10 Krey Boulevard Rensselaer, NY 12144

THIS FILING LETTER DOES NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL

INFORMATION. REPORT SECTIONS II AND III DO NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL INFORMATION. THE BODY OF REPORT SECTION I, AND

SECTION I ATTACHM ENTS I-A THROUGH I-D DO NOT CONTAIN ANY PRIVILEGED OR CONFIDENTIAL INFORMATION. REPORT SECTION I ATTACHMENTS I-E AND I-F CONTAIN PRIVILEGED AND CONFIDENTIAL INFORMATION AND ARE SUMITTED IN A SEPARATE DOCUMENT.

December 20, 2011

Kimberly D. Bose, Secretary

Federal Energy Regulatory Commission 888 First Street, N.E.

Washington, D.C. 20426

Re: Annual Report in Docket Nos. ER01-3001-___, ER03-647-___ and

Request for Privileged Treatment of Attachments 1 and 2 to Report Section I

Dear Ms. Bose:

Enclosed for filing in the above-referenced dockets is the New York Independent System

Operator’s (“NYISO’s”) annual report to the Federal Energy Regulatory Commission (“Commission”) on the NYISO’s Installed Capacity (“ICAP”) Demand Curves and New Generation Projects in the New York Control Area.1 By order dated March 25, 2010, the Commission granted the NYISO

permission to submit this annual report by December 20 of each year2 and by Order dated February 3, 2010, directed the NYISO to file this report for informational purposes only.3

I. List of Documents Submitted

The NYISO submits this report comprised of the following separate sections:

I. Capacity Market Report and Withholding Analysis

II. Report on New Generation Projects

III. New Generation Projects and Net Revenue Analysis

1 New York Independent System Operator, Inc., 117 FERC ¶ 61,086 (2006); New York Independent

System Operator, Inc., 103 FERC ¶ 61,201 (2003), 108 FERC ¶ 61,280 (2004), 121 FERC ¶ 61,090 (2007), 123 FERC ¶ 61,206 (2008). In Docket ER03-647, the NYISO files an annual report regarding its Demand Side Management programs on January 15, and a semi-annual report on its Demand Side Management programs and new generation projects on June 15 each year.

2 New York Independent System Operator, Inc., 130 FERC ¶ 61,237 (2010).

3 New York Independent System Operator, Inc., Order, Docket Nos. ER01-3001 and ER03-647 (Feb. 3,

2010).

Kimberley D. Bose, Secretary December 20, 2011

Page 2

II. Request for Confidential Treatment of Attachments 1 and 2 of Report Section I

In accordance with Sections 388.107 and 388.112 of the Commission’s Regulations,4 Article 6 of the NYISO’s Market Administration and Control Area Services Tariff, Sections 1.0(4) and 4.0 of the NYISO’s Code of Conduct, the NYISO requests Privileged and Confidential treatment of the

contents of Confidential Attachments I-E and I-F of Report Section I (the “Confidential Attachments”). The NYISO also requests that Confidential Attachments be exempted from public disclosure under the Freedom of Information Act (“FOIA”), 5 U.S.C. §522.5

The Confidential Attachments contain privileged and commercially sensitive, and trade secret information that is not made public by the NYISO and that could cause competitive harm to the

affected Market Participants,6 and could adversely affect competition in the markets administered by the NYISO, if publicly disclosed. This information includes the identity of Installed Capacity

Suppliers and offers, and the basis therefor, and costs of the Installed Capacity Suppliers. This

confidential, commercially sensitive information is exempt from disclosure under 5 U.S.C. §522(b)(4). For this reason, the NYISO requests that the contents of Confidential Attachments received Privileged and Confidential treatment and be exempt from FOIA disclosure.

The NYISO requests waiver of any obligation it may have under the Commission’s regulations or the Secretary’s rules to submit a redacted version of the Confidential Attachments. The NYISO

incorporated into the body of Report Section I a masked or aggregated version of the information that is contained in the Confidential Attachments and thereby makes publicly available the information

contained in Confidential Attachments that is not confidential and commercially sensitive. In that

regard, the NYISO has provided a redacted version of the information contained in the Confidential Attachments within the body of the report.

The Confidential Attachments I-E and I-F are submitted separately and are identified and

marked in accordance with the Commission’s regulations and rules published by the Secretary’s Office for submitting Privileged information.

4 18 C.F.R. §§ 388.107, 388.112 (2010).

5 The information provided by the NYISO for which the NYISO claims an exemption from FOIA disclosure is labeled “Contains Privileged Information - Do Not Release.”

6 Terms with initial capitalization not defined herein have the meaning set forth in the NYISO’s Market Administration and Control Area Services Tariff.

Kimberley D. Bose, Secretary December 20, 2011

Page 3

III. Correspondence

Copies of correspondence concerning this filing should be addressed to:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director of Regulatory Affairs *Gloria Kavanah, Senior Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rennselaer, N.Y. 12144

Tel: (518) 356-6000

Fax: (518) 356-4702

rfernandez@nyiso.com

rstalter@nyiso.com

gkavanah@nyiso.com

* persons designated to receive service.

Respectfully submitted,

/s/

Gloria Kavanah

Counsel for

New York Independent System Operator, Inc.

cc:Michael A. Bardee

Gregory Berson

Connie Caldwell

Anna Cochrane

Jignasa Gadani

Lance Hinrichs

Jeffrey Honeycutt

Michael Mc Laughlin

Kathleen E. Nieman

Daniel Nowak

Rachel Spiker

CERTIFICATE OF SERVICE

I hereby certify that I have this day served the foregoing document upon each person

designated on the official service list compiled by the Secretary in this proceeding in accordance with the requirements of Rule 2010 of the Rules of Practice and Procedure, 18 C.F.R. §385.2010.

Dated at Rensselaer, NY this 20th day of December, 2011.

/s/ Joy A. Zimberlin

Joy A. Zimberlin

New York Independent System Operator, Inc

10 Krey Blvd.

Rensselaer, NY 12114 (518) 356-6207

Contents

I.Capacity Market Report and Withholding Analysis.................1

A. Overview..............................................................1

B. Recent Installed Capacity Auction Results....................................4

C. Potential Withholding in the Capacity Markets.................................9

1. All Regions in the NYCA..............................................9

Unoffered Capacity...............................................11

Unsold Capacity.................................................12

2. New York City Locality..............................................14

3. ROS Capacity Market................................................16

Additional Details................................................16

Analysis of Unoffered Capacity......................................19

Analysis of Unsold Capacity........................................21

i. Monthly Price Impacts........................................21

ii. Class Average Going Forward Costs............................22

iii. Unsold Capacity Impact Analysis..............................25

iv. Conclusions...............................................27

Attachment I-A. Unsold Capacity Offers (Masked)

Attachment I-B. Existing Generating Facilities

Attachment I-C. Class Average Avoidable Costs

Attachment I-D. Class Average Going Forward Costs

Confidential Attachment I-E. Unsold Capacity Offers (Unmasked)

Confidential Attachment I-F. Market Participant Explanations

II.Report on New Generation Projects...........................40

Attachment II-A. Interconnection Queue

III.New Generation Projects and Net Revenue Analysis................47

Proposed Resource Additions................................................48

Revenue Analysis.........................................................49

Attachment III-A. ICAP Auction Activity

i

Charts

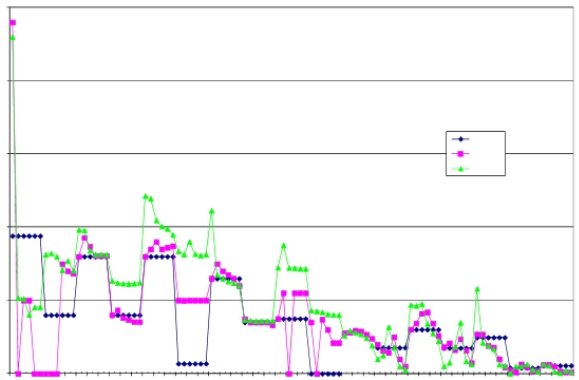

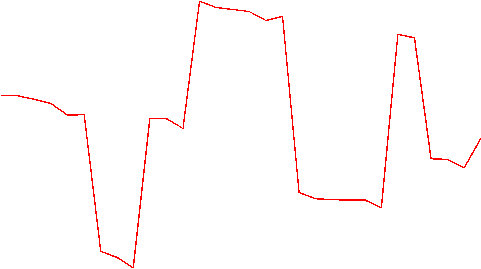

Chart 1. NYCA Market Clearing Prices............................................6

Chart 2. NYCA Offered MW....................................................6

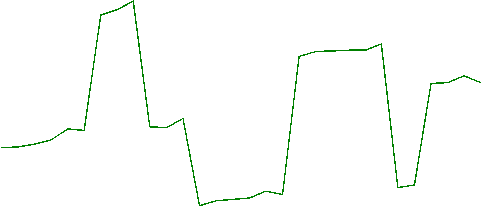

Chart 3. NYC Market Clearing Prices..............................................7

Chart 4. NYC Offered MW......................................................7

Chart 5. Long Island Market Clearing Prices........................................8

Chart 6. Long Island Offered MW.................................................8

Chart 7. Average Percent of Unoffered MW........................................11

Chart 8. Average Percent of Unsold Capacity.......................................12

Chart 9. In-City Mitigation Results 2011..........................................15

Chart 10. NYC Generator and SCR UCAP.........................................16

Chart 11. ROS Capacity Available, Offered, Sold and Exported........................17

Chart 12. NYISO Interconnection Queue Projects...................................47

Chart 13. UCAP-based Revenue Margins..........................................55

Chart 14. UCAP-based Capacity Margins..........................................55

Chart 15. Capacity Market Revenues Relative to CONE Requirements...................56

Tables

Table 1. Unoffered and Unsold Capacity by Locality.................................13

Table 2. ROS Unoffered and Unsold Capacity MW by Type of Market Participant.........18

Table 3. Maximum Price Impact of Unoffered Capacity..............................21

Table 4. Maximum Price Impact of ROS Unsold MW................................22

Table 5. Going Forward Cost Definitions..........................................23

Table 6. Unsold MW Used for GFC Calculations....................................25

Table 7. Price Impact Analysis Results............................................27

Table 8. June 2011 Status of the 2008 CRP Market - Based Solutions and TOs’ Plans.......49

Table 9. Available Capacity vs. Required Capacity..................................50

Table 10. Annual Revenue Requirements in UCAP Terms ($/MW).....................51

Table 11. Benchmark Annual Revenues in UCAP Terms ($/MW).......................53

Table 12. Revenue Margins.....................................................53

ii

I.Capacity Market Report and Withholding Analysis

A. Overview

This report (the “December 2011 Report”) reviews the outcomes of the Installed Capacity

markets administered by the New York Independent System Operator (“NYISO”), assesses the effectiveness of the Installed Capacity1 (“ICAP”) Demand Curves in attracting investment in

new generation, and examines potential withholding activity in the NYISO-administered

Capacity auctions for the three Capacity regions in the New York Control Area (“NYCA”): New York City (“NYC”), Long Island (“LI”), and the Rest of State (“ROS”).2 The December 2011

Report covers the Winter 2010-2011 and Summer 2011 Capability Periods, which span from

November 2010 through October 2011. Similar NYISO reports previously filed cover earlier

periods. The analyses conducted for this report are consistent with the methodology established and first used for the report filed January 15, 2010 in these dockets3 covering November 2008

through October 2009 (“January 2010 Report”).

