10 Krey Boulevard Rensselaer, NY 12144

December 27, 2013

By Electronic Delivery

Honorable Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc.’s Proposed Tariff

Amendments to Implement Simplified and Improved Proxy Generator Bus Pricing Rules; Docket No. ER14-___-000

Dear Ms. Bose:

Pursuant to Section 205 of the Federal Power Act,1 the New York Independent System Operator, Inc. (“NYISO”) hereby submits proposed amendments to its Market Administration and Control Area Services Tariff (“Services Tariff”) to simplify and improve the Real-Time Market2 pricing rules that apply at the NYISO’s external Proxy Generator Buses. Proxy

Generator Buses represent the locations where interchange between the New York Control Area (“NYCA”) and neighboring Control Areas is scheduled.3

The Tariff revisions proposed in this filing:

• consolidate and simplify the more than fifty pricing rules4 that the NYISO uses to

price External Transactions at its external Proxy Generator Buses down to just

seven core pricing rules that can be applied to a variety of circumstances (the

“Uniform Pricing Rules”);

• eliminate real-time Bid Production Cost Guarantee payments to Imports (“RT

Import BPCG”) at all NYCA Proxy Generator Buses; and

1 16 U.S.C. §824d (2013).

2 Capitalized terms not otherwise defined herein shall have the meaning specified in Section 2 of the Services Tariff.

3 A Proxy Generator Bus is “a proxy bus located outside the NYCA that is selected by the ISO to represent a typical

bus in an adjacent Control Area and for which LBMP prices are calculated.” See Section 2.16 of the Services Tariff.

4 Attachment B to the Services Tariff, Sections 17.1.6.2.1 - 17.1.6.4.3, currently specify 49 different Proxy

Generator Bus pricing rules. Additional pricing rules to determine prices at CTS-Enabled Proxy Generator Buses were accepted for filing by the Commission in Docket No. ER12-701 and are ready to be added to the Tariff when Coordinated Transaction Scheduling takes effect in November of 2014. As the NYISO explains below, the Uniform Pricing Rules proposed in this filing are intended to supersede the revisions that the Commission accepted in New York Independent System Operator, Inc., 139 FERC ¶ 61,048 (2012).

Honorable Kimberly D. Bose December 27, 2013

Page 2

• revise the calculation of the Financial Impact Charge (“FIC”) that the NYISO

imposes on External Transactions that are scheduled in the NYISO’s markets, but that fail to flow in real-time due to the actions or inaction of the scheduling

Transmission Customer, to be consistent with the Uniform Pricing Rules.

The proposed Uniform Pricing Rules will produce a more consistent set of prices at times

when Proxy Generator Buses are constrained. Today, the NYISO’s Real-Time Dispatch

(“RTD”) sets the price at all locations that are inside the NYCA, and at all Proxy Generator

Buses when they are not constrained. However, when Proxy Generator Buses are constrained

the real-time price is set by the NYISO’s Real-Time Commitment (“RTC”) in most cases. If the

NYISO’s proposed Tariff revisions are permitted to take effect, LBMPs at constrained Proxy

Generator Buses will be set based on the RTD price, modified to account for RTC External

Interface Congestion that is specific to each Proxy Generator Bus. The proposed pricing change

will subject External Transactions that are scheduled at constrained Proxy Generator Buses to

changes in the RTD price, rather than simply settling them using the RTC price.

The proposed Uniform Pricing Rules also fill a gap in the NYISO’s Proxy Generator Bus

pricing rules that must be addressed before the NYISO can implement Coordinated Transaction

Scheduling (“CTS”) at its border with PJM Interconnection, LLC (“PJM”).5 The proposed

Uniform Pricing Rules are designed to apply at all CTS Enabled Proxy Generator Buses,

including CTS Enabled Proxy Generator Buses that are associated with designated Scheduled

Lines.

The NYISO must develop and complete significant modifications to its market software

in order to implement the Proxy Generator Bus pricing rule improvements proposed in this

filing. To provide the NYISO an opportunity to modify its software to address or respond to any

guidance the Commission may provide, the NYISO respectfully requests that the Commission

issue an order by March 3, 2014 accepting the proposed Tariff revisions effective April 8, 2014.

The proposed Uniform Pricing Rules simplify the rules that the NYISO uses to determine

prices at its external Proxy Generator Buses, making it easier for Transmission Customers to

determine the pricing rule that applies in each circumstance, and permit the price set by RTD to

be incorporated into the real-time prices at all of the NYISO’s Proxy Generator Buses, thereby

allowing Proxy Generator Bus prices to reflect Real Time conditions. The Tariff amendments

proposed in this filing were approved by the NYISO’s Management Committee and its Board of

Directors.

I.Documents Submitted

1. This filing letter;

5 NYISO and PJM propose to implement CTS at their common border in November of 2014. See NYISO’s December 6, 2013 filing in Docket No. ER14-552-000.

Honorable Kimberly D. Bose December 27, 2013

Page 3

2. A clean version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment I”); and

3. A blacklined version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment II”).

II.Discussion

A. Uniform Pricing Rules

The NYISO presently has forty nine different pricing rules in place that are used to determine prices at its external Proxy Generator Buses.6 Factors that are used to determine which pricing rule to apply include:

• whether a Proxy Generator Bus is a “competitive” or “Non-Competitive” Proxy

Generator Bus7;

• whether a Proxy Generator Bus is associated with a “designated Scheduled

Line”8;

• the frequency with which scheduling decisions are being made at the Proxy

Generator Bus

o Hourly,

o Variably Scheduled (quarter-hour schedules), or

o Dynamically Scheduled (five-minute scheduling—not yet in effect9);

• whether or not the Proxy Generator Bus is constrained10; and

• the direction of the Proxy Generator Bus constraint (import constraint or export

constraint).

6 Id.

7 See New York Independent Transmission System Operator, Inc., 104 FERC ¶ 61,220 (2003), on reh’g 105 FERC ¶ 61,347 (2003); New York Independent System Operator, Inc.’s Filing of Tariff Revisions to Implement New

Pricing Rules at Non-Competitive External Proxy Generator Bus, Docket No. ER03-690-000 and attached Patton Affidavit (April 1, 2003).

