UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Public Service Commission, New York Power Authority,

Long Island Power Authority,

New York State Energy Research

and Development Authority, City of New York,

Advanced Energy Management Alliance, and Natural Resources Defense Council

v.

New York Independent System Operator, Inc.

)

)

)

)

)

)

)

)

)

)Docket No. EL16-92-000

)

)

ANSWER OF THE NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

In accordance with the Commission’s Rule 213,1 the June 27, 2016 Notice of Complaint,2

and the July 12, 2016 Notice of Extension,3 the New York Independent System Operator, Inc.

(“NYISO”) respectfully submits its answer to the June 24, 2016 Complaint (“Complaint”)4 in

this proceeding. The Complaint was filed by the New York Public Service Commission

(“NYPSC”), the New York Power Authority, the Long Island Power Authority, the New York

State Energy Research and Development Authority, the City of New York, the Advanced Energy

Management Alliance, and the Natural Resources Defense Council (together, the

“Complainants”).

1 18 C.F.R. § 385.213 (2015).

2 Notice of Complaint, N.Y. Pub. Serv. Comm’n, et al. v. N.Y. Indep. Sys. Operator, Inc., 81 Fed. Reg. 43,594 (2016).

3 N.Y. Pub. Serv. Comm’n, et al. v. N.Y. Indep. Sys. Operator, Inc., Docket No. EL16-92-000 (Jul. 12, 2016).

4 N.Y. Pub. Serv. Comm’n, et al. v. N.Y. Indep. Sys. Operator, Inc., Docket No. EL16-92-000 (Jul. 12, 2016) (Notice of Extension of Time).

The Complaint seeks to modify the buyer-side capacity market power mitigation

measures (“BSM Rules”) set forth in section 23.4 of Attachment H to the NYISO’s Market

Administration and Control Area Services Tariff (“Services Tariff”) with respect to Special Case

Resources5 (“SCRs”).6 Complainants assert that their proposed changes are needed because the

BSM Rules “limit full SCR participation” and interfere with public policy objectives.7 They ask

the Commission to exempt from the BSM Rules all SCRs, including SCRs previously

determined to be subject to Offer Floor mitigation. Alternatively, if a “blanket exemption” is not

granted, Complainants ask that the Commission adopt “program-specific” exemptions.8 This

alternative would involve excluding certain program benefits and payments from the

computation used to determine whether a new SCR is subject to Offer Floor mitigation. If the

alternative relief were granted, the Complaint also requests that the NYISO conduct

redeterminations for SCRs that are currently subject to Offer Floor Mitigation.

The NYISO supports eliminating unnecessary BSM Rules and minimizing the potential interference of BSM Rules with New York State’s public policy objectives, including those

related to SCRs.9 The NYISO is focused on ensuring that the BSM Rules properly balance the

5 Capitalized terms that are not otherwise defined herein shall have the meaning specified in the Services Tariff.

6 The tariff language quoted in the Complaint is not the language presently being implemented by the NYISO. See discussion in Section III, in which the NYISO describes the manner in which it is

implementing the directives of the Commission’s March 2015 order in Dockets Nos. EL07-39-006, et al. N.Y. Indep. Sys. Operator, Inc., 150 FERC ¶ 61,208 (2015) (“March 2015 Order”).

7 See, e.g., Complaint at 2.

8 See Complaint at 2. The NYISO understands references in the Complaint to specific

exemptions for State programs to mean the exclusion of the payments and benefits received by an SCR for its participation in such programs from the computation of an SCR’s Offer Floor.

9 The Commission has already acknowledged that it is not the NYISO’s role to judge the

“legitimacy” of New York State’s policy objectives, including those set forth in the Complaint.

Accordingly, the NYISO takes no position on the Complainants’ arguments regarding the potential

“interference” of the existing BSM Rules with public policies intended to promote demand response. See

2

risk of over-mitigation with the need to mitigate buyer-side market power in the capacity

market.10 The Commission has found that this balance can be maintained by allowing

exemptions under the BSM Rules for resources that have “limited or no incentive and ability to exercise buyer-side market power to artificially suppress [Installed Capacity (“ICAP”)] market