Capacity prices during the Winter 2010-2011 Capability Period exhibited less variation than the previous Winter Capability Periods for the NYCA, and the NYC and Long Island

Localities. The addition of Capacity and an increase in Capacity imports into the NYCA, Long Island and NYC led to historically lower auction prices during the Winter Capability period. Auction prices for the Long Island Locality were set by the NYCA Market-Clearing Price in all six months of the Winter Capability Period.

During the Summer 2011 Capability Period, ICAP auction clearing prices in NYC

exhibited large variation, but on average, were consistent with clearing prices from previous Summer Capability Periods. The average NYC ICAP Spot Market Auction price for Summer 2011 was $4.64/kW-month lower on average than the Summer 2010 average, which was mostly driven by increased Capacity in NYC. Summer 2011 Capacity prices in Long Island and for the NYCA were also lower on average than prices in Summer 2010. The Long Island price was set by the NYCA price for the all months except for September.

1 Terms in upper case not defined herein shall have the meaning set forth in the NYISO’s Market Administration and Control Area Services Tariff (“Services Tariff”).

2 The NYISO administers three Capacity auctions: NYCA, New York City, and Long Island. References in this report to the Rest of State are to the geographic area within the NYCA that excludes the New York City and Long Island Localities.

3 See New York Independent System Operator, Inc.’s Updated Status Report on Stakeholder Discussions Regarding Annual Installed Capacity Demand Curve Reports and Plan for Future Reports (“NYISO Updated Status Report”) at p. 4 (filed with the Commission in these dockets on November 12, 2009). Section I. C. 3. of this report contains an updated analysis of NYCA unsold capacity.

Page 1

For the December 2011 Report period, there was minimal change in the proportion of

Load Serving Entity (“LSE”) Capacity requirements being met from purchases in the NYISO-

administered Capacity markets versus other sources, such as bilateral contracts, when compared

to previous reporting periods. In UCAP terms, in the Winter 2010-2011 Capability Period,

47.31% of LSE Capacity requirements were met through bilateral purchases, while the remaining percent of LSE obligations were met through the NYISO-administered auctions. Similarly, in the Summer 2010 Capability Period, 48.39% of LSE capability requirements were met through bilateral purchases, while the remaining LSE obligations were satisfied through purchases made in the NYISO-administered auctions.

In the NYC and LI Localities, the seasonal average quantities of unsold and unoffered

capacity were less than two percent of available supplies (see Charts 7 and 8). Unsold and

unoffered capacity quantities from ROS resources were about 5.5 percent in Winter 2010-2011

and 3.2 percent in Summer 2011.4 The ICAP offered and purchased in NYCA and each of the

two Localities exceeded the Locational Minimum Installed Capacity Requirements, and prices

have been below the net cost of new entry (“Net CONE”) reflected on the ICAP Demand

Curves.

Overall, the clearing prices resulting from the ICAP Demand Curves in the ICAP Spot

Market Auctions support the conclusion that the ICAP Spot Market Auctions continue to be

attractive to Installed Capacity Suppliers. It continues to be difficult to correlate the effects of

the ICAP Demand Curves on investment in new generation in the NYCA mainly because over

the past several years New York has had Capacity available in excess of the Locational

Minimum Installed Capacity Requirements. The NYISO understands that developers will look

to anticipated future revenues when making near-term investment decisions. At this time, the

current ICAP market structure provides sufficient market signals to anticipate future revenues.

While there were no Reliability Needs identified in the NYISO’s 2010 Reliability Needs

Assessment, the NYISO will continue to monitor potential reliability risks and other issues that

may affect the reliability outlook for New York’s bulk electric system. This effort includes

tracking the planned development of new generation and other proposed interconnection

projects, assessing demand response resources’ participation in the ICAP/SCR program, tracking

and evaluating potential reliability impacts of generator retirements, and evaluating the

cumulative effect of emerging environmental regulations on the existing generation fleet.

4 Section I. C. 3. of this report provides information and analysis of the unoffered and unsold capacity from ROS resources.

Page 2

Over the past year, the NYISO has been engaged in several regulatory proceedings

regarding its Installed Capacity market. These proceedings include revisions the ICAP Demand Curves, revisions to the In-City buyer-side capacity mitigation rules, added provisions for the potential creation of new capacity zones, and changes to the baseline load calculation for Special Case Resources (“SCRs”).

The third triennial Demand Curve reset process was completed on September 15, 2011

with the Commission’s acceptance of the ICAP Demand Curves, which were effective beginning with the October 2011 ICAP Spot Market Auction and will continue through Winter 2014-

2015.5 The fourth triennial Demand Curve reset process will begin in mid-2012 and will follow the process set forth in Section 5.14 of the Services Tariff.

On September 27, 2010, the NYISO proposed enhancements to its In-City buyer-side capacity mitigation measures in a filing at the Commission under Section 205 of the Federal Power Act.6 On November 16, 2010, and in subsequent orders, the Commission accepted the tariff revisions (as revised, the In-City Buyer-Side Mitigation Measures).

The Commission issued an Order on Compliance7 on September 8, 2011, directing the NYISO to develop and file tariff revisions that implement criteria for the determination of new capacity zones (“NCZs”). The NYISO’s NCZ Compliance Filing on November 7, 20118

included modifications to the Services Tariff to identify the deliverability criteria that will be used to determine whether a NCZ is required. That filing is pending before the Commission as of the December 20, 2011 filing of this report.

The Commission issued a Final Rule on demand response compensation in wholesale

energy markets on March 15, 2011. The DR Final Rule ensures that demand response resources are compensated at the market price for energy when the resources are dispatched and are costeffective. The DR Final Rule prescribed a net-benefits test to determine when demand response resources are cost effective. The NYISO made its compliance filing on August 19, 2011. The DR Final Rule also requires a second compliance filing on the feasibility of the dynamic benefits test, which the NYISO plans to file in September 2012.

5 New York Independent System Operator, Inc., 136 FERC ¶ 61,192 (2011).

6 See FERC Docket ERl0-3043, "Proposed Enhancement to In City Buyer-Side Capacity

Mitigation Measures, Request for Expedited Commission Action, and Contingent Request for Waiver of Prior Notice Requirement” (dated September 27, 2010).

7 New York Independent System Operator, Inc., 136 FERC ¶ 61,165 (2011).

8 See FERC Docket Nos. ER04-449 and ER12-360, “NCZ Compliance Filing” (dated November

7, 2011).

Page 3

The Commission issued a Final Rule on demand response compensation in wholesale

energy markets on March 15, 2011.9 The DR Final Rule provides for demand response

resources are compensated at the market price for energy when the resources are dispatched and

are cost-effective. However, the Commission specified in its December 15, 2011 Order that

when the locational marginal price is greater than or equal to the threshold price, all demand

resources that qualify for compensation will receive the locational marginal price payment, but if

that price is less than the threshold price, the Final Rule does not apply to determine the

payment to a demand response resource, and any payment will be governed by the existing RTO

or ISO tariff.10 The DR Final Rule prescribed a net-benefits test to determine the threshold

price when demand response resources are cost effective. The NYISO made its compliance

filing on August 19, 2011. The DR Final Rule also requires a second compliance filing, on the

feasibility of the dynamic benefits test, which the NYISO plans to file in September 2012.

The NYISO continues to believe that the ICAP Demand Curves and their use for the NYISO ICAP markets remains sound. The Demand Curves are structured to provide signals to develop new Capacity when and where it is needed, particularly when compared to the de facto vertical demand curves in place prior to the Summer 2003 Capability Period. 11 Although the specific parameters of the ICAP Demand Curves (i.e., the slope and the height), likely will

continue to be subject to debate in the ICAP Demand Curve reset process, there can be little

doubt that the ICAP Demand Curves provide better price signals to investors than the vertical

demand curves. The ICAP Demand Curves by their very design ameliorate the unstable prices

resulting from the prior vertical demand curves, provide market-driven compensation for

Capacity above the minimum Capacity requirement, and reduce incentives for withholding.

B. Recent Installed Capacity Auction Results

Committed Capacity remains well above minimum Installed Capacity requirements for

the NYCA, and for the NYC and Long Island Localities. In general, the Dependable Maximum

Net Capability (“DMNC”) available from many generators in the NYCA increases in the winter

9 Demand Response Compensation in Organized Wholesale Energy Markets, Final Rule, 18 CFR Part 35, 134 FERC ¶ 61,187 [Order No. 745] (dated March 15, 2011)(“DR Final Rule”).

10 See Order on Rehearing and Clarification, 745-A, issued December 15, 2011, 137 FERC ¶ 61,215 [Order No. 745-A] (dated December 15, 2011).

11 Prior to the May 2003 ICAP Spot Market Auction, Deficiency Auctions used a “stepped”

demand curve with a vertical line segment at the minimum requirement level. All NYISO Demand

Curves have horizontal sections above and below these line segments, at a maximum price and $0.00/kW-

month, respectively, as defined in the Services Tariff.

Page 4

because of the lower ambient temperatures. Capacity offers from External Control Areas also fluctuate seasonally. Further, the NYCA Demand Curve price can decline to zero when supply exceeds the minimum Capacity requirement in the NYCA by 12 percent or more. Accordingly, the NYCA auction clearing prices are consistently at or below half of the estimated net cost of new entry for the peaking unit Capacity.

The amount of Capacity committed to the NYCA, including imports, continues to be

high. The monthly average import levels into the entire NYCA were 1,905.4 MW in the Winter

2010-2011 Capability Period and 2,073.4 MW in the Summer 2011 Capability Period. This

represents a 600 MW monthly increase over levels imported for the previous Winter Capability

Period and a 100 MW monthly decrease relative to the prior Summer Capability Period.

