10 Krey Boulevard Rensselaer, NY 12144

September 21, 2012

By Electronic Delivery

Kimberly D. Bose Secretary

Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426

Re: Joint Study Commissioned by ISO RTO Council and Submitted in

Compliance with Federal Energy Regulatory Commission’s Order No. 745

Requiring the RTOs/ISOs to Examine the Requirements for and Impacts of

Implementing a Dynamic Net Benefits Approach to the Dispatch of

Demand Resources in the Wholesale Energy Markets; Docket RM10-17-

000

Dear Secretary Bose:

The ISO RTO Council (“IRC”) respectfully submits the attached report entitled Options

for Implementing a Dynamic Net Benefits Test Based on the Billing Unit Effect (“IRC

Report”) in compliance with the Federal Energy Regulatory Commission’s Order No.

745.1 The IRC is an industry organization that originally formed in the mid-1990s to

support the introduction of competition and open access transmission service in wholesale

power markets. It is now comprised of the 10 current North American ISOs and RTOs

including Alberta Electric System Operator (“AESO”), California Independent System

Operator (“CAISO”), Electric Reliability Council of Texas (“ERCOT”), Ontario’s

Independent Electricity System Operator (“IESO”), ISO New England (“ISO-NE”),

Midwest Independent Transmission System Operator (“MISO”), New York Independent

System Operator (“NYISO”), New Brunswick System Operator (“NBSO”), PJM

Interconnection (“PJM”) and Southwest Power Pool (“SPP”). The IRC works in a

collaborative fashion to develop effective tools standards, protocols and procedures to

improve competitive energy markets across North America.

1 Demand Response Compensation in Organized Wholesale Energy Markets, Order No. 745, FERC Stats. & Regs. 31, 322 (2011) (hereafter, “Order No. 745”). Paragraph 84 of Order No. 745

1

The IRC members2 appreciate the opportunity the Commission has provided to present a collective examination of the requirements, and impacts of, implementing a dynamic net benefits test in the dispatch of demand resources in day-ahead and real-time energy

markets. The IRC Report, in conjunction with individual compliance filings, is intended to meet the compliance filings obligations for the CAISO, ISO-NE, MISO, NYISO, PJM and SPP. The individual filings will incorporate by reference this IRC Report and will

highlight and expand upon the pertinent analysis and discussion presented in the IRC

Report as applicable to the commitment and dispatch software and algorithms that are

unique to each individual ISO’s or RTO’s markets.3

The IRC Report, which was prepared by Dr. Scott Harvey in collaboration with the IRC

Members, examines the range of implementation choices, issues, and potential costs

associated with the implementation of a dynamic net benefits calculation based on the

billing unit effect as a trigger for the activation of economic demand response. A high level

description of the operation of ISO/RTOs’ unit commitment and dispatch software and

multi-settlement systems is the starting point for this examination. Implementation issues

associated with application of a dynamic net benefits calculation based on the billing unit

effect in ISO and RTO unit commitment and dispatch software are then discussed in

conjunction with an evaluation of four alternative approaches to implementing such a

dynamic net benefits test based on the billing unit effect in ISO and RTO day-ahead and

real-time energy markets. The advantages and disadvantages in implementing of each

alternative are presented. The four alternative approaches examined in the paper are:

• Attempt to develop a solution to the unit commitment and dispatch problem that

applies a net benefits test based on the billing unit effect, utilizing known

mathematical dual optimization techniques and equilibrium constraints;

• Attempt to develop new solution concepts that might permit a faster and better unit

commitment and dispatch solutions to applying a net benefits test based on the

billing unit effect;

• Apply an ad hoc approach to apply a net benefits test based on the billing unit

effect utilizing existing software solution methods that would allow an evaluation of the billing unit effect based on making all demand response bids available for dispatch versus no demand response bids available for dispatch; and

• Apply an ad hoc approach to apply a net benefits test based on the billing unit

effect utilizing existing software solution methods that would allow an evaluation of the billing unit effect from making groupings of demand response bids available for dispatch.

2 The IESO, AESO, and NBSO are not subject to the Commission’s jurisdiction and did not participate

directly in the development of the IRC Report . In addition, ERCOT, which is not subject to the compliance obligations the Commission set forth in Order No. 745, did work collaboratively with the remaining members to support the development of the IRC Report.

3 Each ISO and RTO relies on somewhat different software and processes to schedule and dispatch resources in their day-ahead and real-time energy markets, but all ISOs and RTOs coordinating such markets use

software engines having four distinct components: 1) a unit commitment process; 2) a dispatch engine; 3) a powerflow calculation; and 4) a price calculation step.

2

The basic conclusion of the IRC Report is that the implementation of a more dynamic net

benefit test in the dispatch would likely have adverse impacts on the solution time of ISO

and RTO real-time dispatch software and day-ahead market software. To address these

impacts might likely require simplifications in other elements of the economic

commitment and dispatch software platforms that would result in less efficient solutions

and higher prices for power consumers. Further, the known software formulations utilized

by, and available to, ISOs and RTOs today would necessarily require such a net benefit test

to be implemented in a very restricted manner that would have the potential to routinely

produce anomalous market outcomes and still may not adequately achieve the objectives of

the dynamic net benefits test. The four alternative approaches examined would require, at

a minimum, substantial changes to the existing ISO/RTO software and in some cases may

require entirely new commitment and dispatch algorithms and software.

The IRC respectfully requests that the Commission accept this joint submittal, in

conjunction with the individually filed compliance filings of CAISO, ISO-NE, MISO,

NYISO, PJM and SPP, to meet the compliance obligations set forth by the Commission in paragraph 84 of Order No. 745.

Respectfully Submitted,

Nancy SaracinoStephen G. Kozey*

General CounselVice President, General Counsel, and

Sidney Davies Assistant General CounselSecretary

John Anders*Midwest Independent Transmission

Senior CounselSystem Operator, Inc.

California Independent System OperatorP.O. Box 4202

CorporationCarmel, Indiana 46082-4202

250 Outcropping Wayskozey@midwestiso.org

Folsom, California 95630

janders@caiso.com

Matthew Morais*Carl F. Patka*

Assistant General CounselAssistant General Counsel

Electric Reliability Council of Texas, Inc.Raymond A. Stalter

2705 West Lake DriveDirector of Regulatory Affairs

Taylor, Texas 76574New York Independent System Operator,

mmorais@ercot.comInc.

10 Krey Blvd

Rensselaer, New York 12144

cpatka@nyiso.com

Raymond W. HepperCraig Glazer*

Vice President, General Counsel, andVice President-Federal Government Policy

SecretaryPJM Interconnection, L.L.C.

Theodore J. Paradise*Suite 600

Assistant General Counsel, Operations and1200 G Street, N.W.

PlanningWashington, D.C. 20005

3

ISO New England Inc.202-423-4743

One Sullivan Roadglazec@pjm.com

Holyoke, Massachusetts 01040

tparadise@iso-ne.com

Paul Suskie*

Senior Vice President, Regulatory Policy and General Counsel

Southwest Power Pool, Inc.

415 North McKinley, Suite 140

Little Rock, Arkansas 72205

psuskie@spp.org

* = persons designated to receive service

4

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance

with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §

385.2010.

Dated at Rensselaer, NY this 21st day of September, 2012.

