134 FERC ¶ 61,058

UNITED STATES OF AMERICA

FEDERAL ENERGY REGULATORY COMMISSION

Before Commissioners: Jon Wellinghoff, Chairman;

Marc Spitzer, Philip D. Moeller,

John R. Norris, and Cheryl A. LaFleur.

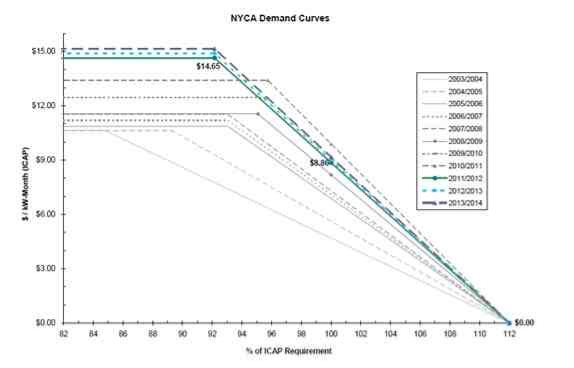

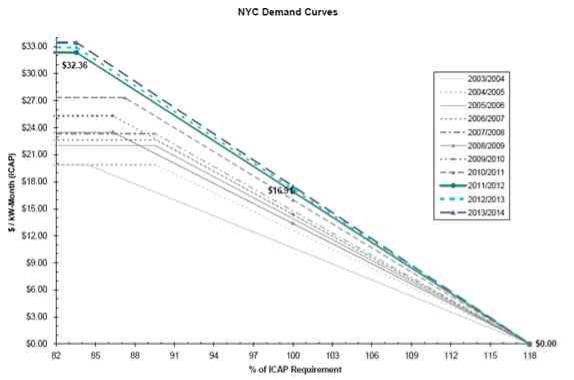

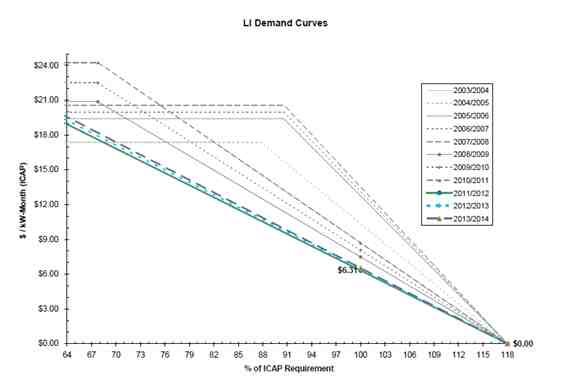

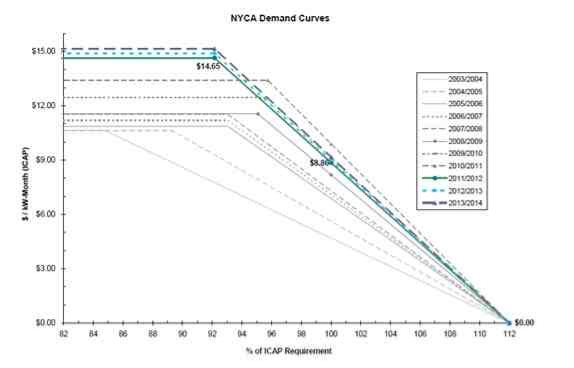

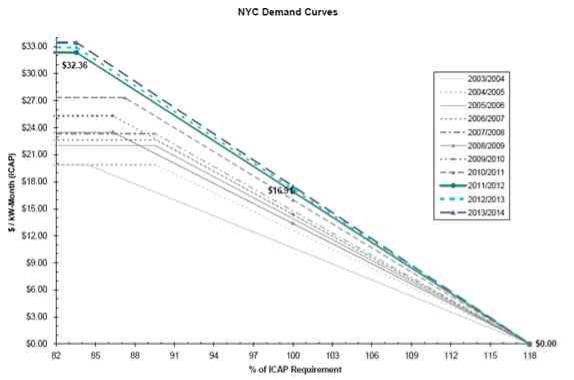

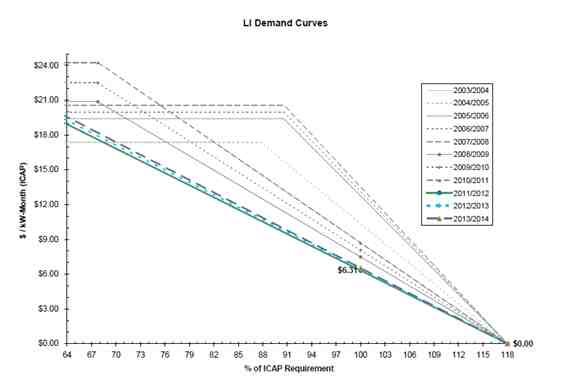

New York Independent System Operator, Inc.Docket No. ER11-2224-000

ORDER ACCEPTING TARIFF REVISIONS SUBJECT TO MODIFICATION,

SUSPENDING FOR FIVE MONTHS, AND DIRECTING COMPLIANCE FILING

(Issued January 28, 2011)

1. On November 30, 2010, the New York Independent System Operator, Inc.

(NYISO) filed revisions to section 5.14 of its Market Administration and Control Area Services Tariff (Services Tariff) pursuant to section 205 of the Federal Power Act

(FPA).1 The proposed tariff revisions update the demand curves for the Installed

Capacity (ICAP) market for capability years 2011/2012, 2012/2013, and 2013/2014.2

The filing also provides supporting documentation and analysis. In this order the

Commission accepts, and suspends for five months, the revisions to the Services Tariff to be effective the earlier of June 28, 2011, or a date set by a subsequent Commission order, subject to modifications discussed in this order. The Commission finds specific

inconsistencies in the determination of the proposed ICAP demand curves and directs a further compliance filing within 60 days of the date of this order.

I.Background

2.NYISO is required to determine the amount of ICAP that each load serving entity

(LSE) must acquire to ensure that adequate resources are available to meet projected load

on a long-term basis taking into account reliability contingencies. The amount of ICAP,

1 16 U.S.C. § 824d (2006).

2 NYISO’s capability year consists of the summer capability period and the winter

capability period that runs from May 1 through October 31 and November 1 through

April 30.

Docket No. ER11-2224-000- 2 -

in megawatts, required to provide adequate resources to meet reliability contingencies for

the New York Control Area (NYCA) is represented by the Installed Reserve Margin

(IRM), which is currently 18 percent.3 In other words, for reliability purposes, NYISO is

required to have an amount of ICAP equal to 18 percent above forecasted peak demand.

NYISO determines the locational ICAP requirement for NYCA, there are separate

location-specific ICAP requirements for LSEs in New York City (NYC) and Long Island

(LI), which reflect the existence of transmission constraints in those areas.4

3. In 2003, NYISO implemented an ICAP market centered on administratively-

determined demand curves for each of the three ICAP zones. The ICAP demand curves define the maximum monthly price in $/kW-month for capacity depending on the amount of capacity offered in each month. A separate ICAP demand curve is applicable for each of the three ICAP zones and is effective for each capability year. Thus, an ICAP demand curve is a monthly price schedule where the market clearing price on the schedule is

determined by the capacity supply offered. Prior to the use of the administratively-

determined demand curves, the ICAP price was determined by what essentially was a

vertical demand curve at the IRM and all capacity above the requirement had no value. The ICAP demand curves are used to determine both price and ICAP quantity

requirements in the monthly ICAP spot market auctions.

4. Section 5.14.1.2 of the Services Tariff requires NYISO to perform a triennial

review to determine whether the parameters for the ICAP demand curves should be

adjusted. The previous review for the 2008/2009, 2009/2010, and 2010/2011 curves was conducted in 2007 and accepted by the Commission in January 2008.5 The review

process typically takes over one year and includes the retention of a consultant to develop and propose a set of demand curves based on the identified criteria, a stakeholder process to comment on and evaluate the proposed curves, and the presentation of NYISO’s final

recommendations to the NYISO Board of Directors. The proposed curves are to be filed with the Commission on or before November 30th of the year prior to the first capability

year of the next triennial period.

3 The New York State Reliability Council, L.L.C. filed the IRM on December 16, 2010 in Docket No. ER11-1392-000.

4 NYC and LI are defined as Localities under section 2.12 of the Services Tariff. As defined by section 2.18 of the Services Tariff, rest-of-state refers to ICAP within NYCA and located outside of the two defined localities.

5 New York Indep. Sys. Operator, Inc., 122 FERC ¶ 61,064 (2008) (2008 Reset

Order).