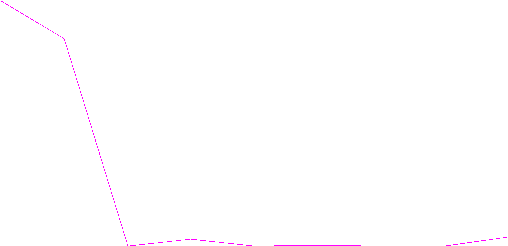

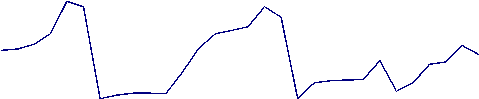

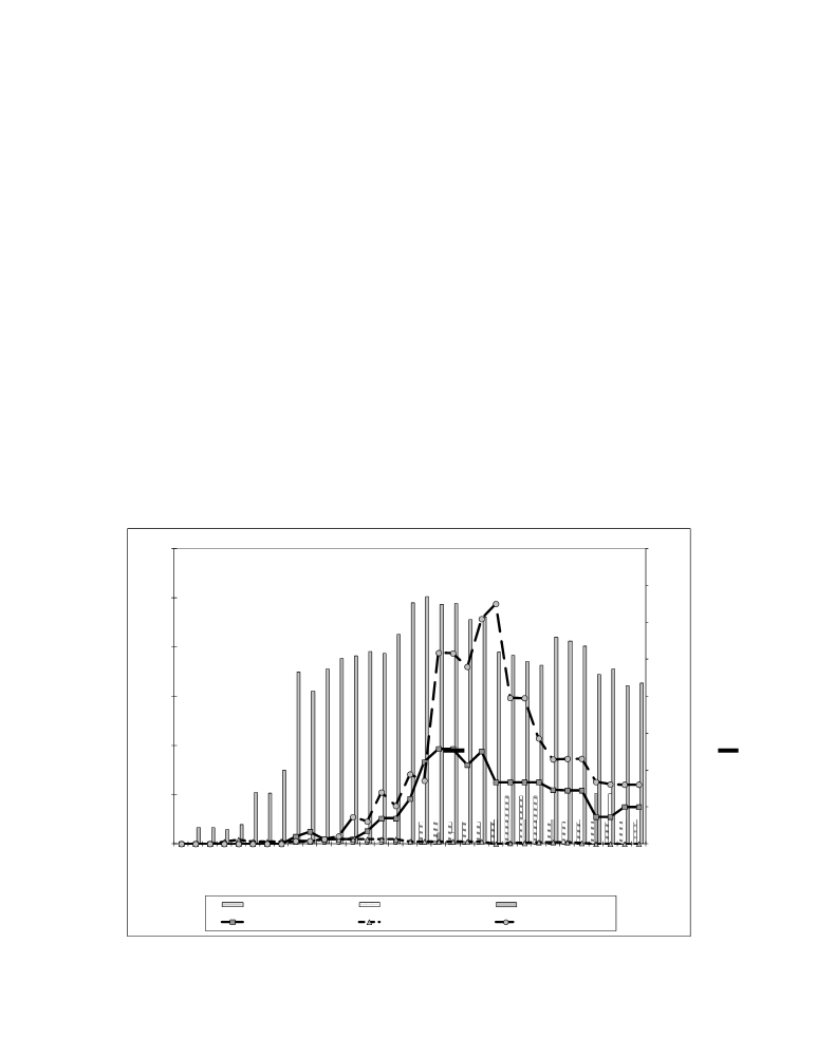

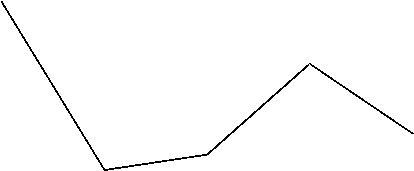

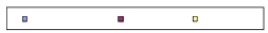

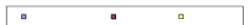

ICAP Market Clearing Prices and auction activity levels from November 1999 through October 2011 for the NYCA, NYC, and Long Island are shown in tabular form in Attachment III-A. Market clearing prices are depicted in graphic form in Charts 1, 3, and 5, and Capacity commitment levels (including unsold MW) are depicted in Charts 2, 4, and 6, below. The

NYCA Unsold MW depicted in Chart 2 includes unsold MW located in ROS, as well as the

Unsold MW depicted in Charts 4 and 6 for the NYC, and Long Island Localities, respectively.

Page 5

Chart 1. NYCA Market Clearing Prices

$5.00

$4.50

$4.00

$3.50Strip

Monthly

$3.00Spot

$2.50

$2.00

$1.50

$1.00

$0.50

$-

Chart 2. NYCA Offered MW

50000

45000

40000

35000

30000

25000

20000

15000

10000

5000

0

NYCA RequirementNYCA ExcessNYCA Unsold

Page 6

Chart 3. NYC Market Clearing Prices

$16.00

$14.00

Strip

$12.00Monthly

Spot

$10.00

$8.00

$6.00

$4.00

$2.00

$-

Chart 4. NYC Offered MW

12000

10000

8000

6000

4000

2000

0

NYC RequirementNYC ExcessNYC Unsold

Page 7

Chart 5. Long Island Market Clearing Prices

$25.00

$20.00

Strip

$15.00Monthly

Spot

$10.00

$5.00

$-

Chart 6. Long Island Offered MW

7000

6000

5000

4000

3000

2000

1000

0

LI RequirementLI ExcessLI Unsold

Page 8

C. Potential Withholding in the Capacity Markets

1. All Regions in the NYCA

This section of the report addresses potential withholding in NYISO-administered

Capacity auctions in all regions in the NYCA from November 2010 through October 2011. It focuses on market outcomes and related behavior since May 2007.

In order to determine for this report whether any potential withholding occurred, the NYISO analyzed the differences between available supply and the supply committed through self-supply, bilateral transactions, and the NYISO-administered auctions. In particular, the

NYISO examined:

• the available NYCA Capacity that was available to be offered into the ICAP Spot

Market Auctions but was not offered (“unoffered capacity”),12

• available NYCA Capacity that was offered into the Spot Market Auctions but was

not sold (“unsold capacity”),

• unoffered capacity as a percentage of available Capacity, and

• unsold capacity as a percentage of offered Capacity.

When Capacity is available but not offered, it is an indication that physical withholding

may have occurred. Similarly, when Capacity is offered at a price that causes it not to clear, it is

an indication that economic withholding may have occurred. The amounts of unoffered and

unsold capacity are determined from the ICAP Spot Market Auction results, because this auction

is the last opportunity for Installed Capacity Suppliers to sell their Capacity. The existence of

unoffered and unsold capacity, however, does not necessarily imply the intent to raise market

prices.

As reflected in the NYISO’s previous reports on the Installed Capacity Demand Curves,

patterns of unsold capacity have varied across each of the Localities. For the entire NYCA, there

generally has been more unsold capacity in winter months than summer months. In Long Island,

historical levels of unsold capacity have averaged near zero; for this reporting period, the

average level of unsold capacity increased slightly, by 5.1 MW per month on average, in Winter

2010-2011, and 9.2 MW per month, on average, in Summer 2011. In NYC, the high amounts of

unsold capacity between Summer 2006 and Winter 2007-2008 coincided with the addition of

12 Available supply is defined as the lesser of the NYISO-accepted DMNC tested capacity and the Capacity Resource Interconnection Service (“CRIS”) MW value, with the Equivalent Demand Forced Outage Rates (“EFORd”) applied.

Page 9

approximately 1,000 MW of new Capacity. These amounts subsided with the introduction of the supply-side mitigation rules in 2008.

There are three types of ICAP auctions in each Capability Period: a Capability Period

Auction (also referred to as the “six-month strip auction”), six Monthly Auctions, and six ICAP

Spot Market Auctions. Capacity may be offered into any or all of the auctions. The NYCA

ICAP requirements are settled for three locations: one each for the NYC and the Long Island

Localities, and one for the NYCA as a whole. Local reliability rules require LSEs in NYC and

on Long Island to procure minimum levels of Capacity from Installed Capacity Suppliers that are

electrically located within the respective Locality. Such Capacity is also credited toward each

NYC and Long Island LSE’s overall NYCA obligation. The NYISO establishes Locational

Minimum Installed Capacity Requirements on an annual basis according to NYISO

Procedures.13

With the exception of the NYC Locality, the Services Tariff does not require Installed

Capacity Suppliers to offer Capacity into the ICAP markets. Until the implementation of the

ICAP mitigation measures set forth in Attachment H of the Services Tariff, which were

effectuated in May 2008, the majority of Capacity in NYC - that of the “Divested Generation

Owners” - had been subject to Commission-approved ICAP mitigation measures that imposed

bid caps and required the units’ Capacity to be offered into the ICAP auctions. Capacity

resources constructed subsequent to the Commission’s approval of the bid caps were not subject

to bid caps or mandated to offer into the auctions. That Capacity and other Capacity inside and

outside of the NYC Locality could be sold in bilateral transactions or offered in one or more of

the NYISO’s ICAP auctions. The Commission’s March 7, 2008 Order14 removed the

requirements unique to the Divested Generation Owners and approved mitigation measures

applicable to all In-City Capacity. The March 7, 2008 Order effectuated new In-City mitigation

measures, based on Pivotal Supplier determinations combined with offering conduct and price

impact thresholds, to determine whether an market power had been exercised. These measures

are set forth in Attachment H of the Services Tariff (including revisions over time, “Supply-side

Mitigation Measures”).

In developing the information for this report, the NYISO examined auction outcomes of

the Capability Periods from Summer 2007, which begins May 1, 2007, through Summer 2011,

13 See Section 2 and Attachment B of the NYISO Installed Capacity Manual.

14 New York Independent System Operator, Inc., Docket No. EL07-39-000, Order Conditionally Approving Proposal, 122 FERC ¶ 61,211.

Page 10

which ended October 31, 2011. Since the Capacity product transacted in NYISO-administered ICAP auctions is UCAP, the following information was examined:

1. Certification data, reflecting the certified MW of UCAP from all Resources within New

York available to supply Capacity to the NYCA. The analysis did not include resources

physically located outside of the NYCA.

2. The amount of UCAP supplied, which includes UCAP sold in any of the NYISO ICAP

auctions, UCAP certified as self-supplied against an LSE’s Capacity obligation, and

UCAP committed through bilaterals.

Unoffered Capacity

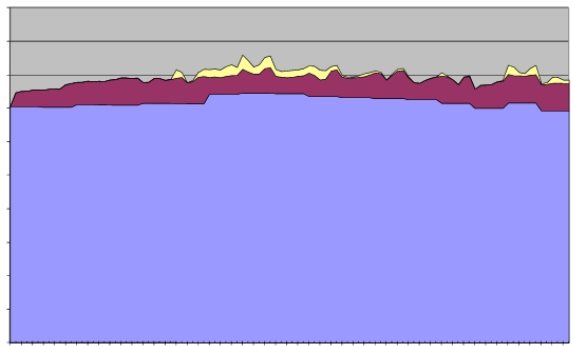

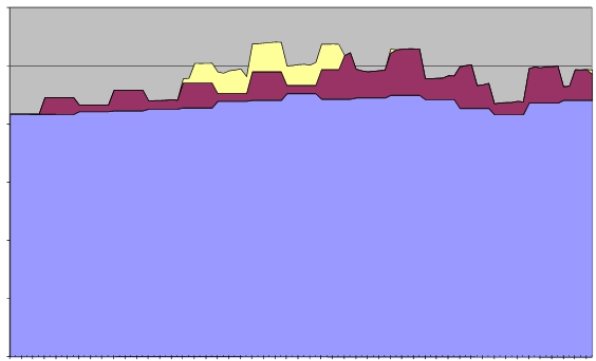

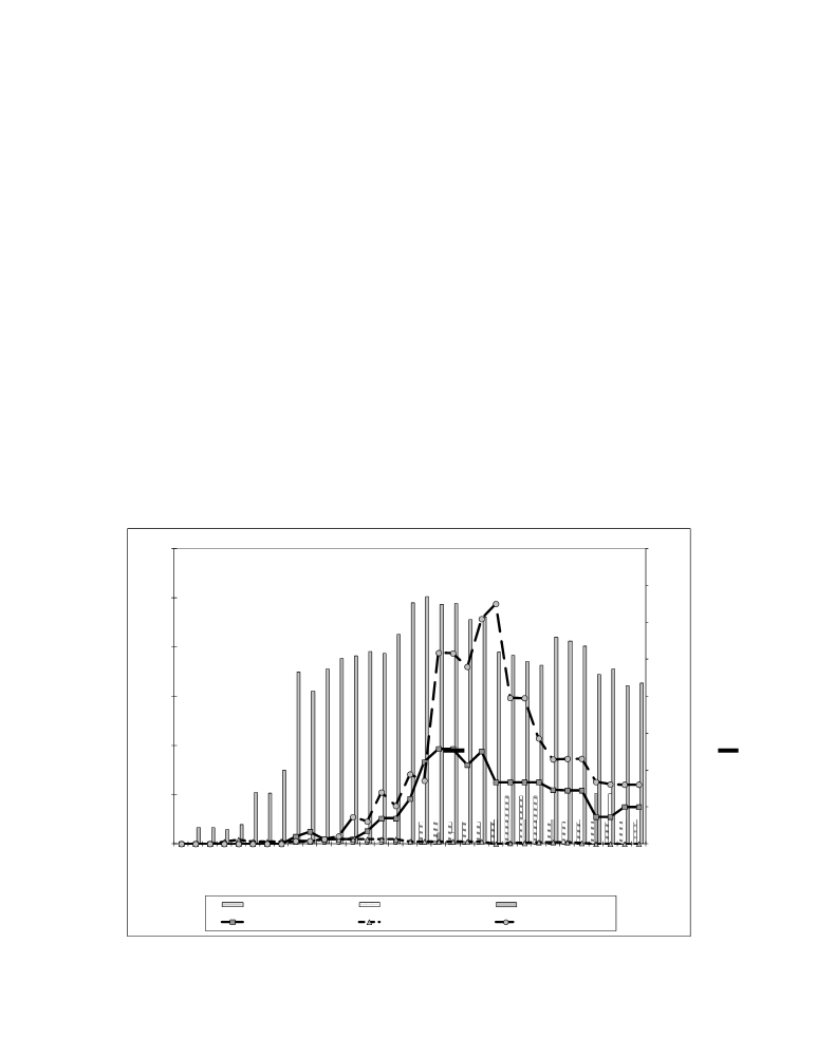

Chart 7 displays unoffered capacity as a percent of available Capacity in each region, for

each of the three regions.

