6

New York Independent System Operator, Inc., 143 FERC ¶ 61,134 (2013).

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

)

New York Independent System Operator, Inc.)Docket No. ER11-4338-002

)

ANSWER TO COMMENTS

AND REQUEST FOR LEAVE TO ANSWER AND ANSWER TO PROTEST

OF THE NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

Pursuant to Rule 213 of the Federal Energy Regulatory Commission (“Commission”)

Rules of Practice and Procedure,1 the New York Independent System Operator, Inc. (“NYISO”)

respectfully submits this answer to the comments of the New York Association of Public Power

(“NYAPP”),2 and seeks leave to answer, and answers, the protest of EnerNoc, Inc.; Viridity,

Inc.; Wal-Mart Stores, Inc.; Converge Inc.; and EnergyConnect, a Johnsons Controls Company

(collectively, “Demand Response Supporters” or “DRS”) (“DRS Protest”)3 regarding the

NYISO’s August 14, 2013 compliance filing in the above-referenced docket (the “Compliance

Filing”).4

As described below, NYAPP and DRS both fail to demonstrate that the Compliance

Filing’s proposals are in any way non-compliant with (i) Order No. 7455 or (ii) the

Commission’s May 16, 2013 order (“May 16 Order”)6 addressing the NYISO’s August 19, 2011

1

2

See 18 C.F.R. § 385.213.

Comments of the New York Association of Public Power on Compliance Filing, Docket No.

ER11-4338-002 (Sept. 4, 2013) (“NYAPP Comments”).

3

4

Protest of Demand Response Supporters, Docket No. ER11-4338-002 (Sept. 4, 2013).

New York Independent System Operator, Inc., Compliance Filing, Docket No. ER11-4338-002

(Aug. 14, 2013).

5

Demand Response Compensation in Organized Wholesale Energy Markets, Order No. 745,

III FERC Stats. & Regs., Regs. Preambles ¶ 31,322 (2011) (“Order No. 745”).

6

New York Independent System Operator, Inc., 143 FERC ¶ 61,134 (2013).

compliance filing.7 Moreover, neither NYAPP nor DRS offer any relevant support for their

claims to the contrary. The Commission should, therefore, accept the Compliance Filing without requiring any modifications.

I. REQUEST FOR LEAVE TO ANSWER

The NYISO is authorized to answer NYAPP as a matter of right because its pleading is styled as comments. The Commission also has discretion to accept answers to protests when they help to clarify complex issues, provide additional information, are otherwise helpful in the development of the record in a proceeding, or assist in the decision-making process.8 The

NYISO’s answer to the DRS Protest satisfies those standards and should be accepted because it addresses inaccurate or misleading statements, and provides additional information that will help the Commission to fully evaluate the arguments in this proceeding.9

II. ANSWER

A.Answer to Demand Response Supporters

1.The NYISO’s Exclusion of Off-Peak Hours from its Supply Curve

Methodology Reasonably Implements the Net Benefits Test and Fully

Complies with Order No. 745, as Demonstrated by the Compliance Filing.

Contrary to the claims made in the DRS Protest, the exclusion by the NYISO of off-peak

hours from the supply curve methodology used to implement the net benefits test is reasonable

7

New York Independent System Operator, Inc., Compliance Filing, Docket No. ER11-4338-000

(Aug. 19, 2011) (“August 2011 Compliance Filing”).

8

See, e.g., Southern California Edison Co., 135 FERC ¶ 61,093 at P 16 (2011) (accepting answers

to protests “because those answers provided information that assisted [the Commission] in [its] decisionmaking process”); New York Independent System Operator, Inc., 134 FERC ¶ 61,058 at P 24 (2011)

(accepting the answers to protests and answers because they provided information that aided the

Commission in better understanding the matters at issue in the proceeding); New York Independent

System Operator, Inc., 140 FERC ¶ 61,160 at P 13 (2012) and PJM Interconnection, LLC, 132 FERC ¶ 61,217 at P 9 (2010) (accepting answers to answers and protests because they assisted in the

Commission’s decision-making process).

9

If the Commission were to conclude that NYAPP’s comments were tantamount to a protest the

NYISO respectfully request leave to answer them on the same grounds that it is seeking leave to answer the DRS Protest.

