10 Krey Boulevard Rensselaer, NY 12144

June 1, 2015

Hon. Kimberly D. Bose, Secretary

Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc., Informational Report, Docket

No. AD14-6-00_

Dear Secretary Bose:

In accordance with Paragraph 23 and the ordering paragraph of the Commission’s

November 15, 2014 Order on Technical Conference (“November Order”),1 the New York

Independent System Operator, Inc. (“NYISO”) respectfully submits this informational report

(“Report”). The November Order directed the “NYISO to explore the issues and evaluate the

proposals discussed at the conference, including the MMU’s recommendations, through its

stakeholder process and file an informational report.”2 This Report describes the various

stakeholder meetings convened, and review process conducted, by the NYISO after the February 26, 2014 Technical Conference3 (“Technical Conference”). The issues discussed in this Report include “whether or not to model Load Zone K as an export-constrained zone for a future ICAP Demand Curve reset proceeding.4 It also discusses whether a proposal can be developed that

could reduce the cost of procuring capacity while meeting the NYISO loss of load (“LOLE”)

objective, as well as other proposals made by the NYISO, the independent Market Monitoring

Unit (“MMU”), and stakeholders at the Technical Conference.

Several related issues were raised by stakeholders at the Technical Conference and in

their written comments. In addition to modeling Load Zone K5 as an export constrained zone,

1 New York Indep. Sys. Operator, Inc., 149 FERC ¶ 61,164 (2014) (“November Order”).

2 Id. at P 23.

3 See New York Indep. Sys. Operator, Inc., Notice of Technical Conference, Docket No. AD14-6-

000 (Jan. 28, 2014), Supplemental Notice of Technical Conference (Feb. 14, 2014), (collectively, the “Technical Conference Notice”).

4 November Order at P 2, citing certain NYISO pleadings in Docket No. ER13-1380 and the

August 13, 2013 order in that proceeding, New York Indep. Sys. Operator, Inc .,144 FERC ¶ 61,126 at

P 20.

5 Capitalized terms not defined herein have the meaning set forth in the NYISO’s Market

Administration and Control Area Services Tariff (“Services Tariff”) and if not defined therein, then in the Open Access Transmission Tariff (“OATT”).

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 2

stakeholders raised issues regarding the methodology to determine the Locational Minimum Installed Capacity Requirements (“LCRs”); rules to eliminate Localities or achieve price

convergence; enhancements to the triggers for creating and “pre-defining” capacity zones (i.e., Localities), and a capacity Deliverability right for transmission projects that increase the

deliverability of a constrained interface.

I.DOCUMENTS SUBMITTED

In support of this filing, the NYISO respectfully submits the following documents that

were provided to stakeholders in 2014 and to date in 2015 as part of the discussions with them:

1. Capacity Zone (Locality) Elimination, presented by the NYISO, at the October 30,

2014 joint meeting of the Market Issues Working Group and ICAP Working Group (“Attachment I”) (also available at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/m

eeting_materials/2014-10-30/Capacity_%20Zone_%20Elimination_Final_103014.pdf

>).

2.Capacity Zone (Locality) Pre-Define & Eliminate, presented by the NYISO, at the

November 17, 2014, ICAP Working Group meeting (“Attachment II”) (also available

at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/

meeting_materials/2014-11-

17/Predefine_Eliminate_Capacity%20Zone_Nov17_Final.pdf>).

3. Treatment of Zone K Export Constraints into the G-J Locality: Market Design

Concept, presented by the NYISO, at the December 18, 2014 joint meeting of the

Market Issues Working Group and ICAP Working Group (“Attachment III”) (also

available at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/m

eeting_materials/2014-12-

18/agenda%203%20NCZ%20_%20Export%20Constrained%20Zones.pdf>).

4. Numeric Example posted by the NYISO with stakeholder meeting materials on its

website, on February 19, 2015 (“Attachment VII”) (also available at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/m

eeting_materials/2014-12-18/Numerical%20Example%20for%20the%2012-18-

2014%20Presentaion%20regarding%20Treatment%20of%20Zone%20K%20Export %20Constraints2.pdf>).

5. 2013 State of the Market Report Recommendation to Enhance Locational Pricing in

the Capacity Market, presented by Pallas Lee Van Schaick of Potomac Economics at

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 3

the August 20, and November 14, ICAP Working Group Meeting (“Attachment V”) (also available at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/

meeting_materials/2014-11-14/Capacity_2013%20SOM__8172014.pdf>).

6. Compliance with FERC Order on Technical Conference re: Treatment of Zone K

Export Constraints into the G-J Locality, presented by the NYISO, at the February

24, 2015 ICAP Working Group meeting (“Attachment VI”) (also available at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg/

meeting_materials/2015-02-

24/agenda%203%20Export%20Constrained%20Zones_ICAPWG%202-24-

15_Final.pdf>).

7. IRM/LCR Process and Dynamics, presented by Mark Younger, Hudson Energy

Economics, at the January 29, 2015 joint meeting of the Market Issues Working Group, ICAP Working Group, and the Price Responsive Load Working Group (“Attachment VII”) (also available at:

<http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/m

eeting_materials/2015-01-

29/agenda%208%20IRM%20LCR%20Process%20Dynamics.pdf>).

8. LCR Process Review; Setting of the IRM and LCRs: the Basic Process; and LCR

Process Review: Next Steps; presented by the NYISO at the March 5, 2015 meeting

of the LCR Task Force (collectively, “Attachment VIII”) also available at:

˂http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg_

lcrtf/meeting_materials/2015-03-05/02_LCR%20Alternative%20for%20Kick-

off%20meeting.pdf˃, ˂

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg_l

crtf/meeting_materials/2015-03-05/03_Background%20Slides_IRM_LCR.pdf˃; ˂

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg_l

crtf/meeting_materials/2015-03-05/04_LCR%20Process%20Next%20Steps.pdf˃.

9. Objective of LCR Methodology Review: Possible Alternatives, presented by the

NYISO at the April 8, 2015 meeting of the LCR Task Force (“Attachment IX”) (also available at:

˂http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_icapwg_

lcrtf/meeting_materials/2015-04-

08/LCR%20Objective_Possible%20Alternatives.pdf>).

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 4

II.BACKGROUND

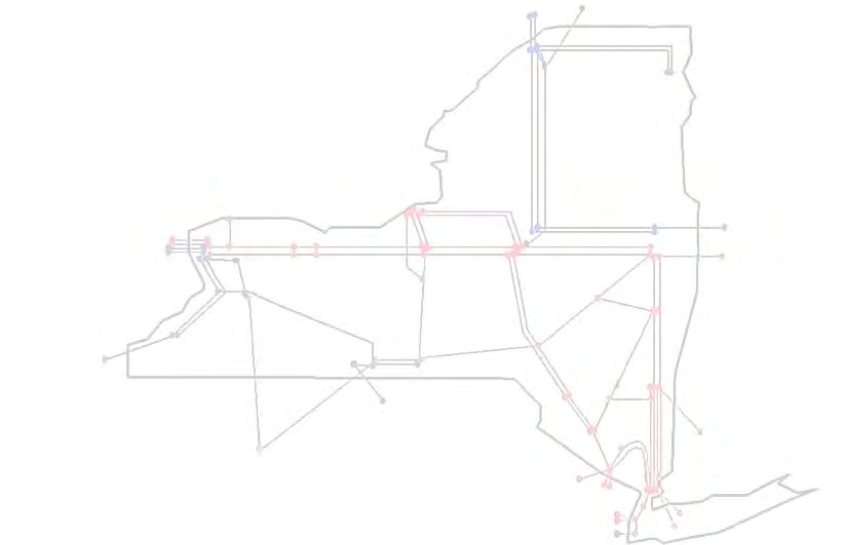

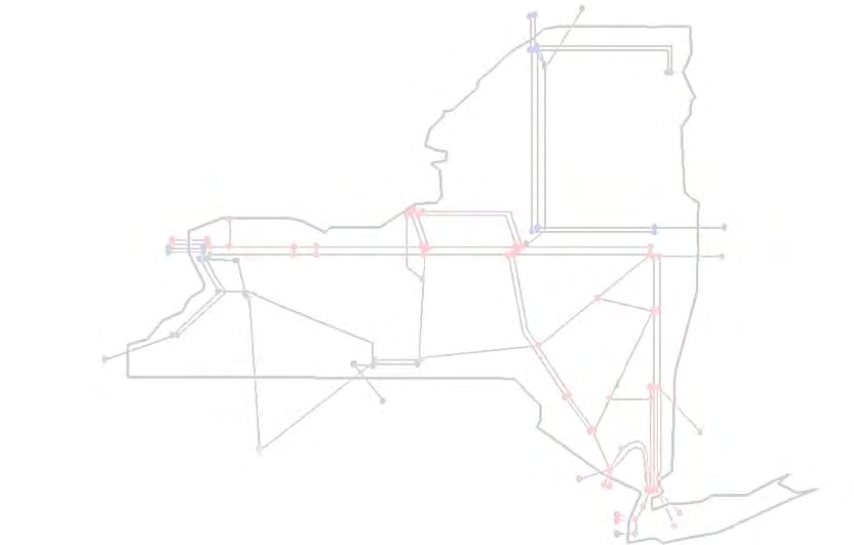

On April 30, 2013, the NYISO filed revisions to its Services Tariff and its Open Access Transmission Tariff (“OATT”) to establish a new Locality that would encompass Load Zones G, H, I, and J but exclude Load Zone K (“the G-J Locality”).6 In that proceeding, certain parties argued that Load Zone K should have been included in the G-J Locality based on assertions that capacity located in Load Zone K could provide some level of support to Load Zones G, H, and I. Some parties also suggested that to the extent that Load Zone K warranted special consideration, it should be modeled as an “export-constrained” Load Zone.7

