Ms. Kimberly D. Bose, Secretary

January 4, 2011

Page 1

Dear Ms. Bose:

In compliance with Paragraph 53 of the Commission’s June 30 2009 order (“June 2009 Order”) in Docket Nos. ER04-449-018 and -019,[1] and the October 4, 2010 Notice of Extension of Time[2] in those proceedings, the New York Independent System Operator, Inc. (“NYISO”) and the New York Transmission Owners (“NYTOs”)[3] respectfully submit this compliance filing. The purpose of this filing is to obtain the Commission’s approval of criteria (referred to herein collectively as “Criteria”, and individually as “Criterion”), and related analytical “Considerations” that would govern the evaluation and potential creation of new Installed Capacity (“ICAP” or “Capacity”)[4] zones in the New York Control Area (“NYCA”). The Criteria and Considerations are described in Section IV. They are the product of an extensive stakeholder process, reflect substantial stakeholder input (including from the NYTOs) and the NYISO’s independent expertise, and input to the NYISO from the NYISO’s independent Market Monitoring Unit (“MMU”). The independent MMU has raised substantial concerns regarding the proposed Criteria and Considerations, which are set forth in Subsection IV.A.4 below.

As is noted in Section IV below, certain details, including the manner in which the proposed Criteria would interact with each other, are still being developed through the NYISO stakeholder process. While awaiting Commission review of this filing, the NYISO intends to continue working through the stakeholder process to further refine and develop details regarding the Criteria and Considerations, and seek stakeholder approval for the process by which the criteria would be applied, the considerations would be evaluated, and a new Capacity zone proposed to the Commission.[5] If requested by the Commission, the NYISO could file a status report on its progress sixty days after the date of the Commission’s order. Section VI provides a general description of the tariff revisions that the NYISO expects would be necessary. It would be appropriate to propose to the Commission certain tariff revisions prior to identifying a new Capacity zone; however, the necessary revisions to other tariff provisions could not practicably be made before the identity of a specific new Capacity zone was known with certainty.

Section V presents a timetable for NYISO effectuation of the Criteria and, if appropriate, the evaluation of the Considerations. The timetable is intended to be an example of the manner in which the application of the Criteria and Considerations may interact, both with each other and with other related NYISO processes, so that they can be more readily understood. The NYISO has been discussing with stakeholders potential tariff revisions to effectuate an implementation process.

1. This compliance filing letter.

Copies of correspondence concerning this filing should be served on:

For the NYISO:

Robert E. Fernandez, General Counsel *Gloria Kavanah, Senior Attorney Raymond Stalter, Director of Regulatory Affairs New York Independent System Operator, Inc. 10 Krey Boulevard Rensselaer, NY 12144 Tel: (518) 356-6000 Fax: (518) 356-4702 rfernandez@nyiso.com gkavanah@nyiso.com rstalter@nyiso.com

For the NYTOs, as set forth on Attachment A.

| *Ted J. Murphy Vanessa A. Colón Hunton & Williams LLP 1900 K Street, NW Suite 1200 Washington, DC 20006-1109 Tel: (202) 955-1500 Fax: (202) 778-2201 tmurphy@hunton.com vcolon@hunton.com |

III. BACKGROUND AND STAKEHOLDER PROCESS

Since the inception of the NYISO-administered ICAP markets there have been separate locational Capacity zones for New York City (Zone J) and Long Island (Zone K). The NYCA Capacity zone is defined as the Rest-of-State Capacity zone, and Zones J and K. The potential economic and reliability merits of creating one or more additional Capacity zones has been discussed in the NYISO stakeholder process for a number of years. In a joint filing submitted in October of 2007, the Filing Parties submitted a Consensus Deliverability Plan. Paragraph 19 of the Consensus Deliverability Plan states that “[t]he NYISO staff and market participants will work collaboratively to develop … criteria for the formation of additional locational ICAP zones.”[6] In the June 2009 Order the Commission directed a filing to establish Criteria to govern the potential creation of such zones. Specifically, the NYISO was directed to:

[M]ake a filing … that satisfies paragraph 19 of the Consensus Deliverability Plan. Such a filing should address the implications and effects of a new capacity zone or zones on the tariff provisions and market rules governing Capacity Resource Interconnection Service.[7]

In addition to this compliance obligation, the independent MMU has urged the NYISO to move towards the establishment of a new Capacity zone.

