UNITED STATES OF AMERICA

BEFORE THE

FEDERAL ENERGY REGULATORY COMMISSION

Astoria Generating Company, L.P.; NRG Power)

Marketing LLC; Arthur Kill Power, LLC; Astoria Gas )

Turbine Power LLC; Dunkirk Power LLC; Huntley Power LLC; Oswego Harbor Power LLC; and

TC Ravenswood, LLC

v.

New York Independent System Operator, Inc.

)

)

)Docket No. EL11-42-000

)

)

)

)

REQUEST FOR EXPEDITED CLARIFICATION, AND

ALTERNATIVE REQUEST FOR REHEARING,

OF THE NEW YORK INDEPENDENT SYSTEM OPERATOR, INC.

Pursuant to Rules 212 and 713 of the Commission’s Rules of Practice and Procedure,

18 C.F.R. §§ 385.212 and 713, the New York Independent System Operator, Inc. (“NYISO”)

requests expedited clarification of certain rulings and clarification, or in the alternative rehearing,

of certain statements in the Commission’s June 22, 2012 Order on Complaint in the above-

captioned docket (“June 22 Order”).1 The June 22 Order generally endorsed the NYISO’s

implementation and administration of its buyer-side market power mitigation rules (“BSM

Rules”), and denied the relief sought by Astoria Generating Company, L.P., NRG Power

Marketing LLC, Arthur Kill Power, LLC, Astoria Gas Turbine Power LLC, Dunkirk Power

LLC, Huntley Power LLC, Oswego Harbor Power LLC, and TC Ravenswood (collectively,

“Complainants”).2 It generally affirmed the transparency of the NYISO’s processes and found

Complainants’ claims that the BSM Rules lacked an objective tariff basis to be without merit.

1 Astoria Generating Company, L.P., et al., 139 FERC ¶ 61,244 (2012) (“June 22 Order”).

2 The June 22 Order makes clear that it applies only to the BSM Rules and determinations made

under them, i.e., the currently-effective buyer-side capacity market mitigation provisions in the NYISO’s

1

The June 22 Order directed the NYISO to make a compliance filing with respect to

certain aspects of the Offer Floor3 mitigation exemption determination test. It also requires the NYISO to provide additional information to stakeholders on the calculation procedures under the BSM Rules and on the outcome of individual mitigation exemption determinations. The NYISO has no issue with any of these determinations. It is working to prepare its compliance filing and to make the required informational postings.

The June 22 Order made a number of rulings, and offered extensive guidance, regarding

the use of inflation in various calculations under the BSM Rules. Certain aspects of these

directives are not entirely clear. The NYISO is therefore requesting that the Commission

confirm the NYISO’s understanding of how it is to account for inflation when conducting the

Part B test4 and when escalating established Offer Floors. The NYISO’s understanding of the

June 22 Order’s requirements is explained below and in Attachment A to this request. The

NYISO is seeking expedited clarification of these points in order to eliminate any possible

confusion, and to avoid potential controversies, over the application of inflation adjustments in

the BSM Rules.

Market Administration and Control Area Services Tariff (“Services Tariff’) Attachment H, including

revisions that were accepted by the Commission, effective November 27, 2010, in its series of orders in

Docket No. ER10-3043. See June 22 Order at P 6. The Commission is separately considering matters

related to the now superseded version of the NYISO’s buyer-side mitigation rules. Id. at n. 11.

3 Capitalized terms not defined herein have the meaning set forth in the NYISO’s Services Tariff, or if not defined therein, the NYISO’s Open Access Transmission Tariff (“OATT”).

4 Services Tariff § 23.4.5.7.2 sets forth the mitigation exemption determination which has two

parts (i.e., the Part A and Part B tests). An Installed Capacity Supplier will be found to be exempt from

an Offer Floor where it passes either the Part A or Part B test. The Part A test does not use Unit Net

CONE values and assumes that the project offers into the ICAP Spot Market Auction at a price equal to

zero. The Part B test evaluates whether a project is projected to be economic over the first three years

after entry.