By:/s/ John C. Cutting

John C. Cutting

Senior Regulatory Affairs Specialist

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, NY 12144 (518) 356-7521

Options for Implementing a Dynamic Net Benefits Test

Based on the Billing Unit Effect

Prepared by Scott Harvey

September 5, 2012

Prepared for the ISO RTO Council

Executive Summary

FERC’s Order 745 instructed the ISOs and RTOs to examine “the requirements for, costs

of, and impacts of implementing a dynamic net benefits approach to the dispatch of

demand resources that takes into account the billing unit effect in the economic dispatch

in both the day-ahead and real-time energy markets.”1 This paper is one part of the ISOs

and RTOs response to the Commission’s inquiry. The basic finding of this paper is that

the only method of implementing a net benefit test based on the billing unit effect using

existing, known software formulations would implement the test in a very restricted

manner that would have the potential to routinely produce anomalous outcomes, and even

this restricted implementation would likely have adverse impacts on the solution time of

ISO and RTO real-time dispatch software and day-ahead market software. These

solution time impacts might in turn require simplifications in other elements of the

software that would result in less efficient solutions, higher cost of meeting load, and

higher prices for power consumers.

The discussion of issues associated with implementation of a dynamic net benefits test based on the billing unit effect is structured around an evaluation of four general

approaches that could be taken to implementing such a dynamic test in either the dayahead or real-time energy markets. The four approaches are:

• Attempt to develop a solution to the unit commitment and dispatch problem that

applies a net benefits test based on the billing unit effect, utilizing known

mathematical dual optimization techniques and equilibrium constraints;

• Attempt to develop new solution concepts that might permit a faster and better

unit commitment and dispatch solutions to applying a net benefits test based on

the billing unit effect;

• Apply an ad hoc approach to apply a net benefits test based on the billing unit

effect utilizing existing software solution methods that would allow an evaluation of the billing unit effect based on making all demand response bids available for dispatch versus no demand response bids available for dispatch;

• Apply an ad hoc approach to apply a net benefits test based on the billing unit

effect utilizing existing software solution methods that would allow an evaluation of the billing unit effect from making groupings of demand response bids

available for dispatch.2

1

Order 745 at paragraph 84. The billing unit effect as specified by FERC in Order 745 compares

the impact of a reduction in load in reducing the market price of power in the real-time or day-ahead market

times the amount of power purchased at the reduced price (see Order at paragraph 50 to 53, and paragraph

79 footnote 162, ) to the payments to demand response required to elicit that reduction in load. FERC

further specified that the calculation of the benefit from the reduction in price would be applied to real-time

load, without regard to the extent to which power consumers had procured power through forward contracts

or the amount of power produced by vertically integrated utilities to meet their customers demand (Order at

Paragraph 102).

2

ISO New England in particular has been working to try to develop such an approach as discussed

further in section IIIE below.

i

The first two approaches entail developing rigorous mathematical solutions to implement

a net benefits test based on the billing unit effect. Either or both approaches might

ultimately yield high quality solution concepts that could be implemented in commercial

programs that would apply a net benefits test based on the billing unit effect in on line

operation. However, both of these approaches require significant focused research efforts

whose outcome and timeline is uncertain. At the end of two or three years they might

produce the requirements to allow the development of programs that would yield high

quality solutions to the net benefit test based on the billing unit effect within solution

time frames that would be acceptable to ISOs and RTOs from an operating perspective,

or they might not.

Implementation of a net benefit test based on the billing unit effect utilizing the third

approach, on the other hand, would not require the development of any new solution

concepts or methods, so could provide the basis for ISOs and RTOs to move forward in

the near-term with the development of software to implement a dynamic net benefits test

based on the billing units effect. This approach has two limitations, however, that the

ISO’s and RTO’s should be aware of. First, the essence of this approach is that it only

compares the billing unit effect benefits of making all demand response bids available for

dispatch or none. This has the consequence that some demand response bids that would

pass the billing unit effect based net benefits test on their own, could fail to pass the test

in combination with all other demand response bids, or conversely that bids that would

not pass on their own, might pass in combination with other more cost effective demand

response bids. This limitation of the third approach could have undesirable consequences

when the billing unit effect based net benefits test is applied in the real-time dispatch and

even more undesirable consequences when applied to the day-ahead market’s

optimization over the 24 hours of the operating day. Second, the increase in computation

time required to implement this approach would require compensating tradeoffs in terms

of extending software solution time or reducing other software functionality that would

tend to raise the cost of meeting load and/or adversely impact reliability or incurring the

costs required to solve two cases in parallel.3

The fourth approach would, similar to the third approach, attempt to utilize only current

software algorithms allowing a dynamic billing unit effect based net benefit test to be

implemented within a defined time frame. It would attempt to avoid the undesirable

consequences of the all or nothing test applied by the third approach, and apply a net

benefits test based on the billing unit effect to groups of demand response bids.

However, while there are ad hoc methods that could perhaps be used to apply this fourth

approach to the day-ahead or real-time dispatch on an uncongested system, these ad hoc

methods would not be workable when applied to a congested transmission system or to

the day-ahead unit commitment, unless combined either with fundamental changes in the

structure of the dispatch software or a research effort to attempt to develop algorithms or

solution methods that would provide an acceptable solution within an acceptable time

3

Some ISOs and RTOs already solve more than one dispatch case. For these ISOs and RTOs

applying the net benefits test using the third approach and solving the comparison case in parallel, would

require running an additional test case for each dispatch case they solve. Hence, an ISO or RTO that

currently solves two dispatch cases in parallel would need to solve four dispatch cases in parallel.

ii

frame from an ISO or RTO operating perspective as under the first and second approaches.

Beyond the implementation challenges associated with each of these approaches,

implementation of a solution based on any of these approaches would require making a

variety of compromises in how a net benefits test based on the billing unit effect would

be applied:

• In real-time dispatch software that includes either full inter-temporal

optimization or look-ahead ramp management functionality;

• In real-time pricing systems that include special pricing rules such as ex

post pricing, ELMP pricing, fixed block pricing or separate scheduling and pricing passes;

• In demand response evaluations in market power mitigation passes or

intra-day look-ahead scheduling and unit commitment evaluations ;

• To evaluate the billing unit effect on the day-ahead market of real-time

price impacts of demand response activation;

These compromises are discussed in detail in Section IV. The critical problem in using

existing software programs, algorithms and solution methods to apply a net benefits test

based on the billing unit effect in a dynamic application is that the dispatch of the demand response resource would be contingent on the outcome of the net benefits test based on

the billing unit effect.

Several recent FERC orders suggest that the Commission does not intend that the

dispatch of demand response resources depend on the outcome of the net benefits test

based on the billing unit effect, rather, it appears that the Commission intends that

demand response resources be dispatched based on their bids, i.e. based on a

conventional production cost minimizing benefit test, with only the nature and amount of

their compensation potentially depending on the outcome of the net benefits test based on

the billing unit effect. If this understanding is correct, the dispatch of demand response

resources based on their bid could be implemented using existing software tools, and the

application of the net benefit test based on the billing unit effect could be carried out after

the fact in the settlements process, i.e. there would be no need for a “dynamic” net benefit

test based on the billing unit effect in the sense of a test carried out as part of the real-

time economic dispatch or in the process of clearing the day-ahead market. While the

application of the net benefit test based on the billing unit effect would be complex to

carry out even within an after the fact settlement process and would require some

simplifications, appropriate simplifications would permit it to be applied without the

development of new market software algorithms or solution concepts.