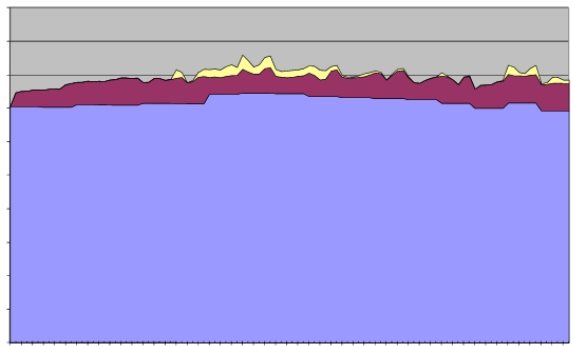

Chart 7. Average Percent of Unoffered MW

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

Summer 2007Winter 2007-Summer2008Winter 2008-Summer2009Winter 2009-Summer 2010Winter 2010-Summer 2011

08091011

LINYCROS

The Long Island Locality has fairly consistent seasonal fluctuations in the amounts of

unoffered capacity, which can be seen in Chart 7. The Long Island Locality is characterized by

Capacity procurement chiefly through bilateral transactions and self-supply. While it appears the

amount of unoffered capacity on Long Island fluctuates between 0.01% and 2.26%, much of the

Page 11

unoffered capacity is not actually available. A portion of the unoffered capacity in Long Island

is associated with generation stations permitted for less than 80 MW, although the DMNC of the

units at each station when aggregated exceeds 80 MW. For example, in four instances on Long

Island, there are two units at a site, and each individual unit at that site can produce more than 40

MW. In the event that one unit is out of service and the Market Participant wishes to run the

other unit at output levels higher than 40 MW, the NYISO must have that higher (actual) DMNC

value in its software system in order for the bid to pass validation. These units do not offer all of

their available Capacity because the site permit restrictions limit the combined output to 79.9

MW.

Prior to Summer 2008, in NYC, the low level of unoffered capacity was principally due to the must-offer requirement applicable to the Divested Generation Owners. Beginning with the Summer 2008 Capability Period, the near absence of unoffered capacity can be attributed to the Supply-side Mitigation Measures effectuated in 2008.

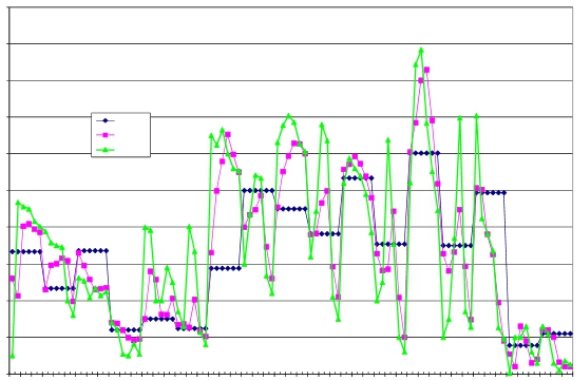

Chart 8 displays unsold capacity as a percent of available Capacity in each region, for each of the three regions.

Chart 8. Average Percent of Unsold Capacity

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

Summer 2007 Winter 2007-08Summer2008 Winter 2008-09Summer2009 Winter 2009-10 Summer 2010 Winter 2010-11 Summer 2011

LINYCROS

Page 12

Unsold Capacity

For all Capability Periods beginning with Summer 2007, nearly all Long Island Capacity

that was offered was sold. In NYC, the average amount of unsold capacity as percentage of

available Capacity trended at near zero levels from the start of the Summer 2008 Capability

Period. For the Summer 2007 and after, nearly all the MW of Capacity resources located in ROS

that offered Capacity into the ICAP auctions were sold. This result has been consistently

observed despite a reduction in the NYCA Installed Reserve Margin from 18 to 16.5 percent for

the 2007-2008 Capability Year and from 16.5 to 15 percent for the 2008-2009 Capability Year,

which was then followed by increases to 16.5 percent for the 2009-2010 Capability Year and

then 18% for the 2010-2011 Capability Year, before the latest reduction to 15.5 percent for the

2011-2012 Capability Year. As discussed below in the ROS section, the amount of unsold

capacity in the ROS region displayed a significant increase in the Winter 2010-2011 and

Summer 2011 Capability Periods.

Table 1 displays the breakdown of unsold and unoffered for each Locality. As part of the

NYISO’s August 24, 2010 ICAP compliance filing,15 the NYISO stated that it would include

unoffered and unsold capacity in the NYC Locality in its Installed Capacity Demand Curves

reports filed annually with the Commission. The unoffered and unsold capacity values for NYC

and ROS are also included to give a full representation of the data that underlies this report.

Table 1. Unoffered and Unsold Capacity by Locality

UnofferedUnsold

MonthNYCLIROSNYCLIROS

Nov-1044.383.9310.20.023.61,378.3

Dec-1015.184.6305.50.00.01,301.7

Jan-1147.982.9317.20.00.0487.9

Feb-111990.6431.60.00.0389.0

Mar-1112.2102.0432.60.02.61,026.7

Ap r-1 125.198.34250.04.61,418.1

May-1126.617.2298.20.00.0141.4

Jun-112314.5176.50.00.0262.3

Jul-1125.414.790.20.31.0921.3

Au g -1 135.311.290.90.027.8844.1

Sep-1162.668.3390.80.012.8499.3

Oct-1147.524.3212.2149.013.6495.7

15 See New York Independent System Operator, Inc., Resubmittal of August 24, 2010 Filing,

Docket Nos. ER10-2210-000, EL07-39-____ and ER08-695-0004, (“August 2010 Compliance Filing”) at

p. 16.

Page 13

2. New York City Locality

In NYC, Pivotal Suppliers are subject to Mitigation Measures. A Pivotal Supplier is an

ICAP Supplier that, along with its Affiliated Entities, Controls In-City Capacity in excess of the

pivotal control threshold.16 The Capacity controlled by Pivotal Suppliers (“Mitigated UCAP”)

must be offered into the Spot Market Auction at a price at or below the lesser of the default

UCAP Offer Reference Level (“Default Reference Price”) or the ICAP Supplier’s Going-

Forward Costs. There is not a “must-offer” requirement for Capacity located in the ROS or

Long Island Localities.

The NYC Capacity that was not sold, as a percent of available Capacity, was less than

0.26% per month on average for the Winter 2010-2011 and Summer 2011 Capability Periods.

The low levels can be explained by the implementation of the Supplier-side Mitigation Measures that became effective as of the Summer 2008 Capability Period.17

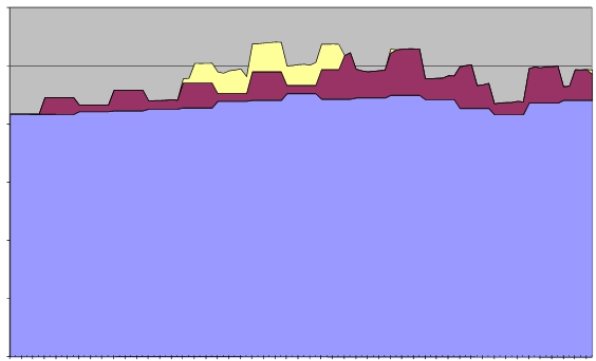

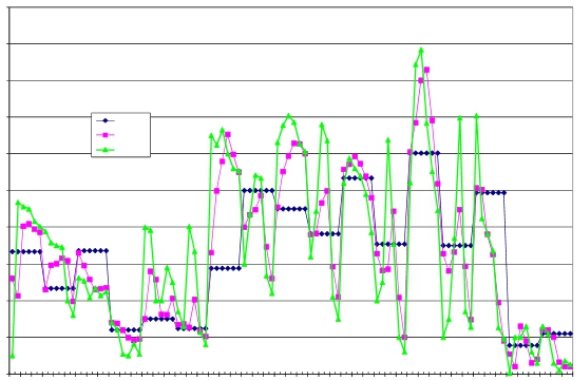

Chart 9 below illustrates the effects of the Supplier-Side Mitigation Measures. As

depicted in Chart 9, these measures include a Pivotal Control Threshold determined by the

surplus amount of NYC Capacity above the Locality Capacity Requirement. An Entity is

deemed a Pivotal Supplier if the number of MW it Controls is greater than the threshold. If an

Entity is a Pivotal Supplier, then it is subject to the Default Reference Price. The Default

Reference Price, as shown in Chart 9, becomes the cap that the Pivotal Supplier must offer at or

below in the ICAP Spot Market Auction unless the Pivotal Supplier’s Going Forward Costs

(“GFCs”), as determined by the NYISO, are higher than the Default Reference Price.

The level of unoffered and unsold MW can be inferred from Chart 9 by comparing the NYC Spot Market Auction price to the UCAP Offer Reference Level (also referred to as the “Default Reference Price”). The Default Reference Price is the price on the demand curve if all available UCAP is offered and sold. The difference between the Spot Market Auction Price and Default Reference Price can be attributed to In-City Capacity that is either not offered or offered at a price above the Default Reference Price. Note that the NYC Spot Market Auction Price will diverge from the Default Reference Price when the NYCA ICAP Spot Market Auction sets the NYC Spot Market Auction price. This divergence is the result of the auction rules, and is not caused by unoffered or unsold NYC Capacity.

16 See Services Tariff Attachment H Sections 23.2.1 and 23.4.5.

17 See earlier reports for the analysis of the New York City Locality prior to the effectuation of the Supplier-Side Mitigation Measures and removal of the bid-caps.

Page 14

Chart 9. In-City Mitigation Results 2011

$16.001800

$14.001600

1400

$12.00

1200

$10.00

1000

$8.00

800

$6.00

600

$4.00

400

$2.00200

$-0

Month

Spot Auction PriceDefault Reference PricePivotal Control Threshold

Page 15

Chart 10 depicts the levels of available generator UCAP and SCR UCAP in the NYC Locality.