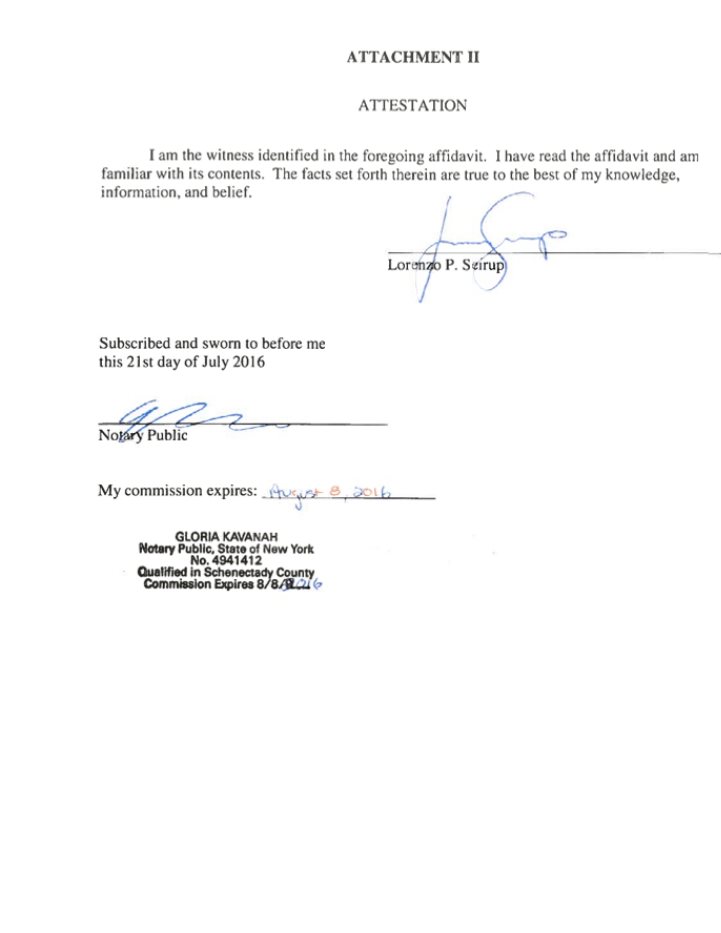

prices.”11 As described in the Affidavit of Lorenzo P. Seirup (the “Seirup Affidavit”,

Attachment II to this Answer), it appears that no external (e.g., State or State-approved) demand response program has the ability to meaningfully increase SCR Unforced Capacity (“UCAP”) to suppress capacity prices in New York.12 Because applying the BSM Rules to new SCRs may

result in over-mitigation,13 the NYISO supports the Complaint’s proposed blanket exemption.

Likewise, the payments and benefits available from individual programs identified in the Complaint do not appear to have ability to artificially suppress capacity prices. Moreover, some of the identified individual programs are intended to address public policy objectives that are not captured by the NYISO’s markets. Therefore, the NYISO also supports the Complaint’s

alternative request for relief with respect to new SCRs that receive benefits and payments for

participating in the programs described in the Complaint.

March 2015 Order at P 30 (“We clarify that our May 20, 2010 Order did not intend for the NYISO to rule on the legitimacy of particular state programs.”)

10 See, e.g., N.Y. Pub. Serv. Comm’n, et. al. v. N.Y. Indep. Sys. Operator, Inc., 154 FERC ¶ 61,088 at P 18, n. 42 (2016); citing PJM Interconnection, L.L.C., 143 FERC ¶ 61,090 at P 26 (2013) (finding that PJM’s buyer-side market power mitigation rules “appropriately balance[] the need for mitigation against the risk of over-mitigation”), order on reh’g and compliance, 153 FERC ¶ 61,066 (2015).

11 N.Y. Pub. Serv. Comm’n, et. al. v. N.Y. Indep. Sys. Operator, Inc, 153 FERC ¶ 61,022 at P 10, P

36 (2015) (“Renewable/Self-Supply Exemption Order”) (“we remain concerned, however, with both the incentive and ability to exercise market power).

12 See Seirup Affidavit at PP 9 -10.

13 See Seirup Affidavit at P 11.

3

The NYISO notes that requests for clarification and rehearing14 of the Commission’s March 2015 Order,15 and the NYISO’s April 2015 compliance filing,16 are pending before the Commission (together the “Pending SCR Filings”). As discussed in Section III, below, the NYISO requests that the Commission act on the Pending SCR Filings at the same time that it acts on the Complaint. Doing so will provide needed certainty and consistency with respect to the application of the BSM Rules to SCRs.

The NYISO does not oppose expedited Commission action in this proceeding17 provided that the Commission does not shorten the standard periods for responses or further filings.