2

The NYISO further requests clarification that the Commission’s statements regarding the ability of Examined Facilities to be retested5 are not meant to contravene the plain language of the retesting provisions of the BSM Rules. To the extent the June 22 Order is to be read as

providing for retesting in situations not contemplated in the BSM Rules, the NYISO submits that this error must be corrected on rehearing.

I.Communications

Communications regarding this pleading should be addressed to:

Robert E. Fernandez, General Counsel

Raymond Stalter, Director of Regulatory Affairs *Gloria Kavanah, Senior Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144

Tel: (518) 356-6000

Fax: (518) 356-4702

rfernandez@nyiso.com

rstalter@nyiso.com

gkavanah@nyiso.com

* -- Persons designated for service.

II.Background

*Ted J. Murphy

Hunton & Williams LLP

2200 Pennsylvania Avenue, NW Washington, DC 20037

Tel: (202) 955-1500

Fax: (202) 778-2201

tmurphy@hunton.com

*Vanessa A. Colón6

Hunton & Williams LLP Bank of America Center Suite 4200

700 Louisiana Street

Houston, TX 77002

Tel: (713) 229-5700

Fax: (713) 229-5782

vcolon@hunton.com

On June 3, 2011, the Complainants filed a complaint regarding the administration of the

BSM Rules. The Complaint alleged that the NYISO’s implementation of the BSM Rules lacked

5 See June 22 Order at P 132 and n. 115.

6 The NYISO respectfully requests waiver of 18 C.F.R. § 385.203(b)(3) (2011) to permit service on counsel for the NYISO in both Washington, DC and Houston, TX.

3

transparency and objectivity and questioned the validity of certain inputs used in Offer Floor exemption determinations.

The June 22 Order found that the NYISO’s implementation of the BSM Rules was

“sufficiently transparent and objective,”7 while directing some minor modifications to enhance transparency.8 The Commission rejected allegations that the NYISO had violated its tariff. The Commission agreed with the NYISO that the BSM Rules were silent with respect to inflation adjustments in the mitigation exemption determinations and for escalation of Offer Floors for mitigated projects, and directed tariff modifications to clarify the treatment of inflation.9 Finally, the Commission upheld the NYISO’s approach to reviewing bilateral contracts and its use of natural gas future prices in making determinations under the BSM Rules.10

III. The Commission Should Clarify the June 22 Order’s Directives Regarding the Use

of Inflation in Determinations Under the BSM Rules

A.The Commission Should Confirm that the NYISO’s Understanding of How

to Account for Inflation Under the Part B Test Is Consistent with the June 22

Order

The June 22 Order confirmed that the Part A test requires the NYSO to use the escalation

factor from the currently effective ICAP Demand Curves.11 With respect to the Part B test,

however, the NYISO was to apply an inflation adjustment.12 The Commission held that “in

7 June 22 Order at P 3.

8 Id. at PP 3, 44, 50, 51, 130 (requiring that the NYISO post on its website numerical examples

and narratives of the application of the Offer Floor exemption determination methodology and requiring

the NYISO’s Market Monitoring Unit to prepare a public report “discussing its assessment of the buyer-

side mitigation determinations” which should be published concurrently with the NYISO’s mitigation

determination results).

9 Id. at PP 60, 72.

10 Id.

11 See Attachment A, Table 1.

12 June 22 Order at P 60.

4

making the Unit exemption determination NYISO should ‘inflate’ or restate Unit net CONE and demand curve price values projected for the three-year future Unit Mitigation Study Period to reflect inflation.”13 The June 22 Order directed the NYISO to apply to the prices projected for the three-year future Unit Mitigation Study Period “the same inflation rate that is included in the latest effective demand curve escalation factor.”14 The stated rationale for this directive was to ensure that there is “a valid comparison of the Unit net CONE to each year of the Unit Mitigation Study Period projected demand curve prices.”15

While the June 22 Order provides helpful guidance regarding how the NYISO is to

account for inflation in its determinations under the BSM Rules, some ambiguity remains with respect to certain scenarios that can arise under the Part B test. The NYISO believes that it understands what the June 22 Order requires it to do in these instances but is seeking expedited clarification to confirm that its understanding is correct.