The NYISO has worked with its stakeholders to develop new Capacity zone Criteria in a total of eleven Interconnection Issues Task Force meetings and Installed Capacity Working Group (“ICAP Working Group”) meetings beginning in 2009. The NYISO also has had other meetings with stakeholders outside of the working group process. In addition, it has received written comments from stakeholders regarding the Criteria and Considerations, as well as related issues, including specific comments in response to NYISO proposals presented at ICAP Working Group meetings.

The NYISO’s proposals evolved significantly as they were developed through the stakeholder process, culminating in the proposed Criteria and Considerations. This filing and the Criteria and Considerations incorporate a substantial amount of stakeholder input (including that of the NYTOs). The NYISO has also consulted with the MMU throughout the development of the Criteria and Considerations.

As described herein, the NYISO intends to continue to work with its stakeholders to develop the details of the Criteria and Considerations and their evaluation, and to propose tariff revisions for a process to create a new Capacity zone based on the Criteria and Considerations described herein. Additional discussions will only improve the quality of the final procedures for the consideration of new Capacity zones. The NYISO believes that this continued stakeholder discussion is necessary to better inform the design of software modifications needed to accommodate a new Capacity zone, a process that is expected to take at least two years.

IV. OVERVIEW OF PROPOSED CRITERIA AND CONSIDERATIONS

The following sections describe the analytical stages through which the NYISO would progress, concurrent with receiving stakeholder input, when evaluating the potential creation of new Capacity zones.[1] The first step would be the NYISO’s analysis of the two “threshold” Criteria described in Section IV.A to identify a Load Zone or group of Load Zones that might warrant classification as a new Capacity zone. The threshold criteria are intended to provide a relatively streamlined initial “pass/fail” test. As Section IV.C explains, the relationship between the two proposed Criteria continues to be the subject of stakeholder discussions. The identification of a Load Zone[2] would constitute a finding that the Load Zone warranted further evaluation as a potential new Capacity zone.

If a Load Zone is identified under the proposed Criteria, the NYISO would proceed to a more rigorous analysis of the Considerations as described in Section IV.B. That analysis would result in a determination of whether a new Capacity zone should be established. If it was determined that a new Capacity zone was warranted, the parameters for the zone would be established during that same process. Any new Capacity zone ultimately would need to be proposed to the Commission along with requisite new and revised tariff provisions. Section IV.C explains that the NYISO proposes to retain an independent consultant (“Consultant”) to conduct an analysis and prepare recommendations, with input from stakeholders to inform the NYISO’s own analysis and recommendations, and that of the stakeholders.

Importantly, the proposed Criteria and Considerations would only evaluate, and thus could only result in the creation of, a new Capacity zone with the same boundaries as one or more of the eleven existing NYCA Load Zones.[3] Partitioning the existing Load Zones for purposes of developing a new Capacity zone would not be practicable or desirable due to the linkages between the various Capacity and Energy market obligations of Installed Capacity Suppliers. Adhering to existing Load Zone boundaries would also be consistent with current practice since the existing New York City and Long Island locational Capacity zones correspond to existing Load Zones “J” and “K” respectively.

A. The Proposed “Threshold” Criteria

1.The “Highway Capacity Deliverability” Criterion

The NYISO currently performs an annual test as part of its “Class Year” interconnection analysis to ascertain whether sufficient inter-zonal transfer capability (“Tie Capacity Margin”) exists at all of its “Highway” interfaces. This test incorporates a number of defined assumptions including existing and new generation, and peak load forecast.[4] Under the proposed “Highway Capacity Deliverability Test,” the NYISO would evaluate whether the available Tie Capacity Margin on each Highway Interface was at least equal to the size (in MW) of the NYCA “new entrant” peaking unit used to formulate the then-effective Demand Curve.[5] Whether there was room on the Highway would be analyzed as if the system were in an equilibrium state, i.e., at the level where the MW of Installed Capacity was equal to the NYCA Minimum Installed Capacity Requirement, without reference to the actual conditions existing at the time that the test was conducted.[6]

The Highway Capacity Deliverability Test would be conducted once every three years, in conjunction with the established process for updating the ICAP Demand Curves. If the results of this test were to indicate that one or more Load Zones would not be deliverable at equilibrium with the addition of the amount of MW of the peaking unit in the Load Zone, then the “threshold” criterion would be considered to have been met. However, if the MW of the peaking unit were deliverable under these conditions, this criterion would be deemed to have not been met.