Chart 10. NYC Generator and SCR UCAP

10,000600

9,500500

9,000400

8,500300

`

8,000200

7,500100

7,0000

Month

NYC Generator UCAPNYC SCR UCAP

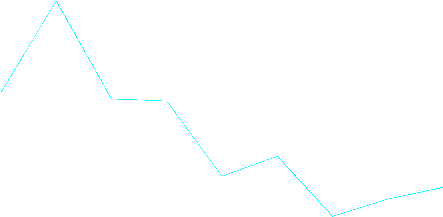

3. ROS Capacity Market

Additional Details

This section of the report addresses possible withholding of Capacity in the ROS region

from November 2010 through October 2011. For this review, the NYISO conducted a detailed

analysis of unoffered and unsold capacity from resources located in the ROS area of the NYCA;

this section of the review does not pertain to Capacity located in NYC and on Long Island.

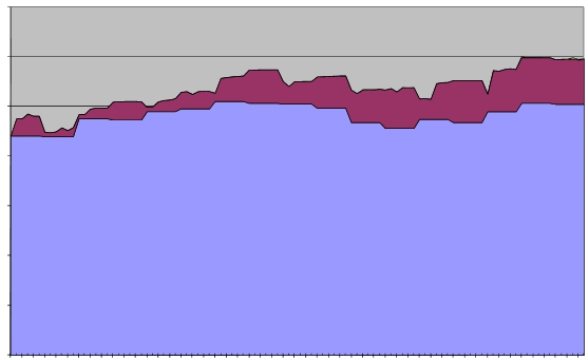

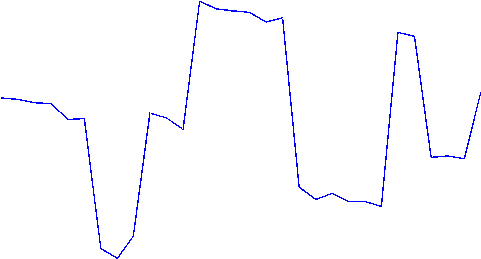

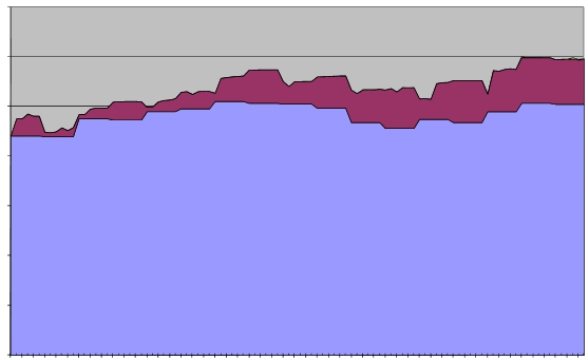

Chart 11 shows monthly average values over each Capability Period for four ROS Capacity variables: available, offered, sold, and exported.

Page 16

Chart 11. ROS Capacity Available, Offered, Sold and Exported

25,0001,400

1,258

24,5001,200

24,0001,000

845

23,500817807800

23,000600

471560

22,500420400

367

289

22,000200

21,5000

ROS AvailableROS OfferedROS SoldCapacity Exports

Examination of ROS Capacity data pertaining to individual Market Participants revealed

general patterns in unsold and unoffered capacity. The patterns suggest a three-way

classification of suppliers by market sector: all generation-owning transmission owners, five

ROS generation owners, and other suppliers, which includes SCRs. 18 Note that these

classifications and the following table follow the same approach in displaying the unoffered and

unsold capacity in the ROS area that was used in the NYISO’s December 2010 Report.19 Table

2 of this December 2011 Report summarizes the monthly averages for each Capability Period from the Summer 2008 Capability Period through October 2011.

18 Special Case Resources participate in the NYISO’s Capacity markets through Responsible Interface Parties.

19See ER01-3001, ER03-647, Motion for Leave to Respond, and Response, of the New York Independent System Operator, Inc. filed July 27, 2009.

Page 17

Table 2. ROS Unoffered and Unsold Capacity MW by Type of Market Participant

Summer 2008Winter 2008-2009Summer 2009Winter 2009-2010Summer 2010Winter 2010-2011Summer 2011

UnofferedUnsoldUnofferedUnsoldUnofferedUnsoldUnofferedUnsoldUnofferedUnsoldUnofferedUnsoldUnofferedUnsold

MWMWMWMWMWMWMWMWMWMWMWMWMWMW

All ROS

TOs204.50.064.10.069.20.091.00.0158.20.0127.70.092.30.0

60.11%0.00%21.22%0.00%56.79%0.00%46.98%0.00%59.90%0.00%26.16%0.00%33.97%0.00%

5 ROS

GenCos67.961.679.5173.824.50.068.751.423.314.171.4179.715.772.9

19.96%100.00%26.30%95.00%20.09%0.00%35.44%66.69%8.82%32.66%14.63%16.46%5.76%6.91%

All Others

incl. SCRs67.80.0158.79.228.20.034.125.782.629.1288.9912.1163.7981.6

19.93%0.00%52.49%5.00%23.12%0.00%17.58%33.31%31.28%67.34%59.21%83.54%60.25%93.09%

Total

Unoffered/

Unsold340.261.6302.3183.0122.00.0193.777.0264.243.2488.01091.8271.61054.5

Total

Available

MW22,980.024,071.023,197.024,116.523,262.124,768.723,126.6

Notes:

(1) All ROS Transmission Owners category includes the TOs’ SCRs

(2) 5 ROS Generating Companies category was used to maintain continuity with the previous reports

Page 18

Salient facts from the above tables are:

• The group of all ROS generation-owning Transmission Owners consistently had

unoffered capacity which ranged from 21% to 60% of total unoffered capacity.

• The group of all ROS generation-owning Transmission Owners had no Capacity that

was offered and unsold capacity.

• The group of five generation owners consistently had unoffered capacity which

ranged from 6% to 35% of total unoffered capacity.

• The group of five generation owners had unsold capacity which accounted for 0% to

100% of total Capacity that was offered and unsold capacity.

• The group of all Others including SCRs consistently had unoffered capacity that

ranged from 18% to 60% of total unoffered capacity for the period Summer 2008

through Summer 2011.

• The group of all Others including SCRs had Capacity that was offered and unsold

capacity that ranged from 0% to 93%.

Analysis of Unoffered Capacity

This section of the report provides a detailed analysis of the unoffered capacity in the

ROS region. This section also presents the maximum price impact of the unoffered capacity, in each month and averaged over the six months of each Capability Period, consistent with the December 2010 Report. In general, the responses suggest that the Installed Capacity Suppliers’ reasons for not offering the Capacity were benign, and none of the instances evidence behavior intended to artificially raise prices.

The NYISO contacted each Installed Capacity Supplier that had at least 15 MW of

unoffered capacity in any one month in either the Winter 2010-2011 Capability Period or the

Summer 2011 Capability Period for an explanation of why it did not offer all of its capacity.20 There were 22 Market Participants with at least 15 MW of unoffered capacity in any month, and the NYISO sought explanations from each of them. The following information was provided to the NYISO by ICAP suppliers.

20 Confidential Attachment I-F is filed as a confidential attachment, which provides a more

detailed summary of Market Participants’ explanations for having unoffered and unsold capacity.

Page 19

1. Thirteen of the Market Participants individually responded that the failure to offer its

capacity was the result of an administrative oversight. The NYISO’s records showed

that twelve of the thirteen Market Participants did not offer capacity in one month,

and one Market Participant did not offer capacity in two months. The majority of

instances had unoffered capacity ranging from 15 to 25 MW; however, in one

instance, a Market Participant did not offer 243.5 MW. That instance was the largest

amount of capacity not offered by a Market Participant due to administrative

oversight.

2. A generation-owning Transmission Owner keeps approximately 30 MW of aging gas-

fueled generation out of operation for the first five months during the Summer Capability Period due to environmental restrictions.

3.A renewable generation owner routinely does not offer approximately 15 MW to 25

MW of UCAP due to neighboring state rules.

4. Four ICAP Suppliers had unoffered capacity associated with their resources being

permanently or temporarily withdrawn from the ICAP market.

5. A generation-owning Transmission Owner routinely does not offer the full quantity

of capacity available from several of its resources. Over the analysis period for this report, this Market Participant did not offer an amount that ranged from

approximately 50 MW to 110 MW in each month. This action was explained to be primarily due to a conservative operating approach.

6. A generation-owning Transmission Owner did not offer 54 MW in each of the Winter

2010-2011 Capability Period due to a natural gas fuel restriction that prevents the plant from being able to run at full capacity.

7. A generation owner has a PURPA contract that prohibits it from selling any Capacity

above the level of the bilateral contract. The amount of unoffered capacity ranges

from 23 MW in Summer Capability Period months to 67 MW in Winter months.

Table 3 below shows the maximum price impact of the unoffered capacity based on the

slopes of the ICAP Demand Curves for the relevant Capability Periods. The maximum price

impact is calculated as the greater of (1) the product of the monthly unsold MW and the slope of

the ICAP Demand Curve and (2) the ICAP Spot Market Auction Market Clearing Price, since

the price impact cannot exceed the auction price. Monthly basis and seasonal averages are

reported. The maximum price impact of the unoffered capacity, averaged over the six months of

Page 20

the Winter 2010-2011 and Summer 2011 Capability Periods, was $0.35/kW-mo and $0.27/kW-

mo, respectively.

Table 3. Maximum Price Impact of Unoffered Capacity

Total

MonthUnoffered

MW

Nov-10310.2

Dec-10305.5

Jan-11317.2

Feb-11431.6

Mar-11432.6

Apr-11425

May-11298.2

Jun-11176.5

Jul-1190.2

Aug-1190.9

Sep-11390.8

Oct-11 212.2

Monthly

Maximum

Price

Impact

$0.01

$0.50

$0.50

$0.65

$0.30

$0.15

$0.65

$0.46

$0.15

$0.05

$0.18

$0.13

Seasonal

Average

Maximum

Price Impact

$0.35

$0.27

Analysis of Unsold Capacity

This section of the report analyzes and reports on unsold capacity in the ICAP Spot

Market Auction. It also presents the maximum price impact of the unsold capacity, in any one month and the price impact average for the six months of the Capability Period. The NYISO contacted each generator for an explanation of its behavior if (a) the class of generators that it was in had more than 15 MW of unsold capacity in a given month and (b) if the generator had a ICAP Spot Market Auction offer that was greater than the generator’s class average Net GFC with half net revenues (“GFCs with half net revenues”, as described below).

In addition to calculating the monthly maximum and average maximum price impacts, three metrics were calculated in this report for the analysis period:

a. Class average going forward costs (“GFCs”), with and without a risk adjustment;

b. Estimated monthly price impacts of unsold capacity associated with offers above class average GFCs.

i. Monthly Price Impacts

Table 4 below includes the average monthly maximum price impact of unsold capacity

for each Capability Period. The price impacts reported in Table 4 exceed the NYISO’s threshold

Page 21

for determining whether GFCs are evaluated in all months of the analysis period, November 2010 through October 2011. Specifically, both of the Capability Period impacts exceeded the $0.20/kW-month threshold. The average price impacts were $0.35/kW-month and $0.24/kW-

month in the Winter 2010/2011 and Summer 2011 Capability Periods, respectively.

