10 Krey Boulevard Rensselaer, NY 12144

August 26, 2014

By Electronic Delivery

Honorable Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc., Informational Filing, Docket

No. ER12-1653-00_,

Dear Ms. Bose:

The New York Independent System Operator, Inc. (“NYISO”) hereby submits the

Informational Filing required by Ordering Paragraph D of the Commission’s November 6, 2012 Order1 and Ordering Paragraph B of the Commission’s May 31, 2013 Order.2 In both Orders the Commission requested this Informational Filing be provided fourteen months3 following the effective date of the NYISO’s Order 755 tariff amendments and software changes, implemented in satisfaction of the Commission’s Order No. 755 directives. The NYISO’s Order 755 tariff amendments and software became effective with the June 26, 2013 market day.

I.Background

The NYISO’s Regulation Service4 market schedules suppliers using their capacity offer for Regulation Service and a single, composite price bid made up of the sum of i) the price

offered for Regulation Capacity and ii) the product of the price offered for Regulation Movement and the uniform Regulation Movement Multiplier (“RMM”). The uniform RMM is a multiplier applied to a unit’s Regulation Movement bid to allow the software to treat that price offer as comparable to the price offer for Regulation Capacity and thus to select a marginal resource by evaluating the price offers from all suppliers comparably.

1 New York Independent System Operator, Inc 141 FERC ¶ 61,105 (2012) (“November Order”)

2 New York Independent System Operator, Inc. 143 FERC ¶ 61,194 (2013) (“May Order”)

3 New York Independent System Operator, Inc. 143 FERC ¶ 61,194 (2013)

4 Capitalized terms used but not defined in this filing shall have the meanings given to them in the Services

Tariff.

Honorable Kimberly D. Bose August 26, 2014

Page 2

Day-Ahead and real-time prices for Regulation Capacity and Regulation Movement are set as the Regulation Capacity bid and Regulation Movement bid, respectively, of the marginal resource needed to fulfill the NYISO’s Regulation Service capacity requirement. Included in

these prices are any cross-product opportunity costs that result from the scheduling of Regulation Service on the marginal facility.

Units are scheduled to provide Regulation Capacity and are then dispatched in real-time to provide Regulation Movement. Scheduled resources are paid for the MWh of Regulation Movement provided in response to the NYISO’s Automatic Generation Control (“AGC”) signal at the market price for Regulation Movement. A performance penalty is charged to resources who do not respond adequately to the NYISO’s AGC signal.

II. The Commission’s Questions and a Summary of the NYISO Response

The Commission directed NYISO to file an informational report analyzing:

A) Its experience, including the degree to which the uniform RMM accurately reflects

the dispatched movement of Regulation Service providers and allows the market to

provide appropriate incentives and cost recovery, particularly as regards to the

interaction between the use of a uniform RMM and setting the Regulation Movement

Market Price.5 Do Regulation Movement prices appropriately compensate the

provision of that service?6

B) Whether the uniform RMM accurately reflects the dispatched movement of

Regulation Service providers.7

C) Whether discrepancies between the RMM and the actual movement that regulation

resources are asked to provide impact the efficiency of the ultimate market prices

paid for Regulation Movement.8

D) Whether it would be more appropriate to use resource specific RMMs, including

some method to recognize that faster-ramping resources scheduled to provide

Regulation Capacity likely will provide more Regulation Movement than slower-

ramping resources.9 Given NYISO’s uniform RMM assumption and proposed method for determining Regulation Movement prices, is the Regulation Movement Market Price compensatory?10

5 November Order P 56.

6 Id. P 62; See also text at ft.nt 10

7 Id. P 60

8 Id. P 62

9 November Order P 62

10 Id. P 63.

Honorable Kimberly D. Bose August 26, 2014

Page 3

The Commission also requested that the NYISO submit a compliance filing containing

either a fully-supported demonstration that NYISO’s interim market power mitigation proposal

meets the requirements of Order No. 755 and the November 6, 2012 Order as a permanent

market power mitigation method or tariff revisions proposing permanent market power

mitigation measures that meet the requirements of Order No. 755 and the November 6, 2012

Order.11

The NYISO’s experience indicates that the uniform RMM allows the market to provide

appropriate incentives and supplier cost recovery particularly with regard to Regulation

Movement and that its Regulation Movement prices appropriately compensate the provision of

Regulation Movement service. However, data on the ratio of instructed Regulation Movement

and average procured Regulation Capacity shows that the set point of the uniform RMM may

need to be adjusted to more accurately reflect the current dispatched Movement of Regulation

Service providers.