Docket No. ER11-2224-000- 3 -

5.Specifically, section 5.14.1.2 of the Services Tariff requires that the periodic

review assess:

(i) the current localized levelized embedded cost of a peaking unit in each

NYCA Locality and the Rest of State to meet minimum capacity

requirements; (ii) the likely projected annual energy and ancillary services

revenues of the peaking unit over the period covered by the adjusted ICAP

demand curves, net of the costs of producing such energy and ancillary

services, under conditions in which the available capacity would equal or

slightly exceed the minimum Installed Capacity requirement; (iii) the

appropriate shape and slope of the ICAP demand curves, and the associated

point at which the dollar value of the ICAP demand curves should decline

to zero; and (iv) the appropriate translation of the annual net revenue

requirement of the peaking unit determined from the factors specified

above, into monthly values that take into account seasonal differences in

the amount of capacity available in the ICAP Spot Market Auctions. For

purposes of this review, a peaking unit is defined as the unit with

technology that results in the lowest fixed costs and highest variable costs

among all other units’ technology that are economically viable.

The remaining provisions of section 5.14.1.2, i.e., sections 5.14.1.2.1 through 5.14.1.2.11 provide the process under which the above review will take place and be filed with the

Commission.

6. The typical ICAP demand curve values ICAP on the y-axis in $/kW-month and

ICAP quantity on the x-axis expressed as percentages of the Minimum Installed Capacity

Requirement for NYCA, NYC, or LI, as applicable. The maximum value for each ICAP

demand curve is 1.5 times the net Cost of New Entry (CONE) or the estimated localized

levelized cost per kW-month to develop a new peaking unit in each locality or in the rest

of state, as applicable. Net CONE is the estimated localized levelized cost per kW-month

to develop a new peaking unit with energy and ancillary services revenues subtracted.

The intersection of 100 percent of the ICAP requirement and net CONE determines the

ICAP reference point. Two defined points, the ICAP reference point and the zero

crossing point (set at 112 percent for NYCA and 118 percent for NYC or LI), articulate a

line segment with a negative slope that will result in higher values for percentages less

than 100 percent of the Installed Capacity Requirement of NYCA or the locality.

Docket No. ER11-2224-000- 4 -

7. The addition of the Capacity Resource Interconnection Service approved by the

Commission in the Deliverability Orders as required by Order No. 2003,6 became

effective in 2008, subsequent to the previous demand curve reset. Pursuant to

section 5.12.1 of the Services Tariff and section 25 of Attachment S of the NYISO Tariff,

a new generator must be determined to be deliverable throughout the capacity zone in

which it interconnects in order to participate in the capacity market. If it is determined to

not be deliverable, the developer is responsible for the cost of System Deliverability

Upgrades necessary to achieve full deliverability as allocated pursuant to the provisions

of the Attachment S. System deliverability upgrades are in addition to the cost of System

Upgrade Facilities required to interconnect for the basic Energy Resource Interconnection

Service to sell energy and ancillary services in the NYISO markets. Previous demand

curves included the cost of System Upgrade Facilities in CONE.

8. A deliverability issue within the rest-of-state capacity zone is relevant to the

instant filing. NYISO’s independent market monitor Dr. David Patton (MMU), as

recently as the NYISO 2009 State of the Market Report, identified a rest-of-state intra-

zonal transmission constraint with regard to the upstate New York (UPNY) and the

Southeast New York (SENY) interface. Capacity that is located in the UPNY region is

not currently deliverable to load zones in the Southeast New York region (also referred to

as Lower Hudson Valley).7 Therefore, new resources located in UPNY must pay for

System Deliverability Upgrades in order to sell capacity in the rest-of-state market,8 or

they must obtain them pursuant to section 25.9.3.1 of Attachment S from a deactivated

generator whose deliverability rights pre-date the deliverability rules. The NYISO 2009

6 Standardization of Generator Interconnection Agreements and Procedures,

Order No. 2003, FERC Stats. & Regs. ¶ 31,146 (2003), order on reh’g, Order

No. 2003-A, FERC Stats. & Regs. ¶ 31,160, order on reh’g, Order No. 2003-B, FERC

Stats. & Regs. ¶ 31,171 (2004), order on reh’g, Order No. 2003-C, FERC Stats. & Regs.

¶ 31,190 (2005), aff'd sub nom. Nat’l Ass’n of Regulatory Util. Comm’rs v. FERC, 475

F.3d 1277 (D.C. Cir. 2007), cert. denied, 552 U.S. 1230 (2008). See generally New York

Indep. Sys. Operator, Inc., 126 FERC ¶ 61,046 (2009); New York Indep. Sys. Operator,

Inc., 127 FERC ¶ 61,318 (2009); and New York Indep. Sys. Operator, Inc.. 131 FERC

¶ 61,242 (2010).

7 The SENY, or the Lower Hudson Valley, region is comprised of load zones G, H, and I and are identified on Figure 2.

8 See NYISO 2009 State of the Market Report at 122.

Http://www.nyiso.com/public/webdocs/documents/market_advisor_reports/2009/NYISO

_2009_SOM_Final.pdf.

Docket No. ER11-2224-000- 5 -

State of the Market Report also recommended that NYISO make preparations to

implement a new capacity zone in 2010.9

Figure 1

II.Summary of the November 30, 2010 Filing

9.On November 30, 2010, NYISO filed revisions to the Services Tariff that

implement revised ICAP demand curves for Capability Years 2011/2012, 2012/2013, and 2013/2014. NYISO states that the filing presents the results of the periodic review of the ICAP demand curves specified in section 5.14.1.2 of the Services Tariff.

9 Id. at 125.

Docket No. ER11-2224-000- 6 -

10. NYISO states that in accordance with the Services Tariff provisions, in the third

quarter of 2009 it solicited proposals from qualified consultants to identify appropriate

methodologies and to develop the ICAP demand curve parameters for the three capability

years beginning in May 2011. NYISO adds that it retained the team of National

Economic Research Associates, Inc. (NERA), with Sargent and Lundy (S&L) as a

subcontractor to NERA (collectively, the Consultant). NYISO explains that the

Consultant began the analysis in December 2009 and participated in thirteen Installed

Capacity Working Group meetings between December 2009 and August 2010, during

which the demand curve reset was discussed and developed. NYISO states that at each

of these meetings, and through written comments, stakeholders provided comments to the

Consultant on the Consultant’s assumptions, analysis, estimates, and preliminary results.

NYISO also states that based on comments received, the Consultant adjusted its

assumptions and methodologies as appropriate, and responded to the comments. On

July 1, 2010, according to NYISO, the Consultant released a first draft of its report for

stakeholder review and comment and on September 3, 2010 as revised on September 7,

2010, the final version was released (Consultant’s Report).10

11. NYISO then prepared its staff report to the NYISO Board of Directors that

includes its recommendations for the ICAP demand curve parameters, the underlying assumptions used in formulating the recommendations, and the three ICAP demand curves (NYISO Report).11 NYISO states that in preparing its recommendation, it

considered the Consultant’s Report, stakeholders’ oral and written comments, and the recommendations of the MMU.

12. NYISO states that following submission of the NYISO Report to the Board,

stakeholders had an opportunity to submit oral and written comments to the Board and these were reviewed by NYISO staff, the MMU, and the NYISO Board. NYISO staff recommended that the Board approve the NYISO Report without any alterations. The instant filing was approved by the Board on November 16, 2010.

10 NYISO November 30, 2010 Filing at Attachment 2, Independent Study to

Establish Parameters of the ICAP Demand Curve for the New York Independent System Operator, September 3, 2010 (revised September 7, 2010, November 15, 2010).

11 NYISO November 30, 2010 Filing at Attachment 3, Proposed NYISO Installed Capacity Demand Curves for Capability Years 2011/2012, 2012/2013, and 2013/2014.

(September 3, 2010) (revised September 7, 2010 and October 30, 2010) (NYISO Report). The Commission includes the ICAP demand curves proposed for the three localities as

Appendix A to this Order.

Docket No. ER11-2224-000- 7 -

13. Based on the Consultant’s study and discussions with the MMU, NYISO proposes

to use the General Electric LMS100 for the NYC and LI demand curves and the General

Electric Frame unit 7FA (7FA) for the NYCA demand curve. The gas-fired LMS100

unit is an aeroderivative combustion turbine and the 7FA is the less efficient frame type

combustion turbine. Both meet the Services Tariff requirements that the unit have the

lowest fixed costs and the highest variable costs and be economically viable.

14. For the calculation of peaking unit cost of new entry (CONE), NYISO proposes to use capital costs, including direct costs encompassed within engineering, procurement

and construction contracts, owners’ costs not covered by the foregoing contracts,

financing costs during construction, and working capital and initial inventories. NYISO proposes that System Deliverability Upgrade costs be excluded from the calculation of

the peaking unit’s CONE.

15. In addition, NYISO proposes to include fixed operating and maintenance cost, including property taxes and insurance, based on the Consultant’s recommendation. NYISO also proposes to recognize full New York City property tax abatement as

discussed below. NYISO adopts the Consultant’s recommendations with respect to the inclusion of variable operating and maintenance costs and the methodology for

determining the annual carrying charge rate used in the calculation of the current

levelized embedded cost of the peaking units.