First, with respect to application of inflation in the Part B test, the NYISO’s

understanding is that it will use the escalation factor from the relevant ICAP Demand Curve to

escalate the Unit Net CONE and projected ICAP Demand Curve prices for any year covered by

the Part B test for which there are accepted ICAP Demand Curves. For years encompassed by

the Part B test for which the accepted ICAP Demand Curves do not apply (i.e., because the Part

B test looks further into the future than the three year duration of the ICAP Demand Curves), the

NYISO will use the inflation rate component of the currently effective ICAP Demand Curve

escalation factor.16 The NYISO believes that this approach is consistent with the Commission’s

13 Id. at P 61.

14 Id. at P 62.

15 Id.

16 Id. at P 61 (stating that “the NYISO should ‘inflate’ or restate Unit net CONE and demand

curve price values projected for the three-year future Unit Mitigation Study Period to reflect inflation”).

5

directive that it should only use the inflation rate when projecting values for the three-year future Mitigation Study Period, and that the Part B test be an “apples-to-apples” comparison of the Unit Net CONE to ICAP prices over the Mitigation Study Period.

This approach would allow for a logical transition between the application of the

escalation factor and the inflation rate component when the Mitigation Study Period coincides

with the next three-year set of ICAP Demand Curves (see Table 2 of Attachment A) and in all

other instances. For example, when the ICAP Demand Curves that are accepted at the time of

the BSM analysis do not apply to any year in the Mitigation Study Period (i.e., when the last year

of the currently effective ICAP Demand Curves ends before the Starting Capability Period

(defined in Attachment H as the first Capability Period in the Mitigation Study Period)) the

NYISO would use the escalation factor for the years for which there are currently-effective ICAP

Demand Curves and the inflation component of the escalation factor for the years of the

Mitigation Study Period. Different versions of this scenario are illustrated in Tables 2 through 4

of Attachment A. Table 2 shows the scenario when the currently effective ICAP Demand

Curves end just prior to the beginning of the Starting Capability Period. Table 3 illustrates the

scenario where the currently effective ICAP Demand Curves end one year prior to the beginning

of the Starting Capability Period. Table 4 illustrates the scenario where the currently effective

ICAP Demand Curves end two years prior to the beginning of the Starting Capability Period. If

the NYISO took a different approach, and if the escalation factor included components other

than an inflation component, it could create a discrepancy between the known ICAP Demand

Curves (and therefore the forecast used in the Part B test) and the inflation rate used for Unit Net

CONE for the Mitigation Study Period (the other component of the Part B test).

6

Second, where a Mitigation Study Period begins prior to the end of the accepted ICAP Demand Curves, the NYISO understands that it should use the escalation factor for the years for which there are accepted ICAP Demand Curves and the inflation component of the escalation factor for remaining years in the Mitigation Study Period. This scenario is illustrated in Table 5, which shows inflation being used for all years other than those for which there are accepted

ICAP Demand Curves. As when the last year of the currently accepted ICAP Demand Curves ends before the Starting Capability Period, years after the three-year period covered by the

accepted ICAP Demand Curves would use the inflation rate component that is included in the latest effective ICAP Demand Curve escalation factor.

Third, the NYISO’s understanding is that, consistent with the Commission’s directives, it should only escalate or inflate the ICAP Demand Curve reference point, of which prices are a function, and not the actual price forecasts themselves.17

Granting clarification of these three points will ensure that the NYISO can make future

mitigation exemption determinations with certainty that it is adjusting for inflation in the exact

manner expected by the Commission. Obtaining clarification now should also reduce the

potential for future disputes before the Commission regarding the application of these provisions.