Nonetheless, the NYISO’s investigation has revealed that any discrepancies between the RMM and the movement that regulation resources are scheduled to provide did not impact the overall efficiency of the market prices paid for Regulation Movement.

The NYISO’s experience also indicates that it would not be more appropriate to use

resource specific RMMs. Appropriate compensation for Regulation Movement results from a uniform RMM and it is unnecessary to use a resource-specific RMM in order to provide

appropriate compensation.12

Finally, the market power mitigation proposal offered by the NYISO in its January 22, 2013 compliance filing meets the requirements of Order No. 755 and the November 6, 2012 Order as a permanent market power mitigation method.

III.Analysis and Conclusions

A. 1. The Uniform RMM allows the market to provide appropriate

incentives.

The uniform RMM is a multiplier applied to Regulation Movement Bids to treat them as

comparable to Regulation Capacity Bids and allow the scheduling and pricing solution to use a

single price bid when scheduling resources to fulfill the NYISO’s Regulation Service

requirement. As explained in the NYISO’s August 17, 2012 filing in this docket, the RMM was

developed by creating a ratio of Regulation Movement MW to Regulation Capacity MW using

data from the 29 month period from January 2010 through May 2012.13 Over the first 9 months

11 New York Independent System Operator, Inc., 143 FERC 61,194 (“May Order”) P 35.

12 A resource-specific RMM would recognize that faster-ramping resources scheduled to provide

Regulation Capacity are likely to provide more Regulation Movement than slower-ramping resources.

13 New York Independent System Operator, Inc. Docket ER12-1653-000, Further Compliance Tariff Revisions, August 17, 2012, at page 3. See also, Attachment I, Affidavit by Rana Mukerji.

Honorable Kimberly D. Bose August 26, 2014

Page 4

of the new market design, the NYISO’s analysis of the amount of Regulation Movement

instructed per MW of Regulation Capacity procured revealed that a reasonably accurate predictor of the amount of Regulation Movement the NYISO will procure is the historical average ratio between the MW of Regulation Movement provided to the amount of average amount of

Regulation Capacity scheduled.

The NYISO performed a time series analysis including observations of instructed

Regulation Movement from June 30, 2013 to March 31, 2014. No overall noteworthy trends or

regular seasonal fluctuations were found in the amount of Regulation Movement scheduled over

this time period. This reveals that an average ratio of Regulation Movement to Regulation

Capacity can adequately predict the amount of Regulation Movement per MW of Regulation

Capacity that will be scheduled. In other words, history is a reasonable predictor of the future

and the RMM reasonably represents how much Regulation Movement any resource will be

instructed to provide.

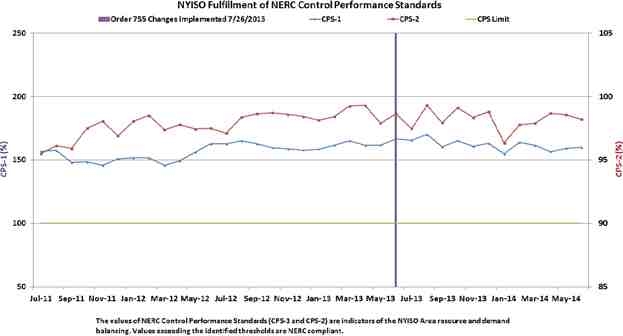

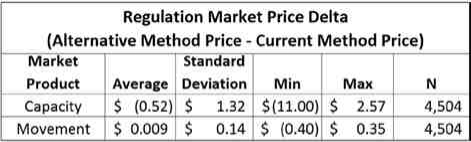

In addition, the use of a uniform RMM has not negatively impacted reliability metrics.

The NYISO has maintained CPS1 and CPS2 reliability compliance while using a uniform RMM

to establish market prices for Regulation Movement and Regulation Capacity (see Figure 1).

