UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

Price Formation in Energy and Ancillary)

Services Markets Operated by Regional)

Transmission Organizations and)

Independent System Operators)

REPORT OF

Docket No. AD14-14-000

THE NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

In accordance with the Federal Energy Regulatory Commission’s (“Commission’s”)

November 20, 2015 Order Directing Reports (“Order”) and consistent with the Commission’s

January 27, 2016 Notice of Extension of Time issued, in the above-referenced docket, the New

York Independent System Operator, Inc. (“NYISO”) hereby submits its Report responding to the

Commission’s questions. The NYISO shares the Commission’s vision for proper price

formation in the wholesale energy and ancillary services markets it administers. The NYISO

continually reviews its markets to identify opportunities to improve long-term market efficiency

by ensuring that market prices reflect, to the greatest extent practicable, the cost or value of each

product.

I. COMMUNICATIONS AND CORRESPONDENCE

All communications and correspondence concerning this Report should be served as

follows:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director, Regulatory Affairs *Alex M. Schnell, Assistant General Counsel/

Registered Corporate Counsel

Garrett E. Bissell, Senior Attorney

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-6000

Fax: (518) 356-8825

rfernandez@nyiso.com

rstalter@nyiso.com

aschnell@nyiso.com

gbissell@nyiso.com

*Person designated for receipt of service.

II. REPORT IN RESPONSE TO COMMISSION QUESTIONS

The NYISO provides the following responses to the topics the Commission instructed it to address in this Report:

A.Pricing of Fast Start Resources

Commission Questions

1. Generally, the fast-start pricing logic consists of a dispatch run and a pricing run that

relaxes the minimum operating limit of block-loaded fast-start resources such that

these resources can set the LMP.

a. Please explain during what period fast-start pricing logic is applied to block-

loaded fast-start resources. For example, does fast-start pricing logic apply

during a resource’s initial commitment period or during its actual run time?

b. Please explain the order in which the various fast-start pricing logic processes

are executed. Specifically, are the dispatch run and pricing run executed

separately or integrated into one process?

c. Some RTOs/ISOs relax the minimum operating limit of a resource only in the

pricing run, but some RTOs/ISOs currently also relax the minimum operating

limit in the dispatch run. Does the fast-start pricing logic relax the minimum

operating limit of a resource in the dispatch run, the pricing run, or both?

Please explain why the RTO/ISO chose the specific approach.

d. When a fast-start resource sets the LMP under the RTO’s/ISO’s fast-start

pricing logic, how does the RTO/ISO ensure that the minimum operating

limits of block-loaded fast-start resources are satisfied in dispatch?

NYISO Response

Block-loaded fast-start resources provide 10-minute and 30-minute non-synchronous reserves. These resources must either be (1) off, or (2) on and running at their upper operating limit (UOL) in order to provide energy. In other words, when a block-loaded resource is on, the minimum generation for the resource is equal to its UOL.

2

Day-Ahead commitments and hourly schedules are determined by the Security

Constrained Unit Commitment (SCUC) to meet bid and forecasted load. Real-Time

Commitment (RTC) software makes the commitment decision for resources in real-time every

15 minutes to meet forecasted load. Real-Time Dispatch (RTD) runs every 5-minutes and

dispatches resources to meet actual and forecasted load, and sets prices.

Offline GT pricing and hybrid GT pricing are two methods used in RTD to set

appropriate prices. These two approaches allow RTD to develop prices using actual generator

costs to address constraints that only require a portion of a block-loaded unit’s capability to

solve.

Hybrid Pricing

In RTD, RTC and SCUC the cost of the next MW (while co-optimizing Energy,

Operating Reserves, and Frequency Regulation) is used to establish the LBMP. The first ideal pass and second ideal pass are used to determine prices, while the physical pass, which follows the two ideal passes, is used to determine schedules in RTD. The physical pass does not utilize data output from the first and second ideal passes. The two ideal passes are required to

accommodate the NYISO’s hybrid GT pricing logic, while offline GT pricing is applied in all three passes. Final prices are established in the second ideal pass.

When block-loaded GTs are committed, dispatching these units to their maximum output, as their operational characteristics require, may displace more economic dispatchable units. The hybrid GT pricing logic allows online block-loaded units to be modeled as dispatchable to

determine prices when their operation is needed to meet load, when the commitment displaces higher cost units, or to satisfy reserve requirements.

3

The physical pass determines the dispatch signal that is sent to all resources while

respecting “physical” parameters, such as minimum generation MW, submitted to the ISO by

Market Participants via their offers. For all committed GTs that are physically block-loaded,

output is fixed at their upper operating limit within the physical pass. GTs only receive

schedules from the physical pass, and do not receive any schedule produced by the first or

second ideal passes.

The first ideal pass of hybrid GT pricing logic determines how each online block-loaded GT will be modeled in the second ideal pass of the hybrid GT pricing logic. Block loaded GTs that have been previously committed can be modeled as fully dispatchable from zero MW to the GT’s UOL, or as block loaded at the GT’s UOL.

Committed block-loaded GTs that are within their minimum run time are modeled as

dispatchable from zero to their UOL in the first ideal pass. These GTs are eligible to set price in the second ideal pass if they are economic and dispatched to produce energy within the first ideal pass. Conversely, any committed block loaded GT that is within its minimum run time and is

not economic during the first ideal pass is not eligible to set price in the second ideal pass.

Committed block-loaded GTs that are outside of their minimum run time are always eligible to set price within the second ideal pass. This approach is reasonable because RTC will turn off

such resources if they are not economic.

The second ideal pass is used to establish prices. Depending on the outcome of the first

ideal pass, GTs will either be modeled as blocked loaded at the GT’s UOL, or fully dispatchable

from zero to the GT’s UOL. If the GT is economically dispatched in the first ideal pass then the

GT will be modeled as dispatchable in the second ideal pass from zero to the unit’s UOL.

Conversely, if such a GT is dispatched to zero during the first ideal pass, then the GT is blocked

4

loaded at its UOL and is seen by the dispatch as a must-take resource which can never be marginal or set price.

Large differences between the physical dispatch schedules and ideal dispatch prices may introduce lost opportunities for more dispatchable resources when prices indicate that the

dispatchable resource should be scheduled at a different output than results from the physical

dispatch. This misalignment between prices and schedules can create unintended incentives for some dispatchable resources to stop following ISO dispatch instructions. The hybrid GT pricing logic avoids large differences between the schedules and prices produced from the physical pass and prices resulting from the second ideal pass by modeling some block loaded GTs as flexible, with prices from the second ideal pass being used for settlements. Modeling some block loaded GTs as flexible in the second ideal pass alleviates “lumpiness” in the resource supply curve by

modeling select block loaded units as dispatchable when establishing prices. The NYISO’s

hybrid approach arrives at a price signal more accurately representing the cost to meet load while reducing the lost opportunity of dispatchable resources.

Additionally, allowing block-loaded resources to be fully dispatchable to zero allows those resources to set the price whenever they were required to meet load. That is, anytime at least one megawatt of the resources output was necessary to meet load, the resource would be eligible to set the price. Limiting the range of dispatchability would tend to prevent these

resources from setting price when only a small portion of their output was necessary to meet load. Because New York has load pockets where only block-loaded resources are available to meet the reliability needs, it is important to allow these resources to be eligible to set price

anytime they are needed to meet load.

5

Offline GT Pricing

The NYISO utilizes the bids of offline 10-minute block-loaded GTs in RTD to set price

on some occasions. Offline 10-minute block loaded GTs are modeled in both the physical pass

and second ideal pass, but do not receive schedules for settlement from RTD. Start-up costs are

considered for offline 10-minute GTs that are qualified to set price. The start-up cost of the

uncommitted GT is divided by the GT’s UOL and added to the energy offer of the GT to arrive

at an adjusted energy offer. Offline block-loaded 10-minute reserve eligible resources are treated

as dispatchable from zero to their Upper Operating Limit within each pass, with a zero

MW/minute ramp down rate to reflect their minimum run time constraint within dispatch.1 The

zero MW/minute ramp down rate was developed because minimum run time constraints are only

enforceable for online resources within the dispatch algorithm and it was important to have the

dispatch of offline GTs represent, to the extent practicable, the GT’s operating characteristics.