I.BACKGROUND

Since the inception of the BSM Rules, the Commission has ruled that SCRs should be

subject to mitigation.18 However, the Commission has also recognized that there are certain

circumstances where payments and benefits under certain State or State-approved programs

should not be considered in the determination of whether a resource should be subject to

mitigation.19 The Commission has also consistently recognized that the BSM Rules need to

balance the risks of both over- and under-mitigation.20 The NYISO, its stakeholders, and the

14 See Request for Expedited Clarification of the New York Independent System Operator, Inc.,

Docket Nos. EL07-39-006, et. al. (Mar. 30, 2015) (“Request for Clarification”); Request for Rehearing of the Indicated New York Transmission Owners, Docket Nos. EL07-39-006, et. al. (Apr. 20, 2015); Request for Rehearing of the New York State Public Service Commission, Docket Nos. EL07-39-006, et. al. (Apr. 20, 2015) the (“Pending SCR Rehearing Requests”).

15 See supra at n. 6.

16 N.Y. Indep. Sys. Operator, Inc., Compliance Filing, Docket No. ER10-2371-002 (Apr. 20, 2015) (the “Pending Compliance Filing”).

17 See Complaint at 37 requests fast track processing; see also Complaint at 61-62.

18 See N.Y. Indep. Sys. Operator, Inc., 124 FERC ¶61,301 (2008) at P 41.

19 See N.Y. Indep. Sys. Operator, Inc., 131 FERC ¶61,170 (2010) at P 133.

20 See, e.g., Consol. Edison Co. of N.Y., Inc. v. N.Y. Indep. Sys. Operator, Inc., 150 FERC ¶

61,139, at P 4 (2015) (“CEE Order”), order on reh’g, clarification, & compliance, 152 FERC ¶ 61,110

(2015); N.Y. Indep. Sys. Operator, Inc., 143 FERC ¶ 61,217, at P 77 (2013) (noting that buyer-side

4

Commission’s rulings, recognize that certain exemptions are appropriate.21 Although the

Commission recently denied a complaint requesting a blanket exemption for SCRs,22 the

Complaint proffers additional information for the Commission to consider, and also seeks the

exclusion of payments and benefits to SCRs from individual programs, which the Services Tariff already invites in certain circumstances.23

II.ANSWER

The Complaint contends that the existing BSM Rules are overbroad and result in “over-

mitigation that protects incumbents from competition, to the detriment of New York consumers

and to the State’s ability to meet public policy goals and requirements in a reasonable manner.”

As the NYISO said in its answer to an earlier complaint seeking exemptions under the BSM

Rules, “[b]oth artificial capacity market price suppression and unnecessary impediments to State

policy initiatives should be avoided. Getting the balance right is essential because over- and

under-mitigation are harmful both to markets and, ultimately, to consumers’ long-term economic

interests.”24 The NYISO believes that the relief requested by the Complaint, i.e., exempting

market power mitigation rules must “appropriately balance the need for mitigation of buyer-side market power against the risk of over-mitigation”). See also PJM Interconnection, L.L.C., 143 FERC ¶ 61,090 at P 26 (2013) (confirming that a PJM buyer-side mitigation tariff proposal “appropriately balances the need for mitigation of buyer-side market power against the risk of over-mitigation”).

21 See, e.g., CEE Order at PP 3, 14; Renewable/Self-Supply Exemption Order at PP 2, 10. See also N.Y. Indep. Sys. Operator, Inc., Docket No. ER15-1281-000 (May 16, 2015) (unpublished letter order) (accepting NYISO tariff revisions addressing exemption and Offer Floor determinations under the BSM Rules for resources requesting Additional Capacity Resource Interconnection Service).

22 See Renewable/Self-Supply Exemption Order at P 53; order denying reh’g & clarification requested on other grounds, 154 FERC ¶ 61,088 (2016). at P 21.

23 See Services Tariff Section 23.4.5.7.5; see also Pending Compliance Filing at 4 (explaining that the NYISO would apply the March 2015 Order’s ruling that all rebates and other benefits from state

programs be included in Offer Floor calculations for new SCRs only to new SCRs located in Load Zone J (i.e., New York City)).