FIGURE 1

Honorable Kimberly D. Bose August 26, 2014

Page 5

A. 2. The use of a uniform RMM with the current Regulation Service

market-based pricing methodology allows adequate cost recovery for Regulation Service.

The current pricing methodology for Regulation Movement, as mentioned above, will

compensate a resource at a market price for Regulation Movement which, on a per MWh basis,

may be less than its MWh bid for Regulation Movement. However, the NYISO guarantees with

a supplemental payment the difference between the day’s compensation for energy and Ancillary

Services provided and the day’s bid-in cost for those services.14 By analyzing its time-series of

data from from 6/26/2013 to 6/30/2014, the NYISO determined that the bid-in costs for

providing Regulation Service were covered by compensation for that service most days for

almost all units.

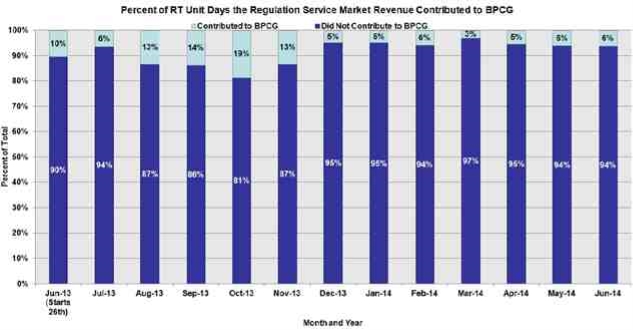

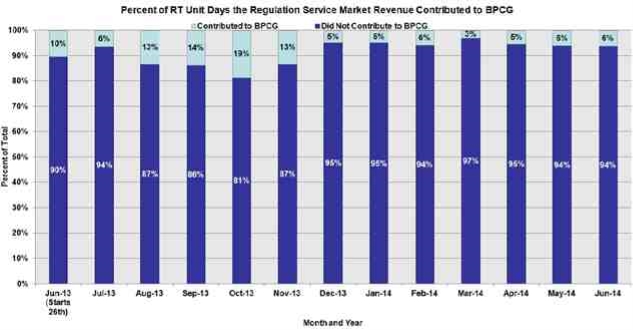

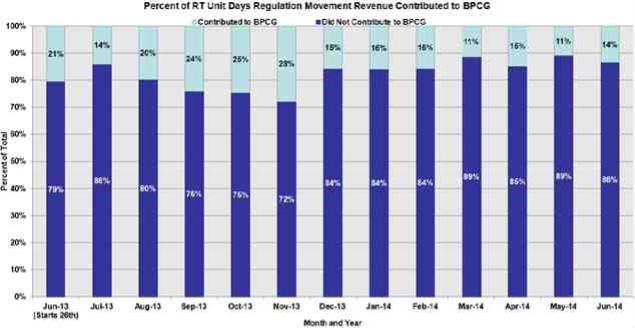

As presented in Figure 2, on the majority of days in which units bid, resources were able to cover their real-time bid costs for Regulation Service with the real-time market prices for Regulation Service. Figure 2 illustrates positive and negative daily net revenue15 from each unit providing Regulation Service. The dark blue bars represent instances where a unit’s sum of net revenue from providing RT Regulation Capacity and RT Regulation Movement was positive for the day. The light blue bars represent instances where a unit’s sum of net revenue from

providing RT Regulation Capacity and Regulation Movement was negative.

14 A Day-Ahead Bid Protection Cost Guarantee (“BPCG”) is paid when Day-Ahead revenues do not cover

Day-Ahead bid in costs and similarly pays a real-time BPCG when real-time revenues do not cover real-time bid in

costs. NYISO Market Administration and Control Area Services Tariff (“Services Tariff”) §§ 4.6.6.1, 4.6.6.3 ,

4.6.6.4 and Attachment C.

15 Net revenue for Regulation Capacity can be calculated as the market price for Regulation Capacity minus the unit’s bid-in cost of Regulation Capacity, multiplied by the number of MW provided. Similarly, net revenue for Regulation Movement can be calculated as the market price for Regulation Movement minus the unit’s bid-in cost of Regulation Movement, multiplied by the movement MW provided.