Therefore, the NYISO respectfully requests expedited clarification to confirm that its

understanding of the June 22 Order’s requirements regarding the use of inflation in the Part B

test, as explained above and as further illustrated in the examples included in Attachment A are

correct.

17 Id. (stating that the NYISO should adjust the “Unit net CONE and projected demand curve

prices”).

7

B.The Commission Should Clarify its Directives Regarding the Inflation Rate

That Is to Be Applied to Annually Adjust Offer Floors After They Are Established

The June 22 Order also directed the NYISO to apply an inflation adjustment to the Offer Floor for non-exempt entrants on an annual basis, after they have entered the market.18 Although the Commission agreed with the NYISO that the Services Tariff was silent on this issue, it found that an inflation adjustment should be applied “in the interest of consistency amongst

methodologies.”19 The Commission concluded that “the demand curve inflation adjustment is an appropriate measure for inflating applicable offer floors”20 determined through either prong of

the mitigation exemption determination.

The June 22 Order is clear that the Offer Floor, once established, is to be adjusted on an annual basis to reflect inflation only.21 It is unclear, however, with respect to the determination of the Offer Floor in two respects.

First, the June 22 Order could be read as directing the NYISO to compare the Default

Offer Floor22 to the Unit Net CONE. Unit Net CONE is a three-year average of annual net

CONE values over the Mitigation Study Period. To make a truly accurate comparison, the

Default Offer Floor, which is an annual number, should be compared to the annual net CONE

value for the first year of the Mitigation Study Period. The NYISO therefore requests expedited

clarification that the three-year average Unit Net CONE is the value that is to be determined for

18 Id. at P 72.

19 Id. at P 73.

20 Id. at P 74.

21 Id.

22 The term “Default Offer Floor” is utilized herein as defined and described in the June 22 Order. See id. at n 11.

8

the Part B test, but that the Offer Floor is determined by comparing the Default Offer Floor with the first year value of the three-year Unit Net CONE.

Second, the June 22 Order does not clearly specify the Offer Floor value for a non-

exempt entrant at the time that it enters the market. The Offer Floor is established for the first

year of the Mitigation Study Period. If an entrant initially offers UCAP after the first year of the

Mitigation Study Period, the NYISO’s understanding of the June 22 Order is that it should adjust

the Offer Floor for inflation in the Capability Year that the entrant first offers UCAP. If an

entrant initially offers UCAP prior to the first year of the Mitigation Study Period, the NYISO

believes that it is required to adjust for early entry and deflate the Offer Floor for inflation. The

NYISO believes this approach is consistent with the June 22 Order’s finding that adjusting for

inflation should maintain “the originally determined offer floor in ‘real’ terms while at the same

time making such values comparable to the prices in the year in which the mitigation occurs.”23

The inflation rate used would be the inflation rate component of the escalation factor of the ICAP

Demand Curves that are effective at the time of the examination. This will ensure that

adjustments are symmetrical, which would promote methodological consistency as required by

the June 22 Order. The NYISO seeks expedited clarification that this approach is correct under

the June 22 Order.

In the alternative, to the extent the Commission finds that the approaches outlined in the

preceding two paragraphs are not consistent with the June 22 Order, the NYISO seeks expedited

clarification regarding the approach(es) that it should use. Further guidance would be necessary

because requiring the NYISO to compare an annual Default Offer Floor value to a three-year

average Unit Net CONE value would be an “apples to oranges” comparison. Also, not allowing

23 June 22 Order at P 73.

9

the NYISO to make upward and downward inflation adjustments to the Offer Floor to account for situations in which a new entrant does not enter the market in the first year of the Mitigation Study Period would not result in a value that is consistent with the June 22 Order’s determination that Offer Floors should reflect inflation.