The Commission accepted the NYISO’s proposal to establish the G-J Locality (without

including Load Zone K.)8 It also directed the Commission’s staff to convene a technical

conference, in a separate proceeding, “to discuss with interested parties whether or not to model

Load Zone K as an export-constrained zone for a future ICAP Demand Curve reset proceeding.”9

The Technical Conference was established to principally discuss whether and how to

model Load Zone K as an export-constrained zone, including whether and how to determine the

MW limit to be placed on capacity located in Load Zone K that can be relied upon to serve the

needs of Load Zones G through J.10 At the Technical Conference, various other issues were

discussed that were related to, but that extended beyond the issues outlined in the Technical

Conference Notice. These additional issues are described above. Multiple parties submitted

post-conference comments that largely reiterated the discussion at the Technical Conference,

many of which had been previously raised in the NYISO’s stakeholder process. The NYISO’s

post-conference comments suggested that the Commission should permit it to continue exploring

those issues and proposals through its stakeholder process.11 The NYISO explained that a

stakeholder process would:

[A]llow the NYISO to consider the process for setting [Locational Minimum

Installed Capacity Requirements (“LCRs”)] and how it may be adapted to

properly reflect export constrained aspects of Localities as well as the treatment of export constrained aspects of Localities in the auction clearing mechanism.

6 New York Indep. Sys. Operator, Inc., Proposed Tariff Revisions to Establish and Recognize a New Capacity Zone and Request for Action on Pending Compliance Filing, Docket No. ER13-1380-000 (April 30, 2013) (“April 2013 Filing”).

7 See November Order at P 2, describing the NYISO’s position in, and other parties’ positions on, the April 2013 Filing. See also New York Indep. Sys. Operator, Inc., 144 FERC ¶ 61,126 (2013) (“August 2013 Order”) at PP 32 - 51.

8 August 2013 Order at PP 52 - 55.

9 Id. at P 56.

10 Technical Conference Notice.

11 Post-Technical Conference Comments of the New York Indep. Sys. Operator, Inc., Docket No. AD14-6-000 (March 26, 2014).

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 5

Further, it would give the NYISO time to continue to consider the potential

development of alternative rules to pre-define and eliminate capacity zones. It

would not risk displacing other priority projects, including those that are being

undertaken in response to earlier Commission compliance mandates or high

priority recommendations by the [MMU] for the NYISO. Providing the

stakeholder process time to function would give the NYISO and its stakeholders

experience with G-J Locality pricing before completing the evaluation and

considering a decision on export constraint modeling. A stakeholder process

would also permit the NYISO to consider changes to modeling rules in tandem

with the triennial process for evaluating and potentially creating New Capacity

Zones.12

The NYISO asked the Commission to delay further action until it had conducted stakeholder discussions and proposed to submit a report by June 1, 2015.13

The November Order accepted the NYISO’s proposal. It concluded that:

[I]t would be worthwhile for NYISO and its stakeholders to explore whether a

proposal can be developed that could reduce the cost of procuring capacity while

meeting the NYISO LOLE objective. Therefore, we accept NYISO’s

recommendation to conduct a stakeholder process and to file a report on this

process by June 1, 2015. While we agree with NYISO that it is premature to

require it to file tariff language by June 1, 2015, we believe that valuable market

rule changes that could reduce costs should not be unduly delayed. Accordingly,

the Commission orders NYISO to explore the issues and evaluate the proposals

discussed at the conference, including the MMU’s recommendations, through its

stakeholder process and file an informational report with the Commission by June

1, 2015.14

III. THE EXPLORATION OF ISSUES AND EVALUATION OF PROPOSALS

THROUGH THE STAKEHOLDER PROCESS

A summary of the steps that the NYISO has taken to consider, analyze, and address

several of the issues raised during the Technical Conference, with the MMU and stakeholders follows below. The stakeholder discussions have illustrated that there are disparate stakeholder interests and concerns. Further consideration through the stakeholder process would allow the NYISO and stakeholders to better assess the benefits and detriments of changes, how those changes might affect other NYISO market initiatives.

12 Id. at 3-4.

13 Id. at 5.

14 Order on Technical Conference at P 23.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 6

Prior to the issuance of the November Order, based on consideration and input from the MMU and its stakeholders, the NYISO had already made it a priority to conduct three discrete

projects in 2014 in order to address issues raised at the Technical Conference. The NYISO

committed to lead further stakeholder discussions regarding (i) market design concepts regarding whether and how to model export constraints in the ICAP Spot Market Auction, (ii) market

design concepts regarding the elimination Localities, and (iii) market design concepts that would lead to pre-defined capacity zones.15

(i)Eliminating Localities

On October 30, 2014, the NYISO presented to and discussed with stakeholders at a joint meeting of its Market Issues Working Group and its ICAP Working Group, whether there is a need for, and potential issues associated with, the concept of eliminating Localities. The NYISO presented background information on why locational capacity is valued in some areas.16 It also discussed some of the challenges and concerns that would arise and need to be addressed in

association with designing a rule set to eliminate a Locality.

Stakeholders expressed disparate views on the concept. End user interests and some

transmission owners recommended that the NYISO consider a change to the current NCZ Study;

i.e., the process, methodology, and parameters used to evaluate the need for a New Capacity

Zone. Their suggestions included having the NYISO monitor the binding interface that gave rise

to the creation of a Locality in order to identify when it was no longer binding. They also argued

that because the NCZ Study, which examines Deliverability, would identify the need for an NCZ

if one MW is constrained at an interface, there should be a rule that the Locality should be

eliminated when the constraint at the interface is relieved by one MW or more. The NYISO

evaluated that proposal and informed stakeholders that it would create the potential for turning

the Locality “on” and “off” thereby creating significant market uncertainty. That uncertainty

includes issues surrounding projects subject to a buyer-side mitigation Offer Floor, the effect on

sales in the Capability Period Auction and Monthly Auction, and price signals to developers and

investors of proposed, under-development, and existing capacity resources. Several stakeholders

agreed with the NYISO’s assessment. There was also discussion of a need to limit the frequency

and add predictability to a design to eliminate Localities, and potential opportunity to ensure an

accurate price signal.

Based on the stakeholder discussions and analysis, and potential opportunity to ensure an

accurate price signal, to advance consideration of eliminating Localities, the NYISO proposed

that a rule should provide that the Locality be eliminated if the binding interface is relieved with

sufficient Deliverability Headroom such that it would not be expected to bind again (at least for

some foreseeable length of time, which would need to be determined) once the Locality was

15 NYISO, 2014 Business Plan Highlights pp , 8, and 9, available at:

<http://www.nyiso.com/public/webdocs/company/strategic_plan/2014_nyiso_businessplanhighlights_fina

l.pdf>

16 See Attachment I.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 7

eliminated. The NYISO also suggested that price convergence might be a preferable trigger for eliminating Localities.

In response, some stakeholders indicated a preference for pursuing eliminating Localities

as opposed to defining under what circumstances price separation should cease. Stakeholders

from the supply sectors indicated more effort should be focused on whether there was even a

need to eliminate Localities and if doing so would jeopardize reliability. Other stakeholders

rejected that suggestion and argued that because only a Deliverability criterion is used to identify

the need for an NCZ, the same criterion should be applied to identifying when to eliminate

Localities. Some representatives of capacity suppliers expressed their continued support for the

concept of pre-defining capacity zones. It was clear from the responses that a large number of

stakeholders that provided input thought that the current Deliverability construct for creating

NCZs possibly should include an additional criterion, and should be re-evaluated as part of the

discussion on rules to eliminate Localities.

