10 Krey Boulevard Rensselaer, NY 12144

THIS FILING LETTER DOES NOT CONTAIN ANY PRIVILEGED OR

CONFIDENTIAL INFORMATION. THE BODY OF REPORT ALONG WITH THE REDACTED VERSIONS OF TABLES 2, 3 AND 4 (MARKED PUBLIC) DO NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL INFORMATION.

ATTACHMENT 1 TO THE REPORT INCLUDES THE UNREDACTED TABLES WHICH CONTAIN PRIVILEGED AND CONFIDENTIAL INFORMATION, AND ARE SUBMITTED SEPARATELY.

June 1, 2012

VIA ELECTRONIC FILING

Kimberly D. Bose

Secretary

Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426

Subject: Semi-Annual Reports on Demand Response Programs and New Generation

Projects; Docket Nos. ER01-3001-000 and ER03-647-000.

Dear Ms. Bose:

Enclosed for filing in the above-referenced dockets are the New York Independent System Operator’s (“NYISO’s”) Semi-Annual Reports to the Federal Energy Regulatory Commission (“Commission”) on the NYISO’s Demand Side Management programs and new generation projects in the New York Control Area. This filing is made for

informational purposes only in accordance with the Commission’s delegated orders issued February 19, 2010 and February 23, 2010 in these dockets.

I.List of Attachments Submitted

1.NYISO Semi-Annual Compliance Report on New Generation Projects,

June 1, 2012 (Attachment I);

2.Attachment A to the NYISO Semi-Annual Compliance Report on New

Generation Projects, (Attachment II);

Honorable Kimberly D. Bose June 1, 2012

Page 2

3.Attachment B to the NYISO Semi-Annual Compliance Report on New

Generation Projects, (Attachment III);

4. NYISO Semi-Annual Compliance Report on Demand Response Programs,

June 1, 2012 - public, redacted (Attachment IV); and

5. Attachment A to the NYISO Semi-Annual Compliance Report on Demand

Response Programs, June 1, 2012 - CONFIDENTIAL (Attachment V).

II.Request for Confidential Treatment of Demand Response Report

Attachment A

The attached Semi-Annual Compliance Report on Demand Response Programs (“Demand Response Report”) summarizes the current status of demand response

participation in the NYISO’s markets as of June 1, 2012. The Demand Response Report includes redactions of confidential, commercially sensitive information in Tables 2 and 4. The redactions are submitted separately as Attachment A of the Demand Response Report, which contains the unredacted versions of Tables 2 and 4.

In accordance with Sections 388.107 and 388.112 of the Commission’s

Regulations,1 Article 6 of the NYISO’s Market Administration and Control Area Services Tariff, Sections 1.0(4) and 4.0 of the NYISO’s Code of Conduct, the NYISO requests Privileged and Confidential treatment of the contents of Attachment A. The NYISO also requests that the Confidential Attachment be exempted from public disclosure under the Freedom of Information Act (“FOIA”), 5 U.S.C. §522.2

The confidential Attachment contains privileged, commercially sensitive, trade

secret information that is not made public by the NYISO. Disclosure of such information

could cause competitive harm to the affected Market Participants,3 and could adversely

affect competition in the markets administered by the NYISO. This information includes

the number of demand response resources in a load zone that, when aggregated, are not

greater than five (5). With such a small number of resources in the load zone, the

NYISO’s aggregation of the data reported for that load zone may not sufficiently mask

confidential and commercially sensitive Market Participant information. Further, because

this confidential, commercially sensitive information is exempt from disclosure under 5

U.S.C. §522(b)(4), the NYISO requests that the contents of Attachment A receive

Privileged and Confidential treatment and be exempt from FOIA disclosure. Attachment

1 18 C.F.R. §§ 388.107 and 388.112 (2011).

2 The information provided by the NYISO for which the NYISO claims an exemption from FOIA disclosure is labeled “Contains Privileged Information - Do Not Release.”

3 Terms with initial capitalization not defined herein have the meaning set forth in the NYISO’s Market Administration and Control Area Services Tariff.

Honorable Kimberly D. Bose June 1, 2012

Page 3

A is identified and marked in accordance with the Commission’s regulations and rules published by the Secretary’s Office for submitting privileged information.4

III.Correspondence

Copies of correspondence concerning this filing should be addressed to Robert E. Fernandez, General Counsel

Raymond Stalter, Director of Regulatory Affairs Gloria Kavanah, Senior Attorney

*David Allen, Senior Attorney

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-6000

Fax: (518) 356-4702

rfernandez@nyiso.com

rstalter@nyiso.com

gkavanah@nyiso.com

dallen@nyiso.com

*person designated to receive service

Respectfully Submitted

/s/ David Allen

David Allen

Counsel,

New York Independent System Operator, Inc.

4 Federal Energy Regulatory Commission Submission Guidelines, July 1, 2010, page 2.

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §385.2010.

Dated at Rensselaer, NY this 1st day of June, 2012.