iii

Table of Contents

I.Overview..........................................................1

II. Design and Structure of Industry Dispatch and Unit Commitment Software..2

III. Net Benefits Test Implementation Choices and Issues...................4

A. Introduction.................................................4

B.Develop New Software Applying Known Methods......................9

C.Develop New Solution Methods; Develop New Software Applying These

Methods......................................................10

D. Modify Existing Software to Apply a Net Benefits Test Based on the Billing

Unit Effect on an All or Nothing Basis...............................10

E.Modify Existing Software to Apply a Net Benefits Test Based on the Billing

Unit Effect to Groups of Demand Response Bids......................15

F.Conclusions....................................................19

IV. Other Design Choices and Market Impacts..........................20

A. Interaction with real-time dispatch software that includes inter-temporal

optimization...................................................21

B.Interaction with special RTO pricing rules...........................24

C.Accounting for the real-time price reductions on the day-ahead supply curve.. 27

D. Interaction with market power mitigation processes................29

E.Impact on in day look-ahead scheduling and unit commitment evaluations..34

F.Interaction with Ramp Capability Products...........................37

V. Alternative Approaches..........................................38

VI. Recommendations..............................................40

Appendix A...........................................................42

Options for Implementing a Dynamic Net Benefits Test Based on the Billing Unit Effect4

Prepared by Scott Harvey5

September 5, 2012

I.Overview

FERC’s Order 745 instructed the ISOs and RTOs to examine “the requirements for, costs

of, and impacts of implementing a dynamic net benefits approach to the dispatch of

demand resources that takes into account the billing unit effect in the economic dispatch

in both the day-ahead and real-time energy markets.”6 This paper discusses the

implementation choices, issues, and potential costs associated with compliance with the

elements of the Commission’s Order 745 that concern the implementation of a dynamic

net benefits calculation based on the billing unit effect as a trigger for the activation of

economic demand response.

Section II of this paper provides a high level description of the operation of industry unit

commitment and dispatch software and multi-settlement systems to provide background

and context for the later discussion. Section III describes the implementation issues that

would be associated with application of a dynamic net benefits calculation based on the

billing unit effect in ISO and RTO unit commitment and dispatch software, then

describes and evaluates the four alternative approaches to implementing such a dynamic

net benefits test based on the billing unit effect in ISO and RTO day-ahead markets and

real-time dispatch summarized above. Section IV discusses a number of secondary

4

This paper was prepared on behalf of seven members of the ISO RTO Council, the California ISO,

ERCOT, ISO New England, MISO, the New York ISO, PJM LLC, and the Southwest Power Pool. The

IRC is comprised of the Alberta Electric System Operator (“AESO”), the California Independent System

Operator (“CAISO”), Electric Reliability Council of Texas (“ERCOT”), the Independent Electricity System

Operator of Ontario, Inc., (“IESO”), ISO New England, Inc. (“ISONE”), Midwest Independent

Transmission System Operator, Inc., (“Midwest ISO”), New Brunswick System Operator (“NBSO”), New

York Independent System Operator, Inc. (“NYISO”), PJM Interconnection, L.L.C. (“PJM”), and Southwest

Power Pool, Inc. (“SPP”). The AESO, IESO, and NBSO are not subject to the Commission’s jurisdiction,

and these comments do not constitute agreement or acknowledgement that they can be subject to the

Commission’s jurisdiction. ERCOT is not subject to the Commission’s jurisdiction with respect to the

issues presented in this NOPR, but is joining in support of the IRC comments. The IRC’s mission is to

work collaboratively to develop effective processes, tools, and standard methods for improving the

competitive electricity markets across North America. In fulfilling this mission, it is the IRC’s goal to

provide a perspective that balances Reliability Standards with market practices so that each complements

the other, thereby resulting in efficient, robust markets that provide competitive and reliable service to

customers.

5

This paper has benefitted from the comments of all of the U.S. ISOs and RTOs. It has particularly

benefitted from the comments and discussion with Khaled Abdul-Rahman of the California ISO of a

number of the issues considered in this paper, but any errors are solely the responsibility of the author.

6

Order 745 at paragraph 85

1

issues in implementing a dynamic net benefits test based on the billing unit effect that

would impose limitations on the design and/or unit commitment and dispatch results that the Commission should be aware of in evaluating alternative approaches to implementing such a dynamic test.

Section V discusses FERC comments and instructions in several Order 745 Compliance

and Rehearing Orders which suggest that a dynamic net benefits test based on the billing

unit effect of the kind that gives rise to the implementation problems discussed in

sections III and IV is not what FERC envisions for Order 745 compliance and hence is

not necessary to comply with the Commissions intent in Order 745. If this understanding

is correct, an alternative approach to implementing Order 745 that would apply a net

benefits test based on the billing unit effect in the settlement process would be feasible.

Finally, section VI briefly summarizes the alternatives and their advantages and

disadvantages in implementing the dynamic net benefits test based on the billing unit

effect.

II. Design and Structure of Industry Dispatch and Unit Commitment Software

Each ISO and RTO relies on somewhat different software and processes to schedule and

dispatch resources in their day-ahead and real-time energy markets, but all ISOs and

RTOs coordinating such markets use software engines having four distinct components:

1) a unit commitment process; 2) a dispatch engine; 3) a powerflow calculation; and 4) a price calculation step.

These components are distinct and in the case of programs developed by some vendors,

the program may cycle through these components more than once in the process of

reaching a solution. The unit commitment process determines which units are on-line

and available for dispatch in a particular period in the dispatch step. This is a

fundamentally different optimization problem than the economic dispatch because unit

commitment has binary, i.e. 0, or 1 choice variables, i.e. the unit is either off line or on

line and significant costs are typically incurred to start an off-line unit and keep it on line

at minimum load. Moreover, the unit commitment decision has irreversible impacts

because of unit’s minimum up times and down times. More complex formulations of the

unit commitment problem, like the one used by California ISO, include combined cycles

or multi-stage generation units with transition time, transition path, and transition cost in

the unit commitment formulation adding more complexity to the solution algorithm

when such a unit is (or could be) in transition from one configuration to another.

The unit commitment is therefore determined based on individual resource’s start-up

costs, minimum load or no-load costs, transition costs and times, incremental energy

costs, minimum run time, minimum down time, and other resource characteristics such as

their cost of providing various types of ancillary services. Because unit commitment is

an integer variable problem, not a conventional linear programming problem, distinct

solution methods, which vary from vendor to vendor, are used to determine the unit

commitment.

2

The dispatch step determines the amount of energy that each on-line unit is to produce. In

this step, the dispatch engine dispatches the available generation to meet load at least cost

on a production cost basis, given the unit commitment, while taking account of resources’

inter-temporal constraints, transmission constraints, both pre and post-contingency, and

other requirements, such as ancillary service requirements.7 These dispatch engines may

be solved by traditional linear programming methods or in some cases using mixed

integer programming. In all of these programs the re-dispatch to solve transmission constraints is based on linear shift factors representing the sensitivity of the flow on a transmission branch or flowgate to power injections at a particular bus/node.

The third component is a powerflow step which calculates the line flows associated with

the dispatch solution to determine whether there are overloads of any monitored element

in any base case or contingency case. The various vendors use different methods to

calculate these flows, some methods entailing an AC powerflow, quasi AC powerflow

solution and others use DC powerflow solutions. Some vendors in some programs solve

a powerflow repeatedly as the program iterates to a solution and others do not. This

powerflow step calculates the transmission overloads, if any, to be solved in additional

unit commitment and/or dispatch steps, and includes criteria for determining when the

line flows are within an acceptable range so that no further iteration is required.

