10 Krey Boulevard Rensselaer, NY 12144

February 18, 2015

By Electronic Delivery

Honorable Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc., Docket No. ER15-___-000;

Proposed Tariff Revisions to Ancillary Service Demand Curves and the

Transmission Shortage Cost

Dear Secretary Bose:

In accordance with Section 205 of the Federal Power Act1 and Part 35 of the

Commission’s regulations, the New York Independent System Operator, Inc. (“NYISO”)

respectfully submits proposed amendments to its Market Administration and Control Area

Services Tariff (“Services Tariff”) and Open Access Transmission Tariff (“OATT”) to revise its

existing Operating Reserve Demand Curves, establish a new Operating Reserve Demand Curve,

as well as revise its Regulation Service Demand Curve and Transmission Shortage Cost. As a

result of the significant increase in the utilization of natural gas as a primary fuel source for New

York generation, constraints in the natural gas transmission network serving the Northeast, and

the experiences of the 2013-2014 winter (the coldest in recent New York history), the NYISO is

actively engaged in identifying ways to further protect reliability by improving the incentives for

generator performance, unit availability and fuel availability. This effort culminated in the

creation of the NYISO’s Fuel Assurance Initiative. The Comprehensive Shortage Pricing project

(“CSP Project”), as further described below and as reflected in the Services Tariff and OATT

amendments being proposed herein, is a major component of the Fuel Assurance Initiative.

The Management Committee approved the CSP Project with a vote of 83.96% in favor. The NYISO requests an Order by April 20, 2015 (i.e., sixty days from the date of this filing

letter), which would allow the NYISO to confidently proceed with developing and deploying the software changes necessary to implement its CSP Project before the proposed effective date of the tariff amendments, as well as avoid any adverse impacts to the schedules for other projects that the NYISO has committed to for 2015.2 The NYISO anticipates the proposed revisions becoming effective no earlier than November 1, 2015.

1 16 U.S.C. § 824d.

2 Such additional projects include the implementation of Coordinated Transaction Scheduling

with ISO New England, Inc. to improve regional coordination (“CTS with ISO-NE”), as well as pursuing

Honorable Kimberly D. Bose February 18, 2015

Page 2

I.Documents Submitted

1.This filing letter;

2.A clean version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment I”);

3.A clean version of the proposed revisions to the NYISO’s OATT (“Attachment II”);

4.A blacklined version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment III);

5.A blacklined version of the proposed revisions to the NYISO’s OATT (“Attachment

IV”); and

6.An Affidavit from Pallas LeeVanSchaick of Potomac Economics, the NYISO’s

Market Monitoring Unit (“Attachment V”).

II.Background

The CSP Project would increase the statewide Operating Reserves3 requirement and

procure a portion of such increased requirement in the southeastern New York (“SENY”)

electrical area (an area comprised of Load Zones G, H, I, J, and K). Tariff amendments are

necessary to establish a new Operating Reserve Demand Curve for SENY, as well as properly

align the values in the NYISO’s existing Operating Reserve Demand Curves, Regulation Service

Demand Curve and Transmission Shortage Cost with the increased reserves requirement and the

new SENY reserves region.

The CSP Project will improve the reflection of operator actions in Energy Market pricing outcomes, thereby improving market efficiency and pricing transparency. Additionally, this project will significantly improve the performance of the generator fleet during critical operating periods, such as the polar vortex conditions experienced during the 2013-2014 winter period. By providing schedules and appropriate price signals to supply resources, the NYISO seeks to

ensure that such resources are properly incented to be available to meet their schedules and

acquire the necessary fuel supplies to meet such schedules.4

enhancements to the NYISO’s current scarcity pricing rules to further improve price formation and market efficiency (“Comprehensive Scarcity Pricing”).

3 Capitalized terms not otherwise defined herein shall have the meaning specified in Section 1 of the OATT and Section 2 of the Services Tariff.

4 Notably, on January 7, 2014, more than 7,000 MW of generators were unavailable in New

York, thereby significantly reducing the level of resources available to the NYISO to maintain the reliable operation of the system throughout the day.

Honorable Kimberly D. Bose February 18, 2015

Page 3

A. Increasing the Statewide Operating Reserve Requirement

New York State reliability rules require the NYISO to procure 10-minute reserves in an

amount sufficient to replace the loss of the largest single contingency (i.e., 1,310 MW) for the

New York Control Area (“NYCA”).5 The NYISO is required to procure half of this amount - or

655 MW - from resources synchronized to the system (“spinning reserves”).6 The NYISO is

also required to procure 655 MW of 30-minute reserves, for a total procurement of 1965 MW in

statewide Operating Reserves every day (i.e., 1.5 times the largest single contingency).7 To

further ensure that there is sufficient capability to restore transmission flows within ratings

following the most severe transmission contingency, the NYISO procures 1,200 MW of its 1,310

MW of 10-minute reserves in the East of Central-East region. The NYISO also procures a

portion of these reserves on Long Island.

The NYSRC further requires the NYISO to fully restore its 10-minute reserves, following

a contingency, within 30 minutes.8 Under its current procurement levels, the NYISO depends on

up to 655 MW of latent reserves to restore the full 1,310 MW of 10-minute reserves should it

need to.9 The NYISO’s Market Monitoring Unit (“MMU”), however, has advised the NYISO to

procure all 1,310 MW required to meet its reliability requirement to fully restore its 10-minute

reserves by buying it all in the wholesale market, rather than relying on 655 MW of latent

reserves to meet such requirement.10 In making such recommendation, the MMU noted that,

although under normal operating conditions, sufficient surplus capacity may readily be available

and can be procured within 30 minutes at little cost, during very high load periods or other very

tight supply conditions, the NYISO may not be able to ensure procurement of sufficient reserves

absent the undertaking of potentially costly out-of-market actions by the operators.11 The

NYISO agrees with its MMU. Accordingly, the NYISO is increasing its statewide reserves

procurement to twice the single largest contingency (i.e., 2,620 MW of Operating Reserves).12

5 New York State Reliability Council, L.L.C. (“NYSRC”) Reliability Rule D-R2a.

6 NYSRC Reliability Rule D-R3.

7 NYSRC Reliability Rule D-R2b.

8 NYSRC Reliability Rule D-R4.

9 Latent reserves are unscheduled reserves held by dispatched generators between their scheduled output levels and their upper operating limits. Such latent reserves, however, do not receive a Day-Ahead schedule with respect to the potential need to provide such additional capability.