(ii) Eliminating Localities and Pre-Defining Capacity Zones

After further analysis and consideration of stakeholder input, at a November 17, 2014

ICAP Working Group meeting the NYISO presented further information and led a discussion of potential market design concepts for pre-defining and eliminating Localities.17 The NYISO

presented some information regarding PJM Interconnection LLC (“PJM”) rules for predefining and eliminating its capacity zones; and discussed possible options for the NYISO. The NYISO and stakeholders also reviewed and discussed potential bulk system or market triggers for

eliminating Localities, and issues that would arise if they are eliminated, including how they

might be compounded or lessened depending on the frequency of the elimination determinations. Many of the issues previously raised by stakeholders, at the Technical Conference and at the October 30 ICAP Working Group meeting were further discussed.

Load interests indicated that in the near-term, price convergence should not be considered

as the criterion for eliminating a Locality because with the current market structure, it is unlikely

to occur. They suggested that the existing market structure be retained and that the trigger for

eliminating Localities be an appropriate amount of Highway interface Headroom with a buffer

(to be defined.) They further suggested that such a criterion for elimination would need to be

balanced with a similar creation rule, and that the rule would also need to consider and balance

reliability and higher costs.

Some suppliers commented that satisfying the Deliverability constraints may not ensure

reliability in a Locality that has load pockets, or where there is significant uncertainty of capacity

remaining in service. They cautioned that the magnitude of headroom used as the criteria to

eliminate a Locality be sufficiently large to ensure reliability. Similarly, they suggested that the

NYISO should apply that same parameter when creating new Localities in order to avoid

reliability problems caused by unexpected loss of capacity. Price convergence was again

17 See Attachment II.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 8

suggested as an alternative, including using price convergence as the criteria to trigger

eliminating Localities. The NYISO was asked to consider a rule to achieve price convergence by shifting the zero crossing point on the ICAP Demand Curve. A representative of load interests expressed disagreement with that proposal.

It was apparent to the NYISO that there was no consensus on the concepts surrounding

rules to eliminate and create Localities. This discussion was also part of the NYISO Budget

Priorities Working Group, where stakeholders expressed disagreement between whether the

project to discuss rules to eliminate capacity zones should be separate or combined with a project

to discuss concepts surrounding pre-defining capacity zones. As discussed below, the Budget

Priorities Working Group process did keep these two projects separated. Based on stakeholder

input received through that process, the NYISO prioritized a project for 2015 reviewing concepts

for eliminating Localities.

(iii) Load Zone K Export Constrained Capacity

At the joint meeting of the Market Issues Working Group and the ICAP Working Group

on December 18, 2014 the NYISO led a discussion for a market design concept to model the

excess capacity that cleared in the Load Zone K ICAP Spot Market Auction as part of the supply

stack in the G-J Locality ICAP Spot Market Auction, up to the level of the export constraint.18

The NYISO provided background on the existing ICAP auction pricing hierarchy rules and

mechanics. The proposed market design concept was based on the concept the NYISO had

introduced at the Technical Conference. Under the proposed concept, the NYISO would solve

the ICAP Spot Market Auction as it does today, with one change. That is, the NYISO would (a)

count the MW that clear above the Load Zone K LCR,19 up to the Load Zone K export limit

MW, toward the G-J LCR and (b) count the remaining MW in Load Zone K that clear above the

Load Zone K LCR (i.e. those above the export limit) toward the NYCA Minimum Unforced

Capacity Requirement (“NYCA Minimum Requirement”). This approach would recognize the

reliability value to the G-J Locality of excess MW of capacity in Load Zone K above the LCR

target, up to the Load Zone K export limit. It would also lower the total cost of capacity. This

approach could reduce costs to loads in the G-J Locality without raising costs to loads in Load

Zone K. Because of its relative simplicity compared to other concepts proposed at the Technical

Conference, the NYISO suggested at this stakeholder meeting that it potentially could be

implemented prior to the next ICAP Demand Curve reset.20

18 See Attachment III.

19 LCR in this context refers to the Locational Minimum Unforced Capacity Requirement. That amount is derived from the Locational Minimum Installed Capacity Requirement. For simplicity in this Report, the NYISO is referring to both as the “LCR.”

20 That timing would depend on the timing of when the proposal became an established rule in

relation to when the ICAP Demand Curve reset independent consultant had an opportunity to consider

fully the implications in its report. It also would depend on whether necessary software revisions could

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 9

Stakeholders expressed little support for this concept. Some stakeholders representing suppliers raised questions regarding the application of buyer-side capacity market mitigation

rules, and were skeptical that the market design concept could be confined to modifying only the auction rules without modifying the NYISO’s process for setting LCRs. They also commented that NYISO’s proposal would not provide proper price signals for capacity to locate in Long

Island. Representatives of load interests were interested in discussing issues further so they

could better evaluate the proposal, and also whether excess capacity in Load Zone K should also be recognized in all Load Zones with which it has ties.

In response to requests from stakeholders, the NYISO posted on its website a detailed

numerical example to further illustrate the Load Zone K export concept it had presented at the

December 18 stakeholder meeting.21 The example shows how the ICAP Spot Market Auction

would clear under the proposal. The NYISO presented the proposal at the February 24, 2015

meeting of the ICAP Working Group. Stakeholders were afforded the opportunity to discuss the

example in detail, and to raise any questions regarding it and the related market design concept

proposal. No stakeholder expressed an interest in the NYISO doing either. Therefore, the

NYISO did not pursue the discussion. Since the posting of the numerical examples, some load interests have indicated that they would like to see this discussion brought back to the

stakeholder process for further review and evaluation. The NYISO will be considering with its stakeholders whether to prioritize that project in the NYISO’s 2016 business plan.

(iv) The MMU’s Locational Capacity Framework

The MMU’s 2013 Annual State of the Market Report 22 included in its list of

recommendations for the NYISO certain capacity market enhancements. The MMU further

recommended that the NYISO “create a dynamic and efficient framework for reflecting

locational planning requirements, including three key aspects: a) Pre-define interfaces/zones that

address potential resource adequacy needs and highway deliverability constraints to allow prices

to accurately reflect the locational value of capacity; b) Grant internal capacity deliverability

rights between zones when private investors upgrade transmission into a local area; c) Modify

demand curve reset methodology to minimize the cost of satisfying planning requirements.”23

These recommendations built on the MMU’s comments at the February Technical Conference.

be deployed in time for the start of the Capability Year to which new ICAP Demand Curves would apply (May 1, 2017).

21 See Attachment IV.

22 Potomac Economics, Ltd., 2013 State of the Market Report for the New York ISO Markets (May 2014) (“2013 State of the Market Report”), available at:

˂http://www.nyiso.com/public/webdocs/markets_operations/documents/Studies_and_Reports/Reports/M

arket_Monitoring_Unit_Reports/2013/2013%20State%20of%20the%20Market%20Report.pdf˃.

23 See Attachment V.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 10

When the MMU initially discussed its 2013 State of the Market Report recommendations,

stakeholders requested that the MMU further discuss this capacity market framework at a

separate ICAP Working Group meeting due to its complexity. At two separate ICAP Working

Group meetings, on August 20, 2014 and November 14, 2014, the MMU led two lengthy

discussions of these recommendations. The MMU discussed its recommendation to enhance

locational pricing and described its view on elements of an enhanced framework that could

dynamically recognize the reliability value of capacity in Load Zone K in the G-J Locality ICAP

Demand Curve.

While the MMU’s presentation was apparently met with interest by the meeting

participants, several also indicated that the MMU proposal would likely require a complete

reworking of the NYISO’s capacity market and potentially impact the policies and rules

administered by the New York State Reliability Council. Stakeholders asked that the MMU

develop and present a cost-benefit analysis that would illustrate a savings to consumers. Other

stakeholders noted that this proposal would not follow the current LCR setting process and could

result in some Localities procuring capacity at levels below the minimum requirements. Some

stakeholders expressed concern regarding how this market design concept would support and

ensure reliability. While there certainly was some interest in the MMU’s market concept,

stakeholders participating in the meeting expressed that further evaluating it would be a

significant long term undertaking that would be unlikely to be completed prior to the next ICAP

Demand Curve reset.

The MMU’s 2014 State of the Market Report included recommendations that effectively repeated the recommendation to adopt a locational framework, but the recommendations in the 2014 report modified the recommendations in the 2013 State of the Market Report based on feedback from stakeholders.24 Specifically, the recommendation was modified to ensure

Localities would not under-procure capacity. The 2014 State of the Market Report provided additional information on potential benefits, but the MMU has indicated it will work with the NYISO’s Planning Department to provide additional information.

The NYISO reviewed the proposal and has taken the position, which is similar to several comments stakeholders proffered, that the MMU’s presented framework, in general, would

require significant changes to the current capacity market, be complicated to define, and

challenging to administer.