The fourth component is a price calculation step, i.e. the step in which LMP prices are

calculated. The price calculation step is carried out after the final unit commitment has

been determined, and after the dispatch step has resolved any transmission constraint

violations. In existing software designs, these prices are not used or even known in the

process of committing generation or dispatching generation to meet load at least cost, but

are determined at the very end of the program cycle. As will be discussed further in

Section IV, special rules that vary from RTO to RTO sometimes apply in this price

calculation step.

Another common characteristic of most US ISOs and RTOs is that they coordinate both

day-ahead and real-time markets.8 These markets are operated as multi-settlement

systems in which day-ahead market schedules are settled at day-ahead market prices and

deviations between real-time generation or consumption and day-ahead schedules are

settled at real-time prices. These day-ahead and real-time markets are linked in ISO and

RTO systems by the use of common transmission system models and constraints, 9 and at

the market participant level by market participants reflecting their expectations regarding

real-time conditions in their day-ahead market bids, offers and schedules.

7

Most ISOs and RTOs at this point in time jointly optimize energy and ancillary service schedules

in their day-ahead markets. Some ISOs and RTOs’ real-time dispatch engines re-optimize ancillary service schedules in real-time while others take ancillary service schedules as given in the real-time dispatch.

8

At present, SPP coordinates a day-ahead scheduling process rather than a complete day-ahead

market but is moving towards implementation of a full day-ahead market similar to those coordinated by the other U.S. ISOs and RTOs.

9

The transmission system representation may change between day-ahead and real-time because of

changes in the status of transmission elements between the time the day-ahead market is initialized and real-time, but the models are representing the same system and constraints.

3

III.Net Benefits Test Implementation Choices and Issues

A.Introduction

This section discusses the core implementation issues associated with the use of a

dynamic net benefits test based on the billing unit effect as prescribed by the Commission

in Order 745 to trigger dispatch of demand response resources in real-time operation or to

schedule them in a day-ahead market. As explained by the Commission in its order, the

meaning of a “dynamic” test in this context is a test that is dynamic in the sense that it is

implemented within the real-time dispatch or within the day-ahead market, because the

outcome of the test determines whether demand response would be activated and hence

what level of demand must be met by the real-time dispatch or the day-ahead market

schedules.10

These core implementation issues are discussed below in the context of four general

approaches that could be used to implement such a dynamic net benefits test based on the billing unit effect. The issues discussed in this section are viewed as “core” issues

because they concern the ability of the ISOs and RTOs to acquire commercial software capable of implementing such a net benefits test within the ISOs and RTOs’ dispatch and unit commitment processes. A number of other less central issues which concern various limitations on the accuracy of such a dynamic net benefits test based on the billing unit effect implemented using these approaches are discussed in section IV.

The fundamental consideration that drives the need for careful consideration of the

method to be used to implement a dynamic net benefits test based on the billing unit

effect in ISO and RTO unit commitment and dispatch software is that the net benefits

calculation based on the billing unit effect is not a standard algorithm such as those

currently used in electric industry dispatch software which maximize net benefits through

the application of algorithms based on production cost minimization. As described in

section II, existing dispatch software does not even calculate clearing prices until the

dispatch problem has been solved. Hence, existing software algorithms would need to be

modified to calculate clearing prices at earlier points in the process of solving the

dispatch or alternatively make use of the shadow prices generated in the solution process

to apply a net benefits test based on the billing unit effect. The real problem, however is

that the changes in software design required to implement a net benefits test based on the

billing unit effect are much more fundamental. A design, in which prices are used to

determine the dispatch, rather than the least cost dispatch determining shadow prices and

clearing prices, requires fundamental changes in the solution process, so existing

software designs and algorithms cannot be used to directly implement the net benefits

calculation.

A further consideration in implementing a dynamic net benefits test based on the billing

unit effect is that all U.S. ISOs and RTOs settle their spot energy markets based on

locational prices (either zonal or nodal). In these markets, power consumers pay, and

10

See Order 745 at paragraph 84

4

generators are paid, the price of power at their location which may differ substantially

between locations on the transmission system as a result of transmission congestion.

Hence, there is not a single supply curve for an ISO or RTO market, there is a supply

curve for incremental power at each location within the ISO or RTO, given the dispatch

of the entire ISO or RTO to meet load at all other locations. Moreover, in a market with

transmission congestion, dispatching demand response to reduce or minimize net

payments by power consumers or to reduce or minimize payments to generators is not

equivalent to dispatching demand response to reduce or minimize gross energy market

payments. This is because gross energy market payments by power consumers on a

congested transmission system equal payments to generators plus congestion rents, and

congestion rents flow directly (through the allocation of FTRs, CRRs, or ARRs) or

indirectly (through the allocation of FTR, TCC or CRR auction revenues) to power

consumers. Hence, applying a net benefits test based on the billing unit effect must

deviate even further from traditional production cost minimizing solution concepts and

algorithms on a congested transmission system.

The billing unit effect benefit to power consumers from the dispatch of demand response to depress spot energy prices would be measured in the presence of congestion by

calculating the reduction in the net energy market payments by remaining load,11 which could be compared to the payment to demand response providers to account for the

billing unit effect in applying the net benefits test to the dispatch of demand response when there is transmission congestion.

One possible outcome from Order 745 implementation is that most or all economic

demand response bids would be submitted in real-time and evaluated in the real-time

dispatch. If this turns out to be the case, it would not be necessary to apply the net

benefits test based on the billing unit effect in the day-ahead market and the impact of

real-time demand response on day-ahead market prices would be felt through the

submission of virtual supply bids and price capped physical load bids in the day-ahead

market. The implications of such an outcome are discussed at length in subsection 5 of

section IV below. Another possibility is that a material number of demand response bids

would be submitted in the day-ahead market and their activation would be need to be

determined by the application of a net benefits test based on the billing unit effect.

There are three features of the unit commitment in the day-ahead market that would make

the application of the net benefits test based on the billing unit effect a more intractable

problem in the day-ahead market than would be the case in the real-time dispatch. These

are 1) the fundamental properties of the unit commitment problem and the methods

currently used to solve it would further complicate development of new algorithms for

solving the unit commitment problem based on a net benefits test that accounts for the

11

The reference to remaining load is to the load that remains after the demand response reductions.

These net energy payments by remaining load would be equal to the total energy price payments to suppliers. The calculation of net load is illustrated in the examples in Appendix A. The reference to “energy price payments” reflects the fact that this calculation would not account for the impact of dispatching demand response on uplift costs or ancillary services market prices.

5

billing unit effect;12 2) further complications introduced by the need to jointly solve the

day-ahead market over the 24 hour time horizon of the operating day; and 3) the potential

for the application of a net benefits test based on the billing unit effect within the unit

commitment process to depress clearing prices through uneconomic generation

commitment, rather than through the intended dispatch of demand response resources.

In Order 745 FERC directed the ISOs and RTOs to depart from the production cost

minimizing benefits test in the dispatch of demand response if the dispatch of the demand response sufficiently depresses energy market clearing prices,13 but has not directed that they depart from production cost minimization in making other unit commitment and

dispatch decisions that would also depress energy market clearing prices and hence

potentially give rise to a billing unit effect. Hence, there is a sense in which the FERC

order envisions two distinct net benefits tests being applied within the unit commitment process, one based on production cost minimization and one based on the billing unit

effect. These features are briefly discussed below to provide context for the discussion of alternative implementation approaches which follows.