The Highway Capacity Deliverability Test would examine the system “as designed” based upon established reliability criteria. It would represent Load and Capacity conditions exactly matching the minimum NYCA reliability criterion (a Loss of Load Expectation of 1 day in ten years). The NYISO believes that the deliverability test at equilibrium is a more meaningful test of whether the system would benefit from the creation of a new Capacity zone. Analyses conducted by the NYISO indicate that if sufficient Tie Capacity Margin is not available at equilibrium, it is reasonable to assume that the lack of Tie Capacity Margin would be exacerbated at higher levels of Capacity excess outside the zone, and potentially mitigated by higher levels of Capacity inside the zone. Further, testing at the then-current level of Capacity during a time of Capacity excess could result in a “false-positive”. For example, testing with excess might indicate the need to conduct a further analysis to establish a new Capacity zone; however, the need would not exist if levels of excess were reduced due to retirements or changes in load growth forecasts.[7]

Certain details must be finalized before the Highway Capacity Deliverability Test can be translated into implementable tariff language. The NYISO intends to vet these details in the stakeholder process in an effort to resolve or narrow different positions. Open issues include whether “equilibrium” should be set by modeling specific anticipated generator retirements, removal of generic MW of generation, or an increase to Load. In any event, the core features of the Highway Capacity Deliverability Test have emerged with sufficient clarity for the Commission to issue an order approving them, subject to final review of the proposed tariff revisions that would be submitted later.

2.The “Reliability” Criterion

Another threshold test would be a “Reliability Criterion” designed to focus on the reliability of the transmission network. Under it, the NYISO would analyze, for each potential new Capacity zone, whether the absence of the largest generator, coupled with an N-1-1 loss of transmission into or generation in the proposed zone would create a resource deficiency condition (i.e., imports and generation less than peak load). The Reliability Criterion would complement the Highway Capacity Deliverability Test. The NYISO would perform the analysis under base case conditions (i.e., ‘as found’) and various credible reliability risk scenarios, as well as potential mitigating factors. The N-1-1 test represents a prudent planning practice and is consistent with NERC reliability criteria.

The NYISO would perform this analysis once every three years, on the schedule described in Section V. As is the case with the Highway Capacity Deliverability Test, work remains to be done, and the NYISO will work with stakeholders on the implementation details for this criterion.

3.The Relationship Between the Proposed Criteria

The NYISO will continue to work with its stakeholders to refine the elements of the tests associated with each Criterion and regarding the relationship between the two threshold Criteria. Based on NYISO's preliminary review, it would be more appropriate to require both the Highway Capacity Deliverability Test and Reliability Criteria, provided credible reliability risk scenarios are incorporated in the Reliability Criterion. A key objective of the ongoing work will be to avoid having rules that result in “false negatives” and to thus maximize the likelihood that the analysis results in the identification of new Capacity zones when warranted. Implementation procedures crafted after further dialogue would result in a more thorough analyses, and in the creation of new Capacity zones, only when warranted.

4.Independent MMU Position

The NYISO’s independent MMU has raised substantial concerns regarding the proposed criteria. The independent MMU continues in its recommendation in the 2008 and 2009 State of the Market reports that the OATT Attachment S Deliverability test applied to proposed new resources in the Class Year process should be the sole basis for determining whether a new zone is necessary. The MMU has advised that a binding constraint under the NYISO’s Attachment S Deliverability test for the Capacity market is analogous to a binding transmission constraint in the Energy market. Hence, just as a transmission constraint binding in the Energy market causes locational energy prices to diverge across the constraint, a determination that new Capacity is not deliverable in the Capacity market should cause Capacity prices to diverge across the binding interface. This cannot happen unless new Capacity zones are defined when the Attachment S Deliverability test indicates that new Capacity is no longer deliverable between areas in the NYISO market. Therefore, the MMU objects to the proposed Criteria because they are not consistent with the current OATT Attachment S Deliverability test, and to the process proposed in this filing that requires additional analysis and review by the NYISO stakeholders. The MMU plans to file an intervention to explain its position in more detail.