24 Potomac Economics, Ltd., 2014 State of the Market Report for the New York ISO Markets

(May 2015) (“2014 State of the Market Report”) at pp. x - ix, 100 - 101, available at:

˂http://www.nyiso.com/public/webdocs/markets_operations/documents/Studies_and_Reports/Reports/M

arket_Monitoring_Unit_Reports/2014/NYISO2014SOMReport__5-13-2015_Final.pdf˃ at pp. xi, 64-65,

102.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 11

(v)Further Consideration of Pre-Defining, Eliminating, and Export

Constrained Concepts

The NYISO’s discussion with it stakeholders of the topics of pre-defining and

eliminating Localities, and export constrained capacity market design concepts also took place in its annual “project prioritization” process. This is the stakeholder process through which, among other things, the NYISO obtains stakeholder input as it establishes what proposals it will bring to the stakeholders as a market design concept proposal for discussion, or a market design approval project to be taken through the governance process for a stakeholder vote. The NYISO

suggested that several issues raised by stakeholders at the Technical Conference and by post-

conference comments, be evaluated in 2015. The potential list included the MMU’s capacity

market framework recommendation described above, modeling export constraints in the ICAP

Spot Market Auction for nested capacity zones, and developing market rules to pre-define

capacity zones combined with rules to eliminate them.

As part of the project prioritization process, based on input from stakeholders,

consideration of rules to eliminate Localities was separated from consideration of developing market rules to pre-define capacity zones. Based on further stakeholder input, the NYISO

committed to consider rules for the elimination of Localities or for the achievement of capacity price convergence. The NYISO is currently developing its follow up discussion on this market design concept, which will be based in part on its consideration of stakeholder input to date. It will be presenting and discussing this concept to stakeholders.

At the February 24, 2015 ICAP Working Group meeting, the NYISO highlighted for

stakeholders key issues that had been raised during the Technical Conference and in post-

conference filed comments.25 The NYISO offered stakeholders an opportunity to make

presentations at a future ICAP Working Group meeting on export constrained modeling

concepts, with the objectives of defining the preferred approach and alternatives, presenting

numerical examples, and describing the benefits and detriments.26 No party requested an

opportunity to make a presentation or lead a discussion, and no party provided materials.

(vi) Consideration of LCR Setting Methodology

In relation to discussions regarding the November Order, and based on discussions with

the stakeholder Operating Committee, the NYISO initiated a process to identify and evaluate

alternatives to the current LCR setting process. The NYISO conducts this process after the New

York State Reliability Council sets the NYCA Installed Reserve Margin (“IRM”). Mark

Younger of Hudson Energy Economics made a presentation to a joint meeting of Market Issues

Working Group, ICAP Working Group, and Price Responsive Load Working Group, on the

25 See Attachment VI.

26 See id. at Slide 8.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 12

“IRM/LCR Process & Dynamics.”27 Mr. Younger described factors that could affect the LCRs, and proposed an analysis of the current methodology, using certain sensitivities.

The NYISO notified stakeholders and the MMU that the LCR Task Force was being

convened and asked them to participate. On March 5, 2015, the LCR Task Force met. In order

to facilitate the NYISO’s and its stakeholders’ consideration of a potential alternative process to

calculate LCRs, the NYISO presented background material so that all stakeholders had a

common understanding of the current process by which the LCRs and the IRM were set. It also

enumerated some concerns previously raised by stakeholders regarding the LCRs, and proposed

next steps for the LCR Task Force to consider alternatives.28 In the meeting, the NYISO,

stakeholders, and the MMU discussed the process to calculate the LCRs and the process by

which it will consider and analyze alternatives. The NYISO responded to numerous questions.

The LCR Task Force met again on April 8, 2015. At this meeting, the NYISO presented and described objectives of the current LCR setting methodology and possible alternatives.29 It solicited stakeholder input to develop a consensus on an objective for the group to focus on when evaluating candidate alternative methodologies to determination the LCRs. The following

objectives were discussed:

Maintain the existing process

Minimize the NYCA-wide capacity procurement costs Minimize the NYCA-wide MW requirement

Lowest Possible G-J LCR: Retain J and K “as found” and determine the minimum G-J

No consensus on the objective was reached at the meeting. Rather, stakeholders suggested

that the NYISO perform studies to demonstrate how the results will differ based on the objective. The NYISO indicated such an approach would require extensive use of resources and should only be undertaken until (and unless) clearer objectives were defined.

IV. THE NYISO’S CONCLUSION AND RECOMMENDED NEXT STEPS

Based on the NYISO’s exploration of the issues and evaluation of the proposals

discussed at the February Technical Conference, including the MMU’s recommendations,

through its stakeholder process, the NYISO has concluded that its existing rules are working and

that incremental enhancements may well be beneficial. It has also concluded that its stakeholder

process and project prioritization process is best suited to continue to explore enhancements to its

27 See Attachment VII.

28 See Attachment VIII.

29 See Attachment IX.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 13

existing market rules. Due to the complexity, a measured approach to identify and define the enhancements, and address implications is appropriate.

The Services Tariff process for identifying the need for an NCZ, obtaining stakeholder

input throughout the process, filing with the Commission proposed rules to implement it, and

then developing an ICAP Demand Curve for the NCZ along with the other ICAP Demand

Curves, was utilized for the first time, in 2013. It resulted in the creation of the G-J Locality. In

accordance with that Services Tariff process, by October 1, 2015 the NYISO will have initiated

the NCZ Study process and have obtained stakeholder input for the NCZ Study to be issued by

January 15, 2016.30 As the NYISO stated at the Joint Technical Conference on New York

Markets & Infrastructure in November 2014, “[t]he NYISO is mindful of the fact that the

creation of the new zone has led to wholesale capacity price increases that have had retail price

implications. But the NYISO believes that the creation of the new zone was necessary, fully

consistent with tariff requirements, and will benefit all New York consumers over time. Needed

investments in resources in the lower Hudson Valley are now being made that will bolster long-

term reliability and lower capacity prices in the region as they enter service.”31 The

Danskammer Generating Station announced its return to service and the Bowline Unit 2 has

entered Class Year 2015 as a step towards returning it to its full capacity, and the 720 MW CPV

Valley Energy Center is proceeding with development.32 These projects will enhance reliability,

which will benefit all consumers.

The process for identifying the need for an NCZ is very transparent; it gives stakeholders and all Market Participants and potential developers advanced notice of the changes in the

market place, and then sends price signals that also have been carefully set in the Demand Curve process. The NYISO recognizes that some incremental adjustments could provide further

benefits and have the potential for reducing costs. However, it also believes that care must be

taken to develop those rules carefully so that the benefits of the tariff-established process to

create new Localities are not compromised, and that uncertainty surrounding the rules does not

chill potential economic investment.

The NYISO is beginning the project prioritization process with its stakeholders for 2016. As described below, the issues the NYISO is suggesting that stakeholder consider includes issues raised at the February Technical Conference:

30 See Services Tariff Sections 5.16.1.2 and 5.16.

31 Written Statement of Emilie Nelson, Vice President - Market Operations, on Behalf of the New York Independent System Operator, Inc., Docket No. AD14-18-000 (Nov. 3, 2014) at 18.

32 On May 28, 2015, CPV announced that it “expects to commence construction [on the project]

in late 2015. See Competitive Power Ventures Closes Investment Transaction with Global Infrastructure

Partners (May 28, 2015), available at: ˂http://www.cpv.com/press_releases.html#web˃˃. The

Interconnection Agreement for the project is fully executed.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 14

Alternative methods for calculating the LCRs: This project would consider alternative

methods for calculating the LCRs for each Locality. The project would include a

continuation of the on-going work of the LCR Task Force.

Modify the ICAP Demand Curve framework to minimize costs of satisfying LCRs: This

project would create a dynamic and efficient framework for incenting the lowest cost

solutions when setting and meeting locational planning requirements in the capacity

market. The MMU has proposed this concept indicating it might enable the capacity

market to better provide locational signals in the future and result in more efficient

market outcomes.

Locational Planning Requirements - Pre-define Localities: This project would consider

rules for reflecting locational planning requirements in the capacity market to better

enable the market to provide locational signals in the future by predefining a set of

interfaces or zones that address potential resource adequacy needs and highway

deliverability constraints.

Develop rules for eliminating Localities or achieving price convergence: This effort

would build on discussions to date and evaluate whether a mechanism to eliminate

Localities is necessary. If it is deemed necessary, then further evaluate the market design concepts for developing the market rules to allow for the elimination of Localities or achieve price convergence when the deliverability constraint(s) that caused its creation is effectively removed such that the constraint can no longer be expected to bind.

Model Zone K as export constrained: This effort would also build upon and enhance

initial design concepts developed with stakeholders.