IV. The Commission Should Clarify that the June 22 Order Is Not Intended to Require

the NYISO to Allow Retesting in Situations Where It Is Not Allowed Under the NYISO’s Tariff or, in the Alternative, Grant Rehearing

A. The Commission Should Clarify that Footnote 115 of the June 22 Order Is

Not Intended to Expand the Categories of Examined Facilities That May Be Retested, or in the Alternative Grant Rehearing

The NYISO respectfully requests clarification regarding footnote 115 of the June 22

Order. It states that “[t]he mitigation provisions permit a re-assessment of the mitigation

exemption determination for a non-exempt unit at any time prior to the unit’s entry into the ICAP Market.” The NYISO requests clarification that footnote 115 should not be read as requiring it to allow for retesting in situations where it would not be allowed by the currently effective

version of the Services Tariff, as accepted by the Commission.24

Section 23.4.5.7.3.5 states:

An Examined Facility for which an exemption or Offer Floor determination has

been rendered may only be reevaluated for an exemption or Offer Floor

determination if it meets the criteria in Section 23.4.5.7.3(I) and either (a) enters a

new Class Year for CRIS or (b) intends to receive transferred CRIS rights at the

same location. An Examined Facility under the criteria in 23.4.5.7.3(II) that did

receive CRIS rights will be bound by the determination rendered and will not be

reevaluated, and an Examined Facility under the criteria in 23.4.5.7.3(III) will not

be reevaluated.25

24 See New York Independent System Operator, Inc., 133 FERC ¶ 61,178 (2010), order on reh’g, 136 FERC ¶ 61,077 (2011) (“Order on Rehearing”).

25 Section 23.4.5.7.3(I), (II), and (III) Examined facilities are defined as follows in the currently

effective version of the tariff: “(I) each proposed new Generator and proposed new UDR project, and

each existing Generator that has ERIS only and no CRIS, that is a member of the Class Year that

requested CRIS, or that requested an evaluation of the transfer of CRIS rights from another location, in

the Class Year Facilities Study commencing in the calendar year in which the Class Year Facility Study

determination is being made (the Capability Periods of expected entry as further described below in this

10

This language clearly provides that the only situation in which the NYISO would reevaluate an exemption or Offer Floor determination is where an Examined Facility “intends to receive transferred CRIS Rights at the same location” (and does not have to go through the Class Year process) or “it enters a new Class Year for CRIS.” The current tariff is clear that projects will not be retested under any other circumstances.

Reading footnote 115 to require that any non-exempt project may be retested prior to its entry would clearly contravene the plain meaning of Section 23.4.5.7.3.5. That provision was not in dispute in this proceeding and no party has suggested, let alone supported a claim, that it should be revised. Thus, the Commission should grant clarification that its statements in the

June 22 Order were not intended to expand the categories of Examined Facilities eligible for

retesting under the Services Tariff.

In the alternative, if the Commission did intend for footnote 115 to expand the categories

of Examined Facilities that would be eligible for retesting to encompass any “non-exempt unit at

any time prior the unit’s entry into the ICAP Market,” the NYISO requests rehearing.

Section 23.4.5.7.3.5 does not authorize the NYISO to retest a non-exempt project “at any time

prior to the unit’s entry into the ICAP Market.” Rather, it clearly provides that retesting is

Section, the “Mitigation Study Period”), (II) (a) each (i) existing Generator that did not have CRIS rights,

and (ii) proposed new Generator and proposed new UDR project, that (a) is an expected recipient of

transferred CRIS rights at the same location regarding which the ISO has been notified by the transferor

or the transferee of a transfer pursuant to OATT Attachment S Section 23.9.4 that will be effective on a

date within the Mitigation Study Period, (III) each proposed new Generator that (a) is either (i) in the ISO

Interconnection Queue, in a Class Year prior to 2009/10, and has not commenced commercial operation

or been canceled, and for which the ISO has not made an exemption or Unit Net CONE determination, or

(ii) not subject to a deliverability requirement (and therefore, is not in a Class Year) and (b) provides

specific written notification to the ISO no later than the date identified by the ISO, that it plans to

commence commercial operation and offer UCAP in a month that coincides with a Capability Period of

the Mitigation Study Period.”