8 See New York Independent System Operator, Inc., 111 FERC ¶ 61,238 at PP 6-9 (2005).

9 The Uniform Pricing Rules proposed in this filing do not address how prices will be calculated at Dynamically

Scheduled Proxy Generator Buses. The NYISO does not have any Dynamically Scheduled Proxy Generator Buses

in service yet, and improvements to the NYISO’s market software are a necessary prerequisite to NYISO

implementing Dynamic Scheduling at a Proxy Generator Bus. The NYISO will develop and obtain Commission

acceptance of Tariff revisions specifying appropriate pricing rules before it implements a Dynamically Scheduled

Proxy Generator Bus.

10 See New York Independent System Operator, Inc., 97 FERC ¶ 61, 206 (2001). ECA-B, which is discussed on

pages 4 and 5 of the Order, required the NYISO to use the Balancing Market Evaluation (“BME”) price at

constrained Proxy Generator Buses. BME was replaced by RTC when the NYISO implemented its Standard Market Design II, in February of 2005. The NYISO’s pricing rules continues to require the NYISO to replace RTD prices with RTC prices at constrained, competitive Proxy Generator Buses. See, e.g., Services Tariff Attachment B,

Section 17.1.6.2.2, pricing rule 7; Section 17.1.6.2.3, pricing rule 12.

Honorable Kimberly D. Bose December 27, 2013

Page 4

Additional Proxy Generator Bus pricing rules, addressing pricing at Coordinated

Transaction Scheduling (“CTS”) Enabled Proxy Generator Buses were accepted for filing in

FERC Docket No. ER12-701,11 and are expected to take effect in November of 2014, when the

NYISO proposes to implement CTS with PJM.12 In total, the Commission has accepted more

than fifty different pricing rules that are intended to be applied at the NYISO’s Proxy Generator

Buses.

The NYISO recognizes that it may be difficult for Transmission Customers and other

Market Participants to sort through the multitude of Proxy Generator Bus pricing rules to identify

the exact pricing rule that applies in a particular instance. The Tariff revisions proposed in this

filing will reduce the more than fifty different pricing rules down to just seven Uniform Pricing

Rules that NYISO will use to determine appropriate Proxy Generator Bus prices at all existing

Proxy Generator Buses and the CTS Enabled Proxy Generator Buses that the NYISO expects to

implement with PJM in 2014 and with ISO-New England in 2015.13 The proposed change will

significantly increase the transparency of the NYISO’s Proxy Generator Bus pricing rules.

In order to understand the proposed Uniform Pricing Rules, some background is needed

on how the NYISO’s Locational Based Marginal Prices (“LBMPs”) are calculated, and why the

LBMP calculated at a Proxy Generator Bus may differ from the LBMPs calculated at nearby

locations that are internal to the NYCA. The NYISO’s LBMPs are composed of three

components: (1) the Reference Bus (Marcy) Price, which represents the cost of Energy in the

NYCA, plus (2) the marginal cost of transmission system congestion at a location, plus (3) the

marginal cost of the losses incurred delivering Energy to Load at a location. The marginal cost

of transmission system congestion can be further broken down into: (a) the marginal cost of

congestion due to constraints at internal (NYCA) locations, and (b) the marginal cost of

congestion due to constraints at the NYISO’s external Proxy Generator Buses.

The cost of transmission system congestion at an external Proxy Generator Bus may

differ from congestion at nearby internal NYCA locations due to one or more of the following

three reasons: (i) there are more economic transactions offered in a common direction (import or

export) than the transfer limit (Available Transfer Capability or “ATC”) of the Proxy Generator

Bus can accommodate, or (ii) the need to respect the NYCA (system-wide) ramp limit is

preventing the NYISO from scheduling or de-scheduling some of the Imports or Exports at the

Proxy Generator Bus consistent with the economics of the underlying offers/bids, or (iii) the

11 New York Independent System Operator, Inc., 139 FERC ¶ 61,048 (2012).

12 See the NYISO’s December 6, 2013 filing in Docket No. ER14-552-000 at 15-17.

13 The Uniform Pricing Rules proposed in this filing are designed to be applied at CTS Enabled Proxy Generator

Buses, including CTS enabled designated Scheduled Lines and CTS enabled Non-Competitive Proxy Generator

Buses. If accepted, the Uniform Pricing Rules proposed in this filing will supersede the CTS Proxy Generator Bus pricing rules that the Commission accepted for filing in Docket No. ER12-701, and those CTS pricing rules will not become effective. In the NYISO filing proposing effective dates for the CTS Tariff revisions (which NYISO

expects to submit in October of 2014), the NYISO will identify the CTS Enabled Proxy Generator Bus pricing rule Tariff changes that are superseded by the pricing rules proposed in this filing, and will ask that they not be permitted to take effect because they have been superseded.

Honorable Kimberly D. Bose December 27, 2013

Page 5

need to respect a Proxy Generator Bus-specific ramp limit is preventing the NYISO from

scheduling or de-scheduling some of the Imports or Exports at a Proxy Generator Bus consistent with the economics of the underlying offers/bids.14 The NYISO’s proposed Tariff revisions refer to these three causes of congestion, collectively, as “External Interface Congestion” because they are only present at external Proxy Generator Buses.

External Interface Congestion is determined by RTC, which is the program responsible for scheduling External Transactions (Imports, Exports and Wheels Through) in New York.

RTD cannot schedule External Transactions, or modify External Transaction schedules. RTD sees the External Transaction schedules as fixed injections or withdrawals. For this reason, RTD is not presently able to determine External Interface Congestion.15

Under the NYISO’s proposed Tariff revisions, subtracting the External Interface

Congestion from the LBMP at a Proxy Generator Bus yields the “Proxy Generator Bus Border LBMP.” The Proxy Generator Bus Border LBMP should closely match the LBMP at nearby internal NYCA locations.

With that background, the proposed seven Uniform Pricing Rules for Proxy Generator Buses are set forth and explained below.

Pricing Rule for Unconstrained Proxy Generator Buses

Uniform Pricing Rule One—at any Proxy Generator Bus, when there is no External

Interface Congestion in RTC15 (for Proxy Generator Buses that are scheduled on an hourly basis) or in the Rolling RTC (for Variably Scheduled Proxy Generator Buses), real-time External

Transaction schedules will be settled using the real-time prices calculated by RTD. In this case, RTC is considered unconstrained for the purposes of scheduling External Transactions and the RTD prices reflect the most up to date system information for the NYCA.