Honorable Kimberly D. Bose August 26, 2014

Page 6

FIGURE 2

The appearance of negative net revenue from Regulation Service may indicate the need

for a Bid Protection Cost Guarantee (“BPCG”) payment.16 Negative net revenue implies that a

unit’s costs for providing real-time Regulation Service on that day were not fully compensated

by payments for Regulation Service on that day. If net revenue from other market services on

that day was not enough to offset the losses in the Regulation Service market, such a unit would

be entitled to a BPCG payment. The relatively little negative net revenue from providing

Regulation Service in Real Time, revealed by Figure 2, indicates that on a significant majority of days, costs for providing real-time Regulation Service are compensated by payments for Regulation Service. Figure 2 also supports the conclusion that the use of a uniform RMM with the current Regulation Service market design is, with very few exceptions, compensating

Regulation Service providers for their costs.

A.3. Regulation Movement prices appropriately compensate for the

provision of that service.

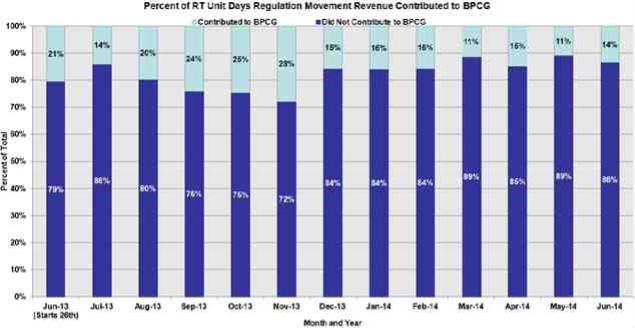

The NYISO has similarly analyzed the negative net revenue from providing Regulation Movement to understand whether the market prices paid for Regulation Movement cover

suppliers’ bid-in Regulation Movement costs. As presented in Figure 3, on the majority of days in which units bid in real-time, resources were able to cover their bid-in cost for Regulation Movement with the market price for Regulation Movement.

16 A BPCG is paid only when the revenues from all market products sold over a day, including Energy,

Operating Reserves and Regulation Service do not cover all bids for those products for those days. As a result, the contribution of negative net revenue in providing Regulation Service as seen in Figure 3 does not necessarily

indicate a BPCG will be paid.

Honorable Kimberly D. Bose August 26, 2014

Page 7

FIGURE 3

From this data, the NYISO reasonably concludes that most units earn positive net

revenue each day for providing Regulation Movement under the NYISO’s market pricing

methodology. As mentioned, a BPCG will ensure that over the day, all resources are

compensated its bid-in costs for the Energy and Ancillary Service products provided for that day.

B. Data on the ratio between Regulation Movement and Regulation

Capacity shows that the set point of the uniform RMM may need to be adjusted to more accurately reflect the current dispatched

movement of Regulation Service providers.

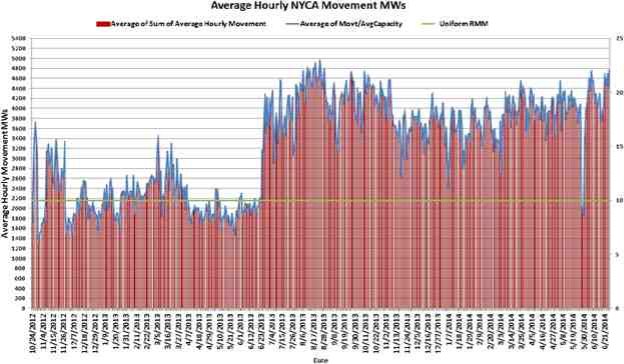

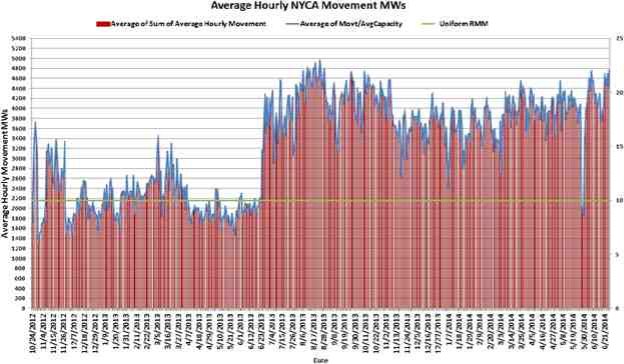

As can be seen in Figure 4, the ratio of Regulation Movement to Regulation Capacity

increased after the implementation of market changes associated with Order 755 on June 26,

2013. In addition, the ratio of Regulation Movement to Regulation Capacity in real-time has

proven to be volatile. The data is not yet sufficient to reasonably establish whether the long term

trend in the ratio of Regulation Movement to Regulation Capacity is still rising, declining or has

stabilized.