The NYISO first introduced the concept of allowing offline 10-minute GTs to set price as a way to establish more efficient pricing in constrained load pockets. The NYISO has found that allowing these GTs to set price provides both the market and the NYISO operators an indication that an offline GT would efficiently solve the reliability need and, therefore, its start-up is

warranted. The offline GT pricing capability is especially useful for adding price transparency to

unanticipated changes between the time that RTC has completed its commitment evaluation and

the 5-minute RTD dispatch evalution when offline 10-minute GTs are the only option for solving

a reliability need. Because offline 10-minute GTs are capable of starting within 10 minutes,

prior to a subsequent RTC execution, they are eligible to set price in RTD.

1 Such units are excluded from commitment when they are within their minimum down time.

6

Offline GTs that are not eligible to provide 10-minute non-synchronous reserve are not eligible to set price in RTD. Instead, the NYISO relies on RTC, with its look-ahead capability, to commit offline GTs with start-up times that are longer than 10 minutes. Once committed, these resources are subjected to the hybrid GT pricing logic within RTD.

Commission Question

1. Generally, the fast-start pricing logic consists of a dispatch run and a pricing run that

relaxes the minimum operating limit of block-loaded fast-start resources such that

these resources can set the LMP.

e. CAISO, ISO-NE, NYISO, and MISO currently relax the minimum

operating limit of eligible block-loaded fast-start resources to zero, while

PJM relaxes the minimum operating limit by 10 percent. Please explain the reasons for the specific approach used to relax minimum operating limits. For SPP, please explain whether minimum operating limits are relaxed to zero or not, and the reasons for the chosen approach.

NYISO Response

The NYISO relaxes the minimum operating limit of block-loaded resources to zero when

applying its hybrid GT pricing logic. This is done so that the algorithm can distinguish between

units that are constrained by the block loading treatment and those that are not. In New York,

there are constrained load pockets where GTs are the only resource that can set the price. It is

important to allow maximum dispatch flexibility for the pricing algorithm to set efficient prices

in these areas.

7

Commission Question

2. Please describe any RTO/ISO and/or stakeholder initiatives or plans, if any, related to

fast-start pricing logic and why those changes are being pursued. What tradeoffs, in

terms of costs and benefits, are the RTO/ISO and/or stakeholders considering during

this process? Please provide a qualitative discussion of whether and how

enhancements to existing fast-start pricing logic could potentially reduce overall

uplift.

NYISO Response

In 2016 the NYISO will be working with its stakeholders on the “Hybrid GT Pricing

Improvements” project. This project is based on recommendation 10 in the Market Monitoring

Unit’s (MMU’s) 2014 State of the Market Report.2 The MMU observed that in 7 to 12 percent

of intervals there are block-loaded units that are economic but are not qualified to set price. This

outcome has been attributed to the Hybrid GT methodology where multiple block loaded GTs

have been committed and not all are found to be eligible to set price. Some GTs are eligible to

set price, while others are not, due to system changes between when RTC evaluated the fleet and

when RTD is dispatching the fleet. The 2016 project will evaluate the proposal to allow all

block-loaded units that are economically committed by RTC to be qualified to set price in the final pricing pass. The project will also evaluate amortizing GT start up costs into their offer over the initial phase of the GT’s commitment and allowing these costs to be reflected in prices. The proposed modification is intended to increase the accuracy of price signals, avoid intervals where the LBMP is lower than the bid cost of the GT, and to reduce uplift.

2 The MMU also raised this concern in earlier State of the Market Reports.

8

Commission Question

3. Please explain the following regarding the RTO’s/ISO’s fast-start pricing logic

eligibility:

a. What type of resource (e.g., combustion turbine) may be considered a fast-start

resource and what are the eligibility requirements (e.g., start-up time and/or

notification time)? Are resources other than block-loaded fast-start resources

eligible to set the LMP under the fast-start pricing logic? Can a fast-start resource

choose not to be included in the fast-start pricing logic?

NYISO Response

What type of resource (e.g., combustion turbine) may be considered a fast-start resource and what are the eligibility requirements (e.g., start-up time and/or notification time)?

All committed block-loaded resources qualified to provide 10-minute nonsynchronous reserves are considered in the NYISO’s hybrid GT pricing logic. Certain Out of Merit

Generation (OOM) types disqualify resources from setting price. These include OOMs due to Transmission Owner (TO) reliability, generator requests, ISO security, ISO voltage support, TO voltage support and for testing.

All 10-minute non-synchronous block loaded resource that are offline are included in the NYISO’s offline pricing logic.

Are resources other than block-loaded fast-start resources eligible to set the LMP under the fast-start pricing logic?

Committed dispatchable resources are considered in the supply curve when establishing prices and schedules; the bids of such resources can set prices. These resources are not directly considered by the hybrid GT pricing logic or offline GT pricing.

9

Can a fast-start resource choose not to be included in the fast-start pricing logic?

All block-loaded resources eligible to provide 10-minute non-synchronous and 30-minute reserves are included in the NYISO’s hybrid GT pricing logic. All 10-minute non-synchronous reserve eligible resources are considered in the NYISO’s offline GT pricing. Fast-start resources cannot choose to be included or excluded from the pricing logic.

Commission Question

3. Please explain the following regarding the RTO’s/ISO’s fast-start pricing logic

eligibility:

b. Can commitment-related start-up and/or no-load costs be accounted for in the

LMP? If so, please explain how and provide numerical examples to illustrate how these costs are included in LMP.

NYISO Response

Start-up and no-load commitment costs are not accounted for in the LBMP unless offline

GTs are used to set the price. This is because dispatched units’ start-up and/or no-load costs

have already been evaluated in the commitment passes, the commitment was determined to

minimize production cost, and as a result LBMPs are largely high enough to cover these

commitment costs. Start-up costs are considered for offline 10-minute GTs that are qualified to

set price and these costs are amortized over the GT’s UOL and added to the GT’s energy offer as

further explained in the NYISO’s response to Pricing of Fast Start Resources question 3(c).

10

Commission Question

3. Please explain the following regarding the RTO’s/ISO’s fast-start pricing logic

eligibility:

c. Can offline block-loaded fast-start resources set the LMP? If so, please explain

how and provide numerical examples to illustrate how such resources set the

LMP.

NYISO Response

Offline 10-minute eligible resources are qualified to set price in the pricing pass. The

minimum output levels of such resources are relaxed to zero. In other words, they are considered dispatchable and are allowed to set the price if they are economic. The start-up costs of each

such resource, divided by the generator’s upper operating limit, is added to the energy offer

costs. Combining start-up costs with energy offer costs when allowing offline GTs to set price ensures that the stated LBMPs cover the GT’s approximate commitment costs. Unlike GTs that have been committed and have an enforced minimum run time over which commitment costs can be recovered, offline GTs do not have an enforced minimum run time. Therefore the LBMP

must immediately account for the commitment costs.

Numerical Example:

Consider the following units and a 475 MW load:

Energy

Offer Price

StatusResource($/MWh)Min GenUOLStart Up Cost ($)

NOT

COMMITTEDGT7550501000

Flexible

COMMITTEDUnit16025300n/a (already online)

Flexible

COMMITTEDUnit23025100n/a (already online)

Flexible

COMMITTEDUnit325550n/a (already online)

11

Physical Pass:

The physical and pricing passes each take place within RTD. Offline GTs are modeled as

dispatchable within the physical pass i.e., their minimum generation level is set to zero. Offline

GTs are not provided a schedule unless committed by the operator. This treatment allows RTD

to price the need for GTs due to changing conditions that were not seen in RTC, while allowing

NYISO Operations to confirm that the condition is expected to continue and is not due to a

transient issue before committing the generator. As explained above, the start-up cost of the

uncommitted GT is divided by the unit’s UOL and added to the energy offer of the unit to arrive

at an adjusted energy offer. The NYISO utilizes Regulation Service to compensate for any under

generation.