The security constrained economic dispatch used by many ISOs and RTOs to meet load

in real-time and to determine day-ahead schedules given the unit commitment generally

has the properties of a conventional linear programming problem with shadow prices that

correspond to clearing prices.14 As noted in section II, however, day-ahead markets also

include a unit commitment step that determines which units can be dispatched in the

dispatch step. The unit commitment problem is a complex integer variable problem that

cannot be solved with conventional linear programming methods. The various U.S. ISOs

and RTOs and their software vendors use a variety of methodologies, including mixed

integer programming, to determine the unit commitment in their day-ahead market.

Not only are existing unit commitment algorithms based on production cost minimization

rather than payment minimization, the current solution algorithms for the unit

commitment step do not develop explicit shadow prices (as is the case in the linear

programming solution to the economic dispatch problem) that could be used as a starting

point for the application of payment minimization within the unit commitment step. This

lack of prices could be addressed by using prices calculated in each dispatch step to guide

the iteration in the unit commitment step and either formulating the objective function in

terms of prices or imposing a side constraint that accounts for price effects, but these

prices will not provide a direct link between changes in the unit commitment and changes

in prices and net payments by remaining load as is feasible with a production cost

minimization objective function.

12

These non-convexities are also present to a degree in the real-time dispatch of some ISOs and

RTOs. The California ISO, for example, uses a mixed integer program to solve the real-time dispatch

because of integer variables associated with non-convex multi-segment ramp rate curves and the modeling

13

14

See Order 745 at Paragraphs 50-54 and 79.

As noted above, this is only partially true for the real-time dispatch software of some ISOs and

RTOs which relies on mixed integer programming to solve the real-time dispatch.

6

The second complication in determining the unit commitment is that it must be solved

jointly over the hours of the day to achieve the overall least cost unit commitment,

because of start-up costs, transition costs, minimum run-times, minimum load costs, ramp rates, forbidden regions, and minimum down times. Hence, all US ISOs and RTOs

jointly optimize their day-ahead markets over at least a 24-hour time frame. This

optimization over time in day-ahead markets has the consequence that a change in load in one hour can impact the unit commitment in a way that changes clearing prices in other hours. For example, in analyzing potential approaches to complying with Order 745 the NYISO reran a day-ahead market case with additional price capped load bids and found that the demand reduction in one hour attributable to the activation of a price capped load bid in that hour caused the clearing price to rise in the following hour. The objective of

the optimization is to minimize the sum or the total cost across all hours rather than

minimizing the cost of meeting load in each individual hour.

Third, it needs to be kept in mind that clearing prices could also be artificially depressed

by committing excess generation in the unit commitment process and paying more than

the clearing price for the generation’s output (i.e. paying uplift in addition to the LMP

price to cover the start-up and minimum load costs of the excess generation). Order 745,

however, only orders above market payments and assignment of uplift costs to consumers

for the uneconomic dispatch of demand response resources that sufficiently depresses

clearing prices in ISO and RTO markets. Hence, any logic structure that is developed for

use in implementing a dynamic net benefits test based on the billing units effect within

the unit commitment step would need to be structured so that it would dispatch demand

response to depress clearing prices based on the billing unit effect net benefits criteria

(whether implemented solely through changes in the objective function or also through

incorporation of sides constraints), but not uneconomically commit generation to depress

clearing prices.

Maintaining such a distinction without introducing unintended consequences would be

one of the additional challenges in applying a net benefits test based on the billing unit

effect within ISO and RTO unit commitment processes. When the dispatch of demand

response depresses clearing prices in the day-ahead market in particular, its dispatch

would potentially also make the commitment of some generation uneconomic. The

normal operation of ISO and RTO unit commitment software would then be to decommit

the uneconomic generation that is no longer needed or economic to meet demand.

However, decomitting uneconomic generation would reduce the price impact of

dispatching the demand response and perhaps cause demand response activation to fail

the net benefits test based on the billing unit effect as the change in the unit commitment

would replace low cost generation with higher cost demand response with little impact on

clearing prices.

If, however, an attempt were made to modify the unit commitment process to not

decommit uneconomic generation when demand response was activated so that demand

response activation would be more likely to artificially depress clearing prices, there

would be a potential for the unit commitment to depress clearing prices by simply

committing uneconomic generation, which would have a billing unit effect similar to the

7

activation of demand response. One of the complications in avoiding such an outcome is

that the commitment of excess generation (i.e. more than would be economic based on a

production cost minimizing benefit test) that depresses clearing prices would always pass

a net benefits test based on the billing unit effect, which does not consider the uplift costs

that would be associated with an inefficient unit commitment but does account for the

uplift costs associated with above market payments to demand response. Hence, there

might be a potential for day-ahead market solutions in which no demand response is

activated because clearing prices are too low, generation profits are reduced because

clearing prices are artificially depressed, but consumer costs rise because too many units are on line and generators receive substantial above market uplift payments.15

With these considerations in mind, we describe four possible approaches to implementing

a dynamic net benefits calculation based on the billing unit effect, discuss the

implementation issues, general timeline and costs associated with each, and identify

known issues with the quality of the solutions each approach would be capable of

producing.

One possible approach would be to develop a solution to the unit commitment and

dispatch problem that applies a net benefits test based on the billing unit effect utilizing known dual optimization techniques;

A second possible approach would be to attempt to develop new solution concepts that might permit a faster and better unit commitment and dispatch solutions applying a net benefits test based on the billing unit effect;

A third possible approach would be an ad hoc methodology that would apply a net

benefits test based on the billing unit effect utilizing existing software solution methods

that would allow an evaluation of the billing unit effect based on making all demand

response bids available for dispatch versus no demand response bids available for

dispatch;

A fourth possible approach would be to develop an ad hoc methodology that would apply a net benefits test based on the billing unit effect utilizing existing software solution

methods that would allow an evaluation of the billing unit effect from making groups of demand response bids available for dispatch.

Each of these general approaches is discussed below, describing each potential approach

in more detail, discussing in general terms the likely time frame in which ISOs and RTOs

would have the ability to acquire commercial software that would implement a net

benefits test based on the billing unit effect in the ISO’s and RTO’s unit commitment and

dispatch software, and commenting on known properties of the solutions produced by

each approach.

15

As discussed below, the potential for this kind of outcome in which prices are depressed more

through the commitment of excess generation than through the dispatch of demand response appears

unlikely under some of the approaches discussed below (such as the third approach) but could become an issue in attempting to implement some of the other approaches.

8

B.Develop New Software Applying Known Methods

As outlined above, the first possible approach to carrying out a dynamic net benefits test

based on the billing unit effect would be to develop a solution to the unit commitment

and dispatch problem that applies a net benefits test based on the billing unit effect

utilizing known dual optimization techniques. For instance, the net benefits test based on

the billing unit effect could theoretically be incorporated into the ISO and RTO’s

optimization as a new non-linear constraint under the current production cost

minimization objective function, or replace the current production cost minimization

objective function with a load or billing unit effect cost minimization objective function.

Both of these mathematical formulations are theoretically possible. The issue with this

approach is that both formulations would have a net benefit test expression that has cross-

product term of the bid megawatt dispatch variables in the corresponding constraint or in

the objective function that may call for the need of non-linear optimization solution

algorithms. It should also be noted that in a net benefits test formulation, the locational

prices are no longer byproducts of the optimization problem as they are in the current

approach and calculated as post process after the optimization. The clearing prices would

now be part of the optimization formulation.