2

and the net benefits thresholds resulting from this methodology are neither anomalous nor

unjustifiably high. Moreover, the NYISO fully explained and supported its reasons for adopting that supply curve methodology in its Compliance Filing.

As an initial matter, DRS are wrong to suggest that excluding off-peak hours is in any

way incompatible with Order No. 745.10 If it were, then the Commission would not have

fashioned the May 16 Order so as to permit the NYISO to provide additional evidence to support that exclusion in the Compliance Filing.11 Instead, DRS are attempting to compel the NYISO to comply with its own preferred interpretation of Commission precedent rather than what Order No. 745 and the May 16 Order actually require.

Second, DRS are wrong to claim that the NYISO has failed to justify the exclusion of

off-peak hours on the merits. In its Compliance Filing, the NYISO clearly justified, with

supporting data showing the effect of including off-peak hours on the dollar threshold, its

conclusion that a properly-designed supply curve should produce a net benefits threshold that is

accurate during the hours when demand response is actually expected to occur - i.e., the high

Load12 hours.13 The NYISO explained that “[t]o use the depressed off-peak, low Load hour

threshold to define the net benefits threshold for the high Load hours would charge Loads for

demand response that does not actually meet the standard specified by the Commission.”14 The

NYISO approach is just and reasonable, and does not constitute a “barrier” to demand response

participation for the reasons articulated in the Compliance Filing. Indeed, as the NYISO pointed

10

11

12

New York Independent System Operator, Inc., 143 FERC ¶ 61,134 (2013). May 2013 Compliance Order at P 39.

Capitalized terms not otherwise defined herein shall have the meaning specified in Article 2 of

the Market Administration and Control Area Services Tariff (“Services Tariff”) or Article 1 of the Open

Access Transmission Tariff (“OATT”).

13

14

Compliance Filing at pp 7-11. Compliance Filing at P 9.

3

out, there can be no “barrier” to demand response in the low Load hours because retail rates will

typically exceed wholesale power costs.15 There is no reason to pay consumers for not

consuming power when the spot price of power is lower than their retail rate. Indeed, as the

NYISO explained in the Compliance Filing, power that would be uneconomic to purchase at the

retail rate should not, at least in the NYISO context, be included in baseline consumption as any

demand response supposedly resulting from such power would, in fact, represent freeriding and

not actual demand response.

Third, the principal substantive argument in the DRS Protest, i.e., that the NYISO’s net

benefits threshold is too high relative to neighboring markets, is misleading. Arguing that the

higher net benefits thresholds calculated for the NYISO over the thirteen study months were

caused by the exclusion of off-peak hours from the supply curve, DRS state that “[t]here are not

sustained, perceptible LMP price differences among Northern New Jersey, New York, or

Southwest New England” that would justify the alleged “outlier” level of the NYISO’s net

benefits threshold.16 Making this comparison based on a generic “New York” price relative to

prices in high priced regions in adjacent Regional Transmission Organizations (“RTOs”),

however, results in a distorted view of the actual situation. A more reasonable comparison is

between prices in the high priced regions mentioned by DRS -- NEPOOL CT and PSEG PJM --

and the regions of New York that are adjacent, and electrically more similar, to them, i.e.,

NYISO Load Zones J & K. Doing so reveals that monthly average day-ahead spot prices are

15

16

Compliance Filing at P 8. DRS Protest at P 6.

4

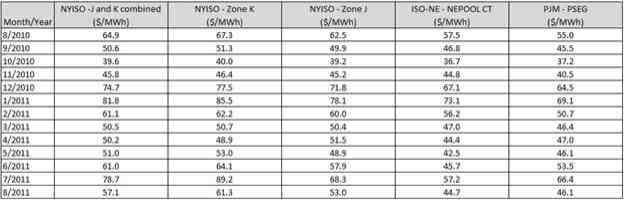

consistently higher in Load Zones J and K than in either of the regions mentioned by DRS. This is clearly demonstrated in the following table:17

Table 1

Thus there is no merit to DRS’ claim that the NYISO’s approach yields anomalous or unjustifiably high results. The net benefits threshold is higher in New York because the underlying prices are higher.