24 Answer of the N.Y. Indep. Sys. Operator, Inc., Docket No. EL15-64-000 (June 29, 2015) at 4-5.

5

SCRs from Offer Floor mitigation, is consistent with maintaining this balance and therefore supports the Complaint.25

A. A Blanket Exemption under the BSM Rules for SCRs Is Warranted

The Commission has been clear that exemptions under the BSM Rules can be appropriate when a category of resources has “limited or no incentive and ability to exercise buyer-side

market power to artificially suppress” capacity prices.26

The NYISO believes that it is reasonable to exempt SCRs from the BSM Rules. As

described in the Seirup Affidavit, the evidence to date does not demonstrate that external demand response programs have the ability to support the use of SCRs to suppress capacity prices.27 The NYISO has observed historic trends that suggest available state- or state-approved program

benefits lack the ability to suppress market prices by increasing SCR UCAP.28 For instance, while the compensation available from distribution companies’ demand response programs has continued to increase over time, there has not been a corresponding material increase in the

amount of UCAP procured through the NYISO’s SCR program.29

If conditions were to change in the future, e.g., the NYISO’s or State programs related to

SCRs changed so that SCRs possessed the ability to suppress prices, then the NYISO would, as

25 Because this proceeding presents a complete record on which the Commission can grant the

relief requested, and because granting the requested relief does not require the development of new tariff

provisions, there would be no need for stakeholder input on how to implement such a change in the tariff.

If the Complaint’s requested blanket exemption were granted, the NYISO would simply eliminate Section

23.4.5.7.5 in its entirety. If the program-specific relief were granted, it would not require tariff revisions. For the reasons described in Section III of this Answer, a ruling on the Pending Compliance Filing will be pertinent to a clear market rule and etariff record.

26 See supra at n. 10.

27 See Seirup Affidavit at PP 9 - 10.

28 Id.

29 See Seirup Affidavit at P 8.

6

required under the Services Tariff, propose additional mitigation measures.30 Under current

circumstances, however, buyer-side mitigation measures addressing SCRs are not warranted.

The Complaint proposes that a blanket exemption “should include SCR resources

currently subject to BSM measures.”31 As a general matter, retesting or exempting resources

that were determined to be subject to Offer Floor mitigation disrupts settled market expectations

and is inequitable. However, the circumstances of this case differ from those that make retesting

of Generators or Unforced Capacity Deliverability Rights (“UDR”) projects32 problematic.

Because only 3.3 MW of SCRs have been determined to be subject to Offer Floor mitigation

over the past five years of enrollment (i.e., since May 2011,) the impact, if any, on the market, or

on Market Participants’ expectations, would be minimal. Moreover, it is very unlikely that

Market Participants’ investment decisions (other than the SCRs’ decisions) were materially

impacted by the imposition of an Offer Floor on 3.3 MW of SCRs. Nor would they be impacted

by the removal of the Offer Floor on such mitigated SCRs as part of a blanket exemption. That

is not the case for determinations regarding Generator and UDR projects because their treatment

under the BSM Rules can materially influence decisions made by other projects and other

Market Participants. Under these narrow circumstances, involving a very small quantity of SCR

MW, with little, if any, potential for market disruption, the NYISO does not object to revisiting

30 See, e.g., Section 23.1.2 of the Services Tariff which obliges the NYISO to file new mitigation measures under Section 205 of the Federal Power Act if it identifies conduct that constitutes an abuse of market power and is not addressed by other tariff provisions.

31 Complaint at 2.

32 See, e.g., Request for Expedited Clarification and Alternative Request for Rehearing of the New

York Independent System Operator, Inc., Docket No. EL11-42-001 (July 23, 2012) at 10-11 (citing

Services Tariff Section 23.4.5.7.3). See also Astoria Generating Co., L.P. v. N.Y. Indep. Sys. Operator,

Inc., 151 FERC ¶ 61,043, at PP 49-53 (2015) (accepting NYISO’s interpretation regarding retesting).

7

prior determinations as requested in the Complaint.33 The NYISO notes that—notwithstanding

its position under the specific facts and circumstances of this proceeding—it continues to believe

that it is inappropriate to re-test units already subject to offer floors under other circumstances.

B.The NYISO Supports the Alternative Request for Relief for Identified

Programs

The Complaint asks that if its request for a blanket exemption is denied, the Commission

find that “the benefits from each of the state programs providing ratepayer support described

herein should be excluded from the mitigation test applied to new SCRs.”34 This proposal is

consistent with Commission precedent affirming that New York State “may seek an exemption

pursuant to Section 206 of the FPA if it believes that the inclusion in the SCR Offer Floor of

rebates and other benefits under a state program interferes with legitimate state objectives.”35

The Commission has also been clear that it is for the FERC, not the NYISO, to judge the merits

of such requests.36

The Seirup Affidavit indicates that the referenced programs are not likely to give new

SCRs any practical ability to suppress capacity prices.37 That is, even if a buyer of capacity may have the incentive to suppress capacity prices, incremental SCR programs do not appear to be a feasible mechanism to suppress capacity prices. Further, the NYISO is not aware of any other reason why the payments and benefits received by SCRs through those programs should be

included in the NYISO’s BSM Rule calculations.