Honorable Kimberly D. Bose August 26, 2014

Page 8

FIGURE 4

Therefore, while the data indicates the current RMM may set too low, the NYISO does

not yet have sufficient data observations to be able to demonstrate the appropriate size of a

permanent adjustment. The NYISO does not want to initiate a change prematurely as a series of

changes may be detrimental to the market. The NYISO will continue to gather data in order to

establish a change to the uniform RMM that it is confident is both appropriate and will not

require a series of adjustments. It will pursue a change in the uniform RMM through the

stakeholder process. To the extent the data indicates a more appropriate RMM would include an

hourly or seasonal factor, it will suggest that as well in the stakeholder process.

The NYISO will begin its review with stakeholders of a revised RMM at the first MIWG in October, 2014. The NYISO’s goal is to present further data on the issue and, at a subsequent MIWG before the end of the year, either recommend an appropriate adjustment or explain why it does not have one.

C. Discrepancies, if any, between the established RMM and actual

movement scheduled on and provided by Regulation Service

providers does not impact the overall efficiency of the market prices paid for Regulation Movement.

The NYISO examined whether a discrepancy between the RMM and the actual

movement that Regulation Service resources provide impacts the efficiency of the market prices

paid for Regulation Movement under the existing implementation. On a theoretical level, setting

Regulation Movement and Regulation Capacity clearing prices through separate optimizations of

Honorable Kimberly D. Bose August 26, 2014

Page 9

each product, and separately selecting a marginal provider of each product could provide a more

efficient market price for Regulation Movement. However, the NYISO does not believe the

current market design negatively impacts the efficiency of these market prices and that a

redesign of the NYISO’s co-optimized selection of Energy, Operating Reserves and Regulation

Service providers is unnecessary. As mentioned in Section A.2 of this letter and as presented in

Figure 2, under the existing design, Regulation Service providers are covering the costs of

Regulation Movement with the market price received for Regulation Movement on the vast

majority of historic days evaluated. And the BPCG will ensure that over the day bid-in costs for

the energy products scheduled, including Regulation Service, will be recovered.

Nonetheless, the NYISO tested the potential efficiency of setting separate prices for

Regulation Capacity and Regulation Movement by creating a hypothetical model. In this model, the NYISO tested whether separately established Regulation Capacity and Regulation Movement prices would cover bid-in costs for the two products more completely and frequently than would market prices created using composite price bids. Establishing separate clearing prices for

Regulation Capacity and Regulation Movement would also eliminate the need to use an RMM, which is needed only if the market design uses composite bids.

Historical bids for Regulation Capacity and Regulation Movement were analyzed for

each hour between 8/1/2013 and 4/30/2014. Resource bids and ramp rates were used to create

supply curves for Regulation Movement which, in one of the two methods described below, were

also used to select units to satisfy the amount of Regulation Movement instructed in each hour of

the day.

Two conditions were considered. In one condition, the “Current Method,” a supply curve was created using each Regulation Service resource’s capacity MW and composite price bid.

This supply curve was used to select units to provide Regulation Capacity and determine the

marginal Regulation Service resource. The market price for Regulation Capacity and for

Regulation Movement was set at the Regulation Capacity bid and Regulation Movement bid,

respectively, of the marginal Regulation Service resource. Compensation for the Regulation

Movement of these units was calculated as a portion of the Regulation Movement historically procured for the hour, prorated across the resources selected for that hour based on their ramp rates and then multiplied by the Regulation Movement price.