10 Potomac Economics, 2013 State of the Market Report for the New York ISO Markets at 69 and 100-101 (May 2014) (“2013 SOM Report”).

11 Id. at 69.

12 In recognition of the concerns raised by the MMU and in light of the experiences of the winter 2013-2014 period, the NYISO is concerned that continued reliance on latent reserves could be

problematic because, in the absence of a schedule to provide their latent capability, supply resources lack any incentive to procure fuel to provide such latent capability if called upon. During certain system

conditions, such as summer or winter peak load days, natural gas-fired generation may be unable to

procure additional natural gas supply to meet a real-time schedule or other real-time instruction to provide additional energy due to constraints on the natural gas system.

Honorable Kimberly D. Bose February 18, 2015

Page 4

As such, the NYISO will continue to procure 1,310 MW of 10-minute reserves in order to restore the loss of its single largest contingency, but will increase its procurement of 30-

minute reserves from 655 MW to 1,310 MW. The NYISO will also continue to procure 1,200 MW of its 10-minute reserve requirement from Eastern Reserves and will procure 330 MW of such 10-minute Eastern Reserves as spinning reserves.

B. Procuring a Portion of Statewide Operating Reserves Requirement in the SENY

Region.

To ensure that the NYISO can respond to the loss of transmission or generation in the

SENY region, the NYISO will be acquiring 1,300 MW of its 30-minute Operating Reserves from

resources located within the SENY region.13 Transmission constraints into this region can

prevent Eastern Reserves from being available to serve the significant load centers located

there.14 Establishing a new SENY requirement of 1,300 MW of 30-minute reserves will account

for the potential loss of two significant transmission facilities serving the SENY region - the 92

Leeds-Pleasant Valley and the 91 Athens-Pleasant Valley lines, which are part of the UPNY-

SENY interface. SENY reserves will assist the NYISO in re-preparing the system in the event of

the loss of these facilities. Accordingly, defining a SENY reserve region15 will increase the

likelihood that Operating Reserves will be deliverable when needed, thus increasing system

reliability.16

The NYISO will continue to procure 120 MW of 10-minute total reserves on Long

Island, but will limit the contribution of Operating Reserves held on Long Island toward meeting

13 The MMU has also recommended that the NYISO implement a 30-minute reserve requirement for the SENY region. See 2013 SOM Report at 69 and 100.

14 Eastern Reserves can be procured from Load Zone F, a Load Zone not included in the SENY region. The transmission constraints of concern can prevent reserves procured from resources located in Load Zone F from being available to serve needs within the SENY region because Load Zone F is located upstream of the constraints at issue.

15 The NYISO first identified SENY as a transmission constrained load pocket in a presentation to the Management Committee in March 2013. See map graphics at:

http://www.nyiso.com/public/webdocs/markets_operations/committees/mc/meeting_materials/2013-03-

27/SENY_Load_Pocket_MC_3_27_2013.pdf. Since 2011, the NYISO has had to rely on a number of

demand response activations in the SENY region to address transmission security issues arising during

high load periods. The NYISO now evaluates transmission security issues for the SENY Load Pocket in

its reliability and economic planning processes. Transmission security refers to the ability of the NYISO

to restore power flows to normal operating limits following a contingency event within a 30-minute

timeframe.

16 See Docket No. ER13-1380-000, New York Independent System Operator, Inc., Proposed

Tariff Revisions to Establish and Recognize a New Capacity Zone and Request for Action on Pending

Compliance Filing at Attachment X, 2013 New Capacity Zone Study Report at 12 (April 30, 2013) (“The UPNY-SENY interface constrained about 849 MW of generation moving from [Load] Zones A through F to [Load] Zones G through I.”).

Honorable Kimberly D. Bose February 18, 2015

Page 5

the statewide or Eastern 10-minute total reserves and statewide, Eastern or SENY 30-minute

reserves requirements to between 270 and 540 MW.17 As explained by Dr. LeeVanSchaick, the NYISO proposal to treat Long Island as nested within the SENY reserve zone is generally

… appropriate because when Long Island reserves are deployed, it

usually: (a) allows a SENY generator outside Long Island to ramp-

down, increasing available reserves in SENY, and/or (b) reduces

transmission flows into SENY, thereby relieving overloaded

transmission facilities into the area. Either way, deploying reserve

units on Long Island usually helps the NYISO maintain reliability

following a contingency that would otherwise overload

transmission into SENY.18

Based on the foregoing, locating 1,300 MW of 30-minute reserves in the SENY region

and establishing a new SENY Operating Reserve Demand Curve will improve the price signals

in this portion of the state and incent resources located there to make Operating Reserves

available. Additionally, as noted by Dr. LeeVanSchaick, the NYISO’s proposal to increase the

NYCA 30-minute reserve requirement, as well as establish a new SENY reserve region will

improve pricing outcomes by reducing the potential need to rely on out-of-market actions to

satisfy applicable reliability criteria, which would not be reflected in market prices.19

III. Justification for Adding New SENY Operating Reserve Demand Curves and

Revising the Current Operating Reserve Demand Curves, Regulation Service Demand Curve and the Transmission Shortage Cost Values

In connection with the Operating Reserves procurement revisions described above, the

NYISO is proposing to add new SENY Operating Reserve Demand Curves, as well as revise the

values it uses for its existing Operating Reserve Demand Curves, Regulation Service Demand

Curve20 and Transmission Shortage Cost (also referred to as the “graduated transmission demand

17 The limitation on the ability of reserves held on Long Island to contribute to the NYCA,

Eastern and SENY reserve requirements is based upon the current Long Island 30-minute reserve

requirement, which varies from 270 MW to 540 MW depending on the hour. As noted by Dr. Pallas

LeeVanSchaick of Potomac Economics, the NYISO’s proposal regarding limitations on the contribution

of reserves held on Long Island to NYCA, East of Central-East and SENY provides a reasonable balance

between the recognition of the value that reserves on Long Island provide and the limitations of the

transmission system that affect the level of energy that can be exported from Long Island to the rest of the

State. Affidavit of Pallas LeeVanSchaick, Ph.D., Attachment V at ¶ 27-29 (“LeeVanSchaick Affidavit”).