/s/ Joy A. Zimberlin

Joy A. Zimberlin

New York Independent System Operator, Inc

10 Krey Blvd.

Rensselaer, NY 12144 (518) 356-6207

NYISO Report on New Generation Projects

June 1, 2012

In its October 23, 2006 order, the Commission ordered the NYISO to submit “a list of

investments in new generation projects in New York (including a description and current status of each such project), regardless of the stage of project development at the time of the filing.”1 The NYISO keeps a list of Interconnection Requests and Transmission Projects for the New

York Control Area (“NYCA”) that includes information about all generation projects in the State that have requested interconnection.

The NYISO interconnection process is described in two attachments of the NYISO

OATT: Attachment X entitled, “Standard Large Facility Interconnection Procedures,” and

Attachment Z entitled, “Small Generator Interconnection Procedures.” Attachment X applies to Generating Facilities that exceed 20 MW in size and to Merchant Transmission Facilities,

collectively referred to as “Large Facilities.” Attachment Z applies to Generating Facilities no larger than 20 MW.

Under Attachment X, Developers of Large Facilities must submit an Interconnection

Request to the NYISO. The NYISO assigns a Queue Position to all valid Interconnection

Requests. Under Attachment X, proposed generation and transmission projects undergo up to three studies: the Feasibility Study, the System Reliability Impact Study, and the Facilities Study. The Facilities Study is performed on a Class Year basis for a group of eligible projects pursuant to the requirements of Attachment S of the NYISO OATT. Under Attachment Z, proposed small generators undergo a process that is similar, but with different paths and options that are

dependent on the specific circumstances of the project.

Proposed generation and transmission projects currently in the NYISO Interconnection

Process are listed on the list of Interconnection Requests and Transmission Projects for the

NYCA (“NYISO Interconnection Queue”). The generation projects on that list are shown in

Attachment A, which is dated April 30, 2012. The NYISO updates the NYISO Interconnection

Queue on at least a monthly basis and posts the most recent list on the NYISO’s public web site

at http://www.nyiso.com/public/markets_operations/services/planning/documents/index.jsp.

Explanations for the various columns of the list are provided in the notations on the last page of the list. The status of each project on the NYISO Interconnection Queue is shown in the column labeled “S.” An explanation of this column is provided in Attachment B. Also, note that the proposed in-service date for each project is the date provided to the NYISO by the respective Owner/Developer, is updated only on a periodic basis, and is subject to change.

1 New York Indep. Sys. Operator, Inc., 117 FERC ¶ 61,086, at P 14 (2006).

INTERCONNECTION REQUESTS AND TRANSMISSION PROJECTS / NEW YORK CONTROL AREA

Page 1 of 2

QueueDateSPWPType/LocationInterconnectionLastAvailabilityProposed In-Service

Pos.Owner/DeveloperProject Nameof IR(MW)(MW)FuelCounty/StateZPointUtilitySUpdateof StudiesOriginalCurrent

115Central Hudson Gas & ElectricEast Fishkill Transformer4/24/02N/AACDutchess, NYGEast Fishkill 345kV/115kVCONED/CHG&E48/19/08None2007/062012

119ECOGEN, LLCPrattsburgh Wind Farm5/20/0278.2WYates, NYCEelpot Rd-Flat St. 115kVNYSEG103/31/12SRIS, FS2005/022013/12

127AAirtricity Munnsville Wind Farm, LLCMunnsville10/9/026WMadison, NYE46kV lineNYSEG114/30/11SRIS, FS2005/122013/12

147NY Windpower, LLCWest Hill Windfarm4/16/0431.5WMadison, NYCOneida-Fenner 115kVNM-NG109/30/10SRIS, FS2006/Q42012/09

154KeySpan Energy for LIPAHoltsville-Brentwood-Pilgrim8/19/04N/AACSuffolk, NYKHoltsville & Pilgrim 138kVLIPA53/31/11None2007/062017

161Marble River, LLCMarble River Wind Farm12/7/048383WClinton, NYDWillis-Plattsburgh WP-1 230kVNYPA113/31/12SRIS, FS20062012/10

166Cape Vincent Wind Power, LLCSt. Lawrence Wind Farm2/8/0579.579.5WJefferson, NYELyme Substation 115kVNM-NG103/1/12SRIS, FS2006/122013/09

169Alabama Ledge Wind Farm, LLCAlabama Ledge Wind Farm2/8/0579.879.8WGenesee, NYBOakfield-Lockport 115kVNM-NG93/1/12FES, SRIS2007/12-2009/122013/10

171Marble River, LLCMarble River II Wind Farm2/8/05132.2132.2WClinton, NYDWillis-Plattsburgh WP-2 230kVNYPA113/31/12SRIS, FS2007/122012/10

180AGreen PowerCody Rd3/17/051010WMadison, NYCFenner - Cortland 115kVNM-NG1112/31/11NoneNone2013/Q4

189Atlantic Wind, LLCHorse Creek Wind4/8/05126126WJefferson, NYECoffeen St-Thousand Island 115kV NM-NG84/30/12FES, SRIS2006/122013/10

197PPM Roaring Brook, LLC / PPMRoaring Brook Wind7/1/057878WLewis, NYEBoonville-Lowville 115kVNM-NG113/31/11FES, SRIS, FS2009/122012/12