B. Additional Analytical Considerations

Once a potential new Capacity zone has been identified using the proposed Criteria, a more detailed analysis of the reliability and economics of the proposed new Capacity zone or zones would be conducted. As part of this effort, the NYISO would select an independent consultant (“Consultant”) to perform specific studies and assessments focusing on and including the Considerations discussed below, to determine whether, in the opinion of the Consultant, a new Capacity zone (or zones) should be created for that Load Zone or group of Load Zones.

1. Net Cost of New Entry Differences

The analysis would consider the differences in the net cost of new entry in each of the adjacent zone(s) or the nested zone in which entry would occur Where reasonably practicable, this comparison would consider the same technology of the units in each zone. Where that is not reasonably practicable, the analysis would assume the use of substantially similar technologies.

A central element to the creation of a new Capacity zone is the development of a preliminary demand curve (“Indicative Demand Curve”). The net cost of new entry is an important element in establishing an Indicative Demand Curve. A curve would be indicative of expected Capacity prices within a potential new Capacity zone, but the Indicative Demand Curve would not necessarily be the same as the actual Demand Curve developed as part of the NYISO’s triennial Demand Curve reset process.[8] Indicative Demand Curves would be an important component of the analysis of price impacts, and prices in comparison to the three existing Capacity zones. As part of developing the parameters for a candidate new Capacity zone’s Indicative Demand Curve, the NYISO would perform a series of Multi-Area Reliability Simulation (“MARS”) runs to examine the locational Capacity requirement for the potential new Capacity zone. As is shown below in Section V, there will be interaction between the indicative parameter results and the Installed Reserve Margin and Locational Reserve Margin studies that are performed annually.

The net cost of new entry would be determined along with the Indicative Demand Curves for each potential new Capacity zone. A net cost of new entry for a particular potential zone that is substantially lower than any adjacent zone examined, or another zone in which the candidate zone is nested, would militate against creating a new Capacity zone. In that situation, price signals from a new Capacity zone would not provide any stronger signal for new entry over the currently existing Capacity zone Demand Curves.

After developing the parameters of the Indicative Demand Curve for a potential new Capacity zone, the NYISO would calculate the Capacity price impacts attributable to the new Capacity zone’s creation in order to gauge potential impacts on consumers. This analysis would consider scenarios with and without the creation of the new Capacity zone using publicly-available forecast data. Further, the NYISO would utilize the then-approved Demand Curve parameters and examine the sensitivities of various parameters of the Indicative Demand Curve in order to ascertain the price impacts. Price changes based on different scenarios would likely be presented in a manner similar to the NYISO’s annual Demand Curves report.[9]

Some stakeholders are interested in quantifying the price impacts of a potential new Capacity zone’s Demand Curve. Stakeholders could use the results of the unbiased scenario analyses with and without the Indicative Demand Curves, and under various sensitivity conditions, to develop their own specific impact scenarios.

3.Market Power

The new Capacity zone analysis would also consider buyer and seller market concentration, including whether one or more Installed Capacity Suppliers would be a Pivotal Supplier in the candidate new Capacity zone and, if necessary, identify market power mitigation measures. If mitigation measures were warranted, however, the NYISO would develop and propose them concurrent with the proposal to introduce a new Capacity zone. This information should be available to the NYISO staff, the NYISO Board of Directors, the independent Market Monitoring Unit, stakeholders, and the Commission when considering a potential new Capacity zone. Because each potential new Capacity zone could present unique issues, which may not be identified or fully understood until after a full analysis of the candidate new Capacity zone was complete, no specific proposed market power parameters or measures are included in this filing. They would instead be developed on case-by-case basis after the evaluation of the potential exercise of market power in each potential new Capacity zone was completed.

C. Implementation of the Proposed Criteria and Considerations

The NYISO intends to propose in its stakeholder governance process tariff provisions for the process to create a new Capacity zone. It is anticipated that the NYISO would conduct the tests to examine the Criteria. If the results of the tests trigger the assessment of the Considerations, the NYISO proposes that it would retain a Consultant to analyze the Considerations. The NYISO would also consult with and obtain input from its independent Market Monitoring Unit and the New York State Reliability Council (“NYSRC”).

If the NYISO were to conclude, based on the input of the Consultant, the independent MMU, the NYSRC and its stakeholders, that a new Capacity zone was appropriate, the NYISO would develop draft tariff revisions for stakeholder and MMU review. Thereafter, the Consultant and the NYISO would prepare and issue final reports, the NYISO would finalize its proposed tariff revisions and, ultimately, submit the revisions to the Commission.