18 Id. at ¶ 27.

19 Id. at ¶ 16-17.

20 See Services Tariff Sections 15.4.7 (Operating Reserve Demand Curve) and 15.3.7 (Regulation Service Demand Curve).

Honorable Kimberly D. Bose February 18, 2015

Page 6

curve”).21 The Commission first approved Operating Reserve Demand Curves (“shortage pricing”) in 2004 when it approved the NYISO’s SMD market rule redesign.22

In its filing seeking authority to redesign its markets in this fashion, the NYISO argued that adopting Operating Reserve Demand Curves would ensure not only that the value of

foregone ancillary services was appropriately reflected in Energy prices during shortage periods, but also that the price of each type of Operating Reserves would not exceed its economic value, particularly at times when the product was scarce or unavailable.23 Additionally, the NYISO noted that the proposed curves would make the NYISO’s scheduling and pricing rules consistent with actual operating practices followed in New York.24

The NYISO has continually reviewed and updated its Operating Reserve Demand Curves to ensure they continue to conform to these standards.25 Since initial implementation in 2005, NYISO’s experience has illustrated additional criteria for evaluating appropriately designed

shortage prices. For example, shortage pricing values should incent the correct short- and longterm desired responses from all energy resources, but not at the detriment of driving energy away from another short region when region-wide shortages occur.

Properly designed shortage pricing will allow the New York energy markets to:

• Provide targeted market signals that align with actual reliability needs of the

NYCA at times when actions are being taken to maintain reliability;

• Provide resources the correct incentives to follow NYISO instructions for meeting

NYCA reliability;

• Create incentives for investment in the areas that need it most, including fuel

assurance investments;

• Reduce the “missing money” covered by capacity payments;26

21 Docket No. ER15-485-000, New York Independent System Operator, Inc., Letter Order

(January 15, 2015). The recently-accepted revisions to the Transmission Shortage Cost require further modification to better align with the revisions proposed in this filing.

22 New York State Independent System Operator, Inc., 106 FERC ¶ 61,111 (2004). The Regulation Service Demand Curve was also established in that proceeding.

23 See Docket No. ER04-230-000, New York Independent System Operator, Inc., Tariff Revisions

Reflecting Implementation of Enhanced Real-Time Scheduling Software at 21 (November 26, 2003).

24 Id.

25 See, e.g., Docket No. ER11-2454, New York Independent System Operator, Inc., Letter Order (February 4, 2011).

26 As explained by Dr. LeeVanSchaick, “[e]fficient shortage pricing reduces the amount of

revenue that must be recovered through the installed capacity market because it provides additional

compensation to resources that perform reliably during stressed operating conditions. Shifting reliance

Honorable Kimberly D. Bose February 18, 2015

Page 7

• Promote additional response from demand response and distributed energy

providers when needed; and

• Facilitate creation of a more level playing field in the market for resources that are

more dependent on revenue from the Energy Market.

In establishing revised values for its Operating Reserve Demand Curves, the NYISO

reviewed recent bid information pertaining to Generators located within New York that are

eligible to provide 30-minute reserves.27 Such information revealed that bid and start-up costs

for certain of such Generators exceeded $700 per MWh during the coincident peak hour for the

Summer 2013 Capability Period and the Winter 2013-2014 Capability Period, respectively.28

Such data further indicated that the current shortage pricing levels would have left a significant

amount of the generating capacity eligible to provide 30-minute reserves unavailable for

economic commitment during the NYCA coincident peak hour for the Summer 2013 and Winter

2013-2014 Capability Periods because such eligible units exhibited bid and start-up cost values

that exceeded the current maximum $200 per MW value for NYCA 30-minute reserves.29

Accordingly, to better reflect operator actions that may be taken to maintain 30-minute reserves by calling upon higher cost Generators that may not have otherwise been scheduled

economically, the NYISO is proposing to increase the maximum Operating Reserve Demand Curve value for NYCA 30-minute reserves from $200 per MW to $750 per MW. As noted

above, the revised value more appropriately reflects potential bid and start-up costs of Generators capable of providing 30-minute reserves, especially during critical peak load periods when such resources are likely to be needed most.30 The NYISO is proposing additional revisions to the values embedded in its current Operating Reserve Demand Curves to:

• ensure continued compliance with applicable reliability requirements;

from the capacity market to shortage pricing tends to reduce overall wholesale costs for load customers because shortage prices are paid only to resources that perform during stressed conditions, while capacity prices must be paid to nearly all in-service resources.” LeeVanSchaick Affidavit at ¶ 12.

27 NYISO, Comprehensive Shortage Pricing at 16-17 (presented at the September 19, 2014 Market Issues Working Group Meeting) available at

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/meeting_materials/201

4-09-19/agenda_04_Comprehensive%20Shortage%20Pricing%20September%20MIWG.pdf.

28 Id. In fact, on July 19, 2013, the bid and start-up costs for a limited number of such Generators slightly exceeded $800 per MWh.

29 Id. Notably, the NYISO established new all-time record peak load values for both the Summer and Winter Capability Periods during each respective hour for which the graphical data was presented at the September 19, 2014 Market Issues Working Group meeting.

30 Dr. LeeVanSchaick further illustrates that the proposed increases to the pricing points for

certain of the Operating Reserve Demand Curves facilitate inclusion of supply resource costs in market prices rather than reliance on out-of-market action. LeeVanSchaick Affidavit at ¶ 19-21.