Adjusted

Energy OfferPhysical Dispatch

StatusResource($/MWh)Min GenUOL(MW)

NOT

COMMITTEDGT9505025

Flexible

COMMITTEDUnit16025300300

Flexible

COMMITTEDUnit23025100100

Flexible

COMMITTEDUnit32555050

Pricing Pass:

The adjusted energy offer of the uncommitted resource is also considered in the pricing

pass. The uncommitted 10-minute non-synchronous eligible GT is modeled as dispatchable

within the pricing pass. Again, the GT is not provided a schedule unless it is committed by the

operator.

12

Adjusted

EnergyPricing

OfferStart UpDispatch

StatusResource($/MWh)Min GenUOLCost ($)Solution (MW)

NOT

COMMITTEDGT95050100025

Flexiblen/a (already

COMMITTEDUnit16025300online)300

Flexiblen/a (already

COMMITTEDUnit23025100online)100

Flexiblen/a (already

COMMITTEDUnit325550online)50

Because the uncommitted GT in the above example is dispatched to serve the 475 MW load, the GT would set the Energy component of the LBMP at $75/MWh + ($1000/50MW) = $95/MWh in the pricing pass.

Commission Question

4. Based on the definition in the RTO/ISO tariff, how much block-loaded fast-start

capacity (in MWs) is available? How much fast-start capacity is not block-loaded? Please provide as seasonal capability (i.e., summer capability) and include only capacity that is currently in service and can participate in the market.

NYISO Response

Section 1.6 of the NYISO OATT defines a Fixed Block Unit (i.e. a block-loaded unit) as

“[a] unit that, due to operational characteristics, can only be dispatched in one of two states:

either turned completely off, or turned on and run at a fixed capacity level.”

The combined upper operating limits of all block-loaded, fast-start, 10-minute eligible units currently in service and participating in the NYISO markets as of February 26, 2016 is approximately 2,000 MW. The summed upper operating limits of dispatchable, 10-minute

13

eligible, fast-start capacity units currently in service and participating in the NYISO markets as of February 26, 2016 is between 1500 MW and 2000 MW.3 The summed upper operating limits of block-loaded, 30-minute eligible, fast-start unit currently in service and participating in the NYISO markets as of February 26, 2016 is approximately 3,000 MW. The aforementioned

figures do not vary significantly when considering summer vs. winter capability.

Commission Question

5. As previously discussed, fast-start pricing logic can result in over-generation or in

resources not following dispatch instructions.

a. Please discuss the extent to which fast-start pricing logic has resulted in over-

generation or resources otherwise not following dispatch instructions.

b. Please describe the current approach, if any, used to address over-generation or

the incentive to not follow dispatch instructions, and discuss the benefits to this

approach versus other potential approaches to address this problem. For example,

approaches include paying resources their opportunity costs, or penalizing them

for deviating from dispatch instructions.

NYISO Response

The NYISO’s generation fleet responds well to NYISO-issued base points and

instructions. The NYISO has not identified its fast-start pricing logic as causing systemic over-

generation, or providing incentives for resources to not follow NYISO dispatch instructions.

The NYISO believes that a combination of well-designed market rules incent resources to follow dispatch instruction and prevent unscheduled overproduction. First, resources changing their bid type from ISO-committed in the Day-Ahead Market to self-committed in the Real-Time Market give up their eligibility to receive Bid Production Cost Guarantee (BPCG) payments in the Real-Time Market. Dispatchable resources are unlikely to risk losing guarantee payments

3 The NYISO uses a range to ensure that its public response does not reveal any Confidential Information.

14

(that are paid over the dispatch day) to garner additional profits over the relatively brief and

unpredictable period when their production is displaced by a block-loaded resource. Second, a generator producing above its basepoint is only compensated for overproduction that exceeds the basepoint by 3% of the generator’s UOL, or less.

Commission Question

6. For those RTOs/ISOs that apply fast-start pricing logic only to the real-time market,

please explain why this methodology is not applied to the day-ahead market.

NYISO Response

The NYISO’s hybrid GT pricing logic is not applied by SCUC or by RTC because all

GTs are modeled as dispatchable in the pricing passes of both SCUC and RTC. SCUC and RTC

can fully evaluate when the units are marginal and thus qualified to set prices, while also

determining the least cost set of resources to serve load. RTD does not commit resources, and is

unable to determine marginality of offline block-loaded units without the hybrid GT pricing

logic.

Commission Question

7. Certain RTOs/ISOs argue that expanding the fast-start pricing logic to resources other

than block-loaded fast-start resources is not needed. However, this limits the amount

of fast-start resources that are able to set LMP. Please explain the advantages or

disadvantages of allowing fast-start resources that are not block-loaded but that have

a limited operating range to set the LMP, and please explain whether it is appropriate

to allow the commitment-related start-up and no-load costs of such resources to affect

prices.

15

NYISO Response

The NYISO only applies hybrid GT pricing logic and offline GT pricing logic to blockloaded fast-start resources. There has been no discussion of allowing dispatchable units to set price because dispatchable fast-start resources are able to set price within their dispatchable range when they are committed. Dispatchable fast-start resources are not common in New York and the few that exist are not situated in constrained load pockets. The expected benefit of

implementing hybrid pricing for these resources is minimal.

B. Commitments to Manage Multiple Contingencies

The NYISO’s SCUC, RTC and RTD secure the transmission system to address single

contingency events. A subset of these single contingency events involve the simultaneous

outage of multiple transmission elements. For example, failure of a circuit breaker due to a fault-

to-ground may be cleared from the system by the operation of multiple circuit breakers, resulting

in the outage of multiple transmission system elements.4 The NYISO does not ordinarily

perform its market evaluations in a manner that would identify the incremental resource

commitments for single contingencies that involve multiple transmission elements.

New York State Reliability Council (NYSRC) reliability rules stipulate that Con Edison “…operate certain areas of the New York State (NYS) Bulk Power System to meet more

stringent local reliability requirements than the rest of the NYS Bulk Power System.”5 The

NYISO accommodates the Con Edison requirements in performing market analysis for resource

4 Paragraph 30 and footnote 61 of the Order describe this example as an N-2 event.

5 Link to NYSRC Reliability Rules:

http://www.nysrc.org/pdf/Reliability%20Rules%20Manuals/RRC%20Manual%20V35%20Final%208-14-15.pdf

16

commitment and scheduling for both Day-Ahead and Real-Time markets. For example, in

performing its Day-Ahead Market evaluations the NYISO includes a set of constraints, including

multiple contingency events, that may be satisfied by combinations of various New York City

(NYC) zone J generator commitments which satisfy the NYC Local Reliability Requirements

(LRR). The Power Supplier uplift associated with the incremental resources committed to

satisfy the LRR is calculated and the costs are allocated to Load Serving Entities in the NYC

zone.

In performing its Real-Time Market evaluations while a Con Edison Storm Watch is in effect, the NYISO includes a set of N-1-1 contingencies involving Con Edison transmission equipment in zones outside of NYC. The NYISO employs a calculation, described in Appendix M of its Accounting and Billing Manual,6 which identifies the incremental costs associated with securing the transmission system for the Con Edison Storm Watch condition. The NYISO

allocates these Storm Watch costs to NYC zone Load Serving Entities.

Commission Question

1. Please describe any RTO/ISO and/or stakeholder initiatives or plans, if any, to

incorporate the costs of multiple contingencies into clearing prices for energy and

ancillary services. This description should include estimated costs and a timeline for implementation.

6 Link to Accounting and Billing Manual:

http://www.nyiso.com/public/webdocs/markets_operations/documents/Manuals_and_Guides/Manuals/Administrativ

e/acctbillmnl.pdf

17

NYISO Response

As described above, the NYISO currently solves single contingency events that may

include the simultaneous outage of multiple transmission elements. The clearing prices for

energy and ancillary services incorporate the costs of securing the system for these events.