V.PROPOSED IMPLEMENTATION TIMETABLE

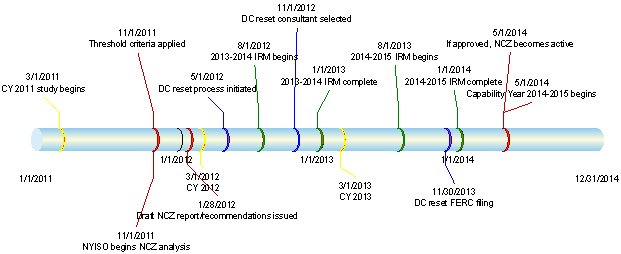

To better understand the proposed Criteria and Considerations, and how they would be utilized, it is helpful to visualize how they would fit within the NYISO’s existing Class Year Interconnection Facilities Study process and triennial Demand Curve reset process, as well as the NYSRC’s procedure for setting the Installed Reserve Margin, and the NYISO’s process for establishing the Locational Minimum Installed Capacity Requirement for the existing New York and Long Island locational Capacity zones. These existing processes inform each other and would all interact with a new Capacity zone creation mechanism. All of these relationships are depicted in the timeline embedded below. The timeline would permit the implementation of a new Capacity zone on May 1, 2014, the same time that the next set of demand curves would become effective.

The timeline is also useful for understanding the implications of various outcomes of the separate Class Year Deliverability Study,[10] and their interaction with the evaluation of the Criteria and Considerations, as described below. As demonstrated by the timeline, it is important to consider how the proposed timing of applying new Capacity zone Criteria and Considerations, consulting with stakeholders, and completing necessary analyses would impact projects within the Class Year that will next and concurrently be evaluated under existing OATT provisions.[11]

If a proposed project within the current Class Year were to reject its System Deliverability Upgrade (“SDU”) cost allocation, the proposed project could enter the next Class Year (“CYn+1”), which would be considered in parallel with the new Capacity zone analysis. Alternatively, assuming the culmination of the new Capacity zone analysis is the proposal to the Commission of a specific new Capacity zone, the project could enter any later Class Year after the Commission rules on the proposed new Capacity zone.[12] If the project were to enter the next Class Year, the developer would know whether the Commission had accepted the proposed new Capacity zone by the time that it must accept or reject SDU costs (i.e., a Commission decision would be issued in July, whereas the Initial Decision Period would begin in November), but the new Capacity zone would not be reflected in CYn+1.

If a proposed project accepts its SDU cost allocation, receives CRIS, and the total posted security is less than 60% of the SDU estimated cost, the SDU will not be modeled in the next ATBA case until at least 60% of the SDU estimated costs are accepted. The proposed project, under Attachment S, has the ability to enter future Class Year deliverability studies, which may result in a lower or no SDU cost allocation. A new Capacity zone could eliminate the need for the SDU (on which the cost allocation was based), provided the 60% threshold for construction of the SDU has not been reached.

Finally, if a proposed project accepts its SDU cost allocation, receives CRIS, and the total posted security is greater than or equal to 60% of the SDU estimated cost, the SDU would be modeled in the next ATBA case. The existence of the constructed SDU should then be recognized in the then-ongoing new Capacity zone analysis process. Possible outcomes of the Highway Deliverability test include a determination that a new Capacity zone is not needed because of SDU construction.

The new Capacity zone evaluation process would best be conducted every three years before the triennial Demand Curve reset process. The proposed timeline provides for the potential identification by the Consultant and the NYISO of a candidate new Capacity zone, and ultimately for its acceptance by the Commission to occur one year ahead of the Demand Curve reset.

Before the first new Capacity zone can be implemented, modifications to the NYISO’s Automated Market System (AMS) used to conduct the Capability Period, monthly and ICAP Spot Market Auctions would need to be designed, developed, tested and deployed. The current software design has hard-coded the three existing Capacity zones (J, K, and NYCA). Existing screens and reports all are based on these embedded Capacity zone definitions. Rules for Pivotal Supplier and buyer-side mitigation are specific to Zone J (i.e., New York City) in the current software. The software would need to be modified to give the NYISO the ability to effectuate mitigation measures in future Capacity zones if necessary. It is expected that the software efforts will require a minimum of two years of effort.

