150 FERC ¶ 61,208

UNITED STATES OF AMERICA

FEDERAL ENERGY REGULATORY COMMISSION

Before Commissioners: Cheryl A. LaFleur, Chairman;

Philip D. Moeller, Tony Clark,

Norman C. Bay, and Colette D. Honorable.

New York Independent System Operator, Inc.Docket Nos. EL07-39-006

ER08-695-004

ER10-2371-000

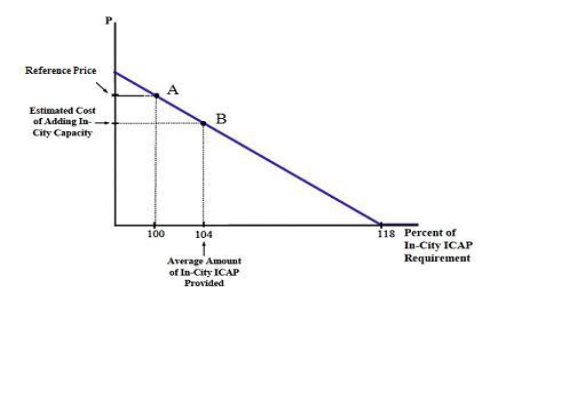

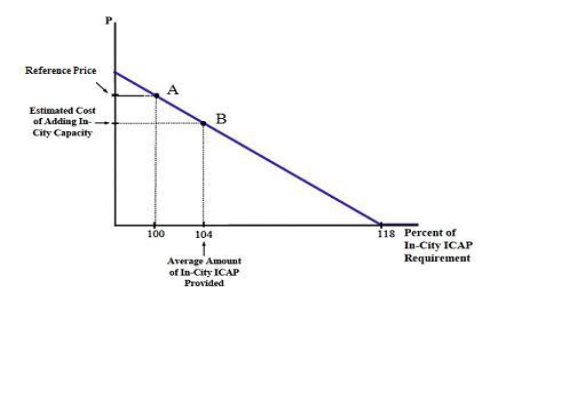

ORDER ON CLARIFICATION, REHEARING, AND COMPLIANCE FILING

(Issued March 19, 2015)

1. In this order the Commission grants, in part, and denies, in part, the requests for rehearing of its May 20, 2010 order1 and directs a further filing by NYISO. The

Commission also accepts, in part, and rejects, in part, the New York Independent System Operator, Inc.’s (NYISO) filing to comply with the May 20, 2010 Order.2 The May 20, 2010 Order granted, in part, and denied, in part, rehearing of the Commission’s

September 30, 2008 order,3 which conditionally accepted NYISO’s tariff proposals to strengthen the mitigation of market power in the New York City (in-City or NYC)

Installed Capacity (ICAP) market. The May 20, 2010 Order also accepted NYISO’s

filing to comply with the September 30, 2008 Order.4

I.Background

2.This proceeding concerns NYISO’s proposals to mitigate market power among

suppliers in NYISO’s in-City ICAP market.5 Prior orders discuss the case in detail and,

1 New York Indep. Sys. Operator, Inc., 131 FERC ¶ 61,170 (2010) (May 20, 2010

Order).

2 NYISO’s compliance filing was docketed ER10-2371-000.

3 New York Indep. Sys. Operator, Inc., 124 FERC ¶ 61,301 (2008) (September 30, 2008 Order).

4 NYISO filed to comply with the September 30, 2008 Order on October 30, 2008.

5 The Commission initially accepted NYISO’s proposals on a conceptual basis in

its March 7, 2008 order. New York Indep. Sys. Operator, Inc., 122 FERC ¶ 61,211

(2008) (March 7, 2008 Order). The March 7, 2008 Order directed NYISO to file the

(continued…)

Docket No. EL07-39-006 et al.- 2 -

thus, we discuss here only the background and rulings of those Commission orders

that are directly relevant at this stage of the proceeding. Of relevance here, in the

September 30, 2008 Order, the Commission accepted NYISO’s proposed definition of

the generator buyer-side Default Offer Floor to be applied to new uneconomic entry of

generation in the in-City ICAP market, and required in-City Special Case Resources

(SCRs)6 to be subject to mitigation. A number of parties sought rehearing of those

rulings. The September 30, 2008 Order also rendered a number of other rulings on other

features of NYISO’s proposed mitigation provisions, with associated compliance filing

directives.

3. In the May 20, 2010 Order, the Commission granted rehearing of the

September 30, 2008 Order’s acceptance of NYISO’s definition of the Default Offer

Floor, found that the Default Offer Floor should be 75 percent of Net CONE as the

Commission defined that term, and directed NYISO to file to correct the calculation of

the Default Offer Floor consistent with that discussion. The Commission also accepted,

subject to conditions, NYISO’s compliance proposal to implement new in-City SCR

mitigation rules.7 Again, a number of parties sought rehearing of these two rulings. This

order addresses the rehearing requests related to these two rulings. Specifically, the

Commission directed NYISO to: (1) file tariff sheets explaining with specificity the

criteria it proposes to use in evaluating whether to include a specific subsidy or other

benefit in its calculation of SCR Offer Floors; (2) to review the merits of the existing

mitigation exemption for small sellers of capacity, report as to whether the exemption

should remain, and if so, explain how the mitigation measures would address certain

market power issues NYISO has raised; (3) equalize the conduct and impact thresholds

actual tariff provisions that were conditionally accepted by the September 30, 2008

Order. As pertains to new entry, the Commission recently directed, pursuant to FPA

section 206, modifications to NYISO’s buyer-side mitigation rules to allow for private

investors that certify they are a purely merchant investment, with no out-of-market

subsidy, and relying solely on market revenues to enter the ICAP market unmitigated.

Consolidated Edison Company of New York, Inc., 150 FERC ¶ 61,139, at PP 4, 45

(2015).

6 A Special Case Resource is a demand side resource that participates in NYISO’s installed capacity market as an installed capacity supplier. See Section 2.19 of NYISO’s Services Tariff.

7 Following a grant of an extension of time to file, NYISO filed to comply with the

September 30, 2008 Order on August 12, 2010, but this filing was rejected due to an

incorrect filing type code. NYISO then withdrew the August 12, 2010 filing and

resubmitted it on August 23, 2010. NYISO subsequently withdrew the August 23, 2010

filing as it had omitted an attachment and resubmitted the August 12, 2010 filing in its

entirety on August 24, 2010. Protests and comments were filed, as discussed later below.

Docket No. EL07-39-006 et al.- 3 -

for Pivotal Supplier physical withholding through exports; (4) revise the penalty for

physical withholding through a failure to offer so that it is the same as the penalty for

physical withholding through uneconomic exports; and (5) revise the tariff to state that

deadlines for requesting and receiving determinations of whether exports would be

uneconomic shall be made in accordance with the deadlines specified in ISO Procedures.

II.Requests for Clarification or Rehearing

4.On June 21, 2010, NYISO filed a request for clarification of the May 20, 2010

Order and Independent Power Producers of New York, Inc. (IPPNY), NRG Companies8 (NRG), and TC Ravenswood, LLC (Ravenswood) each filed a request for rehearing of the May 20, 2010 Order. On July 6, 2010, New York Transmission Owners (NY

Transmission Owners)9 filed an answer to IPPNY’s request for rehearing. On July 21, 2010, as corrected on July 22, 2010, and July 23, 2010, NYISO filed an answer to

IPPNY’s request for rehearing10 and to the NY Transmission Owners’ answer. On

August 5, 2010, IPPNY filed an answer to NYISO’s answer.

A.Procedural Matters

5.Rule 713(d) of the Commission's Rules of Practice and Procedure, 18 C.F.R.

§ 385.713(d) (2014), prohibits an answer to a request for rehearing. Accordingly, we

reject the answers filed in this proceeding.

B.Substantive Matters

1.Generator Default Offer Floor

a.Background

6.Section 23.4.5 of Attachment H, Market Power Mitigation Measures, of NYISO’s

Market Administration and Control Area Services Tariff (Services Tariff) defines the

8 The NRG Companies consist of NRG Power Marketing, Inc., Arthur Kill Power LLC, Astoria Gas Turbine Power LLC, Dunkirk Power LLC, Huntley Power LLC, and Oswego Harbor Power.

9 NY Transmission Owners consist of Central Hudson Gas & Electric Corporation, Consolidated Edison Company of New York, Inc. (ConEd), Long Island Power

Authority, New York Power Authority, New York State Electric & Gas Corporation,

Niagara Mohawk Power Corporation, Orange and Rockland Utilities, Inc., and Rochester Gas and Electric Corporation.

10 NYISO states that its answer also addresses the similar arguments advanced by NRG and Ravenswood in their requests for rehearing.