Table 4. Maximum Price Impact of ROS Unsold MW

Month

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Total Unsold

MW

1378.3

1301.7

487.9

389.0

1026.7

1418.1

141.4

262.3

921.3

844.1

499.3

495.7

Monthly

Maximum

Price

Impact

$0.01

$0.50

$0.50

$0.65

$0.30

$0.15

$0.37

$0.55

$0.15

$0.05

$0.18

$0.13

Seasonal

Average

Maximum

Price Impact

$0.35

$0.24

ii. Class Average Going Forward Costs

The NYISO calculated class average GFCs for generator classes that had at least 15 MW of unsold capacity in a given month. Four generator classes had unsold capacity that met this criterion: natural gas combined cycle, Class A; no. 6 fuel oil steam turbine, Class F; natural gas steam turbine, Class G; and sub-critical coal steam turbine units, Class H.

The NYISO reviewed the ROS generating units listed in the NYISO’s Load and Capacity

Data Report (referred to as the “Gold Book”) applicable to November 2010 through October

2011, and assigned the units to classes based on primary fuel and technology. Attachment I-B to

this report, “Existing Generating Facilities”, shows the generating units in ROS that the NYISO

assigned to the four classes for which class average GFCs were calculated.

For purposes of this report, class average GFCs are defined as costs (other than

production costs) that could be reasonably expected to be avoided if the plant was mothballed for

at least one year. (See Table 5 for definitions.) These GFCs may provide insight into why a

generator offered its Capacity at a non-zero offer price. The assumption for this report is that an

Installed Capacity Supplier would only want to sell Capacity from a generator if the Capacity

Page 22

revenues it receives cover the generator’s GFCs. In this analysis, GFCs are calculated for the

entire Capacity of the plant. For this report, GFCs are calculated from industry data, such as

labor rates, expenses for contract services, administrative and general, and insurance. Attachment I-C to this report, Class Average Avoidable Costs, presents the avoidable fixed cost components of the class average GFCs for classes A, F, G, and H.

Generators face uncertainty about net revenues, among other things, and this uncertainty may influence the prices at which they offer Capacity. To account for this uncertainty, the

NYISO calculated class average GFCs including varying levels of net revenues: full, half, and none. Attachment I-D to this report, Class Average Going Forward Costs, shows the class

average GFCs for classes A, F, G, and H, calculated as the avoidable costs from Attachment I-C less the varying levels of net revenues.

Table 5. Going Forward Cost Definitions

Going Forward Costs (GFCs)Costs that would be avoided or deferred if a generator was

mothballed for a year or more, based on the calculation of

the industry average cost data for the type of generator.

Net energy and ancillary servicesEstimated energy plus ancillary services revenues minus

revenues (net revenues)estimated production costs, with a minimum value of zero.

GFCs with full net revenuesGFCs minus net revenues. This value is used to represent

Net GFCs with certainty of net revenues.

GFCs with half net revenuesGFCs minus 0.5 times net revenues. This value is used to

represent Net GFCs with some uncertainty.

GFCs with no net revenuesGFCs. This value is used to represent Net GFCs without

certainty of net revenues.

Unit Specific Net GFCs withGFCs plus unit-specific adjustments (i.e., the dollar amount

Recognized Adjustmentsidentified by the generator for an adjustment that is readily

recognizable as an appropriate adjustment), minus the unit

specific net revenues.

Unit Specific Net GFCs with allGFCs plus all unit-specific adjustments identified by the

Adjustmentsgenerator, minus the unit specific net revenues.

The NYISO estimated net Energy and Ancillary Services revenues for the units in the

four classes over the analysis period. Net revenues were equal to estimated Energy revenues

plus Ancillary Services revenues minus estimated production costs. A minimum value of zero

was used for net revenues; that is, if production cost exceeded Energy and Ancillary Services

revenues, a value of zero was used for the net revenue figure. Unit-specific net revenues were

Page 23

calculated for 19 generating units in the four classes listed above. Two of the 19 units had

negative net revenue estimates. The net revenues were averaged across the units in each class; the class average net revenues are included in Attachment I-D.

The NYISO implemented the following several enhancements to the net revenue methodology the NYISO used in the December 2010 Report:

• Hourly fuel costs were calculated based on meter data using hourly fuel prices.

• For generators that could burn one or more fuels, hourly data from the EPA Continuous

Emissions Modeling System (CEMS) were used to identify which fuel(s) were burned

and in what proportion. These hourly fuel types or mixes were used as the cost basis for

the hourly fuel cost calculation.

• The startup costs were calculated based on how long the generator had been offline, using

meter data and the generator’s startup cost reference curve.

• Incremental energy above the minimum generation amount was assigned a cost based on

a weighted average heat rate calculated from the generator’s energy reference curve.

GFCs with full net revenues were calculated for use as a proxy for net going forward costs with certainty of net revenues. Annual going forward costs minus full net revenues for the November 2010 to October 2011 period varied from $0.69/kW-year for Class A to $21.64/kW-year for Class H. Summer values ranged from $0.07/kW-month to $2.40/kW-month, and Winter values ranged from $0.04/kW-month to $1.20/kW-month.

GFCs with half net revenues was calculated for use as a proxy for net going forward costs

with some uncertainty. Annual going forward costs minus half net revenues for the November

2010 to October 2011 period vary from $2.37/kW-year for Class A to $26.12/kW-year for Class

H. Summer values range from $0.25/kW-month to $2.90/kW-month. Winter values range from $0.12/kW-month to $1.45/kW-month.

GFCs with no net revenues were calculated for use as a proxy for net going forward costs without certainty of net revenues. Annual going forward costs with no net revenues for the

November 2010 to October 2011 period vary from $13.05/kW-year for Class G to $43.28/kW-

year for Class H. Summer values range from $1.45/kW-month to $4.80/kW-month. Winter values range from $0.73/kW-month to $2.41/kW-month.

Table 6 below shows the amount of unsold capacity by month for which class average

Net GFCs were calculated and the amount of unsold capacity for which class average Net GFCs

Page 24

were not calculated (i.e., generators within classes with less than 15 MW of unsold capacity in

each month). The total unsold capacity values in the second column are for the entire NYCA;

they are equal to the monthly sums of unsold capacity across all three locations in Table 1. The

unsold capacity used in the maximum price impact calculation in Table 4 is based on the ROS

location only.

Table 6. Unsold MW Used for GFC Calculations

Total Unsold MW forTotal Unsold MW for

Totalwhich class averagewhich class average

UnsoldGFCs calculatedGFCs not calculated

MonthMW(Unsold MW > 15)(Unsold MW < 15)

Nov-101401.9703.3698.6

Dec-101301.71242.659.1

Jan-11487.9487.90.0

Feb-11389.0389.00.0

Mar-111029.3903.0126.3

Apr-111422.71278.1144.6

May-11141.4141.40.0

Jun-11262.3262.30.0

Jul-11922.6888.334.3

Aug-11871.8617.2254.6

Sep-11512.1485.526.6

Oct-11658.3545.9112.4

iii. Unsold Capacity Impact Analysis

As part of the analysis of unsold capacity, the NYISO contacts generator owners for unit-

specific information if a generator’s offer for unsold capacity exceeded the class average “GFCs

with half net revenues” for the class to which the generator was assigned. The values of these

GFCs are shown in Attachment I-D. Of the 19 generators for which class average GFCs were

calculated, six generators had offers that exceeded the class average GFCs with half net

revenues. The NYISO calculated unit-specific GFCs for these six units, which were owned by

two Market Participants. As part of this process, the NYISO provided the generation owners the

class average avoidable costs and gave them the opportunity to provide information regarding

adjustments to the class average values to reflect their unit-specific avoidable costs. Both of the

generation owners provided qualitative explanations for their offering behavior but declined to

provide quantitative information. In one case, the Market Participant stated that it does not

analyze GFCs for its auction activity, and that its offering behavior was more related to short-

term costs and risks associated with bidding into the Day Ahead Market. The other Market

Page 25

Participant did not provide quantitative adjustments stating that its units’ net revenues would have likely exceeded the avoidable costs, such that the resulting GFC calculation would have been about the same. Section II of Confidential Attachment I-F includes more detailed

information regarding the explanations of unsold capacity for the two Market Participants that offered above GFCs with half net revenues.

After collecting unit-specific GFC information, the NYISO performed ICAP Spot Market

Auction simulations for a more detailed understanding of how the non-zero price offers may

have affected Market Clearing Prices. Because the two generators that were contacted did not

have quantitative adjustments to the NYISO’s class average GFC calculations, the NYISO did

not analyze any scenarios with adjustments to GFCs.21 Therefore, the NYISO simulated auction

outcomes under three scenarios: GFCs with full net revenues, GFCs with half net revenues, and

GFCs with no net revenues. These scenarios are labeled scenarios 1, 2, and 3 in Table 7.

The NYISO performed the simulations by replacing offers that originally did not clear with the unit-specific GFC at varying levels of net revenues in each of the three scenarios. For the other thirteen generators from whom the NYISO did not request information regarding GFC adjustments, the NYISO utilized GFC values reflecting class average avoidable costs. It is

important to note that offers were only replaced with the GFC value if the offer was not awarded

any MW. If the offer was marginal and only cleared a portion of its MW, or if the offer was

inframarginal, the specific offers at the original offer prices were used. The offers that were

analyzed for purposes of the simulations are provided in Attachment I-A.22

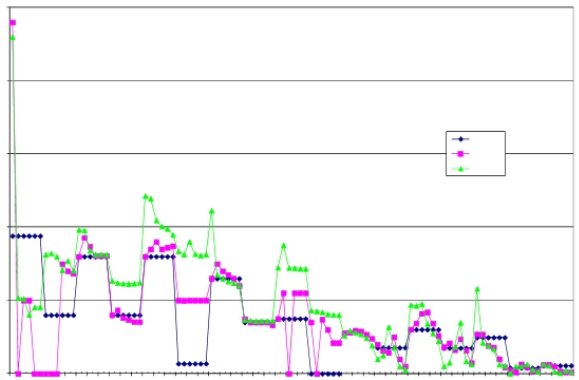

Table 7 shows the results of the auction simulations in each of the three scenarios, for each month of the analysis period. Column B shows the original NYCA ICAP Spot Market

Auction prices. Columns C, D, and E show the simulated NYCA price under each of the three

scenarios. Columns F, G, and H show the price reduction relative to the original clearing price.

The simulation price deltas relative to the original clearing prices are strictly zero or negative.

This results from the simulation methodology stated in the previous paragraph: only offers that

entirely did not clear were replaced with GFCs. The amount of the price reduction shown in the

21 In the January 2010 Report, for the Market Participants that had submitted GFC adjustments, the NYISO calculated GFCs in three manners: disregarding all adjustments, including some recognized adjustments, and including all adjustments.

22 The unmasked unsold capacity offers are provided in Confidential Attachment I-F.

Page 26

simulations is strictly decreasing as less revenues are recognized in the GFC calculations. That outcome is consistent with what would be expected.