In the other condition, the “Alternative Method,” each unit's Regulation Capacity bid and

the MW of Regulation Capacity available from the unit was used to create a supply curve to

select units to provide the Regulation Capacity requirement. The marginal Regulation Capacity

resource set the Regulation Capacity market price. Separately, each unit’s Regulation Movement

bid and ramp rate were used to create a supply curve and select units to provide the Regulation

Movement MW historically procured for the hour. Awards, to satisfy the Regulation Movement

historically procured within the hour, were based on the MW available from each resource over

the hour. The marginal Regulation Movement unit set the Regulation Movement price. As such,

the Regulation Movement price was set such that each scheduled unit’s Regulation Movement

offer would be economic.

Honorable Kimberly D. Bose August 26, 2014

Page 10

In both the Current Method and the Alternative Method resources were scheduled on an hourly basis, cross product opportunity costs were not included in prices, and resources were

assumed for the entire hour not to be ramp constrained. In both methods, hours were excluded from the analysis if the Regulation Demand curve applied to at least one interval. Total

settlements under both methods were calculated and settlement dollars were compared for each unit under both scenarios.

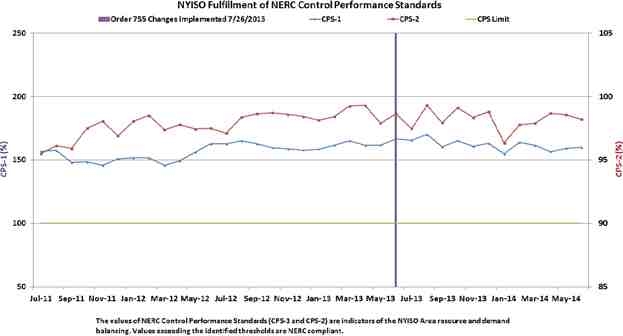

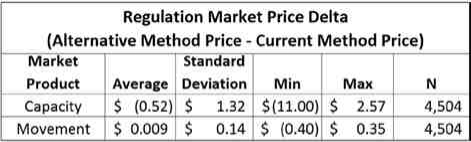

By measuring the difference in the two settlement dollar calculations for each resource,

the NYISO compared how well each method’s design compensated for the product provided. As

Figure 5 indicates, this analysis showed little difference in what each unit would be paid under

either scenario. The estimated average difference between the prices for Regulation Capacity

under the Alternative Method and Regulation Capacity under the Current Method is -$0.52. This

means that Regulation Capacity prices would be expected to decrease by 52 cents on average

under the Alternative Method relative to the Current Method. The estimated average difference

between prices for Regulation Movement under the Alternative Method and Current Method of

$.009 implies the Regulation Movement clearing price would be expected to increase by less

than one penny on average under the Alternative Method relative to the Current Method.

FIGURE 5

Thus, as figure 5 illustrates, whether scheduled using a composite bid created with an

RMM, or scheduled using separately calculated Regulation Capacity and Regulation Movement

supply curves and awarding Regulation Movement to the most economic supplier of Regulation

Movement,17 Regulation Service suppliers were paid nearly identical amounts. The NYISO

presented the aforementioned analysis as part of its stakeholder process on July 7, 2014. 18

17 The Alternative Method used two supply curves to choose the marginal providers of Regulation

Capacity and Regulation Movement but did not attempt to fully co-optimize the trade-offs between Energy,

Operating Reserves and Regulation Service that the NYISO provides in its market software. Neither did the NYISO adjust for behavior changes that may occur with such a change in market design. Nonetheless, the NYISO believes the overall findings of its analysis are appropriate to this exercise. The NYISO believes the results shown here

would have been comparable even had the Alternative Method incorporated a co-optimized scheduling of

Regulation Capacity and Regulation Movement or had the NYISO taken into account behavior changes that may

accompany a co-optimized market design.

18 This analysis was presented to Market Participants at a 7/7/2014 MIWG using a presentation found at -

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic_miwg/meeting_materials/2014-07-

07/Frequency%20Regulation%20Compensation%20July%20MIWG%20FINAL.pdf

Honorable Kimberly D. Bose August 26, 2014

Page 11

The NYISO determined that, given the technical hurdles, and the time and cost of

redesigning the NYISO’s co-optimized selection of Energy, Operating Reserves and Regulation

Service providers - a dramatic scheduling and pricing revision in the NYISO’s Day-Ahead and

real-time market software - the relatively modest gains in market efficiency are far outweighed

by the cost of pursuing them. To date, the NYISO’s stakeholders have provided no feedback

opposing this conclusion. In addition, the results of this exercise demonstrate that the use of a

uniform RMM is not a major contributor to inefficiencies in market prices for Regulation

Movement. This conclusion is also discussed below.