VI.OVERVIEW OF ANTICIPATED FUTURE TARIFF REVISIONS

The June 2009 Order directed the NYISO to make a compliance filing that addressed the issues associated with the potential creation of new Capacity zones, including “the implications and effects of a new Capacity zone or zones on the tariff provisions and market rules governing Capacity Resource Interconnection Service [‘CRIS’].” In compliance with this directive, the NYISO has analyzed its CRIS tariff provisions, and also has identified other existing provisions of its Services Tariff and OATT that potentially will require modification if a new Capacity zone is created.[13] The NYISO has determined, and informed its stakeholders, that relatively few of the tariff provisions required to implement a new Capacity zone could be properly revised without knowing the identity of the new Capacity zone and, even more importantly, whether that zone might be “nested” with others.

A preliminary list of provisions that would appear to be implicated is set forth below. As was noted above, some of these revisions could be articulated in generically applicable tariff language proposed absent a specific candidate new Capacity zone. Others could only be made after a specific new Capacity zone was identified as being warranted pursuant to the application of the Criteria and Considerations

A.Services Tariff: Definitions

Several defined terms in the definition sections of the Services Tariff that refer to, address, or define concepts related to zones may be affected and may require modification if a new Capacity zone were established. These include:

2.13 - Market-Clearing Price

2.21 - Unforced Capacity Deliverability Rights

B.Services Tariff: ICAP Market Sections

Several provisions regarding the Installed Capacity market would need to be evaluated and may require modification if a new Capacity zone is added. These include the following:

Section 5.11.4 - LSE Locational Minimum Installed Capacity Requirements: The addition of a new Capacity zone may require an examination of the calculation of the Locational Minimum Installed Capacity requirement, particularly if the new Capacity zone is a nested zone (i.e., a zone that includes one or more other Capacity zones).

Section 5.14.1.2 - Demand Curve and Adjustments: This section provides the points for the ICAP Demand Curves and would need to be updated to add Demand Curve points for the new Capacity zone.

Section 5.14.3.2 - Installed Capacity Rebates: This section would need to be modified to add provisions for rebates where an Unforced Capacity Shortfall occurs in the new Capacity zone.

Modifications to OATT Attachment S may be required, as the addition of a new Capacity zone could require modifications to the deliverability test applied to the determination of CRIS rights. The following sections would need to be reexamined and possibly modified:

Section 25.12 - Definitions: Certain definitions would need to be updated to reflect the addition of the new Capacity zone. Specifically the term:

- “Capacity Region” explicitly mentions Rest of State, Long Island, and New York City zones and would need to be updated to also refer to the new Capacity zone.

- “External CRIS Rights” may need to be redefined if the addition of a new Capacity zone results in the modification of certain tariff provisions.

- “Highways” identifies specific interfaces (e.g., UPNY-Con Ed) as Highways and thus the definition could be impacted by creation of new Capacity zone.

- Other Interfaces refers to Capacity zones J and K and may need to be updated to refer to the new Capacity zone.

Section 25.3.1 - Scope & Purpose of Deliverability Interconnection Standard: This section contains provisions on general eligibility, related to deliverability, for becoming a qualified ICAP Supplier or receiving UDRs. A new Capacity zone may require the reevaluation of eligibility criteria

Section 25.7.1 - Cost Allocation Among Developers in a Class Year: This section contains provisions on cost sharing for System Deliverability Upgrades. These provisions must be evaluated to determine if modifications are needed if a new Capacity zone is added. There is sensitive relationship between a Developer’s acceptance of an SDU cost allocation and the establishment of a new Capacity zone, as demonstrated by the examples in Section V, above.

Section 25.7.2 - Categories of Transmission Facilities: This section may need to be updated as creating a new Capacity zone could add to the list of Other Interfaces subject to the Deliverability Test Methodology for Other Interfaces.

Section 25.7.3 - New York Capacity Regions: This section lists the three current Capacity zones and how deliverability is applied to those zones, and would need to be modified to reflect the creation of a new Capacity zone.

Section 25.7.4 - Participation in Capacity Markets: This section establishes that a Developer must elect CRIS and satisfy requirements to be an Installed Capacity Supplier or get UDRs. The creation of a new Capacity zone could require the reevaluation of these provisions.

Section 25.7.8 - Deliverability Test Methodology for Highways and Byways: This section will need to be reviewed to determine if the mechanics of the Deliverability test, including the assumptions, need to be revised if a new Capacity zone is created. Subsections 25.7.8.2.9 (regarding the adjustment of external system imports) and 28.7.8.2.14 (regarding Rest of State Highway Interfaces) may also need to be revised if a new Capacity zone is added.

