10 Krey Boulevard Rensselaer, NY 12144

December 14, 2016

By Electronic Delivery

Honorable Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, NE

Washington, DC 20426

Re: New York Independent System Operator, Inc., Docket No. ER17-___-000; Proposed Amendments to the NYISO Market Administration and Control Area Services Tariff to Modify the NYISO’s Fixed Block Unit Pricing Logic

Dear Secretary Bose:

The New York Independent System Operator, Inc., (“NYISO”) hereby proposes revisions to its Market Administration and Control Area Services Tariff (“Services Tariff”) to improve the pricing logic used for Fixed Block Unit1 natural gas-fired turbine Generators (“GTs”) in the NYISO’s RealTime Dispatch (“RTD”) software. The NYISO’s existing Fixed Block Unit pricing logic,

implemented in 2001, produced justifiable results at the time it was implemented, but as system

conditions have changed and technological capability has improved, the existing pricing logic has

become outdated and it may produce economically inefficient prices under the NYISO’s current

system configuration and commitment and dispatch rules.

As explained further below, the NYISO proposes to revise its Services Tariff to allow Fixed Block Units to be eligible to set price in all intervals in which they are dispatched. This will improve the current pricing logic and provide more economically efficient pricing outcomes for New York’s wholesale Energy and Ancillary Service markets.

In accordance with Section 205 of the Federal Power Act2 and Part 35 of the Federal Energy

Regulatory Commission’s (“Commission”) regulations,3 the NYISO submits these proposed

amendments to its Services Tariff. These proposed tariff amendments were approved by the NYISO’s

Management Committee with three abstentions on September 28, 2016. The NYISO is requesting a

flexible effective date no earlier than February 15, 2017.4 The NYISO proposes to submit to the

1 Capitalized terms not otherwise defined herein shall have the meaning specified in Section 1 of the NYISO’s Open Access Transmission Tariff (“OATT”) and Section 2 of the Services Tariff. The term Fixed Block Unit is also defined in Section II of this filing letter.

2 16 U.S.C. § 824d (2010).

3 18 C.F.R. § 35 et seq. (2015).

4 The Commission should not view the request for a flexible effective date of no earlier than February 15, 2017 as a waiver of the NYISO’s right to change rates after sixty days’ notice to the Commission and the public. 16 U.S.C. § 824(d).

Honorable Kimberly D. Bose December 14, 2016

Page 2

Commission, and to provide to its stakeholders, the actual effective date by submitting a compliance filing at least two weeks before the effective date. The NYISO respectfully requests Commission action within 60 days of this filing letter.

I.Documents Submitted

The NYISO respectfully submits the following documents with this filing letter:

1.A clean version of the proposed revisions to the NYISO’s Services Tariff (“Attachment

I”);

2.A blacklined version of the proposed revisions to the NYISO’s Services Tariff

(“Attachment II”); and

3.An Affidavit from Pallas LeeVanSchaick of Potomac Economics, the NYISO’s Market

Monitoring Unit (“Attachment III”).

II.Overview

Included in the fleet of Generators that serve the New York Control Area (“NYCA”) are

natural gas-fired GTs that can only be dispatched in one of two states: either turned completely off, or

turned completely on (and operating at their maximum capacity). These units are known as Fixed

Block Units. The majority of Fixed Block Units also have a minimum run-time that must be satisfied

before the unit can be shut down. Although Fixed Block Units are less flexible than certain other

Generators in the NYCA, they provide a crucial reliability function because they can be committed and

dispatched on short notice (typically ten to thirty minutes), and can be located in targeted areas near

load centers.

In 2001 the NYISO implemented Tariff language and related software upgrades to address the

pricing impacts of Fixed Block Units.5 Under the currently effective Tariff language, Fixed Block

Units are only eligible to set the Locational Based Marginal Price (“LBMP”) under a specific set of

conditions.6 The current price-setting eligibility logic included in the NYISO’s Real-Time Dispatch

(“RTD”) consists of a multi-step process. In the first pricing step, the RTD software models all GTs as

being flexible between zero MW and the Resource’s Upper Operating Limit (“UOL”),7 and then

determines which Resources are economic to serve Load. In the second pricing step, GTs that were

not economic in the first pricing step, and that have not yet achieved their minimum run-time, are

included as block-loaded must run Resources scheduled at their respective UOL. The second pricing

step establishes the Energy, Regulation Service and Operating Reserves prices that are used for real-

time settlement. The block-loaded must run GTs that were not needed in the first pricing step are not