The costs of solving certain multiple contingency events are addressed through the

markets in three primary ways. First, the multiple contingency Con Edison Storm Watch criteria

is secured for explicitly in the Real-Time Market and reflected in clearing prices.

Second, as it relates to the Con Edison LRR criteria that are solved for in the Day-Ahead Market, the solution will include the commitments needed to satisfy the LRR criteria. The

resources required to meet the LRR criteria are eligible to set price. The Con Edison LRR

criteria are not otherwise explicitly reflected in the Day-Ahead Market clearing prices.

However, if the Con Edison LRR criteria were considered after the Day-Ahead Market posted,

subsequent resource commitments would sometimes be required, and would result in an over

commitment of resources transitioning into real-time. The NYISO’s approach develops efficient

commitments and schedules.

Third, as further explained in response to the next question, certain reserve products are used to prepare for multiple contingencies across the New York Control Area (NYCA). Given that the NYISO’s market solution is a co-optimization between energy, operating reserves and regulation with the objective of minimizing total production cost, the cost of solving for multiple contingencies through reserves is already included in the clearing prices. The calculation of clearing prices for each of these products incorporates resource lost opportunity cost, fairly

compensating resources for each product in the majority of intervals.

18

No projects that are currently being considered propose to incorporate the costs of

additional multiple contingency constraints into the market solution. The NYISO and its

stakeholders are, however, considering a project called “Modeling 100+kV Transmission

Constraints,” which is based on a recommendation in the 2014 State of the Market report

produced by the NYISO’s Market Monitoring Unit. The proposed project would assess the

value and impacts of modeling 115/138kV transmission constraints in the Day-Ahead and RealTime Markets.

Modeling constraints on facilities above 100 kV that are not modeled today would be

expected to reduce out-of-market commitments to resolve Western transmission constraints.

Market incentives for investment in resources on the 115kV system in upstate New York may be

improved by reflecting these facilities in the NYISO’s energy and ancillary services markets.

Commission Question

2. Please explain whether constraints or reserve products are used to address multiple

contingencies in the day-ahead and real-time energy and ancillary services markets

and, if so, how such constraints or reserve products are incorporated in market

models. Specifically, describe (1) the criteria for determining what constraints or

reserve products are included in the day-ahead or real-time market model to address

multiple contingencies, and (2) provide a detailed description of how constraints or

reserve products to address multiple contingencies are included in both the day-ahead

and real-time market model.

NYISO Response

Operating reserve constraints are modeled in the Day-Ahead and Real-Time Markets.

Operating reserve constraints are addressed by imposing locational and physical resource

qualifications for providing each type of reserve. The amount of a particular operating reserve

product the NYISO secures its system to depends on rules established by the North America

19

Electric Reliability Corporation (NERC), Northeast Power Coordinating Council (NPCC), and

New York State Reliability Council (NYSRC). The NERC, NPCC and NYSRC rules are used to establish the locational MW requirements for operating reserve procured by the NYISO in the Day-Ahead and Real-Time Markets.7 Not all locational reserve requirements are in place to

secure against multiple contingencies.

Three locational operating reserve product constraints modeled are specific to multiple

contingencies. These include the Southeastern New York (SENY) 30-minute reserve

requirement, the East of Central East (EAST) 10-minute non-synchronous reserve requirement,

and the New York Control Area (NYCA) 30-minute total reserve requirement. Specifically,

1300 MW of 30-minute total reserve is procured in the SENY reserve region in order to re-

prepare the system to withstand the next worst contingency following the occurrence of the worst

contingency for the UPNY-SENY interface. Twelve hundred MW of 10-minute non-

synchronous reserve is procured in the EAST reserve region to restore flows on the Central East

internal interface to within limits following the worst contingency, in order to prepare the system

to suffer the next worst contingency. The NYCA 2620 MW 30-minute total reserve requirement,

tied to an NYSRC rule, is intended to prepare the system to suffer the worst two supply

contingencies before load shedding is required. NYSRC rules also include single contingencies

that involve multiple elements, which are included as constraints within the NYISO’s Day Ahead

and Real-Time Markets.

A Day-Ahead Reliability Unit (DARU) may be committed at the request of a

Transmission Owner (TO), or by the NYISO to address local or statewide reliability needs.

7 NYISO posting of locational requirements:

http://www.nyiso.com/public/webdocs/markets_operations/market_data/reports_info/nyiso_locational_reserve_req

mts.pdf

20

DARU commitments are included with the Day-Ahead Market run, providing for a more

efficient commitment relative to if the unit were committed after the establishment of Day-

Ahead schedules. All requests by TOs to commit generators via the DARU process, as well as NYISO-initiated DARUs, are posted to the OASIS at or before the time of the Day-Ahead

Market close. DARU requests may or may not be to address multiple contingencies. Typically, the TO will provide the ARR that triggers the DARU commitment.

Local Reliability Rules (LRR) defined by the NYSRC are included in the Day-Ahead and Real-Time Markets. Five LRRs are included in the NYISO’s markets. They address locational reserves, unit commitment, potential loss of generator gas supply, and Storm Watch in New

York City (NYC), as well as potential loss of generator gas supply on Long Island.

The NYISO includes in its Day-Ahead Market evaluation the NYC zone generator

commitment combinations which Con Edison identifies as necessary to satisfy NYSRC

requirements. The NYC LRR contingencies are evaluated and may affect resource commitments in each Day-Ahead Market evaluation.

Each NYC LRR requirement is presented as minimum generation requirement to be

satisfied by a subset of the NYC generation resources. There are multiple requirements for

various localities within the NYC zone to secure for thermal, voltage, loss of natural gas and

emissions conditions. Some required minimum generation production values may vary as a

function of demand. NYC generation resources may contribute to satisfying multiple LRR

requirements.

The NYISO includes in its Real-Time Market evaluation the N-1-1 contingencies Con

Edison identifies as satisfying NYSRC real-time operational requirements. Storm Watch

contingencies occur in real-time and require RTC and RTD to secure one or a number of

21

multiple contingencies cases as outlined in the table A.5 of the NYISO Emergency Operations Manual.8 Storm Watch contingencies are included in Real-Time Market evaluations for the period over which Con Edison invokes the procedure. These periods may be non-contiguous within a day and may span multiple days.

Commission Question

3. If resources are manually committed (i.e., committed outside of security constrained

unit commitment processes) to address multiple contingencies, please describe the

criteria used to determine whether a manual commitment will be made and how the

RTO/ISO determines what resources are committed. If resources are manually

committed to address only some subset of multiple contingencies, please describe

what criteria the RTO/ISO uses to determine whether a manual commitment will be

made.

NYISO Response

The NYISO’s SCUC and RTC can commit resources to address multiple contingencies, as described in the NYISO’s response to Commitments to Manage Multiple Contingencies

question 2. The NYISO and Transmission Owners can also manually identify resources that must be committed to meet reliability criteria in advance of the Day-Ahead Market by issuing a DARU designation. Should the need arise to commit additional resources outside of the market process in order to resolve reliability requirements, the NYISO determines which resources are available within the needed timeframe to solve the necessary constraints and commits the most economic resource or resources from the options available to it.

Resources may be manually committed using a Supplemental Resource Evaluation (SRE) when a need arises. An additional type of manual commitment is Out-of-Merit Generation

8 Link to Emergency Operations Manual:

http://www.nyiso.com/public/webdocs/markets_operations/documents/Manuals_and_Guides/Manuals/Operations/e

m_op_mnl.pdf

22

(OOM). An OOM commitment or dispatch can be implemented to secure the bulk power

system, during communication failures, or when the Real-Time Commitment does not

successfully run. Transmission Owners can request that a generator be committed or dispatched OOM for local reliability. Generators that are experiencing operating difficulties can request an OOM through their local Transmission Owner.