16. Expectations as to the amount of ICAP relative to the annual locational and

NYCA minimum ICAP requirement will impact the level of energy and ancillary services revenues received by the new peaking unit. Based upon the Consultant’s energy model and NYISO’s proposed level of excess, NYISO calculated estimated energy and ancillary services revenue of $27.44/kW-year for NYCA, $101.67/kW-year in NYC, and

$168.77/kW-year on LI for the peaking technologies chosen in the study.

17. The Consultant also reviewed the shapes of the current demand curves and found

no basis to change the current shape and zero crossing points. In accord with that

conclusion, NYISO proposes that the current demand curve slope and zero crossing point

be retained and that the zero crossing point remain at 112 percent of the ICAP

requirement for the NYCA and at 118 percent for NYC and LI. NYISO states that this

approach is consistent with its determination in the 2007 reset process that there was no

compelling reason to change demand curve shapes or zero crossing points at that time.

III.Notice, Interventions, and Protests

18.Notice of NYISO’s November 30, 2010 filing was published in the Federal

Register, 75 Fed. Reg. 76,721 (2010), with interventions and comments due on or before

Docket No. ER11-2224-000- 8 -

December 21, 2010. Motions to intervene were filed by: NRG Companies;12

TransCanada Power Marketing Ltd., and TC Ravenswood, LLC; Entergy Power

Marketing Corporation; Astoria Generating Company; and PSEG Energy Resources & Trade LLC and PSEG Power New York LLC. Bayonne Energy Center, LLC (Bayonne Energy) filed a motion to intervene out-of -time.

19. Constellation Energy Nuclear Group, LLC and Constellation Energy Commodities Group, Inc. each filed motions to intervene and comments. The New York Public

Service Commission (New York Commission) filed a motion to intervene and file

comments out-of-time.

20. Motions to intervene and protests were filed by Multiple Intervenors,13 Dynegy

Power Marketing, Inc. and Sithe/Independence Power Partners, L.P., and Dynegy

Northeast Generation, Inc. (Dynegy); Independent Power Producers of New York, Inc.

(IPPNY);14 New York State Consumer Protection Board (Consumer Protection Board);

New York Transmission Owners (NYTOs);15 Calpine Corporation (Calpine); The City of

12 The NRG Companies are: NRG Power Marketing Inc, Arthur Kill Power LLC, Astoria Gas Turbine Power LLC, Dunkirk Power LLC, Huntley Power LLC, and

Oswego Harbor Power LLC.

13 Multiple Intervenors is an unincorporated association of approximately 55 large

industrial, commercial and institutional energy consumers with manufacturing and other

facilities located throughout New York, primarily in the rest-of-state capacity region.

14 IPPNY is a not-for-profit trade association with more than 100 members involved in the development and operation of electric generating facilities and the marketing and sale of electric power in New York.

15 The New York Transmission Owners are: Central Hudson Gas & Electric

Corporation, Consolidated Edison Company of New York, Inc., Long Island Power

Authority, New York Power Authority, New York State Electric & Gas Corporation,

Niagara Mohawk Power Corporation, Orange and Rockland Utilities, Inc., and Rochester Gas and Electric Corporation.

Docket No. ER11-2224-000- 9 -

New York (New York City); the Electric Power Supply Association (EPSA); the New York City Suppliers;16 and GenOn Parties (GenOn).17

21. The City of New York, NYISO, IPPNY, the NYTOs, and New York City

Suppliers each filed answers. The NYTOs also filed an answer to IPPNY’s answer.

IV. Procedural Matters

22. Pursuant to Rule 214 of the Commission’s Rules of Practice and Procedure,

18 C.F.R. § 385.214 (2010), the notices of intervention and timely, unopposed motions to intervene serve to make the entities that filed them parties to this proceeding.

23. Pursuant to Rule 214(d) of the Commission’s Rules of Practice and Procedure,

18 C.F.R. § 385.214(d) (2010), the Commission will grant Bayonne Energy’s and the

New York Commission’s late-filed motions to intervene given their interest in the

proceeding, the early stage of the proceeding, and the absence of undue prejudice or

delay.

24.Rule 213(a)(2) of the Commission’s Rules of Practice and Procedure, 18 C.F.R.

§ 385.213(a)(2) (2010) prohibits an answer to a protest or to an answer unless otherwise

ordered by the decisional authority. We will accept the answers filed in this proceeding

because they have provided information that assisted us in our decision-making process.

V.Discussion

A.Choice of Peaking Unit

1.NYISO’s Proposal

25.NYISO states that in selecting appropriate proxy peaking unit technology for each

region, the Consultant assumed that only units that could be practically constructed in a

particular location would qualify and that the units would be reasonably large scale,

standard generating facilities that are replicable. NYISO also states that after

consideration among stakeholders, it was determined that because currently available

demand response does not have the ability to respond to longer deployments under

16 For purposes of this proceeding, the New York City Suppliers are: Astoria Generating Company, L.P., the NRG Companies, and TC Ravenswood, LLC.

17 GenOn consists of GenOn Energy Management, LLC, GenOn New York, LLC, and GenOn Bowline, LLC.

Docket No. ER11-2224-000- 10 -

current market rule designs, NYISO will consider the use of demand response as the

peaking unit in the next reset cycle contingent on the better definition of the process for identifying the technology types and the methodology for quantifying fixed and variable costs associated with demand response technologies.18

26. NYISO states that like the previous two ICAP demand curve studies, the

Consultant focused on General Electric (GE) generating unit technologies because GE

technologies are representative of other manufacturers’ designs and account for over 56

percent of the peaking units sold both nationally and in New York. The Consultant also

considered the Rolls Royce Trent 60 WLE (Trent 60) unit as a possible peaking unit

technology. NYISO states that the Consultant examined four types of units: a 7FA

Frame unit (7FA), and three types of aeroderivatives: LM 6000, LMS100, and the Trent

60. The Consultant compared the characteristics of each technology and the relative cost on a total cost and a $/kW basis.

27. NYISO contends that the Services Tariff does not explicitly indicate whether the

unit with lowest fixed costs should be chosen based on total cost or cost per kilowatt,19

and NYISO’s two previous demand curve update studies selected the appropriate peaking

technology based in part on cost per kilowatt figures. NYISO agrees with the Consultant

that fixed costs should be measured on a $/kW basis because that approach recognizes the

efficiencies of building two-unit sites and the increased energy and ancillary services

revenue that would be captured, while choosing a peaking technology based on total dollars would ignore these efficiencies.20

28. NYISO proposes to use the LMS100 as the peaking unit to establish both the NYC

and LI demand curves. According to NYISO, the LMS100 was accepted by the

Commission as the peaking unit for NYC and LI in the previous demand curve reset,21 it

has lower capital and operating costs per kilowatt than the LM 6000 and the Trent 60, it

18 NYISO maintains that there is not yet an established set of parameters or

characteristics for a particular demand response technology (i.e., a technology by which load-side resources achieve reductions) to be identified with any reasonable measure of certainty. NYISO contends that even if an identified technology could be ascertained with certainty, the fixed and variable costs make it unsuitable for consideration as a peaking unit in the current demand curve reset review. NYISO Report at 6.

19 See Services Tariff, Section 5.14.1.2.

20 NYISO November 30, 2010 Filing at 6-7.

21 See 2008 Reset Order, 122 FERC ¶ 61,064 at P 23.

Docket No. ER11-2224-000- 11 -

has a lower heat rate (that results in a higher capacity factor and higher energy revenues on a per kW basis), it has a lower fixed cost on a $/kW basis, and it meets environmental requirements.

29. NYISO proposes to use a 7FA unit in the Capital Zone (Load Zone F) as the

peaking unit for setting the NYCA demand curve. NYISO argues that it has a lower

fixed cost on a $/kW basis compared with either the LMS100 or LM 6000, and is

economically viable outside of NYC and LI.22 NYISO states that the Commission

accepted its proposal to use the 7FA unit for the NYCA in the previous demand curve

reset.23

30. NYISO states that certain stakeholders questioned the ability of a 7FA facility to operate under the New Source Review24 standards for stationary sources. NYISO states that it confirmed with the New York State Department of Environmental Conservation that standards would apply only to any new facility emitting greater than 100 tons of

nitrogen oxides (NOx) annually. NYISO argues that a new 2-unit 7FA facility would not be subject to the standards because the 100 ton limit would translate into a maximum run time in Zone F of 1461 hours, and under the assumed levels of excess capacity, the 2-unit 7FA facility would operate below 1200 hours.25

31. NYISO also states that some load-side stakeholders have taken the position that a

lower cost LI proxy unit should be used as the NYCA peaking unit instead of the Frame

7FA. NYISO maintains however, that this suggestion is inconsistent with the Services

Tariff, which requires NYISO and the Consultant to assess the current localized levelized

embedded cost of a peaking unit located in the rest-of-state when establishing the NYCA

demand curve. NYISO also cites its ICAP Manual, which requires that NYISO calculate

22 Id. (citing the Consultant’s Report at 9).

23 NYISO November 30, 2010 Filing at 9 (citing 2008 Reset Order, 122 FERC ¶ 61,064 at P 22).

24 New Source Review is a permitting program adopted by Congress to ensure that

air quality is not significantly degraded from the addition of, inter alia, new power plants.