Honorable Kimberly D. Bose February 18, 2015

Page 8

• reflect the knowledge and information gained from its review of more recent data and

information regarding bid and start-up costs of Generators in New York;

• recognize the increasing value of reserves by product type;

• incent holding reserves in the areas of greatest need; and

• maintain consistency with actions taken by operators to maintain system reliability.

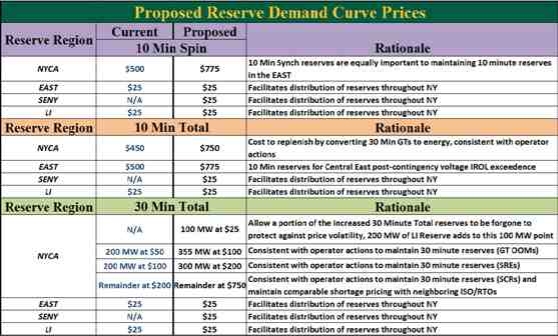

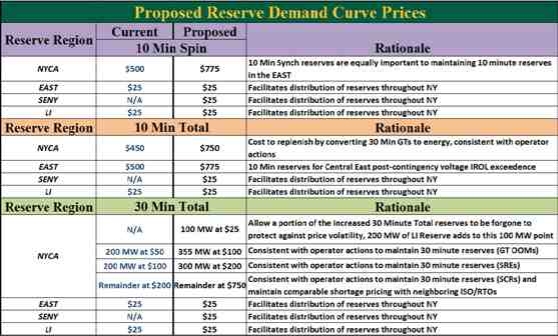

The proposed use of a $25 per MW price level for SENY 10-minute spinning reserves,

SENY 10-minute total reserves and SENY 30-minute reserves is consistent with the value

utilized by the NYISO for other reserve requirements that represent operational

practices/guidelines. When the NYISO initially proposed the use of Operating Reserve Demand

Curves in 2003, it noted that the reserve requirements encompassed by the proposed demand

curves represented a combination of targets corresponding to prescriptive reliability rules and

others corresponding to operational guidelines.31 For all of the reserve requirements

representing operational guidelines, the NYISO proposed to utilize a value of $25 per MW.32

Accordingly, because the establishment of SENY reserve requirements, as proposed herein, is

intended to facilitate the distribution of reserves for managing SENY reliability needs, the

NYISO proposes use of the same pricing value the Commission has previously approved for

similar reserve requirements.33

The NYISO’s proposed revisions to its current pricing values for the Operating Reserve Demand Curves, as well as the pricing values proposed for the new SENY region are reflected in the table below.

31 Docket No. ER04-230-000, New York Independent System Operator, Inc., Tariff Revisions Reflecting Implementation of Enhanced Real-Time Scheduling Software at Attachment II, Affidavit of Andrew P. Hartshorn at ¶ 23 (November 26, 2003).

32 Id. at ¶ 24. This pricing construct was approved by the Commission. See New York State Independent System Operator, Inc., 106 FERC ¶ 61,111 at P 44 (2004).

33 Dr. LeeVanSchaick concludes that use of the $25 per MW pricing level for the SENY reserve

demand curves “is a significant improvement over the status quo.” LeeVanSchaick Affidavit at ¶ 22.

Honorable Kimberly D. Bose February 18, 2015

Page 9

Moreover, appropriate shortage prices should also be aligned with shortage pricing in

neighboring regions to ensure that when the region as a whole is in shortage conditions, energy is not flowing out of the state to a neighboring region as a result of higher priced shortages in such neighboring areas. As such, the NYISO reviewed shortage pricing values in neighboring regions to ensure that the NYISO’s proposed revisions to its shortage pricing provide adequate

incentives to maintain energy in New York during critical operating periods.

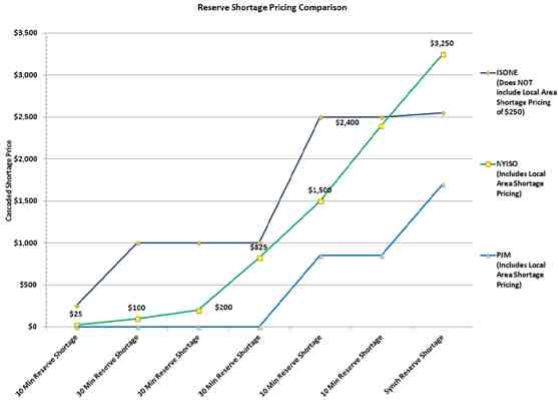

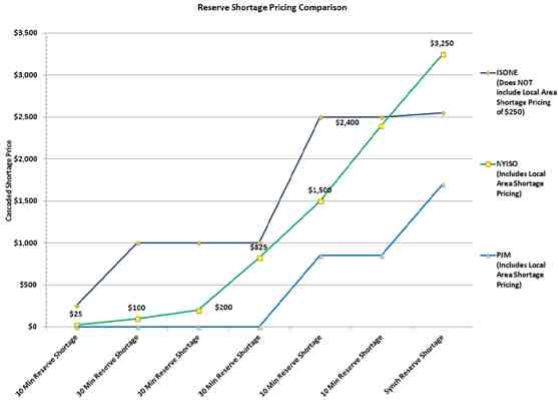

The following figure depicts the NYISO’s proposed Operating Reserve Demand Curve

values in context with the shortage pricing values for neighboring regions. As demonstrated by

this figure, the NYISO’s revised shortage pricing values remain properly aligned with

neighboring regions. Additionally, as the severity of the shortage conditions in New York

increases, the price escalates and ultimately exceeds shortage pricing levels in neighboring

regions to ensure that energy is retained in New York during such critical operating periods.