33 The NYISO takes no position on whether such relief would be permissible under Section 206 of the Federal Power Act.

34 Complaint at 53.

35 March 2015 Order at P 30; citing PJM Interconnection, L.L.C., 137 FERC ¶ 61,145, at P 91

(2011).

36 Id.

37 See Seirup Affidavit at PP 9-10.

8

In addition, certain of the individual programs the Complaint identifies are intended to

address issues that are not captured in the NYISO-administered capacity market, e.g.,

Consolidated Edison’s Distribution Load Relief Program.38 Including such program payments in

the NYISO’s BSM Rule calculations for SCRs could result in over-mitigation because the

payment for the provision of that service is not available from, or set by, the ISO-Administered

Market, nor does it appear intended to suppress wholesale market prices. Thus, including such

payments in the determination of an SCR’s Offer Floor could distort the NYISO’s test of

whether the resource’s entry into the NYISO’s capacity market is economic. Accordingly, the

NYISO supports the Complaint’s alternative request for relief with respect to new SCRs. 39

The Complaint also suggests that the alternative request for “program-specific” relief should include SCRs that were determined to be subject to Offer Floor mitigation at the time of their entry.40 For the reasons specified above with respect to the proposed blanket exemption, the NYISO supports this request.41

38 See Complaint at 29-31.

39 If the Commission grants the Complaint’s alternative request for relief with respect to existing programs in their current form, but denies it to the extent the programs may be revised in the future, the

NYISO respectfully requests that the NYISO not be required to have an obligation to determine whether a program has been revised, or whether it was revised in a manner that would affect whether such revised

programs should continue to be exempt. See supra at n. 9. See also PJM Interconnection, L.L.C., 137

FERC ¶ 61,145, at P 91 (2011).

40 Complaint at 3.

41 If the Commission grants the Complaint’s alternate requested relief, and directs the NYISO to

issue new determinations for existing SCRs previously determined to be subject to Offer Floor mitigation

excluding the identified program payments and benefits, the NYISO respectfully requests that the

Commission identify in its directives whether the NYISO should make such determination based on data

submitted at the time of the enrollment of the new SCR or based information at the time of the

redetermination.

9

III.REQUEST FOR RULING ON THE PENDING SCR FILINGS

As noted above, the NYISO and other stakeholders are awaiting action on the Pending SCR Filings. These filings include: (i) the NYISO’s Request for Clarification that the March

2015 Order’s ruling requiring all rebates and other benefits from New York State programs

received by SCRs to be accounted for in calculations under the BSM Rules (the “SCR Ruling”) was applicable to Mitigated Capacity Zones other than New York City; and (ii) the NYISO’s

Pending Compliance Filing, which proposed to apply the SCR Ruling to new Load Zone J SCRs and not to other existing42 or potential future Mitigated Capacity Zones. Other Pending SCR

Filings challenge the SCR Ruling on its merits.

The NYISO respectfully requests that the Commission act on the Pending SCR Filings no

later than its issuance of an order addressing the Complaint. Commission action is needed to

provide certainty to the NYISO and other stakeholders regarding the scope of the BSM Rules,

their applicability based on the geographic location of the SCR, and the treatment of payments

and other benefits received by SCRs under New York State or New York State-approved

programs. In particular, the NYISO believes, consistent with the position it has taken in an

earlier proceeding,43 that the same rules should apply to SCRs in New York City and in other

Mitigated Capacity Zones. As described in the Pending Compliance Filing, the NYISO is

currently applying different rules in New York City and the G-J Locality while it is awaiting

42 The Complaint refers to the G-J Locality as the “New Capacity Zone.” The G-J Locality was established and became effective in 2013.

43 See Request for Clarification at n. 19 (“See, e.g., Request for Leave to Answer and Answer of

the New York Independent System Operator, Inc., Docket No. ER12-360-001, August 6, 2012 at 10 (‘the NYISO believes that it is essential for the buyer-side mitigation rules, including exemption provisions, to be consistent between New York City and any future [New Capacity Zone] unless there is a valid reason to make a distinction’”).

10

Commission action on its request for clarification.44 Greater certainty on these matters would be beneficial to all Market Participants.

IV.COMMUNICATIONS

Communications regarding this proceeding should be addressed to:

Robert E. Fernandez, General Counsel* Ted J. Murphy

Raymond Stalter, Director of Regulatory AffairsHunton & Williams LLP

* Gloria Kavanah, Senior Attorney2200 Pennsylvania Avenue, N.W.

