, will not encourage owners to submit a Generator

Deactivation Notice sufficiently in advance to permit the NYISO to plan for the Generator’s

orderly deactivation. To the contrary, if an owner knows or expects that its Generator will be

needed for reliability, it will be able to maximize its profits by operating the Generator until it is

no longer expected to be profitable and, only then, submitting a Generator Deactivation Notice.65

If the NYISO is required to immediately begin paying the owner a guaranteed rate that both

covers the Generator’s costs and significantly exceeds expected market-based rate compensation,

the owner will not care that the Generator’s operation is not profitable during the notice period.

62 IPPNY Protests at 19-21.

63 IPPNY Protest at 21.

64 The NYISO had to develop a significant set of new rules to properly implement ISPs because they are Generators that have submitted a Generator Deactivation Notice but that have not executed and RMR Agreement with the NYISO. See, e.g., proposed Services Tariff § 15.8.6, OATT § 38.13 and the other proposed Tariff rules that are cited in those sections.

65 This would potentially delay the submission of a Generator Deactivation Notice by up to 365 days.

The owner of a Generator that is not expected to be needed for reliability will not have the same

incentive.

28

Instead, under IPPNY’s proposal RMR Loads will absorb the losses that the Generator sustains during the notice period, while the owner receives a rate that may equal the deactivating

Generator’s full cost-of-service. Because IPPNY is proposing to require the NYISO to pay a rate that exceeds market compensation (up to a full cost-of-service rate) before the NYISO has the

opportunity to consider or select an alternative solution, IPPNY’s proposed change would not

produce a just and reasonable result;

(b) IPPNY’s argument does not take into account when the Generator Deactivation

Reliability Need is expected to arise, the circumstances under which the identified Reliability

Need is expected to arise, or even the deactivation date specified in the Generator Deactivation

Notice;

(c) 181 days is the time the NYISO expects it will require to obtain necessary avoidable

cost information from the Initiating Generator and to calculate a rate that complies with Section

15.8.6 of the Services Tariff. Since October 19, 2015, the NYISO has posted “completeness”

determinations for two Generator Deactivation Notices (addressing a total of three Generators)

that were subject to the new Generator Deactivation Notice requirement and to the associated

data submission rules. In both cases the NYISO found it necessary to issue multiple requests for

additional information from the Initiating Generator(s) to obtain the avoidable cost components

that NYISO would use to develop an APR. Based on its experience, the NYISO cannot commit

to have a reasonably accurate APR in place 91 days after a Generator Deactivation Notice is

submitted;

29

(d) the NYISO’s proposed timeframe is consistent with the timeframe in which the Midcontinent Independent Transmission System Operator begins paying out-of-market compensation66; and

(e) it is consistent with the notice period that the NYPSC already requires for Generators

that are 80MW or larger. Generators that are 80 MW or larger cannot deactivate prior to the

conclusion of the NYPSC’s 180 day notice period unless the NYPSC grants a waiver of the

requirement.67

In its December 21, 2015 Request for Leave to Answer and Answer in this proceeding, the NYISO explained in detail why it does not support paying rates that might significantly

exceed market compensation before it determines which solution to implement to address a

Generator Deactivation Reliability Need.68 An updated response is provided below because

IPPNY modified some of the arguments that were presented to the Commission in protests of the NYISO’s initial October 2015 Filing.

66 The Midcontinent Independent System Operator, Inc.’s (“MISO’s”) tariff rules require a generator

to submit an Attachment Y Notice to MISO at least 26 weeks prior to changing to a Retire or Suspend

status. If its deactivation would result in a reliability need and MISO does not identify an alternative by

the Attachment Y Notice date to Retire or Suspend, the MISO must file an SSR Agreement with the

noticing generator with an effective date as of the Attachment Y Notice date to Retire or Suspend. See

MISO Open Access Transmission, Energy and Operating Reserve Markets Tariff Sections 38.2.7.a and

38.2.7.c.