5 New York Indep. Sys. Operator, Inc., 95 FERC ¶ 61,121 (2001).

6 New York Indep. Sys. Operator, Inc., Aug. 25, 2000 Request for Partial Rehearing, Docket No. ER00-3038-002, et al., at

11; New York Indep. Sys. Operator, Inc., May 7, 2001 Compliance Filing Containing Tariff Sheets in Order to Implement

the Hybrid Fixed Price Pricing Rule Approved by the Commission on Apr. 26, 2001, Docket No. ER00-3038-004, et al.

7 In this submittal, no distinction is necessary or made between a Resource’s UOLN (normal) and UOLE (emergency). The applicable UOL will be the Resource’s UOL as directed by NYISO Operations at the time.

Honorable Kimberly D. Bose December 14, 2016

Page 3

permitted to set price in the second pricing step and may reduce prices because they supplant the most expensive suppliers that were needed in the first pricing step. This concern can be exacerbated when multiple GTs are running and have not met their minimum run-time constraints.

In its 2015 State of the Markets Report, the NYISO’s Market Monitoring Unit (“MMU”),

Potomac Economics, recommended that the NYISO revise its rules to allow all Fixed Block Units to

set price at all times. The MMU is concerned that the LBMPs produced under the current pricing rules

may not accurately capture the cost of marginal Resources that were scheduled to supply load and

manage congestion. The NYISO agrees with the MMU’s concern. The tariff revisions proposed

herein will provide better price transparency and appropriate investment signals, and will better align

RTD with the manner in which Fixed Block Units are modeled in the NYISO’s Day-Ahead Market

(“DAM”) Security Constrained Unit Commitment (“SCUC”) software and in the NYISO’s Real-Time

Commitment (“RTC”) software.

III.Proposed Tariff Revisions, Analysis, and Justification

The NYISO’s proposal includes substantive tariff revisions to Attachment B of the

Services Tariff (Section 17), as well as certain ministerial revisions to Services Tariff Section 4, Rate Schedule 4 (Section 15.4), and Section 17. In Sections 4, 15.4, and 17 the NYISO proposes minor edits necessary to account for the substantive revisions to Attachment B, and to update

certain cross-references.

A. Substantive Revisions to Improve Real-Time Fixed Block Unit Pricing Logic

The NYISO’s proposed revisions to Services Tariff Section 17 will improve the pricing logic used for Fixed Block Units that are within their minimum run-time and not economic. Real-Time

LBMPs are calculated and produced by the RTD software consistent with the provisions of Services

Tariff Section 17.1. Real-Time LBMPs are determined based on real-time system marginal costs and incorporate the incremental dispatch costs of Resources that would be scheduled to meet the next

increment of Load. Real-Time LBMPs may also incorporate (i) the cost of procuring Regulation

Service or Operating Reserves; or (ii) shortage costs associated with the NYISO’s inability to meet a Regulation Service or Operating Reserves requirement (as set forth in the applicable demand curves set forth in Rate Schedules 3 and 4 of the Services Tariff).8

RTD “runs” are initiated every five minutes to produce prices and schedules over a roughly

sixty-minute optimization period.9 RTD produces binding prices and schedules for the first five

8 Under the NYISO’s offline GT pricing logic, when RTD commits and dispatches offline Resources that are capable of

starting in ten minutes (e.g., the GTs discussed in this filing), RTD includes the incremental dispatch cost of each Resource

in addition to a start-up cost (based on the Resource’s Start-Up Bid) for the purposes of calculating Real-Time LBMPs.

RTD also assumes that each such Resource has a zero downward response rate; that is, RTD assumes the Resource cannot

be backed down after meeting the need in the initial interval(s) in which it was committed and dispatched. The proposed

revisions to the current RTD pricing logic for Fixed Block Units do not modify the current offline GT pricing logic.

9 The RTD optimization horizon is 55 to 65 minutes, depending on the interval. RTD will co-optimize to solve

simultaneously for Load, Operating Reserves, and Regulation Service with the objective of minimizing total production cost over the optimization horizon.