Docket No. EL07-39-006 et al.- 4 -

NYC generator mitigation “Offer Floor” for a non-exempt new generation entrant into the NYC ICAP market as the lower of what we refer to as the Default Offer Floor or the Unit Offer Floor. The Default Offer Floor equals 75 percent of the “Net CONE” of the proxy peaking unit used to design the Demand Curve for NYC. “Net CONE” is defined in section 23.2.1 as follows:

For purposes of Section 23.4.5 of this Attachment H, “Net CONE” shall

mean the localized levelized embedded costs of a peaking unit in the New York City Locality, net of the likely projected annual Energy and Ancillary Services revenues of such unit, as determined in connection with

establishing the Demand Curve for the New York City Locality pursuant to Section 5.14.1.2 of the Services Tariff, or as escalated as specified in

Section 23.4.5.7 of Attachment H.

7. The Demand Curve referenced in the definition of “Net CONE” specifies

capacity prices per kW-month corresponding to different levels of capacity supply. If

capacity supply equals 100 percent of the ICAP requirement, the corresponding market

clearing capacity price is the “Reference Price.” As capacity supply increases beyond the

ICAP requirement, the market clearing capacity price declines linearly until it reaches

zero at 118 percent of the ICAP requirement. In determining the Reference Price, section

5.14.1.2 of the Services Tariff requires NYISO to assess:

(i) the current localized levelized embedded cost of a peaking unit in each

NYCA locality and the Rest of State to meet minimum capacity

requirements [and] (ii) the likely projected annual Energy and Ancillary

Services revenues of the peaking unit over the period covered by the

adjusted ICAP Demand Curves, net of the costs of producing such Energy

and Ancillary Services, under conditions in which the available capacity

would equal or slightly exceed the minimum Installed Capacity

requirement.11

11 Section 5.14.1.2 was revised, effective January 9, 2012, to specify that “[t]he

cost and revenues of the peaking plant used to set the reference point and maximum value

for each Demand Curve shall be determined under conditions in which the available

capacity is equal to the sum of (a) the minimum Installed Capacity requirement and

(b) the peaking plant’s capacity equal to the number of MW specified in the periodic review and used to determine all costs and revenues.” New York Indep. Sys. Operator, Inc., 140 FERC ¶ 61,160 (2012). We note that excess capacity in the ICAP market lowers expected energy and ancillary services revenues and, thus, increases Net CONE which raises ICAP prices by raising the Demand Curve.

Docket No. EL07-39-006 et al.- 5 -

8. NYISO described the Reference Price calculated in accordance with section

5.14.1.2 as equal to “Net CONE”12 and therefore proposed that the Default Offer Floor would equal 75 percent of the Reference Price.

9. However, the NY Transmission Owners pointed out that the Reference Price

determined in accordance with section 5.14.1.2 of the Services Tariff did not equal Net

CONE as defined in section 23.2.1. In accordance with section 5.14.1.2, the Reference

Price is to be adjusted to reflect the expectation that capacity levels in NYC will

generally exceed 100 percent of the ICAP requirement. For the 2008-2011 Demand

Curves, the assumed average capacity level was 104 percent of the minimum ICAP

requirement.13 In contrast, the NY Transmission Owners pointed out that Net CONE as

defined in section 23.2.1 for purposes of in-City mitigation does not include such an

adjustment. Thus, the NY Transmission Owners argued that the Default Offer Floor

should equal 75 percent of Net CONE as defined in section 23.2.1, which on a per kW-

month basis is the Demand Curve price corresponding to 104 percent of the ICAP

requirement, and not 75 percent of the Reference Price corresponding to 100 percent of

the ICAP requirement. The following graph shows the different price points on the

Demand Curve that NYISO and the NY Transmission Owners defined as “Net CONE”

for purposes of establishing the mitigation Offer Floor.14

12 See NYISO Reply Comments, Docket No. EL07-39-000, at 16, n. 44 (filed

December 12, 2007) (Regarding “Dr. Patton’s proposal for a 75% of net CONE

threshold” for buyer mitigation, NYISO stated, “In this context, ‘net CONE’ refers to the reference level at 100% of the minimum capacity requirement that is determined in

setting the NYC demand curve.”). NYISO again referred to this definition of “net

CONE” for purposes of Offer Floor mitigation in its June 11, 2008 answer to protests to its May 6, 2008 compliance filing. NYISO Response to Comments, Docket No. ER08-

695-001, at 12 (filed June 11, 2008).

13 New York Indep. Sys. Operator, Inc., 122 FERC ¶ 61,064, at P 27 (2008)

(January 29, 2008 Order). The assumed level of excess capacity above the minimum

capacity requirement may change in each Demand Curve reset proceeding. However, for ease of discussion in this order, we will refer to the 104 percent capacity level applied in the 2008-2011 Demand Curve reset proceeding.

14 NY Transmission Owners May 27, 2008 Comments, Docket No. ER08-695-

001, at 5.

Docket No. EL07-39-006 et al.- 6 -

Thus, referring to the graph above, NY Transmission Owners proposed that the Default

Offer Floor be set at 75 percent of price B, whereas NYISO proposed that it be set at 75

percent of Price A.

10.In the May 20, 2010 Order, the Commission agreed with NY Transmission

Owners and rejected NYISO’s proposed Default Offer Floor and directed NYISO to

make a compliance filing to correct the calculation of the Default Offer Floor.15

b.Rehearing Arguments of the Parties

11.IPPNY, Ravenswood, and NRG seek rehearing of the May 20, 2010 Order and

request that the Commission reinstate the Default Offer Floor calculated as 75 percent of

the Reference Price. IPPNY agrees with the NY Transmission Owners that the 2008-

2011 Demand Curves reflect an assumed capacity level equal to 104 percent of the in-

City ICAP requirement, but asserts that the Default Offer Floor should be based on the

Reference Price. In IPPNY’s view, supported by an affidavit by Mark D. Younger

attached to its request for rehearing, a Default Offer Floor based on a lower capacity price

corresponding to 104 percent of the ICAP requirement would be inconsistent with the

15 May 20, 2010 Order, 131 FERC ¶ 61,170 at P 31.

Docket No. EL07-39-006 et al.- 7 -

Demand Curve and undercut the ability of the mitigation to prevent price suppression.16 Moreover, Mr. Younger’s affidavit concludes that at the lower price, a hypothetical new entrant would require an unreasonable 40-year amortization period to recover its costs.17 According to IPPNY, a Default Offer Floor based on the lower price level recommended by the NY Transmission Owners would ignore important risk factors used to develop the Demand Curve and artificially suppress capacity prices.

12. Both Ravenswood and NRG support IPPNY’s rehearing request and both assert

that the Reference Price reflects the minimum price needed for a new hypothetical unit to

recover its costs over time. NRG also argues that the Default Offer Floor is designed to

ensure that uneconomic entry does not compromise the ability of the market to provide

for just and reasonable rates. According to NRG, the lower Default Offer Floor

advocated by the NY Transmission Owners creates the potential for buyers to engage in a

greater amount of uneconomic entry and perpetuates reliance on subsidized entry.

Finally, NRG claims that the Commission provided no record support for the lower Offer

Floor and whether it would permit Commission jurisdictional capacity markets to support

new entry.

c.Commission Determination

13.We deny rehearing. The issue on rehearing is which Demand Curve price should

be the basis for calculating the Default Offer Floor: (1) the Reference Price

corresponding to 100 percent of the ICAP requirement (Price A on the graph above); or

(2) a lower price corresponding to the percentage of the capacity requirement

incorporated into the Demand Curve, which was 104 percent in the 2008-2011 Demand Curve reset proceeding (price B on the graph above).18

14. We find that the lower price (price B on the graph above) is supported by the

record as a just and reasonable level for determining the Default Offer Floor.19 Picking

16 IPPNY June 21, 2010 Request for Rehearing at 8. See also NYISO

November 30, 2007 Filing in Docket No. ER08-283-000 at Attachment 6, Exhibit A (2008 - 2011 ICAP Demand Curve reset proceeding filing).

17 Id. Younger Aff. at ¶ 48.

18 We note that, in NYISO’s July 21, 2010 Answer, which we reject above on

procedural grounds, NYISO now agrees with the NY Transmission Owners that price B on the graph above is the proper basis for calculating the Default Offer Floor.