198New Grange Wind Farm, LLCArkwright Summit Wind Farm7/21/0579.879.8WChautauqua, NYADunkirk-Falconer 115kVNM-NG912/31/11FES, SRIS2008/122013/09

201NRG EnergyBerrians GT8/17/05200200CC-NG Queens, NYJAstoria West Substation 138kVCONED96/30/11FES, SRIS2008/022014/06

204ADuer's Patent Project, LLCBeekmantown Windfarm10/31/0519.519.5WClinton, NYDKents Falls - Sciota 115kVNYSEG104/30/11None2008/062013/06

205National GridLuther Forest11/2/054040LSaratoga, NYFRound Lake 115kVNM-NG65/31/11SIS2007/082012/Q2

206Hudson Transmission PartnersHudson Transmission12/14/05660660DC/ACNY, NY - Bergen, NJJWest 49th Street 345kVCONED1211/30/11FES, SRIS, FS2009/Q22013/05

207Cape Vincent Wind Power, LLCCape Vincent1/12/06210210WJefferson, NYERockledge Substation 115kVNM-NG106/30/11FES, SRIS, FS2009/Q42013/09

213Noble Environmental Power, LLCEllenburg II Windfield4/3/062121WClinton, NYDWillis-Plattsburgh WP-2 230kVNYPA1010/31/11SRIS, FS2007/10N/A

216Nine Mile Point Nuclear, LLCNine Mile Point Uprate5/5/06168168NUOswego, NYCScriba Station 345kVNM-NG113/1/12SRIS, FS2010/Q32012/06

222Ball Hill Windpark, LLCBall Hill Windpark7/21/069090WChautauqua, NYADunkirk-Gardenville 230kVNM-NG104/30/12FES, SRIS, FS2008/102014/Q1

224NRG Energy, Inc.Berrians GT II8/23/065090CC-NG Queens , NYJAstoria West Substation 138kVCONED96/30/11FES, SRIS2010/062014/06

227ALaidlaw Energy Group Inc.Laidlaw Energy & Env.10/30/0677WoCattaraugus, NYA13.2kVNM-NG710/28/09NoneN/A

232Bayonne Energy Center, LLCBayonne Energy Center11/27/06500500CT-DBayonne, NJJGowanus Substation 345kVConEd134/30/12FES, SRIS, FS2008/112012/05

237Allegany Wind, LLCAllegany Wind1/9/0772.572.5WCattaraugus, NYAHomer Hill - Dugan Rd. 115kVNM-NG104/30/12FES, SRIS, FS2009/102013/08

239AInnovative Energy System, Inc.Modern Innovative Plant1/31/076.46.4MNiagara, NYAYoungstown - Sanborn 34.5kVNM-NG85/31/11None2007/122012/07

241Noble Chateaugay Windpark II, LLCChateaugay II Windpark3/15/0719.519.5WFranklin, NYDChateaugay Substation 34.5kVNYSEG610/31/11None2008/07N/A

250Seneca Energy II, LLCOntario7/2/075.65.6MOntario, NYCHaley Rd. - Hall 34.5kVNYSEG1112/31/11None2009/102012/11

251CPV Valley, LLCCPV Valley Energy Center7/5/07677.6690.6CC-NG Orange, NYGCoopers - Rock Tavern 345kVNYPA94/3012FES, SRIS2012/052016/05

253Marble River, LLCMarble River SPS8/13/07TBDTBD ACClinton, NYDMoses-Willis-Plattsburgh 230kVNYPA57/31/11None2007/122012/10

263Stony Creek Wind Farm, LLCStony Creek Wind Farm10/12/0794.494.4WWyoming, NYCStolle Rd - Meyer 230kVNYSEG104/30/12FES, SRIS, FS2010/012012/12

264RG&ESeth Green10/23/072.82.8HMonroe, NYB11kVRG&E93/31/12None2008/042013Q1

266NRG Energy, Inc.Berrians GT III11/28/07250290CC-NG Queens, NYJAstoria 345kVNYPA83/1/12FES, SRIS2010/062016/06

267Winergy Power, LLCWinergy NYC Wind Farm11/30/07600600WNew York, NYJGowanus Substation 345kVConEd53/1/12FES2015/012019/01-2020/01

270Wind Development Contract Co LLCHounsfield Wind12/13/07244.8244.8WJefferson, NYEFitzpatrick - Edic 345kVNYPA61/31/12FES/SRIS2010/092015/12

276Air Energie TCI, Inc.Crown City Wind Farm1/30/089090WCortland, NYCCortland - Fenner 115kVNM-NG65/31/11FES, SRIS2011/122014/12

284Broome Energy Resources, LLCNanticoke Landfill3/6/081.61.6MBroome, NYCNanticoke Landfill Plant 34.5kVNYSEG103/31/12None2008/072012/12

285Machias Wind Farm, LLCMachias I3/27/0879.279.2WCattaraugus, NYAGardenville - Homer Hill 115kVNM-NG56/30/10FES2010/122012/12