The basic requirements are established by the Environmental Protection Agency and

permits are issued by state or local air pollution control agencies. See

http://www.epa.gov/NSR/.

25 NYISO November 30, 2010 Filing at 9.

Docket No. ER11-2224-000- 12 -

“the estimated localized levelized cost … to develop a new peaking unit in each

Locality.”26

2.Comments and Protests

32.The NYTOs, the New York Commission, and the Consumer Protection Board

separately conclude that since generation on Long Island has the lowest net CONE, the

ICAP demand curve for the NYCA should be based on the net cost of developing,

constructing and operating a generator in the LI locality. They contend that NYISO

incorrectly interprets the Services Tariff to require that the peaking unit for the NYCA

demand curve be physically located in rest-of-state in order to serve as the proxy unit.

They argue that while NYISO is correct that it is required to assess the costs of a peaking

unit in each NYCA locality and rest of state, the Services Tariff places no limits on

including the peaking unit with the lowest net CONE in a demand curve for a different

location. They further maintain that the Services Tariff requires only that the unit must

be economically viable, regardless of location. As further support, the NYTOs point out

that NYC and LI are included in determining the capacity price for the NYCA in

NYISO’s spot market auctions and the Consumer Protection Board also notes that LI

locality is where profit-maximizing developers would be most likely to develop

additional reliability resources.

33. The NYTOs and Consumer Protection Board state that a NYCA demand curve

based on an LMS100 on LI would support development of the most efficient additional

capacity when it is needed to meet the minimum capacity requirement for the NYCA.27

The NYTOs state that if the ICAP demand curve for the NYCA is not based on

generation that can be developed in a locality at a lower net cost, the resulting ICAP

demand curve for the NYCA will yield capacity revenues that are higher than needed to

induce development to meet the NYCA minimum capacity requirements. As a result,

load-serving entities will either have to purchase more capacity than is needed, purchase

it at higher prices than they should pay, or both. NYTOs state that the analyses that

26 Id. (citing ICAP Manual § 5.5(1)). NYISO states that the Services Tariff

provides that the review will be conducted in accordance with ISO Procedures and that

the ICAP Manual is the chief source of ISO Procedures in respect of the Capacity market. Thus, according to NYISO, the ISO Procedures to be followed include using a peaking unit located in the rest-of-state to establish the NYCA demand curve.

27 Consumer Protection Board December 21, 2010 Protest at 7; NYTOs December 21, 2010 Protest at 3-5.

Docket No. ER11-2224-000- 13 -

NYISO Staff and the Consultant have produced indicated that the use of a Frame 7FA

generator in the Capital Zone is not economically viable.28

3.Answers

34.NYISO reiterates the argument made in its November 30, 2010 Filing that the

Services Tariff does not permit the NYCA demand curve to be set using an LI or NYC peaking unit, but rather requires that the NYCA demand curve be based on the costs of a peaking unit located in the rest-of-state area. NYISO asserts that this point is clarified and confirmed by the ICAP Manual, which is in no way inconsistent with the Services Tariff.29 NYISO also argues that the Consultant’s analysis indicates that a Frame 7FA unit in the Capital Zone would cost less on a $/kW basis than other alternatives in the rest-of-state and is therefore economically viable.

35. IPPNY argues that the argument of the NYTOs for an LI peaking unit are contrary

to the Services Tariff and Commission precedent in accepting the NYISO’s prior demand

curve reset filings. IPPNY also contends that the NYISO ICAP Manual, that stems from

the Services Tariff directives, expressly requires that the NYISO calculate “the estimated

localized levelized cost … to develop a new peaking unit in each Locality (for the ICAP

demand curves for the NYC and LI Localities) or in the rest-of-state region (for the

NYCA ICAP demand curve).”30 IPPNY asserts that its interpretation of the Services

Tariff in the previous demand curve reset process was endorsed by the Commission in the

previous demand curve reset when the Commission accepted a rest-of-state peaking plant

as the basis for the NYCA demand curve, even though the rest-of-state peaking plant had

a higher net CONE than that estimated for the peaking plant located on Long Island.31

28 NYTOs December 21, 2010 Protest at 5 (citing the attached affidavit of Michael

D. Cadwalader at P 7, 14-15; NYISO Report at 19).

29 NYISO January 6, 2011 Answer at 11 (citing NYISO’s November 30, 2010 Filing at n. 26, (citing ICAP Manual at § 5.5(1))).

30 ICAP Manual § 5.5(1) (emphasis added). The Services Tariff provides that the

review will be conducted in accordance with ISO Procedures. The steps delineated lead

to establishing the demand curves. The ICAP Manual is the chief source of ISO

Procedures with respect to the capacity market. Thus, the ISO Procedures to be followed

include using a peaking unit located in the rest-of-state to establish the NYCA demand

curve.

31 2008 Reset Order at P 22-23.

Docket No. ER11-2224-000- 14 -

36. IPPNY maintains that arguments for the placement of a peaking unit on Long

Island falsely assume that it is more economic to develop a peaking unit on Long Island than in the rest-of-state because the Consultant overestimated the net energy and ancillary services revenues that reasonably can be assumed for the LI proxy unit, major

infrastructure changes that were completed near the very end of the demand curve reset period, and the limited export capability of Long Island.32

4.Commission Determination

37.We find that NYISO’s proposal to use the LMS100 peaking unit for developing

the capital cost estimate for NYC and LI and the Capital Zone 7FA peaking unit for

NYCA is reasonable. We agree with NYISO that only reasonably large scale, standard

generating facilities that could be practically constructed in a particular location should

be considered, and that this is consistent with the methodology used in the previous

demand curve reset.33 While we will accept NYISO’s uncontested assertion that demand

response technologies are not practical for use because of deployment limitations of

current market rule designs, the lack of parameters for demand resource technology, and

the unsuitability of fixed and variable costs. We note that NYISO states that it will

consider the use of demand resource technology in the next demand curve reset cycle

contingent upon better definition of the process for identifying technology types, and the

methodology and a means to quantifying the fixed and variable costs associated with

those technologies.34

38. We disagree with the protestors’ assertion that the LI proxy unit be used as the

NYCA peaking unit. This proposal contradicts the plain language of the Services Tariff.

The Services Tariff requires a triennial review to assess “the current localized levelized

embedded cost of a peaking unit in each NYCA Locality and the Rest of State” to meet

minimum capacity requirements in accordance with the ISO Procedures.35 The Services

Tariff defines rest-of-state to be, “the set of all non-Locality NYCA LBMP Load

Zones…includ[ing] all NYCA LBMP Load Zones other than LBMP Load Zones J and

K.”36 Therefore, we conclude that the tariff requires that NYISO determine the localized

32 IPPNY January 7, 2011 Answer 13-14.

33 See 2008 Reset Order, 122 FERC ¶ 61,064 at P 22-23.

34 NYISO November 30, 2010 Filing at 6.

35 Services Tariff, Section 5.14.1.2.

36 Services Tariff, Section 2.18, where Load Zones J and K are NYC and LI respectively.

Docket No. ER11-2224-000- 15 -

levelized embedded costs for three separate peaking units, i.e., one for the NYC (Zone J) locality, one for the LI (Zone K) locality, and one for the rest-of-state. Further, in past applications of the demand curve, the rest-of-state has carried a de facto meaning of all NYCA Load Zones with the exception of NYC and LI.37 Furthermore, protestor’s

assertions would lead to the conclusion that a NYCA peaking unit on LI would need to be deliverable to the entire state, including NYC and rest-of-state. This would infer that a NYCA peaking unit located in rest-of-state would need to be deliverable to NYC and LI, which is not reasonable and not required by the Tariff. Accordingly, we find NYISO

correct in locating the NYCA peaker within the rest-of-state area.