The resultant net benefits test formulation is described as a self-referential Mixed Integer

Non-Linear Program problem. This type of problem formulation is known in

mathematics to be extremely challenging to solve efficiently, let alone optimally, and

requires long solution times due to its non-convexity, non-linearity, discreteness, and also

due to the less-developed mathematical techniques required to handle such mathematical

programs with difficult equilibrium constraints. Both the California ISO and ISO New

England have previously provided FERC with detailed discussions of the complexity of

solving this class of problem. 16 Both ISO New England and the California ISO have

observed that there is no commercially available program capable of solving large scale

problems of this type, let alone solving this class of problem within the solution time

frame of ISO and RTO day-ahead markets or real-time dispatch.

A particularly important unknown is whether these suggested solution methods could be

used or similar concepts used to apply a net benefits test based on the billing unit effect to

the solution of the unit commitment problem, rather than simply to the economic

dispatch. Beyond the unknown workability of applying these known solution methods to

the unit commitment problem, a further deeper unknown in pursuing this approach is the

workability of these solution concepts in solving the unit commitment problem if a net

benefits test based on the billing unit effect is applied to some choice variables (the

amount of demand response activation) and a net benefits test based on production cost

minimization to other choice variations (generation commitment and dispatch) within a

single unit commitment problem.

The solution concepts needed to implement a dynamic net benefits test based on the

billing unit effect would need to be developed, interactions with other elements of the

16

See Declaration of Khaled Abdul-Rahman, Docket RM10-17-001, April 14, 2011, pp 5-7.

9

dispatch software resolved, and execution time impacts addressed, before a dynamic net

benefits test based on the billing unit effect and utilizing these prospective methods and

algorithms could be implemented. There cannot be a fixed timeline for implementation

of a dynamic net benefits test based the billing unit effect utilizing solution concepts and

algorithms that have yet to be developed. Moreover, until the algorithms that would be

used to implement the approach have been developed, evaluated, and tested, there cannot

be any assessment of any potential undesirable features that might be required to

implement such an approach.

C.Develop New Solution Methods; Develop New Software Applying These

New Methods.

A second approach that ISOs and RTOs could take to implementing a dynamic net

benefits test based on the billing unit effect would be to fund academic and/or industry

research that would attempt to develop new solution concepts that might permit a faster

and better application of a net benefits test based on the billing unit effect to both the unit

commitment and dispatch problems. This approach could focus additional research

specifically on the unit commitment aspects of the problem and explore the consequences

of applying multiple benefits tests to different choice variables with the same

optimization problem prior to moving forward with attempting to develop unit

commitment and dispatch software for application in ISO and RTO markets.

Like the first approach, this approach is fundamentally a research project whose timeline

and outcome are uncertain. This second approach has the potential to take longer than

the first approach to develop and implement ISO and RTO software capable of applying a

net benefits test based on the billing unit effect because of the initial time spent on further

research of solution methods, but it must be kept in mind that there is no assurance that

the first approach would in fact be successful. One possible outcome if the first approach

is pursued is that after several years and after spending many millions of dollars on

software development, it will become apparent that existing solution methods cannot

provide acceptable solutions to the unit commitment and dispatch problem using a net

benefits test based on the billing unit effect and that research on new solution methods

must be undertaken. A key advantage of this second approach is that it might reduce the

likelihood of such an outcome in which no solution is developed, and also offers the

potential to avoid reliance on an approach that is sub-optimal, or excessively costly to

implement. The research that would be undertaken under this approach would not only

be an alternative to pursuing the first approach but is also an alternative to proceeding

immediately to implement approaches three and four.

D. Modify Existing Software to Apply a Net Benefits Test Based on the

Billing Unit Effect on an All or Nothing Basis

A third possible approach to carrying out a dynamic net benefits test based on the billing

unit effect would be an ad hoc approach that could be carried out using only existing

industry algorithms. From a software design standpoint therefore, this approach is a

known quantity. While there would be detailed design issues to resolve in implementing

10

this approach, its development would be akin to normal ISO and RTO software

development projects in which these kinds of design issues are routinely resolved, tradeoffs with software performance identified and addressed in one manner or another.

In its simplest form this approach would entail a three step process; solve the dispatch

without activating demand response, regardless of whether it is economic, using the

existing dispatch and powerflow engines, then calculate clearing prices, and then solve

the dispatch again using the existing dispatch and powerflow engines but activating all

demand response that would be economic to dispatch based on its bid price and

calculating clearing prices based on this dispatch. The third step would compare

consumer payments for energy and demand response costs (but not other uplift costs that

would be borne by load),17 between the two cases and choose which solution to base

dispatch instructions or day-ahead market schedules upon, applying the net benefits test

to the two solutions.18

This approach to implementing a dynamic net benefits test based on the billing units

effect would not require development of new solution concepts but would have

implications for dispatch execution time because it would require dispatching the system to meet two distinct load levels.

If the amount of demand response whose dispatch was being evaluated was sufficiently

small, the difference between the two dispatches would be so small in terms of power

flows and constraint impacts that the second solution would likely be quite fast.19 We

have not sought to quantify exactly how small the amount of demand response would

have to be because there would not be much benefit to incurring any of these

implementation costs if the amount of demand response ultimately being dispatched was relatively small. If the amount of demand response being dispatched is not small, then

the software performance impact of a second complete20 solution could be more material. One way to address potential performance problems if there were a material number of

demand response bids would be to solve the two cases in parallel. This would somewhat increase the implementation costs and introduce some additional complexity into real-

time operations but these impacts should be manageable.

While such a three step approach to applying a dynamic net benefits test based on the

billing unit effect would likely be workable from a software implementation standpoint

(i.e. able to solve the dispatch problem within the time frame required for reliable

17

The discussion in this paper assumes that FERC intends that the net benefit test based on the

billing unit effect would only take account of net payments by remaining load based on the energy price,

i.e. would not take account of uplift payments to generators, consistent with our understanding of Order

745 and 745A.

18

This approach can also be thought of as dispatching all demand response based on its bid, subject

to a constraint that it would only be dispatch if the net benefits test were satisfied.

19

If we recall the four components of these software programs described in section I, if the amount

of demand response potentially dispatched is very small, any redispatch would be small and would likely

converge immediately to the new solution with little or no change in line flows or congestion patterns.

20

“Complete” meaning solution of a powerflow, redispatch to eliminate of congestion and iteration

operation of the grid by ISOs and RTOs) in this context, it would have some limitations.

First, such a three step approach would account only for the options of dispatching all

demand response that was economic based on its bid or none of the demand response that

was economic based on its bid, which may not be the outcome the Commission intends.

Second, if there were a material amount of demand response, the activation or

disqualification of all of that demand response based on an all or nothing application of a

net benefits test based on the billing unit effect could cause ramp constraints on generator

output changes to bind in the case in which no demand response was eligible for

activation, perhaps causing a short price spike if no demand response at all were

available. If this situation arose with a net benefits test based on the billing unit effect in

place, one outcome could be that once a material amount of demand response was

activated, the activation of all of the demand response would continue to pass the net

benefits test based on the billing unit effect for some period of time, perhaps hours,

because of spurious ramp constraints that would cause price spikes to be projected if no

demand response were activated, although the activation of that demand response would

be seen to raise consumer costs if tested over a longer period of time in which the ramp

constraints ceased to bind. 21 Another possibility is that no demand response would be

activated as a result of the test and a price spike would occur because all of the demand

response would become unavailable in a single interval. These outcomes are not intrinsic

to the use of demand response nor to the application of a net benefits test based on the

billing unit effect to demand response activation but are a possible consequence of

applying an all or nothing test to all demand response activation; hence a possible

consequence of using this third approach to apply a net benefits test based on the billing

unit effect. It is possible that these kinds of suboptimal outcomes could be avoided by the

development and application of more complex ramp constraint logic in using the third

approach to apply the net benefits test based on the billing unit effect, but this is uncertain

and the impact of a more complex approach on software performance is also uncertain.