Finally, the DRS Protest is wrong to suggest that the mere fact that the NYISO has taken

a different approach to implementing the net benefits test, or may have a higher net benefits

threshold, than other RTOs somehow makes its approach unreasonable or non-compliant with

Order No. 745. Order No. 745 did not mandate a “standardized” approach to implementing the

net benefits test. Rather, the Commission has clearly allowed for regional flexibility, so long as

the approach “can balance the system, is a cost-effective alternative to generation in the

organized wholesale energy markets, and payment of LMP represents the marginal value of a

decrease in demand.”18 The NYISO’s reasonable, well-supported approach meets this standard,

which is consistent with the May 16 Order’s general acceptance of its approach, contingent on

17

The accuracy of the data presented in each of the tables and graphs in this Answer and in

Attachment II is supported by the Confirming Affidavit of Nicole Bouchez, Ph.D., submitted as Attachment I to this Answer.

18

Order No. 745 at ¶ 67.

5

the NYISO’s providing additional justification for its use of peak load hours. DRS’ insistence

that the NYISO adopt the same supply curve methodology as other RTOs is incompatible with

the Commission’s well-established policy that “[e]ach RTO and ISO is unique... [and] therefore

should establish policies and procedures in cooperation with its customers and other stakeholders

that ensure that demand response resources are treated comparably to supply-side resources.”19

Accordingly, the DRS Protest does not demonstrate that the NYISO failed to provide the

additional support that the May 16 Order required. Furthermore, it does not demonstrate that it

was unreasonable for the NYISO to conclude that including off-peak hours would result in a less

accurate supply curve and in Loads paying for demand response that does not meet Order No.

745 standards. The DRS Protest does not even dispute, let alone disprove, the NYISO’s

argument that including off-peak hours would result in excessive charges to Loads.

2. The Functional Form Chosen by the NYISO Is Reasonable for the NYISO

Markets and Effectively Establishes the Point at Which the Billing Unit

Effect No Longer Exists, as Demonstrated in the Compliance Filing.

The DRS Protest makes a variety of claims regarding the functional form chosen by the

NYISO and its method of discerning the point at which the billing unit effect no longer exists on

the resulting supply curve. None of DRS’ claims are accurate, substantiated, or well-grounded in

mathematics or in the NYISO’s actual market data. The DRS Protest wholly ignores the

extensive explanation offered in the Compliance Filing of the NYISO’s approach to smoothing

the curve.20 Its main allegation is that the NYISO chose an improper functional form because

19

Wholesale Competition in Regions with Organized Electric Markets, Order 719, 125 FERC

¶ 61,071 (2008) (Order No. 719), ¶ 50.

20

As the NYISO explains at length in its Compliance Filing, the NYISO opted to use a polynomial

equation with exponential term because it allows the estimated supply curve to better fit the curved

portion of the actual supply curve as well as to accurately portray the mid-MW range, flatter portion of the supply curve. While the functional form adopted serves this purpose well, it did result in a low-MW inflection points that did not reflect the underlying supply curve or identify the point at which the billing unit effect no longer exists. See Compliance Filing at pp 11-14.

6

the chosen polynomial equation with exponential term resulted in a low-MW inflection point that would not have occurred if the supply curve had been properly smoothed.21 DRS assert without any support that because the NYISO’s “model and functional form incorporate multiple

inflection points, NYISO cannot guarantee that its net benefits threshold will be set at the pricing point at which the “billing unit effect” no longer exists.”

Instead, DRS simply declare that the point at which the billing unit effect is eliminated “likely” lies at a value between the two inflection points.22 DRS again offer no support for this claim, which in reality is without any factual basis. The DRS claim also ignores the fact that Order No. 745 does not require the NYISO to determine the net benefits threshold at the point where the billing unit effect is likely gone, but at the point where it is established to be eliminated by the net benefits test and “[b]eyond that point, a reduction in quantity everywhere along an upward sloping supply curve would be cost-effective.”23

Tellingly, the DRS Protest offers no alternative function that better fits the underlying supply curve in the NYISO region. Instead, the DRS Protest simply points out that the PJM Interconnection, LLC (“PJM”) and Midcontinent Independent System Operator (“MISO”) chose different functions. As the NYISO explained above, however, the mere fact that the NYISO has adopted a different functional form from other RTOs is not evidence that it has failed to comply with Order No. 745. Indeed, the DRS Protest’s insinuation to the contrary contradicts the clear language of Order No. 745, where the Commission specifically noted:

There will be inherent differences in the supply curves determined by each RTO

and ISO under the net benefits test required herein, due to decisions the RTOs and

ISOs must make based on supply data for their regions, the mathematical methods

21

22

23

DRS Protest at P 8.