B.Deliverability Costs

1.NYISO’s Proposal

39.NYISO proposes that deliverability costs be excluded from the CONE of the rest-

of-state proxy unit (the Frame 7FA) located in the Capital Zone. NYISO states that the

Consultant identified a range of net CONE results for rest-of-state with and without the

cost of System Deliverability Upgrades but did not take a position on whether these costs

should be included as an element in the demand curves. NYISO states that the Services

Tariff does not expressly state that the cost of System Deliverability Upgrades should be

included in CONE nor is there any precedent from other ISO/RTO markets. In support of

its position, NYISO states that the cost allocation provisions regarding System

Deliverability Upgrades that are contained in the NYISO Tariff were specifically

designed to provide interconnection customers an economic incentive to locate in areas where their capacity would be deliverable.38

40. NYISO further states that including System Deliverability Upgrade costs would suppress desired economic signals because the costs would effectively be shifted to, and be subsidized by capacity buyers by increasing the value of net CONE at equilibrium, provide a windfall to existing generators that are grandfathered from deliverability

requirements, and skew retirement signals. NYISO’s MMU agrees with NYISO stating that under long-run equilibrium, resources may be more deliverable due to reduced

excess capacity and not be exposed to deliverability costs.39

37 2008 Reset Order, 122 FERC ¶ 61,064 at P 22.

38 NYISO December 30, 2010 Filing at 11 (citing New York Indep. Sys. Operator, Inc. 122 FERC ¶ 61,267 (2008)).

39 Id., Attachment 1 at P 15.

Docket No. ER11-2224-000- 16 -

41. NYISO asserts that the value of Transmission Congestion Contracts (TCC) and

incremental TCC awards would offset a generator’s System Deliverability Upgrade costs which are not included in the revenue offsets captured in the calculation of net CONE.

Similarly, NYISO’s MMU asserts that efficient transmission investment will result in

new TCCs of equivalent value offsetting System Deliverability Upgrade costs. The

NYISO MMU further asserts that developers may not incur System Deliverability

Upgrade costs since the NYISO market allows suppliers to procure deliverability rights

from existing retiring resources.

42. NYISO also states that deliverability-related adjustments should be considered in relation to the establishment of a new capacity zone,40 which NYISO notes would

ameliorate the concerns of stakeholders and send clearer economic signals. The NYISO MMU also states that the establishment of a new capacity zone, as recommended in the 2009 State of the Market Report, is more economically efficient than including System Deliverability Upgrade costs in the demand curve.

2.Comments and Protests

43.The New York Commission, Consumer Protection Board, Multiple Intervenors,

and New York City support NYISO’s exclusion of deliverability costs from CONE citing

the cost allocation provisions for System Deliverability Upgrades contained in

Attachment S of the NYISO Tariff that require the interconnection customer to bear the

costs of interconnection. Multiple Intervenors state that allocating deliverability costs to

developers provides the incentive to locate where the capacity provides the greatest

reliability benefits, otherwise, developers will locate where it is cheapest to build

regardless of whether the capacity is deliverable. Multiple Intervenors also contend that a

windfall will occur to generators during the 2011 to 2014 period when no new resources

are needed for reliability purposes and existing resources are expected to supply all

capacity needs.

44. The NYTOs, in support of NYISO’s position, state that the System Deliverability

Upgrade costs are speculative and that it cannot be assumed that a developer would need

to incur them if NYCA were at the minimum capacity requirement. According to the

NYTOs, it is necessary to look at the transmission system with excess capacity removed

in order to make this determination.41 The NYTOs state that their analysis shows that if

surplus capacity were eliminated to the point where the three capacity zones were at the

40 Id. at 11-12 (noting NYISO’s compliance obligation in Docket No. ER04-449-

023).

41 NYTOs December 21, 2010 Protest, Appendix A at P 8.

Docket No. ER11-2224-000- 17 -

minimum requirement simultaneously, 1000 MW of headroom would be created at the UPNY/SENY interface.42 Therefore a new NYCA resource in the Capital Zone would not incur System Deliverability Upgrades.43 The NYTOs also state that it is likely that economic alternatives that address deliverability concerns would be implemented before the need to incur deliverability costs in the capacity market arises.

45. IPPNY44 states that the exclusion of deliverability costs from CONE violates the

NYISO tariff and is therefore unjust and unreasonable. IPPNY requests that the

Commission require NYISO to include the cost of System Deliverability Upgrades in the

calculation of net CONE or require the NYCA demand curve be based on the cost of the

LMS100 proxy unit located in the Lower Hudson Valley where no deliverability costs

would be required. IPPNY also requests that the Commission direct NYISO to base the

NYC proxy unit on actual interconnection costs (including System Deliverability

Upgrade costs) for recent projects. IPPNY states that the NYCA proxy unit located in the

Capital Zone cannot participate in the ICAP market unless it pays for System

Deliverability Upgrades and notes that paying for these upgrades, just as with System

Upgrade Facilities, is fundamental to the interconnection cost policies adopted by the

Commission.45 IPPNY further cites to section 5.14.1.2 of the Services Tariff that

requires the demand curve reset account for the current localized levelized embedded cost

of a peaking unit and to Attachment S section 25.3.1 of the NYISO OATT, which states

that a generation developer must meet the deliverability interconnection standards before

it can qualify as an ICAP supplier. Therefore, according to IPPNY, in order to sell ICAP

in NYCA [rest-of-state] the interconnection customer must be found to be deliverable up

to the UPNY-Con Edison interface, pay for System Deliverability Upgrades to make its

output deliverable, or if available, procure Capacity Resource Interconnection Service

rights from other parties.46

42 As relevant here, headroom is the electrical capacity of the System Upgrade

Facility or of the System Deliverability Upgrade that is in excess of the electrical capacity actually used by the Developer’s generation project.

43 NYTOs December 21, 2010 Protest at 19.

44 IPPNY’s comments are adopted by New York City Suppliers, Calpine, and GenOn.

45 IPPNY December 21, 2010 Protest at 27, 30 (citing Order No. 2003 et al. and NYISO Services Tariff, Attachment S, § 25.1.1).

46 IPPNY notes that purchasing transferable deliverability rights is an alternative to

paying for System Deliverability Upgrades, but states that there is no reason to believe

(continued…)

Docket No. ER11-2224-000- 18 -

46. IPPNY states that while a proxy unit located in the Lower Hudson Valley might

not incur the cost of System Deliverability Upgrades associated with the UPNY/SENY

interface, NYISO’s choice of a Capital Zone proxy unit with no accommodation for

deliverability costs ensures that the NYCA demand curve will not be sufficient to induce

new entry in the upstate region because the unit will be unable to recover its costs.

IPPNY points out, however, that the net CONE for a Lower Hudson Valley proxy unit

would be significantly higher because environmental regulations require the use of an

LMS100 proxy unit which is more expensive that the Frame 7FA proxy unit proposed by

NYISO and located in the Capital Zone. Therefore, IPPNY states that units located

above the UPNY/SENY interface will incur deliverability costs for which they will not

be compensated, while units located in the Lower Hudson Valley will be

undercompensated because NYISO’s demand curve will be “underpinned” by a less

expensive and unrealistic type of peaking unit.47 IPPNY states that using the rest-of-state

proxy unit proposed by NYISO and located in the Capital Zone, accepting NYISO’s

other assumptions, and adding deliverability costs, results in a net CONE of $115.44/kW-

year—an increase of $25.65/kW-year over NYISO’s proposed net CONE.48

47. In response to the MMU’s affidavit, IPPNY states that the MMU fails to justify

the exclusion of System Deliverability Upgrades from net CONE. IPPNY states that the

MMU confuses the cost allocation policies for System Deliverability Upgrades with

whether a proxy unit should include these costs in net CONE. Further, IPPNY asserts

that the point of the process is to provide an accurate reflection of the costs in the demand

curve, and contrary to NYISO’s assertion, the fact that existing generators will obtain the

same price as new entrants cannot be deemed a windfall. IPPNY states that the MMU’s

arguments that capacity will become more deliverable as it approaches equilibrium are

refuted by Dr. Younger because the UPNY/SENY interface would remain overloaded

under equilibrium conditions.49 Dr. Younger first notes the apparent contradiction in the

testimony of the MMU who concludes that the UPNY/SENY deliverability problem will

continue after the system reaches equilibrium. In response to the MMU’s statement that

developers can obtain TCCs, Dr. Younger states that the value of TCCs depends on the

level of congestion which has an inverse relationship to the alleviation of congestion

they would be materially less costly. IPPNY December 21, 2010 Protest at 27, Younger Affidavit at 64.

47 IPPNY December 21, 2010 Protest at 33.

48 Id.

49 Id., Exhibit 2 at P 56-61.

Docket No. ER11-2224-000- 19 -

through transmission upgrades. Therefore the value of TCCs decreases with additional transmission investment (e.g. System Deliverability Upgrades) and would not completely offset the System Deliverability Upgrades.

48. With respect to arguments that a new capacity zone would better send the correct

price signals, IPPNY states that when a new zone is created, the demand curves can be

adjusted to take the new zone into account; but that in the meantime, the demand curves

must be based on the facts at hand and must include an accurate representation of actual

costs.