New York Independent System Operator, Inc.Washington, D.C. 20037

10 Krey BoulevardTel: (202) 955-1588

Rensselaer, NY 12144Fax: (202) 778-2201

Tel: (518) 356-6103tmurphy@hunton.com

Fax: (518) 356-7678

rfernandez@nyiso.com

rstalter@nyiso.com

gkavanah@nyiso.com

*Designated for receipt of service.

V. COMPLIANCE WITH RULE 213(c)(2)(i)

Attachment I to this Answer addresses the formal requirements of Commission Rule 213(c)(2).

44 See Pending Compliance Filing at 4; see also Request for Clarification at 6.

11

VI.CONCLUSION

The NYISO respectfully requests that the Commission take actions in this proceeding consistent with this Answer and rule on the Pending SCR Pleadings no later than its issuance of an order on the Complaint. If the Commission grants fast track processing and requires further actions or additional procedures, the NYISO respectfully requests that the parties’ time to make any filings or file responses not be shortened.

Respectfully submitted,

/s/ Gloria Kavanah

Gloria Kavanah

Counsel for the

New York Independent System Operator, Inc.

July 21, 2016

cc:Michael Bardee

Anna Cochrane

Kurt Longo

Max Minzner

Daniel Nowak

Larry Parkinson

J. Arnold Quinn

Douglas Roe

Kathleen Schnorf

Jamie Simler

Gary Will

12

ATTACHMENT I

Compliance with Commission Rule 213(c)(2)

A. Specific Admissions and Denials of Material Allegations

In accordance with Commission Rule 213(c)(2)(i), to the extent practicable and to the best of the NYISO’s knowledge and belief at this time, the NYISO admits or denies below the factual allegations in the Complaint.1 To the extent that any fact or allegation in the Complaint is not specifically admitted below, it is denied. Except as specifically stated below, the NYISO does not admit any facts in the form or manner stated in the Complaint.

1.Admissions

•The NYISO admits that a blanket exemption for SCRs could enhance the currently

effective BSM Rules but takes no position, and thus neither admits nor denies, that its

current application of the BSM Rules is unjust and unreasonable. Complaint at 2, 4, 5, 6.

• The NYISO admits that it does not appear that the payments or benefits available from

the individual demand response programs described in the Complaint provide a facility that is considering entering the SCR market with the incentive or ability to artificially suppress capacity prices. Complaint at 53-58.

• The NYISO takes no position on the question of, and thus neither admits nor denies, that

the specific demand response programs referenced in the Complaint serve “legitimate”

New York State policy goals because it is not the NYISO’s role to make such judgments. Complaint at 3, 5.

• The NYISO admits that, in accordance with the Services Tariff and OATT, it is

responsible for: (i) providing non-discriminatory open access transmission service,

maintaining reliability, and administering competitive wholesale markets for electricity, capacity, and ancillary services in New York State; and (ii) implementing the BSM Rules pursuant to the Services Tariff. Complaint at 15.

• The NYISO admits that the capacity market is designed to encourage new economic

investment, the retention of existing needed capacity, and to inform retirement decisions by providing a price signal that indicates when sufficient capacity is available or when additional Resources are needed to meet New York’s peak demand and maintain its planning reserve margin. Complaint at 15-16.

• The NYISO admits that the BSM Rules and “Pivotal Supplier” rules are only applicable

in New York City and the G-J Locality. Complaint at 16.

• The NYISO admits that the Complaint’s description of specific current distribution-level

demand response and NYSERDA programs is accurate to the best of its knowledge but

1 Capitalized terms that are not otherwise defined in this Attachment or the Answer shall have the meaning specified in the Services Tariff, and if not defined therein, then as defined in the NYISO’s Open Access Transmission Tariff (“OATT”).

1

takes no position on the Complaint’s characterization of how those programs may be impacted by the BSM Rules. Complaint at 25-35.

• The NYISO admits that the Complaint’s description that “robust demand response

programs” are an element of New York’s energy policy objectives is accurate to the best of its knowledge. Complaint at 35-41.

• The NYISO takes no position on the question of, and thus neither admits nor denies, that

the current version of the BSM Rules interferes with State policy objectives or retail rate

authority or creates a conflict between federal and state jurisdiction. Complaint at 3, 5,

41-61.

• The NYISO takes no position on the question of, and thus neither admits nor denies, that

the application of the BSM Rules to SCRs is consistent with the U.S. Supreme Court’s

decisions in EPSA or Hughes. Complaint at 52-53.