Table 7. Price Impact Analysis Results

ABCDEFGH

Original

MonthMCPS1S2S3S1 deltaS2 deltaS3 delta

Nov-100.010.010.010.010.000.000.00

Dec-100.500.250.280.28(0.25)(0.22)(0.22)

Jan-110.500.250.350.35(0.25)(0.15)(0.15)

Feb-110.650.500.640.64(0.15)(0.01)(0.01)

Mar-110.300.150.150.15(0.15)(0.15)(0.15)

Apr-110.150.010.050.05(0.14)(0.10)(0.10)

May-110.650.650.650.650.000.000.00

Jun-110.550.300.300.30(0.25)(0.25)(0.25)

Jul-110.150.010.050.05(0.14)(0.10)(0.10)

Aug-110.050.020.050.05(0.03)0.000.00

Sep-110.180.100.100.10(0.08)(0.08)(0.08)

Oct-110.130.080.090.09(0.05)(0.04)(0.04)

S1: GFCs with full net revenues

S2: GFCs with half net revenues

S3: GFCs with no net revenues

iv. Conclusions

The results of the simulations shown in Table 7 indicate that the NYCA ICAP Spot

Market Auction prices would have potentially been lower if the offers that entirely did not clear

were offered at the GFC values. In all three scenarios, the price reductions ranged from

$0.00/kW-month to $0.25/kW-month. For the first scenario in which unsold offers were

replaced with GFCs with full net revenues, the price reduction was $0.12/kW-month on average.

The second scenario with GFCs with half net revenues had an average reduction of $0.09/kW-

month, and the third scenario with GFCs with no net revenues also had an average reduction of

$0.09/kW-month.

While these potential price reductions represent a large percentage of the original Spot

Market Auction clearing price, the reductions are a relatively small total dollar amount. As

noted earlier, the simulations were performed by replacing only offers that entirely did not clear

with GFCs, which is why the simulated prices all were lower than the original auction prices. If

all offers were replaced with GFCs, it would be possible for the simulated prices to exceed the

original prices. The unsold capacity analysis is based upon a considerably larger amount of

Page 27

unsold capacity than that historically observed. However, the associated low potential price impacts do not indicate that economic withholding occurred.

The analysis shows that the estimated Going Forward Costs did not indicate that

significant economic withholding occurred over the analysis period. During this period, the

NYCA ICAP Spot Market Auctions cleared well below the estimated Going Forward Costs for the majority of the ROS generators with unsold capacity, which indicates the absence of

significant economic withholding in the ROS region.

A similar conclusion can be drawn regarding the MW amounts of unoffered and unsold capacity. Although there was a historically large amount of unoffered and unsold capacity

shown in Tables 3 and 4, the associated maximum price impact was relatively low. This result is attributable to the fact that the existing UCAP levels consistently exceeded the NYCA zero

crossing point throughout November 2010 through October 2011.

Page 28

Attachment I-A. Unsold Capacity Offers (Masked)