D. The data analyzed do not indicate it would be more appropriate to use

resource specific RMMs. A resource-specific RMM that recognizes faster-ramping resources scheduled to provide Regulation Capacity are likely to provide more Regulation Movement than slower-ramping resources is unnecessary to provide appropriate compensation for

Regulation Movement provided.

A uniform RMM remains the appropriate approach to provide comparability between Regulation Capacity and Regulation Movement price offers given the manner in which the NYISO schedules Regulation Service providers. If utilized with the current market design, resource-specific RMMs would cause faster units to appear more expensive to the optimization and thus less likely to be scheduled than slow resources.19

As established in the NYISO’s January 22, 2013 filing, the use of a uniform RMM does

not result in under-compensating a unit that provides more Regulation Movement than assumed

by the uniform RMM.20 The NYISO’s current implementation recognizes that faster-ramping

resources scheduled to provide Regulation Capacity likely will provide more Regulation

Movement than slow-ramping resources by prorating the need for Regulation Movement in AGC

based on resource ramping ability. In this way, faster moving resources will be scheduled to

provide more MW, and be compensated for more MWs at the market price for Regulation

Movement. By prorating the dispatch, and paying resources for the amount of Regulation

Movement they provide, the NYISO appropriately recognizes a faster resource’s ability to

provide more Regulation Service.21

19 The Commission was correct when it pointed out in its November Order at ft.nt 66 that “Resource

specific RMMs would increase the likelihood that a resource with a high cost of movement may not be considered economic during the Regulation Market clearing process under the NYISO’s current Regulation Service market methodology implemented in compliance with Order 755.”

20 New York Independent System Operator, Inc. Docket No. ER12-1653-000, Compliance Filing, January 22, 2013, (“January Filing”) p.4

21 See P 31 of the May Order wherein the Commission accepted that the use of a uniform RMM in the

clearing process, combined with the use of the resource-specific Regulation Movement Response Rate in dispatch, will result in reasonable commitment of and compensation to frequency regulation resources and that the use of the Regulation Movement Response Rate in the dispatch algorithm will dispatch available resources to meet system needs. “This will ensure that faster responding resources, which will be requested to provide more frequency

regulation service, will have their greater Regulation Movement reflected in their compensation.”

Honorable Kimberly D. Bose August 26, 2014

Page 12

E. The market power mitigation proposal that the NYISO offered in its

January 22, 2013 compliance filing meets the requirements of Order No. 755 and the November 6, 2012 Order as a permanent market power mitigation method.

The NYISO monitors for and mitigates uncompetitive conduct in the Regulation Service market through a conduct and impact assessment that depends upon appropriately set reference prices.22 Currently, the tariff provides that reference levels for Regulation Movement are to be determined through estimation by the NYISO and/or consultation with the resource, but not

through historical bids.23 As explained in the Affidavit of Pallas LeeVanSchaick in the NYISO’s January Filing, using historical bids to establish Regulaion Movement reference levels is

inappropriate, since resources are not incented to bid their Regulation Movement costs under the current Regulation Service market methodology:

[Because] regulation suppliers do not generally have an incentive to submit Regulation

Movement Bids at marginal cost, . . . the bid-based reference level calculation method [is] unsuitable for the Regulation Movement Bid parameter.24

Resources are not incented to bid least cost because they are scheduled based on the

composite bid offers and settled base on the Regulation Movement bid of the marginal

Regulation Capacity supplier. The NYISO’s analysis reveals, however, that any potential market power issues that may present themselves because the NYISO’s market does not provide a

market-based incentive to bid Regulation Movement at least cost have been successfully

alleviated with the Market Mitigation measures accepted as interim measures in the