Over the coming months, the NYISO’s stakeholders will be “scoring” the proposed

projects, which will result in a ranking that the NYISO utilizes to prioritize which projects

stakeholders believe warrant consideration above other projects. The NYISO believes that this

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 15

input is important to assessing where the greatest benefits to the market can reasonably be achieved.33

In any case, the NYISO will be continuing the LCR Task Force. As described above,

however, that work must consider potential implications for the New York State Reliability

Council rules that are utilized to set the IRM, and how the process for determining the LCRs can best complement those rules. It is also possible that the NYISO may have to engage the New York State Reliability Council to consider revisions to the processes or rules for setting the IRM as part of the approach for considering changes in methods for determining LCRs.

Timing of consideration is also important. The NYISO has already informed

stakeholders that as part of the Demand Curve reset process it is now initiating, it plans on

requesting proposals to consider a 4 or 5 year periodicity in addition to the current 3-year

process, and approaches to enhance the projection of the likely Energy and Ancillary Services

revenues of the proxy plant used for setting the curves. With the input from the independent

Demand Curve reset consultant, the NYISO plans on evaluating with stakeholders potential rule

changes that could enhance price signals. This evaluation and any proposal would also consider

revisions to the NCZ Study and the process and timing for the creation of new Localities. The

NYISO believes that there are benefits to the entire system that are appropriate to pursue at this

time and could be achieved in time for the setting of the next ICAP Demand Curves.

The NYISO sought and considered, and continues to seek and consider, the input of the MMU as it evaluates and develops proposals and market design concepts that are described in this report and works with stakeholders to identify projects to consider in 2016. The MMU was given an opportunity to review and comment on this report.

Because the NYISO and its stakeholders have undertaken steps to consider important

issues including rules that could enhance price signals, the stakeholder process should be allowed

to continue to work. The analysis and prioritization in the stakeholder process is perhaps the best

indicator of where value may be achieved for the market. Accordingly, the NYISO respectfully

requests that the Commission not issue a further compliance obligation to pursue development of

specific rules.

33 Also on the potential 2016 projects for stakeholders to consider is the MMU’s proposal, which

the MMU proposes for “scoping” in the 2014 State of the Market Report and during the February

Technical Conference: internal capacity Deliverability rights for transmission upgrades into a local area.

See Post Technical Conference Comments of Potomac Economics, Ltd., New York ISO Market

Monitoring Unit, Docket No. AD14-6-000 (March 26, 2014) at 11; see also, 2014 State of the Market Report at xi, 64-65, 102. The MMU has suggested considering creating a dynamic and efficient

framework for reflecting locational planning requirements in the capacity market to better enable the

market to provide locational signals in the future, by granting internal capacity deliverability rights for AC Transmission between zones when AC transmission is upgraded into a local area. The State of the Market report has not indicated this as a priority item. At this stage, the NYISO believes it would require further information in order to assess its potential.

Hon. Kimberly D. Bose, Secretary June 1, 2015

Page 16

V.SERVICE

This filing will be posted on the NYISO’s website at www.nyiso.com. In addition, the

NYISO will e-mail an electronic link to this filing to the official representative of each party to

this proceeding, to each of its customers, to each participant on its stakeholder committees, to the

New York Public Service Commission, and to the New Jersey Board of Public Utilities.

VI.CONCLUSION

Wherefore, for the foregoing reasons, the New York Independent System Operator, Inc. respectfully requests that the Commission accept this Informational Report.

Respectfully submitted,

/s/ Gloria Kavanah

Gloria Kavanah

Counsel for the

New York Independent System Operator, Inc.

cc:Michael Bardee

Gregory Berson

Anna Cochrane

Morris Margolis

David Morenoff

Daniel Nowak

Kathleen Schnorf

Jamie Simler

Kevin Siqveland

Capacity Zone

(Locality)

Elimination

Mariann Wilczek

Capacity Market Products

New York Independent System Operator

Joint MIWG/ICAP Working Group

October 30, 2014

NYISO, Rensselaer, NY

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Problem Statement

Discuss whether there should be a mechanism to

eliminate a Locality, and if so, market design

concepts to eliminate capacity zones

The Services Tariff uses the term “Locality” to define

established capacity zones

The purpose of this presentation is to solicit

stakeholder feedback

© 2014 New York Independent System Operator, Inc. All Rights Reserved.2

Why do we have Capacity Markets ?

Benefits

Ensure resource adequacy

Provide a market signal for investment

Recover a portion of fixed costs not recoverable in Energy and Ancillary Services Markets

Capacity zones (“Localities”) recognize the value of capacity in the

area.

More focused price signal where capacity is needed Help to address transmission system constraints Long term investment signal

• New - Locate

• Existing - Maintain or increase capability

© 2014 New York Independent System Operator, Inc. All Rights Reserved.3

Localities

The Services Tariff has the set of rules for the

triennial process to determine if a new Locality is

needed and the steps by which it is created (see

Appendix Slides)

The tariff is silent on the elimination of a Locality

© 2014 New York Independent System Operator, Inc. All Rights Reserved.4

Stakeholder Discussion

Do we need to eliminate Capacity Zones ?

G-J, J, K

Suggested Topics

Elimination of a Locality

• Price convergence

• Elimination of a deliverability constraint

• Effect on Offer Floor of units subject to buyer-side mitigation

• Effect on planning processes

• Timing issues

Comments beyond today’s meeting can be sent to

Debbie Eckels (deckels@nyiso.com)

© 2014 New York Independent System Operator, Inc. All Rights Reserved.5

© 2014 New York Independent System Operator, Inc. All Rights Reserved.6

Background for New Capacity Zones

FERC Filings and Orders

June 30, 2009 - FERC Order accepting the deliverability rules directed the NYISO and the NYTOs to

jointly file a proposal to create a new capacity zone.

January 4, 2011 - NYTOs and NYISO filed proposed criteria and considerations to govern the

evaluation and potential creation of new capacity zones.

September 8, 2011 - FERC issued an order which directed the NYISO to file tariff provisions to

specify the process for evaluating, identifying and, if necessary, establishing new capacity zones.

November 7, 2011 - NYISO filed the tariff sheets containing the specific detail.

August 30, 2012 - FERC issued an order accepting the November 2011 filing and made the tariff

revisions by which new capacity zones would be identified and created effective as of January 9,

2012.

June 29, 2012 - NYISO submitted a filing proposing buyer-side and supplier-side ICAP market power

mitigation rules to apply to any newly created capacity zones.

June 6, 2013 - FERC issued an order conditionally accepting the proposed mitigation rules, subject

to a compliance filing.

July 8, 2013 - NYISO filed in compliance with the June 2012 order.

August 23, 2014 - FERC issued a delegated letter order accepting the July 8, 2013 compliance filing.

© 2014 New York Independent System Operator, Inc. All Rights Reserved.7

Process to Define New Capacity Zones

Rules

The Services Tariff Section 5.16 describes the required steps to identify and propose a New Capacity Zone

(NCZ) and Section 5.14 describes how an NCZ is factored into the triennial ICAP Demand Curve reset

process.

The NYISO is required to

•Commence a triennial NCZ Study in the calendar year preceding the calendar year in which the NYISO is required to file the

ICAP Demand Curves (ICAP Demand Curve Reset Filing Year).

•Review with the stakeholders by October 1 of that preceding year the inputs and the assumptions to be used in the NCZ Study.

•Complete the NCZ Study by January 15 of the ICAP Demand Curve Reset Filing Year.

Filings

The Services Tariff requires the NYISO to make one of two types of filings on or before March 31 of each ICAP

Demand Curve Reset Filing Year.

• “[i]f the NCZ Study does not identify a constrained Highway interface, the ISO shall file with the Commission the

ISO’s determination that the NCZ Study did not indicate that any New Capacity Zone is required pursuant to this process, along with a report of the results of the NCZ Study.”

• Propose a New Capacity Zone if the NCZ Study identifies a constrained Highway interface into one of more Load

Zones, including identify the boundary of one or more NCZs and file tariff revisions to implement new NCZ(s) along with the NCZ Study results.

Process Timing

The steps were designed so that the NYISO’s filing to propose an NCZ would be made in time for it to be

considered as part of and concurrent with the periodic review of the ICAP Demand Curves for existing

Localities and the NYCA,

Pursuant to the timing in the Services Tariff, the ICAP Demand Curves for an NCZ would be effective at the

same time other revised ICAP Demand Curves; and in time for all ICAP market activities (e.g. setting the

LCRs, import rights processes) for the first Capability Year after it is proposed and accepted.)