Honorable Kimberly D. Bose February 18, 2015

Page 10

As noted above, the NYISO also uses a Regulation Service Demand Curve to value

Regulation Service when supplies are short34 and a Transmission Shortage Cost (or graduated

transmission demand curve) 35 to value Energy when the supply of dispatchable resources is

short. Because the NYISO co-optimizes the scheduling of Energy, Operating Reserves and

Regulation Service on Resources that have bid in a manner that qualifies them for providing such

services, the demand curve values for shortages in each product need to be compatible. The

NYISO has worked closely with its MMU to set the demand curves at levels consistent with the

NYISO’s actual operating practices, economic theory and region-wide comparability.

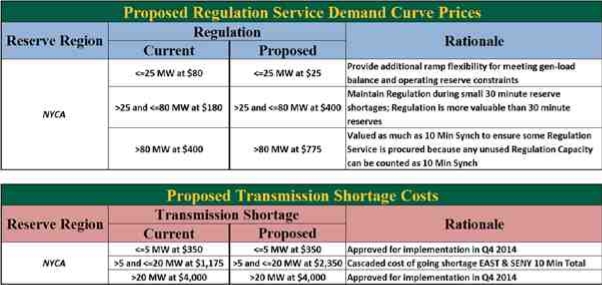

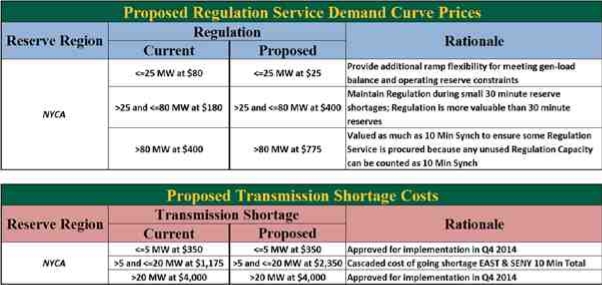

The NYISO is proposing to revise all three pricing values for the Regulation Service

Demand Curve in order to ensure consistency with operator actions and appropriate trade-offs

between the various products. The NYISO is proposing to revise the first pricing point on the

Regulation Service Demand Curve (i.e., for shortages of Regulation Capacity up to 25 MW) to

reduce the current value of $80 per MW to $25 per MW. Use of a $25 per MW value is

34 See Services Tariff Section 15.3.7. The Commission previously approved revising the

Regulation Service Demand Curve from a mechanism having only two pricing points to one that includes three pricing points in 2011. See Docket No. ER11-2454, New York Independent System Operator, Inc., Letter Order (February 4, 2011).

35 The Commission recently approved the NYISO’s proposed revisions to the Transmission Shortage Cost. See Docket No. ER15-485-000, New York Independent System Operator, Inc., Letter Order (January 15, 2015).

Honorable Kimberly D. Bose February 18, 2015

Page 11

consistent with the value utilized in the Operating Reserve Demand Curves for reserve

requirements that represent an operational practice/guideline rather than a prescriptive reliability rule and reflects the operational willingness to forego a limited amount of Regulation Capacity in exchange for scheduling resources to obtain balance between load and supply.

The NYISO is also proposing to increase the value of the second pricing point (i.e.,

corresponding to a Regulation Capacity shortage of more than 25 MW but less than 80 MW)

from $180 per MW to $400 per MW. This proposed increase in pricing is intended to reflect the operational desire to hold Regulation Capacity during periods of small shortages of 30-minute reserves, as well as during small transmission shortages of up to 5 MW. In other words, the

pricing point value reflects an operational preference to maintain Regulation Capacity and

willingness to allow small shortages of transmission or 30-minutes reserves in order to maintain such regulation capability. As such the proposed pricing point value is set higher than: (i) the

first three pricing points for NYCA 30-minute reserves, which are valued at a maximum Shadow Price of $200 per MW; and (ii) the first pricing point of $350 per MW for the graduated

transmission demand curve (i.e., representing the price for transmission shortages of 5 MW or less), but below the final $750 per MW pricing point for NYCA 30-minute reserves and the

second pricing point for the graduated transmission demand curve.

The NYISO further proposes to increase the third pricing point of the Regulation Service Demand Curve (i.e., corresponding to Regulation Capacity shortages of 80 MW or greater) from $400 per MW to $775 per MW. The proposed increase is intended to ensure that Regulation

Capacity is valued equally with the proposed pricing point for shortages of NYCA 10-minute

spinning reserves, thereby reflecting the relative equivalence in operational value of spinning

reserves and Regulation Capacity.36

The NYISO is also proposing to revise the second pricing point of its recently-approved graduated transmission demand curve (i.e., corresponding to a transmission shortage above 5

MW and less than or equal to 20 MW) by increasing the value of such point from $1,175 to

$2,350. Consistent with the intent of the initially-proposed value for the second pricing point of the graduated transmission demand curve, this revised value is intended to ensure that

transmission shortages greater than 5 MW but no greater than 20 MW are equally valued with

avoiding Operating Reserves shortages of East of Central-East 10-minute total reserves, as well as 10-minute total reserves in the new SENY region being proposed by the NYISO. As such the proposed pricing point recognizes the NYISO operators view that limiting transmission

shortages to 20 MW or less and avoiding shortages of 10-minute total reserves in the East of

Central-East and SENY regions are equally important.37

36 Dr. LeeVanSchaick concludes that the NYISO’s proposed revisions to the Regulation Service Demand Curve “… are reasonable and will generally result in an efficient allocation among the different Ancillary Services products.” LeeVanSchaick Affidavit at ¶ 24.

37 Furthermore, as illustrated by Dr. LeeVanSchaick, the proposed increase to the second pricing point of the graduated transmission demand curve provides for the maintenance of appropriate economic priority between the scheduling of Eastern 10-minutes reserves and securing the Central-East interface. LeeVanSchaick Affidavit at ¶ 25.

Honorable Kimberly D. Bose February 18, 2015

Page 12

The NYISO’s proposed revisions to the values for the Regulation Service Demand Curve

and its recently-approved graduated transmission demand curve are shown in the following

tables.