Commission Question

4. For each month during the twelve month period between October 1, 2014 and

September 30, 2015, please provide: (1) an estimate of the number of resource

commitments made in real-time or day-ahead to address multiple contingencies. This estimate should be broken down by geographic area (e.g., reserve zone or load zone), if possible; and (2) an estimate of the dollar amount of uplift paid to resources

committed to address multiple contingencies.

NYISO Response

The NYISO performs a co-optimized dispatch of resources to provide energy, regulation, and reserves to address all system needs incorporating all of the criteria described in response to the prior questions. As such, it is not possible to tie specific resource commitments to a specific set of multiple contingency constraints that are secured in the market software. The cost of a resource committed to resolve one requirement in the model (e.g. a locational operating reserve requirement), may have resulted from the unavailability of another resource that was scheduled to provide a product of greater value (e.g. energy). The multiple contingency commitments that are capable of being distinguished are set forth in the table below.

Transmission Owners are required to provide a reason, including any applicable ARR

codes, for DARUs and the NYISO posts the ARR codes that are provided with its Operational

23

Announcement website posting.9 The NYISO also reports commitments with ARR designations as part of its Operations Performance Metrics Monthly Report.10

The table set forth below identifies the resource commitments and Power Supplier uplift paid for the securing the New York City Local Reliability Rules. It also identifies the number of hours for which Con Edison implemented its Storm Watch Procedure and the storm watch costs allocated to the NYC zone Load Serving Entities.11 For more information on LRR

commitments, please see the NYISO’s response to question 2 under the topic heading

“Commitments to Manage Multiple Contingencies.”

NYC LLR

commitmentUnique NYCNYC LLR DAMStorm WatchStorm Watch

Monthunit-hrsLRR UnitsBPCG $Procedure HoursProcedure BMCR $

10/20142534$165,244.200$0.00

11/20141443$226,885.400$0.00

12/2014284$57,975.680$0.00

01/20151646$849,959.290$0.00

02/2015962$412,982.430$0.00

03/20152392$281,228.7010$0.00

04/20156482$636,567.960$0.00

05/201513263$1,754,951.6321$723,021.91

06/201511976$1,649,918.7627$2,334,798.49

07/20157435$594,603.9019$374,013.76

08/20158426$1,033,885.107$354,525.34

09/20155212$448,454.941$60,637.43

$8,112,657.99$3,846,996.93

9 The NYISO’s operational announcements can be found on its website:

http://www.nyiso.com/public/markets_operations/market_data/reports_info/index.jsp The user must select the

Operational Announcements checkbox to see the reports.

10 The Operations Performance Metrics Monthly Report is located in the Monthly Reports folder at the following

link: http://www.nyiso.com/public/markets_operations/documents/studies_reports/index.jsp

11 Though BMCR is not a form of uplift, it is included in the table for completeness.

24

Commission Question

5. Describe whether and how incorporating additional multiple contingency constraints

or using reserve products in day-ahead or real-time market models would improve

price formation. If taking additional steps to incorporate multiple contingency

constraints or using reserve zones in day-ahead or real-time market models is

unnecessary, impracticable, or would negatively affect price formation, please explain

why.

NYISO Response

The NYISO finds it effective to solve for single contingency events resulting in the outage of multiple transmission elements through the market.

The NYISO has found locational reserve regions to be an effective means of managing

multiple contingencies. When managing multiple contingencies there is often a limited period of time for the NYISO’s operators to restore the system to normal operating conditions following the occurrence of the “first” contingency. This time element can best be modeled in current

market platforms using a locational reserve requirement.

Alternatively, the multiple contingencies can be modeled directly as the simultaneous

loss of several transmission or generation elements. This modeling method has costly side

effects. The modeling must immediately account for reduction in transmission capability which

results in inefficient use of the transmission system and result in higher total production costs

due to the dispatch of less efficient generation. This effectively requires the ISO or RTO to

maintain costly transmission level “reserves” by holding back usable transmission and

generation ramp capability in order to be able to immediately react to the multiple contingency

event, should it occur.

By securing for multiple contingencies in its market evaluations the NYISO provides

power suppliers with commitment and dispatch instructions relating to these conditions in the

25

same manner as securing for the single event contingencies; there is no out-of-the-ordinary communication required.

The effect of securing the N-1-1 contingencies is transparent in that the NYC LLR

commitment type for each commitment is posted, and the cost allocation to the NYC zone Load Servicing Entities separately identifies costs that are attributable to the NYC LRR, and costs that are attributable to the Con Edison Storm Watch procedures. The costs of, and other information concerning the NYC LRR commitments and Storm Watch are included in various reports that the NYISO regularly publishes.12

Power suppliers are able to recover their costs through the combination of LBMP

revenue, Bid Production Cost Guarantee (BPCG) payments and Day-Ahead Margin Assurance Payments (DAMAP). Constraints involving the NYC LRR may affect resource commitment, but these constraints are not priced and so will not directly affect LBMPs. Storm Watch

contingencies are priced and affect the real-time LBMP. The constraints that are activated to address a Con Edison Storm Watch are included in Real-Time Market evaluations when Storm Watch conditions exist in the monitored geography. Con Edison operations invokes Storm

Watch and provides advance notice to the NYISO when possible so that the NYISO may include these contingencies in its look-ahead Real-Time Market evaluation.

The practices the NYISO employs to secure multiple contingency constraints supports

the Commission’s price formation goals. They provide correct incentives for Market

Participants to follow dispatch signals, provide price transparency, and provide the opportunity

for suppliers to recover their costs. As explained above, the NYISO secures for several different

12 See the NYISO’s response to Transparency questions 1 and 2 for information on the reports the NYISO publishes.

26

types of multiple contingency constraints within its market evaluations, minimizing the need for out-of-market resource commitments.

C.Look-Ahead Modeling

Commission Question

1. Please describe any RTO/ISO and/or stakeholder initiatives or plans, if any, related to

look-ahead modeling. For any look-ahead modeling enhancements that the RTO/ISO

and/or its stakeholders are currently considering, please discuss any evaluation of the

costs and/or complexities of look-ahead modeling relative to its potential benefits,

and the estimated time frame for implementation of any look-ahead modeling

enhancements.

NYISO Response

The NYISO incorporated look-ahead modeling into its Day Ahead Market at its

inception in 1999 and incorporated look-ahead modeling into its Real Time Market in 2005.

Post 2005 the NYISO has implemented various look-ahead modeling enhancements.

The NYISO regularly assesses if additional refinements are needed and has included a “RTC-RTD Forward Horizon Coordination Improvements” market design project for 2016. Slight modeling inconsistencies between RTC and RTD look-ahead evaluations can arise as the programs evaluate external transactions and the start-up/shut-down of gas turbines. The

inconsistencies the NYISO is working to address can result in unforeseen ramp constraints,

undermine the accuracy of prices forecasted by RTC, and could contribute to transient shortage conditions and unnecessary price volatility. The 2016 project will investigate possible revisions and adjustment to the look-ahead RTC and RTD evaluations.

27

After the possible revisions and adjustments are identified, costs to change the NYISO’s

market software, as well as impacts to the solution time and RTC/RTD scheduling and pricing

must all be considered when deciding if the NYISO will implement the potential improvements

that it identifies. Though the project has not been discussed at length, should the project find

possible improvements, the total implementation time from initial discussion with stakeholders

to market implementation is estimated to be considerable, given the NYISO’s EMS/BMS System

Upgrade project.13

Commission Question

2. Please list all of the unit commitment and dispatch processes that execute after the

close of the day-ahead energy market, up to and including all unit commitment and

dispatch processes used in the real-time market. Please indicate whether each process

uses look-ahead modeling. With respect to each process that uses look-ahead

modeling, please address each of the topics listed below and include examples where

possible.