290AGreen Island Power AuthorityGreen Island Power4/7/082020LAlbany, NYFMaplewood - Johnson Rd 115kVNM-NG611/30/11SIS2009/122012/Q4

291Long Island Cable, LLCLI Cable - Phase 14/14/08440440WSuffolk, NYKRuland Road 138kVLIPA53/1/12FES2013/012019/01-2020/01

292Long Island Cable, LLCLI Cable - Phase 2a4/14/08220220WSuffolk, NYKRuland Road 138kVLIPA53/1/12FES2013/062019/01-2020/01

294Orange & RocklandRamapo-Sugarloaf4/29/08N/AN/A ACOrange/Rockland, NYGRamapo - Sugarloaf 138kVO&R63/1/12SIS2009/06N/A

295CCH Holdings Group, LLCCross Hudson II5/6/08800800ACNew York, NY-NJJWest 49th St. Substation 345kVConEd512/31/10FES2011/062013/06

305Transmission Developers Inc.Transmission Developers NYC7/18/0810001000DCQuebec - NY, NYJAstoria Substation 345kVNYPA73/31/12FES, SRIS2014/Q12016/Q2

307New York Wire, LLCNew York Wire-Phase 17/29/08550550DCNJ - Kings, NYJGowanus Substation 345kVConEd511/3/10FES2013/072014/10

310Cricket Valley Energy Center, LLCCricket Valley Energy Center9/22/081019.91136CC-NG Dutchess, NYGPleasant Valley - Long Mt. 345kVConEd93/1/12FES, SRIS2014/122015/09

311New York State Electric & GasConcord Casino9/24/0848.048.0LSullivan, NYECoopers Corner - Rock HillNYSEG510/28/09None2009/09N/A

319AES Energy Storage, LLCCayuga Energy Storage12/3/082020ESOnondaga, NYCMilliken 115kVNYSEG512/31/10None2010/07N/A

320AES Energy Storage, LLCSomerset Energy Storage12/3/082020ESNiagara, NYASomerset 69kVNYSEG512/31/10None2010/07N/A

2012_06_01_NewGen_Rprt_Att-A_NYISO_IQ.xlsUpdated: 4/30/2012

INTERCONNECTION REQUESTS AND TRANSMISSION PROJECTS / NEW YORK CONTROL AREA

Page 2 of 2

QueueDateSPWPType/LocationInterconnectionLastAvailabilityProposed In-Service

Pos.Owner/DeveloperProject Nameof IR(MW)(MW)FuelCounty/StateZPointUtilitySUpdateof StudiesOriginalCurrent