2.Denials

• The NYISO denies that the BSM Rules are designed solely to prevent artificial price

suppression by “net buyers with an intent and incentive to depress capacity prices.” As the Complaint acknowledges, the Commission eliminated the “net buyer” concept early in the history of the BSM Rules. Complaint at 16-17.

B.Defenses

Commission Rule 213(c)(2)(ii) requires answers to set forth every defense “to the extent practicable.” The NYISO supports the Complaint’s requests for relief for a blanket exemption or, in the alternative, regarding specified individual program payments and benefits in BSM Rule determinations for new SCRs and therefore offers no defense to them. The NYISO does not oppose, but does assert, that the Complaint’s request that SCRs that were determined to be

subject to Offer Floor mitigation be encompassed by the blanket exemption or be retested if

individual program exemptions are created, appears to be inconsistent with the prospective

nature of relief available under Section 206 of the Federal Power Act.

C.Proposed Resolution Process

Commission Rule 213(c)(4) states that an answer “is also required to describe the formal or consensual process it proposes for resolving the complaint.” As explained in the Answer, because this proceeding presents a complete record on which the Commission can grant the relief requested, and because granting the requested relief does not require the development of new tariff provisions or revisions to the existing or pending tariff section,2 there is no need for any additional processes beyond Commission action on the Complaint.

2 As described in Section III of the Answer, the Pending Compliance Filing proposes revisions to the Services Tariff section that that is the subject of the Complaint.

2

ATTACHMENT II

UNITED STATES OF AMERICA

FEDERAL ENERGY REGULATORY COMMISSION

New York Independent System Operator, Inc.Docket No. EL16-92-000

AFFIDAVIT OF LORENZO P. SEIRUP

Mr. Lorenzo P. Seirup declares:

1.I have personal knowledge of the facts and opinions herein and if called to testify could

and would testify competently hereto.

2. I am the Supervisor of Market Mitigation and Analysis - Installed Capacity for the New

York Independent System Operator, Inc. (“NYISO”). My business address is 10 Krey Boulevard, Rensselaer, NY 12144.

3. My current responsibilities include supervising and coordinating operations of ICAP

Mitigation staff and activities; ensuring administration, implementation and enforcement

of the applicable Installed Capacity1 (“ICAP”) market provisions of the Market

Monitoring Plan,2 administering the NYISO’s supplier-side and buyer-side capacity

market power mitigation measures, which are set forth in Services Tariff Section 23;

conducting market power analyses; and reviewing market data to determine whether

market performance is consistent with a competitive market. Apart from ICAP market

mitigation administration, I also am part of a team that evaluates the need for, and design

of, enhancements or revisions to the NYISO’s capacity market rules.

4. I received a Bachelor of Science degree in Mathematics from Rensselaer Polytechnic

Institute. Since 2012, I have been actively involved in the NYISO’s administration of the

ICAP mitigation rules and in its market power analyses. My ICAP market administration

responsibilities have included performing determinations under the BSM Rules, including

those for Special Case Resources (“SCRs”); calculating Going-Forward Costs,

identifying and evaluating possible withholding; and implementing the monthly supply-

side mitigation measures (i.e., the Pivotal Supplier tests). Apart from capacity market

mitigation administration, I assist in the development of new and revised market rules

(including the ICAP Demand Curve reset) and perform periodic reviews of capacity

market auctions. I am responsible for preparing, and have led the team that prepared, the

annual report to the Commission on the NYISO’s ICAP Demand Curves and potential

withholding issues in Docket No. ER01-3001, et. al. I have participated on the NYISO

teams that developed and responded to pleadings and Commission Orders in the NYISO

proceedings before the Commission that have involved these matters, from 2012 to the

1 Capitalized terms that are not otherwise defined herein have the meaning specified in the Answer of the NYISO, and if not defined therein, then in the Services Tariff.

2 The Market Monitoring Plan is Services Tariff Section 30, Attachment O.

ATTACHMENT II

present. I participated on the team that developed the NYISO’s “reliability must run” (“RMR”) compliance filing in Docket No. EL16-120-000, and that is developing the further compliance filing therein.

5.I submit this affidavit in support of the NYISO’s Answer to the Complaint in this

proceeding.

6.The Complaint seeks to exempt SCRs from the BSM Rules, or in the alternative, to

exclude from the determinations for SCRs under the BSM Rules the benefits and

payments received through specified programs.

7.The purpose of this Affidavit is to provide evidence in support of exempting all SCRs

from the BSM Rules.