Section 25.7.9 - Deliverability Test Methodology for Other Interfaces: This section needs to be reviewed to determine if test would be appropriate for additional Other Interfaces that may be added due to the creation of a new Capacity zone.

Section 25.7.11 - External CRIS Rights: The defined term “External Interface” might be modified by the creation of a new Capacity zone and, if the definition was modified, this section may need to be revised. Subsections 25.7.11.1.4.2 (regarding the Class Year Deliverability Study) and 25.7.11.1.4.2.2 (regarding factoring in import rights) will need to be evaluated.

Section 25.9.2 - No Developer Responsibility for Future Upgrades: Once a Developer posts security for SDU costs, the Developer has no responsibility for additional for the cost of additional SDUs (with limited exception). Implications for this section will need to be considered.

Section 25.9.3.1 - Retaining CRIS Status: It is unknown whether or what effects the creation of a new Capacity zone may have on CRIS rights, so this section should be reviewed in relation to the creation of specific zone.

OATT Attachment X definitions would have to be modified consistent with any modifications to the definitions in Attachment S, as discussed above.

VII.SERVICE

The NYISO will send an electronic link to this filing to the official representative of each of its customers, to each participant on its stakeholder committees, to the New York Public Service Commission, and to the electric utility regulatory agency of New Jersey. In addition, the complete filing will be posted on the NYISO’s website at www.nyiso.com.

VIII.CONCLUSION

For the reasons set forth above, the NYISO and the NYTOs respectfully request that the Commission approve the proposed Criteria and Considerations that are described above. In sum, the NYISO and its stakeholders have identified two threshold Criteria (Highway Capacity Deliverability, and Reliability) that would be used to identify a possible need for a new Capacity zone, and trigger a requirement to further evaluate the zone. Once a candidate zone has been identified, there are three Considerations (net cost of new entry, consumer impact, and market mitigation) that will be evaluated through a detailed series of analyses by the NYISO and its selected Consultant. The timeline set forth in Section V shows that it critical to integrate the identification of new Capacity zones with the timeline of existing processes, such as the Demand Curve reset, the NYSRC’s Installed Reserve Margin determination, and the Class Year SDU cost analyses. There are a number of details associated with the specific test assumptions associated with the proposed Criteria that would benefit from further vetting with stakeholders. The current Capacity market auction software will need significant revision to accommodate the addition of any new Capacity zones. Several sections of the Services Tariff and OATT will need to be revised to accommodate the general process for creating new Capacity zones. The NYISO intends to propose tariff revisions for the new Capacity zone process in its normal stakeholder governance process. If a new Capacity zone is determined to be warranted, additional revisions to the Services Tariff and the OATT in respect of the specific new Capacity zone will be necessary.

/s/ Gloria Kavanah

Gloria Kavanah, Esq.

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144

Email: gkavanah@nyiso.com

Paul L. Gioia Dewey & LeBoeuf LLP One Commerce Plaza 99 Washington Avenue Suite 2020 Albany, NY 12210-2820 Email: pgioia@dl.com | /s/ Elias G. Farrah by GK Elias G. Farrah Nina H. Jenkins-Johnston Dewey & LeBoeuf LLP 1101 New York Avenue, N.W. Washington, DC 20005-4213 Email: efarrah@dl.com njjohnston@dl.com Counsel to the New York Transmission Owners

|

/s/ John Borchert by GK John Borchert Manager of Electric Engineering Services Central Hudson Gas & Electric Corporation 284 South Avenue Poughkeepsie, NY 12601 Email: jborchert@cenhud.com

| /s/ Neil H. Butterklee by GK Consolidated Edison Company of New York, Inc. Orange and Rockland Utilities, Inc. Neil H. Butterklee, Esq. Assistant General Counsel Consolidated Edison Co. of New York, Inc. 4 Irving Place, Room 1815-s New York, NY 10003 Email: butterkleen@coned.com

|

/s/ David Yaffe by GK David P. Yaffe, Esq. Van Ness Feldman, P.C. 1050 Thomas Jefferson Street, N.W. 7th Floor Washington, DC 20007 Email: dpy@vnf.com Counsel to the Long Island Power Authority