Id.

Order No. 745 at Footnote 161.

7

each RTO and ISO chooses to use for smoothing the supply curves, the certainty of changes in supply due to outages in each region, local generation heat rates, and the choice of relevant fuel price indices.24

In fact, the Commission’s central insight - that different regions will require different functions -

is particularly well borne out if the function chosen by PJM in its Order 745 Compliance Filing (the “PJM Functional Form”)25 is applied to the historical NYISO data. As the graphs in

Attachment II illustrate, the PJM Functional Form, while presumably appropriate for PJM, does not provide a good representation of the actual NYISO supply curve. Furthermore, as is shown in Table 2 below, the use of the PJM Functional Form would actually result in a higher net

benefits threshold than the function chosen by the NYISO.

Table 2

NYISO ModelPJM Model

ReferenceStudyHB 13-19 DollarHB 13-19 Dollar

MonthMonthThreshold ($/MWh)Threshold ($/MWh)

Aug-09Aug-1068.5673.31

Sep-09Sep-1062.8077.23

Oct-09Oct-1053.9167.32

Nov-09Nov-1056.7764.38

Dec-09Dec-1072.7371.99

Jan-10Jan-1181.8077.14

Feb-10Feb-1163.2162.13

Mar-10Mar-1151.3153.70

Apr-10Apr-1153.1555.08

May-10May-1158.9958.80

Jun-10Jun-1161.0461.19

Jul-10Jul-1175.1776.46

Aug-10Aug-1166.0168.27

24Order No. 745 at Footnote 160.

25PJM Interconnection LLC’s Order No. 745 Compliance Filing, Docket No. ER11-4106-000

(July 22, 2011) (“PJM Compliance Filing”).

8

The net benefits thresholds in Table 2 and the graphs in Attachment II were calculated by

substituting the PJM Functional Form for the functional form chosen by the NYISO. Aside from this substitution, all other data steps described in the Compliance Filing26 and the 2011

Compliance Filing27 were kept the same. Contrary to the unsupported assertions in the DRS

Protest,28 Table 2 shows that the PJM’s functional form results in a higher net benefits test

threshold in nine of the thirteen months studied. In addition, as can be seen by the charts

provided in Attachment II, the functional form does not fit the supply curve as well as the

functional form that the NYISO has proposed.

Thus, rather than supporting the DRS Protest’s claim that the NYISO failed to properly

smooth the supply curve, the fact that the PJM Functional Form results in a poorer representation

of the supply curve and higher net benefits thresholds for the NYISO’s markets demonstrate how

seriously and carefully the NYISO worked to fulfill its responsibilities under Order No. 745.

The NYISO made a careful and thorough attempt to identify the function that most reasonably

fits the curved portion of the actual NYISO supply curve. The NYISO’s selection is fully

consistent with the purpose of the net benefits test and fully compliant with Order No. 745.

In short, the NYISO smoothed the curve with a just and reasonable mathematical

function that fulfills the purpose of the net benefits test and provides a readily identifiable

inflection point beyond which the billing unit effect does not exist. The NYISO provided

extensive justification for its choice in the Compliance Filing. The Commission should therefore

accept the NYISO’s proposal to use the highest point on the supply curve at which the curve

becomes inelastic as a just, reasonable, and Order No. 745 compliant approach to calculating a

26

27

28

Compliance Filing at pp 11-14.

August 2011 Compliance Filing at pp 4-9. DRS Protest at P 8.

9

net benefits threshold. The NYISO proposal will not produce “flawed” results based on the supposed use of a “flawed” functional model or for any other reason.