19 What may have caused confusion regarding this higher “Reference Price”

Demand Curve parameter figure was that NYISO’s consultant Meehan achieved it by

reducing the amortization period used to calculate Net CONE (as defined by the

Commission) by a factor derived from solving for the effect of the assumed 104 percent

(continued…)

Docket No. EL07-39-006 et al.- 8 -

point B “is not a matter for the slide-rule,” but, rather, involves judgment. While experts

may differ on the appropriate point, we find that price B fulfills the purpose of the

mitigation Offer Floor, for the reasons discussed below and meets the requirements of

Attachment H of the NYISO Services Tariff as it is equal to “Net CONE” of the proxy

generator that is to be used for the Default Offer Floor as defined in Attachment H of the

Services Tariff using a 30 year amortization as approved in the January 29, 2008 Order.

That distinguishes price B from price A insofar as the net cost calculation underlying the

Reference Price at price A was based on an “adjustment” to the Net CONE calculation to

reflect a lower, 17.5 year, amortization. In the 2008-2011 Demand Curve reset

proceeding, the Demand Curve included an adjustment to reflect an average capacity

surplus that is four percent greater than the ICAP requirement. Thus, at the lower price

level corresponding to price B on the graph above, a hypothetical new LMS-100

generator would be expected to recover its costs net of energy and ancillary services

revenues over an approximate 30-year period.20 Consistent with the original affidavit

filed by Mr. Meehan of NERA Economic Consulting (NERA), who developed the

Demand Curves in NYISO’s 2008-2011 Demand Curve reset proceeding, we also agree

that, because of the same four percent adjustment, at the Reference Price, the LMS-100

unit used in the calculation of the NYC Demand Curve would be expected to recover its

costs over a 17.5-year period.21

15. Accordingly, the Commission in the May 20, 2010 Order agreed with and

adopted the analysis of the NY Transmission Owners in their request for rehearing, which showed that the Reference Price was calculated to provide that, at the clearing price

excess capacity (i.e., the capacity of the proxy unit) on ICAP market prices. Thus, both NYISO and the NY Transmission Owners have referred to the Reference Price point at 100 percent of the minimum requirement as being equal to “adjusted” Net CONE and to the lower price at 104 percent of the minimum requirement simply as “Net CONE.”

However, the resulting higher figure Mr. Meehan used as the Reference Price parameter in designing the Demand Curves for NYC as the result of that “adjustment,” nonetheless, was not “Net CONE” as defined in section 23 of the Services Tariff and as approved by the Commission and, therefore, the Reference Price is not to be used to establish the

NYC generator mitigation Default Offer Floor.

20 See NYISO November 30, 2007 Filing Transmittal in the 2008 - 2011 ICAP Demand Curve reset proceeding in Docket No. ER08-283-000 at 12, 18. The

Commission approved NYISO’s use of a 30-year recovery period in developing the

Demand Curves in NYISO’s 2008-2011 Demand Curve filing. January 29, 2008 Order, 122 FERC ¶ 61,064, at P 44.

21 See NYISO, Filing of Tariff Revisions to Implement Revised Demand Curves for Capability Years 2008/2009, 2009/2010, 2010/2011, Docket No. ER08-283-000, Transmittal Letter at 9 (filed November 30, 2007).

Docket No. EL07-39-006 et al.- 9 -

expected in the market (i.e., at the price of the 104 percent excess capacity level

incorporated into the 2008-2011 Demand Curves), the proxy peaking unit would recover its costs over the 30-year period, consistent with the January 29, 2008 Order. 22

16. IPPNY offers testimony from Mr. Younger that price B cannot be the correct

price on which to base the Offer Floor because, at that price, a new entrant would require an unreasonable 40-year amortization period to recover its costs. We generally do not

permit new evidence to be introduced on rehearing,23 and thus, we will not accept Mr.

Younger’s affidavit and analysis. But, even if we were to consider this evidence, we

would reject Mr. Younger’s analysis, which relied on lower energy and ancillary services revenues for the first three years of the analysis of Net CONE compared to the revenues assumed for the remaining 27 years of the analysis. In the January 29, 2008 Order, the

Commission rejected a proposal to base the energy and ancillary services revenues on the three-year period covered by the Demand Curves and approved NYISO’s proposed use of an estimate of such revenues over a 30-year period.24 Mr. Younger’s analysis does

essentially what the Commission rejected in that order.

17. The Default Offer Floor is intended to approximate a competitive offer from a

new entrant, or a capacity price an economic new entrant would require to enter the

market. NYISO proposed and we have accepted that a Default Offer Floor equal to 75

percent of Net CONE,25 specifically 75 percent of the cost of an LMS-100 unit less net

22 May 20, 2010 Order, 131 FERC ¶ 61,170 at P 31; see NY Transmission Owners

October 30, 2008 Request for Rehearing, Docket No. EL07-39-004, et al.; see also

October 4, 2007 Compliance Filing, Docket No. EL07-39-000, Attachment 2, Aff. of

Mr. Eugene T. Meehan, at ¶ 27 (“I]n the NERA/S&L study, we solved for an

amortization period for New York City of 15.5 years. Essentially, we found that

levelizing investment costs for 15.5 years to determine the net CONE, considering that

over time the price would clear below the net CONE, would enable the peaking unit to

earn its cost of capital over a 30-year life.”). Later in its 2008-2011 Demand Curve

Filing in Docket No. ER08-695-000, NYISO used a 17.5-year amortization period to

determine the Reference Price. See NYISO, Filing of Tariff Revisions to Implement

Revised Demand Curves for Capability Years 2008/2009, 2009/2010, 2010/2011, Docket

No. ER08-283-000, Transmittal Letter at 9 (filed November 30, 2007).

23 Commonwealth Edison Co. and Commonwealth Edison Co. of Indiana,

127 FERC ¶ 61,301, at P 14 (2009); PPL Electric Utilities Corp., 124 FERC ¶ 61,229, at P 7 (2008); TransCanada Power Marketing Ltd. v. ISO New England Inc., 123 FERC ¶ 61,149, at P 22 (2008); New York Independent System Operator, Inc., 112 FERC

¶ 61,283, at P 35, n.20 (2005).

24 January 29, 2008 Order, 122 FERC ¶ 61,064 at P 44.

25 September 30, 2008 Order, 124 FERC ¶ 61,301 at P 32.

Docket No. EL07-39-006 et al.- 10 -

energy and ancillary services revenues used to develop the NYC Demand Curve, is

reasonable. This value is based on the default Net CONE as defined in Attachment H of

NYISO’s Services Tariff26 and is based on a 30-year amortization period.27 To develop

the Demand Curve, section 5.14.1.2 requires an adjustment to account for a capacity level

that exceeds the ICAP requirement.28 This adjustment, based on the 2008-2011 Demand

Curves, assumed an average capacity supply equal to 104 percent of the ICAP

requirement, and shifted the Demand Curve so that the estimated levelized net cost of the

proxy LMS-100 unit would correspond to a capacity level equal to 104 percent of the

ICAP requirement. In this way, all prices on the Demand Curve reflect the risk of a

small, but persistent, supply exceeding the ICAP requirement. As a result, the adjustment

produces a Reference Price that exceeds the Net CONE value defined in section 23.2.1.

Thus, in our view, a Default Offer Floor based on the lower price level reasonably

reflects the important risk factor that an expected average surplus capacity level creates.

Market clearing is expected to fluctuate around this level, not around the capacity level

corresponding to the Reference Price (where supply equals the ICAP requirement). This

Demand Curve adjustment needed to account for the risk of surplus capacity is not an

element used to determine the levelized net cost of the proxy LMS-100 unit which is

defined as Net CONE in section 23.2.1.

18. Further, mitigation under the Default Offer Floor is intended to require a

competitive offer from a new entrant that may otherwise have the incentive and ability to

exercise market power by suppressing prices. Our ruling may produce lower capacity

offers than would result under a higher Default Offer Floor. This outcome would be just

and reasonable because it would reflect the competitive cost of new entry.29 The goal of

26 NYISO, Services Tariff, § 23.2.1.

27 January 29, 2008 Order, 122 FERC ¶ 61,064 at P 44.

28 May 20, 2010 Order, 131 FERC ¶ 61,170, at P 27 (“[G]iven the bias toward

excess capacity, the new peaking unit could not be expected to receive the revenue

implied by the net CONE figure over time. Hence, the ICAP Demand Curve could not

incent sufficient new entry without an adjustment to net CONE.”). This adjustment is

required because the New York planning process is based on an objective of ensuring that capacity does not fall below the minimum requirement. The Commission found that it is reasonable to assume that the NYCA will experience some level of capacity above the

minimum requirement and accepted NYISO’s assumed excess levels. See January 29,

2008 Order, 122 FERC ¶ 61,064 at PP 31-34.

29 Higher or lower market clearing prices than the Default Offer Floor are possible

depending on other accepted capacity offers. In the NYC capacity auctions, the last bid

accepted in the auction establishes the market clearing price applicable to all accepted

bids.