11

limited to instances where an Examined Facility “intends to receive transferred CRIS Rights at the same location” or “it enters a new Class Year for CRIS.”

The June 22 Order could not lawfully direct the NYISO to expand the scope of

Section 23.4.5.7.3.5. Such an expansion of the retesting provisions of the BSM Rules would be contrary to the plain meaning of the words in the tariff26 and to the intent of the NYISO when it proposed those provisions in the proceeding that established the current version of the BSM Rules. If footnote 115 were nevertheless intended to revise the NYISO tariff without

explanation, record support, or the necessary findings under section 206 of the Federal Power Act, it would not be consistent with reasoned decision-making. Thus, if the Commission

actually meant to make such a ruling, it should reverse it on rehearing.

B. The Commission Should Clarify That P 132 Requires the NYISO to Reissue

Mitigation Exemption Determinations Only to Those Examined Facilities in

Class Years 2009 and 2010 That Accepted CRIS, or in the Alternative Grant

Rehearing

The June 22 Order, at P 132, stated that “[t]o the extent NYISO provided initial

mitigation exemption determinations prior to those processes, [the Commission] will require

NYISO to revise its determinations with respect to our findings herein.”27 The Commission

should clarify that P 132 only requires the NYISO to reevaluate final mitigation exemption

determinations made under the BSM Rules for Examined Facilities that accepted CRIS. The

26 There is nothing in the Commission proceeding accepting the current version of the BSM Rules that would contradict the plain meaning of the tariff. Paragraphs 25 and 27 of the Order on Rehearing in Docket Nos. ER10-3043-002 and 003 address a related question in a manner that is consistent with the

tariff. See New York Independent System Operator, Inc., 136 FERC ¶ 61,077 (2011). The Order on

Rehearing clearly provided that the Commission accepted section 23.4.7.3.5, as proposed without

modification. The PP 25, and 27 discussions with respect to retesting were in the context of the tariff

provisions allowing for retesting where “the Category I Examined Facility meets certain criteria and

enters a new Class Year to seek CRIS rights or intends to receive transferred CRIS rights at the same

location without further conditions.” Id. at P 23.

27 Id. at P 132.

12

Services Tariff does not authorize the NYISO to reissue determinations to Examined Facilities

that had been in a Class Year and that do not accept CRIS, except when they have entered a new Class Year and accepted CRIS. Section 23.5.7.3 includes such facilities within the definition of “Examined Facilities” while they are going through the decisional rounds of the Class Year

process, but they do not receive final determinations unless and until they enter a new Class Year and accept CRIS. In accordance with the tariff, the NYISO has made a final mitigation

exemption determination with respect to only one project that accepted and received CRIS in the Class Years examined under the BSM Rules. Consistent with the BSM Rules, the NYISO only

intends to reexamine that one project. 28

Consistent with the discussion in the preceding section, the complaint did not challenge

23.5.7.3, there was no discussion of it in the parties’ pleadings, and the June 22 Order did not

expressly direct that it be modified. The Commission should therefore clarify that it is requiring the NYISO to only reexamine any final mitigation exemption determinations under the BSM Rules i.e., the one project that was evaluated with Class Year 2009 and 2010 that accepted CRIS for which the NYISO issued a final determination.

In the alternative, the NYISO requests rehearing of P 132 of the June 22 Order to the

extent that it directs the NYISO to revise any mitigation exemption determinations made for

Examined Facilities in Class Years 2009 and 2010 that did not accept CRIS. Such a requirement

would be inconsistent with the plain language of Sections 23.4.5.7.3, and 23.4.5.7.3.3.