67 Proceeding on Motion of the Commission to Establish Policies and Procedures Regarding

Generation Unit Retirements, Case 05-E-0889, Order Adopting Notice Requirements for Generation Unit Retirements (issued December 20, 2005).

68 See New York Independent System Operator, Inc., Request for Leave to Answer and Answer of

New York Independent System Operator, Inc., Docket No. ER16-120-000 (December 21, 2015) at 8-11,

14-17.

30

1.IPPNY’s Proposal to Require the NYISO to Pay RMR Compensation

Immediately After a Generator Deactivation Reliability Need is Identified is Inconsistent with the Requirement that RMR Agreements be a Limited LastResort Measure

The Initial RMR Order requires the NYISO, relevant transmission owners, and interested

parties to consider alternatives to an RMR Agreement before the NYISO enters into an RMR

Agreement with a Generator. The Initial RMR Order states that RMR Agreements should be

used “only as a limited, last-resort measure” and that alternatives to an RMR Agreement should

be considered in order to “mitigate the need for an RMR designation.” Requiring the NYISO to

begin paying compensation to an Initiating Generator as if the Generator is already operating

pursuant to an RMR Agreement one day after the NYISO’s Generator Deactivation Assessment

is completed (i.e., 91 days after the Generator Deactivation Assessment Start Date), would

change RMR service from a “limited, last-resort measure” into a “first resort” requirement that

applies whenever the NYISO identifies a Generator Deactivation Reliability Need. The

Commission should reject IPPNY’s protest and accept the NYISO’s proposed ISP compensation

rules because they provide the necessary time for the NYISO and affected stakeholders to plan

and implement reliability solutions that could avoid the need to enter into an RMR Agreement.

In paragraph 13 of its Initial RMR Order, the Commission instructed the NYISO to

include in its compliance filing:

13. …Provisions establishing a schedule by which a generator must notify

NYISO of deactivation and clear timelines for action will ensure that NYISO, generation owners, all relevant transmission owners, and other concerned parties have sufficient time to plan and implement the reliability solutions necessary to address any identified reliability issue, which may ultimately mitigate the need for an RMR designation….69

In paragraph 16 of the Initial RMR Order, the NYISO was further instructed that:

69 Emphasis added; internal citations removed.

31

16. …The evaluation of alternatives to an RMR designation is an important

step that deserves the full consideration of NYISO and its stakeholders to

ensure that RMR agreements are used only as a limited, last-resort measure.

To this end, NYISO, in its proposed tariff language, should explain its process for

identifying RMR alternatives in detail, including how the process will ensure a

thorough consideration of all types of RMR alternatives in an open and

transparent manner…. Furthermore, NYISO’s proposal must include the

requirement that any future generation resource-specific RMR filing made with

the Commission should detail the alternative solutions evaluated and justify

the term of the proposed RMR agreement vis-à-vis the timing of alternative

solutions to the identified reliability need. This last requirement reflects our

belief that RMR filings should be made only to temporarily address the need to

retain certain generation until more permanent solutions are in place and that all

alternatives should be considered to ensure that designating a generator for

RMR service is a last resort option for meeting immediate reliability needs.70

The NYISO proposes to perform a Generator Deactivation Assessment71 and, where a

Generator Deactivation Reliability Need is identified, to solicit a broad range of possible

Generator Deactivation Solutions from Responsible Transmission Owners and Developers,72 and

to consider the possible return to service of Generators that are in a Mothball Outage or an ICAP

Ineligible Forced Outage to address the identified Reliability Need.73 The NYISO must next

identify the proposed Generator Deactivation Solutions that are viable and sufficient to satisfy

the identified Reliability Need.74 All viable and sufficient Generator Deactivation Solutions are

considered in determining how to address the identified Generator Deactivation Reliability

Need75 before the NYISO decides that it needs to enter into an RMR Agreement.76 This process

70 Emphasis added; internal citations removed.

71 See proposed OATT Section 38.3.4.

72 See proposed OATT Section 38.4.

73 See proposed OATT Section 38.5.

74 See proposed OATT Section 38.6.

75 See proposed OATT Sections 38.9 and 38.10.

76 See proposed OATT Section 38.11.

32

ensures that the NYISO only executes an RMR Agreement as a last-resort option, after all

alternatives have been considered, consistent with the Commission’s instructions.