Docket No. EL07-39-006 et al.- 11 -

mitigation is to ensure competitive offers from all participants, not to target a higher or lower price. For these reasons, we deny rehearing.

19. Finally, we clarify that the Commission’s ruling does not affect the Demand

Curve reset process. In particular, our decision in no way affects the need to factor in a

surplus assumption to determine the Reference Price, which is a key element in the

determination of the ICAP Demand Curve. Our decision only reiterates that the point on

the Demand Curve that corresponds to Net CONE, as defined in section 23.2.1, is the

localized levelized embedded cost of a peaking unit in NYC net of the likely projected

annual Energy and Ancillary Services revenues. The Reference Price used in setting the

Demand Curve continues to be based on a level of assumed excess above the ICAP

requirement that may vary with each Demand Curve reset, but will always result in a

Reference Price that exceeds Net CONE, as defined in section 23.2.1.

2.Offer Floor for SCRs

20.NYISO proposed an Offer Floor for SCRs equal to the minimum monthly ICAP

payment that the SCR receives from its Responsible Interface Party, plus the monthly

value of any third party payments or other benefits the SCR or Responsible Interface

Party receives for providing ICAP. In accepting NYISO’s proposal, the Commission

stated

where the SCR has agreed to accept a percentage of the market clearing

price with a guarantee of a minimum monthly payment in return for a

capacity obligation, that minimum payment, coupled with other benefits or

subsidies, is a reasonable proxy for the SCR’s net cost of providing that

capacity, which would be difficult to determine, and thus is a reasonable

Offer Floor.30

21. The Commission concluded that subsidies or other benefits designed to encourage SCRs should be included in the calculation of the Offer Floor, stating that “the best

representation of the opportunity cost of that curtailment is the value that will induce the SCR to abstain.”31 However the Commission also stated that

[n]onetheless, it is not our intent to interfere with state programs that

further specific legitimate policy goals. We agree that it is appropriate to

exempt payments an SCR receives from such programs from the

calculation of the price floor proposed by NYISO. Based on the

information provided in this proceeding, the Commission believes it is

30 May 20, 2010 Order, 131 FERC ¶ 61,170 at P 133.

31 Id. P 136.

Docket No. EL07-39-006 et al.- 12 -

reasonable to allow an exemption for the two programs discussed in the filings in this proceeding, [New York State Energy Research and

Development Authority (NYSERDA)] rebates and ConEd’s Distribution Load Relief Program, and exclude the payments received by SCRs under these programs from the calculation of the offer floor.32

22. The Commission also directed NYISO to file tariff sheets listing the criteria it proposes to use in evaluating whether to include a specific subsidy or other benefit in its calculation of Offer Floors for future SCR programs. The Commission also directed NYISO to publish on its website a complete list of SCR programs whose subsidies and other benefits are to be included or excluded in the Offer Floor.33

a.NYISO’s Request for Clarification

23.NYISO seeks confirmation that the May 20, 2010 Order did not intend for

NYISO to evaluate the “legitimacy” of individual state programs that provide for benefits

or payments to SCRs when calculating SCR Offer Floors. NYISO states that such a

requirement would be inconsistent with both Commission policy and NYISO’s role as a

market administrator. NYISO states that it reads the Commission’s single reference to

“specific legitimate policy goals” as a non-dispositive expression of the Commission’s

desire that state programs not be disrupted, rather than a mandate that NYISO undertake

a “legitimacy analysis” of each program. NYISO adds that because of stakeholder

controversy over how SCR payments should be considered in Offer Floor calculations, it

requests clarification that the May 20, 2010 Order does not require NYISO to distinguish

“legitimate” state programs from others in calculating SCR Offer Floors.

24. NYISO states that the requested clarification is consistent with Order No. 719’s

determinations that Independent System Operators and Regional Transmission

Organizations (ISOs/RTOs) must not interpret potentially ambiguous state laws and

regulations.34 NYISO contends that requiring an ISO/RTO to discern the intent of state

policies, and evaluate their “legitimacy,” would be problematic and contrary to

Commission policy encouraging ISO/RTO responsiveness to states that is articulated in

32 Id. P 137.

33 Id. P 138.

34 NYISO June 21, 2010 Filing at 4 (citing Wholesale Competition in Regions with Organized Electric Markets, Order No. 719, 73 Fed. Reg. 64,100 (Oct. 28, 2008), FERC Stats. & Regs. ¶ 31,281 at nn. 78 & 212 (2008), order on reh’g, Order No. 719-A, FERC Stats. & Regs. ¶ 31,292, order on reh’g, Order No. 719-B, 129 FERC ¶ 61,252 (2009); See also Order No. 719-A, FERC stats. & Regs. ¶ 31,292 at P 50).

Docket No. EL07-39-006 et al.- 13 -

Order No. 719 and Order No. 2000.35 NYISO states that it interprets the Commission’s instructions as a mandate to identify criteria that may cause uneconomic SCR entry

harmful to capacity markets, and not to evaluate the legitimacy or goals of SCR

programs, themselves.

b.NRG’s Request for Rehearing

25.NRG argues that the decision to exempt NYSERDA and Consolidated Edison’s

(ConEd) Distribution Load Relief Program payments from the Offer Floor lacks record

support and was internally inconsistent. NRG states that the Commission rejected

requests for a blanket exemption from the Offer Floor for any subsidies or other benefits

designed to encourage SCRs to enter the market and correctly recognized that the Offer

Floor should reflect the costs that induce SCRs to abstain from using power. But then,

NRG asserts, the Commission inconsistently exempted the two main programs that

induce SCRs to enter the market. NRG states that the NYSERDA program offers

incentives to offset the cost of equipment, and asserts that such incentives are directly

tied to participation as an SCR ICAP provider in the NYISO market. NRG adds that the

Distribution Load Relief Program pays customers an additional capacity payment for

actually reducing at least 50 kW of load for a period of not less than four hours and that

demand response providers look to both NYISO and ConEd payments to incent them to

enter the market.

26. NRG further argues that the Commission did not adequately explain its statement

about not “interfere[ing] with state programs that further specific legitimate policy

goals.” According to NRG, properly framed, the issue in this proceeding is not whether

the Commission should interfere with state policy objectives of encouraging demand

resources, but rather whether the Commission should allow SCRs to participate in

Commission-jurisdictional wholesale markets without mitigation, despite an economic

interest and opportunity to suppress capacity market prices. NRG claims that the

May 20, 2010 Order provides no reasoned basis for why applying buyer-side mitigation

to new SCR entrants is inconsistent with state polices or undermines New York’s

provision of incentives to demand response. NRG adds that mitigation of buyer-side

market power from SCRs is not inconsistent with state goals, in that nothing prevents the

state from pursuing legitimate public policy objectives; it simply cannot do so at the

expense of maintaining the pricing integrity of the Commission-jurisdictional capacity

market.

35 Id. at 5 (citing Regional Transmission Organizations, Order No. 2000, FERC Stats. & Regs. ¶ 31,089 at 31,074-075 (1999), order on reh’g, Order No. 2000-A, FERC Stats. & Regs. ¶ 31,092 (2000), aff’d sub nom. Pub. Util. Dist. No. 1 of Snohomish

County, Washington v. FERC, 272 F.3d 607 (D.C. Cir. 2001)).

Docket No. EL07-39-006 et al.- 14 -

27. In addition, NRG asserts that the Commission failed to identify in any way the

specific information upon which it relied for its decision, did not provide the specific

information, and did not provide the criteria it used in determining that the information

provided supported exempting these two programs from the Offer Floor. Moreover,

according to NRG, the Commission compounded the error by establishing a further

proceeding to determine the criteria for exempting additional state programs aimed at

SCRs from the Offer Floor.36 NRG states that reasoned decision making requires that the Commission determine and explain the criteria for exempting these two programs.

28. NRG states that, in any event, the information provided in this proceeding did not

support exempting these two programs. NRG contends that, to be an effective tool, the

Offer Floor must prevail when state initiatives adversely impact the just and reasonable

capacity rate. Thus, according to NRG, the Commission should not have reduced the

Offer Floor for SCRs by exempting the two programs that induce SCRs to enter the

market.

29. Finally, NRG argues that, at a minimum, the Commission should defer exempting these two programs from the Offer Floor pending a decision on the NYISO filing to

specify the criteria for exemption of state programs from the Offer Floor. Further, the Commission should clarify that any decision on that filing will be based on the facts and circumstances of the New York programs.