Pricing Rules for Constrained, Competitive Proxy Generator Buses

Uniform Pricing Rule Two—at competitive Variably Scheduled Proxy Generator Buses when there is External Interface Congestion in the Rolling RTC, real-time External Transaction schedules will be settled using real-time prices that are calculated by adding the Rolling RTC External Interface Congestion to the RTD LBMP.16

14 Ramp limits set the maximum permitted change in net power flows over a period of time. Like limits on Total Transfer Capability (“TTC”) and ATC, ramp limits are reliability criteria that the NYISO and its neighboring Balancing Authorities are required to respect in their commitment, scheduling and dispatch.

15 Until the NYISO implements Dynamically Scheduled Proxy Generator Buses (External Transaction scheduling on a five-minute basis) RTC will determine External Interface Congestion. Enhancements will have to be made to

RTD to implement Dynamic Scheduling in New York.

16 The Rolling RTC is used to determine prices at Variably Scheduled Proxy Generator Buses. See the NYISO’s December 28, 2010 filing in Docket No. ER11-2547-000 at 6.

Honorable Kimberly D. Bose December 27, 2013

Page 6

Uniform Pricing Rule Three—at competitive Proxy Generator Buses that are scheduled on an hourly basis, when there is External Interface Congestion in RTC15, real-time External Transaction schedules will be settled using real-time prices that are calculated by adding the RTC15 External Interface Congestion to the RTD LBMP.17

Uniform Pricing Rules Two and Three address circumstances where RTC is constrained.

The proposed rules modify the currently effective settlement rules. Today, when a Proxy

Generator Bus is import or export constrained, the NYISO settles competitive Proxy Generator

Bus at the RTC price (which is the same price the NYISO uses to schedule External

Transactions). Under Uniform Pricing Rules Two and Three the NYISO proposes to add the

congestion caused by the External Interface Constraints that RTC recognizes to the RTD LBMP

to ensure that incentives remain for External Transaction customers to continue to bid

competitively. In addition, introducing the RTD LBMP into the settlement price at Proxy

Generator Buses allows for a more balanced trading risk. The risk associated with changes in

RTD prices when system conditions change includes both upside benefits (for example, an

Import scheduled in real-time will gain a financial benefit if the RTD LBMP is higher than

projected LBMP RTC used to schedule the Import), and downside risk (for example, an Import

scheduled in real-time will receive a lower than expected settlement if the RTD LBMP is lower

than projected LBMP RTC used to schedule the Import).

The NYISO offers the following simplified example to illustrate the operation of

proposed Uniform Pricing Rules Two and Three, and compare the result to the NYISO’s existing pricing rules:

There are two Transmission Customers (“Trader A” and “Trader B”) that want to

schedule Imports to the NYISO at the same competitive Proxy Generator Bus in the Real-Time Market. Each trader is offering 600 MW of Energy, and the transfer capability of the Proxy

Generator Bus is 1000 MW. There are no other import offers or export bids at the Proxy

Generator Bus. The Reference Bus LBMP in RTC18 is $100/MWh. That means RTC is willing to pay $100/MWh for Energy at all internal NYCA locations and at all Proxy Generator Buses

before constraints that limit power transfers are considered. Trader A offers to sell Energy into the NYISO for $75/MWh. Trader B offers to sell Energy into the NYISO for $-999/MWh,

meaning that Trader B is willing to pay the NYISO up to $999/MWh to accept Trader B’s

Energy. The type of import offer Trader B submitted is referred to as a “price taker” offer,

because Trader B’s offer indicates that Trader B wants its import scheduled with almost no

regard for the price Trader B is paid, or must pay.

17 RTC15 is used to determine prices at Proxy Generator Buses that are scheduled on an hourly basis. See the

NYISO’s December 28, 2010 filing in Docket No. ER11-2547-000 at Attachment II (revising the definition of RealTime Commitment (“RTC”) to specify that RTC15 will establish hourly external transaction schedules).

18 For purposes of this simplified example, “RTC” is either the Rolling RTC at a Variably Scheduled Proxy

Generator Bus or RTC15 at a Proxy Generator Bus that is scheduled on an hourly basis. The example covers one scheduling period—15 minutes at a Variably Scheduled Proxy Generator Bus, or an hour at a Proxy Generator Bus that is scheduled on an hourly basis.

Honorable Kimberly D. Bose December 27, 2013

Page 7

RTC schedules 600 MW of Energy from Trader B and 400 MW of Energy from Trader

A, based on the import offers submitted and the maximum capability of the Interface that is

represented by the Proxy Generator Bus. The price RTC sets at the Proxy Generator Bus is

$75/MWh, because the Proxy Generator Bus is constrained in the import direction, and the next

MW the NYISO would purchase if it could accept an additional MW at the Proxy Generator Bus

would be an additional MW purchased from Trader A. The External Interface Congestion in this

example is $-25/MWh—the reduction in system costs associated with an incremental relaxation

of the 1000 MW constraint limiting power transfers between the Proxy Generator Bus and the

NYCA.

By the time we reach real-time, operating circumstances have changed and are different

from what RTC expected when it scheduled the Imports.19 The RTD LBMP throughout the

NYCA and at the Proxy Generator Bus is stable at $70/MWh.20 Under the pricing rules that are

in effect today, Trader A and Trader B would each receive the RTC price of $75/MWh, even

though the price in real-time is only $70/MWh, because the Proxy Generator Bus was

constrained at the time their Imports were scheduled. Under proposed Uniform Pricing Rules

Two or Three, Trader A and Trader B would each receive the RTD price of $70/MWh, plus the

External Interface Congestion component of the RTC LBMP of $-25/MWh. So, Trader A and

Trader B would receive $45/MWh for their Imports. The difference between the RTC price at

which the Imports were scheduled ($75/MWh) and the Uniform Pricing Rule price at which the

Imports will settle ($45/MWh) is consistent with the $30/MWh reduction21 in real-time prices

that occurred between the time RTC scheduled the Imports, and the time the Energy was

delivered.

As the example illustrates, at competitive Proxy Generator Buses that are constrained in

RTC, proposed Uniform Pricing Rules Two and Three re-assign the risk of changes in real-time

prices from the NYCA loads to the Transmission Customer that scheduled the External

Transaction. As explained above, the risks that are being re-assigned from NYCA Loads to

Transmission Customers include both up-side risks and down-side risks.22 This result is

consistent with the risk that Transmission Customers that schedule External Transactions at

unconstrained Proxy Generator Buses assume today. It is also consistent with the risk that

internal NYCA Generators that are scheduled in the Real-Time Market assume. The proposed

re-assignment of risk is appropriate because Transmission Customers scheduling External

Transactions have the opportunity to incorporate a risk premium into their offers and bids to

19 At times when RTC is not constrained both the NYISO’s existing Proxy Generator Bus pricing rules and Uniform Pricing Rule One expose External Transactions to the change in price that occurred between the time the transaction was scheduled and the time the Energy is actually delivered. Proposed Uniform Pricing Rules Two and Three will improve the consistency of the Proxy Generator Bus prices the NYISO develops.