B.Answer to NYAPP Comments

1.NYAPP Has Not Shown That Its Members Should Be Treated the Same as

Western New York Program Customers

At the direction of the Commission in its May 16 Order, the NYISO proposed in its

Compliance Filing to exclude from the allocation of Day Ahead Demand Response Program

(“DADRP”) costs the Load associated with the customers of the New York Power Authority

(“NYPA”) taking service through a bilateral contract under the NYPA’s Replacement Power and Expansion Power programs, now known as the Western New York Programs.

In its Comments, NYAPP argues that certain of its members should also be excluded from the DADRP cost allocation methodology for the same reasons that the Compliance Filing proposed to exclude customers served under NYPA’s Western New York Programs.29 NYAPP has not, however, explained why these members should be treated the same as Western New York Program customers, relying instead on unsubstantiated assertions that they should be.

There is, however, no specific finding in the May 16 Order holding that NYAPP members

should be excluded, and NYAPP did not make the same evidentiary showing that the Occidental Chemical Corporation (“OxyChem”) made to persuade the Commission to exclude customers

served under NYPA’s Western New York Programs.30

29

30

NYAPP Comments at pp 2-3.

The NYISO has previously sought rehearing of this determination and continues to believe that

customers with bilateral contracts under NYPA’s Replacement Power and Expansion program, the

successor to that program, or any comparable program, benefit from changes in LBMP that result from

the dispatch of Demand Side Resources. See New York Independent System Operator, Inc., Request for

Rehearing and Alternative Requests for Expedited Clarification and Compliance Waiver of the New York

Independent System Operator, Inc., ER11-4338-000 (June 17, 2013) (“NYISO Rehearing Request”)

10

NYAPP asserts that there are NYAPP members that take service under NYPA’s

“preference power” programs and have “bilateral contracts that are fixed at cost.”31 It asserts that the NYISO has access to the exact same information for NYAPP members that are NYPA preference power customers as it does for Western New York Program customers. It offers no further support for this claim.

NYAPP’s assertions are not correct. The NYISO has previously noted that it does not

have full visibility into individual bilateral contracts. It is the NYISO’s understanding, however, based on a review of the various NYPA tariffs and programs, that NYAPP’s members’ contracts are materially different from contracts under the Western New York Program.

Specifically, the Compliance Filing explained that the NYISO is able to track the contract

path of “specific transactions” from: (i) the location of specific NYPA western hydro resources

to (ii) the specific load bus where consumption occurs.32 Compared to its understanding of and

visibility into the NYPA Western New York Programs, the NYISO’s understanding and

visibility of NYAPP members’ arrangements are inherently more limited.

In addition, it is important to note that NYPA is, among other things, a Load Serving Entity (“LSE”) in the NYISO’s markets and is the NYISO’s customer.33 LSEs are the entities who “own” the Load from the NYISO’s perspective and are the entities to whom the NYISO allocates the costs of the DADRP. To the extent permitted by their tariffs, it is at the discretion

31

32

33

NYAPP Comments at P 3.

Compliance Filing at P 28.

Most of the entities represented by NYAPP are not NYISO customers, but rather take retail

service through bilateral contracts with NYPA. The NYISO understands that NYPA serves this Load

both through its own generating units and through energy market purchases made as an LSE. The

NYISO has limited visibility into how NYPA serves specific Load through such bilateral contracts.

The NYISO charges NYPA DADRP costs based on the Load for which it is responsible as a LSE and

does not have visibility into how NYPA further allocates such costs to the Load that it serves under

bilateral contracts.

11

of NYPA or any other LSE in the NYISO’s markets as to how they contract with their customers to pass on the costs of that program, as the NYISO explained in its Compliance Filing.34

2. The Cost Allocation Methodology Proposed in the NYISO’s Compliance

Filing Appropriately Allocates Costs to Customers that Benefit from Demand Reductions.