322Rolling Upland Wind Farm, LLCRolling Upland Wind1/13/0959.459.4W

326NYSEG/RG&ERochester SVC/PST Trans.3/9/09N/AN/AAC

331National GridNortheast NY Reinforcement4/22/09N/AN/AAC

333National GridWestern NY Reinforcement5/5/09N/AN/AAC

335NextEra Energy Resources, LLCCold Creek Spring Wind6/9/09150.7150.7W

336Enfield Energy, LLCBlack Oak Wind6/29/095050W

337Long Island Power AuthorityNorthport Norwalk Harbor7/14/09N/AN/AAC

338RG&EBrown's Race II8/11/098.38.3H

339RG&ETransmission Reinforcement8/17/09N/AN/AAC

342Albany Energy, LLCAlbany Landfill9/3/096.46.4M

343Champlain Wind Link, LLCChamplain Wind Link I9/29/09600600AC

346Beacon PowerScotia Industrial Park11/24/092020F

347Franklin Wind Farm, LLCFranklin Wind12/2/0950.450.4W

349Taylor Biomass Energy, LLCTaylor Biomass12/30/091922.5SW

351Linden VFT, LLCLinden VFT Uprate3/2/101515AC

354Atlantic Wind, LLCNorth Ridge Wind5/13/10100100W

355Brookfield Renewable PowerStewarts Bridge Hydro8/3/1033H

357West Point Partners, LLCNY Power Pathway9/10/1010001000DC

358West Point Partners, LLCWest Point Transmission9/13/1010001000DC

360NextEra Energy Resources, LLCWatkins Glen Wind12/22/10300.8300.8W

361US PowerGen Co.Luyster Creek Energy2/15/11401444CC

362Monticello Hills Wind, LLCMonticello Hills Wind3/7/111818W

363Poseidon Transmission, LLCPoseidon Transmisssion4/27/11500500DC

364Bruce Hill Wind, LLCBruce Hill Wind5/4/111818W

365Transmission Developers Inc.Champlain Hudson SPS7/15/11TBDTBDAC

366NextEra Energy Resources, LLCWatkins Glen East8/2/11150.6150.6W

367Orange & RocklandNorth Rockland Transformer9/14/11TBDTBDAC

368Consolidated Edison Co. of NYFeeder 76 Ramapo to Rock Tavern 10/13/11TBDTBDAC

369Clover Leaf Power, LLCClover Leaf Hollers Ave10/24/11173.9192.8CT

370Smokey Avenue Wind, LLCSmokey Avenue Wind10/28/111818W

371South Mountain Wind, LLCSouth Mountain Wind10/31/111818W

372Dry Lots Wind, LLCDry Lots Wind10/31/113333W

373New York Power AuthorityCoopers Corners Shunt Reactor12/21/11N/AN/AAC

374CPV Valley, LLCCPV Valley II2/21/12820820CC

375Eagle Creek Hydro, LLCEagle Creek Hydro3/6/121111H

377Monroe CountyMonroe County Mill Seat3/16/123.23.2M

378Invenergy Wind NY, LLCMarsh Hill Wind3/29/1216.216.2W

379Seneca Energy II, LLCSeneca II Expansion4/24/126.46.4M

Madison, NYE County Line - Brothertown 115kVNYSEG

Monroe, NYB Station 124 115kVNYSEG

Saratoga, NYF NGrid 230kVNM-NG

Cattaraugus, NYA NGrid 115kVNM-NG

Cattaraugus, NYA Salamanca - Falconer 115kVNM-NG

Thompkins, NYC Black Oak Rd 115kVNYSEG

Suffolk, NYK Northport 138kVLIPA

Monroe, NYB Station 3 / Station 137 34.5kVRG&E

Monroe, NYB Niagara - Kintigh 345kVRG&E

Albany, NYF34.5kVNM-NG

Clinton, NY - VTD Plattsburgh - New Haven, VT 230kVNYPA

Schenectady, NYF Spier - RotterdamNM-NG

Delaware, NYE Sidney - Delhi 115kVNYSEG

Montgomery, NYG Maybrook - Rock TavernCHGE

Richmond, NY-NJJ Goethals 345kVCONED

St. Lawrence, NYE Nicholville - Parishville 115kVNM-NG

Saratoga, NYF Spier Falls - EJ WestNM-NG

Albany, Orange or Westchester, F, G orNM-NG/CenHud or

NYH New Scotland - Roseton or Buchanan 345kVConed

Greene, Westchester, NY F, H Leeds - Buchanan North 345kVNM-NG/ConEd

Schuyler, NYC Hillside - Meyer 230 kVNYSEG

Queens, NYJ Astoria SubstationCONED

Otsego, NYE W. Winfield - Richfield Spring 46kV NYSEG

Suffolk, NYK Ruland Rd. SubstationLIPA

Delaware, NYE Axtell Road Substation 34.5 kVNYSEG

Queens, NYJ Astoria and Farragut Subsations ConEd/NYPA

Schuyler, NYC Montour Falls SubstationNYSEG

Rockland, NYG Line Y94 345kVConEd

Orange, Rockland, NY G Ramapo to Rock Tavern 345 kV ConEd/CenHud

Bronx, NYJ Parkchester City Sub. 138 kVConEd

Otsego, NYF Worcester - Schenevus 23kVNM-NG

Delaware, NYE River Rd Substation 46kVNYSEG

Herkimer, NYE Schuyler to WhitesboroNM-NG

Sullivan, NYE Coopers Corners 345 kVNYSEG

Wawayanda, NYG Rock Tavern to Coopers CornersNYPA

Sullivan, NYE Rio 69kV SwitchyardO&R

Monroe, NYB Sanford Rd. 34.5kVNM-NG

Steuben, NYC Jasper - South Canisteo 34.5kVNYSEG

Seneca, NY C Seneca - Waterloo 34.5kV NYSEG

73/31/12FES, SRIS2012/122014/12

63/31/11SIS2011/122012-2013

1210/31/11SIS2010-20192010-2019

57/31/09None2014/Q22014/Q2

59/30/11FES2012/122012/12

510/31/11FES2010/102013/10

61/31/11SIS20162016

93/31/12None2011/082013/Q1

63/1/12SIS2015/092016/W

101/31/12None2010/122012/Q1 - 2015/12

58/31/10None2014/062014/06

63/31/11None2011/082012/08

35/31/11None2012/122012/12

93/31/12SRIS2012/042012/Q4

96/30/11SRIS2010/11N/A

56/30/11FES2014/122014/12

74/30/12SRIS2012/102012/12

31/31/12None2016/072016/07

31/31/12None2015/05-2016/05 2015/05-2016/05

36/30/11None2013/092013/06

39/30/11None2014/062014/06

94/30/12None2012/112014/12

310/31/11None2016/052016/05

311/30/11None2013/122013/12

47/31/11None2016/Q12016/Q1

31/31/12None2013/Q32014/Q2

512/31/11None2016/062016/06

411/30/11None2016/082016/08

33/31/12None2016/122016/12

33/31/12None2013/122013/12

33/31/12None2013/112013/11

31/31/12None2014/112014/11

53/31/12NoneTBDTBD

43/31/12None2017/052017/05

44/30/12None2013/102013/10

24/30/12None2013/Q42013/Q4

24/30/12None2015/122015/12

7 4/30/12 None 2012/12 2012/12

NOTES: ● The column labeled 'SP' refers to the maximum summer megawatt electrical output. The column labeled 'WP' refers to the maximum winter megawatt electrical output.