20 RTD LBMPs are determined for intervals that are ordinarily/approximately five minutes in duration. In this simplified example NYISO assumes that the RTD LBMP is $70/MWh in each interval.

21

$100/MWh RTC LBMP - $70/MWh RTD LBMP = $30/MWh price difference

22 In other words, the risk that the NYISO proposes to re-assign could increase or decrease the compensation paid to the Transmission Customer, or could increase or decrease the charges paid by the Transmission Customer.

Honorable Kimberly D. Bose December 27, 2013

Page 8

address a concern that real-time LBMPs could change in an adverse manner between the time an External Transaction is scheduled and the time the associated Energy is delivered.

Pricing Rules for Constrained Non-Competitive Proxy Generator Buses and Constrained Proxy Generator Buses that are Associated with Designated Scheduled Lines

At Non-Competitive Proxy Generator Buses and at Proxy Generator Buses associated

with designated Scheduled Lines it is not always appropriate to add External Interface

Congestion to the RTD LBMP when determining real-time settlement prices due to the potential

lack of trading liquidity at these types of Proxy Generator Buses. There are only a limited

number of Transmission Customers that are capable of submitting offers to import and/or bids to

export at Non-Competitive Proxy Generator Buses and at Proxy Generator Buses that are

associated with designated Scheduled Lines. These Transmission Customers may be able to

offer or bid in a way that determines the External Interface Congestion at the Proxy Generator

Bus.23 Consistent with the pricing rules that the NYISO has in place today to address the

potential exercise of market power and/or potential for market manipulation at these Proxy

Generator Buses,24 the NYISO proposes to employ special pricing rules to test the External

Interface Congestion to determine when it should be included in the real-time settlement price at

Non-Competitive Proxy Generator Buses and Proxy Generator Buses associated with designated

Scheduled Lines.

Uniform Pricing Rule Four—applies at Variably Scheduled Non-Competitive Proxy

Generator Buses and at Variably Scheduled Proxy Generator Buses that are associated with

designated Scheduled Lines when the Rolling RTC is constrained in the import direction.25 The

NYISO proposes to add the External Interface Congestion calculated by the Rolling RTC to the

23 In addition to concerns related to the limited number of Transmission Customers that are able to submit bids and offers at Non-Competitive Proxy Generator Buses and Proxy Generator Buses associated with designated Scheduled Lines, concerns may also exist that a non-ISO/RTO Transmission Provider might take actions that could have

significant cost consequences in the NYCA.

24 See Attachment V to the NYISO’s April 1, 2003 filing in Docket No. ER03-690-000, the Affidavit of Dr. David

B. Patton at Para. 15 (“The risk is related to the limited competition that currently exists to import or export physical power in real time.”); Para. 33 (“These [pricing] rules will appropriately limit [a Transmission Customer that

possesses market power in a neighboring market’s] ability to exercise market power in relieving real-time

congestion at the [Proxy Generator Bus], which can result in inefficient pricing at the … Proxy Generator Bus and substantial uplift cost to New York participants.”); and Para. 37 (“Under the pricing alternatives established in the

proposed [special pricing] rules applicable to both import and export constrained situations, the real-time prices at

the … Proxy Generator Bus will be allowed to rise to levels associated with competitive market conditions in New York but not to arbitrarily high or low (highly negative) levels reflecting a lack of competition at the interface.”).

See also Attachment V to the NYISO’s April 10, 2009 filing in Docket No. ER09-981-000, the Affidavit of Dr.

David B. Patton at Paras. 30, 32 (“The rule for import constrained situations prevents the NYISO from being

subjected to paying uneconomic prices to reduce imports from New England and PJM” and “the rule for export

constraints will prevent Market Participants from extracting substantial market power rents when their imports must be accepted in real-time as counter-flow to relieve the export constraint”).

25 Meaning that there are more economically desirable offers to import MWs to the NYCA available at the Proxy

Generator Bus than the NYISO can accept. When a Proxy Generator Bus is subject to an import constraint the RTC price would ordinarily be expected to be lower than the internal NYCA bus prices at nearby locations.

Honorable Kimberly D. Bose December 27, 2013

Page 9

RTD LBMP at the Non-Competitive Proxy Generator Bus or Proxy Generator Bus associated

with a designated Scheduled Line, as long as the Rolling RTC LBMP for the Proxy Generator

Bus is greater than zero. When the Rolling RTC LBMP for the Proxy Generator Bus is negative

External Transactions will settle at the lower of the RTD LBMP or zero. This condition ensures

that incentives remain for traders at Non-Competitive Proxy Generator Buses and Proxy

Generator Buses associated with designated Scheduled Lines to offer competitively.

If the NYISO did not include the test that sets the real-time settlement price at the the lower of RTD LBMP or zero in cases where the Rolling RTC price is negative, Transmission Customers that possess market power would be able to submit a sufficiently large quantity of import offers at the price floor (-$1000/MWh) to ensure their low-priced import offers constrain the Proxy Generator Bus, and set a negative LBMP at the Proxy Generator Bus in RTC. This could lead to either of two undesirable consequences.

First, if the NYISO were to permit the Rolling RTC price to be set at an extreme negative

LBMP, and were to settle based on that extreme LBMP, NYISO would open itself up to the very

same opportunity to engage in market manipulation that caused the NYISO to develop the Non-

Competitive Proxy Generator Pricing rules in 2003.26 Uniform Pricing Rule Four does not allow

settlements to be based upon an extreme negative LBMP that is set by the Rolling RTC. The

NYISO provides an illustrative example of how Uniform Pricing Rule Four protects against this

concern below.

Second, if the NYISO were to simply settle at the RTD price when the Rolling RTC price

is negative, the Transmission Customer would receive the RTD LBMP (which does not include

External Interface Congestion27) for all of its Import MWs, even though the negative Rolling

RTC price indicated that additional imports were not economically desirable. For this reason,

the NYISO limits the compensation to a maximum of $0/MWh when the LBMP that is set in the

Rolling RTC is negative.