NYAPP also suggests that the NYISO should be required to exclude from the DADRP

cost allocation all entities with fixed price bilateral customers, or even all transmission customers

that do not purchase directly from the energy markets.35 Adopting this suggestion is not

warranted by the evidence before the Commission, is not required by the May 16 Order, and

would greatly undermine the ability of the NYISO to properly and equitably allocate the costs of

the demand response programs, and potentially other related programs. As the NYISO has

previously explained in its Compliance Filing, it allocates such costs based on a Load Ratio

Share Methodology to all LSEs. This allocation is based on the premise that all Loads benefit

from interrelated market, operational, and reliability services, including demand reduction

programs, and should therefore equally bear the costs. As was articulated in the Compliance

Filing,36 the NYISO is very concerned that excluding additional Loads served under the

numerous and diverse bilateral contracts outside of the NYPA Western New York Power

Program - loads that collectively account for approximately one-half of the Energy transactions

in New York - would (i) arbitrarily and unfairly shift costs to the remaining Loads, (ii)

necessitate much more visibility by the NYISO into existing bilateral contracts, including retail

level contracts, as well as new bilateral contracts as they are developed and brought to the

market, (iii) give market participants an inefficient incentive to structure their bilateral contracts

34

35

36

Compliance Filing at P 29.

NYAPP Comments at P 2.

Compliance Filing at pp 28-31.

12

in ways that avoid the costs of shared benefits, and (iv) generally provide an inefficient

pecuniary incentive for generating resources to stop participating in the real-time economic

dispatch, reducing reliability, increasing price volatility, and reducing the ability of the NYISO to reliably accommodate intermittent resources.

Finally, NYAPP suggests in a footnote that the Commission “previously rejected

attempts to put the obligation on transmission customers rather than energy market purchasers” in the Order No. 745 compliance proceedings for ISO New England, Inc. (“ISO-NE”).37 This is not the case. The Commission found that ISO-NE’s voluntary proposal to allocate costs to

“energy market purchasers” was reasonable in the context of ISO-NE and rejected arguments that ISO-NE should be forced to adopt a different methodology. 38 Thus, the ISO-NE order is not precedent for imposing a different cost allocation methodology on the NYISO.

III. CONCLUSION

WHEREFORE, the New York Independent System Operator, Inc. respectfully requests that the Commission accept the compliance filing filed on August 14, 2013 in the above

referenced docket without requiring any modifications.

Respectfully submitted,

/s/ Ted J. Murphy

Hunton & Williams, LLP Counsel for

New York Independent System Operator, Inc.

37 NYAPP Comments at Footnote 1.

38 ISO New England, Inc., 138 FERC ¶ 61,042 (2012) at pp 41-42.

13

UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

New York Independent System Operator, Inc.)Docket No. ER11-4338-002

CONFIRMING AFFIDAVIT OF NICOLE BOUCHEZ, PH.D.

Dr. Nicole Bouchez declares:

1.I am the Principal Economist, Market Design of the New York Independent System

Operator, Inc. (“NYISO”). My business address is 10 Krey Boulevard, Rensselaer, New

York, 12144.

2. My responsibilities include the system review of the interaction of NYISO market rules

with the market rules of neighboring markets, the assessment of NYISO market outcomes to identify market efficiency improvement opportunities, and the support of long-term

market design evolution. These responsibilities encompass the evaluation and

development of rules regarding the participation of Demand Side Resources in the

NYISO-administered markets.

3. I have worked as an Energy Economist for 10 years. I hold a Ph.D. and M.A. in

International Economics from the University of California, Santa Cruz and a B.A. in

Economics and International Relations from the University of California, Davis.

4. I submit this affidavit in support of the New York Independent System Operator Inc.’s

Answer to Comments and Request for Leave to Answer and Answer to Protest in Docket

No. ER11-4338-002 (“NYISO Answer”).

5. The purpose of this affidavit is to confirm that the information in the tables and charts in

the NYISO Answer are accurate, that the table and charts were created by me or under

1

my supervision, and that the NYISO Answer accurately describes the information contained in those tables and charts.

6.I have personal knowledge of the facts and opinions herein and if called to testify could

and would testify competently hereto.

7.This concludes my affidavit.

2

CERTIFICATE OF SERVICE

I hereby certify that I have this day caused the foregoing document to be served upon each person designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Commission Rules of Practice and Procedure, 18 C.F.R. § 385.2010 (2013).

Dated at Washington, D.C. this 19th day of September 2013.

/s/ Catherine Karimi

Catherine Karimi

Sr. Professional Assistant

Hunton & Williams LLP

2200 Pennsylvania Ave, NW

Washington, DC 20037

Tel: (202) 955-1500

Fax: (202) 778-2201

E-mail: ckarimi@hunton.com