IV.Description of Tariff Amendments

A. Definitions

The NYISO proposes to revise the definitions of “Operating Reserve Demand Curve”

and “Transmission Shortage Cost,” as well as add a newly defined term “Southeastern New York (SENY)” within Section 2 and Section 1 of the Services Tariff and the OATT, respectively.

A newly defined term “Southeastern New York (SENY)” is proposed to be added to

Section 2.19 and Section 1.19 of the Services Tariff and the OATT, respectively, as follows:

Southeastern New York (SENY): An electrical area comprised of

Load Zones G, H, I, J and K, as identified in the ISO Procedures.

As described in Section III above, the NYISO is proposing to implement a new SENY reserve region in order to improve market efficiency and better reflect its operational desire to ensure that sufficient reserves are scheduled within this transmission constrained region.

The definition of “Operating Reserve Demand Curve” in Section 2.15 of the Services

Tariff and Section 1.15 of the OATT is proposed to be amended to reflect that with the addition

of the SENY reserve region, the NYISO will price twelve Operating Reserve requirements,

rather than nine. The increase in the number of Operating Reserve requirements by three

represents the additional reserve products associated with the creation of a new SENY reserve

region (i.e., 30-minute reserves, 10-minute total reserves and 10-minute spinning reserves).

Honorable Kimberly D. Bose February 18, 2015

Page 13

In addition, the NYISO proposes to revise the definition of “Transmission Shortage Cost”

in Section 2.20 of the Services Tariff and Section 1.20 of the OATT to reflect an increase to the

second pricing point of the graduated transmission demand curve recently approved by the

Commission (i.e., corresponding to a transmission shortage greater 5 MW, but less than or equal

to 20 MW).38 As further described in Section III above, the revisions, in part, propose to

increase the value of the second pricing point from $1,175 to $2,350. Furthermore, the NYISO

is proposing certain enhancements to the definition of “Transmission Shortage Cost” to clarify

that this mechanism consists of a series of pricing points corresponding to different levels of

transmission shortage.

B. Services Tariff Rate Schedule 3

The NYISO is proposing to revise Section 15.3.7 of the Services Tariff to modify the

three pricing points of its Regulation Service Demand Curve. As further described in Section III above, the NYISO proposes to: (i) decrease the pricing point for Regulation Capacity shortages of 25 MW or less from $80 per MW to $25 per MW; (ii) increase the pricing point for

Regulation Capacity shortages greater than 25 MW but less than 80 MW from $180 per MW to $400 per MW; and (iii) increase the pricing point for Regulation Capacity shortages of 80 MW or greater from $400 per MW to $775 per MW.

C. Services Tariff Rate Schedule 4

The proposed revisions to Rate Schedule 4 of the Services Tariff provide for: (i) the

establishment of the SENY reserve region; (ii) the calculation of market clearing prices for

Operating Reserves in the SENY region; (iii) adjustments to the payment logic for Suppliers of

Operating Reserves on Long Island to reflect establishment of the SENY region; (iv) adjustments to the pricing logic for Operating Reserves during scarcity conditions to reflect establishing a

new SENY reserve region; (v) adjustments to the pricing points for the NYISO’s existing

Operating Reserve Demand Curves; and (vi) establishment of Operating Reserve Demand

Curves for the SENY region.

The NYISO proposes to revise Section 15.4.1.1 of the Services Tariff to reflect the

establishment of new locational Operating Reserves requirements for the SENY region.

Moreover, the proposed revisions clarify that a Supplier is only eligible to meet such new

locational requirements to the extent that such Supplier is located within the SENY region.

In connection with the establishment of the new SENY reserve region, revisions to

Section 15.4.4.1 of the Services Tariff are being proposed to provide that the NYISO will

calculate Day-Ahead and Real-Time Market clearing prices for operating reserves in four regions

going forward: (i) West of Central-East; (ii) East of Central-East, excluding the new SENY

region; (iii) SENY, excluding Long Island; and (iv) Long Island. Consistent with the proposed

revision to the definition of “Operating Reserve Demand Curve,” the addition of the SENY

38 Docket No. ER15-485-000, New York Independent System Operator, Inc., Letter Order (January 15, 2015).

Honorable Kimberly D. Bose February 18, 2015

Page 14

region will increase the number of locational Operating Reserves prices that the NYISO will calculate from nine to twelve, in order to account for the three additional reserve products associated with the SENY region (i.e., 30-minute reserves, 10-minute total reserves and 10-

minute spinning reserves).

Section 15.4.4.2 of the Services Tariff is proposed to be amended in order to revise the

logic for determining settlement payment values provided to Operating Reserves located on

Long Island in light of the establishment of the new SENY region. Previously, this Section

established that Operating Reserves located on Long Island would receive settlement payments

as though such reserves were located in East of Central-East (i.e., providing payment based on

the applicable Eastern Reserves price). With the establishment of the new SENY region, the

NYISO proposes to pay such Long Island Operating Reserves as if they were located in the

SENY region (i.e., providing payment based on the applicable SENY reserves price).

The NYISO proposes to revise Sections 15.4.5.1 and 15.4.6.1 of the Services Tariff to

address the establishment of the new SENY region for purposes of calculating Operating

Reserves prices in the Day-Ahead and Real-Time Markets. The market clearing prices for

Operating Reserves products are calculated in a fashion to recognize the capability of “higher”

quality reserves to satisfy the requirements for “lower” quality and less locationally restrictive

reserve products.39 As such the market clearing price for a particular Operating Reserve product

is calculated based on the sum of the Shadow Prices for such product, any lower quality products

within the same reserve area, as well as equivalent or lower quality reserves within less

locationally restrictive reserve areas.40 Accordingly, the NYISO proposes to add new formulas

and Shadow Price descriptions for the SENY region. The new formulas recognize the ability of

SENY Operating Reserve products to satisfy any lower quality reserve products within such

region, as well as equivalent or lower quality reserve requirements for the less locationally

constrained Eastern and Western areas. In addition, the NYISO proposes to revise the market

clearing price calculations for Long Island Operating Reserves products to reflect the continued

ability of such products to satisfy equal or lower quality reserve requirements in the less

locationally restrictive Eastern and Western areas in addition to the new SENY region, which is

also less locationally restrictive than the Long Island reserve area.