Page 29

AUCTIONAUCTIONLOCATIONOFFEROFFERPTIDAWARDEDMARKET

TYPEMONTHDESCRIPTIONCAPACITYPRICENAMECAPACITYCLEARING PRICEUNSOLD

Spot11/1/2010ROS389.00.01Unit61383.10.015.897

Spot11/1/2010ROS313.10.01Unit62308.40.014.746

Spot11/1/2010ROS388.70.01Unit63382.80.015.892

Spot11/1/2010ROS100.00.01Unit6098.50.011.516

Spot11/1/2010ROS79.20.01Unit9478.00.011.201

Spot11/1/2010ROS39.00.01Unit8338.40.010.591

Spot11/1/2010ROS386.20.01Unit68380.30.015.855

Spot11/1/2010ROS57.60.01Unit6956.70.010.873

Spot11/1/2010ROS672.20.01Unit7662.00.0110.190

Spot11/1/2010ROS3.10.01Unit563.10.010.047

Spot11/1/2010ROS8.10.01Unit578.00.010.123

Spot11/1/2010ROS0.20.01Unit550.20.010.003

Spot11/1/2010ROS408.30.01Unit4402.10.016.190

Spot11/1/2010ROS31.80.01Unit2031.30.010.482

Spot11/1/2010ROS0.30.01Unit160.30.010.004

Spot11/1/2010ROS52.70.01Unit12351.90.010.799

Spot11/1/2010ROS265.00.01Unit84261.00.014.017

Spot11/1/2010ROS104.50.01Unit85102.90.011.584

Spot11/1/2010ROS33.50.01Unit9233.00.010.508

Spot11/1/2010ROS1.10.01Unit331.10.010.017

Spot11/1/2010ROS142.50.01Unit24140.30.012.160

Spot11/1/2010ROS40.70.01Unit2540.10.010.617

Spot11/1/2010ROS5.10.01Unit265.00.010.077

Spot11/1/2010ROS59.60.01Unit2758.70.010.903

Spot11/1/2010ROS53.60.01Unit2852.80.010.812

Spot11/1/2010ROS24.90.01Unit2924.50.010.377

Spot11/1/2010ROS15.00.01Unit3014.80.010.227

Spot11/1/2010ROS47.00.01Unit3146.30.010.712

Spot11/1/2010ROS1.90.01Unit321.90.010.029

Spot11/1/2010ROS2.10.01Unit342.10.010.032

Spot11/1/2010ROS13.00.01Unit3512.80.010.197

Spot11/1/2010ROS13.90.01Unit3613.70.010.211

Spot11/1/2010ROS0.10.01Unit370.10.010.002

Spot11/1/2010ROS4.70.01Unit384.60.010.071

Spot11/1/2010ROS6.40.01Unit396.30.010.097

Spot11/1/2010ROS4.60.01Unit404.50.010.070

Spot11/1/2010ROS22.20.01Unit4121.90.010.336

Spot11/1/2010ROS4.00.01Unit1183.90.010.061

Spot11/1/2010ROS0.10.01Unit1050.10.010.002

Spot11/1/2010ROS0.20.01Unit1080.20.010.003

Spot11/1/2010ROS0.10.01Unit960.10.010.002

Spot11/1/2010ROS0.10.01Unit1010.10.010.002

Spot11/1/2010ROS0.20.01Unit1000.20.010.003

Spot11/1/2010ROS0.20.01Unit1140.20.010.003

Spot11/1/2010ROS0.30.01Unit1100.30.010.004

Spot11/1/2010ROS0.70.01Unit1070.70.010.011

Spot11/1/2010ROS0.10.01Unit970.10.010.002

Spot11/1/2010ROS0.10.01Unit1120.10.010.002

Spot11/1/2010ROS0.50.01Unit1160.50.010.007

Spot11/1/2010ROS0.10.01Unit950.10.010.002

Spot11/1/2010ROS0.30.01Unit1150.30.010.004

Spot11/1/2010ROS0.20.01Unit1130.20.010.003

Spot11/1/2010ROS0.20.01Unit1040.20.010.003

Spot11/1/2010ROS0.10.01Unit1170.10.010.002

Spot11/1/2010ROS0.10.01Unit980.10.010.002

Spot11/1/2010ROS1.00.01Unit1061.00.010.015

Spot11/1/2010ROS0.10.01Unit990.10.010.002

Spot11/1/2010ROS0.30.01Unit1090.30.010.004

Spot11/1/2010ROS0.20.01Unit1020.20.010.003

Spot11/1/2010ROS0.20.01Unit1110.20.010.003

Spot11/1/2010ROS0.60.01Unit1030.60.010.009

AUCTIONAUCTIONLOCATIONOFFEROFFERPTIDAWARDEDMARKET

TYPEMONTHDESCRIPTIONCAPACITYPRICENAMECAPACITYCLEARING PRICEUNSOLD

Spot11/1/2010ROS2.00.01Unit 1222.00.010.030

Spot11/1/2010ROS1.60.01Unit 1211.60.010.024

Spot11/1/2010ROS1.50.01Unit 21.50.010.023

Spot11/1/2010ROS0.30.01Unit 10.30.010.004

Spot11/1/2010ROS0.10.01Unit 30.10.010.002

Spot11/1/2010ROS39.00.05Unit 930.00.0139.000

Spot11/1/2010ROS62.40.05Unit 50.00.0162.400

Spot11/1/2010ROS34.60.05Unit 420.00.0134.600

Spot11/1/2010ROS2.30.05Unit 1200.00.012.300

Spot11/1/2010ROS100.00.05Unit 430.00.01100.000

Spot11/1/2010ROS81.70.07Unit 60.00.0181.700

Spot11/1/2010ROS2.10.1Unit 450.00.012.100

Spot11/1/2010ROS35.80.1Unit 880.00.0135.800

Spot11/1/2010ROS38.90.1Unit 900.00.0138.900

Spot11/1/2010ROS20.10.1Unit 230.00.0120.100

Spot11/1/2010ROS60.50.1Unit 910.00.0160.500

Spot11/1/2010ROS63.20.1Unit 1190.00.0163.200

Spot11/1/2010ROS10.80.1Unit 580.00.0110.800

Spot11/1/2010ROS23.80.1Unit 470.00.0123.800

Spot11/1/2010ROS34.50.1Unit 480.00.0134.500

Spot11/1/2010ROS13.60.1Unit 500.00.0113.600

Spot11/1/2010ROS20.30.1Unit 490.00.0120.300

Spot11/1/2010ROS0.30.1Unit 750.00.010.300

Spot11/1/2010ROS0.90.1Unit 760.00.010.900

Spot11/1/2010ROS0.50.1Unit 170.00.010.500

Spot11/1/2010ROS100.00.1Unit 440.00.01100.000

Spot11/1/2010ROS100.00.15Unit 430.00.01100.000

Spot11/1/2010ROS100.00.2Unit 440.00.01100.000

Spot11/1/2010ROS10.10.25Unit 590.00.0110.100

Spot11/1/2010ROS107.80.25Unit 430.00.01107.800

Spot11/1/2010ROS162.20.26Unit 440.00.01162.200

Spot11/1/2010ROS0.20.3Unit 710.00.010.200

Spot11/1/2010ROS85.00.5Unit 770.00.0185.000

Spot11/1/2010ROS10.00.6Unit 790.00.0110.000

11/1/2010 Total5,127.03,748.71,378.302

Spot12/1/2010ROS388.70.5Unit 63164.20.5224.5

Spot12/1/2010ROS85.00.5Unit 7735.90.549.1

Spot12/1/2010ROS50.00.5Unit 8021.10.528.9

Spot12/1/2010ROS38.70.55Unit 800.00.538.7

Spot12/1/2010ROS11.30.55Unit 810.00.511.3

Spot12/1/2010ROS10.00.6Unit 790.00.510.0

Spot12/1/2010ROS50.00.6Unit 810.00.550.0

Spot12/1/2010ROS50.00.65Unit 810.00.550.0

Spot12/1/2010ROS50.00.7Unit 810.00.550.0

Spot12/1/2010ROS50.00.75Unit 810.00.550.0

Spot12/1/2010ROS69.50.85Unit 810.00.569.5

Spot12/1/2010ROS30.50.85Unit 820.00.530.5

Spot12/1/2010ROS389.00.93Unit 610.00.5389.0

Spot12/1/2010ROS100.00.95Unit 820.00.5100.0

Spot12/1/2010ROS100.01.15Unit 820.00.5100.0

Spot12/1/2010ROS50.31.3Unit 820.00.550.3

12/1/2010 Total1,523.0221.31,301.7

Spot1/1/2011ROS3.30.5Unit 41.70.51.6

Spot1/1/2011ROS201.80.5Unit 63104.50.597.3

Spot1/1/2011ROS389.00.93Unit 610.00.5389.0

1/1/2011 Total594.1106.2487.9

Spot2/1/2011ROS389.00.93Unit 610.00.65389.0

2/1/2011 Total389.00.0389.0

AUCTIONAUCTIONLOCATIONOFFEROFFERPTIDAWARDEDMARKET

TYPEMONTHDESCRIPTIONCAPACITYPRICENAMECAPACITYCLEARING PRICEUNSOLD

Spot3/1/2011ROS10.00.3Unit 794.80.35.2

Spot3/1/2011ROS389.00.3Unit 61187.80.3201.2

Spot3/1/2011ROS0.60.33Unit 140.00.30.6

Spot3/1/2011ROS0.40.33Unit 120.00.30.4

Spot3/1/2011ROS4.60.33Unit 80.00.34.6

Spot3/1/2011ROS0.10.33Unit 150.00.30.1

Spot3/1/2011ROS0.30.33Unit 90.00.30.3

Spot3/1/2011ROS0.80.33Unit 100.00.30.8

Spot3/1/2011ROS0.60.33Unit 130.00.30.6

Spot3/1/2011ROS0.70.33Unit 110.00.30.7

Spot3/1/2011ROS388.70.5Unit 630.00.3388.7

Spot3/1/2011ROS110.40.5Unit 770.00.3110.4

Spot3/1/2011ROS313.10.93Unit 620.00.3313.1

3/1/2011 Total1,219.3192.61,026.7

Spot4/1/2011ROS19.50.15Unit 789.10.1510.4

Spot4/1/2011ROS388.80.15Unit 43180.60.15208.2

Spot4/1/2011ROS362.20.15Unit 44168.20.15194.0

Spot4/1/2011ROS10.10.25Unit 590.00.1510.1

Spot4/1/2011ROS164.00.3Unit 610.00.15164.0

Spot4/1/2011ROS10.00.3Unit 790.00.1510.0

Spot4/1/2011ROS0.20.3Unit 710.00.150.2

Spot4/1/2011ROS0.40.3Unit 700.00.150.4

Spot4/1/2011ROS4.90.33Unit 80.00.154.9

Spot4/1/2011ROS0.30.33Unit 90.00.150.3

Spot4/1/2011ROS0.80.33Unit 100.00.150.8

Spot4/1/2011ROS0.90.33Unit 110.00.150.9

Spot4/1/2011ROS0.40.33Unit 120.00.150.4

Spot4/1/2011ROS0.60.33Unit 130.00.150.6

Spot4/1/2011ROS0.60.33Unit 140.00.150.6

Spot4/1/2011ROS0.10.33Unit 150.00.150.1

Spot4/1/2011ROS388.70.5Unit 630.00.15388.7

Spot4/1/2011ROS110.40.5Unit 770.00.15110.4

Spot4/1/2011ROS313.10.93Unit 620.00.15313.1

4/1/2011 Total1,776.0357.91,418.1

Spot5/1/2011ROS168.20.65Unit 7475.10.3793.1

Spot5/1/2011ROS48.30.93Unit 620.00.3748.3

5/1/2011 Total216.575.1141.4

Spot6/1/2011ROS262.30.93Unit 620.00.55262.3

6/1/2011 Total262.30.0262.3

Spot7/1/2011ROS5.10.15Unit 732.10.153.0

Spot7/1/2011ROS5.10.15Unit 742.10.153.0

Spot7/1/2011ROS50.00.15Unit 420.60.1529.4

Spot7/1/2011ROS23.10.15Unit 229.50.1513.6

Spot7/1/2011ROS100.00.15Unit 4341.20.1558.8

Spot7/1/2011ROS50.00.18Unit 430.00.1550.0

Spot7/1/2011ROS50.00.2Unit 40.00.1550.0

Spot7/1/2011ROS42.30.2Unit 430.00.1542.3

Spot7/1/2011ROS50.00.25Unit 40.00.1550.0

Spot7/1/2011ROS7.60.25Unit 590.00.157.6

Spot7/1/2011ROS82.20.3Unit 40.00.1582.2

Spot7/1/2011ROS0.20.4Unit 710.00.150.2

Spot7/1/2011ROS0.30.4Unit 700.00.150.3

Spot7/1/2011ROS13.00.5Unit 770.00.1513.0

Spot7/1/2011ROS236.20.5Unit 630.00.15236.2

Spot7/1/2011ROS19.50.6Unit 790.00.1519.5

Spot7/1/2011ROS262.30.93Unit 620.00.15262.3

AUCTIONAUCTIONLOCATIONOFFEROFFERPTIDAWARDEDMARKET

TYPEMONTHDESCRIPTIONCAPACITYPRICENAMECAPACITYCLEARING PRICEUNSOLD

7/1/2011 Total996.975.6921.3

Spot8/1/2011ROS35.20.05Unit 4219.90.0515.3

Spot8/1/2011ROS3.00.05Unit 751.70.051.3

Spot8/1/2011ROS0.90.05Unit 760.50.050.4

Spot8/1/2011ROS34.50.05Unit 619.50.0515.0

Spot8/1/2011ROS14.30.05Unit 498.10.056.2

Spot8/1/2011ROS14.00.05Unit 507.90.056.1

Spot8/1/2011ROS1.40.1Unit 450.00.051.4

Spot8/1/2011ROS3.20.1Unit 720.00.053.2

Spot8/1/2011ROS15.60.1Unit 870.00.0515.6

Spot8/1/2011ROS4.90.1Unit 860.00.054.9

Spot8/1/2011ROS4.70.1Unit 660.00.054.7

Spot8/1/2011ROS5.10.1Unit 670.00.055.1

Spot8/1/2011ROS3.80.1Unit 520.00.053.8

Spot8/1/2011ROS4.80.1Unit 510.00.054.8

Spot8/1/2011ROS4.50.1Unit 530.00.054.5

Spot8/1/2011ROS4.30.1Unit 540.00.054.3

Spot8/1/2011ROS48.30.1Unit 180.00.0548.3

Spot8/1/2011ROS50.80.13Unit 190.00.0550.8

Spot8/1/2011ROS6.40.15Unit 200.00.056.4

Spot8/1/2011ROS0.30.15Unit 700.00.050.3

Spot8/1/2011ROS0.20.15Unit 710.00.050.2

Spot8/1/2011ROS14.50.17Unit 210.00.0514.5

Spot8/1/2011ROS100.00.18Unit 440.00.05100.0

Spot8/1/2011ROS100.00.2Unit 440.00.05100.0

Spot8/1/2011ROS7.60.25Unit 590.00.057.6

Spot8/1/2011ROS50.00.25Unit 440.00.0550.0

Spot8/1/2011ROS100.00.28Unit 430.00.05100.0

Spot8/1/2011ROS19.50.3Unit 790.00.0519.5

Spot8/1/2011ROS39.70.3Unit 430.00.0539.7

Spot8/1/2011ROS50.00.35Unit 440.00.0550.0

Spot8/1/2011ROS25.00.4Unit 440.00.0525.0

Spot8/1/2011ROS24.90.5Unit 440.00.0524.9

Spot8/1/2011ROS110.30.5Unit 770.00.05110.3

8/1/2011 Total901.757.6844.1

Spot9/1/2011ROS0.30.2Unit 700.00.180.3

Spot9/1/2011ROS0.20.2Unit 710.00.180.2

Spot9/1/2011ROS13.30.2Unit 230.00.1813.3

Spot9/1/2011ROS69.90.2Unit 440.00.1869.9

Spot9/1/2011ROS7.60.25Unit 590.00.187.6

Spot9/1/2011ROS100.20.5Unit 610.00.18100.2

Spot9/1/2011ROS307.80.93Unit 630.00.18307.8

9/1/2011 Total499.30.0499.3

Spot10/1/2011ROS53.00.13Unit 4324.00.1329.0

Spot10/1/2011ROS25.80.15Unit 190.00.1325.8

Spot10/1/2011ROS36.00.16Unit 440.00.1336.0

Spot10/1/2011ROS298.50.2Unit 630.00.13298.5

Spot10/1/2011ROS13.30.2Unit 230.00.1313.3

Spot10/1/2011ROS0.20.2Unit 710.00.130.2

Spot10/1/2011ROS0.30.2Unit 700.00.130.3

Spot10/1/2011ROS7.60.25Unit 590.00.137.6

Spot10/1/2011ROS85.00.5Unit 770.00.1385.0

10/1/2011 Total519.724.0495.7

Attachment I-B. Existing Generating Facilities

Page 34

2011 Capability Year

EXISTING GENERATING FACILITIES AS OF OCTOBER 2010

Owner,NameSUM20112010

LocationFuel

REF.Operator,In-ServicePlateCRISCapabilityCo-Net

NO.and / orDateRatingCap (A)(Megawatts)GenUnitFCTypeTypeTypeEnergy

Billing OrganizationStation UnitZonePTIDTownCntyStYYYY-MM-DD(MW)(MW)SummerWinterY/NTypeTS123(GWh)CF

1064Athens Generating Company, LPAthens 1F23668Athens039362004-05-01441.0316.6310.9395.5CCNG2,243.372.5%

1065Athens Generating Company, LPAthens 2F23670Athens039362004-05-01441.0315.6309.3390.9CCNG1,827.759.6%

1066Athens Generating Company, LPAthens 3F23677Athens039362004-05-01441.0312.8311.1396.1CCNG2,037.165.8%

1659PSEG Energy Resource & Trade, LLCBethlehem GS1F323560Bethlehem001362005-07-01297.7252.3246.6282.4CCNGFO21,409.160.8%

1660PSEG Energy Resource & Trade, LLCBethlehem GS2F323561Bethlehem001362005-07-01297.7252.3246.6282.4CCNGFO21,409.160.8%

1661PSEG Energy Resource & Trade, LLCBethlehem GS3F323562Bethlehem001362005-07-01297.7252.3246.6282.4CCNGFO21,409.160.8%

Class A Averages2004-11-303692842793381,72363.8%

1647NRG Power Marketing LLCOswego 5C23606Oswego075361976-02-01901.8850.3822.0844.5NSTWAFO631.90.4%

1648NRG Power Marketing LLCOswego 6C23613Oswego075361980-07-01901.8835.2826.0843.0NSTWAFO632.80.4%

1335International Paper CompanyTiconderogaF23804Ticonderoga031361970-01-0142.17.69.810.2YSTFO60.10.1%

1119Dynegy Power Marketing, Inc.Danskammer 1G23586Newburgh071361951-12-0172.067.066.565.7NSTTAFO6NGFO23.00.5%

1120Dynegy Power Marketing, Inc.Danskammer 2G23589Newburgh071361954-09-0173.562.761.763.7NSTTAFO6NGFO24.30.8%

1126Dynegy Power Marketing, Inc.Roseton 1G23587Newburgh071361974-12-01621.0614.8609.7626.0NSTTAFO6NGFO2204.63.8%

1127Dynegy Power Marketing, Inc.Roseton 2G23588Newburgh071361974-09-01621.0605.7602.5605.0NSTTAFO6NGFO2159.03.0%

Class F Averages1968-12-18462435428437621.6%

1421Mirant Energy Trading, LLCBowline 1G23526West Haverstraw087361972-09-01621.0577.7578.3558.0NSTTANGFO6180.43.6%

1422Mirant Energy Trading, LLCBowline 2G23595West Haverstraw087361974-05-01621.0557.4529.1561.8NSTWANGFO6112.62.4%

Class G Averages1973-07-016215685545601463.0%