● Type / Fuel. Key: ST=Steam Turbine, CT=Combustion Turbine, CC=Combined Cycle, CS= Steam Turbine & Combustion Turbine, H=Hydro, PS=Pumped Storage, W=Wind, NU=Nuclear, NG=Natural Gas, M=Methane, SW=Solid Waste, S=Solar, Wo=Wood, F=Flywheel ES=Energy Storage, O=Oil, C=Coal, D=Dual Fuel, AC=AC Transmission, DC=DC Transmission, L=Load

● The column labeled 'Z' refers to the zone

● The column labeled 'S' refers to the status of the project in the NYISO's LFIP. Key: 1=Scoping Meeting Pending, 2=FES Pending, 3=FES in Progress, 4=SRIS/SIS Pending, 5=SRIS/SIS in Progress, 6=SRIS/SIS Approved, 7=FS Pending, 8=Rejected Cost Allocation/Next FS Pending, 9=FS in Progress, 10=Accepted Cost Allocation/IA in Progress, 11=IA Completed, 12=Under Construction, 13=In Service for Test, 14=In Service Commercial, 0=Withdrawn

● Availability of Studies Key: None=Not Available, FES=Feasibility Study Available, SRIS=System Reliability Impact Study Available, FS=Facilities Study and/or ATRA Available ● Proposed in-service dates are shown in format Year/Qualifier, where Qualifier may indicate the month, season, or quarter.

2012_06_01_NewGen_Rprt_Att-A_NYISO_IQ.xlsUpdated: 4/30/2012

New Generation Report - Attachment B

1=Scoping Meeting Pending

2=FESA Pending

3=FES in Progress

4=SRIS Pending

5=SRIS in Progress

6=SRIS Approved

7=FS Pending

8=Rejected Cost Allocation/

Next FS Pending--

9=FS in Progress

10=Accepted Cost Allocation/ IA

in Progress

11=IA Completed

12=Under Construction

Interconnection Request has

been received, but scoping

meeting has not yet occurred

Awaiting execution of

Feasibility Study Agreement

Feasibility Study is in Progress

Awaiting execution of SRIS Agreement and/or OC

approval of SRIS scope

SRIS Approved by NYISO Operating Committee

Awaiting execution of

Facilities Study Agreement

Project was in prior class year, but rejected cost allocation—Awaiting

execution of Facilities Study Agreement for next Class

Year or the start of the next Class Year

Project in current Class Year Facilities Study

Interconnection Agreement is being negotiated

Interconnection Agreement is executed and/or filed with

FERC

Project is under construction

13=In Service for Test

14=In Service Commercial

0=WithdrawnProject is no longer in the

Queue

New York Independent System Operator, Inc.

Docket No. ER01-3001-____

Semi-Annual Compliance Report on Demand Response Programs

June 1, 2012

This report summarizes the current status of demand response participation in the New York Independent System Operator’s (NYISO’s) markets as of June 1, 2012. As in previous years, this report focuses on enrolled demand response participation in preparation for the Summer Capability Period.1 A discussion of the current status of several demand response initiatives that the NYISO has underway is also provided below.

Activations of the NYISO’s two reliability-based programs (the Emergency Demand Response Program (EDRP) and the Installed Capacity Special Case Resources (ICAP/SCR)) during the Summer 2011Capability Period were reported in the NYISO’s 2011 Demand

Response Annual Report.2

The NYISO has two economic programs, the Day-Ahead Demand Response Program

(DADRP) and the Demand-Side Ancillary Services Program (DSASP). DADRP offer activity is

sporadic and a limited number of resources participate. With the December 2011 release of

technical specifications for Direct Communication for DSASP, interest and activity in DSASP

has increased and there are a limited number of resources working toward implementation of

their communication infrastructure and completion of the market pre-qualification process.

Demand Response Enrollment

This report presents statistical data on demand response enrollment. Demand response

resources include individual retail electricity consumers that enroll to perform their own load

1 Capitalized terms not defined herein shall bear the meanings assigned by the NYISO’s Market Administration and Control Area Services Tariff.

2 Docket No. ER01-3001-000, NYISO 2011 Demand Response Annual Report (filed January 17, 2012),

and Supplement and Errata to Annual Report (filed January 25, 2012) (collectively, the January 2012

Report).

- 1 -

reductions and curtailment service providers, which is a general term used to identify the NYISO Customers that represent end-use customers in the NYISO’s demand response programs.3

Table 1 identifies the number of curtailment service providers by the following organizational categories:

• Aggregators, entities which enroll retail electricity consumers as individual resources that

may be aggregated for treatment as a single resource;

• Direct Customers, entities which register as a Market Participant with the NYISO to

participate on their own behalf in any of the NYISO’s markets, including the NYISO’s demand response programs;

• LSEs, entities which provide commodity service to retail customers; and

• Transmission Owners (TO), the investor- and public authority-owned transmission and

distribution companies that are NYISO Customers located in New York State.