The NYISO offers the following simplified example to illustrate the operation of

proposed Uniform Pricing Rule Four in a situation where a hypothetical Transmission Customer that possesses market power in a neighboring market attempts to use its market power to

manipulate the markets that the NYISO administers.

“Transmission Customer X” is the only entity that is capable of scheduling Imports and

Exports at a Non-Competitive Proxy Generator Bus that has a 300 MW transfer capability in

both the import and export directions. Transmission Customer X submits the following offers to

26 For a more complete description/explanation of the market manipulation concerns that drove the development of the Non-Competitive Proxy Generator Bus pricing rules, the NYISO provides a link to an October 23, 2002

presentation to its Business Issues Committee addressing the topic:

http://www.nyiso.com/public/webdocs/markets_operations/committees/bic/meeting_materials/2002-10-

23/agenda9_trans_settle_proxy_buses.pdf

27 In this case, including the External Interface Congestion would significantly reduce the price paid to the Import, and could even require the Import to pay the NYISO to import unwanted Energy into the NYCA.

Honorable Kimberly D. Bose December 27, 2013

Page 10

the NYISO at the Non-Competitive Proxy Generator Bus, and receives the following Real-Time Market Schedules:

Non-Competitive Proxy Generator Bus Transfer Capability = 300 MW RTD LBMP = $50/MWh28

Transmission Customer X’s Real-Time Offers/Bids:

• a $-999/MWh, 299 MW29 import offer at the Non-Competitive Proxy Generator

Bus; and

• a $800/MWh offer to wheel 501 MW of Energy through the NYCA, entering the

NYCA at the Non-Competitive Proxy Generator Bus and exiting the NYCA at a

different Proxy Generator Bus30; and

• a $-500/MWh, 700 MW export bid at the Non-Competitive Proxy Generator

Bus.31

Transmission Customer X’s RTC Schedules:

• a 299 MW Import

• a 501 MW Wheel Through the NYCA, entering the NYCA at the Non-

Competitive Proxy Generator Bus and exiting the NYCA at a different Proxy Generator Bus; and

• a 500 MW Export at the Non-Competitive Proxy Generator Bus.32

In this example the RTC LBMP at the Non-Competitive Proxy Generator Bus would be

set at $-500/MWh. The $-500/MWh is set by the 500 MW Export, which had to be scheduled in

order to maintain the more valuable (based on offer price) $-999/MWh price taking Import and

the $800/MWh Wheel Through schedule.

After RTC schedules are issued, the NYISO goes to check-out the Wheel Through with

the sink Control Area. The NYISO is informed that Transmission Customer X failed to get an

import from New York scheduled in the sink Control Area. Because the Wheel Through is not

28 For simplicity, NYISO assumes that the RTD LBMP is a stable $50/MWh over the entire time period covered in the example.

29 The $-999/MWh import offer indicates that the scheduling Transmission Customer is willing to pay up to $999/MWh to get its Import scheduled.

30 The $800/MWh Wheel Through offer indicates that the scheduling Transmission Customer is willing to be

scheduled so long as the difference between the source Proxy Generator Bus LBMP and sink Proxy Generator Bus LBMP does not exceed $800/MWh.

31 The $-500/MWh Export offer indicates that the Transmission Customer is willing to have its Export scheduled if NYISO is willing to pay it $500/MWh or more to take the Energy.

32 The $-500/MWh Export gets scheduled because the $800/MWh congestion bid for the Wheel Through and the $-

999/MWh import offer were both sufficiently high that the Export was scheduled to permit the more valuable Import and Wheel Through to be scheduled. If all of the External Transactions had flowed in Real-Time, the NYCA would have received an additional net benefit because it scheduled the Export.

Honorable Kimberly D. Bose December 27, 2013

Page 11

supported by an Import at the sink location, the NYISO must cancel the Wheel Through but the NYISO cannot go back and change the $-500/MWh LBMP that was set in RTC. Because the Export (that was originally scheduled to support the Wheel Through) was scheduled in RTC, it will still flow. The question is, what price will Transmission Customer X pay or be paid for its net33 201 MW export position?

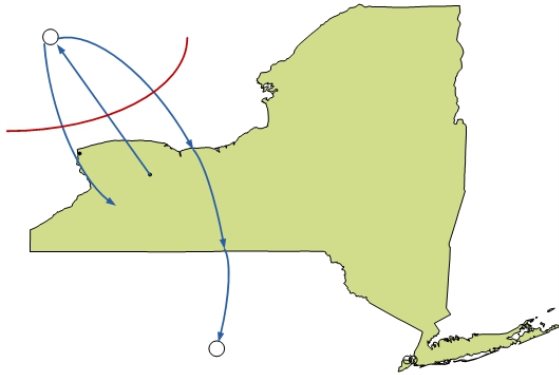

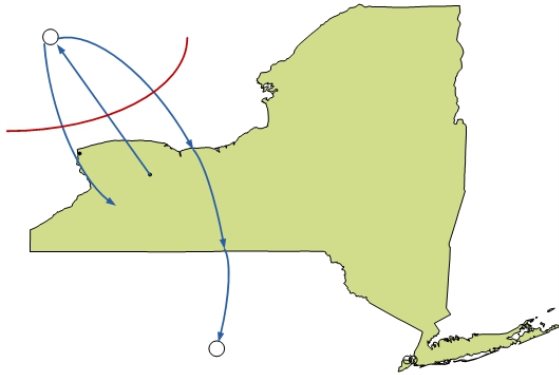

Non-Competitive

Proxy Generator Bus

RTC LBMP = $-500/MWh

Settlement LBMP = $0/MWh after applying Uniform Pricing Rules

Net Transfer Capability

Is 300 MW

RTC is constrained;

net Schedule is

300 MW into the NYCA

NYCA

System (RTD Price)

Export

700 MW

$-500/MWh

Schedule = 500 MW

Import

299 MW

$-999/MWh

Schedule = 299 MW

Wheel Through

501 MW$50/MWh

$800/MWh

Schedule = 501 MW

Cut Schedule = 0MW

X

1 - Scheduled by RTC

2 - Curtailed during coordination of

interchange with sink Control Area

Sink Control Area

Proxy Generator Bus

Uniform Pricing Rule Four protects the NYISO’s markets from paying Transmission

Customer X the RTC LBMP of $-500/MWh to Export Energy from New York. Because the

RTD LBMP is $50/MWh in our example, which is more than $0/MWh, Transmission Customer

X will pay $0/MWh for the 201 MWh of Energy that is exported to the Non-Competitive Control

Area.