39 The reference to “lower” quality reserves herein is intended to refer to a general preferential

order of reserve products whereby spinning reserves are considered “highest” quality, followed by 10-

minute total reserves and then 30-minute reserves. As such, spinning reserves could be used to satisfy

either or both of the applicable requirements for “lower” quality 10-minute total and 30-minute reserves.

40 For example, 10-minute spinning reserves located in the East of Central-East region could also

satisfy the requirements for 10-minute total reserves in the East of Central-East region, 30-minute

reserves in the East of Central-East region, 10-minute spinning reserves for NYCA, 10-minute total

reserves for NYCA and 30-minutes reserves for NYCA. Accordingly, the applicable market clearing

price for 10-minute spinning reserves located in the East of Central-East region is calculated based on the

sum of the applicable Shadow Prices for each of the aforementioned Operating Reserves products.

Honorable Kimberly D. Bose February 18, 2015

Page 15

The NYISO further proposes revisions to its scarcity pricing rules for Operating Reserves

that apply during activations of EDRP/SCR Resources to address the establishment of the new

SENY region. It is important to note that the NYISO is not proposing to change the application

or methodology for its scarcity pricing rules. Instead, the NYISO is merely proposing to extend

such rules to recognize and properly reflect the new SENY reserve region. The proposed

revisions to Section 15.4.6.2 of the Services Tariff reference the addition of a new Section

15.4.6.2.3, which specifies the scarcity pricing rules for SENY reserves that apply to situations where: (i) the NYISO has called upon EDRP/SCR Resources; (ii) the existing scarcity pricing rules set forth in Sections 15.4.6.2.1 and 15.4.6.2.2 have not been used; (iii) the NYISO uses the scarcity pricing rule set forth in Section 17.1.2.2 of the Services Tariff and (iv) the aggregate amount of Available Reserves in all Load Zones encompassed by the SENY region is less than the number of EDRP/SCR MW called upon by the NYISO.

The proposed modifications to Section 15.4.6.2.1 of the Services revise the scarcity

pricing rules for calculating the market clearing prices for Eastern reserve products (i.e., 10-

minute spinning, 10-minute total and 30-minute reserves) during statewide scarcity conditions to

clarify that the applicable clearing price will be the higher of: (i) the highest Lost Opportunity

Cost for any provider of the applicable reserve product(s) specified for the type of Eastern

reserve at issue that is scheduled by RTD and not located in the SENY region; and (ii) the

original market clearing price for the applicable reserve product calculated pursuant to Section

15.4.6.1 of the Services Tariff. In addition, the NYISO proposes to revise Section 15.4.6.2.1 of

the Services Tariff to specify the scarcity pricing rules for calculating the applicable market

clearing prices for SENY reserve products (i.e., 10-minute spinning, 10-minute total and 30-

minute reserves) during statewide scarcity conditions. The proposed additions provide that the

clearing price for the applicable SENY reserve product will be the higher of: (i) the highest Lost

Opportunity Cost for any provider of the applicable reserve product(s) specified for the type of

SENY reserve at issue that is scheduled by RTD and not located on Long Island; and (ii) the

original market clearing price for the applicable reserve product calculated pursuant to Section

15.4.6.1 of the Services Tariff.

Similarly, the NYISO proposes revisions to Section 15.4.6.2.2 of the Services Tariff to

revise the market clearing price calculations for Eastern Reserves during intervals when the

scarcity pricing rules apply for Eastern scarcity conditions, as well as add language to provide

the applicable calculation of market clearing prices for SENY reserve products during such

periods. The NYISO proposes to clarify that the applicable market clearing prices for Eastern

reserve products (i.e., 10-minute spinning, 10-minute total and 30-minute reserves) will be the

higher of: (i) the highest Lost Opportunity Cost for any provider of the applicable Eastern

reserve product(s) specified for the type of Eastern reserve at issue that is scheduled by RTD and

not located in the SENY region; and (ii) the original market clearing price for the applicable

reserve product calculated pursuant to Section 15.4.6.1 of the Services Tariff. The NYISO also

proposes to add language to Section 15.4.6.2.2 of the Services Tariff to provide that the clearing

price for the applicable SENY reserve product (i.e., 10-minute spinning, 10-minute total and 30-

minute reserves) will be the higher of: (i) the highest Lost Opportunity Cost for any provider of

the applicable Eastern or SENY reserve product(s) specified for the type of SENY reserve at

issue that is scheduled by RTD and not located on Long Island; and (ii) the original market

Honorable Kimberly D. Bose February 18, 2015

Page 16

clearing price for the applicable reserve product calculated pursuant to Section 15.4.6.1 of the Services Tariff.

As noted above, the NYISO also proposes to add a new Section 15.4.6.2.3 to the Services

Tariff to establish the scarcity pricing rules for calculating the marketing clearing prices for

SENY reserve products during SENY scarcity conditions. The proposed additions provide that

the clearing price for the applicable SENY reserve product (i.e., 10-minute spinning, 10-minute

total and 30-minute reserves) will be the higher of: (i) the highest Lost Opportunity Cost for any

provider of the applicable SENY reserve product(s) specified for the type of SENY reserve at

issue that is scheduled by RTD and not located on Long Island; and (ii) the original market

clearing price for the applicable reserve product calculated pursuant to Section 15.4.6.1 of the

Services Tariff.