NYISO Response

The NYISO Security Constrained Unit Commitment (SCUC) reliability commitment

process is embedded in its Day-Ahead Market (DAM) process. After DAM closes, if there is a

significant change to the system (e.g. the loss of a generator or a transmission element)

additional generators may be committed through the Supplemental Resource Evaluation (SRE)

process. Units may be SRE’d by the NYISO operators, or at the request of a Transmission

Owner. Generators committed via SRE are eligible to set price in real-time.14 SREs

13 The EMS/BMS Upgrade project is currently underway and scheduled for completion in 2019. This effort will limit the NYISO’s ability to make additional energy market modifications.

14 SRE commitments are at a unit’s Minimum Generation level. Additional, economic Incremental Energy dispatch from an SRE-committed unit is eligible to set price.

28

commitments do not use look-ahead modeling, but RTC and RTD will include SREs within their respective look-ahead optimization horizons.

The SRE process is described in the NYISO’s Transmission and Dispatching Operations Manual, Section 5.7.6, Supplemental Commitment Process:

The NYISO may use the SRE process to commit additional resources outside of

the SCUC and RTC processes to meet NYISO reliability or local reliability

requirements. Transmission Owners (TOs) may request the commitment of

additional generators to ensure local reliability in accordance with the local

reliability rules. The NYISO will use SREs to fill these requests by TOs. In

addition, Generator Owners may request the operation of a specific steam unit if

certain combustion turbines have an energy or a non-synchronous reserve

schedule that necessitates operation of the steam unit due to 24-hour NOX

Averaging Period requirements.

When the NYISO requests that generators submit bids in response to an SRE, ICAP suppliers must offer their available capacity unless an offer is pending in the Real Time market when the SRE request is made or the unit is unable to run due to an outage, operational issues or temperature derates. Special Case

Resources are not required to respond to SRE requests by section 5.12.1 of the Market Services Tariff. However, the NYISO may request SCR and EDRP resources to respond to SRE requests on a voluntary basis.

Since SREs are only performed to address reliability concerns, it is intended that

units committed by the SRE process fulfill their obligation by physically

operating.

NYISO Requests for SREs

The NYISO may perform SREs in response to the following [two] conditions:

1. When Day-Ahead reliability criteria violations are forecast after SCUC has

begun or completed its Day-Ahead evaluation (i.e.: too late for additional dayahead commitments).

2. When In-Day reliability criteria violations are anticipated more than 75

minutes ahead (i.e.: too early for RTC commit additional resources).

Additional commitment procedures that occur after SCUC and ordinarily after SREs

include the Real Time Commitment (RTC) and Real Time Dispatch (RTD). RTC executes every

29

quarter hour and includes a two-and-a-half hour look-ahead with advisory commitments over the look-ahead period. RTD follows RTC, and both optimizations utilize look-ahead capability.

The NYISO’s RTD executes every five minutes and includes a 55 to 65 minute look-ahead,

depending on the interval. The RTC and RTD look-ahead commitment processes are described in greater detail in the NYISO’s response to Look Ahead Modeling question 2(a), below.

From time to time, NYISO operations may implement the Real Time Dispatch -

Corrective Action Mode (RTD-CAM) when the need arises to respond to system conditions that were not anticipated by RTC or the regular RTD. RTD-CAM is used to deal with immediate

system issues quickly and was constructed to minimize execution time, thus RTD-CAM intervals do not utilize look-ahead modeling. RTC, RTD, and RTD-CAM are further described in the

NYISO’s response to Look Ahead Modeling question 2(a) below.

Manual commitments may also occur after SCUC runs. Such commitments are described in the NYISO’s answer to question 3 in the “Commitments to Manage Multiple Contingencies” section of this Report.

Commission Question

2. Please list all of the unit commitment and dispatch processes that execute after the

close of the day-ahead energy market, up to and including all unit commitment and

dispatch processes used in the real-time market. Please indicate whether each process

uses look-ahead modeling. With respect to each process that uses look-ahead

modeling, please address each of the topics listed below and include examples where

possible.

a. Please indicate whether the process uses look-ahead modeling solely as an

advisory tool for operators or, alternatively, whether the process uses look-ahead modeling to make actual commitment, dispatch, and pricing decisions. What is the time horizon considered by the look-ahead model? What are the

commitment/dispatch intervals considered by the look-ahead model? How

frequently does the model execute throughout the operating day (e.g., every 15 minutes, every 30 minutes)?

30

NYISO Response

The NYISO look-ahead modeling process instructs actual commitment and dispatch

decisions, while also providing resources with advisory prices and schedules. The Real Time

Commitment (RTC) program makes binding unit commitment and de-commitment decisions for

the periods beginning fifteen minutes (in the case of Resources that can respond in ten minutes)

and thirty minutes (in the case of Resources that can respond in thirty minutes) after the

scheduled posting time of each RTC run. RTC provides advisory commitment information for

the remainder of the two and a half hour optimization period, and produces binding schedules for

External Transactions to begin at the start of each quarter hour. RTC co-optimizes to solve

simultaneously for all Load, Operating Reserves and Regulation Service requirements and to

minimize the total as-bid production costs over its optimization timeframe. RTC considers

SCUC’s Resource commitment for the day, load forecasts from the load forecasting program and

loss forecasts that RTC itself produces each quarter hour, binding transmission constraints, and

all real-time Bids and Bid parameters. Advisory prices, as well as some of the binding external

proxy generator prices, are produced by RTC.

The NYISO’s Real-Time Dispatch (RTD) program does not make commitment decisions

and will generally not consider start-up costs in any of its dispatching or pricing decisions.15

Each RTD run co-optimizes to solve simultaneously for Load, Operating Reserves, and

Regulation Service and to minimize the total cost of production over its bid optimization

horizon. In addition to producing binding schedules and the majority of binding prices for the

next five minutes, each RTD run will produce advisory schedules and prices for the remaining

15 As explained in the NYISO’s response to Pricing of Fast Start Resources question 3(c), RTD considers the startup costs of non-committed 10-minute eligible resources that are qualified to set price.

31

four time steps of its bid-optimization horizon. RTD uses the most recent system information and the same set of Bids and constraints that are considered by RTC.

When the NYISO needs to respond to system conditions that were not anticipated by

RTC or the regular RTD, such as the unexpected loss of a major generator or transmission line, NYISO operators will activate the specialized RTD-Corrective Action Mode (RTD-CAM)

program. RTD-CAM runs are nominally either five or ten minutes long and, by design, do not include look-ahead capability in order to minimize execution time. Operators manually execute each RTD-CAM.. Unlike RTD, RTD-CAMs can commit 10-minute start resources. When RTD-CAM is activated, the NYISO has the ability to implement various measures to restore normal operating conditions. Section 6.2 of the NYISO’s Transmission and Dispatching

Operations Manual provides additional details on RTD-CAMs.16

16 Link to Transmission and Dispatch Operations Manual:

http://www.nyiso.com/public/webdocs/markets_operations/documents/Manuals_and_Guides/Manuals/Operations/tr

ans_disp.pdf

32

Commission Question

2. Please list all of the unit commitment and dispatch processes that execute after the

close of the day-ahead energy market, up to and including all unit commitment and

dispatch processes used in the real-time market. Please indicate whether each process

uses look-ahead modeling. With respect to each process that uses look-ahead

modeling, please address each of the topics listed below and include examples where

possible.

b. Please discuss whether and how look-ahead modeling affects real-time price

formation and/or operational efficiencies (especially with respect to the

commitment and pre-positioning of fast-start and flexible resources).

NYISO Response

i. Please explain whether and how the RTO’s/ISO’s look-ahead model pre-

positions the dispatch of resources in anticipation of system needs,

especially with respect to expected near-term needs for ramping

capability. Please explain whether and how the RTO’s/ISO’s look-ahead

model optimizes the commitment of resources in anticipation of system

needs.

Look-ahead features are part of both RTC and RTD, each of which are based on the minimization of production costs to meet power system needs through commitment of resources and ramping of resources. Achieving a least production cost commitment and dispatch requires recognition of inter-temporal constraints (e.g. ramp and minimum run time constraints). The RTC horizon is nominally two and a half hours and the RTD

optimization horizon is 55 to 65 minutes, depending on the interval. RTC and RTD

commit and dispatch to resolve anticipated inter-temporal constraints in the look-ahead intervals. RTC and RTD minimize costs over all look-ahead intervals, but only the first interval is binding. All other look-ahead intervals are advisory.