49.In adopting IPPNY’s protest, GenOn Parties state that the Commission should

direct NYISO to revise the NYCA demand curve to reflect the LMS100 proxy unit

located in the Lower Hudson Valley and also direct NYISO to file a separate demand

curve for the Lower Hudson Valley as a new capacity zone.

3.Answers

50.NYISO responds to parties’ arguments for including the cost of System

Deliverability Upgrades in the calculation of net CONE by reiterating its previous

windfall arguments.50 NYISO also states that arguments relating to deliverability costs in NYC are misleading because parties assume that costs previously categorized as System Upgrade Facilities prior to the deliverability rules taking effect, would now be

categorized as System Deliverability Upgrades.

51. IPPNY responds to the arguments raised by the NYTOs that System Deliverability

Upgrade costs are speculative and unnecessary if the system were at the minimum

capacity requirement. IPPNY states that the NYTOs’ improper treatment of certain

resources as capacity resources results in the incorrect claim of excess headroom at

UPNY/SENY.51 In particular, IPPNY asserts that its expert, Mr. Younger, showed that

the NYTOs’ expert, Mr. Franey, incorrectly treated his claimed source of 1,000 MW of

headroom at zero excess capacity, i.e., New York State Electric and Gas Corporation’s

1080 MW of grandfathered transmission and deliverability rights, as if they were firm

rights when in fact, NYISO only treats 38 MW as a capacity resource.52 IPPNY further

50 NYISO January 6, 2011 Answer at 15 (citing 125 FERC ¶ 61,311, at P 35

(2008) regarding the adverse affect of price increases versus the potential benefit to the market).

51 IPPNY January 7, 2011 Answer at 18.

52 Id. at 17-18.

Docket No. ER11-2224-000- 20 -

states that the NYTOs’ assumption that capacity should be reduced to the minimum

requirement is flawed by ignoring the lumpiness of capacity additions, forecast errors, the fact that all rest-of-state retirements will occur above UPNY/SENY, and the ability of retiring grandfathered generators to transfer deliverability rights.

52. The NYTOs state that IPPNY’s arguments are flawed by their use of incorrect

load forecasts and by the fact that they ignore ICAP import rights from PJM

Interconnection LLC. The NYTOs also state that IPPNY’s request that the NYCA curve

be based on a proxy unit in Lower Hudson Valley does not meet the Services Tariff

requirement that the unit be the least cost. The NYTOs respond to IPPNY and New York

City Suppliers that there are locations in NYC where System Deliverability Upgrades

would not be required and also note that this issue was not raised in the stakeholder

process that developed the instant filing (the NYTOs note that the required System

Deliverability Upgrade costs cited for specific projects by IPPNY do not necessarily

relate to the deliverability costs that would be required for the proxy unit). The NYTOs

state that, if it is determined that deliverability costs should be included in CONE, the

costs for NYC can be zero because there are locations within NYC where generators can

interconnect without incurring the cost of System Deliverability Upgrades.53

4.Commission Determination

53.We disagree with the position advocated by NYISO on the issue of deliverability

costs and direct that NYISO revise its demand curve for NYCA and, if necessary, NYC

and LI, to reflect the estimated cost of System Deliverability Upgrades. Deliverability

costs, in the form of System Deliverability Upgrades, are a required cost of investment

for interconnection customers in order to participate in the New York capacity market

and be “economically viable.”54 We therefore find that these are among the “current

localized levelized embedded cost of a peaking unit”55 that the Services Tariff provides

should be included in the formulation of the demand curve. Also, as discussed below, we

do not believe that the inclusion of System Deliverability Upgrades runs contrary to the

Commission’s objectives in accepting the deliverability provisions or that such inclusion

skews the intended economic signals. Therefore, we direct NYISO to revise the NYCA

and, if necessary, the NYC and LI demand curves to reflect the estimated cost of System

Deliverability Upgrades under a level of excess capacity that slightly exceeds the

53 NYTO January 10, 2011 Answer, Beck Affidavit at P 7.

54 Services Tariff Section 5.14.1.2.

55 Id.

Docket No. ER11-2224-000- 21 -

minimum requirement and to file the revised curve in a compliance filing within 60 days from the date of this order.

54. The issue of deliverability has emerged, particularly with regard to the

development of the NYCA demand curve because of a major inter-zonal transmission

constraint within the rest-of-state capacity zone. As discussed previously, capacity that is located upstate from the Southeast New York area which comprises Load Zones G, H, and I (also referred to as Lower Hudson Valley) is not currently deliverable to those

zones over the UPNY/SENY interface. Therefore, new resources must pay for System Deliverability Upgrades in order to sell capacity in the rest-of-state market56 or obtain deliverability rights pursuant to section 25.9.3.1 of Attachment S from a deactivated

generator whose deliverability rights pre-date the deliverability rules.57

55. According to the Consultant’s report, the inclusion of deliverability (i.e. System

Deliverability Upgrades) costs for the rest-of-state Frame 7 proxy unit would increase net

CONE for 2011/2012 from $95.03/kW-yr to $121.98/kW-yr, or by $26.95/kW-yr.58 The

Consultant’s Report notes that there is an inter-zonal deliverability issue in rest-of-state

by which units north and west of the UPNY/SENY could not deliver to Zones G to I and

therefore could not participate in the capacity market for rest-of-state without obtaining

deliverability. The Consultant’s Report also states that NYISO estimates the cost of

deliverability investment to be $178/kW.59 However, these estimates are based on the current surplus, not on a scenario under which available capacity slightly exceeds the minimum requirement.

56. With this background we address the issues raised in this proceeding with respect

to the inclusion of deliverability costs in the demand curves. First we address whether

56 See NYISO 2009 State of the Market Report at 122.

Http://www.nyiso.com/public/webdocs/documents/market_advisor_reports/2009/NYISO

_2009_SOM_Final.pdf.

57 The 2009 State of the Market Report also recommended that NYISO make preparations to implement a new capacity zone in 2010. See 2009 State of the Market Report at 125.

58 NYISO November 30, 2010 Filing Attachment 2, Consultants’ Report at Table

I-1.

59 NERA Report at 73-74. The Consultant notes that the analysis assumes

deliverability costs to be financed by the peaking unit owner and recovered over the life of the unit.

Docket No. ER11-2224-000- 22 -

the tariff requires that the cost of System Deliverability Upgrades be taken into account in

the determination of net CONE. We find that it does. Attachment S of the NYISO Tariff

clearly provides that System Deliverability Upgrades are required if the output of a

generating unit is not deliverable in order to qualify for Capacity Resource

Interconnection Service and to have the right to sell capacity into the capacity zone in

which the resource interconnects. Without satisfying this requirement, an interconnection

customer, such as the proposed rest-of-state proxy unit located above the UPNY/SENY

interface would not be able to participate in the capacity market and earn revenues

associated with the ICAP demand curve. This deliverability requirement is mandatory.

We also note that another mandatory generator interconnection cost that is included in the

proposed as well as previous demand curves is the cost of System Upgrade Facilities for

the proxy unit. System Upgrade Facilities were the only type of identified

interconnection upgrade required previously because, prior to the current demand curve

reset, NYISO offered only one type of interconnection service—Minimum

Interconnection Standard.60

57. Section 5.14.1.2 of the Services Tariff specifies that the demand curve shall

include the “current localized levelized embedded cost of a peaking unit” and does not

exempt any particular cost from this requirement. NYISO points to the provisions

contained in section 5.14.1.2 stating that the Services Tariff does not expressly state that

System Deliverability Upgrade cost should be included.61 We find this argument

misplaced as the provision does not specify any particular cost; it merely provides for the

inclusion of the embedded costs of a peaking unit, whatever it may be. Under current

system conditions, i.e. with an intra-zonal constraint in rest-of-state, deliverability costs

would be a necessary embedded cost of new entry for a generator located upstate of the

constraint, where NYISO has chosen to locate the rest-of-state proxy unit. The same

rationale used to include System Upgrade Facilities in CONE also leads to the conclusion

that System Deliverability Upgrades should not be excluded without specific evidence

that they would not be incurred at a level of excess capacity that slightly exceeds the

minimum requirement. All of these costs meet the above tariff requirement that the costs

included in CONE are current, localized, and embedded.

58. NYISO selected the location of the rest-of-state proxy unit to be in the Capital

Zone located upstate of the UPNY/SENY interface because such unit would have the

lowest net CONE. As IPPNY points out, NYISO could have selected the NYCA proxy

unit to be located in the Lower Hudson Valley which would not have required System

60 See NYISO Tariff, Attachment S, Section 25.2.

61 Filing Attachment 3, NYISO Report at 8.

Docket No. ER11-2224-000- 23 -

Deliverability Upgrade costs to meet the deliverability requirement. However, a new

proxy generator located in the Capital Zone with System Deliverability Upgrades is less

expensive than a new proxy unit located in Lower Hudson Valley without System

Deliverability Upgrades. As with all other costs included in CONE, these

interconnection costs are “localized” as required by the tariff and evaluated with each

demand curve reset cycle to determine whether and to what extent they are a required

cost of new entry. On this basis we find that together, the requirements of the Services

Tariff and the NYISO Tariff require the cost of System Deliverability Upgrades at a level

of excess capacity that slightly exceeds the minimum requirement to be taken into

account when determining CONE.