Honorable Kimberly D. Bose December 14, 2016

Page 4

minute interval and produces advisory prices and schedules for the remaining time intervals.10 Each

RTD run currently consists of three passes that are used to dispatch Resources and calculate prices:

• The first RTD pass (the “First Pass”) establishes physical base points (i.e., real-time Energy

schedules) as well as real-time Regulation Service and Operating Reserves Schedules for the

first (binding) interval, and advisory base points and schedules for the remaining intervals.11

• The second RTD pass (the “Second Pass”)12 currently establishes a least bid cost, multi-period,

co-optimized supply curve for Energy, Regulation Service and Operating Reserves. The

Second Pass treats (i) all Fixed Block Units that are committed by the NYISO’s RTC software,

(ii) all Resources that meet Minimum Generation Levels and are capable of starting in ten

minutes but that have not been committed by RTC (i.e., offline GTs), and (iii) all units

otherwise instructed to be or remain online by the NYISO, as “flexible.” By treating these

Resources as “flexible,” RTD assumes that, regardless of actual operating constraints, the

Resource can be dispatched anywhere between zero MW and its UOL. This assumption is

made regardless of whether the Resource has a minimum run-time physical operating

constraint.13 The schedules for Energy, Regulation Service, and Operating Reserves

established in the Second Pass are not used to physically dispatch Resources; the Second Pass

establishes “hybrid base points” that are at the heart of the revisions proposed herein. Hybrid

base points established by the Second Pass are currently used in the third RTD pass (the “Third

Pass”) to determine whether minimum run-time constrained Fixed Block Units should be

blocked on (and ineligible to set price) or dispatched flexibly (and permitted to set price).14

Under the existing logic, a Fixed Block Unit that (i) was committed by RTC, (ii) had a physical

base point established by the First Pass of RTD, and (iii) that was within its minimum run-time,

would not be awarded a schedule or given a base point in the Second Pass if that Fixed Block

Unit was not determined to be economic to serve Load in the Second Pass. Such Resources

receive special treatment in the Third Pass.

• The current Third Pass15 differs from the Second Pass in three ways: (i) it treats Fixed Block

Units that were committed by RTC (or otherwise instructed to be or remain online by the

NYISO), that received a non-zero base point in the First Pass, but that were not determined to

be economic in the Second Pass, as blocked on at their applicable UOL for purposes of price-

setting (i.e., ineligible to set price); (ii) it produces pricing base points instead of hybrid base

10 In addition to producing a binding schedule for the next five minutes, each Real-Time Dispatch run will produce advisory

schedules for the remaining four time steps of its bid-optimization horizon. For more information about the timeline for

RTD, please see section 6.1 of the NYISO’s Transmission and Dispatching Operations Manual at the following link:

www.nyiso.com/public/webdocs/markets_operations/documents/Manuals_and_Guides/Manuals/Operations/trans_disp.pdf.

11 Services Tariff § 17.1.2.1.2.1.

12 Described as the “first pricing step” in the Overview section of this filing letter.

13 In the Second Pass, a Resource that has a minimum run-time physical operating constraint will be evaluated as if that

physical operating constraint did not exist. Therefore, a Resource with a 2 hour minimum run-time that has been online for

1 hour and that will remain online and generating for at least one additional hour may receive a RTD base point and schedule of zero.

14 Services Tariff § 17.1.2.1.2.2.

15 Described as the “second pricing step” in the Overview section of this filing letter.

Honorable Kimberly D. Bose December 14, 2016

Page 5

points; and (iii) it calculates real-time Energy prices and real-time Shadow Prices for

Regulation Service and Operating Reserves that the NYISO uses for real-time settlement

purposes.16 The Third Pass ensures that Fixed Block Units that are inside their minimum runtime (so they cannot be shut down yet), but that are not economic to serve Load at their Bid price, are not considered marginal for price setting purposes.