This result still may not seem fair. Transmission Customer X did not receive a huge $100,50034windfall for exporting power from the NYCA, but it did get 201 MW of Energy, which cost NYCA loads approximately $10,050,35 for free.

33 500 MW Export less 299 MW Import results in a net flow of 201 MW exporting from the NYCA at the NonCompetitive Proxy Generator Bus.

34 RTC LBMP of $-500/MWh * -201 MWh of exported Energy = $100,500.

35 RTD LBMP of $50/MWh * 201 MWh of additional generation dispatch to supply the export = $10,050.

Honorable Kimberly D. Bose December 27, 2013

Page 12

Although Transmission Customer X did not have to pay for the 201 MW Export,

Transmission Customer X will pay a FIC for its failed Wheel Through. The FIC NYISO would assess to Market Participant X in this example would be $25,050.36

The simplified example illustrates how Uniform Pricing Rules Four through Seven and the FIC operate in tandem to protect NYCA Loads from paying for attempts to manipulate the NYISO’s markets. The FIC and the Non-Competitive Proxy Generator Bus pricing rules will continue to protect the NYISO’s markets and NYCA Loads.

Uniform Pricing Rule Five—applies at Variably Scheduled Non-Competitive Proxy

Generator Buses and at Variably Scheduled Proxy Generator Buses that are associated with

designated Scheduled Lines when the Rolling RTC is constrained in the export direction.37 The

NYISO proposes to add the External Interface Congestion calculated by the Rolling RTC to the

RTD LBMP at Non-Competitive Proxy Bus or Proxy Buses associated with designated

Scheduled Line, so long as the Rolling RTC LBMP for the Proxy Generator Bus is less than

zero.38 Otherwise, the External Transactions will settle at the RTD LBMP. Settling at the RTD

LBMP when the Rolling RTC LBMP is greater than zero ensures that incentives remain for

traders at Non-Competitive Proxy Generator Buses and Proxy Generator Buses associated with

designated Scheduled Lines to offer competitively. If the NYISO did not settle at the RTD

LBMP when the Rolling RTC LBMP is greater than zero, then the NYISO might inappropriately

pay Transmission Customers extremely high prices to Export Energy from the NYCA.

Uniform Pricing Rule Six—applies at Non-Competitive Proxy Generator Buses and at

Proxy Generator Buses that are associated with designated Scheduled Lines that are scheduled

on an hourly basis when RTC15 is constrained in the import direction.39 The NYISO proposes to

add the External Interface Congestion calculated by RTC15 to the RTD LBMP at the Non-

Competitive Proxy Generator Bus or Proxy Generator Bus associated with a designated

Scheduled Line, so long as the RTC15 LBMP for the Proxy Generator Bus is greater than zero. If

the RTC15 LBMP for the Proxy Generator Bus is negative the External Transactions will settle at

the lower of the RTD LBMP or zero. The supporting rationale is the same as Uniform Pricing

Rule Four.

36 For Wheels Through, the FIC is assessed as an Import at the source Proxy Generator Bus and as an Export at the

sink Proxy Generator Bus. In this example, the sink Proxy Generator Bus LBMP was equal to the internal NYCA

LBMP and therefore the real-time Marginal Cost of Congestion at the sink Proxy Generator Bus is assumed to be

$0/MWh. The source Proxy Generator Bus LBMP was set at $0/MWh with an internal NYCA LBMP of $50/MWh,

therefore, the real-time Marginal Cost of Congestion at the source Proxy Generator Bus is $50/MWh. The failed

transaction was original scheduled for 501 MW. The FIC equals the Import charge (501 MW * $50/MWh) plus the

Export charge (501 MW * $0/MWh). FIC for Wheel Through = 501 MW * $50/MWh = $25,050.

37 Meaning that there are more economically desirable bids to export MWs from the NYCA available at the Proxy Generator Bus than the NYISO can accept. When a Proxy Generator Bus is subject to an export constraint the RTC price would ordinarily be expected to be higher than the internal NYCA bus prices at nearby locations.

38 In this case, a “less than zero” LBMP indicates that the NYISO is paying Exports to take Energy out of the

NYCA. Prices above zero would indicate that Exports are paying NYISO to remove Energy from the NYCA.

39 The explanations provided with Uniform Pricing Rule Four also apply to Uniform Pricing Rule Six.

Honorable Kimberly D. Bose December 27, 2013

Page 13

Uniform Pricing Rule Seven—applies at Non-Competitive Proxy Generator Buses and

at Proxy Generator Buses that are associated with designated Scheduled Lines that are scheduled

on an hourly basis when RTC15 is constrained in the export direction.40 The NYISO proposes to

add the External Interface Congestion calculated by RTC15 to the RTD LBMP at Non-

Competitive Proxy Bus or Proxy Buses associated with designated Scheduled Line, so long as

the RTC15 LBMP for the Proxy Generator Bus is less than zero. Otherwise, the External

Transactions will settle at the RTD LBMP. The supporting rationale is the same as Uniform

Pricing Rule Five.

B. Proposed Elimination of Bid Production Cost Guarantees For Imports

The NYISO’s proposed Tariff revisions also remove the Real-Time Bid Production Cost Guarantee for Imports (“RT Import BPCG”). The NYISO’s proposal to remove RT Import

BPCG is consistent with the changes that the NYISO proposed, and the Commission accepted, as part of NYISO’s implementation of Coordinated Transaction Scheduling (“CTS”) with ISO-

NE.41 It is also consistent with the NYISO’s proposal to eliminate RT Import BPCG as part of NYISO’s implementation of CTS with PJM that is presently pending before the Commission in Docket No. ER14-552-000. PJM does not offer make-whole payments to imports from New

York, so the proposed change will bring the NYISO’s rules into closer conformance with PJM’s treatment of transactions at the NYCA/PJM border.

RT Import BPCG is currently paid to a Transmission Customer when the LBMP revenue

it receives for importing Energy to the NYCA does not cover the Bid cost the Transmission

Customer submitted.42 The expected LBMP at the time an Import is scheduled by RTC can

differ from the actual real-time LBMP at the time the Energy associated with the Import is

delivered to the NYISO. This can occur due to changes in system conditions that have not

occurred, or that are not yet reflected in RTC, at the time an Import is scheduled, but that

manifest before the Energy associated with the Import is delivered (hereafter, “latency risk”).