© 2014 New York Independent System Operator, Inc. All Rights Reserved.8

Capacity Zone

(Locality)

Predefine & Eliminate

Mariann Wilczek

Capacity Market Products

New York Independent System Operator

ICAP Working Group

November 17, 2014

NYISO, Rensselaer, NY

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Objectives

Discuss whether capacity zones should be

predefined and, if so, market design concepts to

predefine capacity zones

Continue discussion whether capacity zones should

be eliminated and, if so, market design concepts to

eliminate capacity zones

© 2014 New York Independent System Operator, Inc. All Rights Reserved.2

Request from October 30 MIWG

Stakeholders requested a presentation on how PJM

and ISO-NE eliminate capacity zones

Stakeholders recognized that this request was in the context of markets

that had different capacity zone constructs

The following slides provide a brief overview of how

PJM predefines and eliminates capacity zones

ISO-NE will be presented at a future ICAP Working Group meeting

© 2014 New York Independent System Operator, Inc. All Rights Reserved.3

PJM - Locational Deliverability Area

Locational Deliverability Area (LDA) - Reliability Assurance Agreement

Sub regions used to evaluate locational constraints. LDAs include EDC zones, sub-zones and

combination of zones. A Zone is an area within the PJM Region or such areas that may be

combined as a result of mergers and acquisitions; or added as a result of the expansion of the

boundaries of the PJM Region. A Zone will include any Non-Zone Network Load located outside the PJM Region that is served from inside a particular Zone.

Limited ability to import capacity due to physical limitations of the transmission system, voltage

limitations or stability limitations.

There are currently 27 LDAs.

PJM will analyze the need for an addition of an LDA - Manual 14b

RTEP Market Efficiency Analysis - constrained facilities will be identified(persistent congestion on

a 500kV or above facility or interface) for multiple years beyond the next Base Residual Auction

RTEP Long Term Planning - Future constrained facilities or clusters of facilities are identified

utilizing the long term planning analysis. Potential facilities are screened using thresholds that are utilized in the RTEP long-term planning studies. This analysis is updated annually based on

approved RTEP upgrades. 500 kV and above facilities that advance more than three years between RTEP cycles are identified for further consideration. If the driver for a 500 kV facility advancing

more than three years is linked to a specific event (e.g. significant generation retirement), it may

require further analysis.

Once a facility has been identified utilizing the above methods, distribution factor analysis is

utilized to determine the specific busses included in the analyzed LDA.

The sequence of evaluating areas of differing size involves nesting small sub-areas into larger

areas and finally areas into larger geographical areas of Locational Deliverability Area (LDA).

Any other party may propose to PJM a new LDA and they will study

PJM required to file with FERC if a new LDA (or aggregate of LDAs) is warranted

Sources - PJM Schedule 10.1 of Reliability Assurance Agreement, PJM Manuals 14b PJM Region Transmission Planning Process, Manual 20 - PJM

Resource Adequacy Analysis, Manual 18 - PJM Capacity Market, Manual 35 - PJM Definitions

© 2014 New York Independent System Operator, Inc. All Rights Reserved.4

PJM - Load Deliverability Study (CETO/CETL)

Manual 18 - PJM Capacity Market

The process of determining the Installed Reserve Margin (IRM) that meets the PJM reliability criterion

assumes that the internal RTO transmission is adequate and any generation can be delivered to any

load without transmission constraints. This process helps in determining the minimum possible IRM

for the RTO. However, since transmission may have limitations, after IRM is determined a Load

Deliverability analysis is conducted. The RTO is divided into different sub-regions for this analysis.

These sub-regions are referred to as Locational Deliverability Areas (LDAs) in the Reliability Pricing

Model.

The first step in the Load Deliverability analysis is to determine the transmission import capability

required for each LDA to meet the area reliability criterion of Loss of Load Expectation of one

occurrence in 25 years. This import capability requirement is called Capacity Emergency Transfer

Objective (CETO), expressed in megawatts and valued as unforced capacity. The standard generation reliability evaluation model is used to determine CETO.

The second step in Load Deliverability analysis is to determine the transmission import capability

limit for each LDA using the transmission analysis models. For this analysis, a Transmission Upgrade

including transmission facilities at voltages of 500 kV or higher that is in an approved Regional

Transmission Expansion Plan (“Backbone Transmission”) will be included in the system model only

if it satisfies the project development milestones set forth in the tariff. This import capability limit is

called Capacity Emergency Transfer Limit (CETL), expressed in megawatts and valued as unforced

capacity.

If CETL value is less than CETO value, transmission upgrades are planned under the Regional

Transmission Expansion Planning Process (RTEPP). However, higher than anticipated load growth and unanticipated retirements may result in the CETL value being less than CETO value with no lead time to build transmission upgrades to increase CETL value. These conditions could result in

locational constraints in the RTO.

Sources - PJM Schedule 10.1 of Reliability Assurance Agreement, PJM Manuals 14b PJM Region Transmission Planning Process, Manual 20

- PJM Resource Adequacy Analysis, Manual 18 - PJM Capacity Market, Manual 35 - PJM Definitions

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

5

PJM - Locational Constraints

Locational Constraints are localized intra-PJM capacity import capability limitations (low CETL

margin over CETO) that are caused by transmission facility limitations or voltage limitations that are identified for a Delivery Year in the PJM Regional Transmission Expansion Planning Process (RTEPP) prior to each Base Residual Auction. Such locational constraints are included in the RPM to

recognize and to quantify the locational value of capacity within the PJM region.

An LDA is modeled if:

LDA has CETL < 1.15 CETO

LDA had locational price adder in any of three immediately preceding Base Residual Auctions

LDA is likely to have a locational price adder based on a PJM analysis using historic offer price

levels

LDA is EMAAC, SWMAAC, and MAAC

An LDA that does not meet the criteria above may be modeled if PJM identifies reliability

concerns with LDA

LDAs modeled in a Base Residual Auction are modeled in the Incremental Auctions for the

Delivery Year

A Reliability Requirement and a Variable Resource Requirement Curve will be established for each

constrained LDA to be modeled in the RPM Base Residual Auction.

Capacity Import Limits

First modeled in 2017/2018 year that will limit the delivery of capacity from external source

zones

Sources - PJM Schedule 10.1 of Reliability Assurance Agreement, PJM Manuals 14b PJM Region Transmission Planning Process, Manual 20

- PJM Resource Adequacy Analysis, Manual 18 - PJM Capacity Market, Manual 35 - PJM Definitions

© 2014 New York Independent System Operator, Inc. All Rights Reserved.6

PJM - LDAs

Mitigation

VRR Curves

Locational Requirements

© 2014 New York Independent System Operator, Inc. All Rights Reserved.7

NYISO - Predefine Possible Options

Pursue an incremental approach first

Based on the tariff’s current deliverability construct

• Look at what constraints are likely to bind or where there are likely to be

export constrained zones

The MMU has proposed a dynamic process - Discussion at

August 20, 2014 and November 14 ICAP WG meetings

Complicated to define

Complicated to administer

Requires significant changes to the current capacity market PJM approach

© 2014 New York Independent System Operator, Inc. All Rights Reserved.8

NYISO - Eliminate Possible Options

Actual or projected price convergence with the NYCA

clearing price

Deliverability Constraints are Eliminated

No need to eliminate as prices will converge or nearly

converge

© 2014 New York Independent System Operator, Inc. All Rights Reserved.9

Potential Triggers for Elimination

of a Capacity Zone

Actual or projected price convergence with the NYCA clearing price

What period of time - past or future or both

• How many months, consecutive ?

• Studies performed that the prices converge in a period in the future ?

• Does the IRM/LCR setting process impact the convergence ? Upcoming Market Events

• Transmission builds and enhancements - how far ahead, base case

inclusion rules

• Resource retirements/additions

• What is retiring/being added ? When ?

• Should Mothballs and ICAP Ineligible be considered ?

• How to look forward without Demand Curves for those periods How to look at Price Convergence

• Planning Studies

• Deliverability study, IRM/LCR study, a combination of planning studies or other study ?

• How far out is the study horizon ?

© 2014 New York Independent System Operator, Inc. All Rights Reserved.10

Triggers for Zone Elimination (cont)

Deliverability Constraints are Eliminated

What MW threshold is required to cause elimination

• Incremental MW of interface deliverability capability have been added to

eliminate all likelihood that the interface will become constrained within the horizon period ?

• Compare amount of incremental interface capability to what ?

• What about Generator retirements/additions?

Planning Horizon

• What is the time required to show the deliverability constraint has been

adequately relieved ?

•5 years ? 10 years ? Other ?

• Baseline , inclusion rules ?

• Scenarios

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

11

Alternative Position

No need to eliminate as prices will converge or nearly

converge

Other analysis to support

Changes to the IRM/LCR processes and/or DCR Export constrained zone

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

12

Potential Issues to Elimination

Mitigated Units (buyer-side and supplier-side)

Buyer -side (BSM)

• If a mitigated unit is no longer in a mitigated zone is it no longer

subject to an Offer Floor ?

• What if the eliminated zone becomes a mitigated capacity zone in

the future ?