Commission Determination

30. We clarify that our May 20, 2010 Order did not intend for NYISO to rule on the

legitimacy of particular state programs. However, neither did we intend to grant a

blanket exemption for all state programs that subsidize demand response.37 Upon further

consideration, we conclude that it is not necessary for NYISO to provide a list of criteria

to govern the determination of whether payments under specific programs should be

excluded from the SCR Offer Floor determination. Consistent with the Commission’s

order in PJM, the state may seek an exemption from the Commission pursuant to section

206 of the FPA if it believes that the inclusion in the SCR Offer Floor of rebates and

other benefits under a state program interferes with a legitimate state objective.38 An

36 NRG June 21, 2010 Request for Rehearing at 18 (citing ANR Pipeline Co. v. FERC, 931 F.2d 88, 92093 (D.C. Cir. 1991) (finding the Commission “lack[ed] the clarity and consistency necessary” in granting summary disposition while at the same time expressly leaving open the same issue at hearing)).

37 We have rejected the blanket exemption from mitigation of state sponsored

projects. See PJM Interconnection, L.L.C., 137 FERC ¶ 61,145, at P 89 (2011) (PJM).

38 Id. P 91.

Docket No. EL07-39-006 et al.- 15 -

exemption determination will then be made by the Commission based on the specific request, which will be given public notice and be subject to comments and protests so that the Commission’s determination can be based on a full record. Accordingly, we direct NYISO to file to revise its Services Tariff to provide that, unless ruled exempt by Commission order on a request for exemption filed by the state, all rebates and other benefits from state programs must be included in the SCR Offer Floor.39

31. In the May 20, 2010 Order, the Commission determined that payments under

ConEd’s Distribution Load Relief Program and the NYSERDA rebate program should

not be included in the calculation of the SCR Offer Floor. However, upon further

consideration, we grant NRG’s request for rehearing with regard to these two programs,

reverse the Commission’s findings with respect to these two programs, and direct that

any determination regarding the treatment of rebates and benefits under these two

programs going forward be made in accordance with the procedure we establish above.

We agree with NRG that the current record in this proceeding does not adequately

support the exemption of payments under these two programs from the SCR’s offer floor,

and accordingly, we grant rehearing. We believe that allowing exemptions under such

programs requires the kind of fully developed record that is best made in the give and

take of a Commission proceeding focused on the specific requested exemption. We

emphasize that our determination regarding payments under these two programs rests

wholly on our concern over the insufficient record in this proceeding.

32. The reversal of our prior decision to exclude such payments raises the question of

remedy for past rates that may have been unjust and unreasonable. In fashioning such

remedy, we weigh the complication and cost of resettling the market and the uncertainty

such action could create for market participants against the benefit, if any, to be gained

by such endeavor.40 In this case, we find that the expense, and complexity associated

with attempting to re-create putative market outcomes - as well as the uncertainty for

market participants - outweighs whatever benefit might accrue to the market through this exercise. Accordingly, our ruling here is effective prospectively from the date of this order, and thus will not affect the formerly exempt status of the payments associated with these two programs prior to the date of the order.

39 In the later part of this order dealing with NYISO’s compliance filing, we reject its proposed tariff provision that would establish a blanket exemption for all state

programs. See infra P 79.

40 California Indep. Sys. Operator Corp., 120 FERC ¶ 61,271, at P 24 (2007).

Docket No. EL07-39-006 et al.- 16 -

III.NYISO’s August 24, 2010 Compliance Filing in Docket No. ER10-2371-000

A.Notice of Filing and Responsive Pleadings

33.NYISO’s August 24, 2010 filing to comply with the May 20, 2010 Order was

docketed in Docket No. ER10-2371-000 and notice of the filing was published in the

Federal Register, 75 Fed. Reg. 54,615 (2010), with interventions and protests due on or before September 14, 2010. 41

34. Hess Corporation, NRG Companies, Bayonne Energy Center, LLC, and

Constellation Energy Commodities Group, Inc. and Constellation NewEnergy, Inc.

(collectively, Constellation) filed motions to intervene. On September 2, 2010, NY

Transmission Owners filed a motion to intervene and comments. On September 2, 2010,

as corrected on September 3, 2010, In-City Suppliers42 filed a motion to intervene and

protest.

35.On September 17, 2010, In-City Suppliers filed an answer to NY Transmission

Owners and NYISO filed an answer to In-City Suppliers and NY Transmission Owners.

B.Compliance Procedural Matters

36.Rule 213(a)(2) of the Commission’s Rules of Practice and Procedure, 18 C.F.R.

§ 385.213(a)(2) (2014), prohibits an answer to a protest unless otherwise ordered by the decisional authority. We will accept the answers filed in this proceeding because they have provided information that assisted us in our decision-making process.

41 NYISO initially submitted its filing on August 12, 2010, but used an incorrect filing code and was requested by FERC Staff to withdraw and resubmit the filing.

NYISO states that it resubmitted its filing on August 23, 2012, but inadvertently omitted an attachment. Problems with NYISO’s eTariff software required NYISO to resubmit the entire filing on August 24, 2014.

42 In-City Suppliers consists of Astoria Generating Company, L.P., GDF Suez

Energy North America, Inc., TransCanada Power Marketing Ltd., and TC Ravenswood,

LLC.

Docket No. EL07-39-006 et al.- 17 -

C.Substantive Compliance Matters

1.Definition of Control

a.Background and NYISO’s Filing

37.In the May 20, 2010 Order, the Commission recognized that when control is

defined consistent with Order No. 69743 as we have required, NYISO’s proposal to

exempt small sellers from market power mitigation, which the Commission had

previously accepted, may create a loophole that could give an entity an incentive and

ability to exercise market power by withholding capacity even if it controls less than 500 megawatts of UCAP.44 The Commission, therefore, directed NYISO to review the merits of the existing mitigation exemption and report as to whether the exemption should

remain. If NYISO chose to retain the exemption for small sellers, NYISO was directed to explain how its mitigation proposal would address the market power issues it has

raised without broadening the definition of control.45

38. In its August 24, 2010 Filing, NYISO states that it re-examined the merits of the

existing 500 MW exemption using the updated Demand Curve parameters and prices

from May 2008 through June 2010, and determined that the existing 500 MW exemption

should be retained even with the current, narrower definition of control.46 NYISO adds

that its Independent Market Monitoring Unit (MMU) supports this determination.47

43 In Order No. 697 the Commission said “[A]n entity controls the facilities when

it controls the decision-making over sales of electric energy including discretion as to

how and when power generated by the facilities will be sold.” Market-Based Rates for

Wholesale Sales of Electric Energy, Capacity and Ancillary Services by Public Utilities,

Order No. 697, 72 Fed. Reg. 39,904 (July 20, 2007) FERC Stats. & Regs. ¶ 31,252

(2007). NYISO’s proposed definition broadened the definition of control to include the retention of revenue or other financial benefits from UCAP, which the Commission

rejected in the September 30, 2008 Order on the basis that it went beyond the scope of the March 7, 2008 Order.

44 NYISO asserted that some contract terms could be structured to give a seller a

continuing financial interest in the sales of other market participants so that even though a seller might retain control (as defined under Order No. 697) of less than 500 megawatts of UCAP, it could nevertheless profit from withholding on the capacity it has transferred to a third party. May 20, 2010 Order, 131 FERC ¶ 61,170 at P 23.

45 Id.

46 August 24, 2010 Re-Filing of August 10, 2010 Filing Letter, at 15-16.

47 Id. at 16.

Docket No. EL07-39-006 et al.- 18 -

NYISO states that, over the 26-month period examined, the average required size for

profitable withholding was 575.8 MW and the median size was 676.5 MW. NYISO

notes that although the size for profitable withholding was above 500 MW in summer

months and below 500 MW in winter months, winter withholding is not as much of a

concern because in-City capacity prices are frequently significantly lower and usually set

by the overall NYCA price, which makes the potential opportunity to benefit from

withholding much lower and less predictable than in the Summer.48 NYISO asserts that

this analysis confirms that the 500 MW level is an appropriate level at which to identify

ICAP Suppliers that could benefit from withholding as Pivotal Suppliers.

39. NYISO states that it continues to believe that the risk of market abuses with the

combination of the current definition of control and the 500 MW exemption is greater

than with the narrower proposed definition, but it believes that the advantages of

retaining the exemption outweigh the disadvantages, even after accounting for the

heightened risk. NYISO states that if it were to uncover suspicious conduct, it would

refer the matter to the MMU and consider proposing tariff revisions to address any issues.

NYISO also states that it intends to include the amounts of unoffered, and offered but

unsold, capacity in NYC in its ICAP Demand Curves report that is filed annually with the

Commission.49

b.Protests and Answers

40.NY Transmission Owners agree with NYISO with respect to summer months but

state that their analysis indicates that, in 5 of the 12 winter months that NYISO included

in its analysis, entities with NYC ICAP portfolios of less than 500 MW could have

benefited from withholding, even after taking into account that winter NYC ICAP prices

during this period were sometimes set by the ICAP Demand Curve for the NYCA.50

Therefore, they contend that maintaining the 500 MW exemption has not been justified.