Commission’s May Order.25

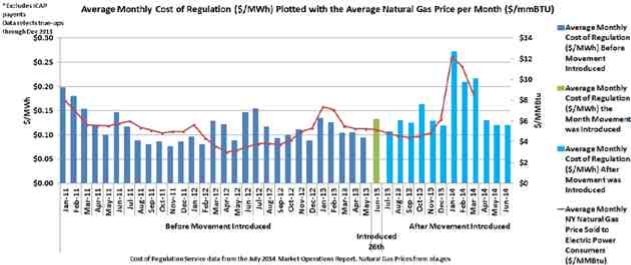

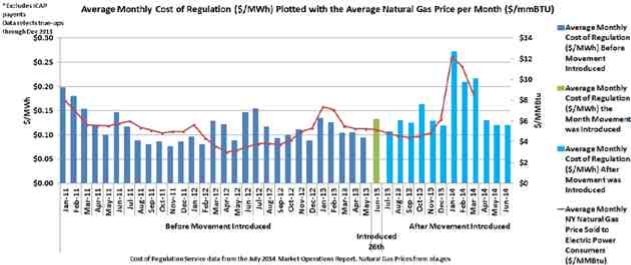

As Figure 6 illustrates, the total cost of the Regulation Service market has remained

roughly the same with the implementation of Order 755. Even though the absence of an

incentive to bid at least cost has the potential to increase the total cost of Regulation Service

considerably, the absence of increased costs to consumers implies that any incentive to bid more

than least cost is not being observed.26 Moreover, the NYISO has seen few instances of

mitigation since the movement component of the Regulation Service market was introduced.

22 See, generally, Attachment F, Section 21 of the Services Tariff.

23 Regulation Capacity reference levels may be set by reviewing the historical bids that have been

scheduled. As documented in Services Tariff Section 23.3.1.4, a reference level based on a Generator’s accepted Bids during competitive periods is the preferred calculation method, provided the NYISO has adequate

data.

24 January Filing Attachment I, P 13

25 May Order P 35

26 See: Jie Chen, Pallas LeeVanSchaick, and David Patton, 2013 State of the Market Report for the New York ISO Markets, Potomac Economics, May 2014 at Appendix J for a review of the operation of the Regulation Service Market for 2013, including the first six months of the new design.

Honorable Kimberly D. Bose August 26, 2014

Page 13

FIGURE 6

Resources may review their reference levels with the NYISO and, if they can justify a

higher reference level through the NYISO’s consultation process, the NYISO will establish a

higher reference level, allowing the resource to offer Regulation Movement and/or Regulation

Capacity at a higher price. Nonetheless, reference levels are unlikely to be higher than would be

appropriate given the reference level development discussed above as the NYISO uses an

estimation process to measure the appropriateness of existing reference levels and, when

appropriate, has revised unit references downward. Of course, Market Participants may consult

on these changes and when presented with a justification for not lowering them, the NYISO will

reset them.

The NYISO’s independent Market Monitoring Unit has authorized the NYISO to indicate that it supports the current mitigation protocols for Regulation Service providers and agrees they should be considered permanent measures. The MMU will be supplying a letter in support of that conclusion concurrently with this filing. Therefore, the NYISO believes the current

Regulation Service market mitigation measures are supportable and sufficiently robust to be

considered permanent mitigation measures in this market.

Honorable Kimberly D. Bose August 26, 2014

Page 14

IV.Communications

Communications and correspondence regarding this filing should be directed to:

Robert E. Fernandez, General Counsel

Ray Stalter, Director of Regulatory Affairs

*Mollie Lampi, Assistant General Counsel

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, N.Y. 12144

Tel: (518) 356-6000

Fax: (518) 356-4702

rfernandez@nyiso.com

rstalter@nyiso.com

mlampi@nyiso.com

*Persons designated to receive service

V.Conclusion

The NYISO respectfully requests that the Commission accept this informational filing in compliance with its directives as stated herein.

Respectfully submitted,

/s/ Mollie Lampi

Mollie Lampi

Assistant General Counsel

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, New York 12144 (518) 356-7530

mlampi@nyiso.com

cc:Michael Bardee

Gregory Berson

Anna Cochrane

Jignasa Gadani

Morris Margolis

Michael McLaughlin

David Morenoff

Daniel Nowak

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §385.2010.

Dated at Rensselaer, NY this 26th day of August, 2014.

/s/ Joy A. Zimberlin

Joy A. Zimberlin

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, NY 12144 (518) 356-6207