8. Certain major NYPSC-approved demand response programs have expanded demand

response program eligibility to a broader range of customers and increased the

compensation for participating resources in recent years. For example, in 2014 the

Consolidated Edison Company of New York, Inc. (“Con Edison”) Rider S and Rider U

programs doubled, or more than doubled, Reservation Payments over 2013 compensation

levels.3 These Riders (which are now collectively Rider T) are a subset of Con Edison’s

commercial demand response programs. Con Edison uses its commercial demand

response programs to reduce load during peak load conditions on its distribution system

and to provide load reductions during contingencies or when the next contingency would

cause an undesirable outcome. Con Edison’s base Reservation Payments increased again

in 2016, by at least 50% across all programs. Con Edison also expanded program

eligibility to Westchester County.4 Con Edison’s and NYSERDA’s programs pursuant to

their joint Indian Point Energy Center Energy Efficiency, Demand Reduction and

Combined Heat and Power Implementation Plan5 has expended $20.6 Million to achieve

25 MW of peak load reduction for the next ten years. On June 18, 2015, the NYPSC

approved distribution-level dynamic load management programs at each of the investorowned utilities in New York State. 6 These programs are similar to Con Edison’s

3 See, e.g., NYPSC Case No. 13-E-0573 - Tariff Filing by Consolidated Edison Company of New York, Inc to make revisions to its Demand Response Programs Rider S - Commercial System Relief

Program and Rider U - Distribution Load Relief Program contained in P.S.C. No. 10 - Electricity, Order Adopting Tariff Revisions with Modifications (March 12, 2014).

4 See, e.g., NYPSC No. Case 15-E-0570 - Tariff filing by Consolidated Edison Company of New York, Inc. to revise its Commercial Demand Response Programs contained in P.S.C. No. 10 - Electricity and conforming revisions to Charge for Demand Management Programs contained in P.S.C. No. 12 -

Electricity, Order approving Tariff Amendments (January 27, 2016).

5 See, e.g., NYPSC Case No. 12-E-0503, Proceeding on Motion of the Commission to Review

Generation Retirement Contingency Plans, Order Accepting IPEC Reliability Contingency Plans,

Establishing Cost Allocations and Recovery, and Denying Requests for Rehearing (November 4, 2013).

6 See, e.g., NYPSC Case No. 14-E-0423, Dynamic Load Management Programs, Order Adopting Dynamic Load Management Filings with Modifications (June 18, 2015).

ATTACHMENT II

dynamic load management programs. Further modifications, with increased payments, to these programs were approved on May 19, 2016.7

9. There have not been large influxes of SCR Unforced Capacity (“UCAP”) participation in

the NYISO’s program even though external demand response programs have expanded

and compensation thereunder has increased (for example, those programs described in the preceding paragraph.) In fact, SCR UCAP during Summer Capability Periods has

remained relatively flat since 2013. There has been some year-over-year variation

attributed to performance and typical yearly resource changes, but I have not observed any large influxes of SCR UCAP corresponding to a compensation increase from an

external (such as a state or state-approved) demand response program.

10. Based upon current participation in the NYISO’s SCR program, and despite past

compensation increases it does not appear as though any external demand response

program has the ability to suppress prices in the NYISO’s capacity markets at this time.

Moreover, it does not appear that a further increase in the breadth or amount of

compensation from external programs would present a credible risk of capacity price

suppression, because history has not shown that similar increases are an effective means

to cause meaningful increases in SCR participation in the NYISO’s capacity market.

11. The NYISO focuses on balancing the risk of over-mitigation and under-mitigation in its

design of the BSM rules. Because there is a lack of evidence showing that SCRs could

be used to effectively suppress NYISO capacity market prices, it appears that a blanket

exemption for SCRs from the BSM rules would not upset that balance at this time.

12. This conclusion is based on the facts and circumstances as they are known to me at this

time. If, in the future, the trends discussed herein no longer appear to be relevant -

particularly if a large influx of SCR enrollments appears to be the result of an aggressive

compensation framework in an external demand response program - then these

conclusions should be revisited and the appropriateness of adopting new mitigation

measures to address any potential new issues should be reevaluated at that time.

13.This concludes my affidavit.

7 See, e.g., NYPSC Case No. 14-E-0423, Dynamic Load Management Programs, Order Adopting Dynamic Load Management Filings with Modifications (May 19, 2016).

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §385.2010.

Dated at Rensselaer, NY this 21st day of July, 2016.

/s/ Mohsana Akter

Mohsana Akter

Regulatory Affairs

New York Independent System Operator, Inc

10 Krey Blvd

Rensselaer, NY 12144 (518) 356-7560