• New units could enter the newly eliminated zone and not be

mitigated and others still mitigated

• Continuation of BSM without the associated Locality creates a

disconnect and unlikely the mitigated unit will come out of

mitigation

Supplier-side (Pivotal Supplier)

• Are business decisions affected by the uncertainty of whether or

not this might apply

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

13

Potential Issues to Elimination (con’t)

CY deliverability study , impacts to SDU cost allocations,

built or not built

Import Rights analysis Tariff rule changes Software issues

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

14

Timing

When and how frequently is the periodic planning study or

other analyses done?

Seasonal

Annual

With NCZ study in a DCR year

Should elimination be coupled with examination of other new

zones or a reconfiguration of an existing one

What time frame does the elimination become effective ?

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

15

Studies and Analyses Impacted

Impacts

What type of impacts

Consumer impacts CRP, RNA

Do market based or backstop solutions impact the elimination

of a zone ?

• If so, how ?

Interconnection, Class Year and Deliverability Studies MMA BSM determinations linked to CY Studies

Timing of studies for zone elimination may conflict with

existing studies; e.g., DCR and IRM/LCR Studies

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

16

Next Steps

Elimination

Provide highlights of ISO-NE

Continue stakeholder discussions on elimination concepts into

2015

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

17

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

18

Treatment of Zone K Export

Constraints into the G-J

Locality :

Market Design Concept

Randy Wyatt

Capacity Market Products

New York Independent System Operator

MIWG/ICAPWG

December 18, 2014

NYISO, Rensselaer, NY

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Background: How did we get here?

The NYISO Tariff provides for the creation of import

constrained zones (Localities)

Tariff prescribed triennial process

New Capacity Zone (NCZ )Study / Highway deliverability constraint test MST §5.16.2 - “In determining the New Capacity Zone Boundary, the ISO

shall consider the extent to which incremental Capacity in individually

constrained Load Zones could impact the reliability and security of the

other constrained Load Zones, taking into account interface capability between the constrained load zones.” (emphasis added)

Other than the above, the tariff is silent on treatment of export constraints

into a Locality

On April 30, 2013 the NYISO filed with FERC to create a G-J NCZ

• K was not included in the NCZ boundary based on reliability analysis, ( MST

§5.16.2 )

•2013 BPWG Process identified MDCP for modeling export constraints in the

ICAP Auction

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

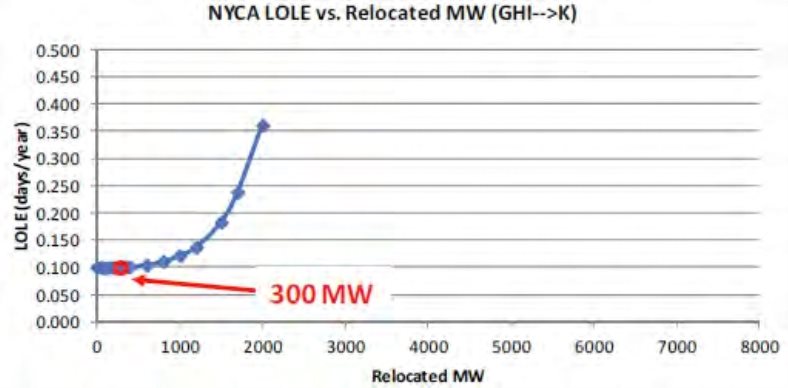

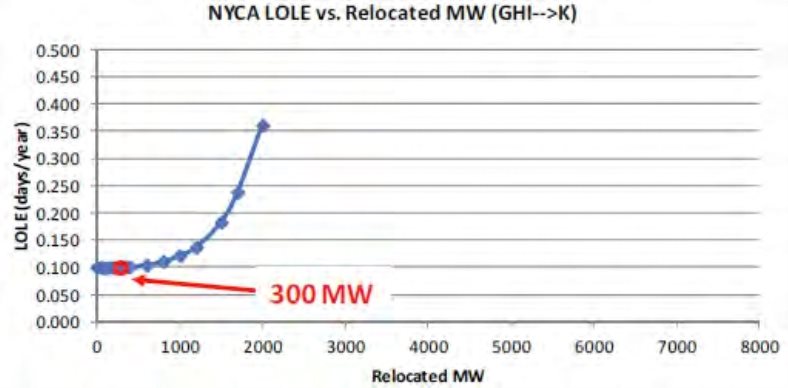

FERC Tech Conference

The purpose of the conference was to discuss

whether or not to model Load Zone K export-

constraints in future Demand Curve reset

proceedings.

NYISO presented transmission security

analysis and resource adequacy analysis

material that demonstrates a 300 MW export

limit from K to GHI

MMU and stakeholder comments support

valuing K capacity reliability benefits in the

new Locality

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

11/25/14 FERC Order

Resulting from the FERC Technical

Conference

FERC’s order

Directed the NYISO to work with stakeholders “to explore

whether a proposal can be developed that could reduce

the cost of procuring capacity while meeting the NYISO LOLE objective.”

Directed the NYISO to “explore the issues and evaluate

the proposals discussed at the conference, including the

MMU’s recommendations, through its stakeholder

process and file an informational report with the Commission by June 1, 2015.”

“[A]gree[d] with NYISO that it is premature to require it to file tariff language by June 1, 2015.”

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

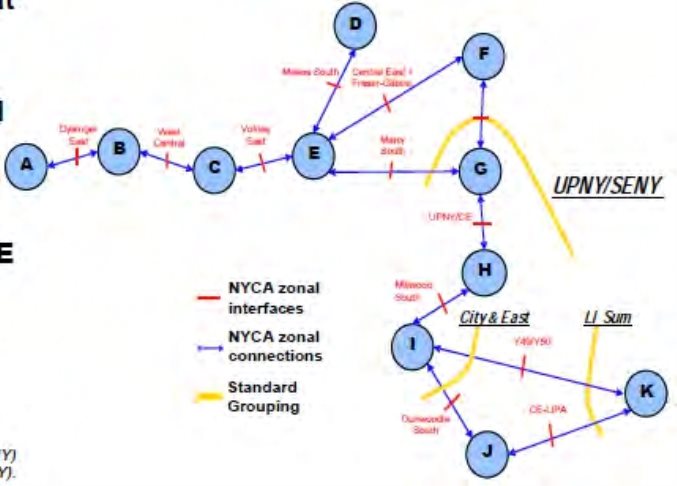

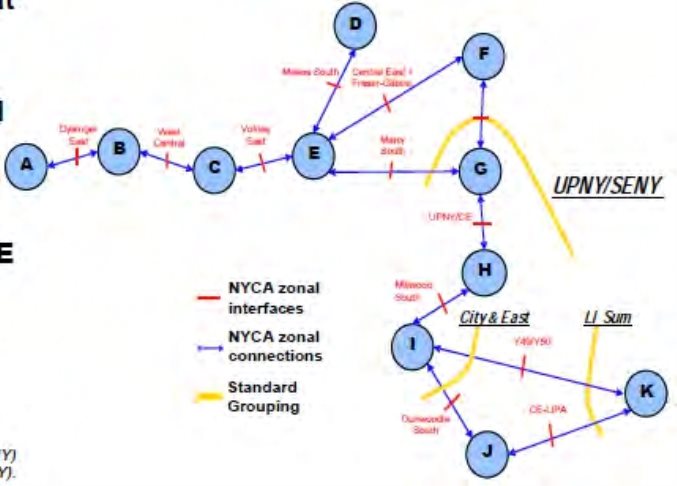

Pricing Hierarchy Rules

Hierarchy rules link Market-Clearing Price (MCP) outcomes in

the auctions

If NYC MCP < G-J* MCP, set NYC MCP = G-J* MCP If G-J MCP < ROS MCP, set G-J MCP = ROS MCP If LI MCP < ROS MCP, set LI MCP = ROS MCP

Rest of State

* G-J Locality

consists of the Lower

Lower

Hudson

Valley

New York City

Long Island

Hudson Valley

(Zones G-I) and New York City (Zone J)

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Capacity Market Mechanics: Background

Conduct and solve Spot auctions for all Demand Curve “regions”

(i.e., the 3 Localities and the NYCA), MW that clear above a

Locality’s Locational Minimum Installed Capacity Requirement

(LCR) are automatically “offered” to satisfy LSEs’ additional

minimum requirements as follows

Zone J MW that clear above requirements are offered in the G-

J Locality.

Zone K MW and G-J Locality MW that clear above

requirements are offered in NYCA.