59. In a further attempt to support the exclusion of deliverability costs, NYISO and

other parties cite to the cost allocation provisions contained in Attachment S of the

NYISO Tariff and to the series of Commission orders under which the provisions

regarding System Deliverability Upgrades were developed. We find that this argument is

misplaced, and, if anything, further supports the inclusion of System Deliverability

Upgrade costs in CONE. NYISO states that the Commission’s policies regarding

deliverability were designed to give interconnection customers an economic incentive to

locate in areas where their capacity would be deliverable and cites to the series of

deliverability orders in which the Commission accepted the cost allocation provisions

contained in the tariff. Including System Deliverability Upgrade costs in the calculation

of CONE does nothing to decrease this incentive because the developer will still evaluate

profitability over the life of the project in determining where to locate. All costs of

constructing a generator are initially borne by the project developer and including such

costs in CONE does not alter this cost allocation. A rational investor expects to recover

its investment costs from the revenue streams generated by the project, one of which is

the NYISO capacity market.62 Therefore, the fact that System Deliverability Upgrades

are initially allocated to the developer pursuant to Attachment S of the NYISO Tariff is

of no consequence here as the developer is still responsible for the cost of its project.

60. We also reject the arguments that capacity buyers will in-effect subsidize

developers and that windfalls will occur if System Deliverability Upgrade costs are

included. All capacity resources that clear in the NYISO monthly ICAP auction,

including demand resources, receive the same market clearing price. The fact that some

cleared resources may have costs less than the market clearing price does not constitute a

subsidy. No windfall to existing resources is created when actual costs of new entry are

incorporated into the demand curve. Markets often provide infra-marginal revenues to

62 IPPNY points out that a developer will choose the lowest cost location for a new project. IPPNY December 21, 2010 Protest, Exhibit 2, at P 43 & 45.

Docket No. ER11-2224-000- 24 -

non-marginal resources. These infra-marginal revenues are important to long-run cost

recovery and do not constitute a “windfall” that should be offset by suppressing the ICAP demand curve. Further, excluding these costs results in net CONE that does not

accurately reflect the developer’s costs and thus, may discourage investment.

61. NYISO also argues that deliverability rights could be transferred from a

grandfathered generator to a new one in the same capacity zone. This argument is also proffered by the MMU. We do not dispute that a new entrant could obtain deliverability rights from a retiring generator pursuant to section 25.9.3.1 of the NYISO Tariff. But this fact does not support a conclusion that the proxy peaking unit under a scenario where available capacity slightly exceeds the minimum requirement would not incur System Deliverability Upgrade costs. This argument therefore does not alter our conclusion that deliverability costs should be reflected in CONE.

62. The NYTOs and the MMU conclude that the phrase “to meet minimum capacity

requirements” in section 5.14.1.2 requires that the deliverability analysis be conducted

while the entire NYCA system is at zero excess capacity.63 We disagree. We find that

deliverability costs should be estimated under conditions where available capacity would

slightly exceed the minimum requirement. This is consistent with the calculation of

energy and ancillary services revenues and will result in internally consistent analyses as

discussed below.64 Therefore we direct NYISO to perform a well-supported

deliverability analysis that reflects a level of capacity that slightly exceeds the minimum

capacity requirements. We recognize that NYISO cannot practically perform the

required analysis in time for the May 1, 2011 start of the capability year. Accordingly,

we direct NYISO to reflect a level of capacity slightly above the minimum in its

calculation of System Deliverability Upgrades included in the determination of CONE

for the proposed demand curves to be filed within 60 days. We anticipate that this

analysis will resolve the issue of whether or not, under this consistent assumption of

excess capacity, sufficient headroom exists to obviate the need for System Deliverability

Costs.

63 However, the MMU acknowledges that System Deliverability Upgrade costs are

likely to be incurred because a significant surplus currently exists. He states “as a

practical matter, it is likely that the particular deliverability issue facing the demand curve

peaking resource in the NYCA today will continue to exist over the longer-term when the

excess capacity is eliminated.” NYISO November 30, 2010 Filing, Attachment 1 at P 15.

64 We discuss the Commission’s determination on the level of excess capacity in section V.D of this Order.

Docket No. ER11-2224-000- 25 -

63. NYISO and the MMU also argue that suppliers are overstating the consequences

of including deliverability costs because a developer could acquire TCCs associated with

increases in transmission capability such as with System Deliverability Upgrades and that

the value of these TCCs would be roughly equivalent to the cost of efficient transmission

investment. Neither NYISO nor the MMU provides support for the value of such TCCs.

We do not agree that the potential for a developer to acquire TCCs would justify

excluding the cost of System Deliverability Upgrades. However, we agree with NYISO

and the MMU that the revenues that could be generated from the value of TCCs acquired

as a result of System Deliverability Upgrades would be appropriately accounted as an

offset to the cost of the deliverability upgrade, and if reasonably estimated, should be

considered in the development of net CONE. Therefore, we conclude that NYISO should

consider the value of TCCs that are created by the construction of System Deliverability

Upgrades in the same manner that it treats energy and ancillary services revenues in the

calculation of net CONE. In this regard, we find that including revenues from TCCs is

consistent with the language contained in section 5.14.1.2 of the Services Tariff regarding

the projected energy and ancillary services revenue offset, as the value of the TCCs held

by a developer should be roughly equivalent to the additional revenue that the developer

would receive by being able to sell its energy at the sink of the TCC. Therefore, we

direct NYISO to revise its net CONE computations to include the reasonably

ascertainable value of TCCs associated with System Deliverability Upgrades and to

include this offset in the revised demand curves that we are directing to be filed within 60

days.

64. We agree with NYISO and the MMU that the creation of a new capacity zone

could provide better locational signals. However, this does not support the exclusion of

required deliverability costs from the determination of net CONE. Further, NYISO

informs us that creation of new capacity zones is not practical during this demand curve

reset period. We also note that in a separate proceeding, NYISO and its stakeholders are

developing criteria for the establishment of new capacity zones and that this stakeholder

process should determine whether a new zone is to be proposed for the next demand

curve reset cycle.65

65 On January 4, 2011, in Docket No. ER04-449-023, NYISO made a compliance filing that includes criteria and a timeline for establishing new capacity zones.

Docket No. ER11-2224-000- 26 -

C.NYC Tax Abatement

1.NYISO’s Proposal

65.NYISO states at the time of the 2007 demand curve filing, the NYC Industrial and

Commercial Incentive Program (ICIP) granted, as a right, reductions in real property

taxes to new industrial and commercial projects, including power plants. NYISO adds

that in July 2008, a revised program was established that effectively removed the tax

abatement for new generating facilities in New York City; however on August 3, 2010,

the Board of Directors of the New York City Industrial Development Authority

(NYCIDA), an agency administered by the New York City Economic Development

Corporation (NYCEDC), revised the Uniform Tax Exemption Policy (UTEP) to induce

the installation of peaking units in NYC. The tax exemption policy provides, in relevant

part:

PlaNYC Energy Program Projects. A PlaNYC Energy Program Project

consists of the acquisition, construction and installation of a Peaking Unit.

For a PlaNYC Energy Program Project, “inducement” consists of the

following: (i) the proposed Peaking Unit will use natural gas, or a

demonstrably cleaner fuel, as its primary fuel; and (ii) the proposed Peaking

Unit will have a full-load heat rate not exceeding either (aa) 7,850

BtuLHV/kWh (ISO 59º, 60% RH, zero losses, sea level) as measured at

generator terminals, or (bb) 8,250 BtuLHV/kWh (9,150 BtuHHV/kWh) as

measured net of power plant parasitic loads; and (iii) nitrogen oxide (NOx)

emissions from the Peaking Unit will not exceed the lesser of (aa) 25 ppm,

or (bb) the then-applicable air-emissions limit as set for the City by the air-

emissions permitting agency or agencies having jurisdiction; and (iv) the

proposed Peaking Unit will be electrically interconnected to the City’s

electrical grid; and (v) the proposed Peaking Unit will satisfy either (aa) a

future reliability need as identified by any one of NYISO, the transmission

owner, or the City, or (bb) an environmental need identified by the City.