As described above, including non-economic Fixed Block Units as blocked on when prices are

determined in the Third Pass results in prices that may not reflect the cost of the marginal Resources

scheduled to satisfy load and manage congestion. In this filing, the NYISO proposes to revise the

RTD logic to provide better price formation and to improve the real-time alignment of prices and

schedules for Fixed Block Units. The NYISO proposes to eliminate the step of calculating “hybrid

base points” in the Second Pass, and instead to calculate real-time Energy prices and real-time Shadow

Prices for Regulation Service and Operating Reserves that the NYISO will use for settlements in the

Second Pass. The change to the logic of the Second Pass effectively eliminates the need to run the

Third Pass. To implement this proposal the NYISO proposes the following revisions to Services Tariff

Sections 17.1.2.1.2.2 and 17.1.2.1.2.3:

17.1.2.1.2.2 The Second Pass

The second RTD pass consists of a least bid cost, multi-period, co-

optimized dispatch for Energy, Regulation Service and Operating

Reserves that treats all Fixed Block Units that are committed by RTC, all

Resources meeting Minimum Generation Levels and capable of starting in

ten minutes that have not been committed by RTC and all units otherwise

instructed to be online or remain online by the ISO, as flexible (i.e., able to

be dispatched anywhere between zero (0) MW and their UOLN or UOLE,

whichever is applicable), regardless of their minimum run-time status.

This pass shall establish “hybrid base points” (i.e., real-time Energy

schedules) that are used in the third pass to determine whether minimum

run-time constrained Fixed Block Units should be blocked on at their

UOLN or UOLE, whichever is applicable, or dispatched flexibly. The

second pass calculates real-time Energy prices and real-time Shadow

Prices for Regulation Service and Operating Reserves that the ISO shall

use for settlement purposes pursuant to Article 4, Rate Schedule 15.3, and

Rate Schedule 15.4 of this ISO Services Tariff respectively. The ISO will

not use schedules for Energy, Regulation Service and Operating Reserves

established in the second pass to dispatch Resources.

17.1.2.1.2.3 The Third Pass

The third RTD pass is the same as the second pass with three variations.

First, the third pass treats Fixed Block Units that are committed by RTC,

or are otherwise instructed to be online or remain online by the ISO that

received a non-zero physical base point in the first pass, and that received

a hybrid base point of zero in the second pass, as blocked on at their

16 Services Tariff § 17.1.2.1.2.3.

Honorable Kimberly D. Bose December 14, 2016

Page 6

UOLN or UOLE, whichever is applicable. Second, the third pass

produces “pricing base points” instead of hybrid base points. Third, and

finally, the third pass calculates real-time Energy prices and real-time

Shadow Prices for Regulation Service and Operating Reserves that the

ISO shall use for settlement purposes pursuant to Article 4, Rate Schedule

15.3, and Rate Schedule 15.4 of this ISO Services Tariff respectively. The ISO shall not use schedules for Energy, Regulation Service and Operating Reserves that are established in the third pass to dispatch Resources reserved for future use.

By removing the price setting eligibility criteria that omitted some Fixed Block Units and including those Units in the supply curve based on their respective Bid prices, the proposed tariff revisions will improve real-time price formation. The improvements will also provide appropriate incentives for efficient long term investment decisions by better aligning LBMPs with the cost a Fixed Block Unit incurs to operate and serve load.