Additionally, if the Commission intended to direct the NYISO to modify those currently

effective tariff provisions without explanation, record support, or the necessary findings under

section 206 of the Federal Power Act, it would be inconsistent with reasoned decision-making.

28 The NYISO notified stakeholders on July 10, 2012 that the only project for which it made a final determination was the Hudson Transmission Partners project.

13

Therefore, to the extent the June 22 Order would require reevaluation of projects ineligible for retesting under 23.4.5.7.5, it must be reversed on rehearing.

V. Specification of Errors and Statement of Issues

In accordance with Rule 713(c), 18 C.F.R. § 385.713(c), the NYISO submits the

following specifications of error and statement of the issues on which it seeks rehearing of the June 22 Order to the extent that its requests for clarification are denied:

• The June 22 Order does not reflect reasoned decision-making to the extent that it expands

the retesting provisions of the BSM Rules to make them applicable to any “non-exempt

unit at any time prior to the unit’s entry into the ICAP Market” in contravention of the

plain meaning of the tariff and does so without explanation, record support, or the

necessary findings under section 206 of the Federal Power Act.

• The June 22 Order does not reflect reasoned decision-making to the extent that it requires

the NYISO to reevaluate Examined Facilities in Class Years 2009 and 2010 that did not

accept CRIS, in contravention of the plain meaning of the tariff and does so without

explanation, record support, or the necessary findings under section 206 of the Federal

Power Act.

14

VI.Conclusion

WHEREFORE, for the foregoing reasons, the New York Independent System Operator, Inc., respectfully requests that the Commission grant clarification, or in the alternative rehearing, of the rulings and statements in the June 22 Order that are described above.

Respectfully submitted,

/s/

Gloria Kavanah, Senior Attorney

New York Independent System Operator, Inc.

10 Krey Boulevard

Rensselaer, NY 12144 518.356.6103

gkavanah@nyiso.com

Date: July 23, 2012

cc:Michael A. Bardee

Gregory Berson

Connie Caldwell

Anna Cochrane

Jignasa Gadani

Lance Hinrichs

Jeffrey Honeycutt

Michael Mc Laughlin

Kathleen E. Nieman

Daniel Nowak

Rachael Spiker

15

ATTACHMENT A

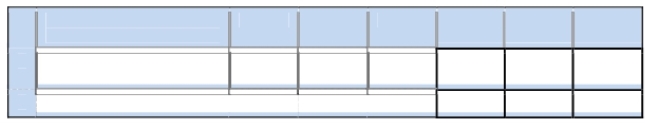

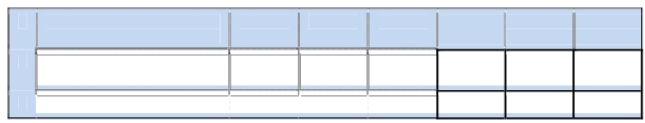

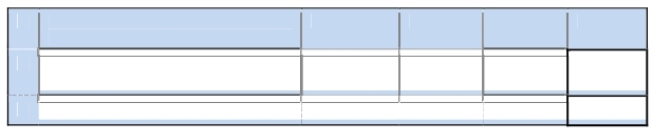

TABLE 1

Part A Test. Project in Class Year 2011. The Part A Mitigation Study Period is year 2014. The escalation factor is used for all years.

Capability Year2011201220132014

(May-April)

1Default Offer Floor2011$EscalationEscalationEscalation

75% Mitigation Net CONE

2Part A Forecast2011$EscalationEscalationEscalation

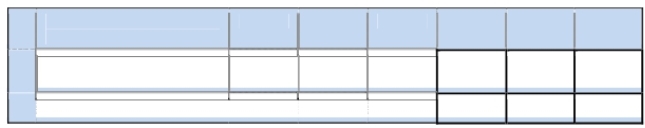

TABLE 2

Part B Test, Case 1. Project in Class Year 2011. The Part B Mitigation Study Period covers years 2014 through 2016. The currently accepted ICAP Demand Curve covers years 2011 through 2013.