Table 1. Demand Response Service Providers by Provider Type

Count as of Change from June

Provider TypeMay 2012 2011 Report

Aggregator25‐8

Direct Customer10‐4

LSE71

Transmission Owner5‐2

Total47‐13

Since the June 2011 Report4, the NYISO’s demand response programs have experienced

a net decrease of 13 curtailment service providers. The decrease in curtailment service providers

3 The term “curtailment service providers” as used in this report refers to Responsible Interface Parties (RIPs) as that term is used in the Installed Capacity Manual, Demand Response Providers (DRPs) as defined in the DADRP Manual, and the four classes of market participants identified in the EDRP

Manual. A retail customer participating in a NYISO demand response program with its own load acts as its own curtailment service provider.

4 Docket No. ER01-3001-000, NYISO 2011 Demand Response Semi-Annual Report (filed June 3, 2011), “the June 2011 Report”).

- 2 -

since last May may be the result of mergers and acquisitions, direct customers that choose to

enroll through an aggregator or LSE, or withdrawal from the NYISO market due to new financial requirements for NYISO market participants that went into effect in October 2011.

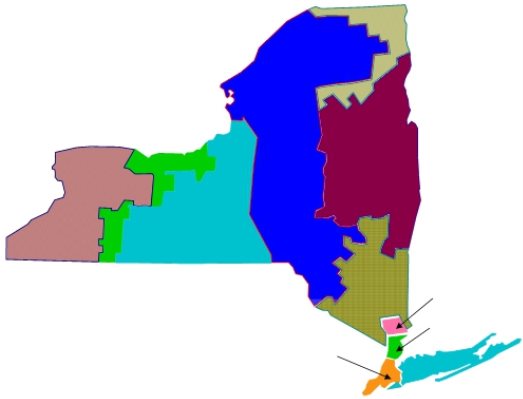

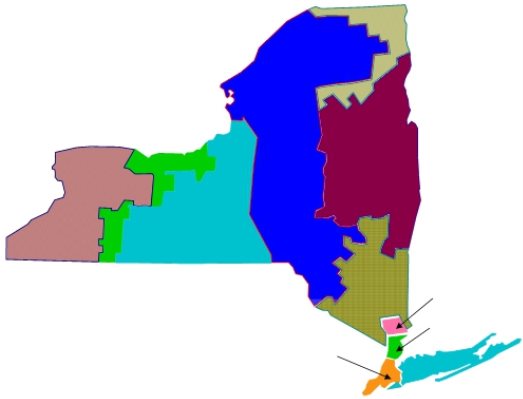

Figure 1 below provides a geographic distribution of resources currently enrolled in the NYISO’s EDRP and ICAP/SCR programs.

Figure 1. Zonal Distribution of Combined Reliability Program Enrollment

EDRP + SCR MW

by NYISO Zone

May 2012

B81.0

AMW

C

392.5101.8

MWMW

Total Enrolled:

1805.5 MW

E

40.8

MW

409.9J

MW

D

F

126.2

MW

G

50.9 MW

459.9 MW

H6.1 MW

I35.0 MW

K101.5 MW

Tables 2 through 4 present zonal enrollment statistics for EDRP, ICAP/SCR, and

DADRP, respectively, as of mid-May 2012. For each Load Zone (Zone), information on the total number of resources, total MW registered, and the amount of load reduction being supplied

through the use of Local Generators is provided. In addition, changes in number of resources and enrolled MW since the June 2011 Report are shown by Zone.

- 3 -

Table 2. EDRP Enrollment: May 2012

Change in

Number ofEDRP MW ofEDRP MW of Count from Change in MW

EDRPLoadEnrolled LocalTotal EDRP May 2011 from May 2011

ZoneResourcesReductionGeneratorsMWReportReport

A178.61.09.64‐0.9

B150.13.43.5142.5

C362.20.02.29‐12.9

D80.00.00.00‐3.7

E3712.90.313.211‐11.9

F3224.24.228.42223.1

G150.00.50.52‐16.6

H*0.00.00.0‐1‐1.8

I*0.10.00.1‐12‐3.6

J90.50.00.5‐13‐4.6

K170.63.23.8173.8

Totals18649.212.661.950‐26.5

* Number of end‐use locations by category is fewer than 5 and has been masked for this public version of

the table. The unredacted values are presented in the confidential appendix submitted as Attachment A.

Enrollment in EDRP shows a reduction of 30% in enrolled MW since May 2011. The

largest reductions occurred in Zones G (Hudson), C (Central), and E (Mohawk Valley). Zone F, Capital, shows an increase of 23.1 MW, nearly one third of the MW enrolled for May 2012.

Nominal changes occurred in all other Zones. The changes in enrollment do not necessarily

indicate that there will be a reduction in enrollment of EDRP resources for the Summer 2012

Capability Period because EDRP resources can enroll in the month prior to when the resources expect to participate. For example, in 2011, the enrolled MW increased by 70% between May (88.4 MW) and July 2011 (148.1 MW).