The rules IPPNY proposes in its protest would effectively require the NYISO to begin

paying full RMR compensation to the Initiating Generator as soon as the NYISO identifies a

Generator Deactivation Reliability Need; before the NYISO even receives proposed alternative

solutions to the identified need. IPPNY’s proposal to require the NYISO to begin paying an

APR that includes Availability Incentives and Performance Incentives or an ODR before the

NYISO even has the opportunity to evaluate alternative solutions is not consistent with the

provisions of the Initial Order that require “thorough consideration” of alternative solutions before an RMR Agreement is executed, nor is it consistent with the rules adopted in other ISO/RTO markets.77

Although it would not be appropriate to require the NYISO to begin compensating an

Initiating Generator as if the Generator has already executed an RMR Agreement with the

NYISO78 immediately after a Generator Deactivation Reliability Need is identified, the NYISO

proposes to compensate ISPs that are required to remain in service beyond the 180th day of the

notice period at the Generator’s demonstrated avoidable costs, including its variable operating

costs. Implementing this approach will return New York Control Area (“NYCA”) Generators to

77 As explained previously, the MISO’s tariff rules provide 26 weeks (which is approximately 180 days) for the MISO to identify a reliability need and develop a solution. See MISO Open Access

Transmission, Energy and Operating Reserve Markets Tariff Section 38.2.7. At minimum, the

Commission should give the NYISO the same amount of time it granted the MISO to determine if a

Reliability Need exists and to evaluate alternatives before it requires the NYISO to implement a nonmarket compensation method.

78 The Initiating Generator has not yet agreed to comply with the terms and conditions of service that are required in the NYISO’s Form of Reliability Must Run Agreement.

33

approximately where they stood before the NYISO proposed its RMR rules.79 Additional

payments under an RMR-like agreement have not generally been available in New York until after the NYPSC’s 180 day notice requirement is satisfied.

2. Paying Generators an APR that Includes Availability and Performance

Incentives or up to Full Cost-of-Service Under an ODR During the Notice Period Would Discourage Generators from Providing Advance Notice or Assisting Efforts to Plan for an Orderly Deactivation

IPPNY argues that if a Generator is not permitted to deactivate immediately after the

NYISO completes a Generator Deactivation Assessment because the assessment indicates that

the Generator’s deactivation presents a Generator Deactivation Reliability Need that the NYISO,

affected Transmission Owners and interested stakeholders must plan to address, then the

Initiating Generator should be paid its choice of either (a) an APR that includes an Availability

Incentive and a Performance Incentive, or (b) an ODR (under which the Generator may seek to

recover its full cost-of-service from the Commission) until the Initiating Generator is permitted

to deactivate.80 The Commission should reject IPPNY’s proposal. Requiring the NYISO to pay

a guaranteed rate that may significantly exceed expected market-based rate compensation to a

deactivating Generator before the NYISO has the opportunity to consider alternatives to

executing an RMR Agreement with that Generator will send the wrong economic signal to

Generators that can reasonably anticipate or know81 that their deactivation will result in a

79 See NYPSC Case No. 05-E-889, Order Adopting Notice Requirements for Generation Unit

Retirements (December 20, 2005), which requires 180 days prior notice before Generators that are 80 MW or larger may deactivate.