For purposes of this Policy: “NYISO” means the New York Independent

System Operator; “transmission owner” means the owner of local facilities

for the transmission of electricity within the City; and “Peaking Unit”

means a facility for the generation of electricity that conforms to at least

one of the following: (aa) the definition applicable on the date hereof

(August 3, 2010) for a “peaking unit” as provided in NYISO Services

Tariff, Section 5.14.bl2; or (bb) for a period to which a particular cost-of-

entry analysis (i.e., a “CONE”) applies, the electricity-generating facility on

which NYISO has based such CONE; or (cc) at any point in time, a facility

Docket No. ER11-2224-000- 27 -

that is generally recognized in the industry as being a “peaking unit.” As

defined herein, a Peaking Unit shall not include the land upon which it is

situated. 66

66. According to NYISO, generation projects that satisfy the established criteria and file a request for abatement are eligible for temporary exemption from real property taxes (full exemption for twelve years, no abatement thereafter), recording taxes, mortgage recording taxes, and sales and use taxes. NYISO notes that, unlike ICIP, the new

program is discretionary on the part of NYCIDA and that the Consultant included in its report the impact of full tax abatement on the NYC demand curve.67

67. NYISO concluded that the most reasonable approach to setting the NYC demand

curve was to assume full tax abatement treatment for the NYC peaking unit. NYISO

asserts that the conditions that must be met to qualify for program benefits are clear, and

projects meeting the criteria set forth in the UTEP should be granted full tax abatement in

accordance with the UTEP provisions. According to NYISO, the NYCEDC

representative stated in the demand curve reset process, including in oral presentations to

the Board, that it is in New York City’s economic interest to grant abatements to peaking

units because doing so would result in lower capacity prices. NYISO states that it has

therefore concluded that New York City will very likely act in a manner that is consistent

with its economic interests and is therefore proposing to use a full abatement assumption

in the determination of net CONE for the NYC demand curve.68

68.NYISO states that stakeholder comments that the UTEP is designed narrowly to fit

the demand curve are irrelevant as the demand curve reset process is limited by the

Services Tariff to using a peaking unit.

2.Comments and Protests

69.New York City, NYTOs, the New York Commission, and Consumer Protection

Board all agree that NYISO’s proposal of a multi-year abatement of New York City

property tax for the NYC proxy peaking unit is reasonable and justified, and should be

66 Third Amended and Restated Uniform Tax Exemption Polity, available at

http://www.nycedc.com/AboutUs/PublicMeetings/NYCIDAPublicHearing/Documents/T

HREEpercent20UTEP.pdf (NYCIDA Policy).

67 See Table I-1 on page 9 of the Consultant’s Report.

68 NYISO November 30, 2010 Filing at 15.

Docket No. ER11-2224-000- 28 -

accepted.69 New York City urges the Commission to uphold NYISO’s determination on this point and reject the suppliers’ objection as unsupported and lacking merit.

70. According to New York City, in 2010, partly because of requests from the same

suppliers who are now criticizing NYISO’s recognition of the tax abatement benefits, the

NYCIDA modified and restated its tax exemption policy to apply to new peaking

generating facilities.70 New York City states that section I.C.1.e of the Tax Exemption

Policy expressly authorizes the NYCIDA to grant financial assistance to any peaking

generating facility that satisfies the criteria; thus, there can be no legitimate dispute that

the NYC proxy peaking unit is eligible for a property tax abatement under the tax

exemption policy.

71. New York City argues that, although the suppliers have made an issue of the

ability of NYCIDA to exercise discretion in awarding financial assistance, the NYISO

Board correctly recognized and understood that the transition from an as-of-right tax

abatement program to a program in which the NYCIDA exercises discretion will not

nullify the award of tax abatements to generating facilities and does not form the basis for

assuming that the NYC proxy peaking unit would not receive any tax abatements.

72. The NYTOs state it is important to clarify that NYISO did not assume that 100 percent of the tax abatements made available under NYCIDA’s tax exemption policy would be granted. Rather, NYISO is assuming only a tax abatement value equal to that given by the former ICIP, which is less than the total potential value of the four tax abatements that are currently available through NYCIDA.71

73. The NYTOs state that assuming that tax abatements would not be granted ignores

the strong incentive that NYCIDA would have to grant such abatements, i.e. denying tax

abatements would also increase the price of ICAP to cover taxes that developers of new

NYC peaking units would not have to bear if they receive tax abatements.72 Finally New

York City adds that the impact on New York City electricity consumers related to the

69 New York City December 21, 2010 Protest at 21; NYTOs December 21, 2010 Protest at 22; New York Commission December 27, 2010 Protest at 7; Consumer

Protection Board December 21, 2010 Protest at 1.

70 New York City December 21, 2010 Protest, Babis Affidavit at 9.

71 NYTOs December 21, 2010 Protest at 21 (citing NYISO’s November 30, 2010 Filing at 15).

72 Id. at 21-22.

Docket No. ER11-2224-000- 29 -

exclusion of the tax abatement benefits equates to potentially hundreds of millions of dollars annually.

74. In contrast, New York City Suppliers, IPPNY, and EPSA argue that property taxes

should be incorporated into the calculation of net CONE without any recognition of tax

abatements. Constellation, Calpine, GenOn and Dynergy all support the comments of

IPPNY.

75. EPSA states it is unclear how the discretionary tax abatement policy will actually

be applied. IPPNY argues that the discretionary tax abatements are a significant risk

since the entity in charge of granting such abatements may choose to deny a request for

abatement in its entirety or to otherwise limit it. IPPNY contends the policy does not

automatically grant a property tax exemption to all new generation projects, instead it

grants the NYCIDA the right to grant tax exemptions to projects which meet both

objective and subjective criteria.73 IPPNY argues neither NYISO nor New York City

offered any evidence that the policy has been utilized, or details definitively

demonstrating how the subjective criteria such as reliability or environmental needs

would be applied or even if the property tax exemption would be granted if all the vague

criteria were met.74 They also argue that the very entity that would be deprived of the

property tax revenue, New York City, has exclusive authority to determine whether an

exemption would be granted. The New York City Suppliers contend that NYISO

incorrectly assumes that the NYCIDA, an agency of New York City, which desperately

needs tax revenues to close its looming budget deficits, will grant any and all new

generators in New York City a 100 percent exemption from property taxes.75

76. EPSA, IPPNY, and New York City Suppliers assert that the current NYC demand

curves are understated by almost 40 percent when property taxes are excluded,76 resulting

73 IPPNY December 21, 2010 Protest at 45 (citing NYCIDA Policy at 2-3, 9-10).

74 Id. at 46.

75 Id. at 44 (citing e.g., New York City Comptroller, The State of the City’s

Economy and Finances at vi (December 15, 2010) (projecting multi-billion dollar budget

deficits for New York City in each of Fiscal Years 2012 through 2014), available at:

http://www.comptroller.nyc.gov/bureaus/bud/10reports/Dec10_State_of_Citys_Finances

2010.pdf.).

76 Subsequent to the repeal of the ICIP Real Property Tax Exemption, IPPNY and

other parties jointly filed a complaint against NYISO with the Commission requesting

that the Commission direct NYISO to reset the demand curves to reflect the property tax

costs that would be levied on the NYC Proxy Unit. The Commission denied the

(continued…)

Docket No. ER11-2224-000- 30 -

in greatly decreased capacity payments.77 IPPNY contends this sends insufficient price signals, and that such risk is unjust and unreasonable especially in an area where

reliability needs have been identified.

77. New York City Suppliers also contend that recognizing tax abatement in net

CONE will eviscerate NYISO’s buyer market power mitigation rule, which is based on

the value of net CONE, and thereby, facilitate buyers’ ability to suppress capacity

prices.78 According to New York City Suppliers, by understating net CONE by roughly

40 percent, NYISO’s assumption of full abatement will artificially reduce the offer floor by a similar amount.79

78. IPPNY and New York City Suppliers conclude that failing to include property

taxes in the demand curve will chill potential investments in new resources in New York City. IPPNY also contends that a generator would need to spend millions of dollars in development costs before finding out whether it would receive the property tax

exemptions that would be necessary to make the project economic.80

79. NYC Suppliers state the proxy unit for the NYC Capacity Zone would not satisfy

certain of the objective criteria contained in the UTEP, and even if it could, it would

almost certainly fail the UTEP’s subjective criteria. NYC Suppliers’ witness David Perri

explains that the LMS100 proxy unit for the NYC Capacity Zone would not meet either

complaint, stating that “it is reasonable to await the scheduled three year update to

account for the elimination of the tax exemption and other changes which will apply to demand curves for the 2011-2012 Capability Year.” Independent Power Producers of New York, Inc., 125 FERC ¶ 61,311, at P 34 (2008).

77 EPSA December 21, 2010 Protest at 14-15; IPPNY December 21, 2010 Protest at 42; New York City Suppliers December 21, 2010 Protest at 45.

78 New York City Suppliers’ December 21, 2010 Protest at 46 (citing Services

Tariff, Attachment H §§ 2.1 (definitions of Offer Floor, net CONE, and Unit net CONE) and 4.5(g) (v) (rules for calculating Offer Floor for Special Case Resources)).