- 4 -

Table 3. ICAP/SCR Enrollment: May 2012

ICAP MW ofICAP MW of Change in Count Change in ICAP

Number ofLoadEnrolled LocalTotal ICAPfrom May 2011 MW from May

ZoneSCRsReductionGeneratorsMWReport2011 Report

A434373.39.6382.9‐76‐7.2

B21370.57.077.5‐37‐37.6

C31997.32.399.6‐3‐27.7

D15459.90.0459.9‐7145.5

E14627.50.127.5‐10‐17.1

F19788.29.697.8‐2‐36.5

G14945.45.050.31‐14.1

H235.20.96.12‐2.7

I13430.34.735.05‐6.7

J2399307.2102.3409.4‐146‐34.0

K80889.78.097.7‐176‐47.1

Totals48371594.3149.41743.7‐449‐85.2

The ICAP/SCR data in Table 3 is based on the enrollments prior to the May ICAP Spot Market Auction. Approximately 8.6% of enrolled MW in ICAP/SCR are attributed to Local Generator resources.

The data in Table 3 shows a MW enrollment decrease of 5% compared with the same

period reported in the June 2011 Report and an 8% reduction in the number of end-use locations. Historic data shows that enrollment in the ICAP/SCR program changes monthly throughout the Summer Capability Period. Between May 2011 and June 2011, for example, there was an

increase of 6% in enrolled end-use locations and an 11% increase in enrolled MW.

- 5 -

Table 4. DADRP Enrollment: May 2012

Change in

Zone

Number of End

Use Locations

DADRP Load DADRP Local Reduction MW Generator MW

Total DADRPCount from Change in MW

MWMay 2011 from May 2011

ReportReport

Total437.00.037.0‐46‐294.4

* Number of end‐use locations by category is fewer than 5 and has been masked for this public version of

the table. The unredacted values are presented in the confidential appendix submitted as Attachment A.

Enrollment in DADRP has been static for several years and many of the enrolled

resources have shown no activity in the energy market for more than three years. The changes in enrollment reported for DADRP are of two types: resources that formally withdrew from the DADRP program in 2011 (7 resources, 26.4 MW) and resources that have been removed from reporting due to inactivity since 2008 to provide a more accurate representation of the enrolled MW in the DADRP (20 resources, 268 MW). The DADRP resources that have been removed from reporting are still eligible to make offers in the day-ahead energy market and will be

counted in future enrollment reports if their activity in DADRP changes.

Demand Side Ancillary Services Program

In December 2011, the NYISO released the technical specifications for NYISO Direct

Communications for DSASP Providers, which are the market participants that represent the

demand side resources in the NYISO’s ancillary services market. As a result, DSASP Providers

have shown an increased interest in the program with more beginning to register. As DSASP

Providers complete the NYISO registration process and install the infrastructure for Direct

- 6 -

Communications for DSASP, the NYISO expects enrollment of individual resources for DSASP. Additional information regarding current activities associated with aggregations for DSASP is

discussed below.

Demand Response Initiatives for 2012

The NYISO is working with its stakeholders on a number of initiatives intended to

improve the administration of its demand response programs, and to address regulatory

directives to facilitate market participation. This section provides a brief synopsis of the efforts to date on these initiatives:

Continued Development of the Demand Response Information System (DRIS)

The NYISO has one planned deployment in June 2012 for DRIS to integrate demand

response event creation and notification into DRIS. This deployment will be used by NYISO

Operators to deploy demand response resources and provide a way for market participants to

respond with an estimate of their anticipated capability directly into DRIS. To familiarize DRIS users with the new capabilities for event notification, the NYISO has scheduled multiple DRIS training sessions and will conduct a communication test shortly after deployment to allow DRIS users to exercise the new features.

Market Rules for Aggregations of Small Demand Resources in the Ancillary Services Market

The NYISO has proposed market rules and procedures for integrating aggregations of

small demand resources into its ancillary service markets through the Demand Side Ancillary

Services Program (DSASP). Presentations to stakeholders on these issues were made in

February, April, and May 2012.5 The NYISO anticipates filing proposed tariff changes in the

late summer 2012.

5 Presentations on Aggregations for DSASP made to the Market Issues Working Group:

February: http://www.nyiso.com/public/webdocs/committees/bic_miwg/meeting_materials/2012-02-

17/Concepts_for_DSASP_Aggregation-MIWG-02-17-12.pdf,

April: http://www.nyiso.com/public/webdocs/committees/bic_miwg/meeting_materials/2012-04-

26/DSASP_Aggregations.pdf,

- 7 -

Order 745 Compliance Filing on the Feasibility of a Dynamic Net Benefit Tests

As directed in Order 745, the NYISO will make a compliance filing in September 2012 to report on the results of a study to determine the feasibility of integrating a dynamic version of the Net Benefits Test on a real-time basis.

Demand Response in the Real-Time Energy Market

The NYISO will begin work with its stakeholders during the second half of 2012 with the objective to complete a market design for demand response in the real-time energy market by the end of 2012.

Implementation of NYISO’s Order 745 Compliance Filing for a Monthly Net Benefits Test

The NYISO submitted its filing in compliance with Order 745 on August 19, 2011. The

NYISO has identified the changes to its systems and procedures that will be necessary to

implement the compliance filing. Once the NYISO receives an order from the Commission on

its compliance filing, it will assess the implementation plan requirements and schedule.

May: http://www.nyiso.com/public/webdocs/committees/bic_miwg/meeting_materials/2012-05-

15/DSASP_Aggregations-MIWG-05-15-12.pdf

- 8 -