80 IPPNY Protest at 21.

81 Generators can pay for the NYISO to perform an additional reliability study before a Generator

Deactivation Notice is submitted. See Reliability Planning Process Manual, Attachment E, Request for

Additional Reliability Study, and Attachment F, Agreements for Additional Reliability Studies; available

at:

http://www.nyiso.com/public/webdocs/markets_operations/documents/Manuals_and_Guides/Manuals/Pla

nning/rpp_mnl.pdf.

34

Generator Deactivation Reliability Need. Paying these Generators a guaranteed rate that may

significantly exceed their expected market-based rate compensation during the notice period will encourage surprises, and reward the last-minute submission of Generator Deactivation Notices.

Ideally, the NYISO wants Generators that are close to the end of their operating lives to continue operating while they are profitable and to cease operation when they no longer expect to be profitable.82 The NYISO’s Tariff rules are intended to incentivize Generators to submit a Generator Deactivation Notice sufficiently in advance of an expected deactivation to permit the NYISO, affected Transmission Owners and interested stakeholders to plan for the noticed

Generator’s orderly deactivation.83

Requiring the NYISO to pay a deactivating Generator a guaranteed rate that may

significantly exceed the Generator’s expected market-based rate compensation as soon as the

Generator Deactivation Assessment is completed84 will not encourage owners to submit a

Generator Deactivation Notice sufficiently in advance to permit the NYISO, affected

Transmission Owners and interested stakeholders to plan for the Generator’s orderly

deactivation. To the contrary, if an owner knows or expects that its Generator will be needed for

reliability, at least temporarily, it will be able to maximize its profits by operating the Generator

until it is no longer expected to be profitable and, only then, submitting a Generator Deactivation

82 As the NYISO explained on pages 17 to 21 of its December 21, 2015 Request for Leave to Answer

and Answer in this docket, expected revenues from the NYISO’s capacity market are reasonably

predictable, and it is appropriate for generation owners to bear the risk of the business decisions they

make.

83 The NYISO’s proposed rules give the owner up to a full year after the conclusion of the 365 day notice period to decide to deactivate the Generator. See proposed OATT Section 38.14.1.

84 This would require cost-of-service payments to commence before the NYISO has the opportunity

to solicit or consider alternatives to executing an RMR Agreement with the deactivating Generator.

35

Notice.85 If the NYISO pays the owner a guaranteed rate that may significantly exceed expected

market-based rate compensation, the owner will not care that the Generator’s operation is not

profitable during the notice period. Instead, loads that had no say in when the Generator

Deactivation Notice was submitted will absorb the losses that the Generator sustains during the

notice period, while the owner receives a rate that may equal the deactivating Generator’s full

cost-of-service. The result proposed in IPPNY’s protest would not be just or reasonable.

The owner might even be able to extend the period over which it is paid a guaranteed rate that may significantly exceed expected market-based rate compensation for its Generator by

being dilatory in providing needed information to the NYISO in order to delay the NYISO’s

efforts to determine the least-cost solution to the identified Generator Deactivation Reliability

Need.

The Commission should reject IPPNY’s proposal to require the NYISO to pay

Generators that are required to continue operating after the NYISO completes its Generator

Deactivation Assessment a guaranteed rate that may significantly exceed expected market-based

rate compensation (up to and including the Generator’s full cost-of-service), during the notice

period. Doing so would incentivize inappropriate behavior. The NYISO’s proposed rules for

compensating ISPs provide appropriate financial incentives to deactivating Generators.

The Tariff rules that the NYISO proposed to the Commission in the Compliance Filing

require the owner of an Initiating Generator to bear any losses that may occur during the first 180

days of the 365 day notice period. The proposed ISP compensation rules set forth in Section

15.8.6 of Rate Schedule 8 to the Services Tariff will enable the NYISO to pay ISPs their

avoidable and incremental costs commencing on the 181st day of the notice period. The

85 This would potentially delay the submission of a Generator Deactivation Notice by 365 days. The

owner of a Generator that is not expected to be needed for reliability will not have the same incentive.

36

proposed compensation structure for ISPs does not include Availability Incentives or