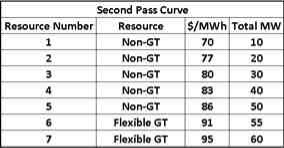

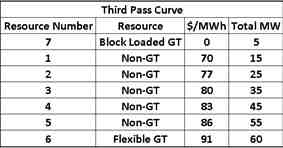

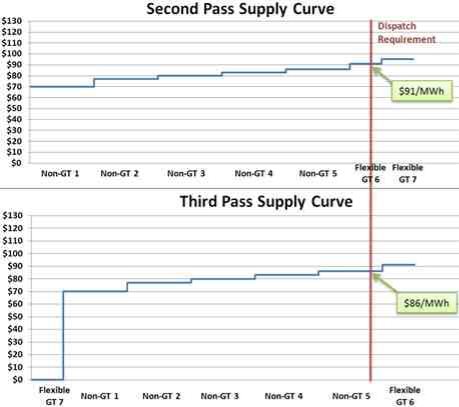

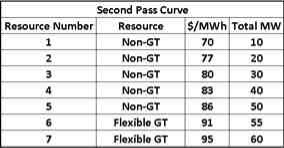

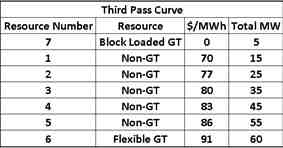

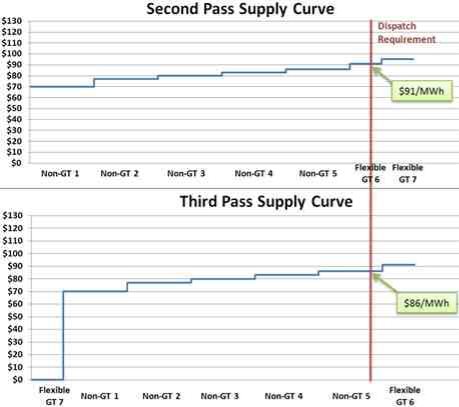

For example, consider the following hypothetical pricing outcome first under the current

Hybrid Fixed Block Unit pricing logic and then under the NYISO’s proposal. In this example there

are six resources; Units 1 through 5 are dispatchable resources, while Units 6 and 7 are Fixed Block

GTs. Under the existing pricing logic, the Second Pass supply curve models the GTs as flexible

between zero and the unit’s UOL. In the Second Pass of our hypothetical, GT 7 is identified as

uneconomic (i.e., it is only on due to minimum run-time constraints). The Second Pass currently

establishes “hybrid base points,” which are used to determine how the GT should be modeled in the

Third Pass. In the Third Pass, GT 7 is effectively block-loaded at its full output, and is included at the

bottom of the supply curve (as if it is a price taker). If 55 MW are needed to serve Load in this

example, the price that would result under the current Fixed Block Unit pricing logic is $86/MWh.

This price is inconsistent with the bids of GT 6 ($91/MWh) and GT 7 ($95/MWh), even though both

of these resources are on and serving load. GT 6 was determined to be economic to serve load in the

Second Pass. Under the NYISO’s proposed pricing rule the price to serve 55 MW of Load becomes

$91/MWh (GT 6 becomes the price-setting resource). The proposed rule produced a price that is more

consistent with the actual cost to serve load than the current Hybrid Fixed Pricing Rule.

Honorable Kimberly D. Bose December 14, 2016

Page 7

Simulations produced by the NYISO indicate that Real-Time LBMPs, Regulation Capacity prices, and Operating Reserve prices may increase slightly as a result of the proposed pricing

improvements.17 The NYISO does not, however, expect to see a change in total production costs, as the physical dispatch of Resources is not impacted by this proposal.

B. Ministerial Revisions to Services Tariff Sections 4, 15, and 17

The NYISO also proposes several ministerial revisions to update certain Tariff section crossreferences and to accommodate the substantive revisions to Attachment B of the Services Tariff

discussed above.

17 The NYISO conducted a market rerun for select days between February 11 and June 15, 2016 and determined that the

price impact of the proposed tariff revisions increased real-time zonal LBMPs from $0.21 to $0.74 per MWh for the rerun days. The average change in clearing price for Regulation Capacity and Operating Reserve for the rerun days was an

increase of $0.01 to $0.24 per MWh. These estimates were not adjusted to consider the frequency with which Fixed Block Units were dispatched; such analysis would likely indicate a much smaller price impact due to the infrequency of

dispatching Fixed Block Units. Considering the frequency with which Fixed Block Units were dispatched, the NYISO

estimates that the proposal could increase Real-Time LBMPs by approximately $0.10 per MWh on average throughout the year. For more information on the analysis conducted by the NYISO, please see the September 28, 2016 Management

Committee presentation at the following link:

http://www.nyiso.com/public/webdocs/markets_operations/committees/mc/meeting_materials/2016-09-

28/Agenda%2007_Hybrid%20GT%20Pricing%20Improvements.pdf.

Honorable Kimberly D. Bose December 14, 2016

Page 8

1. Revisions to Services Tariff Section 4.4 - Real-time Markets and

Schedules

The NYISO proposes to revise Section 4.4.2.1 to update an internal cross-reference from Services Tariff Section 4.4.2.3 to Section 4.4.2.4. This revision is not related to the substantive revisions discussed above, but corrects a previously inaccurate cross-reference.