NY Transmission Owners state NYISO’s other tools for deterring withholding may not

be sufficient to address economic withholding in these circumstances. For example,

according to NY Transmission Owners, NYISO has the power to audit potential

withholding that causes certain increases in price for NYC ICAP, however, that provision

is limited to physical withholding and thus, could permit economic withholding in winter

months.51

48 Id.

49 Id.

50 NY Transmission Owners September 2, 2010 Comments at 3.

51 Id. at 4.

Docket No. EL07-39-006 et al.- 19 -

41. In-City Suppliers respond that even if the math underlying these allegations is

technically correct, the conclusions that the NY Transmission Owners draw are

fundamentally flawed.52 They assert that the NY Transmission Owners do not allege that any supplier used its position as a small entity to benefit the price paid for other MWs with which it was associated.53 In-City Suppliers state that the Commission already

considered and rejected, in its March 7, 2008 Order, assertions raised by load parties with respect to the size of the exemption; thus this is a collateral attack on past Commission orders finding that the supplier exemption itself was properly structured.54

42. In-City Suppliers further state that the alleged benefit is highly speculative and

likely to be very difficult for any small NYC supplier to exact with any degree of

certainty given the unpredictable nature of factors that affect clearing prices, such as the

level of SCRs that will participate in any given monthly spot market auction.55 In-City

Suppliers contend that none of the five months identified in the NY Transmission

Owners’ analysis fell within the period following a transition period when the addition of

1,000 MW of new generation was offset by the retirement of generating facilities in New

York. Since the retirement, according to In-City Suppliers, prices in both summer and

winter periods have cleared against the NYC Demand Curve, not the NYCA curve, with

the result that a small supplier will not be able to successfully employ an economic

withholding strategy.56

Commission Determination

43. We find that NYISO has complied with the May 20, 2010 Order with respect to

the exemption for units that control less than 500 MW of capacity. NYISO reviewed the

mitigation exemption, as the Commission directed, and found that the average size

required for profitable withholding was 575.8 MW. While the figures vary from month

to month and the size in the winter months may drop below 500 MW, we agree with

NYISO that withholding in the winter months is less of a concern given that the clearing

prices in the winter months are frequently set by the NYCA clearing price and are

significantly lower than the summer ICAP prices. Further we agree with In-City

Suppliers that the unpredictable nature of the factors that affect clearing prices make it

52 In-City Suppliers September 17, 2010 Answer at 5.

53 Id. at 6.

54 Id. (citing New York Indep. Sys. Operator, Inc., March 7, 2008 Order, 122 FERC ¶ 61,211, at P 68 (2008)).

55 Id.

56 Id. at 6-7.

Docket No. EL07-39-006 et al.- 20 -

difficult for any small supplier to predict with accuracy any benefit to be gained from withholding small amounts of supply.

44. We also note that NYISO states that it will be vigilant for signs that suppliers that

qualify for the exemption might be engaging in market abuses and that it will refer any

suspicious conduct to the MMU and consider tariff revisions to address any issues.

Accordingly, we find that NYISO provided reasonable justification for the mitigation

exemption.

2.Definition of Default Offer Floor

a.NYISO’s Filing

45.As discussed in the rehearing section of this order, the Commission’s May 20,

2010 Order granted NY Transmission Owners’ request for rehearing with regard to the

specification of the generator mitigation Default Offer Floor. The Commission found

that NYISO’s proposed Default Offer Floor of 75 percent of the Reference Price exceeds

Net CONE as defined by section 23 of the NYISO Services Tariff because the Reference

Price used to develop the ICAP Demand Curve has been adjusted upward to account for

the likely capacity surplus and associated lower ICAP revenue. Thus, the Reference

Price used to develop the Demand Curve is not the equivalent of Net CONE. As the

Commission found in the May 20, 2010 Order, Net CONE (per kW-month) equates to the

price on the ICAP Demand Curve corresponding to 104 percent of the minimum capacity

requirement since the ICAP Demand Curves approved in the 2008-2011 Demand Curve

reset proceeding reflect a market clearing quantity that exceeds the requirement by an

average four percent. The Commission directed NYISO to modify the calculation of the

Offer Floor consistent with that discussion.

46. In its August 24, 2010 filing, NYISO proposes to retain the existing definition of

“Net CONE” but add a definition of a new term, “Mitigation Net CONE,” to section

23.2.1 of Attachment H of its Services Tariff, and to incorporate that new term in the

definition of the Default Offer Floor in place of “Net CONE.” The Default Offer Floor

would be 75 percent of Mitigation Net CONE under NYISO’s proposal. Mitigation Net

CONE would be defined as “the capacity price on the currently effective in-City Demand

Curve corresponding to the average amount of excess capacity above the in-City ICAP

requirement, expressed as a percentage of that requirement, that formed the basis of the

in-City Demand Curve approved by the Commission.”57 NYISO states that under its

proposal, it would not be necessary to revise the definition of Mitigation Net CONE

every time the Demand Curves are re-set. NYISO adds that its proposed distinction

between the terms “Mitigation Net CONE” and “Net CONE” will clarify the mitigation

measures and avoid any implication that determinations in the in-City mitigation context

57 NYISO August 24, 2010 Filing at 4.

Docket No. EL07-39-006 et al.- 21 -

regarding the definition of Mitigation Net CONE might have precedential effects on the

Demand Curves. There were no protests to or comments on NYISO’s proposal.

b.Commission Determination

47.We find that NYISO’s proposal to add a new term “Mitigation Net Cone” is

consistent with the May 20, 2010 Order and, therefore, it is accepted. NYISO’s proposed new term “Mitigation Net CONE” tracks the Commission’s clarification that the proxy

unit levelized net cost value per kW-month to be used for purposes of applying Default

Net CONE in the NYC buyer-side mitigation exemption and Default Offer Floor

determinations equates to the price point on the relevant Demand Curve at the level of

excess capacity used to design the Demand Curve (104 percent of the ICAP requirement for the 2008-2011 Demand Curves). Thus, Mitigation Net CONE is a per-kW-month

equivalent of Net CONE (which, as defined in the NYISO Tariff, is a total net cost

parameter). Of course, since Mitigation Net CONE is less than the Reference Price, the Reference Price exceeds the per-kW-month equivalent of Net CONE. Adding the term

“Mitigation Net CONE” allows the Tariff to clearly describe how the Default Offer Floor is to be calculated as the Demand Curve is reset over time.

48. However, we clarify that, by accepting NYISO’s proposal, we are not agreeing

with NYISO that Net CONE as currently defined in Attachment H is a different total net

cost amount than the Net CONE on which the per-kW-month Mitigation Net CONE price

is based.58 There cannot be two “Net CONE” amounts, a higher one for purposes of the

Demand Curves and a lower for purposes of mitigation. The May 20, 2010 Order

rejected NYISO’s interpretation of the existing defined term “Net CONE” as that price at

100 percent of the ICAP requirement on the ICAP Demand Curve. On this basis, we

found in the rehearing portion of this order that NYISO was in error in referring to the

Demand Curve Reference Price calculated to establish the 2008-2011 Demand Curves as

“Net CONE.” The Commission has clarified here and in the May 20, 2010 Order that

there is only one meaning for the term “Net CONE” as set forth in section 23.2.1 of

Attachment H, and that is the levelized net cost of the proxy unit using the appropriate

amortization period as discussed above in Paragraph 14 (30 years in the case of the 2008-

2011 Demand Curves), which is the price point on the Demand Curve as defined by the

new term “Mitigation Net Cone.”

3.Penalty for Withholding ICAP

49.Physical withholding of ICAP includes unjustified retirements, a Pivotal

Supplier’s failure to offer all uncommitted ICAP into the NYISO markets, and a Pivotal

Supplier withholding by exporting. Thresholds for identifying physical withholding are

specified in section 23 of Attachment H. This section also allows market participants to

58 NYISO August 24, 2010 Filing at 5.

Docket No. EL07-39-006 et al.- 22 -

take advantage of higher prices in external markets. Thus, a determination of physical

withholding by exporting must entail a measurement of whether the export is economic.