The NYISO also proposes to revise Section 15.4.7 of the Services Tariff to: (i) revise the pricing points and associated values for the existing Operating Reserve Demand Curves

consistent with the table set forth in Section III above; and (ii) establish new Operating Reserve Demand Curves for the SENY region and pricing points associated therewith consistent with the table set forth in Section III above. The proposed revisions are as follows:

• Increase the price for quantities less than or equal to the target level for NYCA

10-minute spinning reserves from $500 per MW to $775 per MW;

• Establish: (i) a price for SENY 10-minute spinning reserves equal to $25 per MW

for quantities less than or equal to the target level for such reserves; and (ii) a

price equal to $0 per MW for quantities in excess of the applicable target level;

• Increase the price for quantities less than or equal to the target level for NYCA

10-minute total reserves from $450 per MW to $750 per MW;

• Increase the price for quantities less than or equal to the target level for Eastern

10-minute total reserves from $500 per MW to $775 per MW;

• Establish: (i) a price for SENY 10-minute total reserves equal to $25 per MW for

quantities less than or equal to the target level for such reserves; and (ii) a price equal to $0 per MW for quantities in excess of the applicable target level;

• Revise the Operating Reserve Demand Curve for NYCA 30-minute reserves to

include the following four pricing points to replace the currently-effective three

pricing points: (i) a price equal to $25 per MW for quantities that are less than the

target level for such reserves but fewer than 300 MW less than such target level;

(ii) a price equal to $100 per MW for quantities that are greater than or equal to

300 MW less than the target level for such reserves but fewer than 655 MW less

than such target level; (iii) a price equal to $200 per MW for quantities that are

greater than or equal to 655 MW less than the target level for such reserves but

fewer than 955 MW less than such target level; and (iv) a price equal to $750 per

Honorable Kimberly D. Bose February 18, 2015

Page 17

MW for quantities greater than or equal to 955 MW less than the target level for such reserves;

• Establish: (i) a price for SENY 30-minute reserves equal to $25 per MW for

quantities less than or equal to the target level for such reserves; and (ii) a price

equal to $0 per MW for quantities in excess of the applicable target level; and

V.Effective Date

The NYISO respectfully requests Commission action within sixty days from the date of

this filing (i.e., April 20, 2015) to provide the NYISO and Market Participants with timely notice

that the changes proposed herein have been accepted. Such timely action by the Commission

will: (a) allow the NYISO to confidently proceed with developing and deploying the software

changes necessary to implement its CSP Project; (b) ensure the NYISO’s capability of achieving

the desired effective date for this proposal; and (c) assist the NYISO in avoiding the potential for

adverse impacts to other projects it has committed to for 2015 in the event that modifications are

required to the software changes associated with the CSP Project in response to Commission

action relating thereto.41

The NYISO requests a flexible effective date for the Services Tariff and the OATT

revisions proposed in this filing which will be no earlier than November 1, 2015.42 The NYISO proposes to submit a compliance filing at least two weeks prior to the proposed effective date which will specify the date on which these revisions will take effect. Consistent with

Commission precedent, the compliance filing will provide adequate notice to the Commission and to Market Participants of the implementation date for the CSP Project.43

To the extent necessary, the NYISO requests a waiver of Commission regulations to

allow the NYISO to make this filing more than 120 days prior to the date on which the proposed

service is to become operational.44 No Market Participant will be prejudiced by this request

because the proposed implementation timetable was developed in consultation with Market

Participants. As such, Market Participants have known for some time that the NYISO does not

41 As noted above, such additional projects include, but are not limited to, CTS with ISO-NE and Comprehensive Scarcity Pricing.

42 The NYISO currently remains on schedule to deploy the software changes necessary to

implement its CSP Project in June 2015. Such software once deployed will remain inactive until such time as the NYISO establishes an effective date for the proposed revisions contained herein pursuant to the process proposed in this filing.

43 See, e.g., New York Independent System Operator, Inc., 106 FERC ¶ 61,111 at P 10 (2004)

(“We will allow NYISO to implement parts of the filing prior to September 2004, as such parts become ready for implementation, provided that NYISO adheres to the three steps identified above in Paragraph 5 of this order.”); Docket No. ER11-2544-000, New York Independent System Operator, Inc., Letter Order at 1 (February 10, 2011); and Docket No. ER15-485-000, New York Independent System Operator, Inc., Letter Order at 2 (January 15, 2015).

44 See 18 C.F.R. § 35.3(a)(1).

Honorable Kimberly D. Bose February 18, 2015

Page 18

plan for its CSP Project to become effective earlier than November 1, 2015. Furthermore, as noted above, the NYISO will provide at least two weeks prior notice before implementation of its CSP Project, including the revisions to the Services Tariff and the OATT proposed herein if they are accepted by the Commission.

VI.Requisite Stakeholder Approval

These amendments were approved by the NYISO Management Committee on December 17, 2014 with a vote of 83.96% in favor. The NYISO’s Board of Directors approved the

proposed revisions on January 13, 2015.

VII.Communications and Correspondence

All communications and service in this proceeding should be directed to:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director, Regulatory Affairs *Garrett E. Bissell, Senior Attorney

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-6107

Fax: (518) 356-7678

rfernandez@nyiso.com

rstalter@nyiso.com

gbissell@nyiso.com

*Person designated for receipt of service.

VIII.Service

The NYISO will send an electronic link to this filing to the official representative of each

of its customers, to each participant on its stakeholder committees, to the New York Public

Service Commission, and to the New Jersey Board of Public Utilities. In addition, the complete

filing will be posted on the NYISO’s website at www.nyiso.com.

Honorable Kimberly D. Bose February 18, 2015

Page 19

IX.Conclusion

Wherefore, for the foregoing reasons, the New York Independent System Operator, Inc. respectfully requests that the Commission accept for filing the proposed revisions to the Services Tariff and the OATT that are attached hereto within sixty days of the date of this filing (i.e., by

April 20, 2015) with a flexible effective date not earlier than November 1, 2015, to be provided with two weeks’ notice.

Respectfully submitted,

/s/ Garrett E. Bissell

Garrett E. Bissell

Senior Attorney

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, New York 12144 (518) 356-6107

gbissell@nyiso.com

cc:Michael A. Bardee

Gregory Berson

Anna Cochrane

Morris Margolis

David Morenoff

Daniel Nowak

Kathleen Schnorf

Jamie Simler

Kevin Siqveland