2. Revisions to Services Tariff Section 15.4 - Rate Schedule 4, Payments

for Supplying Operating Reserves

The NYISO proposes two revisions to Rate Schedule 4 of the Services Tariff. The first

revision updates existing language in Section 15.4.6.1 that stated real-time clearing prices were

determined by the Third Pass as described in Services Tariff Section 17.1.2.1.2.3. Because the

NYISO’s substantive revisions describe above move the real-time clearing price logic from the Third Pass to the Second Pass, the NYISO proposes to replace “Third” Pass with “Second” Pass. Consistent with the proposed changes in Attachment B, the NYISO also proposes to update the cross-reference to the applicable provision in Attachment B that describes the RTD pass establishing real-time price to reflect that this pass is described in Section 17.1.2.1.2.2.

3. Revisions to Services Tariff Section 17.1 - LBMP Calculation

The final ministerial revisions proposed by the NYISO are included in Services Tariff Section

17.1. These revisions update the following internal cross-references related to the calculation of

LBMPs: updating one reference from Section 4.4.3.3 to Section 4.4.2.4, and updating a second from Section 17.1.1.1.3 to Section 17.1.2.1.3. These updates are not related to the substantive revisions to Section 17 discussed above, but correct previously inaccurate cross-references.

IV.Effective Date

The NYISO respectfully requests Commission action within sixty days from the date of this filing (i.e., February 12, 2017) in order to provide the NYISO and Market Participants with timely notice that the changes proposed herein have been accepted. Such timely action by the Commission will: (a) allow the NYISO to confidently proceed with developing and deploying the software changes necessary to implement the proposed Fixed Block Unit pricing logic; and (b) enable the NYISO to achieve the desired effective date for this proposal.

The NYISO requests a flexible effective date for the tariff revisions proposed herein. The

NYISO proposes to submit a compliance filing at least two weeks prior to the proposed effective date

that will specify the date on which these revisions will take effect. The NYISO currently anticipates

the proposed revisions becoming effective with a software deployment on or before February 28, 2017. The NYISO, however, will be unable to propose a precise effective date until the software changes are closer to deployment. Consistent with Commission precedent, the compliance filing will provide

adequate notice to the Commission and Market Participants of the implementation date for the revised Fixed Block Unit pricing logic.18

18 See, e.g., New York Indep. Sys. Operator, Inc., 106 FERC ¶ 61,111 at P 10 (2004); Docket No. ER 11-2544-000, New

York Indep. Sys. Operator, Inc., Letter Order at 1 (February 10, 2011); Docket No. ER15-485-000, New York Indep. Sys.

Honorable Kimberly D. Bose December 14, 2016

Page 9

V.Stakeholder Approval

The proposed amendments were approved by the NYISO Management Committee on

September 28, 2016 with no votes in opposition, but with three abstentions. The NYISO’s Board of

Directors approved the proposed revisions for filing with the Commission on October 18, 2016.

VI.Communications and Correspondence

All communications and service in this proceeding should be directed to:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director, Regulatory Affairs Garrett Bissell, Senior Attorney

*Gregory J. Campbell, Attorney

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-8540

Fax: (518) 356-7678

gcampbell@nyiso.com

*Person designated for receipt of service.

VII.Service

The NYISO will send an electronic link to this filing to the official representative of each of its

customers, to each participant on its stakeholder committees, to the New York State Public Service

Commission, and to the New Jersey Board of Public Utilities. In addition, the complete filing will be

posted on the NYISO’s website at www.nyiso.com.

Operator, Inc., Letter Order at 2 (January 15, 2015); New York Indep. Sys. Operator, Inc., 151 FERC ¶ 61,057 at P 20

(2015).

Honorable Kimberly D. Bose December 14, 2016

Page 10

VIII.Conclusion

For the foregoing reasons, the NYISO respectfully requests that the Commission accept for

filing the proposed revisions to the Services Tariff that are attached hereto within sixty days of the date

of this filing with a flexible effective date that will be specified in accordance with Section IV of this

filing letter.

Respectfully submitted,

/s/ Gregory J. Campbell

Gregory J. Campbell Attorney

New York Independent System Operator, Inc.

10 Krey Blvd.

Rensselaer, New York 12144 (518) 356-8540

gcampbell@nyiso.com

cc:Michael Bardee

Nicole Buell

Anna Cochrane

Kurt Longo

Max Minzner

Daniel Nowak

Larry Parkinson

J. Arnold Quinn

Douglas Roe

Kathleen Schnorf

Jamie Simler

Gary Will