The amount of the penalty is also at issue.

a.Conduct and Impact Test

i.Background

50.In its May 6, 2008 filing in this proceeding, NYISO proposed a conduct and

impact test to make the determination of whether an ICAP export constitutes physical

withholding. An ICAP export must fail both the conduct and impact test to be subject to

the mitigation penalty.59 Section 4.5(d)(i) describes the conduct element of the test. It

would conclude an export constituted physical withholding when the export price was at

least five percent less than the NYC price, net of costs and measured over the relevant

timeframe. Section 4.5(d)(ii) describes the impact element of the test. It would conclude

an export constituted physical withholding if it contributes to at least a five percent

increase in NYC prices, provided such increase is at least $.50/kilowatt-month.60

51. In the September 30, 2008 Order, the Commission directed NYISO to raise its

penalty threshold to $2/kW-month and 15 percent, but did not specify whether the

threshold related to the conduct and/or impact tests. In response to the September 30,

2008 Order, NYISO filed to revise its impact threshold for physical withholding, but not

its conduct threshold. In the May 20, 2010 Order, the Commission stated that it intended,

in the September 30, 2008 Order, to direct NYISO to file to change both the conduct and

impact thresholds to be the greater of $2/kW-month and 15 percent. Therefore, in the

May 20, 2010 Order, the Commission accepted the revised impact threshold but directed

NYISO to revise its conduct threshold to 15 percent or more, provided such increase is at

least $2/kW-month.61

ii.NYISO’s August 24, 2010 Filing

52.NYISO proposes to modify section 23.4.5.4.1 to provide that the conduct

threshold for exports would be deemed to be withholding if the difference between

estimated and actual prices for exports of UCAP and in-City sales was the greater of 15

percent or $2/kW-month.

59 NYISO, Compliance Filing, Docket No. ER08-695-001, at 14 (filed May 6,

2008).

60 Id.

61 May 20, 2010 Order, 131 FERC ¶ 61,170 at P 74.

Docket No. EL07-39-006 et al.- 23 -

iii.Protests and Answers

53.In-City Suppliers state that currently Pivotal Suppliers that physically withhold

through uneconomic export are not assessed a penalty unless the threshold levels defined

in the Services Tariff are exceeded; however, under NYISO’s proposal, no threshold is

applied to physical withholding through failure to offer. In-City Suppliers assert that the

Commission clearly intended to treat all forms of physical withholding by Pivotal

Suppliers in the same manner;62 thus, the thresholds defined in the Services Tariff must

be applied to both situations. In-City Suppliers argue that NYISO’s proposal will

undermine the critical balance between load and supplier interests that the Commission

sought to achieve in its March 7, 2008 Order, that it over-penalizes Pivotal Suppliers that

fail to offer all uncommitted ICAP, and this proposed revision is inconsistent with

NYISO’s prior submissions wherein NYISO proposed to apply thresholds to both types

of physical withholding.63 According to In-City Suppliers, NYISO stated that such rules

were intended to be invoked when the withholding in question had a defined impact.64

In-City Suppliers contend that NYISO’s proposed change makes the treatment of

uneconomic sales and failure to offer uncommitted ICAP less similar, rather than

equivalent.

54. NYISO responds that In-City Suppliers seek to expand the scope of the

Commission’s directive by including a requirement that NYISO apply an impact

threshold on penalties for a failure to offer, a modification the Commission did not

require. NYISO argues that the penalty for a failure to offer has always been triggered

solely by a Pivotal Supplier’s failure to offer all applicable MWs of capacity, and

application of an impact threshold would undermine the effectiveness of the penalty rule.

NYISO states that adding an impact test to the existing “must offer” requirement would

eviscerate the penalty and undermine the intent of it because any withholding by a Pivotal

Supplier can have a significant adverse impact on the capacity market. NYISO also notes

that the May 20, 2010 Order specifically discussed the conduct and impact thresholds to

be applied in determining whether to assess penalties for physical withholding through

uneconomic exports, without directing NYISO to adopt similar provisions for physical

withholding through failure to offer.65

62 In-City Suppliers September 2, 2010 Protest at 20-21 (citing New York Indep. Operator, Inc., 131 FERC ¶ 61,170 at P 38 (2010)).

63 In-City Suppliers September 2, 2010 Protest at 20-21 (citing New York Indep. Operator, Inc., 131 FERC ¶ 61,170 at PP 66-67 (2010)).

64 Id.

65 NYISO September 17, 2010 Answer at n. 12.

Docket No. EL07-39-006 et al.- 24 -

Commission Determination

55. We find that NYISO’s proposed revisions to section 23.4.5.4.1 to equalize the

conduct and impact thresholds for withholding through exports comply with the May 20, 2010 Order. We also agree that NYISO complied with the Commission’s directive to

equalize the amount of the penalty for withholding by failure to offer. It is reasonable

that both types of withholding, i.e., failure to offer and withholding through exporting, be treated the same. That is, all megawatts of ICAP determined to be withheld should be

subject to the same mitigation penalty. Accordingly, we accept NYISO’s revisions to

section 23.4.5.4.1 of its Services Tariff.

56. We reject the In-City Suppliers contention that the Commission intended that a

conduct and impact test should also be used to judge whether withholding through failure

to offer should be deemed withholding and subject to withholding penalties. A conduct

and impact test is necessary to judge whether an export constitutes physical withholding

because a decision to export reflects expectations about price differences between

markets. It would not be appropriate to mitigate all exports that were uneconomic

because price expectations were not realized by the exporter. Economic exports could be

unduly discouraged if price uncertainty was not taken into account, and a conduct and

impact test is a reasonable way to recognize this uncertainty. However, a conduct and

impact test is not needed to make a withholding determination if a supplier fails to offer

its available capacity as it is simply the failure to offer available capacity that constitutes

withholding.66 Thus if a supplier fails to offer its available capacity into the market, it

should be subject to withholding penalties.

57. It is reasonable that both types of withholding, i.e., failure to offer and

withholding through exporting, should be treated the same. That is, all megawatts of

ICAP determined to be withheld should be subject to the same mitigation penalty.

58.Accordingly, we accept NYISO’s revisions to section 23.4.5.4.1 of its Services

Tariff.

b.Penalty Amount

59.In the May 20, 2010 Order, the Commission found that NYISO’s penalty for

Pivotal Supplier physical withholding through a failure to offer all uncommitted ICAP

into the NYISO markets was excessive and should be the same as the penalty for

physical withholding through uneconomic exports.67 The Commission stated that its

66 Section 23.3.1.1 contains Thresholds for Identifying Physical Withholding. This section specifies, inter alia, that physical withholding of a Generator may be determined if 10 percent of its capability is not offered.

67 May 20, 2010 Order, 131 FERC ¶ 61,170 at P 38.

Docket No. EL07-39-006 et al.- 25 -

reasoning in the September 30, 2008 Order with regard to physical withholding through uneconomic exports applied equally to other types of physical withholding.68 The

Commission directed NYISO to file revised tariff sheets to reflect a penalty in the

amount of 1.5 times the difference between the clearing prices in the New York City

Spot Market Auction with and without the amount (in MWs) deemed to be physically withheld from the in-City market.

i.NYISO’s Filing

60.NYISO proposes to modify the penalty provisions of section 23.4.5.4.2 of

Attachment H to provide that, if mitigated UCAP is not offered or sold as specified,

the Responsible Market Party for such Installed Capacity Supplier

shall pay the ISO an amount equal to the product of (A) 1.5 times the

difference between the Market-Clearing Price for the New York City

Locality in the ICAP Spot Market Auction with and without the

inclusion of the Mitigated UCAP and (B) the total of (1) the amount

of Mitigated UCAP not offered or sold as specified above, and (2)

all other megawatts of Unforced Capacity in the New York City

Locality under common Control with such Mitigated UCAP.69

NYISO also proposes a conforming modification to the penalty calculation

provisions in section 23.4.5.6 to provide that ICAP suppliers that are not Pivotal Suppliers would be subject to the same penalties as ICAP Pivotal Suppliers for

similar conduct. NYISO states that absent this modification, Pivotal Suppliers

would be subject to lower penalties for similar conduct than would ICAP suppliers that were not Pivotal Suppliers, a result that would be inequitable and presumably, unintended by the Commission.

Commission Determination

61. We find that NYISO’s modification of section 23.4.5.4.2, with respect to the

amount of the penalty, complies with the Commission directive. Further, we agree with

NYISO that Pivotal Suppliers and non-Pivotal Suppliers should be subject to the same

penalties for similar conduct. Accordingly, we accept NYISO’s modification of section

23.4.5.4.2 and its conforming modification to section 23.4.5.6.