Statewide Load currently absorbs the cost of protecting Transmission Customers that schedule

Imports from latency risk.

Latency risk increases as the time between RTC’s scheduling decision and the delivery of

the Energy increases. In its CTS with PJM filing that is pending before the Commission, the

NYISO’s proposes to move its evaluation of import offers and export bids 15 minutes closer to

real-time operations. The NYISO’s proposed improvement will significantly reduce latency risk

by halving (reducing from 30 minutes to 15 minutes) the time period between RTC’s scheduling

decision and actual Energy flowing between the NYISO and a neighboring Control Area.

40 The explanations provided with Uniform Pricing Rule Five also apply to Uniform Pricing Rule Seven.

41 See New York Independent System Operator, Inc., 139 FERC ¶ 61,048 at PP 20 and 21 (2012); NYISO’s Proposed Tariff Amendments to Add External Coordinated Transaction Scheduling Market Rules and Request for Waiver, Docket No. ER12-701 at 6-7 (December 28, 2011).

42 At Variably Scheduled Proxy Generator Buses RT BPCG is only available to Imports that are offered on a quarter-hourly basis. See Services Tariff Section 18.6.1.2.1.

Honorable Kimberly D. Bose December 27, 2013

Page 14

In approving CTS with ISO-NE, CTS with PJM, and the Tariff revisions proposed in this filing, the NYISO’s stakeholders elected to re-assign the cost of hedging latency risk to

Transmission Customers. Transmission Customers offering to import Energy to the NYCA have the ability to include perceived latency risk in the $/MWh component of their import offer.

Eliminating the RT Import BPCG payments for Imports will leave to each Transmission

Customer the decision on how recovering the cost of latency risk fits within its bidding strategy. Transmission Customers that are able to hedge latency risk most effectively and efficiently (at

the lowest cost) will gain a market advantage.

The NYISO proposes to eliminate RT Import BPCG payments for all Imports entering

the NYCA, without regard to whether the Import is offered via a CTS Interface Bid, or a

Decremental Bid; without regard to the NYCA border at which the Import is scheduled (PJM,

ISO-NE, Hydro Quebec or Ontario); and without regard to the scheduling interval (15 minute or

hourly). The removal of RT Import BPCG protection for Imports directly parallels the

Commission approved removal of RT Import BPCG protection for Imports at the NYCA/ISO-

NE border.43 When CTS with ISO-NE goes into effect, RT Import BPCG will be eliminated at

that border. It would not be appropriate to protect some Imports from latency risk, but not

others.

The NYISO’s proposal to eliminate RT Import BPCGs will also improve the consistency

of the regional treatment of Imports and Exports. The NYISO has never offered a real-time

BPCG to Exports. Transmission Customers that want to schedule Exports from the NYCA

already incorporate their exposure to latency and curtailment risks into their Export Bids.

C.Proposed Modifications to Make Calculation of the Financial Impact Charge

Consistent with the Uniform Pricing Rules

Sections 4.5.3.2 and 4.5.4.2 of the Market Services Tariff set forth Financial Impact

Charges (“FIC”) that are designed to protect NYCA loads from paying for costs caused by

External Transactions that fail due to the actions, or inaction, of the Transmission Customer that

submitted the External Transaction. When an Import, Export or Wheel-Through that is

scheduled in RTC fails at operator checkout with a neighboring Balancing Authority for a reason

that was within the scheduling Market Participant’s control (such as the Market Participant’s

failure to reserve ramp in the neighboring market), the Market Participant that scheduled the

failed External Transaction is required to pay a FIC that is designed to recover a portion of the

cost that the NYCA incurs due to the Market Participant’s unexcused failure to deliver or receive

the scheduled MWs. The FIC was developed to address actual Market Participant behavior that

caused significant, unwarranted, costs to be paid by New York loads. The behavior that the FIC

is designed to deter was believed to be intentional at the time it was prohibited.44

43 See New York Independent System Operator, Inc., 139 FERC ¶ 61,048 at PP 20 and 21 (2012).

44 See New York Independent System Operator, Inc., 97 FERC ¶ 61, 206 at 3-4, 7-8 (2001) (“NYISO states that its

staff determined that transactions were failing to check out with neighboring control areas with great frequency and

that the pattern of failures suggested that some market participants were deliberately attempting to manipulate prices

Honorable Kimberly D. Bose December 27, 2013

Page 15

The revisions proposed in this filing are designed to align the calculation of the FIC with the proposed Uniform Pricing Rules. For Imports, the proposed change to Section 4.5.3.2 of the Market Services tariff substitutes the Congestion Component of the LBMP for the difference between the RTC and RTD LBMPs. The “Congestion Component of the LBMP” includes both External Interface Congestion and any internal NYCA congestion determined by RTD for the relevant interval. The same substitution is made for Exports in Section 4.5.4.2 of the Services Tariff. In addition, the NYISO proposes to multiply the congestion component of the Export penalty calculation by negative one in order to accurately represent the direction of the power flows and their expected impact on the NYCA in the FIC.

III. Description of Proposed Revisions to the Services Tariff

The NYISO’s proposed revisions to its Services Tariff, including Attachments B and C to the Services Tariff, are described below.

In addition to the revisions described below, in Attachment B to the Services Tariff the NYISO proposes some ministerial and grammatical corrections, and some re-numbering of sections and cross-references that it does not describe.

A. Services Tariff Sections 4.5.3.2 and 4.5.4.2; FIC for Failed Transactions

The NYISO proposes to modify the Financial Impact Charge (“FIC”) to align it with the

proposed Uniform Pricing Rules. To calculate the FIC that applies to failed Imports, the

proposed change to Section 4.5.3.2 of the Market Services tariff substitutes the Congestion

Component of the LBMP for the difference between the RTC and RTD LBMPs. The

“Congestion Component of the LBMP” includes both External Interface Congestion and any

internal NYCA congestion determined by RTD for the relevant interval. The same substitution

is proposed for Exports in Section 4.5.4.2 of the Services Tariff. In addition, the NYISO

proposes to multiply the congestion component of the Export penalty calculation by negative one

in order to accurately represent the direction of the power flows and their expected impact on the

NYCA in the FIC.