This approach could be applied in the presence of transmission congestion, although its

impact on software performance would likely be more material and might require other

changes that would raise the cost of meeting load. However, this approach could produce

a variety of unintuitive outcomes when used to apply the net benefits test based on the

billing unit effect on a congested transmission grid that might not be consistent with the

Commission’s intent.

The dynamic application of a net benefits test based on the billing unit effect utilizing this

approach on a congested transmission system would require dispatching the system with

no economic demand response dispatched, then with all economic demand response that

is in merit dispatched, and then a comparison of the net payments by remaining load

between the two cases. This net benefits calculation would be only slightly more

complex than the net benefits calculation absent congestion. However, this approach to

applying the net benefits test based on the billing unit effect has several unattractive

features in the presence of transmission congestion that might not be consistent with

21

This is analogous to the problem that the New York ISO had at start up with spurious price spikes

due to spurious ramp constraints in the initial version of the hybrid dispatch.

FERC’s goals. First, there is a potential with this approach for the outcome of the net

benefits test for demand response at one location on the transmission system, to depend

on prices and price impacts elsewhere on the transmission system. 22 While there is an

intrinsic potential for the application of a dynamic net benefits test based on the billing

unit effect to cause price responsive loads that pay the real-time spot price to not be

dispatched off despite bids that were less than the LMP price at their location (because

the bid might not satisfy the net benefits test despite being economic), the potential lack

of predictability in the activation of individual demand response resources would likely

be exacerbated if a dynamic net benefits test based on the billing unit effect were applied

collectively on an all or nothing basis to all demand response offers across the grid of the

ISO or RTO.23

The potential for such outcomes might discourage power consumers from attempting to

respond to prices because of the unpredictability or might cause such price responsive

power consumers to adjust their consumption on their own based on real-time prices

rather than participating in ISO or RTO demand response programs, reducing the

economic benefit from their demand response because the ISO or RTO would not be able

to accurately account for their response in its unit commitment and dispatch decisions.24

Second, although it is difficult if not impossible to foresee the outcome of a dynamic net

benefits test based on the billing unit effect applied in this manner because the outcome

would depend on the amount of demand response available, its offer prices and the level

of future energy prices, applying the test across the footprint of an ISO or RTO on an all

or nothing basis, might cause the outcome of the net benefit test to vary more from

interval to interval for many resources than would be the case if the net benefits test were

individually applied to each demand response bid.25 Such an increased degree of

dispatching demand response on and off in an unpredictable manner that would be

unrelated to the bid price of the demand response resource or to LMP prices at its

location, might undermine the attractiveness of providing demand response through the

ISO or RTO dispatch. While this potential for unpredictable variability in dispatch

outcomes is intrinsic in the application of a net benefits test based on the billing unit

effect, it appears that there is a potential for this to be aggravated if this approach were

used to carry out the test on a congested transmission system.

22

23

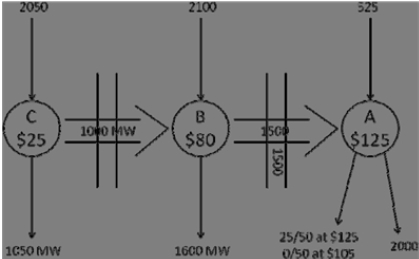

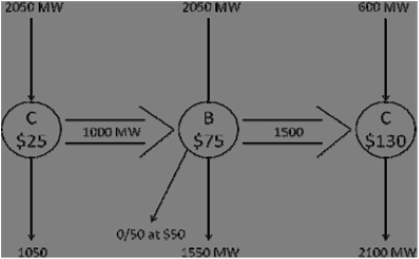

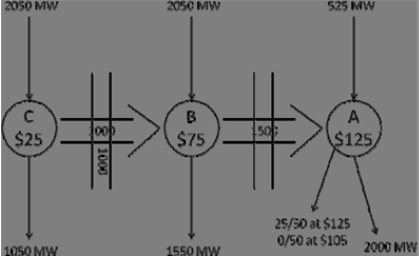

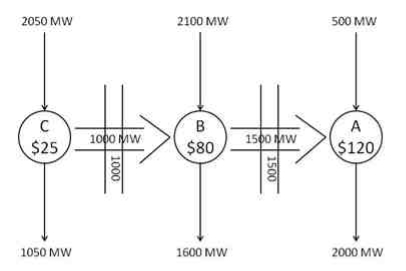

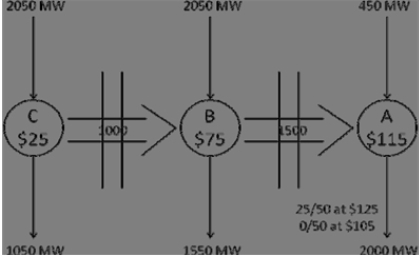

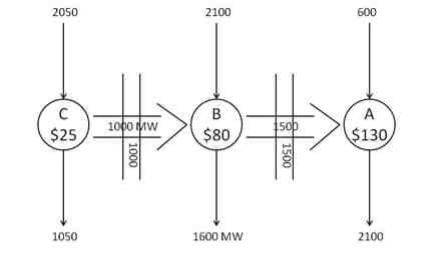

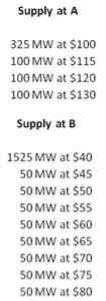

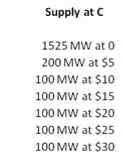

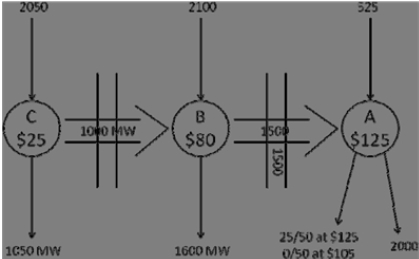

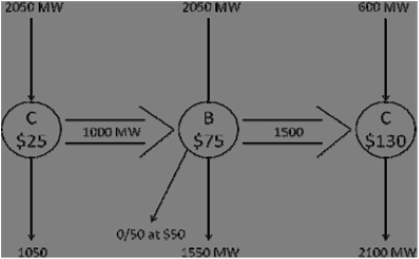

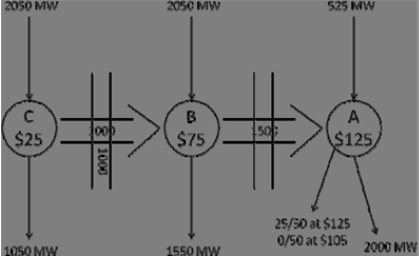

This is illustrated in the examples portrayed in Appendix A.

This approach would by its nature sometimes cause demand response activation to fail the net

benefits test applied to all in merit demand response when the application of the net benefits to a subset of in merit demand response would have passed.

24

This increased unpredictability at the resource level could also make it difficult for ISOs and

RTOs to predict in advance how the net benefit test would come out, which would have adverse

implications for the application of market power mitigation and look ahead in-day unit commitment and scheduling software, as discussed in subsections 4 and 5 in section IV below.

25

That is, demand response bids that would consistently pass the net benefits test if evaluated

individually might pass and fail the test in an unpredictable pattern if evaluated jointly with many other bids across the footprint of an ISO or RTO.