68 Id.

69 NYISO Market Services Tariff, proposed section 23.4.5.4.2.

Docket No. EL07-39-006 et al.- 26 -

4.Pivotal Supplier Export Ex Ante Approval Process

62.In the May 20, 2010 Order, the Commission accepted as modified NYISO’s

compliance filing to institute an ex ante approval process for Pivotal Supplier capacity

exports that would allow exporters to request determinations of whether exports would be

uneconomic and would therefore constitute physical withholding. In response to protests

that NYISO should be required to include a specific deadline for making the ex ante

determinations, NYISO proposed and the Commission accepted alternative language that

stated in section 23.4.5.4.3 “[s]uch requests, and the NYISO’s response shall be made in

accordance with the deadlines specified in ISO Procedures.” The Commission and

NYISO agreed that it is appropriate to specify such level of administrative detail in the

ISO procedures.

63. NYISO proposes the language stated above in a modification to section 23.4.5.4.3 of its Services Tariff to clarify that in the ex ante approval process for Pivotal Supplier capacity exports, requests for determination of whether exports would be uneconomic

and NYISO’s response to these requests will be in accordance with the deadlines to be specified in the ISO Procedures.

Commission Determination

64.We find that NYISO’s modification to section 23.4.5.4.3 complies with the

May 20, 2010 Order. Accordingly, we accept NYISO’s proposed revisions.

5.Changes Applicable to SCRs

a.Applicability and Duration of SCR Mitigation Rules

65.In the May 20, 2010 Order, the Commission found NYISO’s proposal to mitigate

uneconomic “new entry” by SCRs to be reasonable but rejected NYISO’s proposals to

(1) consider an SCR as “new entry” that is subject to mitigation when it re-enters the

market after a year’s absence70 and (2) terminate SCR mitigation after 12 months.71 The Commission held that SCRs, like uneconomic new generation, should be subject to

mitigation for a single, initial period and that mitigation should apply until the new

SCR’s capacity has been accepted in the market at a price at or above its Offer Floor for a total of 12, not necessarily consecutive, months. The Commission reasoned that meeting this requirement will show that the SCR’s capacity is economic over several different

seasons even though the capacity might not be accepted in all months of a calendar year

when offered at that price level.

70 May 20, 2010 Order, 131 FERC ¶ 61,170 at PP 106-107.

71 Id. P 107.

Docket No. EL07-39-006 et al.- 27 -

66. In addition, the Commission directed NYISO, consistent with the exemption

provided for new generation, to provide an exemption for new SCRs if, for the first year after entry into the market, the market price is expected to exceed the SCR Offer Floor. The Commission also directed NYISO to revise section 4.7 so that the six-month limit on mitigation measures does not apply to in-City mitigation.

i.NYISO’s Filing

67.NYISO proposes to modify section 23.4.5.7.5 of the Services Tariff to state that

an in-City ICAP supplier that is an SCR shall be subject to an Offer Floor beginning with the month of its initial offer to supply ICAP and lasting until its offers of ICAP have been accepted in the ICAP spot market auction at a price at or above its Offer Floor for a total of twelve, not necessarily consecutive, months. NYISO proposes to add that SCRs shall be exempt from the Offer Floor if the ISO projects that the ICAP spot market auction price will exceed the SCR’s Offer Floor for the first 12 months that the SCR is

reasonably anticipated to offer to supply Unforced Capacity.

68. NYISO states that it must have certain data from Responsible Interface Parties in

order to make the SCR Offer Floor exemption determination and that if it receives such

data by a certain date prior to the spot market auction, it could provide the Responsible

Interface Parties with determinations of whether the SCR was exempt and, if not exempt,

the price of the SCR’s Offer Floors. NYISO is also proposing to revise section 23.4.5.7.5

to specify that SCRs for which NYISO has not received all of the required SCR

information by a deadline to be specified in the ISO procedures will not be eligible to

offer or sell capacity until the required information is provided. NYISO also proposes to make conforming changes to section 23.4.8, which would provide an exception for the inCity generator and SCR mitigation periods from the otherwise applicable six-month limit on market power mitigation measures.

Commission Determination

69. We find that NYISO’s filing with respect to the applicability and duration of SCR mitigation complies with the May 20, 2010 Order. We find that it is reasonable to treat an SCR as ineligible to offer to sell ICAP if the Responsible Interface Party fails to

provide, by the deadline specified in the ISO procedures, the data needed to make the exemption determination or to determine the price of the SCR’s Offer Floor.

b.SCR Offer Floor

70.In the May 20, 2010 Order, the Commission accepted NYISO’s compliance

proposal to add a new section to Attachment H to include in the SCR Offer Floor the

monthly value of any payments or other benefits the SCR or Responsible Interface Party

Docket No. EL07-39-006 et al.- 28 -

(RIP) receives.72 The Commission rejected arguments of protesters that subsidies or

other benefits designed to encourage SCRs should be eliminated from the calculation of

the SCR Offer Floor, reasoning that the best representation of the opportunity cost to an

SCR of curtailing power “is the value that will induce the SCR to abstain.”73

Nonetheless, the Commission stated that it did not intend to interfere with state programs

that further specific legitimate policy goals and agreed with the protests that it is

appropriate to exempt payments an SCR receives from such programs from the

calculation of the Offer Floor.74 The Commission further stated that, based on the

information provided in this proceeding, it is reasonable to allow an exemption for two

programs discussed in the filings in this proceeding: NYSERDA rebates and ConEd’s

Distribution Load Relief Program.75 With respect to future programs, the Commission

directed NYISO to file tariff provisions explaining, with specificity, the criteria it

proposes to use in evaluating whether to include a specific subsidy or other benefit in its

calculation of SCR Offer Floors and to provide full support for the criteria it has

chosen.76 Further, the Commission directed NYISO to publish on its website a complete

list of programs whose subsidies and other benefits are to be included in the Offer Floor,

as well as all programs whose subsidies or benefits are to be excluded from the

calculation of the Offer Floor.77

i.NYISO’s Filing

71.In its compliance filing, NYISO states that, for the reasons specified in its

June 21, 2010 Request for Clarification, it does not believe that the Commission could

have intended for NYISO to pass judgment on the “legitimacy” of individual state

programs. NYISO states that it assumes that the Commission would agree that state

programs should be presumed to be aimed at serving valid public policy goals, and,

therefore, it interprets the May 20, 2010 Order as directing it to consider the potential for

payments or other benefits received by SCRs to cause uneconomic entry that would harm

the capacity markets. NYISO states that it does not believe that any of the programs of

which it is aware that are currently administered or approved by New York State, or a

governmental authority thereof, are currently causing uneconomic entry that would harm

72 May 20, 2010 Order, 131 FERC ¶ 61,170 at PP 109, 131.

73 Id. P 136.

74 Id. P 137.

75 Id.

76 Id.

77 Id. P 138.

Docket No. EL07-39-006 et al.- 29 -

the capacity markets. Therefore, NYISO proposes to exclude all payments and other

benefits to SCRs under state programs from the Offer Floor calculation. NYISO states

that its MMU agrees that this represents a reasonable approach at this time. Accordingly,

to comply with the May 20, 2010 Order, NYISO proposes to modify section 23.4.5.7.5 to

read as follows:

The Offer Floor calculation shall include any payment or the value of other benefits that are awarded for offering or supplying In-City Capacity, except for payments or the value of other benefits provided under programs

administered or approved by New York State or a government

instrumentality of New York State.

72. NYISO states that it will continue to monitor the impact of other benefits from

state programs, and to consider any stakeholder concerns that such programs may

individually, or collectively, be promoting uneconomic entry. NYISO adds that should it

determine that the exemption from the Offer Floor computation of payments and other

benefits from state programs may or has become harmful to the capacity market, it will

propose appropriate tariff changes given the circumstances at that time. NYISO adds that

since the SCR mitigation provisions were added to Attachment H, the level of new SCRs

sold by any one Responsible Interface Party has not exceeded the impact threshold.

NYISO concludes that even if every new SCR added by a single Responsible Interface

Party were offered in an ICAP auction at a level below the SCR’s respective Offer

Floors, including payments and other benefits from state programs, the currently-defined

SCR uneconomic impact threshold would not be reached. NYISO also states that it will

post on its website the names of the two programs identified by the Commission and any

other known state programs that would be exempt from the Offer Floor calculation, as

well as any other programs providing payments or benefits that would be excluded from

or included in the calculation of an SCR’s Offer Floor. In addition, NYISO states that it

will invite stakeholders to inform it of programs that are not posted on its website that

should be included in or excluded from an Offer Floor determination.

ii.Protests and Answers

73.In-City Suppliers argue that NYISO has failed to comply with the Commission’s

directive to provide criteria, with specificity and full support for evaluating whether

subsidy and benefit programs should be included in the SCR Offer Floor calculation. In-

City Suppliers state that NYISO’s “feigned belief” concerning its inability to pass

judgment on the legitimacy of individual state programs is without merit. In-City