Capability Year201120122013201420152016

(May-April)

1Annual Net CONE of2011$EscalationEscalationInflationInflationInflation

Examined Facility

2Part B Forecast2011$EscalationEscalationInflationInflationInflation

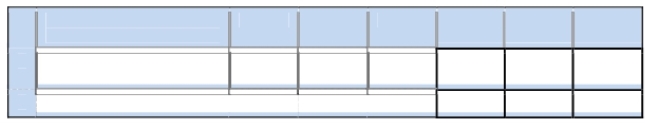

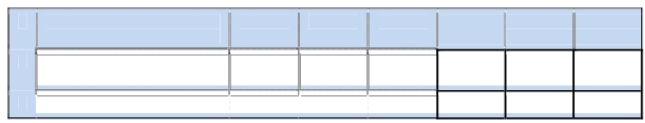

TABLE 3

Part B Test, Case 2. Project in Class Year 2012. The Part B Mitigation Study Period covers years 2015 through 2017. The currently accepted ICAP Demand Curve covers years 2011 through 2013.

Capability Year201220132014201520162017

(May-April)

1Annual Net CONE of2012$EscalationInflationInflationInflationInflation

Examined Facility

2Part B Forecast2012$EscalationInflationInflationInflationInflation

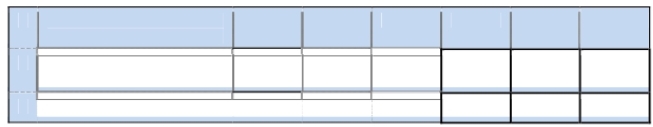

TABLE 4

Part B Test, Case 3. Project in Class Year 2013. The Part B Mitigation Study Period covers years 2016 through 2018. The currently accepted ICAP Demand Curve covers years 2011 through 2013.

Capability Year201320142015201620172018

(May-April)

1Annual Net CONE of2013$InflationInflationInflationInflationInflation

Examined Facility

2Part B Forecast2013$InflationInflationInflationInflationInflation

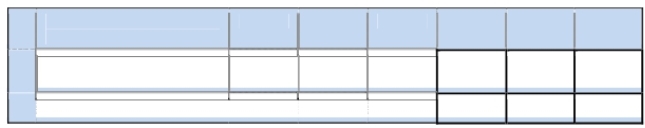

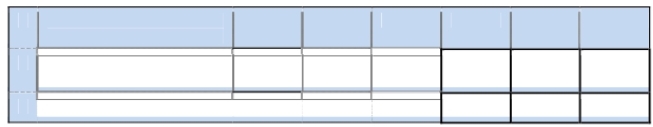

1

TABLE 5

Part B Test, Case 4. Project in Class Year 2013. The Part B Mitigation Study Period covers years 2016 through 2018. The currently accepted ICAP Demand Curve covers years 2014 through 2016.

Capability Year201320142015201620172018

(May-April)

1Annual Net CONE of2013$EscalationEscalationEscalationInflationInflation

Examined Facility

2Part B Forecast2013$EscalationEscalationEscalationInflationInflation

For purposes of the preceding tables:

• Escalation means the escalation factor from the accepted ICAP Demand Curves, and

• Inflation means the inflation rate identified by the Commission in relation to the

escalation factor in the accepted ICAP Demand Curves.

For purposes of illustration, the currently accepted ICAP Demand Curves use an escalation factor and a short-term inflation rate of 1.7 percent.

2

CERTIFICATE OF SERVICE

I hereby certify that I have this day caused the foregoing document to be served on the official service list compiled by the Secretary in this proceeding.

Dated at Washington, DC, this 23rd day of July, 2012.

/s/Catherine Karimi

Catherine Karimi

Hunton & Williams LLP

2200 Pennsylvania Ave, N.W. Washington, DC 20037

(202) 955-1500