RTC may elect to commit or schedule otherwise uneconomic resources, including

generation and/or interchange, in order to ensure sufficient ramp capability is available to

33

meet anticipated changes in resource commitments/de-commitments, changes in load or transmission outages, with the goal of minimizing production costs over the entire lookahead interval. Likewise, RTD may elect to ramp otherwise uneconomic resources early in the hour-long optimization horizon in order to ensure sufficient ramp capability is available to meet anticipated changes due to resource commitments/de-commitments, load, interchange ramps or transmission outages.

ii. If the RTO/ISO uses look-ahead modeling to make unit commitment

decisions, how far in advance of real-time does the operator issue

commitment instructions? Does this time period for issuing commitment

instructions differ by resource characteristics, such as start-up time?

There are two mechanisms to get commitment decisions prior to the start of the Real-

Time Market. The first is the DAM which posts results by 11:00 on the day before the real-time operating day. The second is the SRE process, which can be engaged if unexpected conditions occur after the close of the DAM. If the SRE process is implemented, results are posted as soon as the decision is made by the operators.

RTC software makes commitment decisions in real-time. RTC makes binding unit

commitment and de-commitment decisions for the periods beginning fifteen minutes (in the case

of Resources that can respond in ten minutes) and thirty minutes (in the case of Resources that

can respond in thirty minutes) after the scheduled posting time of each RTC run. RTC provides

advisory commitment information for the remainder of the two and a half hour optimization

period, and produces binding schedules for External Transactions to begin at the start of each

quarter hour.

34

SCUC and RTC each take into account a generator’s start-up time. RTC can start-up generators with 30-mintue and 10-minute start-up times.

iii. Please explain whether and how look-ahead modeling affects real-time

prices. In this regard, please explain whether and how the look-ahead model calculates actual real-time prices, and whether and how constraints in future periods affect price formation.

The real-time price (LBMP) is calculated in RTD recognizing the inter-temporal

constraints, such as ramp constraints, expected future system topology changes (such as the

scheduled outage of a transmission line), future resource availability changes (such as the forced outage of a generator that received a Day-Ahead schedule), load changes, etc. Thus, future

constraints can affect the binding period real-time price.

Whenever there is an intertemporal constraint such that a change in future dispatch costs will occur due to a dispatch decision made in the initial time step, all of the incremental costs must be included in the price of the initial time step in order to properly evaluate whether the least-cost dispatch decision is made.

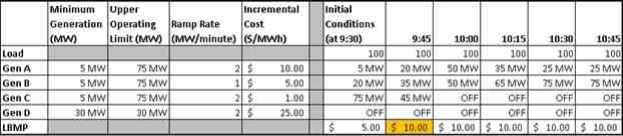

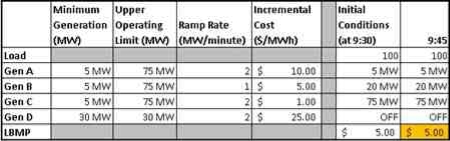

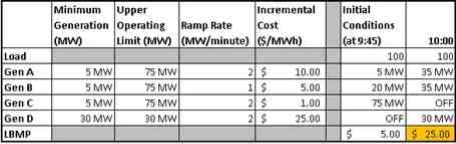

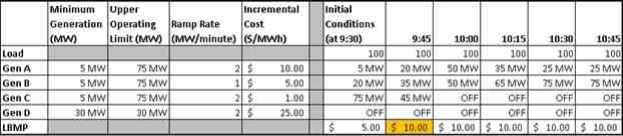

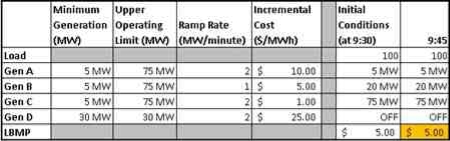

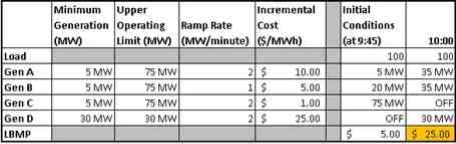

Consider a scenario with four generators that must be scheduled to minimize production

cost while respecting physical parameters including the Upper Operating Limit (UOL), minimum

generation limit and ramp rate of each generator. The look-ahead example in Table 1 (below) is

contrasted with examples that do not include look-ahead capability in Tables 2a and 2b. The

initial condition at 9:30 in Table 1 shows an incremental cost of $5.00, which is exactly the same

as the 9:30 interval in the set of conditions in Table 2a. The 9:45 interval in Table 1 has

incremental cost of $10.00 because Generator A has been dispatched upward to serve load; the

35

optimization horizon in the look-ahead case recognizes that Generator C must shut-down at

10:00 and Generator A is dispatched up in anticipation of Generator C’s shut-down.

Conversely, the case in Table 2a does not include Generator C turning off at 10:00 in its optimization horizon and thus does not move Generator A; the incremental cost calculated in Table 2a for 9:45 remains at $5.00 (slightly lower than Table 1). However, in Table 2b the 10:00 interval reflects a $25.00 incremental cost to commit Generator D in order to accommodate the shut-down of Generator C. The incremental cost in Table 2b is significantly higher than the

incremental cost in Table 1 for the 10:00 interval.

In the example, look-ahead modeling avoids the need to commit the quick start unit

(Generator D) to serve load, as well as the price spike associated with that commitment.

36

“With Look-Ahead” Table 1

“Without Look-Ahead” Table 2a

“Without Look-Ahead” Table 2b

iv. Please discuss whether and how look-ahead modeling can reduce out-of-

market commitments by operators.

Prepositioning the system to address anticipated future constraints can increase the

number of solutions available and thus reduce the need for out-of-market commitments. If the

NYISO did not have look-ahead modeling in RTC and RTD that incorporates ramp rates,

minimum run time, minimum down time, and other generator commitment parameters, the

37

NYISO’s operators would be required to intervene more frequently in the NYISO’s commitment and dispatch process.

v. Please explain whether and how look-ahead modeling provides greater

benefits when used to make actual market decisions rather than solely as an advisory tool for operators.

RTC and RTD minimize production cost over their respective evaluation horizons. Each

program makes market decisions. The look-ahead modeling sends the right signal to the

marketplace to preposition resources in anticipation of expected future events. Having RTC and

RTD utilize look-ahead modeling to make decisions allows the commitment and dispatch

process to build upon previous decisions. The market software with its look-ahead capability is

able to commit and dispatch more quickly, consider more variables and, generally, to realize a

lower total production cost relative to what an operator could achieve if the software was used

only as an advisory tool.

Incorporating look-ahead modeling into the market solution minimizes the manual

processes and operator decisions that would be required if look-ahead modeling is only used as

an advisory tool for operators. During dynamic system conditions and events it can be

challenging for operators to identify the appropriate commitments as quickly as an automated

market solution.

38

vi. Please discuss any other potential or actual benefits from look-ahead

modeling.

As explained above, look ahead modeling provides a more accurate representation of

system conditions and allows for the anticipation of ramp constraints, resulting in more accurate instructions to resources and more efficient scheduling with neighboring control areas.

Commission Question

3. Please describe any RTO/ISO and/or stakeholder initiatives or plans, if any, related to

look-ahead modeling. For any look-ahead modeling enhancements that the RTO/ISO

and/or its stakeholders are currently considering, please discuss any evaluation of the

costs and/or complexities of look-ahead modeling relative to its potential benefits,

and the estimated time frame for implementation of any look-ahead modeling

enhancements.

a. Are there any features of existing look-ahead models that could adversely affect

price formation (for instance, are there any instances in which existing look-ahead

model designs could lead to inaccurate price signals)? If so, please describe these

features in detail and discuss whether any improvements are warranted.

b. Please describe any other challenges, complexities, or practical limitations

associated with look-ahead modeling. Where possible, please provide

quantitative examples.