B.Services Tariff Section 4.6.6.5; Elimination of Real-Time Bid Production

Cost Guarantee for Imports

The NYISO proposes to modify Section 4.6.6.5 of the Services Tariff to eliminate RT

Import BPCG. The proposed revised language makes clear that External Transactions (Imports,

Exports and Wheels Through) are not eligible to receive a Bid Production Cost Guarantee in the

in the Northeastern markets by cancelling external transactions with one affected control area and not the other.” … “These proposals address problems in the NYISO-administered markets, increase efficiency in the NYISO’s

markets, and have widespread stakeholder support.”); see also, New York Independent System Operator, Inc.’s

Filing of Tariff Revisions to Make Permanent Certain Temporary Market Rules Pertaining to External

Transactions, submitted in Docket No. ER01-3112-000 on September 25, 2001.

Honorable Kimberly D. Bose December 27, 2013

Page 16

Real-Time Market. The reasons for the proposed elimination of RT Import BPCG at the

NYISO’s external Proxy Generator Buses are explained in Section II.B of this filing letter.

C. Section 17/Attachment B to the Services Tariff; Uniform Pricing Rules

The proposed revisions to Attachment B to the Services Tariff propose to replace the 50+ existing Proxy Generator Bus pricing rules with seven Uniform Pricing Rules. The vast majority of the changes are to Section 17.1.6 of Attachment B, which sets forth the Real Time LBMP

Calculation Methods for Proxy Generator Buses. The NYISO described the proposed Uniform Pricing Rules in great detail in Section II.A of this filing letter and provided examples of how the Uniform Pricing Rules will operate. In this section the NYISO points out a few implementation details that it did not already describe above.

In Section 17.1.6.1 the NYISO proposes to replace the term Proxy Generator Bus

Constraint Cost with the terms External Interface Congestion and Proxy Generator Bus Border LBMP. The more precise terms, which are described in Section II.A of this filing letter, are used in the Uniform Pricing Rules that follow.

In Section 17.1.6.2 the NYISO proposes to add language explaining how it will apply

External Interface Congestion to RTD intervals when RTC and RTD are not perfectly aligned.

Sections 17.1.6.2.1, 17.1.6.3.1 and 17.1.6.4.1 of Attachment B to the Services Tariff all

contained pricing rules for Dynamically Scheduled Proxy Generator Buses (Proxy Generator

Buses that are scheduled on a five minute basis). The NYISO has never implemented a

Dynamically Scheduled Proxy Generator Bus in its markets and significant improvements to the

NYISO’s RTD software will need to be made before the NYISO can implement a Dynamically

Scheduled Proxy Generator Bus. The existing pricing rules for Dynamically Scheduled Proxy

Generator Buses are not consistent with the Uniform Pricing Rules proposed in this filing. In

addition, the NYISO is not certain that the existing pricing rules would produce a just and

reasonable result under all circumstances as it does not yet have a complete market design for a

dynamically scheduled product. The NYISO proposes to remove the pricing rules for

Dynamically Scheduled Proxy Generator Buses and replace the rules with a statement that the

pricing rules for these Proxy Generator Buses are “to be determined.”

Proposed Uniform Pricing Rule One first appears in Section 17.1.6.2.2. Proposed

Uniform Pricing Rule Two first appears in Section 17.1.6.2.2. Proposed Uniform Pricing Rule Three first appears in Section 17.1.6.2.3. Proposed Uniform Pricing Rules Four and Five first appear in Section 17.1.6.3.2. Proposed Uniform Pricing Rules Six and Seven first appear in

Section 17.1.6.3.3.

Section 17.1.6.5 of Attachment B to the Services Tariff sets forth the rules for calculating the loss and congestion components of the real-time LBMP at Non-Competitive Proxy Generator Buses, and at Proxy Generator Buses that are subject to the Special Pricing Rule for designated Scheduled Lines. The proposed revisions to the calculation make the marginal loss and

congestion calculation consistent with Uniform Pricing Rules Four through Seven.

Honorable Kimberly D. Bose December 27, 2013

Page 17

D.Section 18/Attachment C to the Services Tariff; Elimination of Real-Time

Bid Production Cost Guarantee for Imports

The NYISO proposes to modify Section 18.6 of Attachment C to the Services Tariff to

eliminate RT Import BPCG. The proposed revised language makes clear that External

Transactions (Imports, Exports and Wheels Through) are not eligible to receive a Bid Production

Cost Guarantee in the Real-Time Market. The reasons for the proposed elimination of RT

Import BPCG at the NYISO’s external Proxy Generator Buses are explained in Section II.B of

this filing letter.

IV.Requested Effective Date and Request Regarding the Timing of Commission Action

and Request for Waiver, if Necessary

The NYISO respectfully requests that the Commission issue an order by March 3, 2014, accepting the proposed tariff revisions effective April 8, 2014. The requested effective date is more than sixty days after the date of this filing.

V. Stakeholder and NYISO Board of Directors Approval

The NYISO’s Management Committee approved, by a show of hands with one

abstention, the Tariff revisions proposed in this filing on September 30, 2013. The NYISO Board of Directors approved the proposed Tariff revisions on November 19, 2013.

VI. Communications and Correspondence

All communications and service in this proceeding should be directed to:

Raymond Stalter, Director, Regulatory Affairs

Michael DeSocio, Manager, Energy Market Design *Alex M. Schnell, Registered Corporate Counsel *James H. Sweeney, Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-6000

Fax: (518) 356-8825

aschnell@nyiso.com

jsweeney@nyiso.com

* Designated to receive service.

Honorable Kimberly D. Bose December 27, 2013

Page 18

VII. Service

The NYISO will send an electronic link to this filing to the official representative of each

of its customers, to each participant on its stakeholder committees, to the New York Public

Service Commission, and to the New Jersey Board of Public Utilities. In addition, the complete

filing will be posted on the NYISO’s website at www.nyiso.com.

VIII. Conclusion

Wherefore, for the foregoing reasons, the New York Independent System Operator, Inc. respectfully requests that the Commission accept its proposed Tariff revisions for filing effective April 8, 2014.

Respectfully submitted,

/s/ Alex M. Schnell

Alex M. Schnell, Registered Corporate Counsel James H. Sweeney, Attorney

New York Independent System Operator, Inc.

cc:Michael A. Bardee

Gregory Berson

Anna Cochrane

Jignasa Gadani

Morris Margolis

Michael Mc Laughlin

David Morenoff

Daniel Nowak