13

Another limitation of this third approach would be the complexities in applying this

approach across the 24 hours of the day-ahead market. One method of isolating the

billing unit effect of activating demand response in a particular hour would be to solve

the unit commitment for the entire day, with demand response activated in a single hour

and compare the net payments by remaining load in that case to those using a unit

commitment solved with demand response not activated in any hour. This process could

then be repeated for each hour for a total of 25 solutions to the day-ahead market to apply

the net benefits test based on the billing unit effect to demand response in each hour.

This way of applying the net benefits test would, however, obviously be unworkable

from a software performance standpoint because of the number of complete day-ahead

market solutions required.

The unworkability of applying such an approach could be reduced by executing the 25

day-ahead market solutions in parallel on multiple systems, then using the results of these

solutions to apply a net benefits test based on the billing unit effect on an hour by hour

basis to determine in which hours the bids would be active. The day-ahead market would

then be solved in a final run based on the results of the net benefits test applied to these

parallel solutions. Such an approach would require extending the time frame of ISO and

RTO day-ahead markets and would entail the additional costs and implementation

complexity of solving 25 day-ahead market cases in parallel but would not require the

development and application of any new solution concepts or algorithms. However,

the results from applying such an approach might provide a very poor measure of the

actual billing unit effect if demand response passed the net benefits test based on the

billing unit effect in several hours but not in other hours, as the market solutions for the

runs which determined the activation status for demand response would potentially have

quite different unit commitments, so the results of combining the demand response

activations over the day would quite likely lead to results that were different from those

in any of the 25 cases.

Another method to account for the inter-temporal effects would be to solve the day-ahead

market twice, once with no demand response activated and once with all demand

response activated, and apply the net benefits test based on the billing unit effect to total

demand response costs and net payments by remaining load over the day, with all

demand response over the day either passing or failing the net benefits test. A limitation

of this way of solving the problem would be that demand response bids in some hours

might be cost effective yet fail the net benefits test because other demand response bids

would not be cost effective in other hours. In particular, demand response in peak hours

might not pass the test because its impact would be tested in combination with demand

response in off-peak hours that might not be cost effective as measured by the test. An

advantage of this approach beyond its simplicity is that demand response activation in the

market run would be consistent with the results of the net benefits test.

A third method of accounting for the inter-temporal impacts of demand response in

applying a net benefits test based on the billing unit effect would involve solving the day-

ahead market three times, once with no demand response activated and once with all

14

demand response activated.26 The net benefits test based on the billing unit effect would

then be applied to demand response in each hour separately based on the results of the

two initial runs, assuming that any difference in net payments by remaining load in a

particular hour between the two cases was a result of demand response activated in that

hour. Then the day-ahead market would be solved a third time with demand response

available for dispatch only in the hours in which it passed the net benefits test based on

the billing unit effect as applied to the two initial runs. A final step would choose the

solution with the lowest net payments by remaining load. 27 This third method of

accounting for the inter-temporal impacts avoids some of the limitations of the first and

second methods but has several limitations, a) demand response might not be activated in

a particular hour because of price increases due to changes in the unit commitment in

other hours; b) the billing unit effect in the third day-ahead market solution could be quite

different from those in the other two solutions because demand response would be turned

on in some hours but not in other hours, resulting in different unit commitments.

From a practical standpoint, the net benefits test based on the billing unit effect would need to be applied using either the second or third of the alternatives described above because of the unworkable performance impacts of the first alternative, unless it were implemented by running the 25 cases in parallel.

Overall, this third approach to applying the net benefits test based on the billing unit

effect on a dynamic basis either in the real-time dispatch or day-ahead market does not, at

least in its simplest form, require development of any new algorithms or solution

concepts, so could be implemented. The actual performance implications of this

approach on market software would need to be examined by each ISO and RTO

individually given their market design and software execution requirements and each ISO

and RTO might find it necessary to make compromises in other elements of their real-

time dispatch or day-ahead market solutions in order to accommodate the dynamic

application of the net benefits test based on the billing unit approach using this approach.

The key limitations of this approach are the consequences of the all or nothing

application of the test across demand response bids at different price levels, different

locations, and, in the context of the day-ahead market, different hours of the day.

E. Modify Existing Software to Apply a Net Benefits Test Based on the

Billing Unit Effect to Groups of Demand Response Bids.

A fourth possible approach to implementing a dynamic net benefits test based on the

billing unit effect within ISO and RTO economic dispatch programs would be structured

to take account of the possibility that if there are many demand response bids, the

activation of all of the economic demand response bids might fail a net benefits test based

on the billing units effect, but activation of a portion of the demand response bids could

pass the net benefits test. Absent development of new algorithms and solution methods

26

27

These two runs could be run in a parallel to reduce solution time.

Because of unit commitment differences, it cannot be assumed that either the production costs or

payments to generators would be lower under the third solution than for the first or second solution.

15

as discussed above with respect to the first approach, applying a dynamic net benefits test based on the billing unit effect that distinguishes between these two situations would entail an iterative approach in which the dispatch would be solved for incremental levels of demand response activation, with the goal of determining the optimum level of

demand response activation based on the net benefits test criterion28 within an acceptable number of iterations from a performance standpoint.

If there were a material number of demand response offers, attempting to evaluate the

billing unit effects associated with the dispatch of individual demand response bids would

likely make this fourth approach much more unworkable than the third approach from the

standpoint of dispatch execution time.29 Moreover, even if there were generally only a

small number of demand response offers, this kind of approach would still be unworkable

because ISOs and RTOs could not be assured that there would always be a small number

of demand response offers to be accounted for and would not be able to rely upon real-

time dispatch software that would sometimes solve within the required time frame and

sometimes not. 30

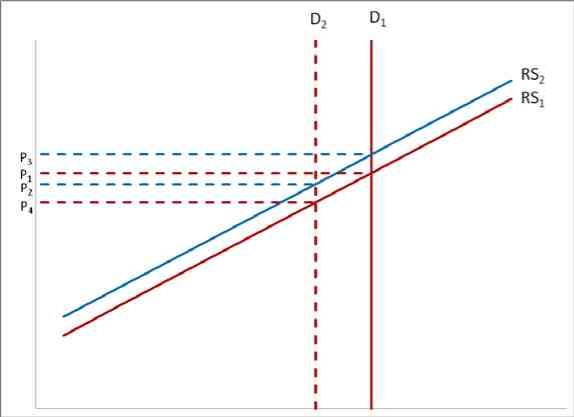

One way to reduce the number of incremental levels of demand response evaluations required to implement the fourth approach would be to apply the net benefits test based on the billing unit effect to bids within specified bid price ranges, rather than to each

individual demand response bid, e.g. to test all demand response bid at less than $50, then all bid at less than $55, then all bid at less than $60 etc.31

A fundamental barrier to implementing the net benefits test using these kinds of

approaches is that they would not be feasible on a congested transmission system or in the context of the unit commitment problem in the day-ahead market (or potentially in real-time dispatch software that has to solve similar non-convexities such as the

California ISO’s dispatch software).

First, it would not be possible to apply a price based grouped evaluation to demand

response bids on a congested transmission system because demand response at different

28

It is presumed that the “optimum” in this situation would be the largest amount of demand

response that could be activated based on its bids and satisfy the net benefits test. Another possible criterion would be the level of demand response activated based on its bids that would maximizes the pecuniary benefit to load as calculated based on the net benefits test.

29

This fourth approach would also have the unattractive property that there would often be situations

in which some but not all of the demand response bids submitted with prices less than the actual clearing price would be dispatched. This situation would likely be confusing to market participants but is not

obviously worse than the outcome under the third approach in which it might often be the case that none of demand bids submitted with prices less than the actual clearing price would be dispatched.

30