NYISO Response

As discussed in the NYISO’s response to Look-Ahead Modeling question 1, the “RTCRTD Forward Horizon Coordination Improvements” market design project slated for 2016 will be considering the slight modeling inconsistencies between the RTC and RTD look-ahead

evaluations that arise as the two programs evaluate external transactions and the start-up/shut-

down of gas turbines, and will investigate possible revision and adjustment of the look-ahead RTC and RTD evaluations to address the identified inconsistencies.

39

D.Uplift Allocation

Commission Questions

1. Please provide a high-level overview of the RTO’s/ISO’s existing framework for

allocating uplift charges (e.g., briefly explain the principles that guide the

RTO’s/ISO’s allocation of uplift charges and summarize at a high level how these

principles are applied in the day-ahead and real-time energy and ancillary services

markets).

NYISO Response

The NYISO’s cost allocation rules are designed to differentiate and categorize uplift costs

based on the underlying cause of such costs.17 In doing so, the NYISO identifies whether uplift

costs are attributable to actions taken to ensure statewide reliability or actions taken to address

local reliability.

The NYISO allocates uplift costs consistent with “beneficiaries pay” principles (i.e., those receiving the benefits of a given action ultimately bear its costs). Uplift payments to

ensure statewide reliability are allocated to all loads in the New York Control Area (NYCA), while uplift costs associated with local reliability issues are allocated only to the load within the transmission district for which the local reliability actions were taken.18 Real-time uplift costs are allocated to the applicable loads on a Load Ratio Share basis, based on the actual real-time metered load during the hours in which such uplift costs were incurred.

17 As further described in its response to Transparency question 1, the NYISO provides regular reporting to its Market Participants and to the public detailing the categorization and assignment of various uplift costs.

18 The NYISO’s existing uplift allocation procedures are consistent with the recommendations of Potomac

Economics in that the NYISO categorizes uplift costs based on the underlying cause and then allocates costs based on cost causation principles. See Potomac Economics Price Formation Comments at 16-18.

40

Commission Questions

2. Please identify any specific areas where the RTO/ISO believes that its existing uplift

allocation methodology needs improvement. Please discuss these areas, along with

any RTO/ISO and/or stakeholder initiatives or plans aimed at improving uplift

allocation.

a. Please identify any specific transaction types, resource types, schedule deviations,

or other uplift drivers that cause uplift on a regular basis, but do not receive an

allocation of uplift charges under current market rules.

b. Please discuss the complexity of re-designing existing market rules and settlement

systems to better align uplift allocation with cost-causation principles. Please

provide a qualitative assessment of whether and how the potential benefits of

improved uplift allocation outweigh the cost and complexity of implementation

and application.

c. Commission staff’s 2014 paper on uplift noted that a small number of resources

receive the majority of uplift payments in every RTO/ISO. Additionally, PJM

asserts that existing uplift allocation rules likely mute investment signals due to

lack of clarity regarding where uplift payments are being received, and asks the

Commission to provide guidance on principles for uplift allocation. Please

identify any specific areas where the RTO’s/ISO’s current uplift allocation

methodology could potentially mute investment signals.

NYISO Response

The NYISO’s method is designed to allocate the cost of uplift to the customers that are

benefitting from the action that caused the uplift. The allocation of uplift to external transactions could be improved. The NYISO supports the reciprocal elimination of uplift and other fees

allocated to external transactions. The allocation of uplift and other fees reduces trade between regions and adversely impacts total production costs.

To ensure that its revenues cover the expected uplift costs and other transaction fees, a

Market Participant will submit an external transaction request when the expected price difference

between regions exceeds the expected total fees. In financial terms, the participant will

incorporate a margin into its offer to cover the expected fees. This rational behavior prevents

price convergence between regions. System costs will be higher than necessary because the

41

interties will tend to be under‐utilized, relative to external transaction volumes if there were no per‐megawatt transaction fees. In economic terms, transaction fees on external transactions act like a ‘hurdle’ that deters trade and distorts production costs upward.

Allocating uplift and other transaction fees to external transactions impedes price

convergence between regions and raises system production costs. The magnitude of the benefits to loads from eliminating an uplift allocation to external transactions, in the form of lower LMPs due to greater inter‐regional competition, could exceed the cost of uplift and transaction fees that must be recovered from other sources.

Other than addressing the allocation of uplift to external transactions, the NYISO has not identified any areas for improvement where its allocation of uplift mutes appropriate price or

investment signals. The NYISO has not identified any areas where the benefits of changing its uplift allocation methods would outweigh the costs associated with doing so. The NYISO

already identifies individual sources of uplift, down to specific operator actions or market

participant requests, to ensure that uplift is properly allocated, and continually seeks ways to

improve the transparency of the amount of uplift payments. Please see the NYISO’s response to Transparency question 2 for more details about how it reports on and assigns the costs associated with actions taken to protect system or local reliability.

The NYISO has a settlements simulator that allows it to understand expected settlement impacts before the NYISO proposes changes to its market rules. This settlement simulator has become an invaluable tool when the NYISO evaluates its hypothesis and rationale for changing market and/or settlement rules.

42

Commission Questions

3. Please explain the methodology by which the RTO/ISO allocates day-ahead and real-

time energy and ancillary services market uplift, including an explanation of whether

and how the allocation rules follow cost-causation principles. [fn. Please include in

this response a discussion of virtual transactions.] In this regard, please explain the

following (referencing specific charge codes to the extent that it is practical):

a. Explain whether and how day-ahead and real-time energy and ancillary services

market uplift is allocated to transactions that cause the commitment of resources that receive uplift payments;

b. Explain whether and how the RTO/ISO allocates real-time energy and ancillary

services market uplift to market participants’ deviations from day-ahead

schedules, and whether and how deviations that increase the need for actions that cause uplift (harming deviations) are netted against deviations that reduce the need for actions that cause uplift (helping deviations);

i. explain whether and how uplift related to real-time resource commitments for

transmission constraint management is allocated to schedule deviations;

ii. explain whether and how uplift related to real-time resource commitments for

system reliability is allocated to schedule deviations;

c.Explain the locational granularity with which this uplift is allocated (e.g., RTO-

wide, zonally);

i. explain whether and how uplift related to real-time resource commitments for

voltage and local reliability is allocated to local transmission areas or zones;

d. Explain whether day-ahead and real-time energy and ancillary services market

uplift is allocated on an hourly, daily average, or another basis;

e. Discuss and explain whether there are certain components of day-ahead and real-

time energy and ancillary services market uplift that cannot be allocated

consistent with cost-causation principles, and if so explain how these are

allocated;

f. Explain the conditions under which the RTO/ISO exempts from the allocation of

each charge any market participants, transactions, or schedule deviations that

would otherwise receive an allocation, and explain the rationale for such

exemptions.

g. Finally, list and explain the categories of transactions, or schedule deviations to

which the RTO/ISO allocates day-ahead and real-time energy and ancillary

services market uplift charges. For the period spanning October 1, 2014 through

September 30, 2015, report the share of day-ahead energy and ancillary services

market uplift (in percentage terms) allocated to each category. Similarly, report

the share of real-time energy and ancillary services market uplift allocated to each

category over the same time period. Do not identify any specific market

participants.

43

NYISO Response

The NYISO has three major categories of uplift:

1) Bid Production Cost Guarantees (BPCG) - both Day-Ahead and real-time: A make-

whole payment paid primarily to generators when a unit’s cost to run has exceeded its

LBMP + ancillary service revenue for the time period committed by the NYISO.

Generators must bid such that the NYISO commits the unit in order to be eligible to

receive a BPCG. Self-Committed generators are not ordinarily eligible for BPCG

payments.19

2) Day Ahead Margin Assurance Payments (DAMAP) - The NYISO will make a generator

“whole” to its Day-Ahead margin if the unit is committed in real-time and actions