David Clarke Long Island Power Authority Alfred E. Smith Building 80 South Swan Street 6th Floor Albany, NY 12210 Phone: (518) 482-4715 Cell: (516) 313-8295

| /s/ Andrew Neuman by GK New York Power Authority Andrew Neuman, Esq. New York Power Authority 123 Main Street White Plains, NY 10601-3170 Email: andrew.neuman@nypa.gov

|

/s/ Catherine P. McCarthy by GK New York State Electric & Gas Corporation Rochester Gas and Electric Corporation Catherine P. McCarthy, Esq. Dewey & LeBoeuf LLP 1101 New York Avenue, N.W. Washington, DC 20005-4213 Email: catherine.mccarthy@dl.com

R. Scott Mahoney, Esq. New York State Electric & Gas Corporation Rochester Gas and Electric Corporation Durham Hall, 52 Farm View Drive New Gloucester, ME 04260 Email: scott.mahoney@energyeast.com

| /s/ Roxane E. Maywalt by GK Niagara Mohawk Power Corporation d/b/a/ National Grid Roxane E. Maywalt, Esq. National Grid USA Service Company, Inc. 40 Sylvan Road Email: roxane.maywalt@us.ngrid.com

|

cc:Michael A. Bardee

ATTACHMENT A

Nina H. Jenkins-Johnston

Dewey & LeBoeuf LLP

1101 New York Avenue, N.W.

Washington, DC 20005-4213

Email:njjohnston@dl.com

Central Hudson Gas & Electric Corporation

John Borchert

Manager of Electric Engineering Services

Central Hudson Gas & Electric Corporation

284 South Avenue

Poughkeepsie, NY 12601

Email: jborchert@cenhud.com

Consolidated Edison Company of New York, Inc. and

Orange and Rockland Utilities, Inc.

Neil H. Butterklee, Esq.

Assistant General Counsel

Consolidated Edison Co. of New York, Inc.

4 Irving Place

Room 1815-s

New York, NY 10003

Email: butterkleen@coned.com

Stuart Nachmias

Vice President, Energy Policy & Regulatory Affairs

Consolidated Edison Co. of New York, Inc.

4 Irving Place

Room 2315-s

New York, NY 10003

Email: nachmiass@coned.com

Long Island Power Authority

David P. Yaffe, Esq.

Van Ness Feldman, P.C.

1050 Thomas Jefferson Street, N.W.

7th Floor

Washington, DC 20007

Email: dpy@vnf.com

David Clarke

Alfred E. Smith Building

80 South Swan Street

6th Floor

Albany, NY 12210

Phone: (518) 482-4715

Cell: (516) 313-8295

New York Power Authority

New York Power Authority

Andrew Neuman, Esq.

New York Power Authority

123 Main Street

White Plains, NY 10601-3170

Email: andrew.neuman@nypa.gov

William Palazzo, Director, Market Issues Group

New York Power Authority

123 Main Street

White Plains, NY 10601-3170

Email: william.palazzo@nypa.gov

New York State Electric & Gas Corporation

Catherine P. McCarthy, Esq.

Dewey & LeBoeuf LLP

1101 New York Avenue, N.W.

Washington, DC 20005-4213

Email: catherine.mccarthy@dl.com

R. Scott Mahoney, Esq.

New York State Electric & Gas Corporation

Rochester Gas and Electric Corporation

Durham Hall, 52 Farm View Drive

New Gloucester, ME 04260

Email: scott.mahoney@energyeast.com

Niagara Mohawk Power Corporation d/b/a National Grid

Roxane E. Maywalt, Esq.

National Grid USA Service Company, Inc.

40 Sylvan Road

Waltham, MA 02451-1120

Email: roxane.maywalt@us.ngrid.com

Bart Franey

Director of Federal Regulation

Niagara Mohawk Power Corporation d/b/a National Grid

300 Erie Boulevard West

Syracuse, NY 13202

Email: bart.franey@us.ngrid.com

Rochester Gas and Electric Corporation

Catherine P. McCarthy, Esq.

Dewey & LeBoeuf LLP

1101 New York Avenue, N.W.

Washington, DC 20005-4213

Email: catherine.mccarthy@dl.com

R. Scott Mahoney, Esq.

New York State Electric & Gas Corporation

Rochester Gas and Electric Corporation

Durham Hall, 52 Farm View Drive

New Gloucester, ME 04260

Email: scott.mahoney@energyeast.com