Resale of the MW that cleared above LCRs offsets the cost to

load in the Locality

Revenue to ICAP Suppliers in Localities where MW cleared

above requirements is not impacted by the resale

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

NYISO’s Proposed Market Design Concept

Originally presented at FERC Tech Conference

NYISO conceptual design elements

One export constrained zone: Load Zone K Set up rules to ensure equivalent results to a

simultaneous solution

• Determination of a cap on Zone K capacity that could be

used to satisfy the G-J LCR

• Model Zone K export caps in the Spot Auction

• This cap would stay fixed in the Spot auction

• Explore mitigation rules and subsequent settlement rules

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Market Design Concept:

Auction Mechanics for Treatment of

Export Constraints into a Locality

Solve the auction as we do today, apply hierarchal

pricing rules to result in a simultaneous auction

outcome, with an additional step

Offer the MW that clear above the Zone K LCR, up

to the K export limit MW, into the G-J auction at a

zero price

Offer the remaining MW that clear in K above the

Zone K LCR (i.e., those above the export limit) into

NYCA at a zero price

Clear NYCA same as today

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Questions and Comments

The NYISO is seeking comments on

the treatment of Zone K export

constraints

Additional comments, beyond those

received at today’s presentation,

should be sent to

DEckels@NYISO.com by January 7,

2015

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

Next Steps

January - review feedback from

stakeholders re: Treatment of Zone K

Export Constraints

February - Continue discussions with

stakeholders including stakeholder

feedback and alternative approaches

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

© 2014 New York Independent System Operator, Inc. All Rights Reserved.

This Numeric Example has been posted on February 19, 2015 with the December 18, 2014 MIWG Materials to accompany

the NYISO presentation entitled: "Treatment of Zone K Export Constraints into the G‐J Locality: Market Design Concept"

RequirementsLI LSENYC LSELHV LSEROS LSETotalsRequirementsLI LSENYC LSELHV LSEROS LSETotals

LI Zone60000006000LI Zone60000006000

NYC Zone0100000010000NYC Zone0100000010000

GHIJ Zone0105004500015000GHIJ Zone0105004500015000

NYCA (TD) Zone65001100050001750040000NYCA (TD) Zone65001100050001750040000

GHI Zone0500450005000GHI Zone0500450005000

ROS Zone5005005001750019000ROS Zone5005005001750019000

SupplyLINYCLHVGHIJ TotalROSNYCA TotalSupplyLINYCLHVGHIJ Total ROS

Base Case7000110005500165001750041000Base Case70001100055001650017500

Base Case ‐ LI with 1000MW of Excess over LCR Rqmt., 500MW in Excess of NYCA IRM Rqmt. Export Case ‐ 300MW (Export Limit) of LI Excess to G‐J, LI LSE's Receive G‐J $

LINYCGHIJNYCALI LSE ‐> GHIJLINYCGHIJ NYCA

Clearing Prices$7$18$12$6Clearing Prices$7$18$10$6

LocationLINYCLHVROSTotalsLocationLINYCLHVROSTotals

Paid to Generators$49,000,000$198,000,000$66,000,000$105,000,000$418,000,000Paid to Generators$49,000,000$198,000,000 $55,000,000 $105,000,000 $407,000,000

LI Requirement60000006000LI Requirement60000006000

LI Excess10000001000LI Excess10000001000

LI Purchased70000007000LI Purchased70000007000

NYC Requirement0100000010000NYC Requirement0100000010000

LI ‐> J Export00000LI ‐> J Export00000

NYC Excess01000001000NYC Excess01000001000

NYC Purchased0110000011000NYC Purchased0110000011000

GHIJ Requirement0105004500015000GHIJ Requirement0105004500015000

LI‐> GHIJ Export00000LI‐> GHIJ Export‐3002109000

GHIJ Excess0105045001500GHIJ Excess0105045001500

GHIJ Purchased0115504950016500GHIJ Purchased‐300117605040016500

GHI Purchased0550495005500GHI Purchased‐300760504005500

NYCA Requirement65001100050001750040000NYCA Requirement65001100050001750040000

NYCA Excess162.5275125437.51000NYCA Excess162.5275125437.51000

NYCA Purchased6662.511275512517937.541000NYCA Purchased6662.511275512517937.541000

ROS Purchased‐337.5‐27517517937.517500ROS Purchased‐37.5‐4858517937.517500

Total Costs to LoadTotal Costs to Load

LI$49,000,000$0$0$0$49,000,000LI$49,000,000$0$0$0

NYC$0$198,000,000$0$0$198,000,000NYC$0$198,000,000$0$0

GHI$0$6,600,000$59,400,000$0$66,000,000GHI($3,000,000)$7,600,000$50,400,000$0

ROS($2,025,000)($1,650,000)$1,050,000$107,625,000$105,000,000ROS($225,000)($2,910,000)$510,000$107,625,000

Total$46,975,000$202,950,000$60,450,000$107,625,000$418,000,000$418,000,000Total$45,775,000$202,690,000$50,910,000$107,625,000$407,000,000

The prices and quantities used in the example are not actual values but are approximated to show relative magnitudes for the purpose of this illustration.

2013 State of the Market Report

Recommendation to Enhance Locational

Pricing in the Capacity Market

Pallas LeeVanSchaick

NYISO Market Monitoring Unit

Potomac Economics

Installed Capacity Working Group

August 20, 2014

Introduction

• Additional details were requested about Recommendation #1 in

the 2013 SOM Report, which was to:

Create a dynamic and efficient framework for reflecting

locational planning requirements, including:

a) Pre-defining interfaces/zones to satisfy planning reqs

b) Granting financial capacity transfer rights for Tx upgrades

c) Set demand curves to minimize cost to satisfy planning reqs

• This presentation covers:

Concerns with current capacity market framework

Principles and objectives of an enhanced framework

Key elements of an enhanced framework for (a), (b), & (c)

An alternative concept for (a) & (c)

- 2 -

Current Capacity Market Framework:

Overview of Concerns

• The following slides discuss five concerns with the current rules:

1) The delay in the creation of an NCZ in SENY has contributed

to an increase in overall costs for loads in recent years;

2) Prices are inconsistent with the value of resources in each

zone, leading to over-procurement in low-value areas;

3) Transmission projects are not compensated for their value in

the capacity market, undermining incentives for investment;

4) If additional retirements lead to resource adequacy issues

outside SENY, the capacity market will not provide efficient

signals for investment; and

5) The capacity market does not provide incentives for helping

resolve transmission security issues, although these have

become increasing prevalent in recent RNAs.

- 3 -

Current Capacity Market Framework:

Effects of Delay in Creation of NCZ in SENY

• Resource Adequacy & Transmission Security issues for UPNY-

SENY have long been identified in planning studies.

• The slow process for creating the G-J Locality has:

Contributed to the 21 percent decline in Lower Hudson Valley

unforced capacity from Summer 2006 to Summer 2013;

Led to years of inflated LCRs and capacity prices for NYC (e.g.,

3 percent increase in LCR $47/kW for 2013/14);

Erected inefficient barriers to entry in Zones A to F where new

resources would be subject to a more stringent Highway

Deliverability Test; and

Contributed to a dramatic change in capacity prices for the Lower

Hudson Valley from 2013/14 to 2014/15 (instead of gradual one).

• Under the current process, a new NCZ would be created 2 to 4

years after similar problems would emerge in the future.

- 4 -

Current Capacity Market Framework:

Prices Not Consistent with Reliability Value

• The reliability value of adding resources in each area could be

more efficiently reflected in the Demand Curves or the LCRs.

Capacity prices are not consistent with the LOLE impact of

additional capacity in each area (in the scenario below where each area is at its LCR/IRM). Note, as Zone K capacity rises above the LCR, LOLE impact falls more quickly than in other areas.

2013 SOM Table 7: Cost of Improving Reliability from Additional Capacity

Monthly DemandAnnual Change inAnnual Cost of

Curve ReferenceLOLE from 100 MW1 Percent LOLE

Point ($/kW-mo)Capacity AdditionImprovement

Locality(1)(2)=(1)/(2)

G-J Locality$12.140.9%$12 Million

NYCA$8.840.3%$27 Million

Zone J (New York City)$18.551.0%$17 Million

Current Capacity Market Framework:

Under-Compensating Transmission Investment

• The current market rules provide no capacity payments to most

internal transmission facilities.

However, transmission investment can significantly reduce the

cost of maintaining adequate installed reserve margins.

- Transmission provides a benefit in capacity market

comparable to generation.

This may lead to under-investment in transmission.

• New generation projects may be able to interconnect in a

manner that increases TTC on key interfaces.

However, this may require additional expenditures.

Hence, generators may forego opportunities to increase TTC,

since they receive no compensation in the capacity market.

Current Capacity Market Framework:

Effects of Future Retirements

• Future retirements could change the distribution of resources

dramatically, which could increase the importance of interfaces

not currently addressed in the capacity market.

Example: Retiring Ginna & Huntley would lead to resource

adequacy violations in western New York.

- The result of those events under the current market rules

would be an increase in the IRM and/or LCRs.

• Even if necessary NCZs are eventually created, the lengthy and

uncertain process will not provide efficient market incentives

when critical resource adequacy needs arise in the future.

Investors will not have incentives to enter until after these

issues become critical and costly.